When applying for a mortgage loan, the borrower will be required to provide an insurance policy. If it is mandatory to insure collateral, borrowers still have many questions regarding other types of financial protection. Banks try to protect their interests by making the interest rate dependent on the availability of the policy.

If an accident or other event specified in the contract occurs, the debt to the creditor will be covered by the insurance company. However, such protection will not be superfluous for the recipient of a mortgage loan, because housing loans often amount to considerable amounts. Let's look at mortgage insurance using the example of programs offered by JSC VSK.

"VSK" - Mortgage calculator for life and property insurance

An online application is available for mortgage loan recipients from Sberbank. The procedure for obtaining an insurance policy is simple and intuitive; you do not need to visit the company’s office to do this.

It will only take a few minutes to issue a VSK mortgage policy. You need to prepare your passport and loan agreement; these are the documents you will need to purchase insurance.

1. To use the online calculator on the VSK website, follow the link: shop.vsk.ru/credit_health/calculation.

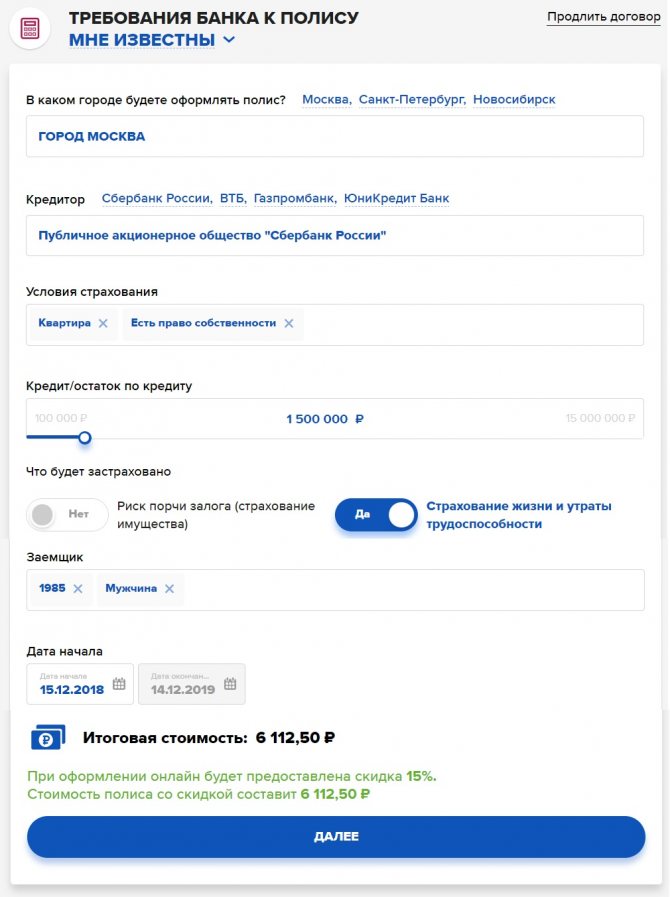

2. Basic parameters for calculating the cost of the policy:

- Region of residence.

- Start date of the new policy.

- Balance of credit debt.

- Policyholder details (date of birth, gender).

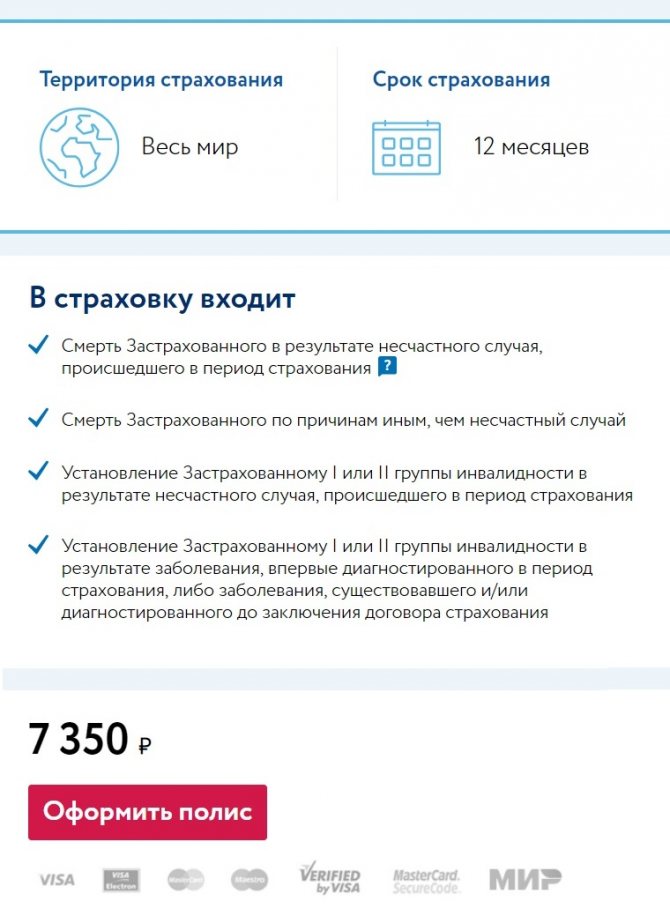

3. At the bottom of the page the insurance risks that this policy covers and its cost will be listed. Below is an active button “Place a policy” for electronic purchase of financial protection.

