Sberbank is one of the few that tries to ease the financial burden on its clients as much as possible. Unique promotions and offers help you purchase your own home at minimal cost.

Until September 11, 2020, there was an unprecedented program to reduce the mortgage percentage in DomClick from Sberbank. Having submitted an application, the borrower, if approved, could reduce the loan rate and reduce his monthly payment.

Today there are no such offers in Sberbank. However, every borrower has the right to use mortgage restructuring or refinancing services. The following information is required to be read in order to avoid difficulties when completing the application.

Is it possible to reduce the interest rate on an existing mortgage?

Expert opinion

Irina Bogdanova

Work experience at Sberbank for 12 years.

It is impossible to reduce the interest rate on an existing mortgage, since the law does not provide for the possibility of changing the terms of the loan after signing the agreement.

But Sberbank offers alternative options that reduce the credit burden on the borrower during financial problems:

- Restructuring is an opportunity to change the terms of an existing mortgage with Sberbank. After proper restructuring, the debt burden will decrease due to an increase in the loan repayment period.

- Refinancing is a program aimed at helping clients with a mortgage from another bank in Russia. The financial burden will be lower due to more favorable conditions for the borrower. I also call it “re-mortgage”.

The only program that allows you to directly reduce the mortgage percentage directly at Sberbank was closed on September 11, 2018. All those who managed to submit an application before this date can only check its status through the DomClick portal.

As of today, it is impossible to apply for a reduction in the interest rate on an existing mortgage with DomClick. However, it is possible to apply for mortgage refinancing to other banks, for example:

| Bank | Loan amount, up to | Bid | Mortgage term |

| up to 30,000 rub. | from 9.8% | up to 30 years old | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

Restructuring

Restructuring allows you to improve the existing conditions under the current loan agreement. The program is needed to reduce the size of the payment, without directly changing the current interest rate.

Sberbank offers clients three mortgage restructuring options:

- Change of currency - a dollar mortgage can be converted into a ruble at a more favorable rate.

- Changing the loan term - by increasing the loan repayment period, the amount of monthly payments is reduced.

- Providing a deferment is a grace period with a short-term reduction in monthly payments.

Arguments for formalizing a restructuring program for the purpose of subsequent recalculation of payments:

- Decrease in income (dismissal, salary reduction, etc.).

- Conscription for compulsory military service.

- Maternity leave to care for a child.

- Partial or complete loss of ability to work.

Main stages of debt restructuring:

- collecting the necessary package of documents;

- read the terms and conditions and submit an application;

- upon satisfaction of all bank requirements, obtain approval;

- sign a restructuring agreement.

For registration you will need:

- Passport of a citizen of the Russian Federation (its copy).

- Certificate confirming income for the last 3 months (not required in case of dismissal).

- A document confirming the absence of permanent employment.

- Application for maternity leave.

- A notarized copy of the employer’s order to change the terms of remuneration.

- Notification of upcoming layoffs.

- Application for registration with the employment service, indicating the amount of benefits received.

- Certificate confirming incapacity, disability, death.

You can apply for recount at the bank office or online on the official website of Sberbank. After logging into the system using your phone number, you must fill out all fields of the application form according to reality and attach scanned copies of the required (at the first stage) documents to the application.

Refinancing

Refinancing is a program that allows you to profitably change the terms of repayment of a mortgage taken out from another bank.

List of banks to which it is profitable to refinance a Sberbank mortgage

| Bank | Loan amount, up to | Bid | Mortgage term |

| up to 30,000 rub. | from 9.8% | up to 30 years old | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

