Mortgage lending is the most common way to become a homeowner not only in Russia, but also abroad. Buying an apartment or house abroad can be considered as a profitable investment, which will only increase in value over time. From this point of view, Germany is the most attractive.

Here, a mortgage loan will be issued to local residents and non-residents on equal terms. Therefore, the excitement around this topic is growing, and along with it, the number of questions about obtaining a mortgage in Germany is increasing. Each of them will be answered in the article.

Features of mortgages in Germany

Russia, later than other major world powers, began to issue targeted loans to its citizens for the purchase of housing. This has led to the fact that by 2018-2019 the mortgage system is just being formed and cannot offer the same low rates as in the USA and Europe.

If you carefully examine the banking system of European countries, it will become clear that Germany is in the most advantageous economic position. This allows it not to raise the mortgage rate above 5% per annum for non-residents and 2% per annum for its citizens. And in 2020, the interest rate on housing loans reached its lowest point. And all this against the backdrop of a stable economic environment and growing demand for affordable housing.

Naturally, Russians are becoming interested in the offers of German banks. Increasingly, they are taking out a mortgage not in the Russian Federation, but in Germany. But before you go to the country in search of real estate, you need to understand the features of a housing loan in Germany. Experts count them not so many.

Supply and demand

Demand in the country significantly outstrips supply. Good options are rare, so offers for purchasing square meters in houses are popular:

- Which are at the construction stage and will be put into operation in 2-3 years;

- Whose construction is just planned (according to the law, an apartment can be sold even in a building for which a pit has not even been dug).

There are also offers on the secondary housing market, but they differ from Russian ones. The fact is that the developer gives a 100-year guarantee for each house commissioned. Based on this, an apartment “aged” 80 years can be considered new and in good condition. And the secondary material, which is not of the best quality, may be 200 years old. Such proposals are of little interest to foreigners.

Cost of square meters

As in any other country, in Germany the price of real estate depends on:

- From the location relative to the center and proximity to the transport interchange;

- Time of construction;

- Squares.

There is another purely local rule - the cheapest housing is located in the east of the country, and the most expensive is being built in the west. The price range reaches 1,500 euros per square.

The secondary fund is one of the most inexpensive in Germany. If you need to pay 4,000 euros per square meter in a new building in Munich, then a secondary building, under equal conditions, will cost about 1,500 euros per meter.

Procedure for transferring the amount

German banks set their own transaction rules for different types of real estate. If the borrower purchases a ready-made home, the financial institution will transfer the full amount to the seller’s account. If you buy an apartment in a building that is still under construction, banks will make tranches in installments. Usually the first transaction is the largest, and the rest are divided into equal or unequal parts.

Requirements for title borrower

In Germany, banks are responsible for checking the financial situation of potential borrowers. For creditors, it is important that the income was received legally, and that a substantial amount, at a minimum, should remain in an account with a German credit institution for several years.

Due to scrupulous verification, the preparation of documents for a mortgage lasts for 3-4 months on average. In rare cases, the issue is resolved within 2 months.

Expenses

A mortgage in Germany is not only about the down payment and monthly payments. You will have to pay for the following mandatory services:

- Realtor;

- Title transfer agencies;

- Notary and more.

If a foreigner plans to buy an apartment, additional expenses will amount to up to 5% of its cost, and a house is even more expensive - at least 10% of the total amount, not including annual expenses for maintaining a bank account.

Mortgages in Germany as one of the best ways to invest free money

An apartment in Germany with a mortgage is quite expensive, but such a purchase is more than profitable for the following reasons:

- Extremely high rental costs

An apartment in Germany can easily be rented out with a mortgage, and thus the tenants will pay the monthly installments almost in full, and the owner will only have to pay a couple of hundred euros.

- Constantly rising housing prices

German construction companies simply cannot cope with the number of people wanting to buy a house or apartment. Even housing that will be put into operation only in 2-3 years is quickly sold out.