We recommend comparing the cost of a policy for Sberbank with Ingosstrakh Insurance Company; mortgage insurance can cost up to 50% less than with VSK.

- To do this, follow the link: ingos.ru/mortgage/calc and fill out all the fields to calculate the cost of the insurance policy.

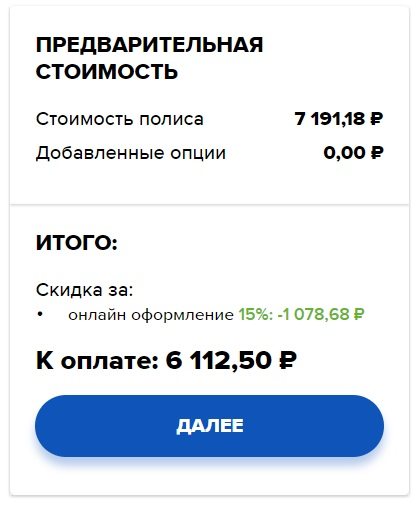

When specifying exactly the same data, the cost of the policy in Ingosstrakh was 6,112 rubles, and in VSK the contract price was 7,350 rubles, it turns out that the insurance became cheaper by 1,238 rubles or 16.8%, the agreement is a good saving.

To obtain mortgage insurance from VSK you need:

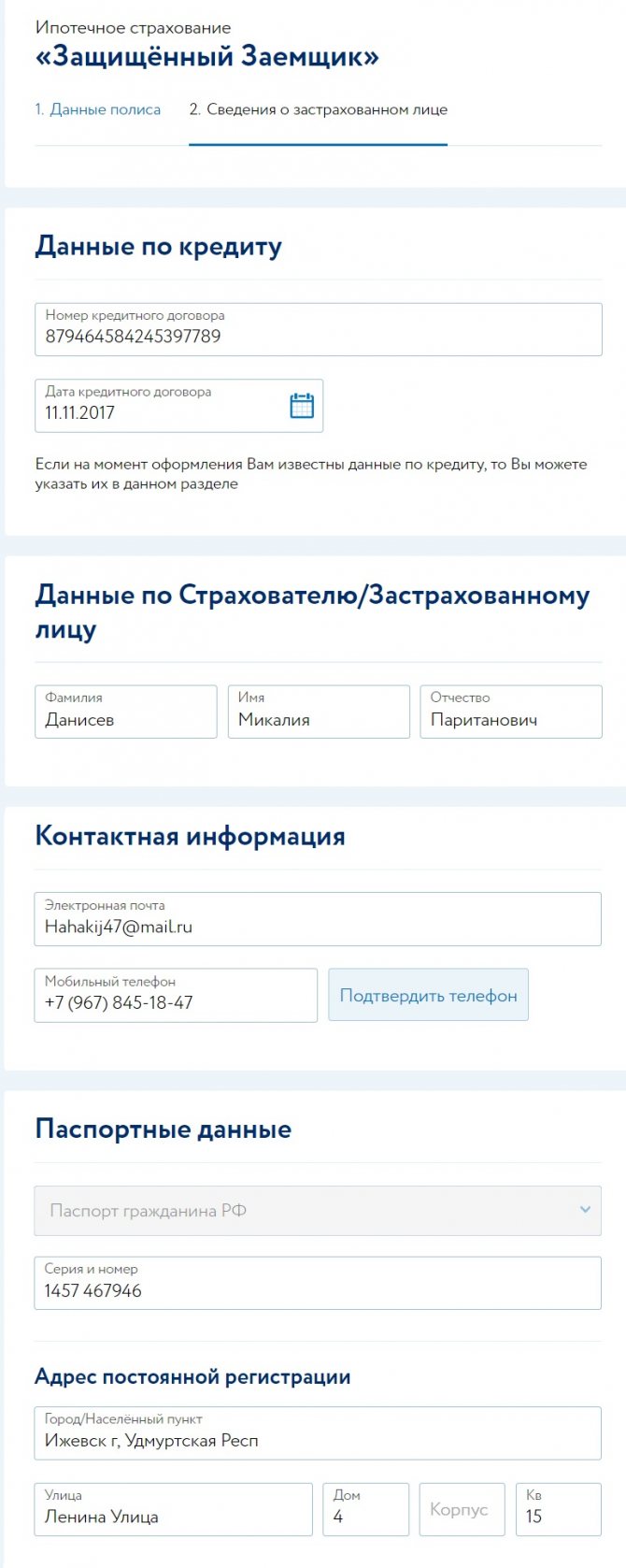

4. Follow the link to apply for a policy and fill in more accurate information about the borrower:

- Number and date of the housing loan agreement.

- Client's personal details.

- E-mail address.

- Telephone number for contact.

- Passport details.

- Place of residence.

5. Next, you should tick the agreement that until the loan is repaid, the beneficiary is Sberbank, and after that the client’s heirs or himself.

6. The second mark indicates agreement with the application-declaration; it lists diseases for which insurance payment will not be made. This document must be read very carefully, because if you have these ailments, you cannot count on repaying the mortgage.

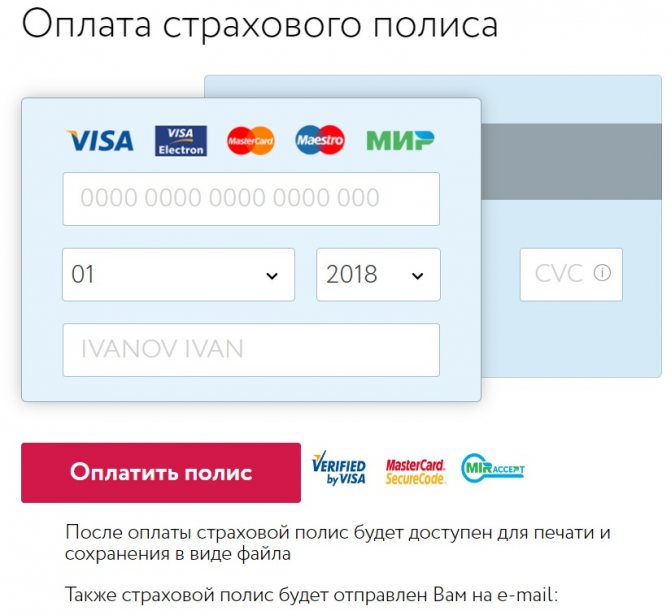

