A decrease in bank rates on mortgage loans this year has provoked an increase in potential borrowers applying for a housing loan for housing in new buildings, country real estate, and land plots for individual construction. Every second Russian bank also has federal and preferential programs for certain categories of citizens, whose mortgage application allows them to qualify for comfortable housing with partial repayment from the state budget.

The list of mortgage programs makes it possible to choose loyal and comfortable conditions without high overpayments for the period of using a bank loan. Let's look in detail at what is needed to apply for a home loan, and where a borrower can find a complete list of financial institutions issuing mortgages.

Universal application for a mortgage in several banks in 2020

Each applicant can submit a completed application to the bank after choosing an economical and comfortable program that meets the conditions and requirements. If the borrower does not want to cooperate with a specific lender, he has the right to submit a universal application in writing or electronically, which is sent and considered by several banks.

In the methods of submitting such applications:

- through the websites of capital developers (for example, PIK Group);

- with the involvement of a credit broker who is well versed in bank mortgage offers;

- in writing with a personal visit to bank branches and representative offices.

Important! There are special offers from financial institutions of the Russian Federation that allow you to apply for a mortgage online with an attractive discount on the annual percentage (1-2%). Study promotions and unique mortgage lending programs to calculate the most favorable conditions.

If an applicant applies to the office of a city developer, an approximate payment schedule is first drawn up, based on the basic conditions of Russian banks on the developer’s list of partners. This type of assistance is considered the most effective due to the minimal time spent, but has the main disadvantage - the borrower can choose a home with a mortgage only on the primary market.

How to apply for a mortgage loan?

First, it is necessary to clarify that the Sberbank Online service allows you to apply for a consumer loan only, and such a service is provided exclusively to salary clients.

If you want to fill out an application for a mortgage loan, you have two options: personally contact a bank branch or make an application through its official website.

To do this, you need to go to the Sberbank website, select the “Take a loan” section, and then go to “House loan”. Then all you have to do is study all the bank’s offers and choose the appropriate program. Next, a page will open with a description of the conditions, an online calculator and a “Fill out an application” or “Submit an application” button.

The application service then redirects to a website where borrowers can:

- Study the accredited new buildings offered by the bank.

- Calculate the loan offer based on the required amount, purpose of purchase, as well as the availability of funds for the down payment. Based on this, the service will determine the overpayment and monthly payment, and will also tell you what level of income you need to have to apply for a mortgage. If your income is insufficient, you will need to either attract co-borrowers or reduce the amount.

- You can submit an application online and at the same time significantly reduce the interest rate if the client agrees to conclude a life insurance contract (1% discount), electronic registration of the transaction in question (the rate is reduced by 0.5%), as well as the purchase of housing from some developers with a repayment period of no more than seven years (rate reduction by 2%).

The online mortgage application consists of the following sections:

- Passport details;

- Personal data of the borrower;

- Family status;

- Loan information;

- Information about income level and work;

- Additional Information.

Is it worth applying to several banks at once?

In practice, applicants do not dare to send an application to several banks at once to obtain a housing loan. The main reason remains the recording of all submitted applications in the borrower’s credit history, which can be requested by subsequent lenders at any time. The opinion that a large number of applications will negatively affect the client’s reputation is erroneous.

In fact the situation is like this:

- all types of lending applications (mortgage, car loan, consumer loan, etc.) are stored in the CI database for no more than 5 days;

- after receiving a refusal to lend from a specific financial institution, information about the application often does not have time to be recorded in the CI, and therefore cannot be received by another bank.

Is it possible to take out a second mortgage? Practice

The law does not limit the number of mortgages issued by a borrower, but in practice the financial institution must ensure the absolute solvency of the client. The documents and requirements are similar to the main housing loan, but it is advisable to supplement the package of documents with extracts from a medical institution confirming full legal capacity.

Even a 2020 mortgage is not a reason to refuse a borrower’s desire to take out another housing loan for another property or land plot for their own construction of a residential building.

There is a high probability of refusal to re-mortgage if:

- the client has a negative credit history;

- the level of family income was revealed to be insufficient to repay several mortgages;

- there are no own savings to make the down payment (usually up to 30-40% is requested for the second loan);

- the collateral has low liquidity;

- there are minor dependents present.

Important! In order for a repeated application to be approved, the borrower needs to attract guarantors with a high income, indicate additional sources of family financing, and contact the servicing bank (lenders are more willing to accommodate paying clients halfway).

The refusal of a banking institution with the motive “having a primary mortgage” is officially illegal, but in reality there is no point in proving one’s case. Financial organizations have a loyal attitude towards clients aged 25-40 years with the provision of additional collateral in the form of real estate.