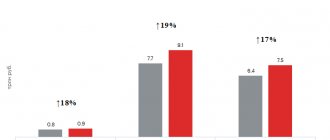

The increase in the cost of apartments is evidenced by the fact that in 2020 alone the increase was about 4%, which is a record among all EU countries.

And if this growth rate continues, then within 10 years real estate will recoup its value by 40%, and after 20 years housing will almost completely pay for itself.

- Low loan interest

Mortgage rates in Germany are among the lowest in the world. And the larger the down payment, the lower the interest rate will be. Under normal conditions, the mortgage lending rate is 3-4%, and if you make half the cost of housing as a down payment, the rate will be reduced to 2%!

Considering the constant increase in rental prices, you can rent out an apartment to guests and receive a small but stable income and cover the bank’s interest rate.

Mortgages in Germany are quite profitable for Russians, and you shouldn’t give up the opportunity to make your life better.

What are the benefits of a loan in Germany for Russians?

A mortgage in Germany for Russian citizens seems to be quite a profitable undertaking for many reasons.

The main ones are collected in the following list:

- The exceptional quality of German residential buildings is that developers do not skimp on materials and try to use the latest technologies when constructing structures.

- Record low mortgage rates – 2020 saw its lowest rates in a decade.

- Flexible requirements and conditions for concluding a contract with a financial institution - clients planning to purchase a house/apartment for 100,000 euros or more can count on an individual rate reduction, preferential terms under the contract and other bonuses.

- The right to rent out real estate - despite the fact that, according to German laws, square meters purchased with a mortgage in Germany (for Russians and not only) belong entirely to the bank until the contract is closed, the apartment can be rented out, which will partially cover the costs of loan payment.

German financial institutions have a positive attitude towards the fact that the borrower plans to rent out the property. This is considered as additional income, which indicates the client’s solvency. If you mention at the stage of negotiations with the bank that the apartment will be rented out, you can achieve a reduction in the interest rate or other concessions.

A big plus for Russians is the fact that German credit institutions do not impose separate requirements on foreigners. Even in a difficult political situation, citizens of the Russian Federation can be sure that the attitude towards them will be the same as towards Germans, Croats or Americans. The main thing that worries bank managers when considering a mortgage application is 3 characteristics of the client:

- Solvency;

- Full time job;

- Availability of funds to pay the down payment.

If a Russian meets the stated requirements, he will be able to take out a mortgage in Germany without any problems.

Account and working with the bank

If you buy an apartment building in Germany, then an invoice is required to receive the rent. By the way, for profitable real estate, a bank loan can be covered from income from rental housing

.

- Opening an account is free.

- The cost of maintenance is 150 euros per year.

- Bank card - 10-20 euros.

Money from the card can be freely transferred in Russia or withdrawn from any ATM. The card is sent by mail to the Russian Federation or Germany - to the address of the purchased house or by proxy.

The account can be managed through the website, online banking is available - an analogue of Sberbank Online. We help you open an account within one day with the online banking function (management via the website), you can manage it from Russia.

To obtain a mortgage in Germany, you need to top up your bank account. There are 3 options:

- Translated from Russia.

- Cash in the bank (up to 10,000 euros).

- The most convenient way is through the Internet - online banking is available, you can make transfers.

Mortgage for foreigners: conditions, terms and rates

German credit institutions are happy to provide loans to foreigners. The role of a borrower can be equally successful:

- Individuals;

- Legal entities.

It is easier to draw up contracts for amounts over $100,000. It seems strange to many, but in German banks it is much easier to get a large loan than a small one. This is explained by determining the client’s solvency - a person with a consistently high income will be a profitable client who will take out a mortgage on prestigious real estate.