7. After this, you can purchase an insurance document by paying immediately using a debit or credit card. You need to indicate the card number, its expiration date and the three-digit code on the back.

The completed policy will be sent to the specified email address. It is accompanied by insurance rules, a receipt of payment and a memo. The electronic version has the same legal meaning as paper printed on official letterhead. If a client loses insurance documents, he can always restore them in his personal account on the VSK website.

Registration and Login to the VSK Personal Account

To take advantage of all the capabilities of the site shop.vsk.ru, you must have a valid personal account on the VSK website. If you don't already have one, you should create an account. To do this you need:

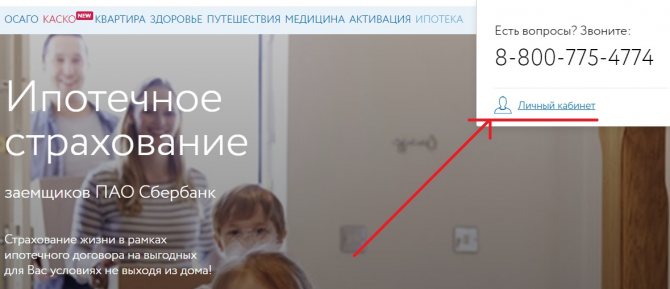

1. Go to the official portal of the company : shop.vsk.ru.

2. On the main page, find the button to enter your personal account and click it.

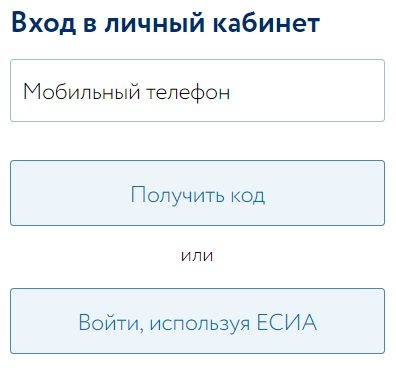

3. Next, the system will prompt you to log in using your username and password or register.

4. By selecting the last item, the client can create a new account using a mobile phone and an SMS message sent to it. The second option is to log in through a single account on the State Services portal. New clients are registered automatically when purchasing an insurance policy.

