Bank AK Bars

AK Bars is one of the largest Russian universal banks, occupying a strong position in the market of financial and credit services. It issues loans, provides settlement and cash services to legal entities, attracts funds from clients for deposits, buys and sells securities. Today, the AK Bars branch network has 249 offices located in 134 locations in Russia.

Requirements for the borrower and real estate

The borrower must meet the minimum requirements put forward by the organization:

- Russian citizenship, permanent or temporary registration;

- age from 18 to 70 years at the end of the mortgage agreement;

- official employment and at least 3 months of experience in the current workplace.

The purchased real estate is also subject to restrictions:

- wear and tear is no more than 50%, the building should not be on the waiting list for major repairs, demolition or reconstruction;

- cement, reinforced concrete, stone or brick foundation;

- consent of the insurance company to accept the object for insurance;

- the apartment building must be located in the cities where the bank’s territorial divisions are located, or in the nearest populated areas - from 100 to 300 km. (depending on the region).

AK Bars Bank mortgage programs: conditions

The bank's mortgage line is represented by a variety of offers. Thanks to this, borrowers of any category can find the best option. Using borrowed funds, you can purchase real estate in residential and commercial buildings, in new buildings, under construction, or in the secondary market.

Secondary

Potential borrowers of AK Bars Bank have the opportunity to become owners of finished housing on the secondary market.

With the Megapolis program, you can take out a mortgage for a room or apartment in the secondary residential sector. Loan terms range from one year to twenty-five years. The smallest amount of a loan agreement is 500 thousand rubles. The down payment must be 10% of the value of the mortgaged property.

If maternity capital funds are used to purchase an apartment, the first payment may not be required. For business owners and individual entrepreneurs, the maximum possible loan amount is 15 million rubles.

A mortgage from AK Bars Apartments Bank is intended for the purchase of non-residential premises under construction in multifunctional buildings or multi-storey residential buildings. The main condition is accreditation of the developer company by AK Bars. The minimum loan amount is 500 thousand rubles, the maximum is 15 million rubles.

The down payment must be higher than 20% of the price of the apartment purchased with a mortgage. Real estate purchased under the “Apartments” program and the rights of claim under the investment agreement become collateral.

Important! The property must have a degree of completion of at least 10% for a multi-story building, and at least 25% for a low-rise building.

New building

You can buy a new home with the Perspective program. The amount of the down payment is from 10% to 80% of the total cost of the property that is planned to be purchased with a mortgage. The interest rate depends on the degree of readiness of the property for use and does not change throughout the entire term of the loan agreement. The degree of readiness must be more than 30% and is determined by the bank. The mortgaged property becomes collateral for the loan until the date of full fulfillment of obligations under it.

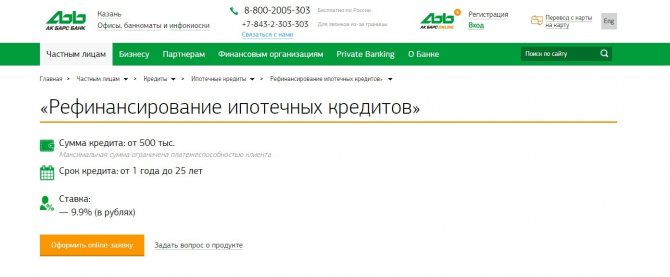

Mortgage refinancing

Borrowers from other banks can profitably re-issue a mortgage and reduce the interest rate on it. This can be done by participating in the mortgage loan refinancing program of AK Bars Bank. Residential properties that are eligible for this program:

- Apartment in a multi-storey building;

- A plot of land with a residential building;

- Townhouse with land.

The maximum mortgage amount depends on the borrower's ability to pay. However, it cannot exceed 90% of the assessed value of the property. Also, it should not be more than the amount of the remaining debt and interest on the refinanced mortgage. Before the refinancing agreement is executed, the loan is secured by an increased interest rate, after which it is secured by the mortgaged property.

Basic requirements for a loan that the borrower plans to refinance at AK Bars Bank:

- You do not need the approval of the creditor bank to transfer real estate as collateral;

- Restructuring and deferments were not formalized for the loan that is supposed to be refinanced;

- Housing owned by the borrower;

- Property under completed construction;

- Six loan payments were made;

- There are no unpaid or overdue debts;

- The main borrower cannot be replaced;

- Part of the debt was not repaid with money from maternity capital.

Loan repayment is carried out only by annuity payments.

Family mortgage

Young families with and planning children can purchase their own housing in a new building or a house under construction with a mortgage on preferential terms at 6% per annum. The loan amount is from 500 thousand to three million rubles, for residents of Moscow and St. Petersburg - up to eight million rubles. It should cover up to 80% of the cost of the purchased housing. That is, the down payment must be at least 20%.

The preferential 6 percent rate is valid for the first three years after the birth of the second child in the period from 2020 to 2022. At the birth of the third child, the period of validity of the preferential rate increases to 8 years. After this period, the interest rate is set at 2% higher than the key rate of the Central Bank on the date of signing the loan agreement. If the borrower refuses life, health, property insurance, the rate will increase by another 5%.

