Buying an apartment these days is difficult without obtaining a mortgage.

It is mortgage lending that is becoming the most popular banking product.

I would like to have a reliable partner in terms of monetary sponsorship and guarantees from the developer.

Thanks to the new electronic platform from Sberbank, this became possible. This is an updated service that allows you to find real estate in any city and get money for its purchase.

The website domclick.ru contains detailed information about the properties offered by real estate agencies and the conditions for their purchase.

In this article we will tell you how to use the new resource from Sberbank and see how convenient the Personal Account is for a home buyer.

Description of the main page of the site

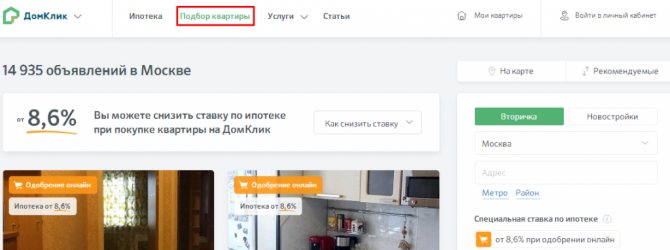

On the main page of the service there is a main menu at the top of the screen.

This includes sections:

- Buy;

- Take off;

- Mortgage;

- Services;

- My house;

- Magazine.

There are two sections in the upper right corner: “Post ads” and “Login or register”

All actions to obtain a mortgage for a specific property or place an advertisement are carried out in the Personal Account.

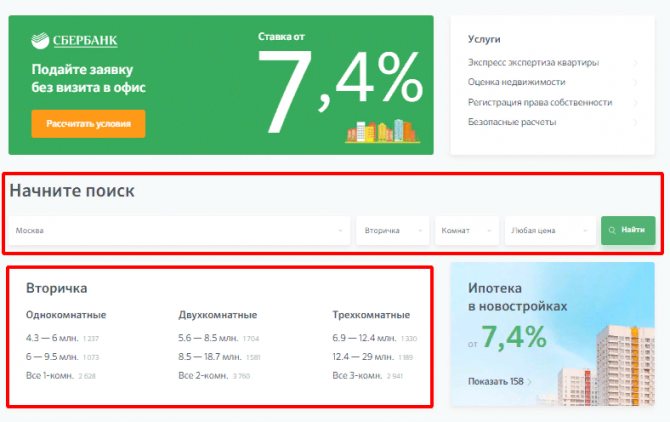

As you can see in the screenshot, at the top of the site there is also a search for real estate, where you can select the search region and set the necessary parameters.

The service is intended for the category of buyers and sellers

- Buyers include individuals or organizations who want to find a profitable option

- Sellers include individuals, real estate agencies, realtors, developers

Personal offices (offices) are created for both groups, in which all purchase and sale operations can be carried out.

The 4 most visited sections are displayed right above the search, so that the user of the DomClick website does not have to search for the right one for a long time

Below, a site visitor can view the traffic counter or click on the “show offers” button and see the properties for sale on the map

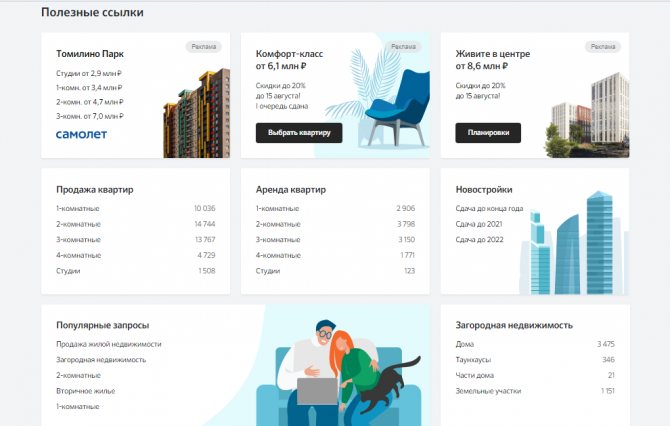

In the “Useful Links” section there is real estate advertising, and above it there are useful sections:

- Sale of apartments;

- Apartments for rent;

- New buildings;

- Popular queries;

- Countryside real estate.

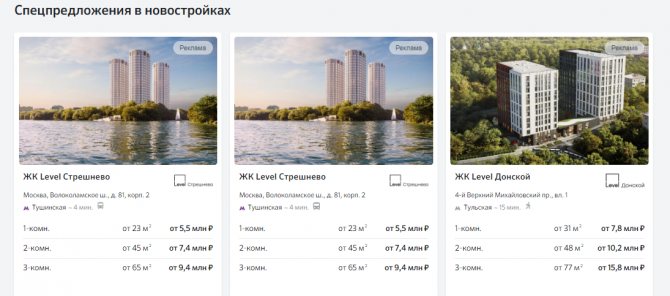

In the middle part of the main page of the site there is advertising on mortgage programs in new buildings from Sberbank and apartments offered for sale

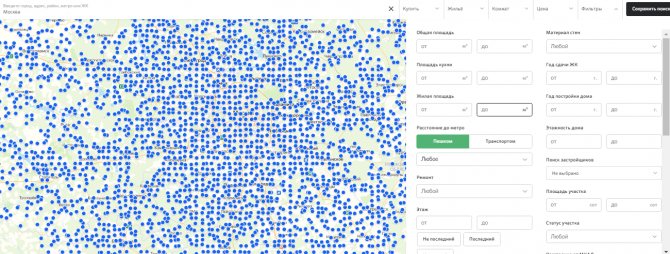

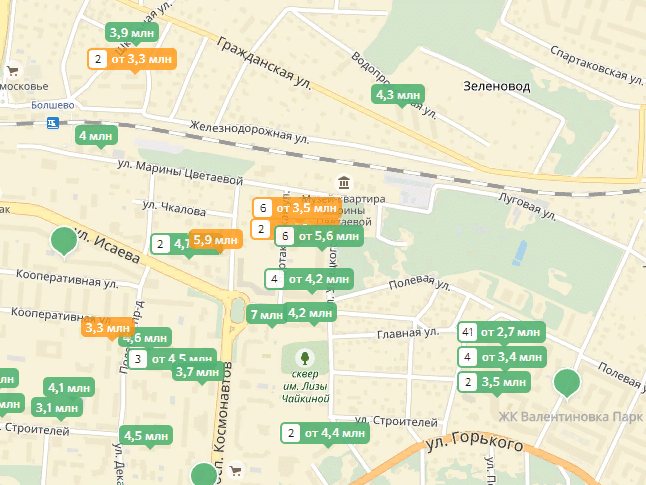

By clicking on the “view on map” button you will be transferred to a map with real estate properties for sale, on it you can select the desired region and specify the appropriate search parameters.

