Home » Articles » Mortgage » Interest-free mortgage in 2020

October 11, 2020 One comment

Is it possible to get an interest-free mortgage in 2020, what is it? How to purchase an apartment with a mortgage without overpaying interest and using assistance from the state.

Not every citizen can currently afford to buy housing in our country.

With the introduction of mortgage loans from non-state banks, buying a home has become more affordable, but not for everyone.

Some categories of the population, for example, young families, are entitled to receive assistance from the budget, which is benefits for the purchase of an apartment.

However, is there now an interest-free mortgage and how to apply for it?

Legislation

On November 30, 2020, a special Government Resolution No. 1567 was signed, which regulates the receipt of rural mortgages in Russia.

Loading…

Taking too long?

Reload document

| Open in new tab

The main goal of the introduced rural mortgage at 3 percent is to attract citizens to live and work in the countryside. Thus, it is intended to reduce the number of disappearing villages and develop their territories and economy. However, not only low interest rates will attract new residents: the state has also begun to take measures to improve the territories of settlements, provide them with transport and engineering infrastructure, and promote employment of local residents.

In total, 2.3 trillion rubles were allocated for the implementation of the project, part of which comes from the federal budget.

When will a mortgage start at 3%?

The program will be implemented from January 1, 2020. Accordingly, citizens applying for a mortgage at 3 percent will have to submit applications after the specified deadline.

Important! According to the draft resolution, the program will operate in the period 2020-2025. At the moment, the program is already working in Rosselkhozbank and in March the first mortgage loan for rural mortgages was issued. From May 20, 2020, the program started working at Sberbank, but is now suspended due to the limit being used up.

Procedure for obtaining a mortgage

According to the conditions for obtaining a mortgage from Sberbank with state support in 2020, to apply for a loan you must:

Poll: are you satisfied with the quality of services provided by Sberbank in general?

Not really

- Familiarize yourself with the current conditions of the mortgage lending program with state support.

- Analyze and determine whether the borrower and his family meet the established requirements.

- Fill out and submit a loan application through the online portal or at your nearest bank branch.

- Choose an apartment in one of the new buildings that have been accredited by Sberbank.

- Conclude a purchase and sale agreement or DDU (assignment of claims) with the developer.

- Use the electronic transaction registration service (optional).

Attention! Before applying for a mortgage, experts recommend calculating all lending parameters using an online calculator.

General terms and conditions of the program

According to the text of the resolution, preferential rural mortgages will be issued only for the purchase of residential premises in certain territories. This will include:

- rural settlements and territories;

- small settlements and inter-village territories that have common areas within the municipal district;

- small settlements;

- settlements: workers and urban type, which are part of urban districts;

- cities with a small population (up to 30 thousand people) and united with neighboring rural areas by close ties: common use of infrastructure facilities, common economic factors (including labor and social).

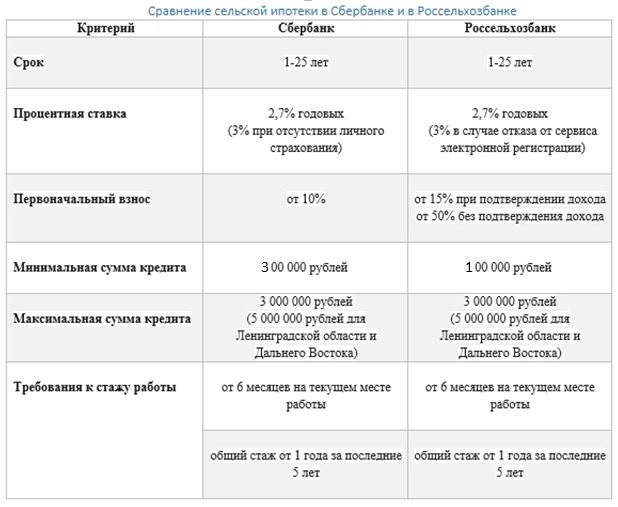

Exceptions! Mortgages at 3 percent per annum will not be available for the purchase of housing in municipalities of Moscow, the Moscow region and St. Petersburg. A complete list of rural mortgage areas is presented here.

In addition, there are other restrictions:

- They relate to the period for concluding a loan agreement (after 01/01/2020),

- The amount of the loan provided is from 100,000 to (5 million rubles for the purchase of real estate in the Far East or Leningrad region and 3 million rubles for other areas),

- Interest rate from 0.1 to 3% (a reduction in mortgage rates of less than three percent is possible due to additional subsidies from regional authorities),

- Mortgage term up to 25 years,

- The size of the down payment (from 10% of the loan value).

Important! Such government support will only be available once. After purchasing a home with a mortgage at 3 percent, it cannot be sold for 5 years.

Interest-free mortgage from Russian Railways

Young professionals, as well as pensioners who were or are in the structure of the Russian Railways company, have special benefits when registering and purchasing real estate. Support is provided exclusively to company employees , and not to every interested Russian citizen. Don't confuse this!

