You want to take out a loan, but the bank believes that your income is not enough and offers to attract

a co-borrower or guarantor . Or vice versa: you are asked to become a co-borrower or guarantee for someone else’s loan. Let's figure out what the differences are and what you risk by agreeing to one role or another.

What is the difference between a co-borrower and a guarantor?

A co-borrower is the same borrower.

He has the same rights and obligations as if he took out the loan himself. Even when you are persuaded to sign an agreement just “for show” and it is not you who will use the credit money, you have a great responsibility. If the main borrower for some reason cannot pay the loan on time, the co-borrower will have to contribute the money.

The guarantor guarantees

for the borrower - guarantees the bank that the loan will be repaid within the agreed period. The guarantor is not obliged to monitor the borrower's payment schedule. If he is late with payment for a couple of days, the guarantor will not be in any danger. But if the delay is serious, the bank will present demands to the guarantor - and then the debt will be reflected in his credit history.

For large loans, both co-borrowers and guarantors can be involved at the same time. If the borrower stops paying, the co-borrower will have to repay the debt. If he also does not make payments, then the guarantor will have to pay.

Let’s take a closer look at how the requirements for co-borrowers and guarantors differ, their capabilities and responsibilities.

Differences between a co-borrower and a guarantor

For most people unfamiliar with the intricacies of banking, these two concepts do not represent a significant difference, but in fact this is far from the case. The main difference between a co-borrower and a guarantor arises from the principles of each of them being responsible for their contractual obligations. And this measure is different for them. It is for this reason that commercial companies are more willing to enter into transactions involving a co-borrower rather than a person acting as a guarantor under the agreement.

So, the fundamental difference between these two concepts is as follows:

- The level of solvency of the co-borrower is taken into account when determining the maximum possible loan amount, potentially changing it upward. The intended purpose of the person who has taken on this function is precisely the ability to increase the lending threshold when the applicant’s income does not allow him to do this on his own. But the material wealth of the guarantor is not taken into account anywhere and cannot influence the final amount of the loan.

- The total income of the co-borrower is added to the income of the person directly applying for the loan, and, based on the intended purpose of the borrowed funds, is able to guarantee either full or partial repayment to the bank. In the second case, the wealth of the guarantor should allow him, if necessary, to undertake the payment of interest and the principal of the loan in full.

- The co-borrower and the person who received the money in hand are legally equal in their rights and obligations to the financial institution with which they signed the agreement. This allows the co-borrower to become a shared owner of the loaned item. The guarantor does not have such rights and will not be able to compensate for his own costs in this way if the debt has to be paid to him.

- If there are delays under the loan agreement, the function of the payer automatically passes to the co-borrower. The guarantor begins to pay the bills only after the court decision. Until this moment, banks do not have the right to demand money from him. If, as part of the agreement, co-borrowers also participate in it, then the legal rule of the third stage works, when first the borrower pays the debt, then the co-borrower, and only then a guarantor is involved.

What documents do I need to provide?

Typically, the co-borrower must provide the bank with the same set of documents as the borrower: passport, SNILS or TIN, marriage certificate, income certificate, certified copy of the work book. Each bank may have its own set of documents.

Sometimes the list of documents for the borrower and co-borrower may differ. For example, under the family mortgage program, the main borrower must provide birth certificates for children, but the co-borrower does not need to do this.

In most cases, the guarantor must provide only a passport, a certificate of income and a certified copy of the work book.

The co-borrower signs the loan agreement together with the borrower, but the guarantor does not. The bank enters into a separate guarantee agreement with him.

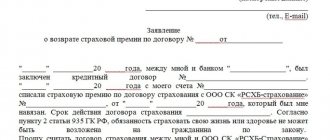

If the loan agreement provides for mandatory insurance, the co-borrower will also have to sign an insurance agreement. This is usually not required of the guarantor.

What is the difference between a guarantor and a co-borrower?

When issuing mortgage loans for long periods, banks attract so-called co-borrowers in addition to guarantors.

This primarily includes the husband or wife, who is often a co-borrower by default. But they can also be other relatives: brothers and sisters, parents, grandparents (up to 5 co-borrowers in total). Each of them will contribute to paying the mortgage. This measure will strengthen the bank’s confidence in the main borrower and will provide a greater chance of timely payment and repayment of the issued loan. At first glance, the terms “guarantor” and “co-borrower” are very similar:

- Both categories are required to take part in obtaining a loan;

- The banking agreement requires them to have the necessary certificates and documents (passport, income certificate, etc.);

- Their personal signatures must appear on all loan documents.