In your personal account, you should select the mortgage product you are interested in and go to the section dedicated to it. After carefully reading the terms of service, you can calculate its cost. To do this, click the “Buy policy online” button.

What affects the cost of mortgage insurance?

The cost of mortgage insurance depends on:

- Loan debt.

- Paula. For men, the cost of the policy will be higher.

- Age. The lowest coefficient applies to young people.

- Client's profession. There are different classes of hazards to which people are exposed at work. The coefficients for the teacher and the climber will be different.

- Health status. When applying for a policy, a person needs to truthfully answer the questions of an extensive questionnaire, in accordance with this, the cost of the life insurance policy will be set.

To insure the premises, the year of construction, the material of the walls and ceilings, the presence of sources of open fire, gas and other factors are important. When applying for a repeat policy, many companies offer a discount or hold promotions for regular customers; you should clarify in advance the possibility of receiving them.

Necessary documents for a mortgage at VSK Insurance

To apply for a VSK insurance policy you will need:

- Passport.

- Loan agreement.

- Technical documents for the property to clarify the features of the structure.

The insurance company will not request other documents from the mortgage borrower. When issuing a policy electronically, you do not need to present documents.

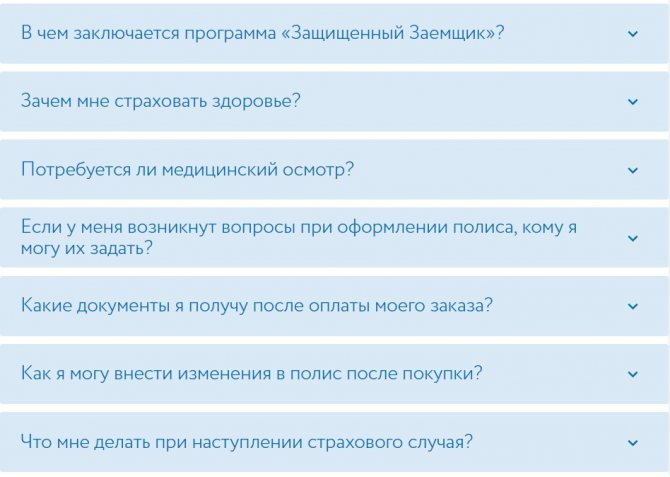

Questions and Answers on Mortgages at VSK-Dom

The main questions about insurance that people have when taking out a mortgage loan are:

- Answer

Why insure life and health?

In the event of an unforeseen situation, death or disability of the borrower, the remaining debt on the home loan will be paid by the insurance company. The apartment will not be sold against the mortgage and will go to the heirs.

- Answer

Do I need to undergo a medical examination?

The policyholder only needs to fill out an application; there is no need to visit a doctor or collect certificates.

- Answer

Who can answer my questions about financial protection?

For detailed information, you can call the VSK hotline: 8-800-775-47-74 or send a message from the website in a special form.

- Answer

Will I receive documents after purchasing an electronic policy?

Yes, a policy, insurance rules, a memo and a receipt for insurance payment will be sent to you by email.

- Answer

If an insured event occurs, what should you do?

Call the VSK hotline number and describe the situation. Next, proceed according to the instructions received from the insurance company employee.

You can see all the answers to frequently asked questions on the website or call the hotline.

"VSK" - Is it possible to refuse mortgage insurance?

A prerequisite for obtaining a housing loan is the registration of an insurance policy for the property. Sberbank only insures premises; you do not need to buy a policy for land plots.

All other insurance programs can be activated only on a voluntary basis. No one can force them to buy them. Banks have the right to increase the interest rate in the absence of financial protection for the borrower, which they actively practice, because for them uninsured loans are a big risk.

Prolongation procedure

You can renew your insurance contract for a mortgage loan with Sberbank online or in person at the office. Let's look at each renewal procedure step by step.

In-office extensions include:

- Visit to the office of the insurance company.

- Provision of documents.

- Waiting for the policy to be generated.

- Studying the terms and signing.

- Payment.

- Receive your copy in your hands.

Renewal via the Internet:

- Generating calculations using the calculator on our portal.

- Selection of offer.

- Go to the insurer's website.

- Filling out all sections: personal data, property characteristics and deadline.

- Payment.

- Receive mortgage insurance via email.

List of documents

To renew a mortgage insurance agreement with Sberbank, you will need a full package of documents. To purchase insurance you must provide:

- borrower's passport;

- document for the apartment to confirm ownership;

- technical certificate;

- previously concluded insurance form;

- application in the approved form.

As for the application form, it is filled out during a personal visit to the office. The template is issued by a company specialist. With electronic insurance, the form is filled out remotely by entering information in all sections of the application.