How to get a mortgage at Sberbank

| Credit program | Sum | Term | Bid | An initial fee |

| New building | up to 30,000,000 rubles | up to 30 years old | from 4.60% per annum | from 15% |

| Ready housing | up to 30,000,000 rubles | up to 30 years old | from 8.10% per annum | from 15% |

| Mortgage for families with children (state support) | up to 12,000,000 rubles | up to 30 years old | from 1.20% per annum | from 20% |

| Home construction | up to 30,000,000 rubles | up to 30 years old | from 9.30% per annum | from 25% |

| Non-target | up to 10,000,000 rubles | up to 20 years | from 11.30% per annum | — |

| country estate | up to 30,000,000 rubles | up to 30 years old | 8.50% per annum | from 25% |

| Military mortgage | up to 3,005,000 rubles | up to 25 years | 8.15% per annum | from 15% |

Product Description

At Sberbank, mortgage lending is provided to individuals and legal entities with Russian citizenship, whose age at the time of application exceeds 21 years, and at the time of repayment - no more than 75 years. The borrower must have a total work experience of 5 years, and at least six months at the last place of work. But if you are a salary client, this condition will not apply. When the amount approved by the bank is not enough, it is allowed to attract co-borrowers (from 1 to 3 people, for a young family this number can reach 6 people).

Their income is also taken into account. To apply for a mortgage, you must present documents: application form, passport + one of your choice. You will also need certificates confirming your income and work. If the loan is taken out with collateral, you will additionally have to provide documents on the collateral. A mortgage at Sberbank is given in the place where the borrower or co-borrower is registered, or in the region in which the property being financed is located.

The largest loan amount is 30 million rubles. The maximum loan term can be 25-30 years. The down payment varies from 15-25% or more. The rates are different. Mortgages for young families in Moscow are issued on preferential terms - from 1.20% per year. If you want to take out a mortgage to purchase a new apartment, you should pay at least 4.60% every year.

If the borrower needs to get a loan to build a summer house or house, the deposit will be 25% or more, interest will be from 9.30% per annum, and the minimum amount of loan funds will be 300 thousand rubles. Sberbank allows the client to independently choose the payment date and change it once a year. You can get a mortgage if:

- fill out an application and provide a package of documents;

- wait for an answer. The application is reviewed within 2-5 days. If the verdict is favorable, the bank will request documents on the property;

- sign all loan documentation;

- undergo state registration.

Find out more about Sberbank >

What to look for when applying for a mortgage? Preparation of documents

Before an online application is sent to all banks using a special service or a financial consultant (broker), it is necessary to study in detail the terms of the future loan agreement and the bank’s requirements. Applications that contain the slightest discrepancy between the borrower, including age limits, profitability and other factors, are immediately rejected.

Each applicant first takes into account:

- the amount of monthly mortgage payments, which is no more than 50% of official income;

- availability of the required amount of funds to pay for PV (approximately 20-25%, more often 30-40%);

- type of housing, location features, which affects the level of liquidity and calculation of the mortgage limit for issuance.

Before submitting an application, the borrower must collect basic documents for housing, including an expert assessment, a purchase and sale agreement or DDU. It is also necessary to have technical documentation for living space, SNILS, INN and other personal documents (check the full list with specific banks, where all the paperwork for obtaining a loan for living space is described in detail).

Procedure for submitting an online application

On the official websites of banks there are mortgage forms that you can fill out and send for verification. They indicate passport details, desired loan terms and contacts. For such an application, you will receive a decision without visiting the branch - if approved, the credit manager will call you back.

For example, to apply for a mortgage at Sberbank, you need to follow the instructions:

- Go to the official page of the bank.

- Find the “Mortgage” section.

- Select the appropriate program and click on the “Submit Application” button.

- On the page that opens, log into your personal account (or register it) and fill out the form.

Mortgage loans in cities

Taking out a mortgage is easier in practice due to the large number of available assets and developed infrastructure. Houses and apartments in urban-type settlements, villages and villages have low liquidity; the bank is critical of such objects and sets the minimum cost of such real estate.

Also, a mortgage application in the city will be considered by the maximum number of banks that have branches in the region of circulation. The periphery rarely has a large list of representative offices of Russian banks; the choice is very limited.

Important! For residents of small settlements, an online application will allow them to choose the most comfortable conditions in any Russian bank that accepts electronic applications.

How to pre-calculate your monthly mortgage payment?

Before submitting your application, you can calculate your mortgage parameters using an online calculator.

