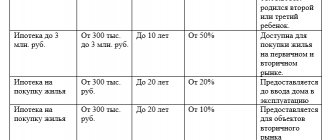

Bank mortgage terms

The down payment is set at a minimum of 10% of the value of the property

MTS Bank offers the following conditions for its borrowers:

- The maximum mortgage amount is 8,000,000 rubles and 15,000,000 rubles for real estate in a new building within Moscow;

- The mortgage is provided for a maximum period of 3 to 25 years;

- Interest rates depend on the lending program and the borrower's candidacy.

For payroll clients, more favorable conditions are provided in the form of the possibility of registration without providing a full package of documents, as well as early repayment without commissions and additional payments.

Is it profitable to refinance a mortgage at MTS Bank?

MTS Bank offers to refinance your mortgage at a rate of 9%. In this case, the loan is issued without a commission, and if you have a good credit history or have a salary card, the application will be considered in a maximum of 2 days.

For example , if the mortgage was issued at 14%, the remaining loan term is 16 years, and the current amount of debt is 3.5 million rubles with a monthly payment of 45,550 rubles, then after refinancing at 9% at MTS Bank the payment will be reduced to 34,459 rub. per month. The monthly savings will be 11,091 rubles, and the bank will have to return 2,129,472 rubles.

Requirements for borrowers

Borrowers can only be citizens of the Russian Federation

MTS Bank sets somewhat non-standard requirements for its borrowers, which are related to the range of persons who can be mortgage borrowers:

- Only salary clients, bank employees, as well as persons who have entered into an employment contract with;

- Reaching the age of 18 years at the time of filing the application and no more than 65 years at the time of full repayment of the mortgage debt, and in the case of the borrower reaching the age of majority, but not reaching the age of 23 years, it is necessary to involve co-borrowers who are over 23 years old;

- Availability of permanent registration;

- A stable source of income, and the work must be located in the place of the bank’s authority;

- At least 3 months of experience at the current place of work;

- Total work experience or entrepreneurial activity - at least one year;

- Possibility of attracting co-borrowers up to 4 people along with the main borrower.

Mortgage conditions for salary clients of MTS Bank

There are two mortgage lending programs available here. The borrower can purchase both finished housing and a new building. In addition, he has the option of refinancing a loan taken from any other bank.

In any case, only clients who are employees of the following organizations can apply for a mortgage:

- MTS Bank;

- AFK Sistema;

- who are participants in the MTS Bank salary project.

Unfortunately, an outsider will not be able to get a loan. This project is intended exclusively for “our” employees and salary clients.

The amount, rate and duration of the loan depend on the selected product and the status of the borrower.

Requirements for borrowers

In order for an application to be accepted for consideration under any available program, the borrower must meet the basic requirements:

If an individual entrepreneur acts as a co-borrower, then the period of operation of his company must be at least 12 months, and the activity must generate income

- minimum age – 18 years; age limit (by the year of making the last mortgage payment) – 65 years;

- total experience – at least 1 year; duration of work in the last place - from 3 months (borrowers who have successfully completed the probationary period are also allowed to participate in the program).

For persons whose age ranges from 18 to 23 years, it is necessary to have at least one co-borrower. At the same time, his income is taken into account when calculating the applicant’s credit rating and the minimum loan amount.

In total, you can attract no more than 4 co-borrowers. Each of them must satisfy basic conditions (except for the place of work - here you can attract employees of any enterprises).

Similar requirements are established when refinancing a mortgage at MTS Bank. At the same time, additional conditions are added to loans that are subject to refinancing. For example, delays on them are not allowed.

Early repayment

When repaying a mortgage, there are no restrictions on early repayment. You can repay the loan even the next day after registration - just send an application and ensure that there are sufficient funds in the loan account.

Application validity period

The decision to issue a mortgage is valid for 3 months after approval . Therefore, the client has the opportunity to choose the housing he likes and complete all the necessary paperwork.