Important! The seller of the apartment must be a legal entity!

Construction of a private house

The Comfort mortgage lending program is provided for borrowers planning to purchase a plot of land and build a house, cottage or townhouse on it. The possible loan amount is from 500 thousand rubles, but not more than 80% of the cost of the purchased plot (up to 100% when raising maternity capital funds). The interest rate has been increased by 0.5% for individual entrepreneurs and business owners.

Commercial real estate

AK Bars Bank has a “Business” mortgage program especially for business owners and their own businesses. It provides for the purchase of commercial real estate with a 30 percent down payment. A property purchased with a mortgage becomes collateral until the debt on it is fully repaid.

General conditions and features of mortgages at Ak Bars Bank

The bank offers 6 mortgage programs designed for different types of real estate. The maximum loan amount from this bank depends on the client’s solvency. In some cases, the mortgage size can reach 12-20 million rubles.

Interest rates also vary. They largely depend on the size of the down payment. In addition, the borrower is given the opportunity to reduce the overpayment. To do this, you need to provide additional collateral or several additional documents.

The greatest demand in this bank is the Megapolis program, designed for buyers of secondary housing. Here you can take out a loan in small amounts (from 500 thousand rubles) and for a very long period.

Ak Bars does not lag behind its competitors in that it offers to refinance mortgages taken from other banks. Let's consider the conditions of various mortgage programs of Ak Bars Bank in more detail.

AK Bars Bank mortgage interest rates in 2020

| Type of mortgage loan | Minimum interest rate |

| "Perspective" | 8% |

| "Mortgage refinancing" | 9,9% |

| "Family Mortgage" | 6% |

| "Megapolis" | 10,2% |

| "Apartments" | 9,5% |

| "Comfort" | 10,3% |

| "Business" | 14,5% |

| "Perspective Plus" | 12,1% |

Allowances and additional options

Borrowers who have obtained a mortgage under the Comfort and Megapolis programs are participating in a special promotion. They receive a discount of 0.3% from the established interest rate from the bank. It is combined with other bonuses provided to certain categories of borrowers.

Interest rates and mortgage terms of Ak Bars Bank

The minimum interest rate under Ak Bars Bank programs is 6%. Issued on a mortgage with state support for families with children and raising maternity capital. The maximum percentage is 12.9% - issued for the purchase of commercial real estate. For many programs, you can reduce the rate by 1% if you sign up for a personal insurance contract.

The size of the loan and the terms of the loan, the terms of the mortgage may vary depending on the program. The terms for which you can get a mortgage loan can range from 1 to 25 years, and the size – no more than 20 million rubles.

Mortgage calculator AK Bars Bank

Loan amount

Payment type

Interest rate, %

Maternal capital

date of issue

Credit term

Early repayments

| date | Type | Amount/rate | |

Schedule

Table

| Term | 0 months |

| Sum | 0 rub. |

| Bid | 0 % |

| Overpayment | 0 rub. |

| Start of payments | 0 |

| End of payments | 0 |

| Required Income | 0 |

| № | date | Payment | Main debt | Interest | Balance owed | Early repayments |

On our website you can calculate the optimal monthly payment amount, loan term and interest rate using the AK Bars Bank mortgage calculator . All calculations are carried out taking into account the requirements for borrowers, the conditions for issuing mortgage funds and the amount of funds available for the down payment.

Mortgage calculator Ak Bars. Online mortgage calculation Ak Bars 2020.

- Mortgage calculator online

- AK Bars

Select a mortgage loan Ak Bars for online calculator calculation

Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 8% — up to 25 years Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 9.9% — up to 25 years Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 10.2% — up to 25 years Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 11.8% — up to 25 years Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 12.1% — up to 25 years Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 14.5% 10 000 000 up to 15 years Currency Min. bid Max. sum Max. term Commissions Peculiarities rubles 17% — up to 6 months

36 398

1 367 793

4 367 793

| payment date | Principal payment | Duty | Interest payment | Interest | Monthly payment | Remainder | Principal balance |

