The essence of restructuring

The main goal of this program is to help the borrower when difficult life problems arise. If a client, for example, lost his job or was hospitalized with a serious illness, or other force majeure situations occurred in which he would not be able to repay the loan, then he should immediately submit a written application to the bank to revise the agreement.

The bank will review all submitted documents and application and make a decision. You should know that only those borrowers who have always repaid their debt on time will be able to receive a positive answer.

In other cases, a negative answer can be expected. VTB 24 Bank always goes the extra mile for its clients and helps them get out of a difficult financial situation as painlessly as possible.

Restructuring opportunities

Due to the worsening economic situation, there were many times more people wishing to participate in the restructuring program and VTB 24 Bank was forced to reconsider the conditions.

Today, this service can be used by clients who have entered into contracts:

- for car loans . Here the client can count on a reduction in monthly payment. In another case, he will be offered a loan holiday to pay interest;

- for issuing a credit card . In this case, restructuring is possible and profitable if the borrower has withdrawn all the money and does not pay the debt, and fines and interest are constantly being charged on the loan balance.

But as for mortgages, there is very little information here.

Restructuring of VTB mortgage with the help of the state

On April 20, 2020, a decree was issued on refinancing mortgages with the help of the state. Thanks to the new changes, the amount of state aid has been tripled.

To date, the number of overdue debts on foreign currency loans has decreased by half, and on ruble loans is also rapidly decreasing.

ARHML is an institution that provides a state program for reviewing VTB mortgage clauses for your property. Foreign currency borrowers have the best chance of taking advantage of it, but those whose apartments are in rubles also have a chance.

Restructuring methods

There are different options for implementing a mortgage restructuring program for an individual:

- You can write off part of your existing debt ;

- you can make changes to the original contract (in particular, change the term of the contract, thereby reducing the monthly payment);

- you can use the client's collateral , which will be accepted to pay off the debt partially or even completely.

Careful work is carried out with each client individually. And if the option does not suit the borrower, he can always offer his own conditions. The bank will also consider them.

The optimal solution may be to conclude a new mixed agreement, where the bank and ARHML will be the mortgage holders. They can cover the loan with their own funds for the borrower.

A stabilization loan is also an option. Here, ARHML provides a loan that allows the borrower to cover the loan costs. Then the client is given a grace period when he can only pay interest. And after that, you will need to repay the balance of the debt to the bank, as well as to the agency, at your own expense.

You can transfer your loan to another person if he agrees to fulfill all debt obligations.

What to do if the answer is negative

If the bank refuses to restructure, the individual will have to resolve the issue with the resulting debt through the court. However, the borrower cannot be the plaintiff in the lawsuit; only the creditor has such a right. As a rule, the banking institution goes to court 3 months after you stop making monthly payments.

In court, the loan debtor must prove that the reasons for not paying debt obligations to the bank are compelling, and also provide evidence of attempts to peacefully resolve the dispute.

Consultation with a lawyer on the procedure in case of a bank’s refusal to restructure a loan, including a mortgage.

Please note that when approving a restructuring through the court, there are certain advantages for an individual:

- a way to limit the creditor in imposing penalties and fines;

- reduction of already accrued penalties by more than 3 times;

- get the opportunity not to pay the debt for a year, or reduce monthly payments to a minimum amount.

Depending on the workload of the courts, you can receive a decision to change the terms of the contract within 1-2 months.

Terms of restructuring at VTB 24

Although it is currently not so easy to restructure a mortgage at VTB 24, there are still options in which you can qualify for this service. In particular, these are:

- if the mortgaged property is the borrower’s only living space;

- if the borrower’s income has decreased by 30% or more over the past 6 months;

- if after paying monthly payments , the remaining total income for each person in the family is less than two subsistence minimums established by the state.

To receive this service, the borrower will need to provide all documents confirming this information.

Documents for mortgage restructuring at VTB24

The bank employees already have the main package of documents for your loan. Therefore you will need:

- Passport

- Application with a request to consider the possibility of loan restructuring.

- A copy of the work book with the employer’s notes.

- A document about the deterioration of your financial situation. It could be:

- a certificate of income indicating that you are not able to pay the debt in full;

— a certificate from the labor exchange stating that you are unemployed and receiving appropriate benefits;

- pregnancy certificate - it implies a rapid deterioration in the client’s financial situation.