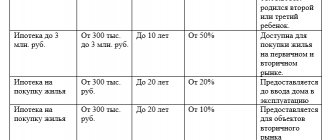

Getting a loan in Germany for the first time is more difficult than subsequent times. In addition to the standard package of papers, the borrower will be asked to increase the down payment to 50% of the cost of housing. Subsequently, the contribution amount will be reduced to 20%, and depending on the amount of the transaction, it may be completely reduced to zero.

At the stage of negotiations with the bank, the borrower can increase the initial amount by 20-30%. The bank is willing to make such changes, simultaneously reducing the mortgage loan rate.

The term of a home loan in Germany is usually calculated in five years, but the official minimum limit is set at 3 years. The maximum term will be 30 years. Foreigners taking out money to buy a home on credit should know that the term of the mortgage agreement primarily affects the calculation of the rate - 0.5% is added every 5 years. Most often, the contract is concluded for 10-15 years. This is the optimal loan repayment period for Europe.

See this same topic: What should you do next after paying off your mortgage in full?

German banks have many requirements for a potential borrower, but the most often put forward are the following:

- Availability of a valid account in one of the financial institutions of Germany - it must be opened no later than 2 years before applying for a loan and regularly replenished.

- By the age of the borrower - at the time of concluding the agreement, the bank client must be 21 years old, and at the date of repayment of the mortgage be no older than 65 years.

- Confirmation of income - a certificate of income for 6 months is required from individuals, and account statements for the past 2 years from legal entities.

- Preparation of certificates on the amount of monthly mandatory payments.

If the borrower already has loan or alimony obligations, he must document that he regularly makes payments. Based on this information, the bank determines the percentage of income that, along with the mortgage, will be spent on mandatory tranches. By law, they should not exceed 35% of all income, including funds received from renting out real estate.

German financial institutions only take into account income received within their country. When applying for a housing loan, a foreigner’s earnings in his home country are not accepted as evidence of solvency. Therefore, individuals must have a stable income from employment, and legal entities must be registered in Germany and immediately conduct their main activities.

Mortgage conditions for Russians

The main condition of a mortgage in the Republic of Germany is a low percentage of monthly payments to repay the loan body. This allows even foreign citizens to buy real estate, opening up for them the possibility of painless deduction of funds during the period specified in the contract. Therefore, most Russians, as soon as they settle down in Germany, prefer to take out a mortgage loan from a bank to buy their own home.

To take possession of a purchased apartment, you first need to find out the prices in euros, determine the area suitable for living, compare your financial capabilities in the future and the cash at hand. Often, special consultants provide assistance in choosing an object to purchase - this is definitely not the case at Sberbank.

The German government really makes every effort to attract foreign citizens to purchase real estate, providing, among other things, consulting services. You don’t need to go anywhere for this; the bank employee who issues the mortgage loan usually has all the information about the real estate market in his area and can give reasonable advice to a foreigner buying a home.

Interest rates

Residential mortgages in federal Germany are distinguished by favorable conditions: the average rate remains at 5-6, but sometimes there are discounts of up to 2-3%. Before taking out a loan, the borrower must study the offers of several (3-4 are enough) banks, meet with their representatives and communicate on the spot, and only then choose the best one.

For a first mortgage, a fee of 40-50% of the total contract value is usually called. This money will have to be collected in order to immediately pay at the bank. After the loan is fully repaid, for subsequent loans the rate drops to 20% (sometimes it is canceled altogether). A client who has justified their trust deserves a completely different attitude than a newcomer: hence the reduction in annual and monthly interest on loans.

Instructions for obtaining a mortgage

Consultants strongly recommend that before obtaining a mortgage, you conduct a small analysis, review the real estate market, and identify your area of interest - a house, an apartment, a mansion. “Try on” the probability of repaying the loan, taking into account long-term planning.

The German state is one of the most stable in Europe; things rarely change radically. But even taking this into account, it is possible to change (reduce) the interest rate in order to attract a new client. A few hundred or even thousands of euros will not be superfluous to anyone, so before you get a mortgage, you should prepare - collect the necessary information.

