Is it possible to get a loan in Russia?

Russian banks do not provide mortgage loans for the purchase of real estate in other countries of the world. First of all, due to the high cost of verification procedures for foreign real estate, which Russian banks would have to organize. As a result, interest rates, which are already 2-3 times higher than those of Western banks, would simply become sky-high.

There is a large group of countries where it is in principle possible for Russians to obtain a mortgage loan, but the requirements and procedures of banks in these countries are strict in relation to non-residents (primarily in relation to non-residents of the EU). In practice, this leads to a relatively low approval rate for mortgage loans for Russians. The above applies to Italy, Greece, Portugal, Czech Republic, USA, Turkey, Croatia, Finland.

It is in these cases that Russian banks come to the rescue. If it is fundamentally important for a buyer to purchase a foreign real estate property using a loan, but it is not possible to obtain a mortgage from a foreign bank, then Russians apply for a loan to a Russian bank - even if the interest on the loan is higher there.

Countries where it is difficult to get a mortgage loan

Many financial institutions in Western countries have tightened requirements for Russian resident clients. Market participants agree that the reason for this phenomenon is related to the difficulties of transferring money abroad. Another important factor is the legality of the origin of the money. Questions do not arise for a buyer who can prove with documents that he is using funds received from the sale of a previously existing home to purchase real estate. But if the applicant shows that the money was received for a certain service from the Seychelles, the bank may ask to provide a certificate confirming the payment of taxes.

The list of countries in which it is very difficult for our compatriots to obtain a mortgage loan is presented in the table.

| A country | Fixed rate, from | Duration, years | Size, up to |

| Great Britain | 4,5% | From 5 | 0.7 |

| Austria | 3,5% | Up to 25 | 0.6 |

| Switzerland | 1,75% | To 10 | 0.5 |

| Czech | 0.05 | Up to 35 | 0.6 |

| Italy | 3,5% | Up to 20 | 0.6 |

One more question cannot be ignored. Many Russians, having gone to work in Bulgaria, remain there for permanent residence. The employing company does not always provide housing to the employee, and if it does, it is often on unfavorable terms. Therefore, many decide to get their own apartment.

It should be noted that the conditions for long-term housing loans in Bulgaria are even more unfavorable, even in comparison with our country. This includes the presence of additional commissions and a relatively high rate (the value of the latter indicator in different banks varies between 7.1-15%). Although a mortgage in Bulgaria for Russians is a possible solution to the housing problem, these disadvantages are not offset by the rather low cost of apartments. Thus, as of mid-2020, the cost of one square meter of housing in this country fluctuated around 533 euros (about 630 dollars). For comparison: for the second half of 2020 in Russia, the standard for this parameter was set at 38,296 rubles (a little more than $650).

Thus, taking into account the additional costs, it is not profitable for our compatriot to take out a mortgage in Bulgaria. It’s better to take a closer look at developers offering installment payment services.

What is the price?

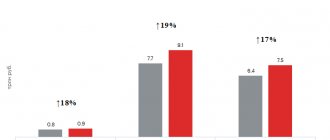

Real estate market experts agree on one thing: it is much more profitable to take out a mortgage loan to purchase foreign real estate from the foreign bank where the real estate is purchased. The average fixed mortgage rate in the EU and the USA was 3.5-6% per annum, the loan term was 30 years, the loan size was 60-80% of the value of the purchased property.

According to experts, the easiest places for Russians to get a loan are in the UK, Germany, Spain, Cyprus, France and Israel. The lowest rates on mortgage loans are observed in Finland and Israel (within 3.1-4.5% per annum). Mortgage rates in the “core” EU countries are also not high - on average 3.1% -5% per annum. The remaining conditions for granting loans are basically similar for developed countries.

Mortgage abroad. How can a Russian get a mortgage abroad?

25 Nov

2014 Contents

:

- Apartment with a mortgage abroad. pros

- Mortgage abroad. Conditions

- Documents required for obtaining a mortgage abroad:

- How to choose a property?

- How to get a mortgage abroad. Procedure for obtaining a loan

- Costs associated with purchasing property abroad

- Adviсe:

Do you want to buy an apartment abroad and take out a mortgage loan? Don't know where to start? Where to go, what documents are required, how to get a mortgage abroad? Read about all this in the article.

Apartment with a mortgage abroad. pros

By applying for a mortgage abroad and contacting a foreign bank, you will receive a number of advantages:

- Favorable interest rates (relative to similar lending conditions in Russian banks).

- The level of housing prices, and therefore the amount of the mortgage, is significantly lower than in Russia.

