Mortgage conditions at Vostochny Bank

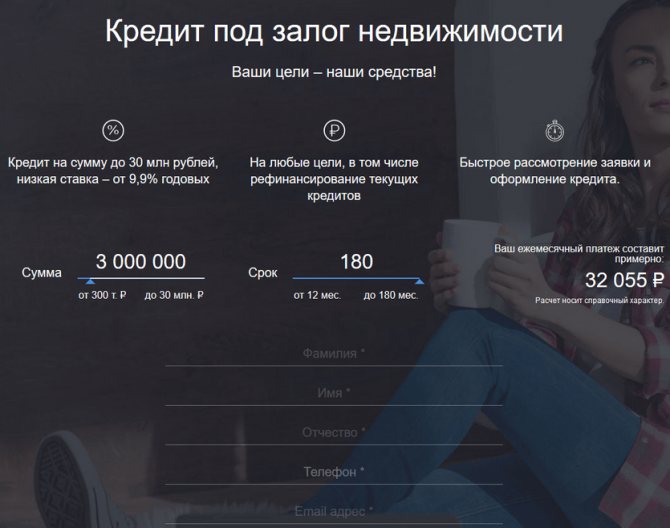

Until 2010, Vostochny Bank was called Orient Express Bank and issued mortgages with a down payment of 10%. In 2020, the bank will only issue a loan secured by existing real estate. The funds received can be spent for any purpose, for example, to purchase an apartment, land or to build a country house. Next, we will look at the conditions under which such a loan is issued.

Also read: Consumer cash loan at Orient Express Bank: conditions, rates and reviews

Requirements for collateral

Vostochny Bank offers to calculate your mortgage using a calculator from the official website, and then apply for a loan for the purchase of real estate that meets the following criteria:

- The property has no encumbrances (encumbered properties can only participate in the refinancing program).

- The property is owned by an adult on the basis of ownership rights.

- The housing is located in the region where there is a branch of Orient Express Bank.

- There are no minors registered at the facility address, and there are no arrests or restrictions on registration actions.

The lender issues a favorable loan at a low interest rate for the purchase of primary and secondary real estate. Additionally, collateralized lending is provided.

Mortgage calculator

A calculator is posted on the bank's official website. With its help, you can calculate the approximate payment per month on a consumer loan. To do this, just indicate the desired loan amount.

For example , with a loan amount of 3 million rubles. the payment will be 28,752.17 rubles. per month.

How to submit an online application for a mortgage at Vostochny Bank

You can get a preliminary decision without visiting the bank by submitting an application through its official website.

The questionnaire is completed in 5 stages:

- We indicate the desired amount and loan term, as well as full name, phone number, email and date of birth.

- Enter your passport details and information about your place of birth.

- Fill in information about your registration and residence address.

- We indicate the type of ownership of the property that is planned to be pledged and its area.

- We confirm the application using the code received via SMS.

After reviewing your application, a manager from Eastern Bank will contact you. He will inform you of a preliminary decision and offer a convenient time to apply for a loan.

Orient Express Bank loan calculator guide

So, it has already become clear to you that you cannot do without a loan calculator and you should not do without it when making such important decisions.

Such a program can be complex or simple; it can give you average information or something closer to reality, which depends on the number of indicators taken into account when calculating. However, even the smallest amount is enough to sign a loan agreement that is truly beneficial not only for the lender, but also for you as the client. On the website of the above-mentioned bank, in the section with a description of each loan, there is a simple, but no less convenient and useful, online calculator. It is easy to use, anyone can do it. In front of you on the left will be the terms of the loan, which are taken into account by the program, and on the right there are two bars with a slider - the loan amount and the loan term. At the end, after you have selected the most acceptable ratio, you receive information about what your monthly contribution will be equal to under such a program. As you can see, there is nothing extraordinary in such a scheme, although the information is, of course, of a very general nature. You should always remember that banks are favorable and more loyal to regular customers than to new ones who come for a loan for the first time. So, based on this, when you visit the office, you may be offered the same loan on terms changed in your favor, which may ultimately lead to a reduction in the monthly payment. But if you chose a loan based on the fact that you can afford the maximum payment, then this will be a pleasant additional bonus and will undoubtedly convince you to conclude such a profitable deal as soon as possible. However, at the very first stage, so to speak, of separating the flies from the cutlets, the Orient Express Bank consumer loan calculator will become an excellent and indispensable assistant for you. Using such a tool is very convenient and practical; the online calculator will quickly outline for you all the prospects for obtaining a cash loan from the bank of your choice according to the scheme you have chosen. Take only a loan that you can repay with little or no effort from your current monthly income. Always try to be guided only by your existing financial capabilities; do not take out a loan with the expectation of a sudden increase in salary, receiving an inheritance, quickly selling an apartment, etc. If you still hope for something, it is better to wait to apply for a loan until you receive additional financial resources in your hands. It is likely that then it will be easier for you to take out a loan, and it will turn out to be even more profitable than those offered to you by banks today. Found a mistake? Select it and press Ctrl + Enter

Collateral requirements

Eastern Bank accepts as collateral apartments in buildings with a height of more than 2 floors, as well as individual houses with an area of 100 sq. m. meters built after 1998. Commercial real estate can be used as collateral provided that it is a permanent structure.

