A mortgage from Zenit Bank will help solve your housing problems. Purchases under a loan agreement are made not only for apartments in new buildings, but also for a plot of land with a spacious house.

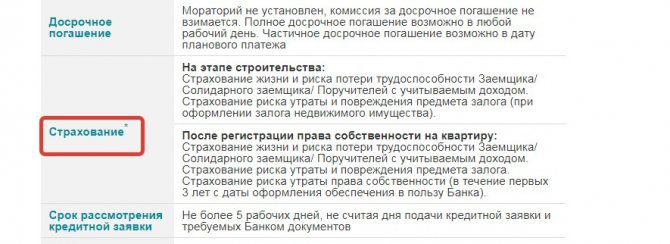

The bank tries to minimize the risk of loss with the help of insurance and surety , which is why this is mandatory in some loan products.

Zenit Bank is a large commercial entity that is part of a group of the same name.

Its liquidity and solvency are at the highest level, which is why the bank offers clients many interesting loan programs.

General characteristics of the bank

Zenit Bank occupies 25th place in the reliability rating. In the capital of Russia, the financial institution has a large network - 70 branches and 160 ATMs. It was founded in 1994 and is now a stable and full-fledged bank that offers services to individuals and corporate clients.

Information about the activities of Zenit Bank on the official website.

The main office is located at: 129110, Moscow, per. Bath with number 9, and the website is https://www.zenit.ru/. Phone number for free calls or + 7.

Mortgage conditions

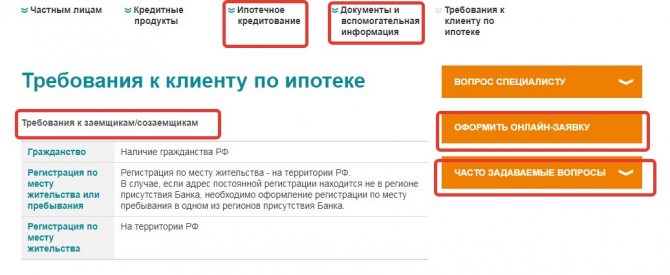

A client who has Russian citizenship, a positive credit history and permanent registration in the Russian Federation . The loan agreement must be drawn up in the region where Zenit Bank provides services.

In addition to these conditions, the borrower must also have an official job, and the payment for the future loan, according to the bank’s calculations, should not exceed 40% of income.

The Zenit Bank website contains detailed information about the terms of mortgage lending.

Mortgage lending has its own conditions, which depend on the specific case:

- Duration: 3-30 years .

- First payment: 10-30 %.

- Rate up to 19% .

- Amount: no more than 14 million rubles .

Zenit Bank has several programs, which were developed jointly with partner companies. In them, the interest rate starts at 12.6% , and the loan amount is determined based on the region where the property is located. The loan term depends on the size of the down payment, but in most cases does not exceed 25 years .

Zenit Bank offers to take advantage of special mortgage conditions.

Customer reviews about Zenit Bank

Those citizens who took out a mortgage from Zenit Bank note the favorable terms of mortgage lending, a large list of offers, favorable conditions for concluding a transaction, and the possibility of refinancing the mortgage.

A separate category of borrowers are military personnel, whose number at the bank is constantly increasing. The military note that at Zenit Bank they are given the opportunity to choose a mortgage program specifically for the military.

This bank is also suitable for young families with two or more children under the terms of mortgage programs, since it allows them to use maternity capital as a down payment.

But it is impossible to say that the bank has only gratitude. There are also dissatisfied clients who waited a long time for their application to be approved, who were not properly advised, took a long time to transfer money, etc.

Every bank, including Zenit, has both satisfied and dissatisfied customers . Here you need to proceed from individual characteristics and preferences.

Before going to the bank, it is advisable to familiarize yourself with the lending programs on the bank’s website and read the conditions for obtaining a mortgage.

Commercial bank Zenit can compete well with large banks such as Sberbank or Gazprombank. It offers clients a variety of mortgage lending programs.

The bank has developed 5 mortgage products only for the military . Every year the bank tries to reduce the mortgage rate, so those who wish can use another service - mortgage refinancing to reduce the financial burden and interest on the mortgage.

For convenience, the bank offers clients a map of new buildings in which mortgages from Zenit Bank are available. The management of this financial structure is doing everything possible to attract clients, expand the borrower base, and gain the status of a serious and justified bank.

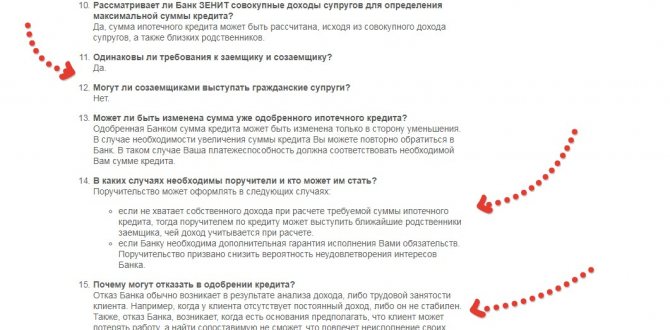

Requirements for the borrower

Co-borrowers and borrowers who wish to receive a positive response to obtaining a loan from Zenit Bank must meet the established conditions.