Advantages and disadvantages

Applying for a loan in Germany for the first time, and even as a foreigner, is fraught with certain difficulties. Like any serious structure, the bank insures its funds against various unforeseen events, so for Russians, as non-residents, the percentage of payments will be quite high. You will also need to present an extract of your income for the last 12 months (mandatory).

These are all disadvantages, but the advantages include a real chance to acquire your own home without paying extortionate fees to the lender. Experience shows that paying off a mortgage loan is quite possible. Proof of this statement is the number of Russians who legalized themselves abroad and purchased real estate in the European Union.

To become the full owner of an apartment or house on German soil, it is not at all necessary to save money for a long time by opening savings deposits. An open mortgage loan from one of the local banks allows you to buy a home relatively quickly and without any problems. In the future, you can rent it out or live in it yourself.

Main settings

| Term | on average 20 years |

| Percent | 1,5% — 2% |

| Loan amount based on property value | Maximum 70%, for foreigners 50% on the first loan |

| Minimum down payment | 30%, for foreigners 50% |

| Borrower's age | 18 years (at the time of issue) -65 years (at the time of completion of payments) |

| Share of loan payment in the borrower's income | 35% |

| Early repayment | must be specified in the contract |

| Additional total costs when applying for a loan | Approximately 1% |

What should a borrower pay attention to?

The procedure for applying for a loan to purchase a home is fraught with many pitfalls. Foreigners do not always pay attention to the intricacies of obtaining a loan, and after signing the agreement they regret their haste. Even at the stage of negotiations with a financial institution, you need to pay attention to the following points:

- Type of mortgage - the most profitable option is to choose a loan with a fixed rate for the entire period of the contract (this will be discussed below).

- The ratio of the size of the payment and the level of income - the optimal option would be 40% of earnings.

- Availability of personal savings - the down payment ranges from 30% to 50% of the cost of housing, and additional costs will be at least 10% of the total amount.

- It is important to consider that German banks meticulously assess all possible risks. Therefore, the loan amount directly depends on how the personality of the potential borrower will be assessed.

What do you need to know?

Mortgage loans are usually issued as an annuity loan, since unchanged payments provide a good basis for calculation for the client.

Annuity loan

An annuity loan is a form of real estate financing. In Germany, the interest rate is usually fixed for 5, 10 or 15 years. The contract can then be terminated or extended. The calculation scheme for a German mortgage loan is quite simple and straightforward. From the amount of the mortgage loan, the financing bank deducts its annual interest (Zinsen) for providing the loan. In addition, the bank client selects the annual repayment percentage of the loan body (Tilgung). From these two values, the total payment (Rate) is added up. This amount is then divided by 12 months and thus the monthly costs of maintaining the loan are calculated. The loan is recalculated every month after the monthly annuity payment is paid. In this case, the annuity payment remains unchanged for the entire loan term, while the amount on which annual interest is calculated (Zinsen) decreases monthly, and payments to repay the loan body (Tilgung) increase monthly.

Ownership

The property becomes your property only after the final repayment of the mortgage loan. Despite this, real estate can be sold at any time by providing the bank with a guarantee of payment of the remaining loan amount, for example from the money received for the sale of the home.

Interest rate

The interest rate on mortgage loans in Germany is currently about 1.5 – 3.5% per annum. Such a low interest rate, as well as the possibility of obtaining an indefinite residence permit (for legal entities), makes obtaining a mortgage loan for the purchase of real estate for Russian citizens very attractive.

Tax credit

In accordance with the double tax treaty between Russia and Germany, the Russian tax authorities provide a tax credit for income taxes paid in Germany.

One-time expenses

One-time expenses when purchasing real estate in Germany are calculated from the amount fixed in the purchase and sale agreement:

- 3.5% — purchase tax;

- 2.0% — expenses for notary and legal registration;

- 3.5% - brokerage services;

- 2.5% - mortgage brokerage services.

