Zapsibkombank programs: conditions

The financial institution has been operating relatively recently. This is not such a large bank, so it is trying with all its might to bring the company to a new level. Exclusive mortgage lending programs are a real highlight.

Trying to make the conditions convenient, the bank is gaining a user flow. Analysts advise hurrying if you want to take out a mortgage. Then there may not be such discounts.

Let's look at the best programs. There are only 8 of them, distinguished by the following offers:

- Reduced interest rate;

- Expanding the loan repayment terms;

- Convenient document preparation.

Secondary

If you buy a house/land/apartment on the secondary market, that is, when the property already had owners, it is not new, then the bank offers an excellent program “Mortgage for Ready Housing”.

Advantages:

- Duration up to 30 years;

- The entry fee is only 10%.

Conditions:

- The property is put under collateral;

- The client must be over 21 years old;

- Positive credit history.

New building

This offer will allow you to buy an apartment in a new building. You will receive any amount, there are no limits.

The main thing is to make a down payment, which is equal to 10% of the property price.

A long repayment period allows the borrower to choose the amount of the monthly payment.

Orange mortgage

Zapsibkombank program, valid until December 31, 2018. Advantages of the "Orange Mortgage":

- No down payment;

- No invoice registration required;

- There is no need to order work to assess the value of the apartment or house purchased by the borrower.

The interest rate will vary as it depends on:

- Client's salary level;

- Debts in the borrower's database;

- Does the person make a down payment?

If the user bought real estate on the secondary market, then it is pledged.

Family mortgage

This type of lending allows young families to obtain a preferential mortgage with an interest rate of 6%. The main condition is that the second or third child must be born between 2020 and 2022.

The down payment will be 20% of the housing price. The subsidized rate will be valid from 3 to 8 years. After the end of the term, if the borrower has not repaid the funds, it will be necessary to recalculate and select another program that meets the conditions.

Mortgage for students

This service from Zapsibcombank will defer mortgage payments while the applicant’s child is studying at a university. The rate will not increase until the facility is put into operation.

The longest loan term is 30 years. Requirements:

- No late payments for previous loans;

- Positive credit history;

- Down payment – 10%;

- Interest rate – from 9.7%.

Loan secured by real estate

You can take out a mortgage on a property by pledging your existing property as collateral. You can indicate an apartment, a dacha, a house.

Sometimes the bank allows you to put a typewriter or securities as collateral. Under this program, an increased interest rate will apply, and the loan term will be reduced to 20 years.

Purchase of land

If you have your eyes on a plot to build a house, then the program will suit you. Conditions:

- Payment period up to 30 years;

- Primary contribution – 10%;

- Rate – 12% per annum.

You can recalculate if you build a building on the site before the payment deadline. The bank will reduce the interest rate if the borrower pledges the built house as collateral.

Look at the same topic: How to get a tax deduction when buying an apartment with a military mortgage? Step-by-step instruction

Construction of a residential building

During the construction process, you can buy an apartment in a residential building at a great discount. This type of lending is for you if you want:

- Buy a new apartment at a resale price;

- Get a low interest rate;

- Become a VIP client.

Provisions:

- Rate from 10 to 10.9% per annum;

- Payment term – 30 years;

- Down payment – 10%.

Programs offered

Mortgages in ZSKB in 2020 are represented by several programs. They differ in percentages, amounts, terms and other features. Clients can calculate the conditions in advance using the Zapsibkombank mortgage calculator on our website at the bottom of this article.

Clients can receive money through the following options:

- Ready-made housing: up to 50 million rubles are offered at 9.3−10% per year. The down payment must be at least 15%. You can spend money on purchasing a finished apartment or “non-standard” objects: apartments in wooden houses, buildings built before 1960 or falling under the “Renovation” program or similar. You can also buy a dorm room or share.

- New building: the conditions remain the same, but you can only buy an apartment in a new building.

