Types and conditions of credit programs at Post Bank

The list of services offered by Post Bank does not include a mortgage.

However, the financial institution offers several other programs that can be used by both individuals and legal entities to purchase a home on credit. These include:

- Cash loan.

- Mortgage refinancing.

- Lending to corporate clients.

- Loan for pensioners.

- Purchases on credit.

Post Bank is a young credit organization. Therefore, there is no large list of products in its arsenal. Many people are interested in whether the bank has special programs for young families.

Today, a credit institution cannot issue a mortgage using maternity capital. There is also no opportunity to take out a loan to build a house or sign a mortgage agreement without a down payment.

Cash loan

To purchase an apartment at Pochta Bank, an able-bodied citizen of the Russian Federation can use exclusively the “Cash Loan” program.

A mortgage in this form can be issued under the following conditions:

| Purpose of lending | Any purchase |

| Mortgage term | Up to five years |

| Loan amount | No more than 2,000,000 rubles |

| Securing the deal | Purchased housing |

| Additional fees | None |

| Early repayment | Allowed |

| Additional agreements | Collateral insurance agreement. |

| Personal insurance contract. |

The pricing policy for apartments and houses on the real estate market is such that very large sums are needed to purchase them, on the primary market throughout the country, and on the secondary market in the central regions.

Based on the proposed conditions, you can take out a mortgage from Pochta Bank for secondary housing.

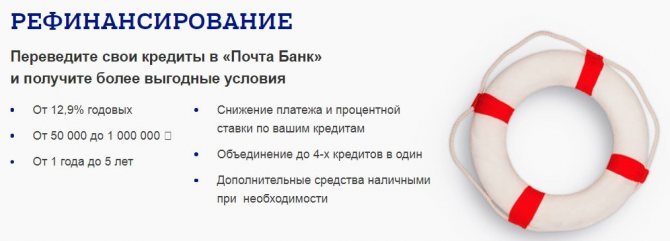

Refinancing

If you have already taken out a mortgage from another financial institution, you can use the home loan refinancing service at Post Bank.

The key points of such an agreement are the following conditions:

- The amount of debt should not exceed 1,000,000 Russian rubles.

- The term of such a mortgage can range from 12 to 72 months.

- Opportunity to attract co-borrowers.

- Proof of income is not required.

What is needed for registration

Each bank has requirements for the borrower. Post Bank offers a loan with a minimum set of documents and conditions. Compared to other financial institutions, Post Bank treats its customers favorably.

- The borrower must be an adult, but not older than 80 years at the end of the contract. Those. if the loan term for pensioners is 3 years, then you can apply for it at age 77;

- The borrower must be a citizen of the Russian Federation with permanent residence on its territory;

- The loan can only be obtained by working citizens with a permanent income, except for pensioners and students;

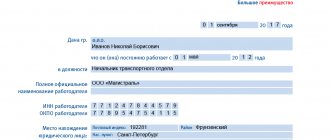

- You don’t need a certificate of income; you will need the employer’s TIN and your SNILS. You also need to provide your contact number, additional number and employer contact;

- You can take out a loan together with co-borrowers. In this case, you will be able to take more amount than is available to you.

Interest rates in 2020

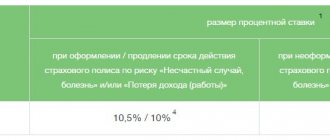

The loan is provided on payment terms. The interest rate for using a mortgage from Post Bank varies from 14.9% to 17%.

Mortgage rates depend on:

- Type of housing purchased.

- Applicant's credit history.

- Attracting co-borrowers.

The interest rates also depend on the status of the borrower. If the applicant is a recipient of wages or pension accruals from Pochta Bank, then he is guaranteed to receive a discount on the cost of the mortgage in the amount of one percentage point.

Requirements for the borrower

Post Bank has a reputation as a fairly loyal credit institution that does not impose strict requirements on its clients and package of documents. Among the key requirements for potential debtors:

- Age limit is at least 18 years.

- Having Russian citizenship.

- Permanent registration in any Russian region.

- Availability of a valid mobile phone.