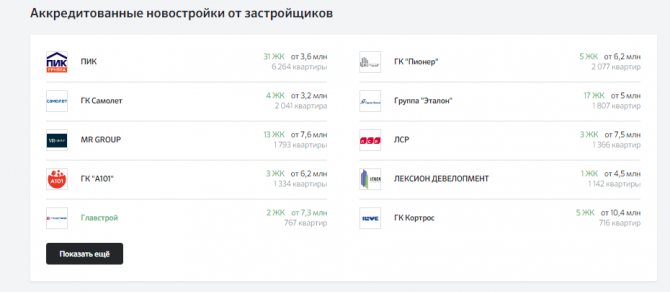

Below you can find a list of accredited agencies and accredited new buildings from developers. To study the list in more detail, click on the “show more” button.

At the bottom of the screen you can use the calculator, enter your personal account, place an ad or send an apartment for approval

Scrolling down the page, the user can view useful articles from the DomClick blog.

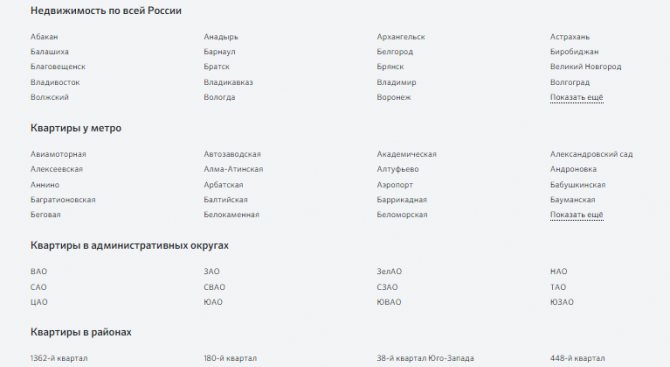

At the very end of the page you can specify the region you are searching for real estate

To buy real estate, you first need to choose the city in which you plan to make a purchase, then decide on the property itself.

This could be real estate on the secondary market or new buildings.

The service is quite convenient. It allows you to select the area of future residence with prices indicated, as well as view the property on the map.

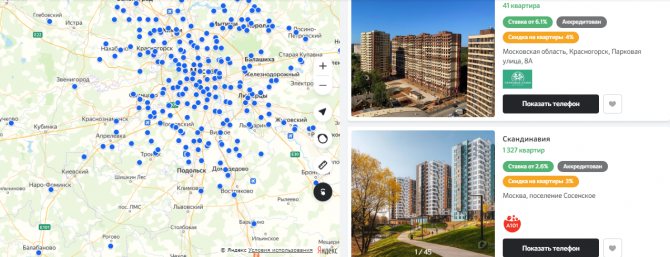

Next are offers for specific apartments and new buildings with photos and descriptions.

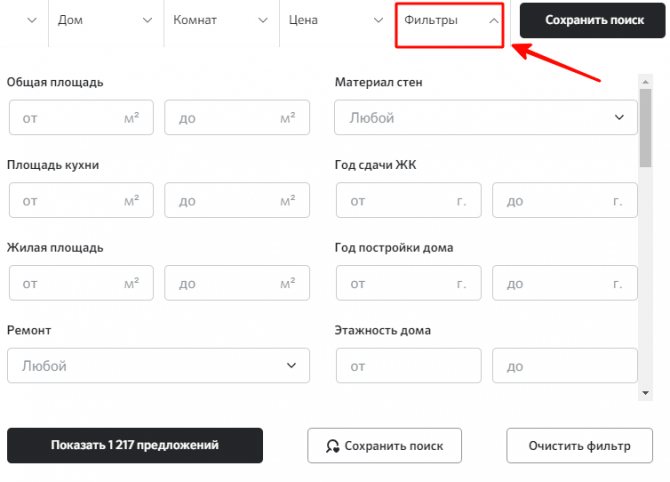

For convenience, use search filters that will help you quickly find the option you need, without viewing all the information.

On each real estate card displayed on the screen, there are special icons with mortgage interest.

They also help the visitor to view the most suitable options for themselves.

How to apply for a mortgage on the DomClick portal from Sberbank

You can start applying for a mortgage immediately after completing registration on the site. There are several ways to apply for an apartment you like:

- Find a suitable apartment in the DomClick catalog and send an application from your real estate card

- Leave an application for a mortgage without reference to a specific property (and then send the apartment for consideration to the bank)

First way.

In the first case, go to the “Buy” menu, then select the type of property - new building or secondary housing and then filter the list of apartments by city, number of rooms, square meters, cost and other parameters.

Next, click on the object card and in the upper right corner click on the seller’s phone number - the system will prompt us to indicate your phone number at which the seller will contact you.

Now you need to talk with the owner of the property or an agent representing the interests of the buyer and clarify the details you are interested in about the apartment, and maybe arrange a meeting to inspect the property if the description of the property presented on the website is clear and completely satisfactory to you.

Important! To send a mortgage application to the bank, the conversation with the apartment seller must last at least 15 seconds. After this conversation, the “Send apartment for approval” button will become available to you, which sends information about the property and the client who wants to purchase it to the bank. Based on the results of the review, you will receive a response from Sberbank within 3 business days. If approved, all that remains is to visit the bank and sign a mortgage agreement.

Second way.