| October 2020 | 16 398,28 | 20 000,00 | 36 398,28 | 2 983 601,72 | |||

| November 2020 | 16 507,60 | 19 890,68 | 36 398,28 | 2 967 094,12 | |||

| December 2020 | 16 617,65 | 19 780,63 | 36 398,28 | 2 950 476,47 | |||

| January 2021 | 16 728,44 | 19 669,84 | 36 398,28 | 2 933 748,04 | |||

| February 2021 | 16 839,96 | 19 558,32 | 36 398,28 | 2 916 908,08 | |||

| March 2021 | 16 952,22 | 19 446,05 | 36 398,28 | 2 899 955,85 | |||

| April 2021 | 17 065,24 | 19 333,04 | 36 398,28 | 2 882 890,61 | |||

| May 2021 | 17 179,01 | 19 219,27 | 36 398,28 | 2 865 711,61 | |||

| June 2021 | 17 293,53 | 19 104,74 | 36 398,28 | 2 848 418,07 | |||

| July 2021 | 17 408,82 | 18 989,45 | 36 398,28 | 2 831 009,25 | |||

| August 2021 | 17 524,88 | 18 873,39 | 36 398,28 | 2 813 484,36 | |||

| September 2021 | 17 641,72 | 18 756,56 | 36 398,28 | 2 795 842,65 | |||

| October 2021 | 17 759,33 | 18 638,95 | 36 398,28 | 2 778 083,32 | |||

| November 2021 | 17 877,72 | 18 520,56 | 36 398,28 | 2 760 205,60 | |||

| December 2021 | 17 996,91 | 18 401,37 | 36 398,28 | 2 742 208,69 | |||

| January 2022 | 18 116,89 | 18 281,39 | 36 398,28 | 2 724 091,80 | |||

| February 2022 | 18 237,67 | 18 160,61 | 36 398,28 | 2 705 854,14 | |||

| March 2022 | 18 359,25 | 18 039,03 | 36 398,28 | 2 687 494,89 | |||

| April 2022 | 18 481,65 | 17 916,63 | 36 398,28 | 2 669 013,24 | |||

| May 2022 | 18 604,86 | 17 793,42 | 36 398,28 | 2 650 408,38 | |||

| June 2022 | 18 728,89 | 17 669,39 | 36 398,28 | 2 631 679,49 | |||

| July 2022 | 18 853,75 | 17 544,53 | 36 398,28 | 2 612 825,75 | |||

| August 2022 | 18 979,44 | 17 418,84 | 36 398,28 | 2 593 846,31 | |||

| September 2022 | 19 105,97 | 17 292,31 | 36 398,28 | 2 574 740,34 | |||

| October 2022 | 19 233,34 | 17 164,94 | 36 398,28 | 2 555 506,99 | |||

| November 2022 | 19 361,57 | 17 036,71 | 36 398,28 | 2 536 145,43 | |||

| December 2022 | 19 490,64 | 16 907,64 | 36 398,28 | 2 516 654,79 | |||

| January 2023 | 19 620,58 | 16 777,70 | 36 398,28 | 2 497 034,21 | |||

| February 2023 | 19 751,38 | 16 646,89 | 36 398,28 | 2 477 282,82 | |||

| March 2023 | 19 883,06 | 16 515,22 | 36 398,28 | 2 457 399,76 | |||

| April 2023 | 20 015,61 | 16 382,67 | 36 398,28 | 2 437 384,15 | |||

| May 2023 | 20 149,05 | 16 249,23 | 36 398,28 | 2 417 235,10 | |||

| June 2023 | 20 283,38 | 16 114,90 | 36 398,28 | 2 396 951,72 | |||

| July 2023 | 20 418,60 | 15 979,68 | 36 398,28 | 2 376 533,12 | |||

| August 2023 | 20 554,72 | 15 843,55 | 36 398,28 | 2 355 978,40 | |||

| September 2023 | 20 691,76 | 15 706,52 | 36 398,28 | 2 335 286,64 | |||

| October 2023 | 20 829,70 | 15 568,58 | 36 398,28 | 2 314 456,94 | |||

| November 2023 | 20 968,57 | 15 429,71 | 36 398,28 | 2 293 488,38 | |||

| December 2023 | 21 108,36 | 15 289,92 | 36 398,28 | 2 272 380,02 | |||

| January 2024 | 21 249,08 | 15 149,20 | 36 398,28 | 2 251 130,94 | |||

| February 2024 | 21 390,74 | 15 007,54 | 36 398,28 | 2 229 740,20 | |||

| March 2024 | 21 533,34 | 14 864,93 | 36 398,28 | 2 208 206,86 | |||

| April 2024 | 21 676,90 | 14 721,38 | 36 398,28 | 2 186 529,96 | |||

| May 2024 | 21 821,41 | 14 576,87 | 36 398,28 | 2 164 708,55 | |||

| June 2024 | 21 966,89 | 14 431,39 | 36 398,28 | 2 142 741,66 | |||

| July 2024 | 22 113,33 | 14 284,94 | 36 398,28 | 2 120 628,33 | |||

| August 2024 | 22 260,76 | 14 137,52 | 36 398,28 | 2 098 367,57 | |||

| September 2024 | 22 409,16 | 13 989,12 | 36 398,28 | 2 075 958,41 | |||

| October 2024 | 22 558,56 | 13 839,72 | 36 398,28 | 2 053 399,85 | |||

| November 2024 | 22 708,95 | 13 689,33 | 36 398,28 | 2 030 690,91 | |||

| December 2024 | 22 860,34 | 13 537,94 | 36 398,28 | 2 007 830,57 | |||

| January 2025 | 23 012,74 | 13 385,54 | 36 398,28 | 1 984 817,83 | |||

| February 2025 | 23 166,16 | 13 232,12 | 36 398,28 | 1 961 651,67 | |||

| March 2025 | 23 320,60 | 13 077,68 | 36 398,28 | 1 938 331,07 | |||

| April 2025 | 23 476,07 | 12 922,21 | 36 398,28 | 1 914 855,00 | |||

| May 2025 | 23 632,58 | 12 765,70 | 36 398,28 | 1 891 222,42 | |||