Annuity payments are equal payments, paid at certain intervals, containing funds to pay interest and partial repayment of the loan. If the loan is repaid with annuity payments, it means that you will pay the same amount on the loan each month, regardless of whether you are at the beginning or end of the loan term.

Types of mortgage repayments

The Russian system of credit loans differs significantly from the one in Germany. Therefore, it is not easy for foreigners to immediately understand the types of loan repayments that the bank offers them. The section will discuss the pros and cons of all options.

Fixed interest rate

This is the most popular option. The essence of the proposal is that during the term of the contract the borrower pays the same amount every month. In the first years, most of it consists of interest on the loan, and in subsequent years it smoothly flows into the body of the loan. But the bank client does not notice the difference, since for him the amount does not change.

This option is the most convenient for Russians, as it allows them to calculate their expenses and income several years in advance. This is an undoubted advantage of a fixed rate, but it also has a disadvantage - with a general decrease in mortgage interest rates over the years following the signing of the agreement, the borrower will not be able to take advantage of the chance to reduce his credit time by renewing the agreement with the bank.

Redeemable mortgage

This system is little known in Russia, but in Europe it acts as a classic version of a mortgage loan. In Germany, this repayment option is based on the following nuances:

- The basis of payments is the repayment of interest on the loan, which does not depend on the number of years.

- The client himself suggests what share of the loan he would like to repay annually - this amount cannot be less than 1%.

- An interest rate is added to the specified amount.

- Based on the obtained figures, the loan term is calculated.

For Russians, this option is convenient because it allows a change in the payment schedule in favor of a larger repayment amount. This can be done in the form of a one-time tranche.

The disadvantages of a redeemable mortgage include difficulties with early repayment of a housing loan if the financial situation of the title borrower improves in the future.

Payment of interest only

In Germany, this option is not the most popular, as it involves a number of risks for financial institutions. First of all, it is not suitable for those who plan to take out a large loan with a small down payment. Banks simply will not offer this method of loan repayment to the client.

It consists of paying interest in equal installments during the term of the agreement, and the principal of the loan in one tranche in the last months.

Typically, an interest-only mortgage can be obtained by people who plan to purchase real estate for commercial or rental purposes. With the assistance of an experienced mortgage broker, you can convince the bank that this is the type of loan repayment that is convenient for it in a particular case.

The German banking sector is characterized by an individual approach to any client. With clear general requirements, managers carefully consider each case and select an acceptable payment option.

How to choose the monthly contribution amount

It is not difficult to determine the amount that will have to be paid to the bank during the first year. To do this, it is enough to know the loan amount, term and interest rate. For example, with a 10-year mortgage of €100,000 at 3.22% per annum in the first year, you will pay the bank €3,220 in interest, or €268.33 per month. This amount does not pay off your debt, but pays interest on the loan. The debt itself will be paid off with the amount you can pay over the cost of interest. For example, if you are able to pay €600 per month, then the loan body will be repaid at €331.67 per month, or approximately €4 thousand per year. That means you'll pay off about 4% of your mortgage in the first year. This quantity in Germany is called Tilgung.

The higher this indicator, the higher the monthly payment, but also the faster the speed of debt repayment. As a rule, in German banks Tilgung is 1%, but under such conditions it will definitely not be possible to repay the loan in 10 years. But when requesting a higher Tilgung, the percentage also increases. With a Tilgung rate of 4%, the mortgage interest will no longer be 3.22%, but 3.42%. This is a kind of protection for banks from paying off their debt too quickly and unprofitably.

To avoid this banking trap, there is Sondertilgung - the opportunity to deposit a certain amount once a year to pay off the debt itself without paying interest. Typically, it is 5% or 10% of the initial debt. It is very important that your mortgage agreement includes this option.