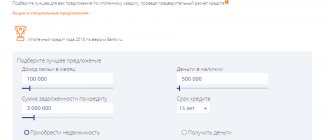

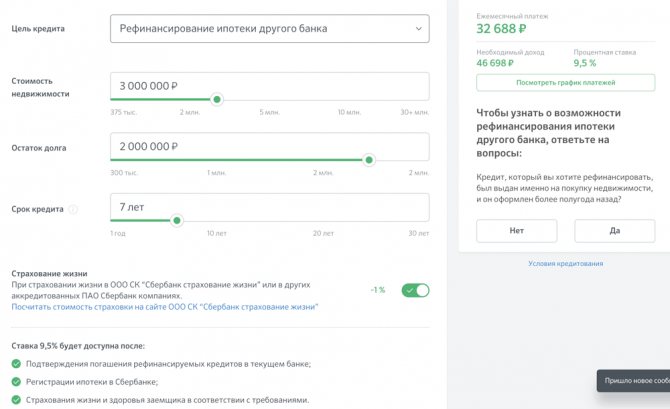

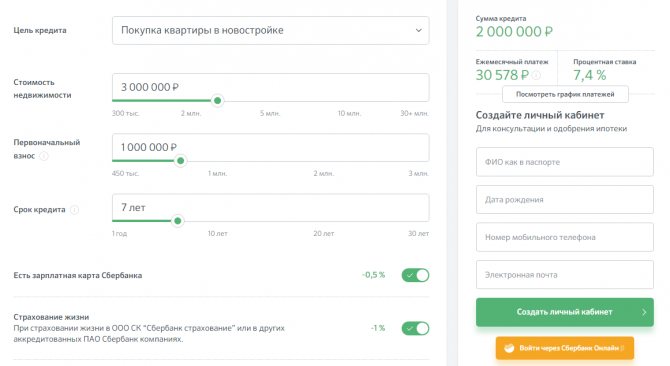

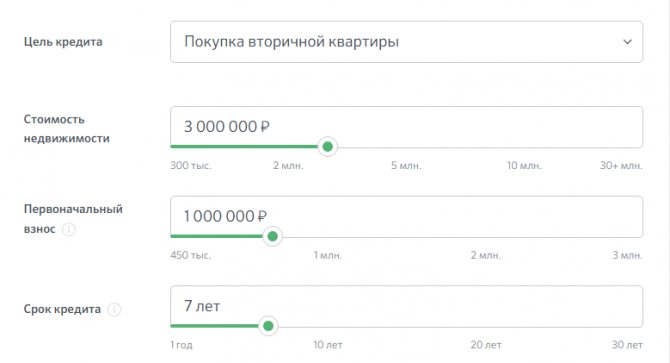

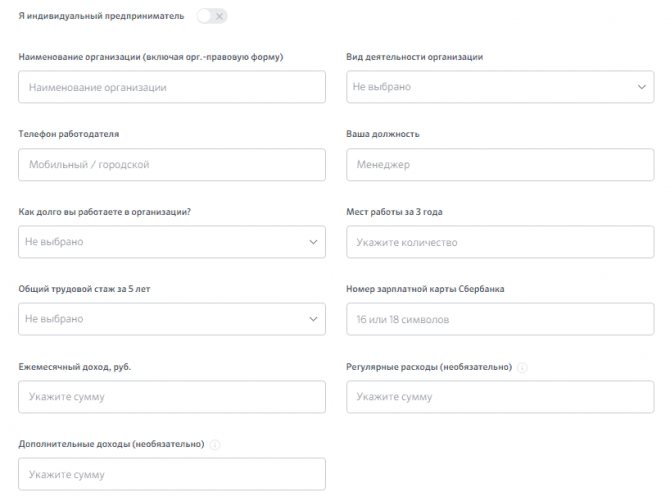

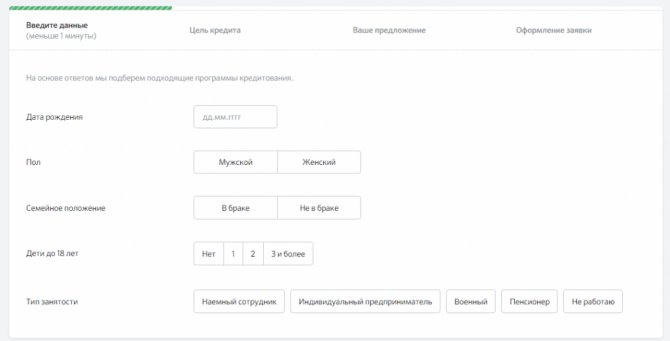

In the main menu on the website, go to the “Mortgage” section - “Submit an application”. The following form for submitting a request to the bank will open:

The form will require you to fill out the following fields:

- Purpose of the loan (purchase of real estate, construction of a house, purchase of a parking space, etc.). In the same paragraph, you select the type of mortgage lending program (if available): military mortgage or mortgage with government support for families with children

- Property cost (the full cost of the property is indicated)

- Down payment (here you must select the amount of the down payment - at least 15% of the cost of the purchased object)

- Loan term (from 1 year to 30 years: banks are more willing to approve mortgages with a longer term)

- Life insurance (optional insurance, which allows you to reduce the interest rate by 1%. Insurance of the real estate itself is mandatory for the entire mortgage period)

- Having a Sberbank salary card (is your advantage over the bank)

- Electronic registration of a transaction (Registration of property rights without visiting Rosreestr and the MFC. Reduces the interest rate by 0.1%.)

- Young family (One of the spouses is under 35 years old or you are a single parent under 35 years old). If you meet the conditions of this government program, then the interest rate is reduced by another 0.5%.

Correctly filling out all the above points allows you to use the calculator to calculate the approximate cost of your future housing loan (the calculation received is not an offer and is approximate).

As a final result, in the right column you will receive the final parameters of the future loan:

- Amount of credit

- Monthly payment amount

- Required income for bank approval of this mortgage

- Individually calculated interest rate (based on the data you filled in)

Also, if necessary, you can view the payment schedule by clicking the appropriate button under the calculation.

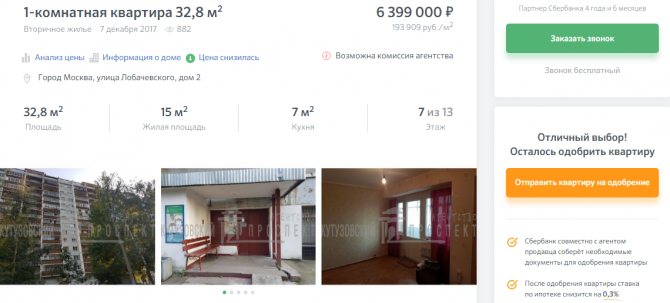

Possibility of reducing mortgage interest rates

An online service from Sberbank allows clients to receive a discount on their mortgage rate.