| June 2025 | 23 790,13 | 12 608,15 | 36 398,28 | 1 867 432,29 | |||

| July 2025 | 23 948,73 | 12 449,55 | 36 398,28 | 1 843 483,56 | |||

| August 2025 | 24 108,39 | 12 289,89 | 36 398,28 | 1 819 375,17 | |||

| September 2025 | 24 269,11 | 12 129,17 | 36 398,28 | 1 795 106,06 | |||

| October 2025 | 24 430,90 | 11 967,37 | 36 398,28 | 1 770 675,16 | |||

| November 2025 | 24 593,78 | 11 804,50 | 36 398,28 | 1 746 081,38 | |||

| December 2025 | 24 757,74 | 11 640,54 | 36 398,28 | 1 721 323,64 | |||

| January 2026 | 24 922,79 | 11 475,49 | 36 398,28 | 1 696 400,86 | |||

| February 2026 | 25 088,94 | 11 309,34 | 36 398,28 | 1 671 311,92 | |||

| March 2026 | 25 256,20 | 11 142,08 | 36 398,28 | 1 646 055,72 | |||

| April 2026 | 25 424,57 | 10 973,70 | 36 398,28 | 1 620 631,15 | |||

| May 2026 | 25 594,07 | 10 804,21 | 36 398,28 | 1 595 037,07 | |||

| June 2026 | 25 764,70 | 10 633,58 | 36 398,28 | 1 569 272,38 | |||

| July 2026 | 25 936,46 | 10 461,82 | 36 398,28 | 1 543 335,91 | |||

| August 2026 | 26 109,37 | 10 288,91 | 36 398,28 | 1 517 226,54 | |||

| September 2026 | 26 283,43 | 10 114,84 | 36 398,28 | 1 490 943,11 | |||

| October 2026 | 26 458,66 | 9 939,62 | 36 398,28 | 1 464 484,45 | |||

| November 2026 | 26 635,05 | 9 763,23 | 36 398,28 | 1 437 849,40 | |||

| December 2026 | 26 812,62 | 9 585,66 | 36 398,28 | 1 411 036,79 | |||

| January 2027 | 26 991,37 | 9 406,91 | 36 398,28 | 1 384 045,42 | |||

| February 2027 | 27 171,31 | 9 226,97 | 36 398,28 | 1 356 874,11 | |||

| March 2027 | 27 352,45 | 9 045,83 | 36 398,28 | 1 329 521,66 | |||

| April 2027 | 27 534,80 | 8 863,48 | 36 398,28 | 1 301 986,86 | |||

| May 2027 | 27 718,37 | 8 679,91 | 36 398,28 | 1 274 268,49 | |||

| June 2027 | 27 903,16 | 8 495,12 | 36 398,28 | 1 246 365,34 | |||

| July 2027 | 28 089,18 | 8 309,10 | 36 398,28 | 1 218 276,16 | |||

| August 2027 | 28 276,44 | 8 121,84 | 36 398,28 | 1 189 999,73 | |||

| September 2027 | 28 464,95 | 7 933,33 | 36 398,28 | 1 161 534,78 | |||

| October 2027 | 28 654,71 | 7 743,57 | 36 398,28 | 1 132 880,07 | |||

| November 2027 | 28 845,74 | 7 552,53 | 36 398,28 | 1 104 034,32 | |||

| December 2027 | 29 038,05 | 7 360,23 | 36 398,28 | 1 074 996,27 | |||

| January 2028 | 29 231,64 | 7 166,64 | 36 398,28 | 1 045 764,63 | |||

| February 2028 | 29 426,51 | 6 971,76 | 36 398,28 | 1 016 338,12 | |||

| March 2028 | 29 622,69 | 6 775,59 | 36 398,28 | 986 715,43 | |||

| April 2028 | 29 820,18 | 6 578,10 | 36 398,28 | 956 895,25 | |||

| May 2028 | 30 018,98 | 6 379,30 | 36 398,28 | 926 876,28 | |||

| June 2028 | 30 219,10 | 6 179,18 | 36 398,28 | 896 657,17 | |||

| July 2028 | 30 420,56 | 5 977,71 | 36 398,28 | 866 236,61 | |||

| August 2028 | 30 623,37 | 5 774,91 | 36 398,28 | 835 613,24 | |||

| September 2028 | 30 827,52 | 5 570,75 | 36 398,28 | 804 785,72 | |||

| October 2028 | 31 033,04 | 5 365,24 | 36 398,28 | 773 752,68 | |||

| November 2028 | 31 239,93 | 5 158,35 | 36 398,28 | 742 512,75 | |||

| December 2028 | 31 448,19 | 4 950,09 | 36 398,28 | 711 064,56 | |||

| January 2029 | 31 657,85 | 4 740,43 | 36 398,28 | 679 406,71 | |||

| February 2029 | 31 868,90 | 4 529,38 | 36 398,28 | 647 537,81 | |||

| March 2029 | 32 081,36 | 4 316,92 | 36 398,28 | 615 456,45 | |||

| April 2029 | 32 295,24 | 4 103,04 | 36 398,28 | 583 161,22 | |||

| May 2029 | 32 510,54 | 3 887,74 | 36 398,28 | 550 650,68 | |||

| June 2029 | 32 727,27 | 3 671,00 | 36 398,28 | 517 923,41 | |||

| July 2029 | 32 945,46 | 3 452,82 | 36 398,28 | 484 977,95 | |||

| August 2029 | 33 165,09 | 3 233,19 | 36 398,28 | 451 812,86 | |||

| September 2029 | 33 386,19 | 3 012,09 | 36 398,28 | 418 426,67 | |||

| October 2029 | 33 608,77 | 2 789,51 | 36 398,28 | 384 817,90 | |||

| November 2029 | 33 832,83 | 2 565,45 | 36 398,28 | 350 985,07 | |||

| December 2029 | 34 058,38 | 2 339,90 | 36 398,28 | 316 926,69 | |||

| January 2030 | 34 285,43 | 2 112,84 | 36 398,28 | 282 641,26 | |||

| February 2030 | 34 514,00 | 1 884,28 | 36 398,28 | 248 127,26 | |||