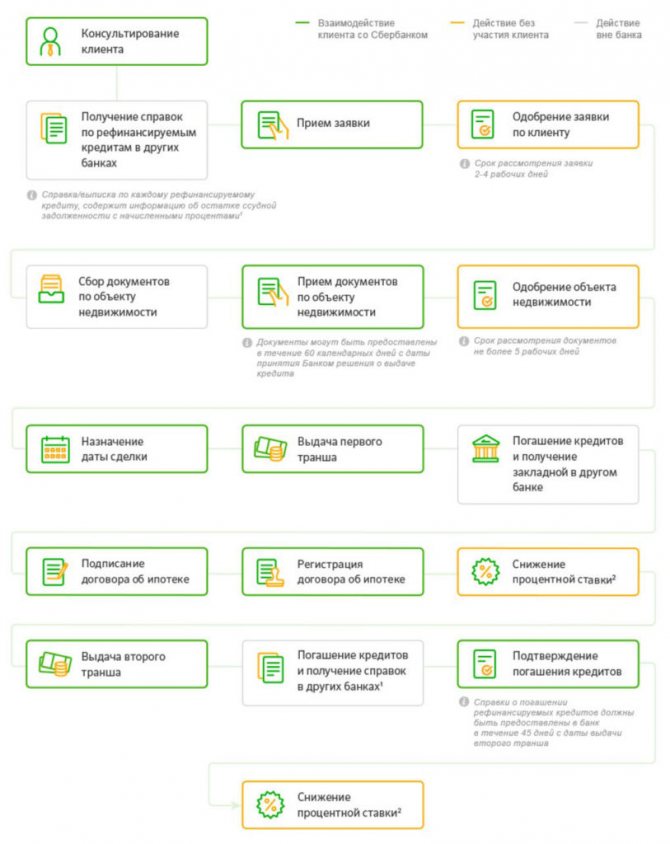

Stages of registration:

- collection of necessary documentation;

- filling out an application at the bank’s office or on the official DomClick portal https://ipoteka.domclick.ru/ (review from 2 to 4 days);

- after approval, provide the original documents to the Sberbank office within 3 months and conduct an assessment of the mortgage housing (3-5 days);

- sign an agreement to receive a loan at 12.9% to pay off debt in another bank, the interest rate is reduced by 2% after passing all stages (at the final stage it is 10.9%);

- repay a mortgage from another institution and obtain a certificate of no debt; this must be done within two months after receiving a loan from Sberbank;

- a certificate must be sent to Rosreestr in order to remove the encumbrance from the property;

- apply for a mortgage at Sberbank and submit documents with the manager to Rosreestr to register the transaction; after processing the request (10-30 days), the rate will be reduced by 2%.

The last 3 points must be completed within 60 days so that the bank does not begin the procedure for collecting the issued loan. If the borrower does not meet the deadline, he has the right to apply for a deferment.

The borrower has the right to simultaneously refinance loans from other banks, but in this case, funds are issued in two stages:

- First. Loan to pay off a mortgage.

- Second. After refinancing a mortgage loan, the remaining funds are issued to cover other existing financial obligations.

Documents for an alternative reduction in the interest rate on a loan or credit through the DomClick portal:

- Application form for refinancing.

- Passport.

- Document confirming income and work record.

- Existing mortgage loan agreement.

It should be taken into account that refinancing will require costs:

- registration of insurance policies;

- expenses for registration and valuation of real estate.

Therefore, it is important to calculate your own benefit.

| Mortgage debt, rub. | Monthly savings, rub. | Refinancing costs | ||

| — 1% | — 2% | — 3% | ||

| 1 million | 500 | 1000 | 1500 | 15500 |

| 1.5 million | 800 | 1600 | 2400 | 21000 |

| 2 million | 1050 | 1600 | 3100 | 26500 |

| 3 million | 1600 | 3200 | 4600 | 37500 |

| 4 million | 2150 | 4250 | 6300 | 48500 |

| 5 million | 2825 | 5560 | 8250 | 59500 |

| 6 million | 3500 | 6870 | 10200 | 70500 |

The calculation in the table was carried out at the rate before the reduction of 12.5%.

Let's consider an example: the borrower's mortgage debt is 3 million rubles for 7 years. At Sberbank, the interest rate was reduced by 2%, as a result, he will save 38,400 rubles in a year, and 268,800 rubles for the remaining period. Thus, the total benefit will be 231,300 rubles over 7 years.

Recalculation for early repayment of a mortgage in Sberbank - step-by-step instructions

The process of early repayment of debt at Sberbank is no different from what is required from clients at other institutions in 2019.

Borrowers will have to:

- submit an application indicating the exact date and amount of payment;

- deposit money on the specified day;

- wait for the debt to be recalculated and a new payment schedule to be received.

The situation is a little more complicated when using maternity capital to pay. The difficulty lies in the fact that money is credited to the credit account not by the debtor, but by government bodies that control the management of maternity capital. That is, it is almost impossible to name the exact date of enrollment in advance, so it is worthwhile to promptly seek help from Sberbank employees and follow their recommendations and instructions.