- Housing: the maximum amount remains the same, the interest rate rises to 13.5%, the down payment is up to 20%. You can use the funds to purchase an apartment on the primary or secondary markets, a townhouse or a house (or its construction).

- For students: you can get up to 50 million rubles at 9.3−10% per year. It is possible to purchase a finished apartment or in a new building, a townhouse, as well as non-standard options. In addition to the collateral, a spouse's guarantee is required. Several people can become homeowners: they must be registered as co-borrowers.

- Orange mortgage: if the largest amount is the same, the program is different. The interest rate is 8.25−8.8%, there is no down payment. You can only buy housing in a new building.

- Family mortgage: suitable for purchasing housing in a new building or for refinancing. You can get up to 12 million rubles with a down payment of 20%. The main difference of the program is its preferential conditions. If a second child was born in a family since 2020, the interest rate will be 6% for the first 3 years. If a third baby is born, the period increases to 5 years. If the second and third children were born during the grace period, the grace period increases to 8 years. At the end of this period, the percentage rises to the standard one.

- Money for building a house: under this option, the client can receive up to 50 million rubles at 10.5-12.5% per year. They can be transferred in a single “piece” or in parts. A land plot or lease rights to it are accepted as collateral; a guarantee from a third party or legal entity will also be required. When the client submits a certificate of registration of ownership, the mortgage will be transferred to the house under construction with a plot. After this, the guarantors are released from their obligations.

- Purchase of land (or lease): the bank provides an amount of up to 50 million for the purchase of a land plot, which serves as collateral. It is necessary to have a spouse as a co-borrower. The rate is 10.5−11% per year.

- Refinancing: This is a procedure for obtaining funds to pay off existing loans, in this case a mortgage. Zapsibkombank provides up to 50 million for on-lending to borrowers at 9.3−15.5%. The money can be spent on “non-standard” items, such as a share in an apartment or a dorm room.

- Non-residential real estate: we are talking about commercial options, garages, parking spaces, parking spaces or vegetable stores. The bank offers up to 100 million, the rate is 12.5-13.5% per year.

In all situations, the interest rate will be lower for public sector employees and accredited enterprises, for clients with a positive credit history in any bank. The percentage will increase if there is no insurance, if you take out a loan for “non-standard” real estate (which is more difficult to sell), or if your credit history is not ideal. If possible, it is more profitable to take out a social mortgage or with a government support program.

The longest period in any program is 30 years, except for the “Housing” and “House Construction” options. For the latter it is 20 years.

By clients with an impeccable credit history, Zapsibkombank understands citizens whose credit history includes no more than 5 cases of delinquency. The total number of overdue days must not exceed 15 days.

Zapsibkombank mortgage interest rates

The company offers the most favorable conditions. The company actively cooperates with government programs that provide support to young families, military personnel, orphans and single mothers.

When choosing a bank, we pay most attention to interest rates. The lower it is, the more profitable the banking product will be. There are organizations that deliberately increase interest rates, but approve the product for everyone. This is a guarantee of their protection in unforeseen circumstances.

Here everything works on a different principle. A positive answer will not be given to all consumers; candidates undergo a strict selection process to receive a loan. The more information about you, the lower the interest rate.

At good interest rates they approve:

- For those who are an active client (interest rate from 10.25%);

- Salary users of the bank;

- If the person has an institutional debit or credit card;

- If you have a good and long credit history.

The minimum mortgage interest rate at Zapsibkombank is 6% for young families who take part in the state program. There are also discounts for pensioners. You need to find out more details from a consultant by phone, or you will have to stop by the office.

Mortgage rates

Zapsibcombank offers its clients a wide selection of tariffs that are suitable individually for each. It is worth talking about this in detail and determining how they differ from each other, as well as what their benefits are for the borrower.