In addition to the similarities, there are also differences between these concepts:

- Unlike the guarantor, the co-borrower is also a co-owner of the loan funds. Together with the main borrower, he has the right to spend the loan received. The guarantor does not have such an opportunity.

- As a rule, there is a family relationship between the co-borrower and the main recipient of the loan, and not only acquaintances or relatives, but also any other persons can become guarantors.

- Co-borrowers bear joint and several guarantees on an equal basis with the main borrower, paying the principal and interest on the loan. This means that any of the co-borrowers can pay the current payment.

- The guarantor is responsible for the loan if the borrower stops servicing the debt.

- When calculating the entire mortgage amount, the income of the co-borrower is taken into account. And the guarantor is simply a guarantor of the repayment of the loan, and does not affect the size of the future mortgage in any way.

After obtaining a mortgage, the main difference between the co-borrower and the guarantor will be what results each of them expects after fulfilling the obligations under the agreement:

- Regardless of the type of liability (subsidiary or joint and several), the guarantor cannot claim to receive the property, even if it was paid for at his expense.

- If the main borrower systematically makes late payments, violates the terms of the agreement, or refuses to pay the mortgage altogether, the bank can collect this debt from its co-borrower. And if he conscientiously fulfills the financial obligations under the contract, then the acquired property can be re-registered to him.

Is it possible to change the loan size and interest rate with the help of guarantors and co-borrowers?

The financial situation and credit history of the co-borrower directly affect the terms of the loan. The bank checks the co-borrower in the same way as the borrower: place and length of work, income, financial discipline. The loan amount, interest rate and term for which it is issued may depend on the results of the check.

As a rule, the higher the income of the co-borrower, the greater the amount the bank is willing to lend. If the financial situation of the co-borrower inspires confidence in the bank, then this may lower the interest rate on the loan.

But the income and credit history of the guarantor almost never affect the parameters of the loan. Most often, the bank simply informs whether such a guarantor is suitable for it or not.

Does the borrower's debt affect the credit history of the co-borrower and guarantor?

The co-borrower’s credit history contains complete information on the main borrower’s loan, including payment history. Moreover, the outstanding portion of the loan is considered the debt of the co-borrower. If he wants to take out a loan for himself, financial institutions will calculate the size of the new loan taking into account this debt.

Someone else's credit or loan is not reflected in the guarantor's credit history. But only as long as the borrower makes payments regularly. If the borrower stops repaying the loan, then the obligations are transferred to the guarantor - and the debt appears in his credit history.

Do the co-borrower and the guarantor have the right to property purchased on credit?

By default, neither the co-borrower nor the guarantor become the owners of the property purchased with loan money. They acquire ownership of an apartment, car or other item only if they, together with the borrower, are listed as buyers in the purchase and sale agreement.

Only spouses automatically become owners. For example, when they take out a mortgage, the purchased home is considered their jointly acquired property, unless a marriage contract with other conditions has been concluded.

In other cases, the co-borrower and the guarantor can enter into an agreement on mutual obligations with the main borrower. In such an agreement, it can be stated that the co-borrower (guarantor) will become the owner of the property for the purchase of which a loan or loan was issued if he is forced to pay the debt instead of the borrower.

In addition, if the borrower and co-borrower initially intend to pay equally on the loan, they can immediately obtain equal ownership of the property.

Rights and obligations of the co-borrower and guarantor

What distinguishes a co-borrower from a guarantor is the ability to have equal ownership rights with the debtor to property assets purchased with loan funds. At the same time, he bears the full joint and several obligation to pay for outstanding current contributions. All clauses of the agreement apply equally to both the main borrower and his contractual backup.

As for the loan guarantee, everything looks a little different. If it is impossible to pay scheduled contributions, it is the guarantor who is obliged to repay them. By law, he has the right to do the following:

- close the overdue payment and continue to return funds to the bank within the existing payment schedule;

- close contractual obligations with one early payment.

If the company no longer has claims against this party to the contract, he has no right to count on full or partial compensation for damage, and the collateral property objects do not pass to him. The lender has the right to oblige him to pay not only for the body of the debt, but also for late payments, penalties, and interest rates on the loan.

The guarantor is released from the obligations assumed only in exceptional cases:

- death or death of the borrower;

- unauthorized introduction by a commercial company of additional clauses into the contract without notifying all parties involved in the process;

- when transferring the remaining amount of the debt to collection firms without his written consent - in this case, all obligations of the guarantor to the bank or collectors are canceled automatically.