| March 2030 | 34 744,10 | 1 654,18 | 36 398,28 | 213 383,16 | |||

| April 2030 | 34 975,72 | 1 422,55 | 36 398,28 | 178 407,44 | |||

| May 2030 | 35 208,90 | 1 189,38 | 36 398,28 | 143 198,54 | |||

| June 2030 | 35 443,62 | 954,66 | 36 398,28 | 107 754,92 | |||

| July 2030 | 35 679,91 | 718,37 | 36 398,28 | 72 075,01 | |||

| August 2030 | 35 917,78 | 480,50 | 36 398,28 | 36 157,23 | |||

| September 2030 | 36 157,23 | 241,05 | 36 398,28 | -0,00 |

The Ak Bars online mortgage calculator will calculate all the data.

We have added the ability to select the Ak Bars mortgage lending program so that you can immediately start calculating and not have to think about what percentage to set.

Rate data is updated daily, so you can be confident that interest rates and Ak Bars mortgage programs are up to date.

You only need to indicate the amount you want to borrow and select the mortgage term. By changing this data, you can select online the necessary parameters of a mortgage loan, which you will be comfortable paying monthly.

Advantages of our Ak Bars mortgage calculator:

- Free, no registration required

- Formula for calculating monthly payments Ak Bars

- We regularly update data on conditions and interest rates for calculating a mortgage loan in Ak Bars in 2020.

- Ak Bars mortgage calculator calculates both annuity and differentiated payments

To make a mortgage loan as profitable as possible for you, you should use our special financial tool - the Ak Bars online mortgage calculator. It will help you:

- Select the Ak Bars mortgage lending program. Get interest rates

- Choose the optimal monthly payment amount based on your income

- Get detailed information about payments (how much you pay on interest, how much on principal)

- Calculate the possibility of early repayment of the mortgage

Who is our Ak Bars mortgage calculator suitable for:

- For individual entrepreneurs

- For pensioners

- For individuals

- For legal entities

- Of course, Ak Bars provides the most favorable conditions for salary card holders

We use the Ak Bars consumer loan calculation formula, so you can be confident in the results of loan repayment.

If you need to calculate a consumer loan in Ak Bars, use the Ak Bars loan calculator for 2020

Requirements for the borrower

To obtain a mortgage loan from AK Bars Bank, the borrower must meet the following requirements:

- Age from 18 to 70 years;

- Temporary or permanent registration in Russia;

- Minimum three months of work experience at the last place of work;

- The total length of service over the past five years is at least one year.

No more than four individuals can act as additional borrowers. Their income will be taken into account when determining the maximum amount of borrowed funds issued.

AK Bars Bank mortgage

Redemption

A previously issued loan for the acquisition/construction of a residential real estate property (apartments in an apartment building, a residential building with a land plot, a townhouse with a land plot) from other credit organizations. A previously issued loan for the acquisition/construction of a residential real estate property together with other loans (consumer loans, car loans, credit cards/overdrafts) other credit organizations Also, together with the above purposes, it is possible to provide an additional amount for personal purposes

Requirements

- Citizen of the Russian Federation

- The age limit at the end of the loan agreement is 70 years.

- Minimum age 18 years

- Permanent or temporary registration on the territory of the Russian Federation at the time of submitting documents

If the Borrower is a male person under the age of 27 who does not have documents confirming a deferment from military service until the age of 27 or dismissal from military service with enlistment in the reserves, then issuing a loan to such a Borrower is possible, subject to the involvement of an additional Borrower (s) who are not subject to conscription for military service and have a confirmed income.