- To obtain a mortgage abroad, the same package of documents is required as in our country.

Mortgage abroad. Conditions

General characteristics of mortgage programs are as follows:

Currency: US Dollar, Euro or local.

Interest rate:

- fixed (established by agreement at a certain level);

- floating (changes every year);

- combined (constant for the first 3 years, then set depending on the policy of the foreign bank).

Loan term: from 5 years (installments) to 30 years.

Down payment: from 10%.

Conditions for early repayment:

- from the first month of payments;

- some time after the contract is signed (for example, after 6 months).

Property insurance conditions*:

- mandatory;

- optional.

*mortgage loan rate will be lower if you sign up for this service.

Documents required for obtaining a mortgage abroad:

- Your foreign passport.

- Salary certificate, employment contract with the employer or personal income tax certificate 3 (if you are an individual entrepreneur).

- An extract of your credit history (BKI reports or certificates from the bank where you repaid the loan).

- Documents confirming your status:

- certificate of ownership in Russia for an apartment, land plot, country house, car;

- availability of shares;

- bank statements on the movement of funds in the account.

You may need:

- Characteristics from your company (for example, that you have worked for this company for a long time and have established yourself as a responsible employee).

- Additional check of your solvency: monthly regular contributions to a deposit opened in a foreign bank. Such requirements are imposed, for example, when applying for a mortgage in Germany.

How to choose a property?

How to properly apply for a mortgage on an apartment so as not to make a mistake? First of all, choose appropriate accommodation. If your goal:

- family vacation or moving abroad - choose an apartment or cottage on the seashore, consult with your family.

- making a profit - thoroughly study the local real estate market and its trends, carefully weigh the pros and cons of your future purchase, consult with lawyers.

When applying for a mortgage in Europe, find out if there are any specific laws prohibiting actions that are usual for a Russian citizen. For example, in France you will not be able to build a fence to enclose your private beach. This is unacceptable by local standards.

How to get a mortgage abroad. Procedure for obtaining a loan

- Sign an agreement with a mortgage broker.

- Select the property and sign a preliminary purchase and sale agreement with the owner.

- Prepare the translation of the documents required for the transaction into the official language of the country of your choice.

- Have your property appraised by a company accredited by a foreign bank.

- Provide documents to the bank, fill out an application and wait for a decision.

- Sign the mortgage agreement after receiving a positive response from a foreign financial institution (financial institution).

- Obtain a certificate of ownership of foreign property.

Costs associated with purchasing property abroad

- Registration of passport and visa.

- Payment for the services of a notary, mortgage broker, lawyer (if advice on local legislation is required), translator (if you do not speak the local language.

- Cost of translation of documents required for submission to KFU.

- Costs associated with visiting the country to select real estate and complete the transaction.

- Commission services of a foreign bank for issuing a mortgage loan.

- The cost of opening and maintaining a special account intended for settlements on a mortgage transaction abroad.

- Property registration services.

Adviсe:

- By becoming the owner of a foreign apartment or villa, you can obtain a residence permit or become a citizen of this state. The conditions for obtaining citizenship depend on the specific country in which you purchased the property.

- Like any other loan, a mortgage issued abroad requires timely payments. If you do not comply with the deadlines, the KFU will take decisive action and your collateral apartment will be put up for auction for debts. For example, in Italy, this procedure is put into effect after only 7 cases of late payment.

- If you are at a loss when choosing property, are not familiar with local customs and are afraid of taking the wrong step, seek the help of professionals: lawyers, brokers, agents. These specialists know local laws and customs. They can explain in accessible, non-official language the contents of the documents you sign. An even better option is if these are your friends living in this country.

Countries with the most attractive mortgage conditions for Russians:

| A country | Size | Term | Bid |

| Great Britain | up to 70% | up to 20 years | from 3.3% |

| Germany | up to 60% | up to 20 years | from 3.9% |

| Spain | up to 60% | up to 40 years old | from 4.3% |

| Cyprus | up to 70% | up to 40 years old | from 3.6% |

| France | up to 80% | up to 25 years | from 2.9% |

| Israel | up to 60% | up to 30 years old | from 3.5% |

Where can I get a mortgage?

For Russian citizens, countries in which it is possible to purchase real estate with the help of borrowed funds can be divided into 2 groups: countries with the most favorable conditions and countries with a low probability of issuing a loan. Let's consider the conditions in more detail.