To do this you need:

- fill out an application and send it from the website to the bank;

- choose from the proposed options housing with a special icon;

- send the object for approval;

- get an interest rate reduction of 0.3%.

The collection of documents necessary for the operation will be entrusted to Sberbank employees.

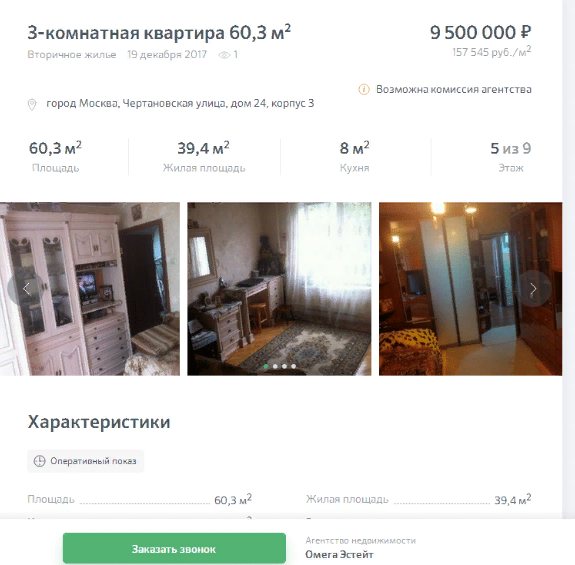

Click on the photo of the apartment you like and go to the detailed information page.

Get acquainted with the data and pricing policy. You will have the opportunity to use an online call to clarify some details. This option will be available on the right side of the screen.

If everything suits you, then click on the button to send the apartment for approval and use favorable conditions from Sberbank when purchasing.

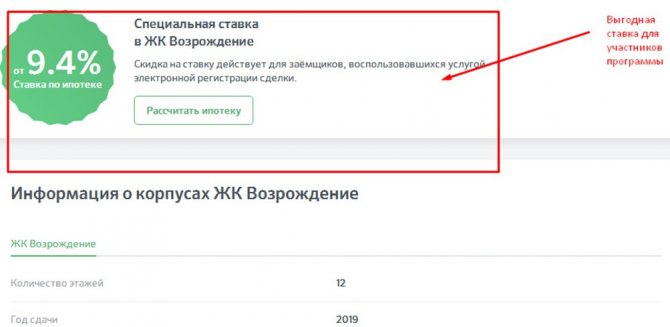

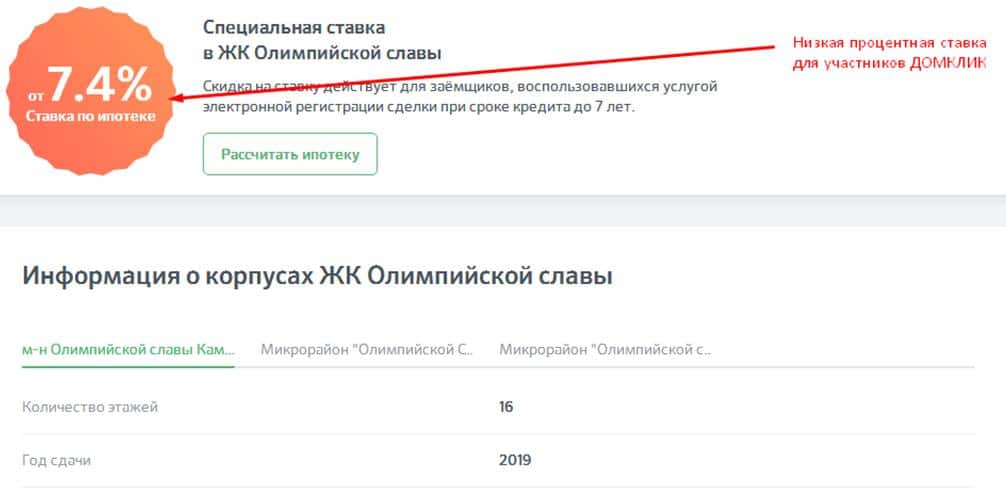

Partners Sberbank DomClick

In the short time the program has been in effect, a large number of developers and realtors have joined the program and managed to appreciate the benefits of the portal. For example, for buyers who purchase housing through the system, developers/realtors can offer discounts and bonuses. For example, it offers a comfortable rate for new housing.

(new building) offers an even more favorable loan rate. These conditions were made possible solely thanks to the platform.

Registration in LC

Using the capabilities of the Personal Office service will require registration.

To do this, you can use the services of a calculator and go to the page for filling out personal data.

The system will take you to the required page to calculate the cost of housing and enter personal data to access the Client’s Personal Account.

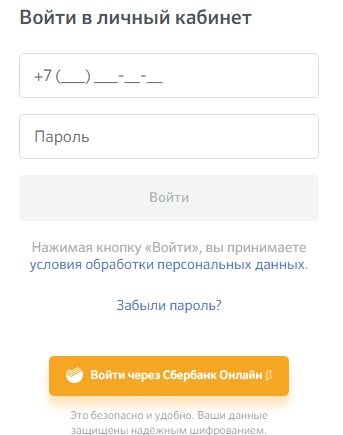

If you are already a bank client and have access to your personal account, then click on the login button through the online service.

If this is your first time contacting Sberbank, then fill out the requested fields of the form and click on the button to create a personal account.

After entering personal information, an activation code in the system will be sent to your mobile phone number.

Confirm your number and a new window will open in front of you, where you need to come up with a secret code (password) combination for further login to your personal account.

At the bottom of the window, be sure to confirm your agreement to the terms of use in order to proceed to full-fledged work in the Personal Office.

To further enter your personal account, click on the login button on the Domklik website and enter only your phone number and the password you created.

After logging in, all available functions of the service will open to you.

If you have forgotten your password, use the link to restore your secret information.

Click on the line “forgot your password” and follow the system instructions.

Login to your Personal Account

After registration, you can enter your personal office.

Information with personal data will be displayed on the main page.

At the top, you need to decide on the amount of the expected mortgage loan.

To complete a home purchase transaction, you need to go through several steps:

- obtain limit approval;

- search for real estate;

- send the requested documents to the bank;

- obtain approval of the selected object;

- sign contractual documents;

- register the deal.

In your office, you can go through all these stages quickly, without wasting time visiting offices and viewing the apartment.

All information will be available on the service. This is very convenient for both the home seller and the borrower. Fill out your profile in your Personal Account.