There is no fee for processing a loan; the money is transferred directly to the seller’s account.

Types of mortgage programs of MTS Bank

MTS Bank's mortgage programs are quite diverse and are classified depending on the type of real estate that the borrower plans to purchase with a mortgage.

Video on the topic:

Housing in a new building

Mortgages for the purchase of housing in new buildings involve some risk for the bank, so they are issued in two directions - changes in interest rates after completion of construction or a single rate from start to finish.

Interest rates are standardly set at 14% per annum for the maximum down payment and the longest loan term. The minimum down payment is 20%.

The interest rate during construction can be 12.75%+2%.

The security for the mortgage is the right to participate in shared construction, and after the facility is put into operation, the apartment itself.

Housing on the secondary market

Housing on the secondary real estate market includes apartments and houses that are purchased from previous owners.

They are subject to the condition of mandatory assessment of the real market value and comparison of it with the seller’s price.

The amount of the down payment on the mortgage must be at least 10% of the value of the property, and interest rates are set at 11.75% per annum.

Vacation home

A country house can be purchased exclusively together with the land plot on which it is located.

It doesn’t matter whether it’s a townhouse, a private house or a cottage.

The down payment from the borrower's own funds must be at least 15% , and interest will be from 14.5%.

According to two documents

This program provides a simplified procedure for obtaining a mortgage by submitting just two documents without income certificates.

The amount of the down payment to guarantee the borrower's solvency must be at least 10%.

Interest rates are determined depending on the type of real estate that is purchased - from 12.75% + 2% per annum.

You can find out more about the list of banks issuing mortgages based on two documents here.

Refinancing

Refinancing involves changing the creditor bank in order to be able to repay the mortgage on more favorable terms.

You can learn more about applying for mortgage refinancing in this article.

When choosing MTS Bank, borrowers can count on interest rates from 12.25% per annum with collateral of at least 15%.

Useful video:

For any purpose

In order to obtain a mortgage under this program, the borrower must have certain real estate that can be provided as collateral to the bank.

Then the purpose of lending is not determined.

The mortgage amount is determined by the value of the mortgaged property.

The down payment is from 20% of the mortgage amount with interest rates from 16% per annum.

Mortgage refinancing through MTS Bank

A special mortgage refinancing program at MTS Bank allows you to combine several payments into one and significantly reduce the cost of servicing the loan.

Terms of restructuring

A payroll client of MTS Bank can combine in one payment as part of a restructuring: ordinary loans, credit card debts, car loans, mortgages.

When refinancing a targeted loan, it is possible to remove property - an apartment or a car - from collateral. Key terms:

- currency - rubles only;

- duration of payments – from 6 months;

- there must be no delays (current or past);

- amount – from 50 thousand rubles to 3 million rubles;

- term – from 1 to 5 years;

- rate – 11.9%/13.9%/15.9% depending on the allocated amount.

Mortgage in MTS Bank

Mortgage

Application review time is maximum 2 days. If the client decides to join the financial protection program (i.e., takes out insurance), he will receive a discount of 1-2 percentage points.

Refinancing is carried out on the basis of a passport and existing loan agreements (you also need to provide account details for transferring money). MTS Bank independently repays refinanced loans, i.e. the borrower will receive cash only in excess of the total debts.

If the proposed conditions are not satisfactory, then you can consider other banks for refinancing. Some of them do not refinance their own mortgages, but willingly lure clients from other lending institutions. As a rule, there are special offers for salary clients.

Rate reduction to 11.9%

The program provides:

- rate reduction to 11.9%;

- reducing the monthly payment to a comfortable level;

- choosing a repayment date for a new loan;

- the possibility of obtaining free funds at your personal disposal (i.e. you can get a loan for a larger amount than you have obligations).

Mortgage calculator

In order to calculate the amount of your monthly payment and assess your ability to pay it, you can use a mortgage calculator.

It allows you to find out how much the borrower will have to transfer to the bank every month.