The real estate serving as collateral must be located in a locality within the bank's service area. The owners of the pledged property and those registered in it cannot be minors.

Requirements for potential borrowers

Vostochny Bank provides loans to:

- solvent persons from 21 to 76 years old;

- depending on the amount and collateral, potential borrowers under 26 years of age must have a permanent job experience of at least 6 months;

- in the case of obtaining consumer loans for large amounts, these requirements also apply to borrowers over 26 years of age, but usually it is enough to have a stable income for the last 3 months.

In the case of a loan secured by real estate, the requirements for collateral - its insurance, consent of co-owners - have much greater weight. The possibility of control by the bank also comes into force - the location of the pledged property in the territory of presence of Vostochny Bank, the absence of registered minors in the pledged property, etc.

Customer reviews about mortgages at Vostochny Bank

Novikova Victoria:

Yakusheva Ekaterina:

Samsonova Valeria:

“When we decided to buy an apartment for our daughter, we were faced with the problem of not having enough money. We contacted Vostochny Bank because we are their regular customers, and they offered us a loan with collateral. We were pleased with the rate. We received the money in about a week without any unnecessary red tape.”

Ovchinnikov Peter:

“I applied for a mortgage loan from Vostochny when I purchased a plot for the construction of a country house. Most banks refused to even consider such loans, but here the employee was able to find suitable conditions. I was kept informed at all stages of loan approval, and the processing went without any surprises.”

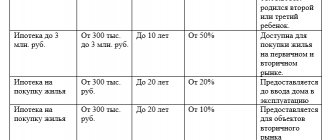

Mortgage programs of Eastern Bank

For convenience, all systems will be considered in the order in which they are listed above. The Eastern Bank mortgage program called “New Building” is designed specifically for clients who want to purchase an apartment at the construction stage. It involves issuing money according to the following characteristics:

- The loan amount is determined based on the geographical location of the object considered in the agreement. In the case of Moscow, St. Petersburg, as well as the regions adjacent to them, this figure will be a minimum of 500 thousand rubles and a maximum of 30 million. For all other regions of Russia, the limit will be lowered to 15 million rubles.

- The lowest interest rate is 9.70%, but it is only offered to holders of certain benefits. Most often, its value is 11%, but it can be lowered by making an initial contribution exceeding 20% of the total loan amount.

- The period during which debt obligations can be valid ranges from 3 to 30 years.

- The required advance payment is at least 15%. An important point: it can be reduced to 10% through the use of maternity capital.

The product “For finished housing” implies the purchase of real estate on the secondary market. Not only apartments, but also private houses or apartments are available to choose from. Its conditions are in many ways similar to the previous one, but there are some differences. Among these, we can note the increase in the minimum interest rate to 9.80%. To obtain it you will also need to make an increased down payment amounting to 30% of the cost of housing.

“Refinancing” is a special system designed not for the purchase of any real estate, but for changing the terms of the mortgage loan that the applicant already has. In this case, the debt obligations under the previous loan are fully repaid, after which the borrower can choose more favorable mortgage terms from Vostochny Bank.

The latter are presented in the following list:

- First, it should be noted that the minimum interest rate on a variable loan can be 9.5%. In addition, there is one that is perfect for citizens who focus their payments on the current state of affairs in the economy. In this case, the size of the indicator will be equal to 15.13%.

- The amount of the loan issued is limited to 85% of the total amount of debt currently available. When using the “Variable Rate” this figure will be reduced to 70%.

- The period during which the loan can be repaid can be 3-30 years.

- No advance payments are required.

Lending “Secured” offers the client to purchase any real estate from the primary or secondary housing markets, provided that he pledges to the bank an existing residential property (apartment or apartment). The parameters when working with this program will be as follows:

- The loan size is also determined by the geographical location of the acquired property and is limited to 30,000,000 rubles for the northern and southern capitals, or 15,000,000 for all other regions. In this case, this amount cannot exceed 60% of the value of the collateral property, but can fully cover the purchase price.

- The interest rate in this case will be at least 10.5%. It is worth noting that an important aspect of receiving money is confirming the feasibility of the loan. If the relevant documents are not provided, this figure will increase by 4%. An important point: if the entry fee does not exceed half of the amount received, the rate will increase to 11.5%.

- The loan period is limited to 30 years, but must exceed 3 years.

The “military” mortgage from the Eastern Bank was developed specifically for citizens participating in the savings mortgage system that provides housing for military personnel. It offers users unique transaction options:

- First of all, it is worth noting that the loan amount must be at least 500,000, but not exceed 2,509,211 rubles. In this case, the geographical location of the apartment or house does not matter.

- There are also no restrictions associated with the loan period, but it is worth noting that it must last more than three years. The only restriction is the age of the recipient, which must not exceed the limit for military service.

- The interest rate for this program is fixed and is 9.3%. It should be noted that all loan payments will be made by the state as long as the borrower is in military service.

- The minimum initial payment is 20% of the loan amount. It can be reduced through the use of maternity capital.