You will need to enter personal information indicating your passport details.

Leave your contact information: phone number and email address.

Here you will need to indicate your education, place of work, income and other information.

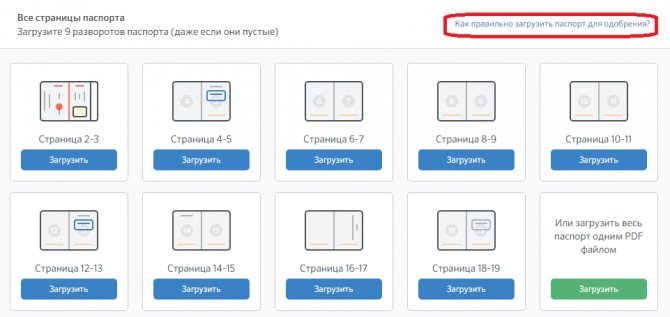

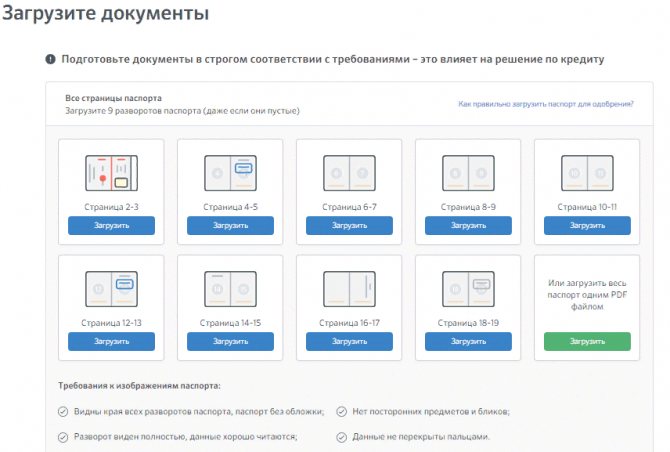

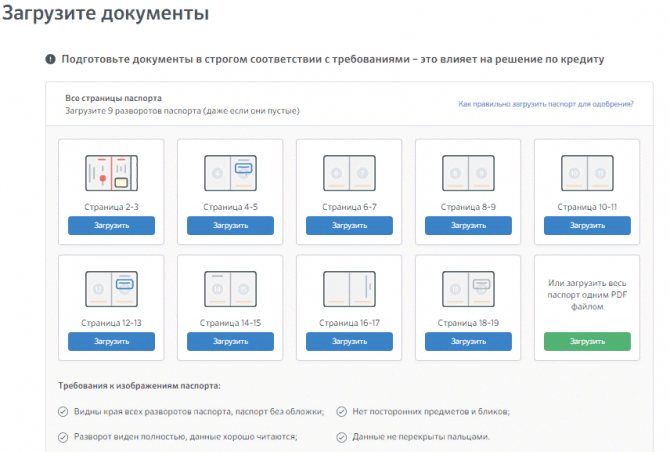

Below on the page you need to scan all the pages of your passport and post them in your personal account.

Download instructions are included. Click on the link on how to do this correctly and download the document pages.

Requirements for posted photos:

- scanning is carried out without the cover, to view all corners of the pages;

- there should be no glare or extraneous images;

- the text must be clear and readable;

- Do not cover the data with your fingers.

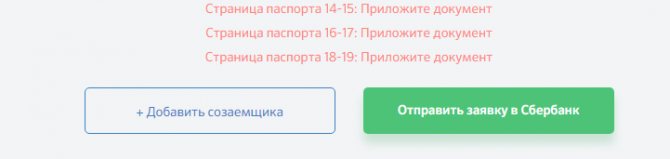

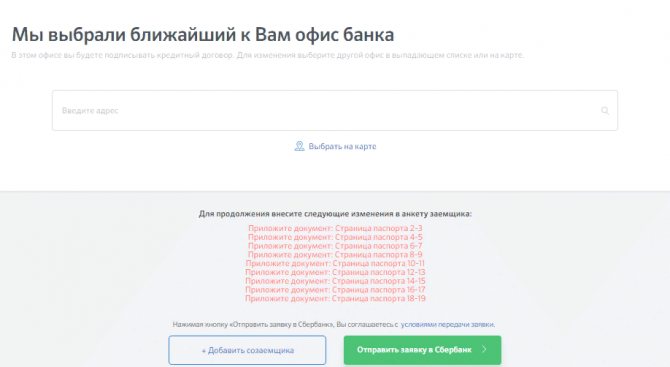

If any data is not filled in, a message will appear at the bottom of the page indicating the missing information.

They will be indicated in red font. Correct the shortcomings and click on the green continue button.

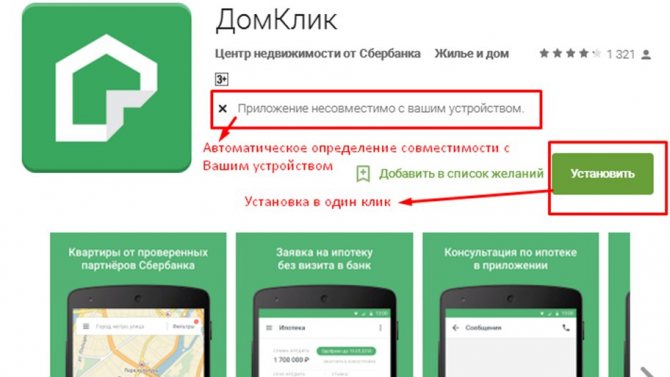

Mobile application DomClick

The site offers you to always be in touch. Users can download a special application, thanks to which they can log into their personal account, check out new products on the housing market, contact the manager, upload documents, and request mortgage approval.

To download the application on Android or iPhone, follow one of the links below:

To install the application, download it from the Play Store or AppStore (free). To do this, just make sure it is compatible with the device (Android or iOS) and click “Install”. Compatibility is determined automatically upon download.

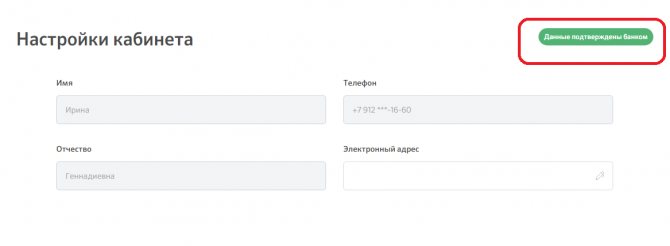

Profile Settings

To set up your personal data, click on your initials in the upper right corner and proceed to filling out basic information.