What loan information is available to the co-borrower and guarantor?

Co-borrower payment schedule, information about the amount of current debt, as well as information about payments already made.

The loan agreement specifies how the bank provides this information to the co-borrower. As a rule, detailed information about the loan is available in the mobile application and the co-borrower’s personal account on the bank’s website.

The bank is not obliged to tell the guarantor about the amount of outstanding debt, payments made or upcoming payments, as long as the borrower pays money according to the schedule. The bank begins to inform the guarantor only if the borrower stops paying and responsibility for repaying the debt passes to the guarantor. However, some banks include the guarantor's right to access this information in the guarantee agreement, loan agreement or banking rules.

Is liability for late payments the same?

If the main borrower does not make payments on time, then the obligation to repay the debt in any case passes to the co-borrower or guarantor. But at different speeds and with different consequences.

The co-borrower may immediately find out that the payment is overdue. This information can be easily verified through online banking or a mobile application. Within 7 days, the bank will additionally send him an SMS message, push notification or email about this - the specific method is specified in the loan agreement.

Information about the delay is reflected in the credit history of the co-borrower. Therefore, it is in his interests to immediately make the next payment on the loan, otherwise in the future it will be more difficult for him to obtain a loan.

The guarantor does not always find out about delays immediately. Usually only after the bank demands him to make the next payment for the borrower and pay a fine for late payment. As a rule, the guarantee agreement sets a period within which the guarantor must transfer the money. The countdown begins from the moment he receives the bank's request.

If the guarantor fulfills this requirement within the time frame set by the bank, the borrower’s delays will not affect his credit history. But if he doesn’t deposit the money on time, it will be considered his own delinquency - and will ruin his credit image. In addition, the surety agreement usually stipulates penalties in case the guarantor does not pay the money on time.

If the co-borrower or guarantor does not begin to repay the borrower's debt voluntarily, the bank may go to court.

If the loan is not repaid after a court decision, bailiffs have the right to seize the accounts and deposits of the co-borrower or guarantor. In cases where there is not enough money to repay the debt, bailiffs may auction off the property of a co-borrower or guarantor in order to repay the debt to the bank.

The guarantor is responsible for the borrower

Co-borrower and guarantor - what is the difference between these two concepts? For a more complete disclosure of the issue, let's figure out what their rights and responsibilities are. Today, in many banks, the presence of a guarantor is mandatory for a significant proportion of mortgage loan products. This is explained by the fact that the bank tries to insure itself as much as possible against the risk of non-payment by the borrower of the housing loan. Of course, the insurance policy paid by the borrower also acts as a guarantee. However, since the 2008 financial crisis, lenders are looking to spread the straw in any way possible.

To become a guarantor, a candidate must meet certain requirements:

- the guarantor can be either an individual or a legal entity with a good reputation and sufficient income;

- Delinquencies in the credit history and the presence of unpaid loan debts are not allowed;

- some banks require that the guarantor be a relative of the borrower;

- The guarantor must not be over 65 years old at the time of repayment of the mortgage loan.

Unfortunately, if the guarantor does not have a personal interest in you solving your housing problem with the help of a mortgage, it will not be easy to persuade him. After all, everything can turn out like in that song: “We ate the sweet berry together, but I ate the bitter berry alone.” The guarantor must be prepared for the following delicate moments:

- if the borrower cannot repay the loan, the entire burden of debt obligations falls on the shoulders of the guarantor (responsibility for the loan is joint and several);

- if the borrower fails to repay the loan, the debt is first collected from the guarantor, and only then the collateral is collected;

- the guarantor is responsible for paying off the mortgage not only with his income, but also with his personal property;

- If the guarantor himself wants to take out a loan, the debt on the guarantor loan will be taken into account when deciding whether to approve or disapprove the loan.

Before putting your signature on the mortgage agreement, the guarantor should carefully study all its clauses and think about force majeure situations that may occur. For example, in the event of the death of the borrower, the agreement must clearly indicate how exactly the debt to the bank will be closed. In the judicial practice of the Russian Federation, both in the regions and in the capitals, there were cases when the guarantor had to pay off the mortgage debt after the death of the borrower. At the same time, the guarantor did not receive any real ownership rights to the mortgaged housing. Today, judges less often take the side of credit institutions in such cases, but it is not a bad idea to protect yourself from the risk of an unpleasant situation.