Countries with the best deals

Lending conditions for the most popular countries for obtaining foreign mortgages, which are characterized by a loyal attitude towards foreign borrowers, are given in the table below.

| A country | Interest rate | Deadline for settlement with bank | Down payment,% of the cost of housing | Peculiarities |

| Spain | 4 - 5% (when choosing a fixed percentage); 2 – 3% (floating rate) | Up to 30 years old | From 20 | The country's leading banks provide loans to foreigners, offering conditions comparable in their benefits to the conditions for the local population. |

| USA | From 5% per year | From 15 to 30 years | At least 30 | Russians with a work visa or green card with a stable income can get a mortgage in America. |

| Germany | 3 – 5% per annum | From 5 to 40 years | Not less than 40 | The largest German banks provide loans on favorable terms to both their citizens and non-residents. Russians will be able to take out a loan in the amount of 50 thousand euros with a repayment period of up to 40 years. |

| France | From 2.5% per year | From 5 to 20 years | From 30 | The minimum mortgage amount in France is 75 thousand euros. Both fixed and floating interest rates apply. |

| Türkiye | At least 6% per annum | Up to 20 years | From 25 | Mortgages in Turkey are issued by the largest banks in the country in Turkish lira, euros, US dollars and even rubles. Russians are treated with loyalty. |

The listed countries have increased attractiveness for our citizens in purchasing residential real estate due to low interest rates, prestige and the absence of strict requirements for clients.

Countries where it is difficult to get a mortgage

Here we can conditionally distinguish between states in which it is difficult to obtain a mortgage loan, and states in which it is almost impossible to do so.

Below is a table with the conditions for obtaining a mortgage in countries with strict requirements for foreign clients.

| A country | Interest rate | Deadline for settlement with bank | Down payment,% of the cost of housing | Peculiarities |

| Czech | 4 – 5% per year | 5 – 30 years | From 30 | A client with long-stay status in the country, who has a high income and the ability to deposit at least 30% of the price of the purchased property into a bank account will be able to obtain a loan for the purchase of Czech real estate. |

| Bulgaria | From 7 to 15% per annum | From 5 to 20 years | At least 30 | Mortgages in Bulgaria are issued in local currency (Bulgarian Lev). Foreign borrowers are subject to strict requirements. The greatest chance of getting a loan is for a young specialist who works in a local company and earns a high income. |

| Great Britain | 4 – 6% per year | From 5 to 35 years ( | From 30 | Mortgages in the UK for Russians have a lot of restrictions regarding the maximum loan amount, requirements and package of documents. Banks prefer to work with Russian investors and clients with an English residence permit. |

| Australia | From 4.5 | Up to 30 years old | From 40 | Mortgages in Australia are characterized by restrictions on the type of property purchased. Non-residents can buy mortgages in new buildings, but this will be quite difficult to do on the secondary market. A long-term work visa will also be required. |

Loans in Denmark, Switzerland, and Belgium are also in demand among Russians, but obtaining them will be difficult.

Among the countries that are practically inaccessible to Russian citizens in terms of obtaining a mortgage for housing, we can note:

- Italy.

Mortgages in Italy are issued with rates starting from 5% per annum and allow you to purchase real estate in prestigious areas of the country. However, extremely stringent requirements are imposed on Russian citizens here: they require a valid bank account (on which regular transactions are carried out for 2-3 years) and the presence of other real estate in the Eurozone.

- Japan.

Japan is a country with very high prices for residential real estate. The policy of banks here is aimed at stimulating mortgage lending for their citizens, and not for foreigners. Therefore, mortgages in Japan are practically unavailable for Russians.

- China.

There are also serious requirements for foreigners, which make obtaining a mortgage in China an extremely difficult procedure.

Attention! As for lending in friendly countries of the Near Abroad, namely mortgages in Armenia, Kyrgyzstan, Uzbekistan and other CIS countries, Russian borrowers are treated extremely loyally and kindly here. Due to financial openness between countries, it is also easy to obtain a mortgage in Belarus.

Minuses

To obtain a mortgage, you will have to incur large travel costs to visit the country where the property is located. It is important to eliminate visa problems - if you do not have permission to visit a foreign country, it makes no sense to buy real estate there. In addition, if you do not know the local language, you will have to pay for document translation and consulting services. These problems can be solved by a real estate agency, which will have to pay a percentage of the transaction.

Despite certain difficulties and inconveniences when obtaining a mortgage for foreign real estate, your money and nerves will pay off handsomely, since today they offer conditions abroad that are more favorable than in Russia.

Advice to Sravni.ru: There are always companies abroad founded by Russians. Contact them - it will be easier to complete the mortgage transaction.