Please provide your phone number and email address. If you logged in through online banking, the information confirmed by the bank will already be present in your account data.

They can be edited and saved at any time. A special icon will be displayed indicating that the data is valid.

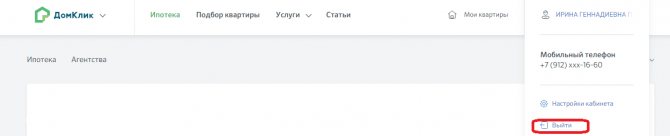

By clicking on your initials on the main page, you can go to the line to log out of the system.

Description of services

All possible site functions are available on the main page of your Personal Account.

There are also sections on mortgage lending, selection of apartments, and article materials.

Among the services offered on the service, you can use:

- assessment of objects;

- carrying out an examination;

- electronic registration;

- receiving an extract from the Unified State Registration Register;

- conducting secure payments.

At the bottom of the Personal Account screen, you can make an online call or use chat services to contact the manager.

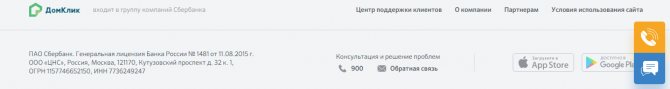

At the bottom of the page there is information for contacting the company. There is information about the organization here; terms of cooperation and rules for using the online resource.

As you can see, programs are available for downloading the program's mobile application.

Features for users

The resource is beneficial for all visitors to this site:

- it makes it possible to reduce the time required to carry out all transactions;

- you can buy or sell housing in a short time;

- at any time, check the data of the object and the data of the buyer (seller);

- promptly complete and sign all necessary documents.

Now let's look at what exactly the client-buyer receives:

1. Information on the amount approved by the bank for mortgage lending will always be available in your Personal Account.

2. The user has the opportunity to thoroughly study the current offers from Sberbank and choose a profitable option for himself.

3. Get all the information about the proposed property with photo reports.

4. Choose the apartment you like and discuss the details with the developer online.

5. Use the services of the bank’s partners: insurers, appraisers, agencies.

6. Possibility of choosing a realtor by filtering by cost, services provided, reviews.

7. Submit an online purchase application.

8. Upload all documents required for the transaction on the service page and send to the bank for approval.

9. Monitor the process of events using SMS alerts or email notifications.

For those who put their properties up for sale, the service is doubly useful.

Developers will have to post all the information about themselves with contact details, documents for the right to conduct construction, and indicate the terms of cooperation for buyers.

The Domklik service from Sberbank will allow you to:

- update and expand your customer base;

- attract new financial resources;

- increase the prestige of your organization;

- increase real estate sales volumes.

The last point is more suitable for real estate agencies.

Let's take a closer look at the services offered in your Personal Account.

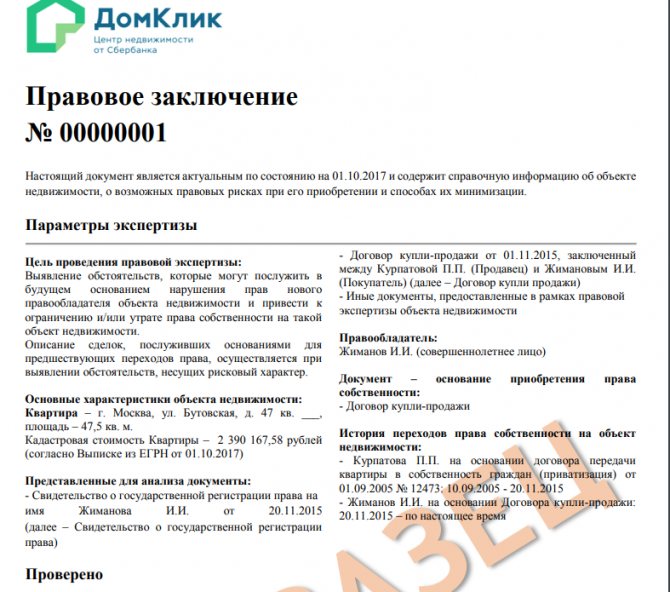

Legal expertise

This is a very important point when purchasing real estate.

As you know, there are certain risks associated with various circumstances:

- rights of heirs;

- obtaining an apartment illegally;

- absence of one of the family members in privatization;

- bankruptcy of the seller.

These points may be challenged in court, and your purchase will be declared invalid.

In order not to take such an object, it is always necessary to conduct a legal examination.

It includes:

- analysis and collection of documents;

- history of transfer of rights to an apartment since 1998;

- checking the seller's reliability;

- issuing recommendations and conclusions from specialists.

By using this service, the client receives a written certificate of the examination performed with the wishes of the expert.

The received document has legal force, as it is sealed with the signatures and seals of the lawyers who carried out this inspection.

Duration: 3 days.

Valuation of housing purchase objects

Conducted by a subsidiary of Sberbank - the Real Estate Center.

To order the service, use the toll-free number - 8-800-7075236.

Duration: from 1 day. The service is paid.

An appraisal is necessary to ensure the value of the apartment and not overpay.

You can evaluate:

- land plot;

- apartment;

- room;

- share;

- house;

- areas with buildings.

Electronic registration

A convenient way to register purchased housing without visiting the MFC and Rosreestr.

There is no need to set a meeting time or stand in queues; all you need to do is sign a loan agreement with Sberbank and send the documents online.

When using this service, the bank provides a discount on mortgages in the amount of 0.1%.

The service includes:

- payment of state registration fees when transferring rights to real estate;

- issuance of a special signature (qualified) for the participating parties;

- online sending of necessary certificates and documents to Rosreestr;

- control over the processing of documents in Rosreestr;

- providing clients with a personal assistant manager.

The registration procedure is quite simple. The bank does everything for you. All you have to do is wait for the completed purchase and sale agreement by email.

An extract of registration from the Unified State Register will come with the Agreement.

Mortgage refinancing from Sberbank

DomClick provides mortgage refinancing. Features of the procedure:

- Combining several loans into one. The maximum refinancing amount should not exceed 1,500,000 rubles.