- Work experience at current place of work – from 3 months.

All considered loans, with which you can buy a home, are issued without the need to confirm employment and income. Therefore, such requirements are not voiced.

In most cases, borrowers are assessed by scoring systems that check the person’s absence from numerous stop lists and the quality of their credit history. A borrower who applies for a loan, but is on the black lists of most lenders in the Russian Federation and has a negative credit history, will be denied.

How to lower your mortgage interest rate?

The interest component of a mortgage loan is quite high.

Therefore, the management of Post Bank in the current 2020 has provided its borrowers with the opportunity to reduce it. This can be done by connecting . The essence of this product is as follows:

- The applicant pays the cost of connecting to this service according to the institution’s tariffs;

- Repayment of mortgage debt within twelve months from the date of signing the loan agreement without violating its terms regarding timely payments.

As a result, employees of the credit structure recalculate the cost of the mortgage for the entire period of the transaction. Overpaid funds are returned to the borrower to a special savings account.

Repayment of this amount is made only on the day of full repayment of mortgage obligations.

How to get a mortgage from Leto Bank?

Hello, Victor! Because the lending market is booming, many people may have multiple loans at the same time. The main thing is that the amount of monthly income allows you to repay them on time. But if we are talking about large amounts of lending, then any loans issued earlier and unpaid on the day of application are a potential threat for the bank.

Please keep in mind that in all financial institutions, including Leto Bank, mortgages, like car loans or business loans, are fairly among those types of services that require a package of additional documents to complete.

Special attention is paid to their consideration. Therefore, if you have outstanding loan obligations, you will need to provide the bank with evidence that your monthly income allows you to easily pay payments on current loans and on a future mortgage.

Find out which bank will approve your mortgage Take a short test and find out which banks are ready to approve your mortgage. Select a suitable bank from the list, submit an online application and receive money. Proof of solvency can be a 2-NDLF certificate, which you can easily obtain from your accounting department. If you are the owner of any property that can serve as collateral, then provide the bank with documents confirming ownership.

If you have deposits or other savings deposits, it is best to take statements from the relevant financial institution about their availability, size and attach them to the main document. This will serve as additional confirmation of your solvency and reliability.

Before contacting a bank to apply for a loan, it is better to soberly weigh your options.

To do this, use the service that most banks provide their clients today, including Leto Bank - a mortgage calculator. With its help, you can calculate for yourself the optimal loan term and, accordingly, the amount of the monthly payment.

To apply for a mortgage loan, you will also need the consent of your spouse, parents or other immediate relatives. In some cases, at the request of the bank, a guarantor who is not related to you may be needed.

If the amount of the existing outstanding loan is very insignificant, or its repayment period has almost come to an end, then it may not play a significant role in the bank’s decision on the application.

Mortgage calculator

The desire to purchase a home does not stop a person from facing possible difficulties.

Having decided to sign a mortgage loan, many cannot immediately assess all the advantages and disadvantages of such an operation. There is a special mortgage calculator program for this. There are a lot of them on the Internet. This resource makes it possible to assess your credit load and correlate it with your real capabilities.

Knowing the expected mortgage amount, interest rates, debt repayment scheme and the amount of additional fees, the applicant can calculate the overpayment and draw up a payment schedule for this loan.

This document is indicative only. The actual amount may differ slightly from that calculated independently. However, this will be the starting point in signing the mortgage deal.