Where to send documents

The documents required to purchase mortgage insurance from Sberbank should be sent to a specialist’s email account. With electronic insurance, the address will be displayed on the screen of your computer or mobile phone.

When purchasing insurance online, all documents must be uploaded in your personal account.

Important ! When renewing mortgage insurance through your Sberbank personal account, you will not need to upload documents. The main thing is to confirm that personal information and passport data remain unchanged. If the data has changed, you will need to make corrections and send a copy of the borrower’s passport.

How to inform the bank that the policy has been renewed

An extended mortgage insurance form from Sberbank must be sent to a bank specialist. Of course, you can call and provide information over the phone, but the policy must be included in your file.

You can inform about the extension in any way convenient for you.

Options:

- In person in the office. To do this, you will need to contact the Sberbank office where the loan was received. Send the extended document to a specialist or secretary. Following the visit, you should request a copy of the policy, with a note of acceptance.

- Send to Sberbank email address. In this case, you should send a high-quality copy of the extended contract to the email of the manager who oversees the contract. By sending a copy to general mail, you risk that it simply will not reach the right specialist.

- To the office via courier or registered mail. You can send renewed insurance by registered mail with notification or via courier. The second option is expensive, so it is used extremely rarely by clients.

"VSK" - What risks does mortgage insurance cover?

A mortgage loan requires a long repayment period, and the loan amount is often measured in millions of rubles. It is difficult to predict how the life circumstances of a person who has taken out such a loan will turn out. No one can guarantee that in 10 years he will still be able to work, and that the apartment will not collapse as a result of a domestic gas explosion. It is for such unforeseen events that mortgage insurance is issued.

VSK has been working in the field of financial protection for more than 20 years and is currently a partner of many banks. In particular, the company has current accreditation with Sberbank, which for many years has been a leader in the amount of mortgage loans issued.

Mortgage insurance includes the following risks:

- Loss of ownership of acquired real estate.

- Death or disability of loan borrowers.

- Damage to structural parts of the property or its complete loss.

The current policy terms and conditions have emerged as a result of many years of work with real insured events. The company states that payment will be made within 5 days after receipt of documents from the borrower without unnecessary bureaucratic delays. Financial protection is available worldwide.

"VSK" - Types of mortgage insurance: apartments and houses

Mortgage liability insurance refers to the issuance of policies that include the above risks. They can be purchased individually or as a set.

The agreement is concluded between the title borrower (or all borrowers in the case of life and health insurance) and the insurance company. The bank is the beneficiary, which means that the funds will be transferred to the client’s loan account to repay the debt, and will not be issued to him.

If a person who has received a mortgage is no longer able to repay the debt for a valid reason, which is specified as an insured event in the contract, the loan will be paid for by VSK. After this, the bank will have no claims against either the borrower or his heirs in the event of death.

Borrower's life and health insurance

If a client suffers a fatal accident or dies as a result of illness, the law will pass on the debt to his heirs. The absence of a policy will result in the debt still having to be repaid. Otherwise, the mortgaged apartment will be sold in court. This is extremely unprofitable for the client, because such property is valued much less than its market value, and the bank does not return the interest paid.

This type of insurance includes the following risks:

- Death due to an accident.

- Death from an illness that the borrower became aware of after taking out the policy, or which he documented to a VSK representative when concluding the contract.

- Group 1 or 2 disability resulting from unforeseen circumstances or illness.

To pay the amount to cover the mortgage loan, it is necessary that unfortunate circumstances occur during the period of validity of the agreement with.

It should be remembered that it will not be carried out if there are negative factors that influenced the outcome of the event. These include:

- Recorded use of alcoholic beverages or drugs.

- Taking medications without the recommendation of the attending physician, even if these drugs are available for sale without a prescription.

- The borrower has a mental disorder.

- HIV disease or AIDS.

The mortgage debt of a person who, at the time of injury:

- He himself committed a criminal act.

- Got behind the wheel without a license or while intoxicated, and transferred control of the vehicle to a person in such a state.

- He was involved in extreme sports.

- Participated in sports competitions of any direction.

- Controlled an airplane or other aircraft.

The last three points can be included in the policy by agreement. If a person regularly engages in mountaineering, participates in relay races, or is fond of hang gliding, he is obliged to indicate this when concluding the contract, but the coefficient for him will be higher.

You should not count on payment if a tragic event occurred as a result of a disease of the cardiovascular system, oncology or another disease that the client knew about, but did not notify the insurance company.