- Closing a loan regardless of the type of housing purchased. But the remaining amount must be no less than 500,000 rubles and no more than 80% of the property price.

- Receiving an additional amount of 1,000,000 rubles indicating the purpose of their use.

Refinancing a mortgage through DomClick has a number of advantages:

- presence of a personal manager;

- interest rate from 9.5%;

- no hidden fees;

- increasing the credit limit;

- reducing your monthly mortgage payment.

Sberbank does not issue refinancing for clients who took out a mortgage here. The service is available only to representatives of third-party banking companies.

Secure payments

This is a paid service. It provides the opportunity to conduct financial transactions between parties without visiting bank offices.

Process:

- the real estate buyer sends money to the account of the Sberbank Real Estate Center;

- The center, in turn, requests documents from Rosreestr on conducting and recording the transaction;

- upon receipt of a positive response, the money goes to the seller’s account.

Thus, Sberbank conducts a preliminary check and does not allow its clients to transfer money directly.

This will protect the borrower’s finances from rash actions and preserve them.

In your Personal Account you can receive an extract from the Unified State Register of Real Estate online for any property.

To do this, open the appropriate section in the services and enter the data. You will need a cadastral number or address of the property.

Extracts will help determine ownership of the property at the moment and find out whether the property is subject to seizure. For example, whether it is on bail.

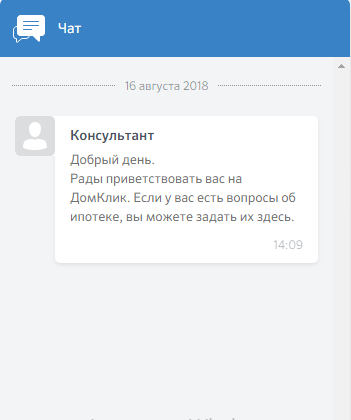

Hotline DomClick

You will need support contacts if you have any questions while working with your account or mortgage. Sberbank has a well-developed support system. The fastest way to contact a consultant is through a chat with technical support in your personal account. even for non-registered site visitors.

In such a chat, you can solve mediocre questions, for example, about the procedure for applying for a mortgage. If problems arise or you need detailed advice, you can call the DomClick hotline: 8-800-1001-900. Each registered client is assigned his own manager, who will answer the call at the specified number.

You can also contact the assistant in the application or your personal account on the service.

You can order a call to receive feedback only between the buyer and the author of the ad. Each region has different DomClick numbers, from which you will receive a call when ordering.

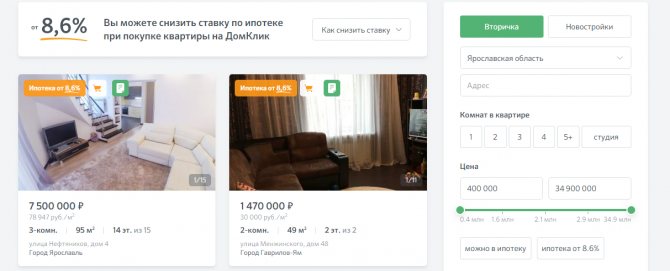

Selection of apartments in LC

Open the apartment selection tab in your account and look at the available options for purchasing a home.

To quickly find the option you need, use the selection (filter) options on the right.

First, indicate the region where you want to buy a home.

On the right side, select a secondary home or a new apartment you want to purchase, indicate how many rooms you need and indicate the price available to you and the conditions: with a mortgage or not.

Additional characteristics:

- kitchen area;

- total area of the apartment;

- floor;

- bathroom: combined or not;

- presence of a balcony.

If you need photos of the apartment, be sure to select the item with photo materials.

Based on the parameters you specify, the system will select apartments that meet your requirements.

All you have to do is look at them and decide on some purchase option.

Mortgage

To apply for a mortgage and calculate the cost, open the mortgage section. In your Personal Account you can get advice from specialists.

To calculate, you can use the calculator on the Domklik website.

The section contains links to obtain detailed information from Sberbank about a loan for the purchase of a home, and you can also find out about the conditions for reducing the interest rate.

Let's move on to the calculator itself.

Here you will need to indicate:

- purpose of lending;

- price;

- an initial fee;

- loan terms.

The purpose means the purchase of real estate:

- on the secondary market;

- apartments in houses under construction;

- country estate;

- refinancing;

- home construction;

- military mortgage;

- loan with government support.

At the bottom of the calculator are the conditions under which the client can achieve a reduction in the interest rate.

This includes:

- purchase on the Domklika service;

- reduction to 0.5% for bank clients who have a Sberbank salary card;

- for life insurance - 1% discount;

- when using the electronic registration service - 0.1%;

- for young parents a discount of up to 0.5% is possible.

Use every opportunity to get the lowest interest rate on a loan for the purchase of a property.

Functions and capabilities of the DomClick personal account

The advantage of the DomClick portal is its wide functionality. Sberbank provides clients with the following services:

- online mortgage calculator;

- data on all real estate objects;

- electronic transaction registration;

- technical support available at any time of the day;

- ordering a certificate from the Unified State Register of Real Estate;

- making mandatory monthly mortgage payments;

- legal and appraisal assessment of housing;

- convenient payment schedule.

Important! If the client has questions, doubts or misunderstandings about the rules for registering or paying off a mortgage, the client can always contact technical support in the portal’s personal account.

Selection of apartments in your personal account

In this section of the personal account, the client, using filters, can choose the appropriate option for future housing.

You can select an apartment on the map or by sorting. In the first case, the system will direct you to the Yandex. Maps”, where real estate options are marked with an approximate price and number of offers in the area.

Click on the price and you will see a complete list of offers in this house.

If the description suits you, click on the selected apartment. The system will display parameters and photos of the property.

In the “Filters” section, you can enter detailed desired parameters for your future apartment.

Submitting an online mortgage application with Domclick

Before applying for a loan, you need to apply for a mortgage. First, the system will provide approximate loan parameters for the selected property.

If you are satisfied with the conditions, proceed to filling out the application.

Next, upload scans of documents.

At the last stage, the system will offer to find the nearest Sberbank office. You can also add a co-borrower if necessary. Click "Submit Application".

Note! By sending a questionnaire to a financial institution for consideration, the client gives Sberbank the right to check his credit history and also use personal data.