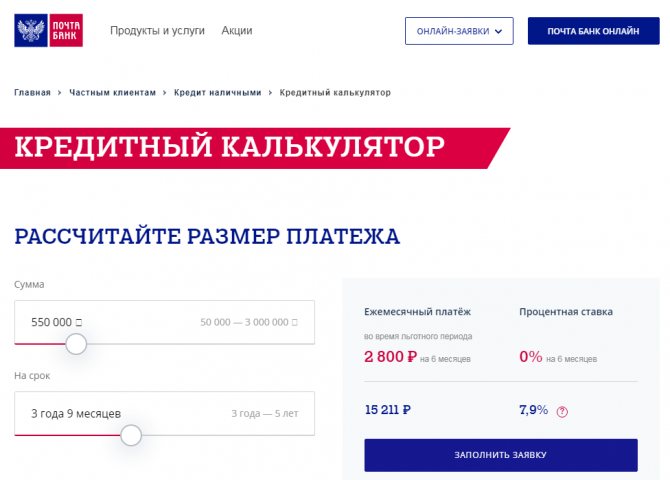

Mortgage loan calculator

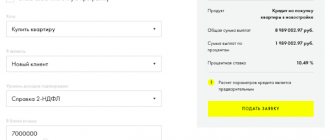

The bank's official website contains a calculator that calculates the amount of the monthly payment pochtabank.ru/cash-calculator. The result is never 100% correct, since the interest rate is set by the financial institution for each client individually.

Example of a mortgage calculator.

You can also use our calculator:

Loan calculator provided by calcus.ru

Does payments include down payment?

The terms of most loan programs do not require a down payment. For this reason, this parameter does not need to be specified in the calculator when calculating the monthly payment online.

What data to enter

In the calculator you need to specify only 2 parameters - the desired amount (from 50 thousand to 3 million rubles) and the term (from 3 to 5 years).

Ease of use of the calculator

The calculation is performed instantly and automatically after specifying the desired loan parameters.

The result includes the following information:

- approximate monthly payment;

- interest rate that may be set by the financial institution;

- monthly payment with the “Zero Doubts” option activated.

If you are satisfied with the information obtained using the Pochta Bank mortgage calculator, you can click on the “Fill out the application” button and apply for a loan.

Insurance contract

When drawing up an agreement to issue a consumer loan, the borrower has the opportunity to refuse to purchase an insurance policy. If you decide to take out a mortgage from Pochta Bank, signing an insurance contract for the purchased home will be mandatory.

This is due to the fact that the apartment or house that you buy with credit funds becomes collateral for the mortgage. And the credit structure is interested in ensuring that such property does not suffer from the actions of third parties.

Insurance conditions for each individual case are considered individually. The cost of such a policy depends on the following components:

- Amount and term of mortgage;

- Type of housing purchased;

- Its technical characteristics and location.

Does Post Bank issue mortgage loans?

Post Bank is not a company with a long history, but with an excellent reputation. Although the financial organization has been operating relatively recently, only in 2020, it has already become one of the most popular and successful in our country. It offers banking services to both individuals and legal entities. is not issued at Pochta Bank .

This service is not provided by the company. The reason that the organization does not yet have a mortgage program is that it is still relatively young. In the future, the likelihood that the bank will begin to provide such loans is very high.

But the bank can still help with obtaining funds for a house, a new apartment or secondary housing. To do this, you can use a non-targeted loan , which allows you to obtain funds for any purpose.

How to get a mortgage at Post Bank?

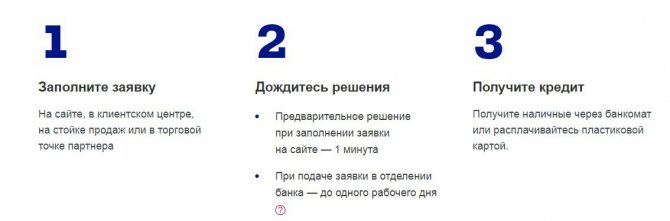

To obtain a mortgage, you must submit an application to a Post Bank branch. This can be done in two ways:

- By personally visiting a branch of a financial institution.

- By submitting an online application.

Submitting a mortgage application online does not exempt the applicant from visiting Post Bank. In this case, the bank’s specialists will review your application and send a preliminary response to your email address.

If the decision is positive, you will be informed of the list of documents required to sign the transaction. They will also agree with you on the date of your visit to the Post Bank branch.

Here, with the help of competent and qualified employees, you will fill out a questionnaire according to the established template. Sign permission to use your personal data. Next, the entire package of documents is transferred to the credit committee, which will make a final decision. Once approved, you can find a suitable apartment within three months.

With the documents for the purchase and sale of housing, come to the Post Bank branch, purchase an insurance policy for the property and receive funds.