Mortgage for families with children

This mortgage program is intended for families who are expecting a new addition to their family from 2018 to 2022, that is, the birth of a second or third child. The main advantage of this tariff over others is the low annual rate, which ranges from 6% per year.

The down payment for this program is 20%. The loan amount should not exceed more than 8,000,000 rubles for residents of Moscow and St. Petersburg. For residents of all other regions of the country, with the exception of those listed above, the amount is no more than 3,000,000 rubles. Payments in this tariff are made monthly. This program can be an excellent opportunity for large families to purchase their own apartment on favorable terms.

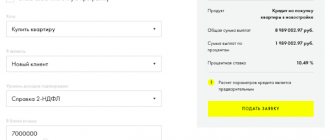

New building program

Thanks to this mortgage tariff, Zapsibcombank clients have the opportunity to purchase an apartment in a new building on favorable terms. A mortgage under this program is taken out by the borrower for a period of up to 30 years, which allows the volume of monthly payments to be distributed as profitably as possible.

The interest rate per year is from 9.3%, and the amount of the down payment is taken from 10% of the total amount. The peculiarity of this tariff is that the interest rate does not increase during the submission of the Mortgage to the registration authority.

The loan amount is determined by 90% of the price of the property. Payments are made monthly. There is also the possibility of comprehensive and selective insurance, providing a high degree of reliability. If you have a desire to buy an apartment in a new building, but there is no way to save enough money for a one-time purchase, then this offer definitely deserves attention.

Purchase of finished housing

Ready-made housing with a mortgage is an excellent opportunity to quickly and conveniently solve the housing problem for a young family or other people. Zapsibkombank can offer its clients the opportunity of a convenient loan for finished housing with a maximum loan amount of up to 90%.

Thanks to an annual rate of 9.3% per year and a down payment of 10%, this loan will be a good option for purchasing ready-made housing on favorable terms.

Mortgage for students

The name of this tariff speaks for itself. The main feature of this loan program is the ability to delay the start of the first mortgage payments for 3 years, but should not exceed the period until the student graduates. Thanks to the 30-year loan term, it becomes possible to flexibly customize the monthly payment that suits him.

Payments under this program can be made either in equal monthly amounts or with the possibility of reducing the payment amount each month. If you are still studying at a university, but are already thinking about purchasing your own home, then this type of mortgage will suit you well.

Mortgage on land

Your own plot of land can be used for many purposes, but it is not always possible to purchase the required land area immediately, at full cost. That is why Zapsibcombank provides its clients with the opportunity to take out a mortgage on a plot of land.

Under this program, the total loan amount should not exceed 80%, and the down payment amount is 20%. This tariff also provides the right to lease a land plot, as well as a mortgage on it. The annual rate will be from 10.5% per year.

Maternal capital

If there are two children in a family, they are provided with a certificate that can be used to pay off the down payment on the mortgage. Zapsibcombank offers families mortgages at a reduced rate of 10.25%.

To apply for a mortgage with maternity capital, you must meet the following conditions:

- Spouses must be in a relationship that is officially registered.

- Borrowers must be classified as citizens of the Russian Federation.

- Co-borrowers cannot own a business that will be jointly owned.

- Real estate is registered with the right of joint ownership of spouses.

- You cannot register ownership of children if they have not reached the age category of 18+.

- The husband and wife are indicated in the Unified State Register of Real Estate as owners of residential real estate.

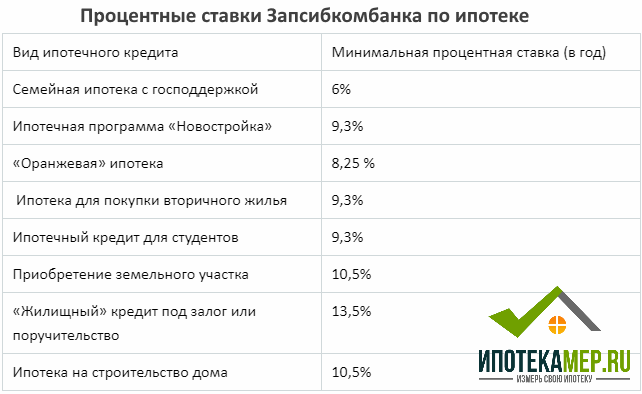

Interest rates at Zapsibkombank

The parameters of mortgage loans can be studied using the table.