Russian Railways OJSC cooperates with VTB24 Bank, and therefore in the branches of this financial institution it is possible to draw up a mortgage agreement with special subsidies. The benefit is that the employer himself will directly compensate for 7.5% of the monthly overpayment of payments. This is the standard rate for all employees of Russian Railways.

If the application is filled out by a young specialist under 30 years old or employees with many children, then in such cases the company’s benefit will cover 8.5% of loan payments. Then, when choosing certain bank mortgage programs, the loan will be either interest-free or with a minimum monthly overpayment.

Who is eligible for the benefit?

It was noted above where and under what conditions it is permissible to purchase a house with a mortgage at 3 percent. What requirements are imposed directly on the potential borrowers themselves and what you should pay attention to when choosing a residential premises - we will consider further.

Requirements for the borrower

The regulatory legal act adopted on August 29, 2020 presents the requirements for potential users of the benefit. These may be persons:

- Those who have permanent registration in the village and work here (as an individual entrepreneur/under an employment contract) in the following areas: agro-industrial, social, veterinary medicine (aimed at working with farm animals). The minimum period of employment at the last place of work is indicated - more than a year.

- Having registration at the place of residence in rural areas and also conducting activities in the above areas.

Important point! Rosselkhozbank and Sberbank do not require registration in a village and work there to obtain a rural mortgage at 3 percent, so it can be applied for for both city residents and those who do not work in the village.

Financial institutions put forward certain requirements for borrowers. They are interested in meeting the following criteria:

- Availability of Russian citizenship.

- Age from 21 to 75 years. At the same time, by the time the mortgage payments are completed, the borrower should not be more than 75 years old.

- Solvency confirmed by income certificates.

If desired, banks may require other indicators to be met. It is recommended that you contact your prospective lender directly for more information.

Requirements for residential premises

According to the contents of the resolution dated May 31, 2019, number 696, financial institutions, when considering applications for preferential mortgage lending, will pay attention to the area where the residential building itself is located. The “quality” of real estate is also required to be checked. Bank employees will be interested in compliance with the following criteria:

- The property provides the opportunity for year-round living.

- Engineering systems are connected to the house, that is, household members can fully use electricity, water supply, heating and sewerage. In gasified areas, attention will be paid to the availability of gas supply in the home.

- The area of the house is sufficient for all residents (the norm of square meters per person will be taken into account - each municipality has its own values).

Banking institutions require a real estate assessment before issuing a mortgage. The amount calculated by experts should not differ significantly from the loan size.

Attention! SNTs cannot participate in the rural mortgage program. This is explained by the fact that they are located outside populated areas, i.e. are not eligible for the program. In addition, this property will not be liquid for the bank, because it will not be able to sell it at a high cost.

Main problems and issues of the program

Despite its apparent attractiveness, the subsidy project has problems and shortcomings that make it unprofitable for some borrowers.

- Large down payment compared to other products and banks. At Sberbank, for a preferential housing loan, the first mandatory part of the payment is established - 20% of the total cost of the property. For example, if the cost of an apartment is 4,000,000, you will need to deposit 800,000. Not all families with small children have such an amount.

- Short period of benefit, significant increase in monthly payment after its end. Of course, as long as the reduced rate is in effect, payments will not greatly affect the family budget. However, after the end of the benefit, the financial burden will increase significantly. Let's take the same calculation as an example. If the cost of housing is 4,000,000, the first payment is 800,000, the term is 15 years, the payment will be 27,000 under the preferential program. However, after its expiration, the payment amount will increase to 33,900. A very noticeable difference.

- Mandatory registration of life, health, property insurance. Without this, the mortgage will not be issued at all. The cost of these services is quite high.

- The ability to purchase an object using borrowed funds only from a legal entity. This means that we are talking about new buildings. An apartment that has just been built or is under construction will require large financial investments, and the move will be postponed until the renovation and completion of all work.

- Infringement of the rights of families where the second and third child was born before January 1, 2020.

The most important question is whether it is possible to combine several benefits under the program. For example, use a mother's certificate as a down payment. This point is not specified in the bill; it remains at the discretion of the bank.

What kind of housing can be purchased with a rural mortgage?

According to the terms of the program, a potential borrower has the right to purchase the following types of housing:

- Acquisition of a plot of land in a village and further construction of a private house on it for living under a contract;

- Construction or completion of construction of a residential building on your own site under a contract;

- Purchase of a finished or under construction property, as well as a property with a plot on the territory of rural settlements.

Important point! A rural mortgage cannot be used to repay a previously issued loan. You can send a subsidy for home repairs through Rosselkhozbank.

How to get a mortgage at 3 percent

Since mortgages at 3 percent for the rural development project will be issued only from the beginning of 2020, there are some questions regarding this point. We tried to sort them out.

Before submitting an application, it is necessary to clarify whether the locality chosen by the borrower is included in the preferential program for rural mortgages. To do this, you should refer to the Decree of the Government of the Russian Federation No. 1567 of November 30, 2019. It states that the lending object must be located in rural areas or rural agglomerations. Accordingly, the borrower needs to find the locality of his choice among them. To do this, you should use the list of rural areas, for example, the Krasnodar Territory.