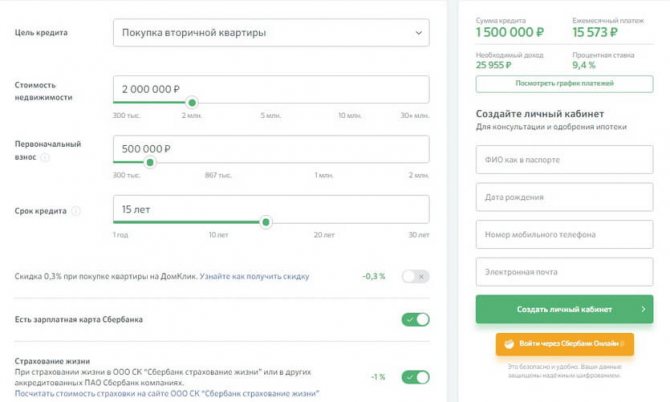

For example, on the Sberbank website for calculations in the calculator you need to indicate:

- purpose of the loan;

- property value;

- the amount of the down payment;

- loan terms.

Calculation example:

- the purpose of the loan is to purchase a secondary apartment;

- cost - 2 million;

- initial payment - 500 thousand;

- term - 15 years.

Result : the monthly payment will be 15,573 rubles, the rate is 9.4%, the required income for approval of the application is 25,955 rubles.

Search for applications online in Moscow

Online search systems for mortgage offers allow you to simultaneously view the most popular and profitable offers. Special filters allow you to select current offers from financial institutions of the Russian Federation depending on the borrowers’ belonging to a certain social category, by type of real estate, type of loan agreement (for example, for refinancing).

Some sites are created by real estate agencies and brokerage organizations that will take over the entire process of applying for a mortgage loan, first submit an application on behalf of the client with further support.

Applying online in Moscow

Home loan comparison services will help you determine specific offers that are available at financial institutions at the time of viewing. Each mortgage loan is accompanied by a special calculator that allows you to see real data on the total mortgage amount for the entire repayment period and monthly payments. The filter also allows you to see whether the income level of a particular individual is suitable for this program and the cost of the selected housing or not.

Attention: the detailed information presented on websites for selecting mortgages for submitting an application online complies with the conditions and requirements of the central offices. The borrower must clarify the bank's requests at the place of residence separately.

Comparative table of online mortgage applications in Moscow

Let's look at some mortgage programs where you can leave a preliminary application for consideration via the Internet, regardless of the type of real estate, age limits and other conditions for borrowers.

| Creditor's name | Current interest rate | Housing loan repayment period | Amount to be issued |

| TransCapitalBank | From 7.95% | 15 years | Up to 12 million rubles. |

| National Mortgage Factory | 11,99% | 20 years | Up to 10 million rubles. |

| Fora-Bank | From 9.5% | 25 years | From 600 thousand rubles. |

| Center Invest | From 9.75% | 60 months | Up to 5 million rubles. |

Important! In addition to contacting official commercial institutions (banks), borrowers are given the opportunity to obtain a mortgage from third-party companies that are more loyal to clients with a negative CI or unofficial sources of income.

You can leave this form in person at a representative office of a private lending institution or through an online website in electronic form.

How to increase your chances of getting your online application approved

A refusal of an application is not a death sentence for clients of the service, as our specialists have prepared a number of tips to help those who have a negative credit history.

- The “Mortgage Selection” service will allow you to familiarize yourself with the main conditions imposed by participating banks. This information should be reviewed before submitting your online application to determine the most suitable bank for your loan.

- One of the tips on mortgage terms is that the longer the loan term, the higher the chance of confirming your solvency. Therefore, banks most often confirm the application of those borrowers who choose the maximum possible term, thereby choosing the minimum monthly payment. In addition, many banks allow borrowers to close their mortgages earlier than the agreed period and recalculate interest in favor of the client.

- A big role in considering the request is played by the client’s ability to make a down payment - 15-20% of the cost of the property will favorably influence the bank’s decision. Few representatives of the financial world work without a down payment, so before submitting an online application, you need to familiarize yourself with the bank’s requirements.

- It is worth clarifying the attitude of creditor banks to age restrictions . Among them there are even those who offer mortgages to non-working pensioners, but this needs to be carefully considered, since such a positive point may affect other requirements and conditions.

- If a potential borrower has any questions about the service , bank conditions or loan servicing, then he has the opportunity to contact specialists for a free consultation. Here you can ask questions without registering.

- Clients of the service also have the opportunity to contact a special free online lawyer . He will advise clients on all sorts of issues related to litigation in the field of real estate and lending, as well as familiarize them with the legal aspects of mortgage lending.

As a result, clients of the online application service have many tools to facilitate the process of applying for a real estate loan. All that remains is the small matter - the borrower's desire.