Mortgage for families with two or more children

As part of the state support program for families with two or more children, Sberbank provides mortgages on special conditions. The main condition is that children must be born between 2020 and 2022.

The conditions of this lending program are presented in the table.

| Currency | Ruble |

| Duration, years | 1 — 30 |

| Amount, rub. | 300 000 — 12 000 000 |

| An initial fee | 0.2 |

| Insurance | Mandatory life and health insurance of the borrower, home insurance |

This program provides for the purchase of finished or under construction real estate.

For a young family

The program involves reducing mortgage rates by 0.4% on the secondary market for young families. Spouses must be no more than 35 years old. A family can be with or without children. Single-parent families with one parent and children are allowed to participate.

Lending terms:

| Currency | Ruble |

| Duration, years | 1 — 30 |

| Amount, rub. | 300 000 — 12 000 000 |

| Bid | From 8.8% |

| Insurance | Mandatory life and health insurance of the borrower, home insurance |

It is permissible to defer payments for three years at the birth of a child; for the birth of two children, the deferment will be up to 5 years.

Mortgage plus maternity capital

Maternity capital is state support for Russian families who will have a second and subsequent children. The certificate amount currently amounts to 453,026 rubles.

Program conditions:

- Purchase of a completed apartment. It is impossible to purchase real estate in a building under construction.

- The period between the preparation of documentation at the bank and the decision of the Pension Fund of the Russian Federation does not exceed six months.

- Taking out a mortgage without insurance increases the interest rate by 1%. Receiving your salary from another bank increases it by another 0.5%.

- The purchased housing must be divided.

The interest rate under this program varies between 8.6 - 9.5%. To increase the approved amount, it is recommended to invite two guarantors.

Military mortgage

The program is aimed at purchasing finished or under construction housing for military personnel. Mortgage terms are presented in the table.

| Currency | Ruble |

| Duration, years | 1 — 20 |

| Amount, rub. | up to 2,502,000 |

| Bid | From 9.5% |

| An initial fee | 0.15 |

To apply for a mortgage program from Sberbank, a military man must first participate in the savings system for 3 years, after which he can apply to purchase an apartment.

Answers on questions

On almost every page, in every section, at the bottom of the page there are questions with answers on various topics.

You can again use filtering:

- all questions;

- common topics;

- rate reduction and refinancing;

- real estate questions.

Before ordering an online call or writing a message to the service administration.

Look at ready-made answers to questions on a topic that interests you. Perhaps you will find the answer there.

Let's select the most frequently asked questions:

They refused the loan. What to do?

It is impossible to find out the reason for the refusal, since the bank does not explain them. But the letter sent to your address will indicate the deadline when you can re-apply for a loan. There are cases when an application can be resubmitted immediately after a refusal.

What documents are needed to apply for a mortgage?

To submit an application, it will be necessary to provide a passport and a reliable photo. Requirements for online photography can be found at the requirements link.

The borrower must document his income. For this purpose, a certificate in form 2-NDFL for the last six months of work is suitable.

The information in the provided certificate and in the passport must match. You can provide a certificate of income drawn up in a bank form.

The sample is available in the documents, it can be downloaded on the service itself or in your Personal Account.

For hired employees, a certified copy of the work record book is required.

For those who are unable to confirm income, you will have to provide:

- military ID;

- driver's license;

- international passport;

- serviceman's document;

- federal services employee ID.

For IP you will need:

- submitted declaration;

- enterprise registration document;

- license for the right to conduct activities (upon request).

Lawyers must have a certificate, and notaries must have an order of admission.

For married persons, a registration certificate will be required.

If the client has children under 18 years of age - birth certificate.

More detailed information can be obtained on the website or by calling the indicated telephone numbers to contact employees.

What benefits are available for participants in Sberbank salary projects?

This category of citizens can receive additional opportunities and benefits from Sberbank.

1. Discount on mortgage interest rate. Given if money is credited to a Sberbank card account in at least the last two months.

2. A simplified scheme for submitting documents to the bank for mortgage lending.

If salary funds were credited to the Sberbank card for at least 4 months out of 6, then you do not need to provide a certificate of income. You will also not need to provide a copy of your work record.

Who is a co-borrower?

Usually relatives act as co-borrowers. These could be parents, children, spouse, brothers, sisters. It is possible to enroll up to six people as co-borrowers.

The spouse is primarily assigned to this category. An exception may be when there is a prenuptial agreement.

Co-borrowers can increase your chances of getting a larger loan. The mortgage limit will be determined based on the number of borrowers and the documents provided by them.

The more information you provide about your co-borrowers, the higher the chance of approval from the bank and receiving a loan for a larger amount.

Attention! All information on this site is presented for informational purposes only. The site does not collect or process personal data. Federal Law No. 152-FZ of July 27, 2006 “On Personal Data” is not violated.

Download the Domklik application for android Download the Domklik application for iPhone

FAQ

DomKlik clients, especially newcomers, often have questions about applying for a mortgage, finding housing, and appraising real estate. Let's try to answer some of them.

What are the requirements for a mortgage borrower?

To obtain a mortgage, Sberbank sets its own conditions:

- age 21-65 years (Young Family program - no older than 35 years);

- official employment;

- stable income;

- Russian citizenship;

- positive credit history;

- work experience in one workplace for at least 180 days.

Mortgages are not issued to citizens registered at a drug dispensary or psychiatric hospital. Mortgage lending is not available to clients who have committed a criminal or administrative offense.

How to apply for a mortgage in your Sberbank personal account

To apply for a loan you need to submit an application for consideration. To do this, on the main page of the site, click “Mortgage”.

At the bottom of the page, select the “Choose a program” tab.

Complete your application in four steps.

Submit your application for review and wait for bank approval. Changes in the status of your application can be tracked in your personal account.

After approving the questionnaire, select the apartment you want to purchase. To do this, use the search and filters.

Having chosen housing, send the necessary documents. At this stage, you can order a premises assessment service. At the end of registration, select the nearest Sberbank office where you will come to sign documents.

How to apply for a mortgage

To provide documents to the bank, you just need to upload scans of them.

How long does it take to make a decision on a mortgage?

According to the bank's rules, a maximum of 5-8 days is allowed for consideration. During this time, the client's documentation package and his financial condition are checked. Preliminary approval of the application will come on average within 1-2 days.