Subtleties of mortgage lending

To be sure that the agreement with the bank is concluded on mutually beneficial terms, you need to study the basis of the German mortgage system, some aspects of which will be discussed below. the loan repayment option is convenient for him in a particular case.

The German banking sector is characterized by an individual approach to any client. With clear general requirements, managers carefully consider each case and select an acceptable payment option.

Mortgage lending limit

A standard housing loan does not exceed 65% of the total cost of the purchased home. This is the maximum possible that banks can give. With such an amount, the rate will be very attractive for the client, and the loan term is set at 10-15 years.

If the client does not have the money for a large down payment, then he will have to request a larger mortgage limit from the bank. The financial institution may accommodate the client, but in this case it will raise the interest rate. Depending on the situation, it can double. The term of the contract will automatically increase to 20-25 years.

Overpayments and underpayments

Pedantic German bankers do not accept deferments of monthly loan tranches. Such phenomena as “mortgage holidays”, “breaks” or “debt restructuring” are unknown in Germany. Therefore, before applying for a mortgage, foreigners should consider whether they can conscientiously fulfill their obligations.

But, despite the strictness, banks are flexible in their approach to monthly payments, allowing:

- Increasing the rate to reduce the loan term;

- Reduced rate for contract extension;

- Changing the payment schedule (this can be done 2-3 times during the entire period of cooperation with the bank);

- One-time share payments.

The last point significantly reduces the shared burden. If the client needs it, the financial institution includes a clause in the contract for a one-time tranche once a year in the amount of 5% of the remaining debt. The amount is set at 1-5%. Banks usually do not accept larger payments.

Registration deadlines

From the beginning of studying the real estate market to completing a transaction in Germany, it takes about 4 months. Of them:

- It takes 1.5 months to search for a property;

- 4 weeks are spent visiting banks;

- 4 weeks are spent visiting banks;

- 2-3 weeks should be allocated for collecting documents;

- up to 4 weeks the credit institution reviews the application;

- It takes 2-3 days for the transaction itself to be registered.

A number of banks consider the application within 1.5 months. Therefore, when negotiating with the seller, you need to specify a long settlement period in the agreement.

Mortgage term

Considering the practice of mortgage lending in Germany, it turns out that the average loan term is 10 years. Russians can sign an agreement with a bank for 5-40 years.

Germans are wary of the risks of loan defaults. In the country, it is rare for an apartment to be sold at auction if several payments are missed. If the borrower has serious financial problems, he immediately reports them to the financial institution. After reviewing the application, they meet him and extend the contract, while simultaneously reducing the monthly loan burden.

Look at the same topic: What is a mortgage by force of contract and by force of law: the main differences

Life insurance

Most German banks practice issuing mortgages only with mandatory life insurance for the borrower. This is done with the client’s consent and provides both parties to the agreement with financial security in the event of an insured event.

The most common insurance option is Risikolebensversicherung. It is built according to the following scheme:

- The insured person makes a payment every year;

- In the event of the client's death, his family receives full compensation;

- If the insured event does not occur, the company pays the client the entire accumulated amount.

The payment can be a lump sum or split into several parts.

The credit institution carefully checks the documents submitted for consideration. If errors or forgery are found in them, the potential borrower will not receive a housing loan in Germany. All subsequent attempts will be interrupted at the stage of negotiations with the bank.

Additional costs when purchasing real estate in Germany

The costs of the buyer of a property consist of:

- Loan amount (loan body);

- Interest assigned by the bank;

- Additional expenses.

They are calculated as a percentage of the property price:

- State tax – 3.5-6.5%;

- Registration of ownership – 0.5-1%;

- Notary services – 1.5-3%;

- Services of brokers, brokers and realtors – 3-6%;

- Entering data into the cadastre – 0.5%;

- Bank commission for processing documents for a loan – 1%;

- Audit of an apartment or house – 0.5-1.5%.

In addition to the listed costs, there are also fixed rates:

- Valuation of a property as collateral – 1,500 euros;

- Preparation of statements and maintaining a bank account – maximum 150 euros (every year).