Title insurance

The right of an interested party to recognize a purchase and sale transaction as invalid is established by law. Sometimes this happens with mortgaged apartments. Title insurance involves the following risks:

- Loss of ownership of the pledged property, which occurred due to the conclusion of a transaction in violation of the law.

- Encumbrance – a court decision on the residence of third parties or forced entry.

Legal events that are recognized by the court are considered. The statement of claim and decision must be made during the period of validity of the contract with VSK.

The insured amount will not be paid if the property has the following features:

- He was subject to foreclosure for the owner's debts.

- Seized due to improper maintenance or in the event of a natural disaster.

- Confiscated, that is, taken away by the state under the circumstances established by law.

- It is destroyed by the owner, resulting in a risk for neighbors and the residents themselves.

- Acquired as a result of pressure, blackmail. The client could not adequately evaluate his actions at that moment.

Apartment design

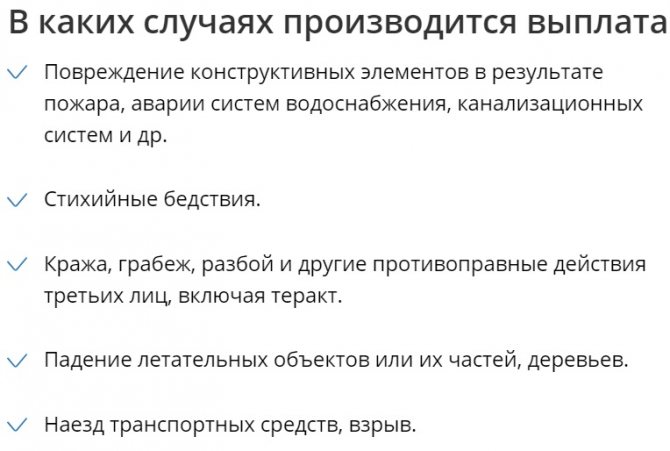

If the remaining insurance contracts are concluded voluntarily, then the bank will force the structure of the apartment or residential building (walls, floor, ceiling) to be insured. This is due to the fact that collateral is the only significant guarantee of repayment of mortgage debt. The following risks are covered for the apartment:

- Serious damage due to fire, flooding, explosion, etc.

- Collapse or failure of a structure due to a natural disaster (hurricane, earthquake, tsunami, etc.).

- Criminal influence (theft, burglary).

- An airplane, a pole, or a tree falling on a house.

- Hitting a car, bus, etc.

Land plot insurance is carried out to a limited extent, because only the soil layer and planted plants are exposed to risks. New buildings under 3 years old, buildings over 50 years old and emergency buildings cannot be insured.

The presence of an obvious defect is also an obstacle to concluding an agreement with VSK; banks do not provide loans for such property.

The mortgage repayment amount will not be paid if:

- The property was intentionally damaged by the borrowers themselves.

- Serious defects in the property were not disclosed prior to the conclusion of the contract.

- The apartment is not used for living, but for other purposes.

- Utilities were turned off in a residential building due to a large debt.

- There was an unauthorized redevelopment.

No losses

The product is designed to make it easier for clients to fill out and submit a tax return for personal income tax refund. Persons who have purchased real estate or are paying off a mortgage have the right to a refund of taxes paid.

In the first case, the policyholder can claim up to 260 thousand rubles, and in the second - up to 390 thousand rubles (mortgage interest). You can exercise your right of return once in your life. To quickly carry out transactions on the VSK website, borrowers have access to a personal account.

Types of mortgage insurance

There are 3 main types of insurance when taking out a mortgage loan.

The following policies are offered to clients:

- from accidental loss or damage to the collateral, allowing the bank to protect itself from the risk of destruction of property;

- from loss of ability to work, health or life of the debtor, which automatically entails the disappearance of the person who is obliged to pay the debt under the contract;

- against loss of ownership of purchased living space (title insurance).

In 2020, borrowers are actively offered comprehensive insurance that combines all 3 listed types of policies. It allows you to save on fees, but prevents the client from refusing unnecessary services, since they are included in the total cost of service.

Mandatory

Special attention is due to the fact that some of the listed services are required by law, so it will not be possible to refuse some policies. Thus, current regulations prohibit not paying mortgage insurance every year if we are talking about the risk of property loss. Collateral is what guarantees the bank repayment of the debt, so it must be protected especially actively. And the insurance will guarantee that the lender will not lose his own investments, regardless of the circumstances. It is important to emphasize that damage to the pledged property due to the fault of the debtor is not an insured event, so the client will have to repay the debt on time, regardless of what happened.