| Type of loan program | Minimum rate, % per annum |

| New building | 9,3 |

| Orange mortgage | 8,25 |

| Loan for the purchase of land | 10,5 |

| Family mortgage | 6 |

| Housing loan with collateral | 13,5 |

| Mortgage for students | 9,3 |

| Loan for building a house | 10,5 |

| Secondary housing | 9,3 |

How to reduce your mortgage interest rate

Zapsibcombank does not offer special programs to reduce the loan rate.

Zapsibkombank mortgage calculator

The bank's official website has a special visual tool - a mortgage calculator. A potential borrower can always go to the resource, use the counter, which will help make a preliminary analysis and compare the client’s desires and capabilities.

The final data is provided to the borrower in a simple form that is understandable to the average person. It is clearly written there:

- How much money can a bank allocate for a mortgage? Your personal data is taken into account: salary, work experience, length of service.

- The main parameters are entered. Amount, loan term, amount of the down payment, interest rate, amount of the total overpayment for the entire time.

The mortgage calculator will help:

- Save time;

- Schedule a payment schedule in advance;

- Adjust your plans.

Conditions

The bank can offer several mortgage programs for different categories of residents with loyal conditions for each of them.

The conditions for issuing a mortgage at PJSC Zapsibkombank are interest rates, as well as the amount of the down payment and the loan term. General conditions under which you can take out a mortgage :

- Any amount for the purchase of real estate.

- Possibility of choosing housing both on the primary market and on the secondary market.

- You can take out a mortgage secured by the property you are purchasing, as well as without collateral.

- Mortgage loan for land.

- The loan is provided only in ruble equivalent.

- Interest rates from 9.5%.

- Programs for students.

Requirements for the borrower

Zapsibcombank puts forward the following requirements for borrowers:

- You must be a citizen of the Russian Federation;

- Availability of permanent registration in the area where the representative office of TKB Bank is located;

- Age from 18 years;

- Maximum age – 65 years;

- Work experience of 6 months;

- The organization where the payer works must be registered at least 1 year ago.

To get a mortgage you need:

- Have work experience;

- Be a citizen of the Russian Federation;

- Collect a package of necessary documents;

- Come to the bank's representative office for a consultation.

Mortgage lending is a complex banking service that requires having a permanent job and high solvency. The bank needs guarantees that you will be able to repay the debt.

Package of mortgage documents

In order for you to be approved for a mortgage at Zapsibcombank, you need to provide a number of the following documents:

- Properly completed (in advance) consumer questionnaire;

- Passport of a citizen of the Russian Federation;

- A copy of the man's military ID, if he is under 27 years old;

- A copy of the work book, which is certified by the boss;

- Certificate of income;

- Report from the BKI department;

- The result of an independent property assessment;

- Deed of sale and purchase;

- Marriage certificate;

- Certificate of divorce;

- Child's birth certificate;

- Certificate for maternity capital;

- TIN;

- Tax return.

Look at the same topic: Conditions for refinancing a mortgage at Otkritie Bank in [y] year

Required papers

The list of required documents in 2020 is formed depending on the chosen program and the borrowers themselves. For example, students will need a student ID to be approved for certain mortgages.

An approximate list of papers will be as follows:

- Completed application form.

- Passport (copy).

- International passport (copy), if available.

- For men, a military ID or other document confirming military service.

- SNILS (just indicate the number in the application).

- TIN, if information about it is not indicated in other documents (for example, in the 2-NDFL certificate).

- Documents relating to mortgage real estate.