If a settlement is a rural agglomeration, then it is necessary that no more than 30 thousand people live in it. This settlement should be included in the development program.

Where to contact

If they wish to receive a preferential government mortgage, potential borrowers will have to contact Sberbank or Rosselkhozbank. The Ministry of Agriculture undertakes to publish a complete list of such organizations in the near future.

Attention! The first for rural mortgages at 3 percent began accepting applications from Rosselkhozbank. You can submit documents to this bank starting January 9, 2020. A preferential rate of 2.7% can be obtained when purchasing personal insurance. The registration requirement is on the territory of the Russian Federation at the place of residence or stay (that is, not necessarily in rural areas). Work experience for individuals must be at least 6 months at the last (current) place of work and at least 1 year of total work experience over the last 5 years. Experience in the village is not necessary. At Rosselkhozbank you can choose the type of mortgage payment: differentiated or annuity.

When contacting the chosen bank, it is recommended to take with you a certain list of documents - this will allow you to immediately submit an application for loan approval.

Sberbank launched rural mortgages on May 20, 2020, but has temporarily suspended accepting applications.

Detailed conditions for rural mortgages in Rosselkhozbank and Sberbank are presented in the table:

Package of documents

The regulatory legal act adopted by the Government of the Russian Federation regarding the implementation of the rural development project states that the list of required documentation will be determined directly by the joint-stock company "Bank DOM.RF" and other banking enterprises. If we take into account what documents institutions request when issuing mortgage products for other projects; It is assumed that the package of documents will be something like this:

- Passport of a citizen of the Russian Federation.

- Military ID or deferment certificate.

- Certificates and contracts confirming the client’s solvency. For officially employed persons – work book/contract, income certificate; for individual entrepreneurs – certificate of registration as an individual entrepreneur, tax return for the last 2 years; for pensioners - pension certificate, certificate of pension amount.

- Documents for the purchased property: assessment report, passports (cadastral and technical), certificates of ownership of previous owners and their passports of citizens of the Russian Federation.

If we take into account the requirements of a mortgage at 3 percent, then most likely the following will be added to the basic documents: the presence of a stamp on permanent registration in the village, proof of labor activity in the above-mentioned areas, certificates and employment contracts.

Procedure for obtaining a loan

The issuance of mortgages at 3 percent will be carried out according to the following scenario:

- Contacting a potential borrower to the financial institution of interest to receive consulting assistance.

- Collection, preparation and submission of documents for approval of the application.

- If the answer is positive, the additional required package of papers will be provided.

- Signing a loan agreement.

- Registration of real estate in Rosreestr (until the end of mortgage payments, an encumbrance will “hang” on the residential premises).

The entire procedure can take quite a long time - from 1 to 3-4 months. Therefore, it is advised to be patient.

List of documents

The most time-consuming part of lending is collecting the necessary papers and certificates.

The list of documents includes:

- original and copies of all pages of the borrower’s and co-borrowers’ passports;

- marriage or divorce certificate;

- documents confirming the presence of children;

- certificate of family composition;

- documents confirming the special status of the borrower (single mother, large family, low-income, etc.);

- an extract from the Unified State Register of Real Estate about the absence of real estate ownership;

- documents confirming the level of family income sufficient to repay the loan;

- a copy of the work book.

News

Many media outlets have already paid attention to the innovation. Latest news on the program:

- The Government of the Russian Federation will approve an initial mortgage payment for the purchase of housing in rural areas in the amount of 10%. The interest rate on the loan will be 0.1-3% (the exact amount depends on the region of residence of the potential borrower). They also noted the maximum period for which the loan is issued – 25 years.

- Mordovia is carefully preparing for the full implementation of the new project. The head of the republic, Vladimir Volkov, told the publication that land is now being prepared for massive construction of residential premises for new rural residents, additional jobs are being created, and measures are being taken to improve the infrastructure. According to him, residents of all settlements with a population of up to 40 thousand people will be able to take advantage of the program, but there is an exception village - Ruzaevka, where other projects will be implemented.

As you can understand, the program aroused interest among residents of the country. This means there must be a demand for such an offer.

conclusions

Some conclusions should be drawn regarding the soon-to-be-introduced program of preferential mortgage lending:

- A new program - preferential mortgages and improved living conditions in the village. Accordingly, this should attract citizens to move to small settlements.

- A mortgage at 3 percent is a very profitable loan, which is especially important for rural residents (here wages often leave much to be desired). Also, a low down payment threshold should make the loan more affordable.

- The requirements for preferential borrowers are not so stringent: this means that many people will be able to take advantage of the program.

Do you have any questions on the topic? Ask our lawyer questions - we will be happy to help you. And also don’t forget to like and repost the post.

By the way, the Far East will have its own incentive for purchasing real estate. Read more about her here.