Optional

All other listed services are optional, so you can refuse them. Their imposition by bank managers violates the law, so any attempt to force a client to sign up for an unnecessary service can become a reason for a complaint to regulatory authorities, for example, Rospotrebnadzor. But it is important to consider that the issuance of a mortgage loan is implicitly dependent on obtaining insurance. This is due to the fact that the lender is not obliged to explain to clients the reasons for the decision. That is, in the event of a refusal due to an unissued policy, it is almost impossible to prove that it was the borrower’s reluctance to sign additional contracts that became the reason for the rejection of the application.

Mortgage insurance at VSK: where is it cheaper to get it?

The mortgage recipient must understand that cheaper does not mean better. You can get a home loan policy a little cheaper, but its cost will not include the main risks. VSK partner banks recommend using the standard insurance package, which is available when applying for a mortgage loan directly from the bank or through your personal account on the VSK website. It already takes into account all potential risks for the borrower and the collateral.

If the client works in hazardous work or engages in extreme sports, it makes sense to contact an agent and include these conditions in the policy. In this case, the cost of insurance will be higher.

Insurance "VSK" offers mortgage borrowers only the types of insurance specified in this article. To clarify current tariffs, you should use a calculator, because the cost consists of several coefficients.

How not to make a mistake with your choice?

Whether to insure life or not, each person decides independently. In Western countries, where the insurance culture is more developed, comprehensive mortgage protection is common.

In Russia, many are still trying to save money on insurance. We must remember that all tragic events in life happen unplanned, and protecting your family from a huge debt is a reasonable and correct decision.

Unfortunately, often after an accident, heirs try to resolve the issue of paying off the mortgage and leaving the property in their ownership, but in the absence of payments, this is unlikely to succeed. Thus, the mortgage burden is transferred to the borrower's relatives, who are not always able to repay the debt.

If you are in doubt about whether it is worth insuring your health, calculate how much you will save on interest payments, even if the bank only reduces the rate by 1% when taking out a policy. Usually this amount is enough to pay the insurance premium. It turns out that the mortgage borrower does not lose anything, but, on the contrary, gains financial protection.

What happens when the insurance is not paid by the borrower?

If the client does not want or forgets to renew the policy, the bank will increase his interest rate. This rule is stated in the terms of the loan agreement. When an insured event occurs, no payment is made. Refusal to prolongation would be appropriate if the client plans to repay the loan in full in the near future.

Features of mortgage insurance

"VSK Insurance House" offers effective programs for people buying real estate with a mortgage. This insurance is:

- title (property rights),

- ability to work, health, life,

- property (“Constructive”).

Calculate the cost of insurance services using an online calculator by visiting the insurer's website. There you can compare insurance products from mortgage insurance companies and make the best choice.

Purchasing a mortgage insurance policy can give the borrower a beneficial advantage: some banks reduce loan rates if such insurance is available, and many will not approve a loan application without it.

Title insurance is one of the popular types of guaranteed protection; it eliminates the risks of loss of the right to own real estate and the imposition of an encumbrance on credit housing. Having an insurance policy will provide support from the insurer, who will fulfill all obligations to the creditor instead of the debtor.

Mortgage insurance is impossible without fulfilling the mandatory requirement of a banking organization - life and disability insurance of the borrower. If the debtor becomes disabled or suddenly passes away, his obligations will be fulfilled by the insurance company. For example, the policyholder had an accident and lost his ability to work. He still has the right to own the apartment, but he is unable to pay the mortgage. Then the insurer will do it.

Almost all banks accept VSK Insurance House policies. At the same time, it is worth remembering that in an effort to protect itself and its capital from the risk of non-repayment of debt, the bank will certainly require the client to conclude an insurance contract for mortgage lending.

To purchase a life insurance policy, simply enter the name of the creditor bank and the loan amount in the calculator. The cost of the insurance service will be calculated automatically. Payment can be made online. The electronic policy has the same legal force as the paper version.

If you want to insure your property against various types of risks, the borrower can purchase a “Constructive” policy from VSK. It will protect your apartment or house from complete loss or partial damage as a result of flooding, fire, or other negative factors and events. The buyer can insure any part of the house or apartment, for example, only utilities or facade finishing. After the occurrence of an insured event, the property owner can count on receiving monetary compensation.

"VSK" - Insured event on mortgage property, what to do?

If an insured event occurs, you should check the insurance conditions and clarify whether it is really included in the risks. You can find out more detailed information by calling the hotline: 8-800-775-47-74 or in the office.