The assessment of the borrowers' solvency is made without taking into account the income and expenses of the person subject to conscription

Permanent employment: total work experience and work experience at the last place of work must be at least 3 months

If the Borrower is an individual entrepreneur/business owner, the activity must be carried out for at least 12 months. In this case, the employing organization can be organizations registered in the Russian Federation and foreign companies with branches and representative offices in the Russian Federation. If it is necessary to attract “Co-borrowers” under a loan agreement, the requirements for the “Co-borrower” are identical to the requirements for the Borrower

Requirements for the subject of collateral

Residential A property in a multi-apartment residential building must meet the following requirements:

- Free from any restrictions (encumbrances) of rights to it, incl. rights of third parties, with the exception of the right of residence (use) of family members of the owner-mortgagor

- Located in the cities where the territorial divisions of PJSC "AK BARS" Bank are located (or the nearest settlements located at a distance of no more than 100 km from them)

- Registered with the state registration authorities of real estate rights and transactions with it in accordance with current legislation

- Have a separate bathroom from other apartments or houses (this requirement does not apply to cases where the purchased Property is a room)

- Should not be located in multi-apartment buildings of the barracks type, wooden type (including prefabricated panel buildings)

- Should not be located in the basement of a building

Requirements for the building in which the property is located:

The building in which the Property is located, built in 1956 or older, must meet the following requirements:

- Not in a state of disrepair

- Not registered for major repairs, reconstruction with resettlement, demolition

- At the time of issuing the loan, the insurance company’s consent must be provided to accept insurance

- Property No requirements apply to buildings built in 1957 or younger

A property in the form of a detached residential building (cottage for permanent residence)/townhouse (blocked building) must meet the following requirements:

- Located in the cities where the territorial divisions of PJSC AK BARS Bank are located (or the nearest populated areas located at a distance of no more than 100 km from them1)

- Be located in a populated area on the territory of which there are other houses (individual, multi-apartment) suitable for living

- Have an access road that provides year-round access to the land plot on which a detached residential building is located (cottage for permanent residence)

- The percentage of wear is no more than 50% (and no more than 40% - if the walls of the Property are made using wooden materials (according to the conclusion of the Collateral Examination Unit / Evaluation Report of an independent appraiser)

- Be suitable for year-round living Have a constant power supply from an external source

- Be provided with a gas or electric heating system (real estate properties with only stove heating are not accepted as collateral for a mortgage loan if this is the main source of heating), as well as cold water supply (including autonomous)

- For newly built real estate, it is allowed to lack sanitary equipment and interior decoration, connecting the residential building to water, gas supply, and heating systems

- Be in satisfactory condition, free from defects in structural elements and engineering equipment that could lead to an accident at home

- Do not belong to the category of dilapidated housing

- Have a cement, reinforced concrete, stone or brick foundation

- Lending is possible only simultaneously with the land plot

Package of mortgage documents

The standard list of documents required when applying for any type of mortgage loan includes:

- Application form;

- Passport of a citizen of the Russian Federation or other document recognized as an identity document;

- A document confirming the presence of a permanent place of work and income;

- SNILS;

- Military ID;

- Certificate of marriage or divorce;

- Certificate of registration (if it is temporary);

- Marriage agreement (if any).

The bank may request any additional certificates and documents that are necessary to make a decision on the application. Providing them will increase the chances of receiving a positive response. Documents on the property that is planned to be purchased with a mortgage can be provided to the bank after receiving preliminary approval.

Pros and cons of a loan here

Advantages of a mortgage loan from AK Bars Bank:

- short work experience at the current place;

- down payment – from 10% of the cost of the property;

- the opportunity to use maternity capital, participation in the state program for families with children;

- large selection of mortgage programs;

- promotions and special offers;

- submitting an application online.

It is enough to have a short work experience, officially confirmed income that allows you to repay the loan, and the amount of the down payment. It is convenient that the future borrower can choose the most profitable lending program, calculate a convenient repayment period and the amount of the monthly payment without leaving home. You can immediately submit an application on the website and receive a preliminary decision on it.

AK Bars is attractive for young parents who want to spend their maternity capital on improving their living conditions and get a mortgage with government support. Collecting the necessary documents may cause some difficulties, since their list is quite large compared to other banks.

Flaws:

- a large list of documents for obtaining a loan;

- a significant increase in rates upon refusal of insurance;

- increasing the cost of mortgages for entrepreneurs.

A mortgage at AK Bars is affordable for many citizens of our country. This is a large and stable financial organization, the reliability of which has been confirmed by leading rating agencies. Those who are planning to take out a mortgage and are looking for convenient options can be advised to pay close attention to AK Bars Bank.

Insurance

When issuing a mortgage loan, you can take out two types of insurance – personal and property. Mortgage property insurance is mandatory for the entire period of validity of the mortgage agreement.

A personal insurance policy is purchased voluntarily by the borrower and protects against risks associated with accidents and illnesses.

Important! If the client refuses personal insurance, the mortgage interest rate will be 1% higher than the established one.