If the mortgage loan was issued during the period when the client was married, then documents confirming the deterioration of his current financial situation may include:

- divorce certificate;

— a document confirming the loss of work by the spouse;

— statement of payment of child support;

- death certificate of the spouse.

A serious illness or acquired disability may also be considered important arguments facilitating a positive decision on your request (mortgage restructuring at VTB 24). In this case, you will also need relevant documents - a certificate from the hospital, a certificate of disability.

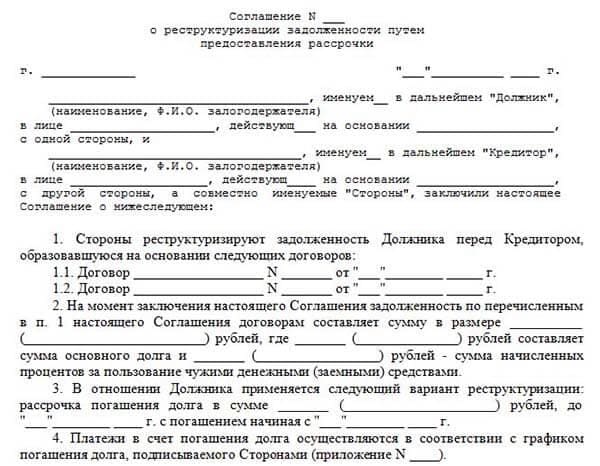

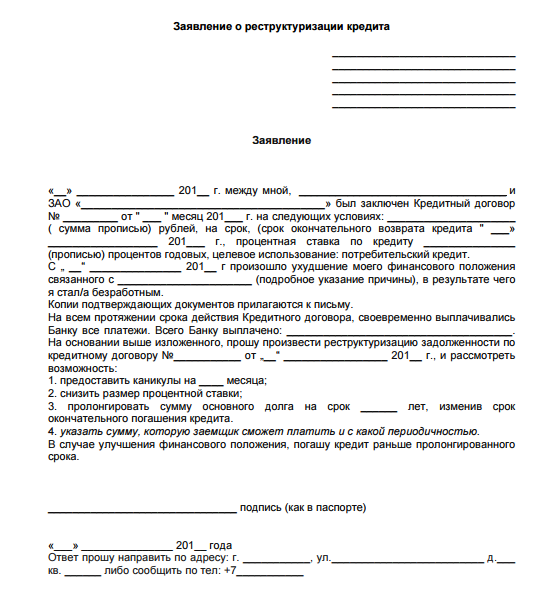

Example of an application form for mortgage restructuring VTB 24 sample

You can draw up an application either by hand or in printed form, certainly in two copies - after registration with a bank employee, one version will remain in your hands. It will come in handy if the case goes to trial.

There is no single established form for writing such a statement. No one is stopping you from writing it in free form, but you should definitely include the following information:

- Details of your mortgage agreement.

- The amount of remaining debt.

- Monthly payment amounts.

- Reasons why you need to review the terms of the agreement regarding loan repayment.

- Wishes you have regarding the restructuring of your mortgage loan.

If you are wondering how to refinance a loan using two documents, then we have especially compiled for you the top 5 banks where you can do this

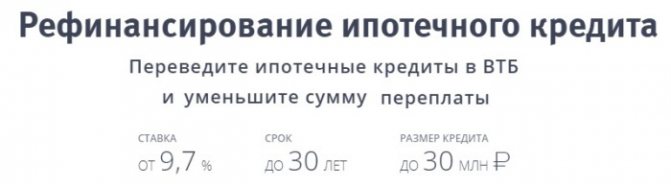

What bet can you expect?

Today you can refinance your mortgage at different banks. 9.7% in ruble currency in 2020

To receive exactly this percentage, certain conditions must be met.

For example, a citizen must be a bank client and receive a salary on a VTB 24 card.

In addition, you must obtain comprehensive mortgage insurance. Since without this insurance the interest rate will increase by at least one percent.

After filing an application for restructuring, the interest can be from 13.95 per annum or more . This depends on the decision of the bank and the documents submitted by the borrower.

Reduce interest rates through restructuring

One of the conditions for restructuring an existing bank loan is a reduction in the interest rate. It is more profitable for the lender to revise the parameters of the existing loan rather than not receive any payments from the borrower. The financial institution takes this step openly, as it is interested in receiving a certain benefit from the transaction with the client. In such a situation, you only need to confirm your insolvency, as well as your integrity before the bank. This will allow you to qualify for a program with favorable conditions, as well as a subsequent reduction in the payment burden.