Advantages and disadvantages of a mortgage loan at Pochta Bank

Before deciding whether to take out a loan to buy a country house or apartment, you need to evaluate all the pros and cons of the offers.

Post Bank acts as a lender very often. He is chosen for:

- Fast decision making.

- The need to submit a minimum package of documents.

- Loyal attitude towards clients.

In addition, it issues loans for the purchase of housing without a down payment. But financial institutions also have disadvantages. These include:

- Lack of special mortgage programs (for example, for maternity capital).

- There are no military mortgage offers.

- There are restrictions on the amount of the loan issued.

- Short debt repayment terms.

Post Bank offers can be beneficial for young families who do not have enough money . If clients need several million, for example, to buy a private house, then the organization will not be able to offer a profitable program.

List of required documents

An undeniable advantage of Pochta Bank is the absence of huge packages of documents for concluding a mortgage transaction.

For a citizen of the Russian Federation, a passport and insurance number of an individual personal account are sufficient. Credit institution employees may require an individual employer tax number.

No supporting document is required; it can simply be communicated to the responsible manager. Additionally, documents for the purchased housing will be required. These include various certificates and certificates. A complete list of them can be found on the official website of Post Bank.

Customer reviews about mortgage lending at Post Bank

In addition to the official website and online calculator, potential borrowers should take a closer look at the reviews of people who have already completed an agreement or even repaid the debt. This will help to find out details that are not indicated in official documents and are not mentioned by managers. The main thing in such cases is to remember that some comments are written under the influence of emotions, and therefore may contain inaccurate information. It is worth separating them from truthful, honest and objective messages about banking services.

Additional services

For the convenience of customers, Pochta Bank employees suggest paying attention to additional services. Their connection is free of charge. The borrower can use it one-time during the calendar year. This allows you to recalculate the amount of monthly payments for the remaining period of the transaction.

If the date of receipt of income by the applicant changes, he can once a year change the payment date established by the credit transaction to one that is more convenient for him. This opportunity is provided by the “Change payment date” service.

Pochta Bank cards are available for recipients of income. This will allow you not to waste time going to bank branches. It will also reduce the risk of late mortgage payments.

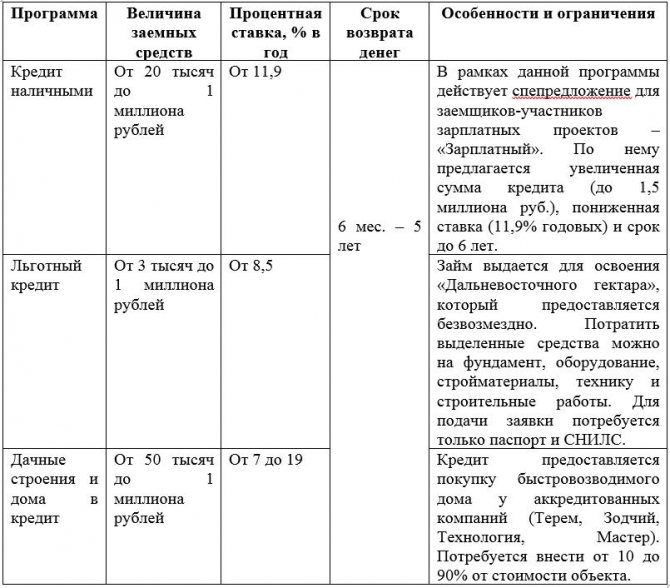

Lending conditions Post Bank

In general terms, lending conditions for the purchase of housing using borrowed funds have the following characteristics:

- debt repayment period – up to 6 years;

- maximum loan amount – up to 1.5 million rubles;

- interest rate – from 8.5%.

IMPORTANT! Credit products of Post Bank do not involve the transfer of purchased property as collateral.

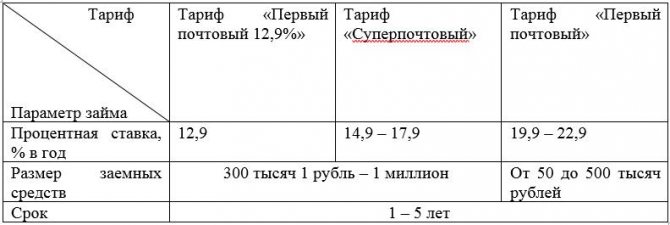

Below is a table with the parameters for obtaining a loan that can be used to solve your housing problem.