Insurance organizations accredited by AK Bars Bank to provide its borrowers with services for all types of insurance:

- AK BARS Insurance;

- NASCO;

- AlfaStrakhovanie;

- SOGAZ;

- Agreement;

- RESO-Garantiya;

- Military Insurance Company;

- Zetta Insurance;

- SAC "Energogarant";

- SPAO "Ingosstrakh"

If desired, the borrower may choose another insurance company not included in this list. But it is necessary to check the organization’s compliance with all the requirements of AK Bars Bank.

Mortgage calculator

Ak Bars Bank's mortgage calculator allows the future borrower to obtain information on the loan agreement and correctly calculate the budget for the years ahead. A mortgage loan is a loan that must be repaid for more than one year, so it is important not only to calculate the financial capabilities of the future borrower, but also to choose a bank.

Public joint stock company Ak Bars has been operating in Russia since 1993. The bank provides more than 100 types of services for both corporate and private clients. Today, there are more than 230 Ak Bars Bank offices throughout the country and more than 3 million individuals have already used the organization’s services.

Ak Bars Bank's online calculator is a tool for calculating the costs of a future mortgage loan. To work with the service, the user needs to know the following information:

- loan size;

- mortgage term;

- percent;

- the amount of the down payment on housing.

This is the main information on which calculations are made. The source data can be changed during the calculation process.

Pros and cons of a mortgage at Ak Bars Bank

When it is difficult to choose a specific financial institution, it is worth weighing all the advantages and disadvantages of obtaining a mortgage loan from it.

Advantages of obtaining a mortgage at AK Bars Bank:

- Short period of required work experience;

- Wide age range of clients;

- A small amount for a down payment;

- Some programs may use money from maternity capital;

- You can attract up to four co-borrowers.

The disadvantages include an increase in the mortgage interest rate in case of refusal to take out a personal insurance policy and a rather impressive list of necessary documents.

Advantages and disadvantages of a mortgage at Ak Bars Bank

Before you finally decide on the bank from which to take out a mortgage, you should carefully study the reviews of existing clients and understand all the pros and cons of a particular institution.

Advantages:

- A short period of work experience in your current position is required.

- A high down payment is not required - starting from 10% of the cost of the property.

- High maximum loan amount - up to 20 million rubles.

- A large number of mortgage programs, which allows almost every borrower to find a product that is ideal for them.

- It is possible to make maternity capital as a down payment.

- You can attract up to four co-borrowers. This increases the chances of getting a mortgage for clients with low wages.

Flaws:

- The first and very significant disadvantage of loans from this bank is a significant increase in the interest rate if the client refuses voluntary insurance.

- A large list of documents for a mortgage - some competitors provide a loan based on only 2-3 documents.

- Increase in interest rate for entrepreneur borrowers.

- Another drawback that is noted by quite a large number of clients is that credit managers are trying their best to impose insurance on the property through Ak Bars. In this case, it is worth remembering that no bank has the right to dictate to its clients where to take out insurance.

Customer reviews about mortgages at AK Bars Bank

- Two months ago I applied for a mortgage with AK Bars. The staff pleased us with their friendly attitude and assistance at all stages of the loan agreement. I had to leave for another city for personal reasons, I sent all the necessary certificates by fax. Now I visit a bank branch when I make my monthly payment. And they always greet me politely, quickly serve me and patiently answer all my questions. Thanks to the bank and its professional employees!

- I took out a mortgage loan in September 2014. Fortunately, there were no problems or hiccups. Judging by reviews of other banks, registration at AK Bars takes a little longer, probably due to the fact that all requests and documents go through the main office in Kazan. The loan manager always answered all my questions and doubts that I asked both by email and by phone. Of the three banks accredited for a mortgage specifically for the new building in which I wanted to live, it was AK Bars that offered the most favorable conditions - low interest rate, cost of insurance, transfer of money to the development company without charging a commission, the ability to provide documents by e-mail. A small minus is the fact that on the day of drawing up the loan agreement, they did not print out the payment schedule for technical reasons. So I came for him again the next day. But in general, the impressions of cooperation with AK Bars Bank are the most pleasant and positive.

- She was a client of AK Bars Bank from 2013 until recently. Yes, precisely in the past tense, since a few days later I fully paid off my mortgage loan debt. I believe that the mortgage department employs highly qualified employees. Everything was organized clearly, without delays - from submitting an application to returning the mortgage. There was no need to wait for documents for weeks, as my friends suffered at another well-known bank. The feedback with the client is excellent, always timely informing about all changes, new products, maps. They gave me a free card, advised me in detail about all its capabilities, and told me how to top up my account from a third-party bank card without commission. Thanks to the staff of AK Bars for prompt and high-quality work and for saving my personal time!

- I have been serviced by AK Bars for three and a half years. My husband and I took out a mortgage, the whole procedure took a little over a month. The interest rate is real, no tricks. The conditions are truly transparent and open, there are no hidden fees or commissions. Managers and operations officers work efficiently and without delay. They are always friendly and explain everything if necessary. In my situation, when I did not qualify for the state support , the bank met me halfway and helped me with consultations. I will continue to cooperate with AK Bars Bank and wish it prosperity.