To do this, simply fill out all the fields that contain information about the terms of the mortgage and click “calculate”; the calculator shows not only the amount of monthly payments, but also the total overpayment to the bank as a result of obtaining a mortgage.

Applying for a mortgage loan

After choosing MTS Bank to apply for a mortgage, you must fill out an application, which is accompanied by all the necessary documents confirming information about the borrower.

MTS Bank provides the opportunity to submit an application via the Internet, which is very convenient and allows you to find out, even without leaving your home, whether they will give you a loan and for how much.

The bank considers the borrower's candidacy, paying attention to the level of income and solvency.

As a general rule, monthly mortgage repayment expenses should not exceed more than 60% of the borrower’s family income. It also takes into account whether he has other real estate, permanent work and other factors.

MTS Bank employees promise a very fast review of the loan application, which lasts up to 24 hours. If the borrower submits the application in person, he will receive a verdict within an hour.

Video on the topic:

After this, the borrower must select the property for the purchase of which he needs a mortgage.

Since this real estate in almost all cases is pledged to the bank, it must have sufficient liquidity to cover the amount of the mortgage and interest on it. Liquidity, like the real market value of real estate, is determined during the assessment.

The services of a professional appraiser are paid by the client or later included in the cost of the mortgage. If there are discrepancies in the actual cost of housing and the price set by the buyer, the bank may refuse to issue a mortgage for this property unless the parties agree to reduce the price. Documents for housing are also provided in order to later formalize the encumbrance during state registration.

Read about how to remove the encumbrance after paying off your mortgage here.

Once all terms have been agreed upon, a mortgage agreement is drawn up and signed by all parties in person. It indicates all borrowers and co-borrowers, the conditions for issuing and repaying the mortgage.

Read about the legal rights and obligations of a co-borrower under a mortgage loan here.

It is worth paying close attention to the issue of monthly payments, the possibility of deferred payments and the conditions for early repayment.

MTS Bank requires mandatory registration of an insurance policy for the collateral

An insurance contract is concluded together with the mortgage agreement.

The risks covered by insurance are indicated by the bank depending on the type of property.

If the borrower wants to get additional discounts on interest rates, he can also take out personal insurance in case of disability, illness or death.

Money to purchase a home is transferred to the borrower's bank account.

After the purchase and sale transaction, together with the registration of ownership, a note is made about the bank's encumbrance of the property until the mortgage debt is fully repaid, which means that the borrower cannot change its legal status without the bank's consent.

List of required documents

You must also provide a copy of your work record

To apply for any type of mortgage at MTS Bank, you must submit the following documents:

- Together with the borrower's application form - a copy of all pages of the passport, a copy of the document confirming completion or deferment from military service - for men under 27 years of age, a copy of the document confirming state registration in the territory where the bank operates;

- A copy of the employment contract;

- Certificate of income for the last six months;

- Tax payment certificate.

Co-borrowers provide the bank with the same documents. All copies are considered only if the originals are present.

In addition, the borrower can submit other documents confirming his special status and right to receive benefits.

If there is property that can act as collateral for a loan or guarantee the client’s solvency, he also submits title documents.

Decor

To get a mortgage loan from MTS Bank, you need to start by collecting the required documents. These include:

- Application in the form of a questionnaire. It can be downloaded and filled out on the official domain or obtained from the nearest branch.

- Certificate of income for the last six months. Filled out according to the bank form or 2-NDFL. No paper is required for company employees.

- Passport.

- Employment history. For salary clients and the organization’s employees themselves, this document is not mandatory.

- Copy of SNILS.

To receive the refinancing service, you will additionally need: a copy of the loan agreement, a document on the debt on the loan, papers for the property.

After collecting the necessary documentation, you can begin to apply for the mortgage itself. The procedure in this case will be as follows:

- Come to the bank branch with a ready-made package of papers. Give them to the employee, indicating your contact number.