Situations where debtors cannot fulfill their obligations to contribute an additional amount deserve special attention. In such cases, you need to submit a second application, with a message about the withdrawal of the first and refusal of early repayment.

What are the terms of early repayment at Sberbank?

We have already discussed the importance of submitting an application with notification of the desire to increase the payment or make an additional contribution. It must be sent 15 days before payment. You can withdraw your application at any time before the day the account is replenished.

The method of submitting an application deserves special attention. Borrowers can submit either a written application or simply call the contact center. But the first option is preferable, since it guarantees that the application will not be lost and will be received by the manager.

To what has been said, it must be added that the bank cannot reject the application.

Minimum payment

There are no restrictions on the amount of payment. Borrowers can make either a small payment or a significant contribution that can completely cover the debt. But it is important to take into account that submitting an application and notifying the bank about your intentions makes small payments pointless, since the difficulties with payment turn out to be more than the benefits.

But it may be convenient to round the next payment according to the schedule to a round value (up to a thousand or 500 rubles). This will simplify the calculations and eliminate the need to change money if the payment is made in cash through an ATM.

Conditions for reducing interest on loans under the refinancing program

A mortgage application is submitted in full compliance with the basic requirements of the program:

- the loan is issued only in rubles;

- the minimum amount for a loan eligible for refinancing is 300 thousand rubles;

- the maximum amount is 7 million rubles, but not more than 80% of the cost of housing;

- repayment period - up to 30 years;

- refinancing just one mortgage.

When submitting an application, you must provide a passport and the documents listed above.

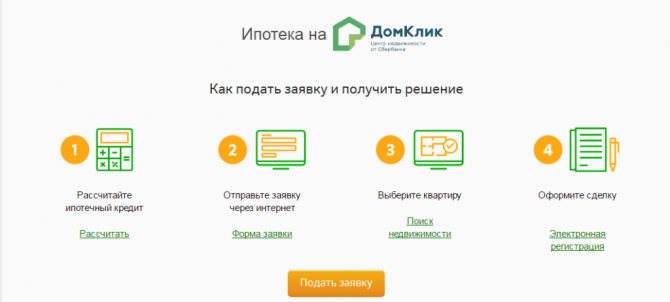

Online application for DomClick to refinance a Sberbank mortgage

You cannot submit an application through Sberbank Online directly from the official website; this can only be done on the DomClick portal.

This requires:

- go to the official website of the service;

- in the upper right corner “Login to your personal account”;

- register through Sberbank Online.

After confirmation, you must fill out an application for refinancing:

- Submit an application through the DomClick portal section.

- In the loan purpose column: select “Refinancing”.

- Enter all mortgage information. Choose a convenient repayment term, taking into account the size of the monthly payments.

- Proceed to fill out the application. Some fields of the questionnaire will be filled in automatically when registering through Sberbank Online.

- Enter information on the remaining points in full accordance with reality, attaching the required package of documents.

- After checking the data, you can send an application to Sberbank.

- All that remains is to wait for the bank's decision on refinancing the mortgage. Application processing takes from 2 to 5 business days.

If the answer is positive, you need to select suitable housing and begin the registration procedure.

How to find out the decision on applications for rate reduction submitted earlier

Sberbank provides every borrower with the opportunity to learn about rate reductions:

- You can check the status of an interest reduction application submitted to DomClick by calling the hotline 8 (800) 7709-999, giving the operator your personal number, full name or application ID.

- Find out the status of the application to reduce the mortgage percentage through DomClick from Sberbank. By clicking on “Check request status”, the system will redirect the client to the DomClick portal, where you need to enter a phone number.

What are mortgage rates in 2020?

Expert opinion

Irina Bogdanova

Work experience at Sberbank for 12 years.

Mortgage loan rates depend on the program chosen. They vary from 6% to 13%.

Current mortgage rates at Sberbank can be checked with employees of the financial institution or on the official website.

Current loan rates in DomClick

Mortgage rates for the purchase of an apartment depend on the possibility of subsidizing, the loan term and premiums. To calculate, you do not need to register on the portal, just use the mortgage calculator on our website.

Purchase of housing under construction

The program is designed for the purchase of real estate in a building under construction on the primary market.

Rates:

- With subsidies for up to 7 years - 8.5%.