- Documents regarding the encumbrance (if the collateral is an apartment that is not being purchased).

- An independent expert's assessment of the cost of housing. Paper is not needed when applying for a student loan and when purchasing non-residential premises.

- A document confirming income for the last 6 months. Not needed if the borrower receives salary on a bank card.

- A copy of the work book (or contract), each page of which is certified by the seal of the organization. Not needed if the client has been working for the company for more than a year.

- For students, proof of study is required when applying for certain mortgages.

- To apply for the benefit program, families will also need birth certificates of their children.

When refinancing, the list will be expanded. This is due to the need to provide complete information about the current loan.

When refinancing, the following documents will need to be added to the main list:

- An application for early repayment of the mortgage certified by the current lender. This confirms the lender's consent to reissue the mortgage.

- Loan agreement.

- Certificates indicating the balance of the debt, the dates of collection and repayment, and the amount of the monthly payment.

- Account number for transferring money.

Additionally, information on arrears for the last year and data on the balance of principal and interest may be requested. If necessary, Zapsibcombank may request additional documents.

How to apply

To complete the paperwork you will have to contact:

- To the employer;

- Tax;

- Bank.

After collecting documents and certificates, you must come to the department. Staff will give you a form to fill out. The application is processed within 3 business days, after which the bank responds.

In order for the mortgage registration procedure to take place in accordance with the rules, it is necessary to study the entire process in advance and collect the necessary papers. Choose a favorable tariff for yourself to save money.

To get a mortgage you need:

- Have work experience;

- Be a citizen of the Russian Federation;

- Collect a package of necessary documents;

- Come to the bank's representative office for a consultation.

Your application may take from 3 to 7 business days to be considered. In advance, you can calculate an approximate payment schedule yourself.

Pros and cons of mortgages at Zapsibkombank

Zapsibcombank has its advantages and disadvantages. The company has managed to establish itself as a reliable partner providing quality services.

The main advantages include:

- Benefit for the borrower;

- Reduced interest rates;

- Many interesting mortgage programs;

- Some offers allow you to avoid making a down payment;

- Trust in the consumer;

- Extended loan repayment terms.

Minor disadvantages:

- Not all cities have Zapsibkombank offices;

- Little popularity among the population;

- No flashy advertising.

How to reduce the mortgage interest rate at Zapsibkombank?

If you have a home loan with this bank and want to reduce the interest rate, you can go to the branch where the mortgage was issued and write an application requesting a reduction in the interest rate.

The application will be reviewed within 1-4 days, after which the bank will make its decision: approve the reduction or refuse the client, indicating the arguments.

A reduction in the interest rate is not beneficial to any of the banks, so the client should be prepared for a refusal.

The most optimal and realistic option for reducing mortgage interest is early full or partial repayment of debt. In this case, it is also necessary to submit an application to the bank for recalculation of interest.

Zapsibkombank is one of the largest regional banks in the Russian Federation. Judging by customer reviews, this bank can be trusted.

Reviews

Thanks to reviews on the Internet, we can find out a little more information about the company. For many, positive feedback is an impetus to action.

Evgeny Spiridenkov, Moscow “Good afternoon, I’ll tell you about my experience of working with Zapsibcombank. We took out a mortgage here, the conditions are very favorable. I liked everything, the attitude towards the client is very polite. We will recommend you to friends.”

Marina Olegovna, Yekaterinburg “Hello, I want to share my opinion about Zapsibkombank. This is an excellent company that provides quality services to the public. We took part in the program for young families and contributed maternity capital. We got the apartment of our dreams on favorable terms. We no longer worry about having to save money.”

Yuri Alexandrovich, Voronezh “We got a mortgage at Zapsibkombank, we liked the conditions. The staff offers a variety of programs. Everyone can choose their own requirements. A good bank for people. We’ve been paying interest at a reduced rate for three years now, and so far we’re happy with everything.”