- Wait for the results of approval or refusal. The processing time for a mortgage for a new building or secondary housing is about 4 working days. When refinancing, the waiting period can reach 10 days. In some unforeseen cases, the deadlines are delayed for some more time, but the bank warns about this in advance.

- If your application is approved, you will be notified by telephone and invited to visit the branch again.

- Here you have to choose the desired property and inform MTS Bank about your decision in order to coordinate everything.

- Then you need to sign an agreement with the developer or owner to purchase the apartment.

- Afterwards you will have to issue all insurance policies. This is not a mandatory part, but you shouldn’t neglect it, because otherwise you will accrue extra interest (up to 5). In total, you should take out three types of insurance: personal (life and disability), property, title (purchase insurance). The policies must be renewed annually for the duration of the loan. This will result in a decent amount, but it will still be more profitable than additional interest.

- Next, pay the initial amount (if so specified in the agreement).

- Record the transfer of ownership. At this stage, you will need the help of a notary who will certify the documents.

- Sign an agreement for the provision of mortgage lending services at MTS Bank.

- Transfer the monthly amount according to the agreement.

See on the same topic: Zenit Bank: military mortgage in [y] year

There are several ways to repay a loan. Without a commission, you can deposit money through the cash desks and terminals of MTS Bank (however, when depositing more than 15 thousand rubles, a commission may be charged), through the mobile application in your personal account and in MTS salons. Other methods are through a third-party bank (tariffs for each financial institution are different) and using electronic payment systems (here again everything depends on the specific case, but there will still be some kind of commission).

It is most profitable to repay the loan directly from MTS Bank so as not to overpay extra interest. For late payment of payments there is a fine: 0.06% of the delay for each day.

This financial institution has the possibility of early repayment of the loan. It can be done within 24 hours after the loan is issued. To do this, you just need to send an application to the bank and prepare the required amount of money in your account.

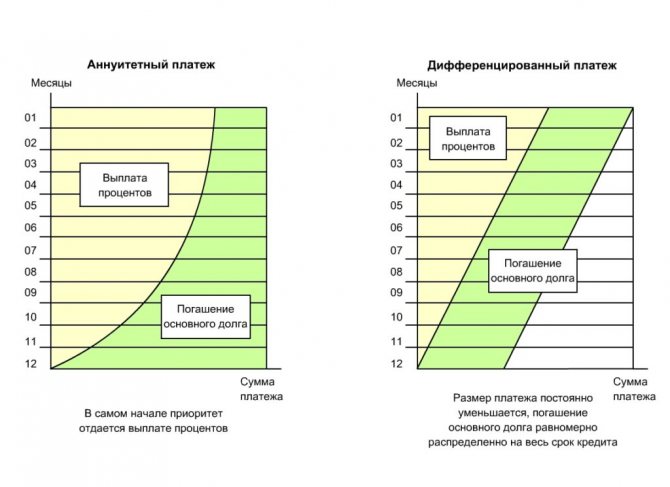

Mortgage repayment

The mortgage is repaid in equal monthly annuity payments.

The difference between annuity and differentiated payments

With a fixed interest rate, the amount of monthly payments is calculated initially and can only change if part of the mortgage is repaid early or the loan term is changed.

With a variable interest rate, the monthly payment is recalculated every year or at another period of time during which the interest changes.

In one of our articles, we looked at mortgage interest rates in Russian banks, which can be found by following the link.

Advantages and disadvantages

The pros and cons of applying for a mortgage at MTS Bank include the following:

| pros | Minuses |

| Quite transparent and favorable conditions. | Limited circle of borrowers. |

| Low interest rates. | Impossibility of waiving the down payment. |

| Long loan term and possibility of refinancing. | The need for careful and regular payment of monthly payments, as in any bank. |

| Possibility of using public funds. | — |

How to get a mortgage from MTS Bank

MTS Bank will approve your mortgage application within 2 business days. The decision will be valid for 3 months. During this time, you need to find a suitable apartment. And then you will need to evaluate it in a company that has the appropriate license.