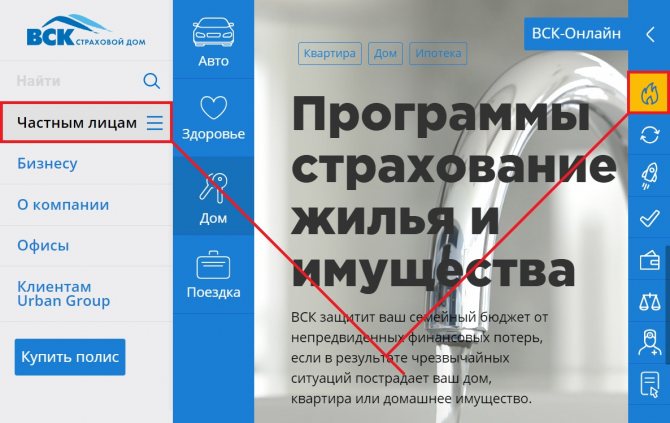

To send an application, there is now no need to personally contact VSK; just fill out the electronic form on the website:

1. From the main page, go to the “Individuals” section (vsk.ru/#?home) .

2. In the column on the right, select “Insured event”. The button for this option is stylized as a flame.

3. In the new window, select “Mortgage”, “Property” or “Health” from the drop-down list, depending on the situation.

4. In the “Documents” tab, you can clarify exactly what supporting documents the insurance company will need to consider your application.

All forms can be downloaded from the link: .

5. The link “What to do” provides detailed explanations of the client’s further actions.

6. After this, you should follow the link for remote dispute resolution. Attach all the necessary documents to your application and wait for VSK’s response.

You can also act in the traditional way - call the insurance company, clarify the list of supporting documents and write a handwritten application at the VSK office.

Additional Information

If you have any questions when applying for a mortgage insurance policy, you can call the toll-free hotline number 8-800-775-47-74 or send a message to the email address VSK insurance company specialists will help you.

Before the policy begins, you can make changes to it if necessary. To do this, call the phone number indicated above or send a message to

If an insured event occurs, contact representatives of the VSK company using the toll-free hotline 8-800-100-00-50 and briefly describe the problem to them. VSK specialists will advise you on further actions.

Reviews about mortgage insurance at VSK-Dom

Customer reviews about cooperation with VSK insurance are contradictory. There is also a positive opinion about fast and high-quality service.

But there are enough negative reviews, the main reasons for which are:

- Delaying the return of the insurance premium in case of early repayment of the mortgage.

- Loss of documents for insurance payment.

- Disloyalty to clients.

- Delay in payment of the insurance amount in the event of an accident.

I would like to hope that with the introduction of electronic policy issuance and remote dispute resolution, shortcomings in the insurance company’s system will be eliminated.

All reviews can be viewed on the portal: banki.ru/insurance/vsk .

Mortgage insurance calculator in Ingosstrakh online

Ingosstrakh offers clients comprehensive mortgage insurance. The program is called “Mortgage Insurance”. The policy can be purchased in full or you can select the necessary options.

Ingosstrakh's mortgage insurance portfolio includes:

- real estate insurance;

- personal insurance, that is, risks associated with the life and health of the borrower;

- title insurance.

For military personnel purchasing housing on credit from the company, there is a special offer “Rosvoenipoteka”. To compare Ingosstrakh offers with other insurance organizations and choose the most profitable one, you can calculate the cost online using our calculator.

To apply for a policy you will need:

- application form, which can be filled out on the company’s official website;

- passport;

- title and valuation documents for real estate;

- medical report on the state of health required for life insurance.

"VSK" - Accredited mortgage insurance companies

"VSK" is one of the few insurance companies accredited by the largest mortgage lender - Sberbank. This means that the company meets all reliability requirements and can be a permanent partner of the bank:

- The company must operate in the insurance market for at least 3 years.

- Comply with all Russian legislation.

- Must be solvent and financially stable.

- She has no significant litigation.

- No bankruptcy has been initiated.

- List of accredited companies in Sberbank - sberbank.ru/ins_comp_prop.pdf.

Strict compliance with all specified parameters allows us to be among the leaders in the insurance market. Despite such varied reviews, it should be noted that the VSK Insurance House has been operating for a long time and offers its clients competitive service rates.

However, before signing an agreement with VSK, you should carefully read all its terms, because there are many pitfalls in the issue of mortgage insurance.

What happens if you refuse mortgage insurance?

If you refuse life insurance on a mortgage, the following will happen:

- the bank will refuse to issue money (in case of cancellation of the policy before signing the agreement);

- the lender will increase the interest rate by 1-2 percent, depending on the terms of the mortgage agreement (if refused after a year or more).

If you try to refuse insurance for the risk of loss of real estate, you may terminate the contract and demand to repay the debt in full, since in this case the requirements of the law and the rights of the bank will be seriously violated.