There are 3 special tariffs for the Cash Loan program, which apply to borrowers with an open Basic savings account. Parameters of such tariffs:

In addition, the client can add additional options and services to each product. Among them:

- “Guaranteed rate” (12.9% per annum);

- “I’m missing a payment”;

- “I am changing the payment date”;

- "Credit Information";

- “Regular auto repayment”;

- “Early repayment with reduced payment.”

All listed services are paid. The commission amount is set based on the bank's current tariff policy.

The products “Preferential” and “Country buildings and houses on credit” are targeted loans. The bank strictly monitors where and for what exactly the allocated money will be spent. This is confirmed with the help of financial documents, statements, and contracts.

Debt repayment

You can repay your mortgage debt through Post Bank ATMs. In this case, you need to know the details of the agreement and have a payment card with you. There is a limit on the maximum amount. You can repay no more than 15,000 Russian rubles. Funds are credited on the same day.

We also wrote about how and where you can pay for a loan at Pochta Bank.

You can also use the online service on the Post Bank website. You must carefully fill in all required fields. Funds will be credited the next business day.

Early repayment of a mortgage can be made at any day without applications or other approvals.

Maternal capital

In Russia, only three financial institutions offer mortgage programs for maternity capital: Sberbank, VTB24 and Bank of Moscow.

Post Bank does not work in this direction. This is due to the fact that the bank began its activities not so long ago, so not all products are available to customers yet.

The situation may change in the near future . Basically, Post Bank provides mortgages without a down payment. The funds received on credit are used to pay for real estate or for on-lending.

Customer Reviews

Many reviews about mortgage lending from Post Bank can be found on the Internet. Positive statements predominate among them.

Yulia, Novy Urengoy: “I closed my loan. Very pleased with the service. They spoke in detail and unobtrusively about the conditions, changes in the financial structure, and offered new products.”

Natalya, Kirov: “I started an application for a loan online, the manager quickly called back, confirmed the application, everything is fine!”

Andrey, Samara: “Thank you very much to the managers. I wanted to buy an apartment on credit, and since I previously had no credit history, many banks refused, the post office bank approved a slightly smaller amount than I needed, but I still bought myself a home.”

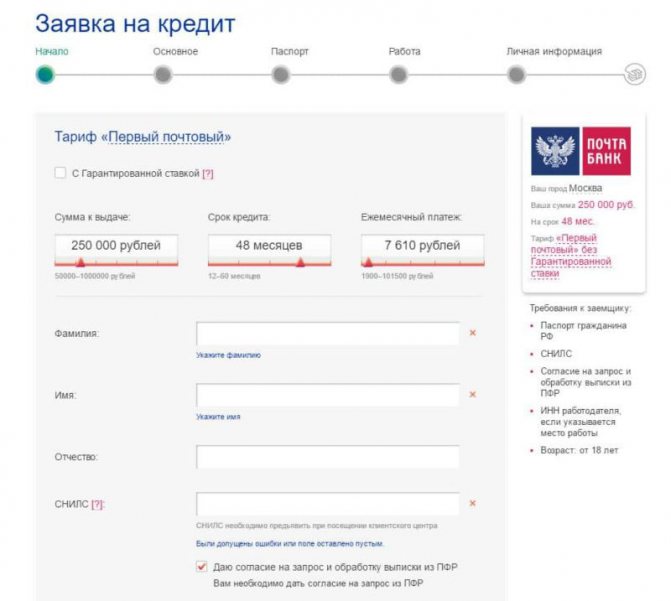

Completing an online application for a mortgage on the bank’s official website

You can apply for a loan remotely on the official website of the financial company. To do this, you need to fill out the required fields of the questionnaire offered by the lender and submit it for consideration.

The answer comes to the mobile phone or email specified in the online application.

If the decision is positive, the client will need to come to the office with the necessary papers to sign the loan agreement.

Applying for a loan online.