On average, at the time of concluding a transaction, the borrower must have at least 10,000 euros in free money.

It is also worth taking into account the maintenance of real estate, which in Germany is much more expensive than in Russia. Late monthly payments will result in immediate disconnection from water and gas.

Requirements for borrowers

Banks have the same requirements for German citizens and non-residents of the country. The following categories of potential clients are in favor with credit institutions:

- Those in public service;

- Having a fixed income above the average level;

- Those who scored high on the Shoof scale.

The last item on the list concerns the borrower's credit history. Those who conscientiously handled financial obligations at home and abroad receive the highest scores. If the applicant does not have a credit history, the bank will classify this as an obvious shortcoming.

The description of the property will also be important for managers. Those who buy an apartment have a greater chance of getting a mortgage:

- In a prestigious area;

- In a good condition;

- In a new building;

- In a house under construction.

For a financial institution, a significant argument in favor of the applicant’s candidacy will be personal savings. They play the role of insurance in case of material problems.

List of documents

German banks rarely request additional documents from clients; usually a standard package consisting of:

- Copies of a foreign passport and Russian identity card;

- Application form filled out in German;

- Confirmation of salary amount;

- Bank account statements;

- Tax return;

- Real estate valuations.

The bank also needs an official description of the apartment/house.

Repaying a mortgage in Germany

Financial institutions do not encourage early repayment of home loans. But they meet the borrowers and find an option for early closure of the contract that would suit both parties to the agreement.

Rate, Zinsen and Tilgung: what are they?

A fixed mortgage loan, as the most popular debt repayment scheme, is easily calculated several years in advance. The payment scheme is built from:

- Rate – total annual payment;

- Zinsen – bank interest, which is part of the Rate;

- Tilgung is the body of the loan, constituting the second part of the Rate.

Knowing the Rate and dividing it into 12 parts, you can determine the monthly payment, which will remain the same, although Zinsen tends to zero and Tilgung increases.

Sondertilgung – an opportunity to repay the loan amount faster

If the client is confident in his financial situation, he can, after negotiations with the credit institution, add a Sondertilgung-Möglichkeiten clause to the agreement. It states that once a year the client can deposit from 3% to 7% of the loan amount.

Such an amendment to the contract does not oblige the borrower to make such a payment. But if desired, a tranche can be made.

Asian regions

In Asia, bank branches can only be found in Turkey. In this country, it is possible to take out a loan to purchase housing in national currency, dollars or Euros, as well as rubles. The size of the bets depends on the selected currency. When applying for a loan in Russian rubles, the interest rate is 18% per annum. In dollars and Euros it is up to 7.2 percent. And in Turkish lira – 11.2.

These indicators are valid for participants in the mortgage lending program for foreign citizens. This type of loan is available to Russian citizens, provided that they can pay at least 40 percent of the cost of the selected residential property for purchase with a mortgage .

How can a foreign citizen get a mortgage?

A foreigner, like a German citizen, goes through several stages in the process of obtaining a mortgage. They need to be approached with all seriousness.

Step one: analysis of proposals

There is an atmosphere of competition in the German banking industry, so it is recommended to visit 10-15 institutions in search of the most advantageous offers. If you mention in one of the banks about the advantageous offer received from the previous one, you can get an even more interesting offer.

But this will only happen if certain characteristics of the property are met:

- New building;

- Prestigious location;

- Renting.

It is not customary to look for housing on your own in Germany. This is done through:

- Real estate companies;

- Internet resources (an online credit calculator is often posted here);

- Brokers.

Available housing options are represented by the following proposals:

- Reihehäuser - standard houses lined up in a row;

- Eigentumswohnung – apartments within the city.

The most prestigious options are:

- Doppelhaus – cottage for 2 families;

- Einfamilienhaus – house for 1 owner;

- Altbauhauser is an old mansion.