- Above 7 years - 9%.

- Basic - 10.5%.

Additional allowances:

- +0.2% - if PV is within 15% - 20% (not including the upper limit);

- +1% — upon termination of a life insurance contract;

- +0.3% - for borrowers without a Sberbank salary card;

- +0.1% - if you refuse the “Electronic Registration Service”;

- +0.3% - for clients who have not confirmed income when making a down payment of 50%.

Purchase of finished housing

Possibility of purchasing an apartment from Sberbank under a loan agreement on the secondary real estate market.

Mortgage program rates:

| Contract rate | With proof of income | No proof of income | ||

| Promotion "Showcase" | No promotion | Promotion "Showcase" | No promotion | |

| Basic | 10,7% | 11% | 11,3% | 11,6% |

| As part of the “For Young Families” campaign | 10,2% | 10,5% | 10,8% | 11,1% |

Key feature: the premiums are similar to the “Purchase of housing under construction” offer. Moreover, unlike housing under construction, if you buy an apartment on the secondary market, you can move into it immediately.

Refinancing mortgages and other loans

A program for relieving credit burden by drawing up a new mortgage agreement on really favorable terms.

Rates before and after registering a transaction:

| Goals | Rate before confirmation of repayment of refinanced mortgage | Rate before confirmation of loan repayment | Rate after confirmation of repayment of all loan products |

| Before/after mortgage registration | |||

| Mortgage | 12,9%/11,9% | — | 10,9%/10,9% |

| Mortgage + consumer loan + car loan + credit card + cash | 13,4%/12,4% | 12,4% | 11,4%/11,4% |

| Mortgage + cash for own purposes | 13,4/12,4% | — | 11,4%/11,4% |

Mortgage under the program Purchase of finished housing

Created for participants in the Housing Renovation Program in the city of Moscow with the aim of relocating residents from dilapidated houses and further reconstructing dilapidated real estate.

Rates:

- 10.5% per annum - for borrowers transferring salaries to an account in Sberbank;

- 10.8% - for other clients;

- 11.1% - for clients who have not confirmed income, but subject to making a 50% down payment.

An additional surcharge of +1% is charged when canceling life insurance.

Mortgage with state support for families with children

A program under which the government pays a portion of the mortgage interest. If a second child appeared in the family in 2020, the loan is issued at a rate of 6%, and it is valid for three years.

If a third child is born during the grace period, the term under the terms of the “Mortgage for Large Families” program increases by another 5 years. At the end of government subsidies, the mortgage interest rate will be 9.5%.

Construction of a residential building

A program that allows bank clients to start building their own home. Lending is carried out at a rate of 11.6% with some surcharges:

- +0.3% if the borrower is not a payroll client;

- +1% - until the mortgage is registered;

- +1% - upon termination of a life and health insurance contract.

country estate

A mortgage loan for the acquisition of land, purchase or construction of a summer house is issued at a rate of 11.1% with similar premiums as under the “Construction of a Residential House” program.

Non-targeted loan secured by real estate

A program that allows you to apply for a loan without having to confirm the purpose of the loan. Acts as an alternative option for obtaining a mortgage without a down payment.

Issued at 13% with surcharges:

- +0.5% - if there is no salary account;

- +1% - if you refuse insurance.

Mortgage plus maternity capital

Execution of a loan agreement with the participation of maternity capital as a down payment or additional collateral.

A mortgage is issued at 10.5% with possible surcharges:

- +1% — upon termination of a life insurance contract;

- +0.3% - for borrowers without a Sberbank salary card;

- +0.1% - if you refuse the “Electronic Registration Service”;

- +0.3% - for clients who have not confirmed their income when making a down payment of 50%.

Military mortgage

Possibility to purchase real estate if you have a military personnel ID. The interest rate is 9.5%.

Garage or parking space

Loan for the purchase of a parking space or the acquisition/construction of a garage. Issued at 11.6% with the following premiums:

- +0.3% - for clients receiving salaries from another bank;

- +1% - until the mortgage is registered;

- +1% - if you refuse life insurance.

Loan restructuring

A program to help borrowers experiencing temporary financial difficulties. In this case, the bank offers clients deferments, changes in the loan currency or payment terms.