Before applying for a mortgage, you need to carefully prepare. Namely, study all the requirements and conditions, calculate the interest rate in a mortgage calculator, evaluate the possibility of making a down payment and the optimal number of years. After all these steps, you can send an application on the official website of AK Bars Bank or visit its office.

To increase your chances of approval, we recommend submitting an online mortgage application to AK Bars Bank, as well as six other banks using this link. If you have any questions about the Ak Bars Bank mortgage or need advice on paperwork, we are waiting for you at a free consultation. Sign up with an online consultant.

Please rate and like the post, and also familiarize yourself with mortgage rates in other banks today.

Mortgage programs of Ak Bars Bank

Ak Bars Bank's mortgage programs are suitable for clients with different financial capabilities and requirements. The bank offers the following conditions for lending:

- metropolis – program for the purchase of finished housing;

- prospect – lending for the purchase of apartments in buildings under construction;

- refinancing – repayment of previously issued loans for the construction or purchase of residential real estate;

- mortgage with state support for families with children - a loan for the purchase of housing using maternity capital;

- mortgage for commercial real estate - issued for the purchase of non-residential premises for retail or office purposes;

- comfort – a loan for the purchase of a land plot or residential real estate with a land plot;

- apartments - for the purchase of non-residential premises at the construction stage - apartments.

On the Ak Bars Bank website for each of the programs, you can fill out an online application and receive a preliminary response. If approved, the client must visit the nearest bank office to finalize the issue.

What to do after approval

Once approved for a mortgage loan, the person must complete the following steps:

- Select a property (if this has not been done previously).

- Collect documents related to this object (appraisal report, purchase and sale agreement, extract from the Unified State Register, etc.).

- Take out insurance.

- Sign agreements with the bank and the seller.

- Register the deal.

Mortgage insurance

Insurance of the collateral is mandatory under the laws of the Russian Federation. You must purchase such a policy regardless of the bank you choose. It must be renewed every year of lending without fail.

Personal insurance for the recipient of a mortgage loan at AK Bars Bank and his co-borrowers is a voluntary choice of the client. However, refusing it increases the interest rate.

The list of accredited partners posted on the bank’s website includes 9 companies:

- "AK Bars Insurance";

- "Alfa Insurance";

- "VSK";

- "Sogaz";

- "Energogarant";

- "RESO-Garantiya";

- "Zetta Insurance";

- "Agreement";

- "Ingosstrakh"

However, you can also purchase a policy from insurance institutions not included in it. To do this, you need to provide the bank with documents confirming that the selected company meets the requirements.

Mortgage programs and conditions of AK Bars Bank

AK Bars mortgage programs allow you to obtain a targeted loan for a period of up to 25 years. The interest rate and loan size are determined by the selected program.

Secondary housing

Secondary housing purchased on account of a mortgage issued in AK Bars must meet a number of requirements:

- be registered in accordance with the established procedure;

- to be free from encumbrances;

- have a separate bathroom;

- be located in the region where the bank operates.

If the building was erected in 1956 or earlier, the following conditions must be met:

- the house is not in disrepair;

- the building is not included in the list of subjects subject to major repairs or demolition;

- The insurance company is ready to conclude a contract for this object.

The minimum loan amount is 500 thousand rubles. The down payment starts from 10% of the cost of housing.

New building

This program can only be applied if the developer and the facility are accredited by the bank. Its conditions:

Mortgage program from Ak Bars New building.

- the minimum loan amount is 500 thousand rubles, the maximum depends on the client’s solvency;

- initial payment of at least 10% if the loan amount does not exceed 8 million rubles. for Moscow and St. Petersburg and 5 million rubles. for other regions;

- Compensation for the first installment is possible entirely from maternity capital funds.

Family mortgage

AK Bars proposes to issue a targeted loan under the state program for assistance to families with children for a maximum amount of 6 million rubles. (12 million for Moscow, St. Petersburg and adjacent regions).

In this case, the same requirements apply that apply to the property depending on its type in programs without a preferential rate.

Construction of a private house

If we are talking about a private house, then a down payment of 20% will be a prerequisite. The object acting as collateral must meet the requirements regarding its location, resource supply system, etc. Lending to the object is possible only in conjunction with the land. The site must belong to the category “Land of settlements” or “Land for agricultural purposes”.

Commercial real estate

The maximum loan amount for the purchase of commercial real estate is RUB 10 million. regardless of region. According to the rules of this program, the down payment cannot be less than 30% of the price of the property.

Mortgage refinancing

The minimum amount to start cooperation is 500 thousand rubles. It is possible to simultaneously refinance several loans, including a combination with non-mortgage loans. Within the framework of this program, you can receive an additional amount for personal needs. You cannot use maternity capital under its terms.

Refinancing of mortgage loans from Ak Bars.

The maximum refinancing amount cannot exceed 80% of the appraised value of the collateral property.