It is important to consider that in Germany the sale of housing with tenants is allowed. It is impossible to evict them before the end of the contract.

Step two: preparing the necessary documents

This stage must be taken with the utmost seriousness and avoid mistakes that could lead to a refusal to grant a loan.

Step three: opening a bank account and replenishing it

All real estate transactions in Germany are paid only through the bank. To open an account you will need:

- Personal presence of the client;

- Copies of 2 ID cards;

- Certificate of registration;

- Completed application form;

- Recommendations.

The country's financial institutions are afraid of working with “dirty” money, so they demand to show the source of the money.

The account is opened only in euros, and you can work with it immediately after concluding the agreement.

Step four: conclusion of the contract

Issues of obtaining a mortgage loan are regulated by 2 documents:

- GC of Germany;

- Law on Mortgage Banks.

The agreement between the bank and the borrower is concluded taking into account the inclusion of mandatory clauses:

- Amount including interest;

- Conditions for obtaining a mortgage in Germany;

- Description of all payments;

- Possible ways to pay off debt;

- Conditions for termination of the contract.

The document outlines the range of actions that the borrower has the right to perform with real estate - registering, insuring and more.

Deadlines

Germany is a slow country. The term for obtaining a mortgage in Germany is up to 60 days.

3 steps

- Preparation of documents, analysis of proposals - from 1 to 3 weeks.

- Your visit to Germany, preferably for 2 full days.

- The waiting time for a response is from 2 to 4 weeks.

Next is opening an account and signing a mortgage loan agreement with the bank.

Mortgage loans in Germany are issued for a period of up to 40 years. As a rule, we consider short-term options - 4-6 years - with the possibility of early repayment.

Offers from German banks

Each financial institution in the country offers its own offers to mortgage borrowers, but it is impossible to study them all from a distance. The table shows the most interesting options from major banks.

| Description | Name | ||

| Deutsche Bank | Commerzbank | Sparkasse | |

| Annual rate | 1-10% | 0,77% | 1,54% |

| Duration of the contract | up to 30 years old | up to 50 years | up to 40 years old |

| Early repayment | 10% | individual approach to the issue | individual approach to the issue |

| Credit minimum | 25,000 euros | 25,000 euros | individual approach to the issue |

| Credit maximum | not installed | 750,000 euros | individual approach to the issue |

| Bank characteristics | the largest and most profitable for obtaining a housing loan | oldest financial institution | the most popular credit institution in Germany |

| Monthly payment amount for a loan of 100,000 euros | 865.83 euros | 865.83 euros | 568 euros |

When considering offers from banks, it is worth considering that not all of them cooperate with foreigners. The above financial institutions and about 10 other names offer housing loans to non-residents for a long term.

A mortgage in Germany today is not a pipe dream, but a real opportunity for Russians to become the owners of their own apartment or house in one of the cozy German towns.

Deutsche Bank

The largest bank in Germany. He provides mortgages on the most favorable terms. The borrower can be a citizen of the country and a foreigner. The minimum interest rate in this bank can be 1.5%

Rice. 1. Deutsche Bank logo

Banks are launching their own mortgage lending programs. The most detailed information is available to the borrower during a personal consultation at a bank branch.

Deutsche Bank even offers “green mortgages” and family home financing. Behind this is a combination of annuity loans and home loan financing.

The housing loan is based on a combination of bridge financing and pure housing finance.

Table 2. Mortgage conditions at Deutsche Bank

| Offer | Index |

| Annual interest rate | 1-10% |

| Loan terms | up to 30 years old |

| Maximum special repayment | 10% of the remaining debt |

| financing | up to 100% of the purchase price |

| Minimum loan amount | 25 000 € |

| Maximum amount | Not determined |

| Fixed borrowing rate | 0.76% per annum |

| Valuation (monthly repayment) | 865.83 euros |

Source: deutsche-bank.de