As it was before

Just recently, when you asked a banking specialist at a Sberbank branch about the possibility of reducing the interest rate, you heard a categorical refusal. It is really justified - you signed the contract, you agreed to the conditions that were stated in it, the money was given to you exactly at the rates announced in advance, and you were satisfied with it.

On the other hand, over the past few months, interest rates on mortgage offers in all financial institutions have decreased significantly. If previously it was almost impossible to take out a housing loan from Sberbank at less than 13-14%, now they offer from 9.5% per annum.

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

Borrowers began to be indignant - why should they overpay? Complaints, claims, and many letters began asking for a revision of the terms of existing contracts.

And only in August 2020, news appeared on the official website of Sberbank that it had begun accepting and considering applications from mortgage borrowers in order to revise rates. What conditions:

- If you were given a mortgage, i.e. a targeted loan for the purchase or construction of housing, then you can count on your interest rate being reduced to 10.9% or 11.9% per year (taking into account the life and health insurance of the borrower or not),

- If the loan was secured by real estate, i.e. funds were issued for your personal purposes, the reduction will be up to 11.9 or up to 12.9% with the same conditions (with or without insurance).

Later in this article:

Advice for new borrowers

Ways to reduce rates for potential borrowers:

- Sign a contract for life and health insurance - 1%. However, when you factor in the cost of the policy, the actual savings are 0.5%.

- Register a mortgage without visiting the MFC and Rosreestr - 0.1%.

- Reduce your mortgage interest rate through DomClick by submitting an online application - 0.3% discount.

- Buy an apartment from the developer at a discount for up to 12 years - 2%.

- Confirm income - 0.3%.

The DomClick loan calculator will help you find out the true benefit.

It is important to consider that not all apartments come with a discount. Before registration, you need to familiarize yourself with the options offered by developers at reduced rates.

What properties can you lower your rate on?

You can reduce the lending rate on any property, but only if you take out a mortgage on normal terms, without benefits.

Who can get approval for a rate reduction?

Anyone can submit an appeal, but only if they comply with the bank’s mandatory conditions. It will be an excellent bonus if the client already has a savings account for a large amount of money.

Important to remember! The program to reduce the lending rate has been discontinued and it is impossible to submit an application!

Question answer

Are there social programs to reduce interest rates?

Sberbank does not have such programs. However, the borrower can relieve part of the loan burden by using maternity capital. Also, if you meet the basic requirements, you can become a participant in the mortgage subsidy program.

Is it possible to go to court?

It is possible, but only if the bank fails to comply with its direct obligations. In other cases, it is better to contact the customer support center by phone. In a difficult financial situation, Sberbank will always meet borrowers halfway.

Where can I apply for a mortgage interest rate reduction?

There is no sample for filling out an application at a Sberbank branch, since the interest rate reduction program has been eliminated.

To reduce your credit burden, you can submit an application for refinancing or restructuring your mortgage.

What is needed to reduce the amount of payments through DomClick

You cannot directly change the loan interest rate, but you can apply for a rate reduction through DomClick through debt restructuring.

Is there mortgage indexation at Sberbank?

Mortgage indexation is a myth! The good thing about a mortgage is that the amount is fixed in rubles, and then no one cares what happens to the ruble - just pay yourself interest for the reporting period and the next part of the remaining debt.

Reasons for reducing rates

Current borrowers are disappointed because they took out more expensive loans, and the agreements have already been signed and changes in conditions are provided only in exceptional cases. A team of qualified lawyers is working on bank loan agreements; the document will have legal force after it is signed by both parties.

Important! The loan agreement specifies cases of changes in conditions. The bank does not have the right to increase the current rate if this is not specified in the agreement (for example, linking the rate to Mosprime, etc.). The bank can lower the rate, but this is its right, not its obligation.

The borrower has the right to submit an application for a possible reduction in the mortgage interest rate , but the final decision will be up to the bank. By the way, you are required to accept the application for review; refusal in this case is unlawful.

Possible reasons for reducing rates are identified:

- the client became a participant in one of the government social programs offering benefits.

- Mortgage rates have dropped significantly on the market.

- On-lending is possible due to the deterioration of the borrower’s financial condition or other circumstances not provided for in the agreement.

You shouldn’t place your hopes on a rate cut, as this will significantly reduce the bank’s profits. Therefore, particularly compelling reasons are needed to reduce interest rates.

Currently, Sberbank is reducing rates on existing loans to a maximum of 9%.