After receiving the real estate valuation report, you must contact MTS Bank to approve the purchased housing. Then you can negotiate with the sellers and conclude a deal.

When the purchase and sale agreement and the mortgage are signed, you should contact the MFC and register the ownership rights in Rosreestr.

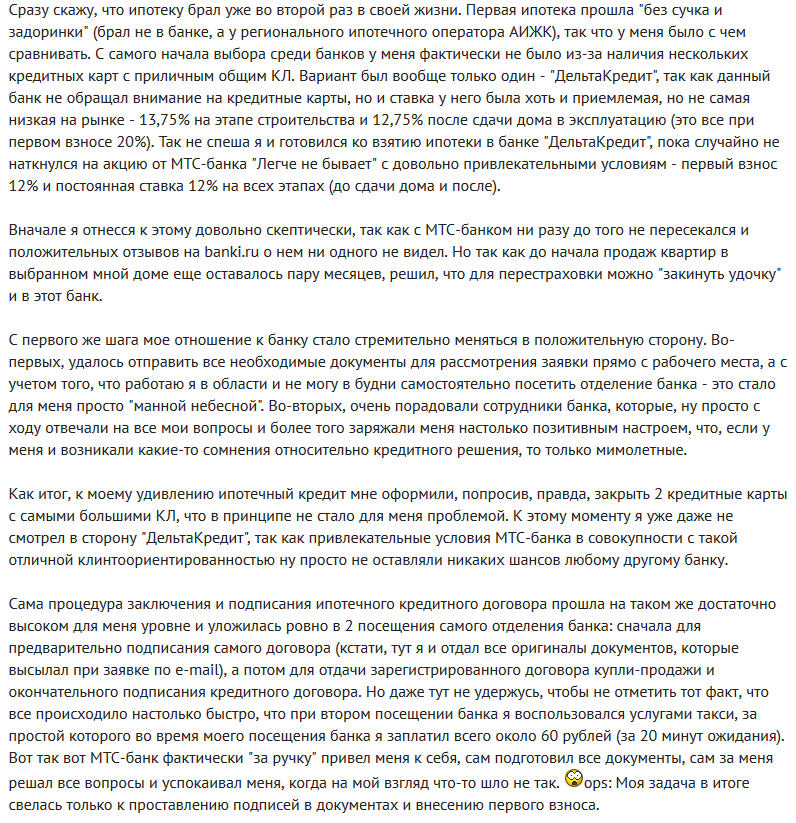

Reviews

Oleg, 40 years old : “MTS Bank offers mortgages for employees on very favorable terms, so I had no doubt in choosing the bank, since I have been working here for 10 years. I decided to buy a house outside the city for my parents. The registration procedure went very quickly, and then I had free money, so the debt was repaid ahead of schedule and without any commissions.”

Irina, 25 years old : “I needed a mortgage very quickly, a friend recommended MTS Bank and the application program for two documents. Indeed, the opening went quickly, and the procedure itself did not bother me at all. Then I saw that interest rates were lower than in other banks.”

Customer reviews about mortgages at MTS Bank

Gulyaev Andrey:

Zhuravleva Eleonora:

Vlasov Ivan:

“I have been a client of MTS Bank for a long time. I decided to fill out an application for a mortgage. Literally a few hours later the manager contacted me and asked me to send documents. The application was approved without any problems. When approving the apartment and conducting the transaction, everything also went smoothly. Now I’m trying to repay the loan ahead of schedule and, I hope, that there will be no problems with the removal of the encumbrance either.”

Krylova Evgenia:

“We have long considered the possibility of buying an apartment with a mortgage. We came across a good offer, and it was important for us that the bank approve everything quickly. We submitted the application at the MTS Bank office immediately with a complete set of documents and literally a day later we already received a positive decision. The apartment was approved in about a week, and we managed to buy exactly what we wanted.”