Important! On the Internet you can find a lot of comments regarding restructuring at VTB Bank, but you should not rely only on them, since all the conditions for such a service are purely individual.

Every borrower can face financial difficulties. In such a situation, you can refinance the loan, and in case of refusal, request a loan restructuring from the bank. This allows you to significantly reduce the payment burden by increasing loan terms and lowering interest rates. VTB Bank actively cooperates with its clients, since refinancing is a benefit not only for the client, but also for the lender.

What time period is possible?

If a client contacts the bank regarding the restructuring of a loan agreement, then he can choose any option:

- in the next six months, pay only interest and leave the principal debt alone;

- reduce monthly payments by half for a year;

- the total loan period can be increased to 10 years;

- if the loan was received in any currency, you can convert the debt into rubles on a preferential basis and partially repay the debt through budget financing in the amount of 600 thousand rubles .

It is important to note that only those clients who have carefully made all payments and have not previously had late payments or fines can qualify for such rather convenient conditions.

Calculation example

To evaluate the full benefits of the bank’s offer, you can use any lending calculator. For an approximate calculation, you need to take arbitrary values.

| Current loan debt | 400,000 rubles |

| Time until full repayment | 60 months |

| Interest rate on current mortgage | 15% per year |

All values will be calculated using the formula: total amount of debt: term + interest rate: 12 = monthly payment amount. If you use this formula, you should get 9516 rubles. When restructuring a mortgage for 10 years at an interest rate of 14% per year, the payment is reduced to 6,211 rubles.

Important! All calculations presented are indicative, so the client’s final benefit may be significantly greater.

Requirements for the borrower

Only a Russian citizen can apply for restructuring. In addition, he must be at least 21 years old and no more than 70 years old.

The borrower must have more than one year of work experience and have sufficient income to renegotiate the terms of the mortgage agreement.

The following applicants can also count on a positive decision:

- People who have become disabled.

- If there are disabled children in the family.

- Citizens who participated in hostilities and have official confirmation of this.

- If the family has two or more children under 18 years of age.

- If the borrower lives in housing that is recognized as unsafe.

- Public sector employees with more than 5 years of experience.

- Borrowers entitled to subsidies.

- Municipal employees.

If the client has additional facts that allow him to qualify for a restructuring, then these also need to be provided to the bank.

Requirements

VTB provides mortgage restructuring exclusively to individuals.

Requirements for them include: Russian citizenship, territorial registration, return limits from 21 to 70 years. The borrower must not be overdue for mandatory payments for more than 6 months.

Socially vulnerable citizens can also count on the provision of services:

- military veterans;

- families with disabled children;

- employees of budgetary organizations;

- disabled people;

- families with 2 or more minor children;

Borrowers who fall into the above category must provide supporting certificates.

Required documents

The documents provided to the bank for the restructuring process, in addition to the standard set, include additional certificates.

The purpose of the latter is to confirm the decrease in the client’s solvency.

The package of documents includes:

- Russian passport;

- work book or its certified copy;

- certificate of registration with the Central Employment Service upon redundancy;

- financial documents on income;

- certificate of family composition;

- loan agreements, if there are existing debt obligations in other banks.

If your total income has decreased due to health reasons, you must provide medical documentation.

Required documents

To submit documents for restructuring, you must prepare the following package:

- personal passport of a Russian citizen;

- information about earnings and place of work in the form of an official certificate;

- if the client is unemployed, it is necessary to provide information from the employment center about this and the benefits received;

- a certificate from a medical institution about the pregnancy of a client expecting the birth of a child in the near future;

- if the borrower has additional income, this must also be declared;

- client's death certificate.

Only after receiving all the documents will the bank consider the borrower’s application to provide him with favorable loan repayment conditions.

How to apply

There are several options to apply for restructuring:

- Online application submission.

- Through a bank branch.

- In other ways.

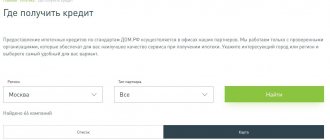

It is worth noting that today VTB 24 Bank does not have a special program aimed at restructuring mortgages. But you should still use the option of submitting an application online through the bank’s website.

To do this, you need to go to the VTB 24 website and go to the “Refinancing” section. Here you will find an application form in which you must fill out the following information:

- all your personal data, including detailed information from your passport;

- information about the loan: date of receipt, agreement number, amount and type;

- information about work or lack thereof;

- certificates of income received.