The agreement clearly states the period for which the guarantor is responsible for payments on the loan. There are situations when the guarantor is responsible for paying the mortgage only until the mortgage is registered on the mortgaged property until the purchase and sale transaction is completed. And sometimes the guarantor’s responsibility remains for the entire loan term, up to the full repayment of the loan.

Is it possible to change the terms of the contract?

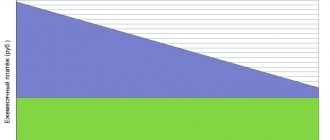

The co-borrower can change the terms of the loan agreement, but only with the consent of the main borrower. For example, he can contact the bank with a request to increase the loan term and reduce monthly payments - to restructure the loan. Or vice versa, .

In the case of a mortgage, a co-borrower can apply for a mortgage holiday if he finds himself in a difficult life situation. But when the bank decides whether the case fits the vacation conditions, it will begin to evaluate the total average monthly income of the borrower and co-borrower.

The main risk of the main borrower is that without the consent of the co-borrower, he does not have the right to change the terms of the agreement. For example, if a co-borrower does not provide information about his income or is categorically against increasing the loan term, the borrower will not be able to extend payments.

The guarantor does not sign the loan agreement and cannot influence its terms. But if the borrower, for example, increases the size of the loan, this will not affect the guarantor’s obligations - unless he gives his consent to this and signs a new guarantee agreement.

If the guarantor takes upon himself to repay the debt (voluntarily or by court decision), he will be able to negotiate its terms with the bank. Perhaps the bank will agree to restructure the loan.

Is it possible to split the loan and pay off only part of the debt?

Theoretically, this is possible. In this regard, it is easier for guarantors - they can initially stipulate a guarantee in the contract, which secures responsibility for only part of the debt.

Co-borrowers may try to negotiate with the bank to split the loan between them. But banks are reluctant to do this. It is important for the lender that the entire loan is repaid. And he doesn't care who does it. The more defendants, the higher the chances of repaying the debt in full.

Preferential loans most often cannot be divided into several, since they are issued under special conditions and individual borrowers will no longer comply with them.

For example, under the family mortgage program, preferential loans can be received by families in which a second or subsequent child was born. The bank will not divide such a loan in half between mom and dad - simply because the collateral for the mortgage loan is one home and it cannot be divided.

The terms of the loan can be changed by court decision, then. But the court rarely makes such decisions. For example, the divorce of co-borrowers is a sufficient reason for the court to change the terms of their loan agreement.

In this case, both the guarantor and the co-borrower have the right to demand that the borrower reimburse them for the costs of repaying the debt in full or in part. If you cannot reach an agreement peacefully, you can go to court.

The difference between a guarantor and a co-borrower on a mortgage

Having understood for ourselves what is the difference between a guarantor and a co-borrower, let’s consider the nuances of their fulfillment of mortgage obligations.

The mandatory joint participation of the spouse (even if he has no income) in mortgage lending is due to the fact that the purchased housing plays a collateral role in securing a long-term mortgage. If circumstances arise that do not allow the recipient of the loan to service its repayment, the collateral can be sold at auction, and the debt to the creditor can be closed with the funds received.

The Family Code allows the joint property of spouses to be used as security exclusively for the common debts of the married couple. Therefore, to ensure its financial security, the bank involves the second spouse in the mortgage lending process as a bearer of the same obligations as the main borrower. The presence of a marriage contract between the spouses with conditions for the division of property allows one to avoid involving the second spouse as a co-borrower. But then the rights to real estate will be distributed differently.

The role of the guarantor is to ensure that the debt is repaid to the bank that issued the mortgage. To do this, he must have a level of income sufficient to fulfill his obligations to the bank.

In the event of an unfavorable development of the situation related to the need to repay a mortgage loan, the citizen who has guaranteed for the borrower has the right to go to court in order to recover from him the funds spent on fulfilling his obligations to the credit institution.

Attention! The main difference between a mortgage loan guarantor and a co-borrower is that his liability arises only if the borrower fails to fulfill his financial obligations to the bank. The co-borrower, together with the main borrower, is obliged to make timely and full payments to repay the debt.

If I take out a loan, who should I attract - borrowers or guarantors?

It is more profitable for the borrower to attract a co-borrower than a guarantor. After all, if a co-borrower has a good and stable income, there is a chance to get a loan on more favorable terms.

But keep in mind: you will have to coordinate all important decisions on the loan with your co-borrower. And if he is against, for example, mortgage holidays, most likely you will not be able to take them. Therefore, it is better to take as co-borrowers close relatives with whom you have a common budget and financial interests, or flexible friends with whom it is easy to come to an agreement.