After the application is received by the bank, it will be reviewed and then the bank manager will contact the borrower and report the results.

To submit an application for restructuring through a bank branch, you need to submit the entire package of documents in person to the bank.

How to fill out an application correctly can be found right there on the stand in the office building. You can write it by hand or type it on a computer.

The bank will accept a correctly completed application for consideration and make a decision within 3-5 business days.

Features of applications not according to the sample

Banks also allow this application format. The application must necessarily indicate:

- name and details of the bank to which the application is addressed;

- information about the loan provided (number, terms and date of the agreement);

- the date and month when the payment was first delayed;

- the main problem due to which it is impossible to make payments on time;

- proposals to the bank regarding changes to your agreement.

Such a document must be drawn up in two copies and when accepted by the bank, the manager is obliged to put a date and stamp indicating that the document has been accepted for consideration.

Thanks to such a document, the client can protect himself from problems if the bank begins to charge penalties or fines on the loan.

How does the bank review applications?

If all documents submitted by the client are correctly completed and submitted on time, the bank will review them within a few days.

When the decision is made and the application is approved by the bank, the bank manager will contact the client by telephone and invite him to the branch for a final discussion of the terms of the contract and signing of documents.

If a positive decision is not made, the client will receive a letter with a justified refusal.

VTB 24 Bank meets its clients halfway and always tries to offer the most favorable loan repayment terms, but only if the borrower has a positive credit history.

Conditions of the mortgage restructuring program for individuals

VTB 24 mortgage restructuring is available to clients if they meet the following mortgage lending conditions:

- There are no existing arrears under the mortgage agreement.

- The restructuring program is available if you have a debt of over 30 thousand rubles.

- The service is available to individuals aged 18 to 65 years.

- Only citizens of the Russian Federation can receive debt restructuring.

- It is possible to restructure the loan if you have a positive credit history.

- An individual has access to a reduction in the interest rate if they have worked for at least 1 year (in their last position for more than 3 months).

You can restructure loan debt at 10.9% per year. For registration, a passport, a certificate in the form of VTB Bank, as well as an application and 2-NDFL are provided.

Important! To use the service, an individual must convince the creditor of his insolvency.

Frequent reasons for failures

When concluding an agreement with a bank, the client should remember that obligations arise on both sides. And they must be completed exactly on time, which is specified in the document.

If a client does not pay monthly installments on time, this is the most common reason for refusing debt restructuring.

But it happens that due to the high workload of a bank employee, the client’s application is not considered properly and the borrower is automatically refused. In this case, you need to send the documents again or contact a lawyer for advice.

Refusal from restructuring

First of all, it is worth noting that the bank will make a decision for each person individually. All this will be influenced by the following factors:

- conscientiousness and responsibility of the borrower;

If you have paid off most of the loan, the bank will most likely accommodate you.

- having a good credit history;

If you have always made regular loan payments in the past, this is a big plus for you.

- original terms of the contract.

The initial terms of the mortgage agreement also have a great influence. If your mortgage was issued at 14% per annum, then most likely VTB will decide to meet you halfway and improve the terms of the agreement.

Thus, we can conclude that there are quite a few reasons for a bank’s refusal to provide a mortgage refinancing program. However, for the borrower this is the only way not to spoil the credit history and pay off the debt.

Grounds for refusal

There can be quite a few reasons for refusal, here are some of them:

- you have paid the smallest part of the debt;

- the terms of the contract are already quite loyal;

- the client changes jobs too often;

- the client does not contact the bank;

- lack of prospects for further cooperation in the bank’s opinion.

What to do if you have received a refusal to restructure from VTB

If you receive a refusal to restructure your mortgage, ask for a written response with the reason. Once you have resolved it, you can try to re-apply.

If the refusal is given again, you can try to contact another financial institution in order to take out a new loan to repay the old one (refinancing program), for example, to Sberbank.

Advantages and disadvantages of restructuring

Even in such a seemingly profitable deal in all respects, you can find both advantages and disadvantages.

The disadvantages include the following points. If the client has already been declared bankrupt, then the possibility of restructuring is not provided at all.

Preservation of your credit history by repaying the loan in smaller amounts, the likelihood of deferred payment or payment in minimal amounts, as well as a guarantee to the bank to return its finances without litigation or the services of collectors - all this can be attributed to the advantages of restructuring.

In any case, the bank loses part of its profit in case of late payments by the client. The client will also be forced to pay more in the end, and for a longer period of time.