Zenit Bank imposes strict and comprehensive requirements on borrowers.

The indicated indicators cannot be changed for an individual client , so if you do not meet them, then you should not try your luck in this bank.

| Current requirements | Restrictions |

| Age for male borrowers | From 22 years old |

| Up to 60 years old | |

| Age for women | No more than 55 years old |

| Official work activity | From two years |

| The length of service at this place of work from which you provide a certificate for the bank | More than six months |

| Citizenship by passport | Russian |

| Registration | In all localities of federal significance |

Maximum amount for a military mortgage at Zenit Bank

The borrowing limit for the military loan program depends on the product selected. Thus, for a loan for one military person, the amount cannot exceed 3.57 million rubles. If both spouses serving in the Russian army are borrowers at the same time, then the loan size will be limited to 7.14 million rubles.

Additionally, at Zenit Bank, clients are given the opportunity to increase the maximum amount to 3 million rubles for programs for military personnel and up to 6 million rubles for spouses. Such an increase is possible due to the difference between the amount of the monthly payment and the amount of payment due to a targeted housing loan (allocated by the state), which the serviceman repays independently from his own savings.

There are no differences in the amount for the secondary and primary real estate markets.

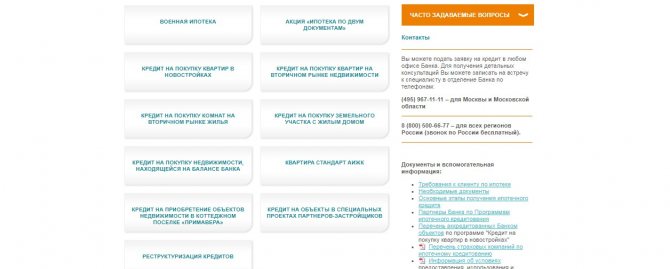

Current mortgage programs of Zenit Bank

The official website provides a complete list of mortgage programs of this bank, which are provided for both categories of the real estate market.

The borrower can choose the mortgage option that suits him best.

The amount goes to the borrower in rubles and for a period of no more than 30 years at a rate of 10 and a half percent.

Each mortgage has separate terms, terms and rates.

| Name | Target | Bid, % | Loan amount, rub. | Peculiarities |

| Military mortgage | Secondary and primary market | 10.5 | 300 thousand – 2,350,000 | Small bet, requires collateral of valuable property |

| Mortgage loan agreement for a new building | For an apartment, a house with a plot | 12,6-15,5 | 270 thousand – 14 million | Borrower's age is no more than 60 years, insurance and collateral are required |

| Purchasing a plot with a residential building | Not a new building | 13,1-15 | 270 thousand – 14 million | Large penalties for late payments |

| Buying an apartment in Morton houses | New building type apartment | 12,6-15,5 | 540 thousand – 14 million | A surety bond is required, as well as a deposit. |

| Buying an apartment in SU 155 | Apartment of any size, primary type | 12,5-14,5 | 300 thousand – 8 million | You need to take out insurance |

| Buying rooms on the residential market | Living room | 15,6-17,5 | 270 thousand – 14 million | Big bet, insurance required |

| Purchasing real estate in the cottage town “Reserved Forest” | Plot of land, house with plot | 12,7-14,6 | 270 thousand – 14 million | No work experience required, requires collateral of liquid assets |

| Buying an apartment in the Korenevsky Fort residential complex | New flat | 12,6-15,5 | 540 thousand – 14 million | Requires collateral or surety |

| Buying an apartment in PIK houses | Apartment in the category of new buildings | 12,6-15,5 | 270 thousand – 14 million | Need a guarantor and insurance |

Military mortgage

This mortgage is being implemented in Zenit Bank according to draft law No. 117-FZ .

Acquired housing that meets the bank's requirements can be issued by a borrower who, in addition to having Russian citizenship, must also have permanent registration in the country.

The borrower's creditworthiness must not be past due so that the bank can freely provide its services.

Actions of a military personnel to obtain a mortgage loan.

The loan program has the following advantages:

- Does not require your own funds for a down payment.

- The application is considered if two documents are available .

- You can use maternity capital .

- Effectively solves the housing problem of military personnel .

- Does not require guarantors for the loan.

- You can also repay the loan through savings.

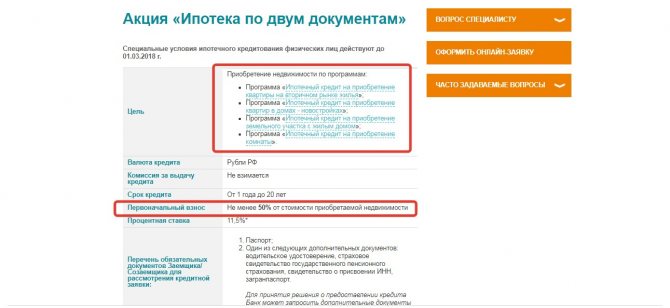

Mortgage under two documents

Special conditions apply for a limited period until 03/01/2018 for the following programs:

- For registration in new buildings .

- For apartments built several decades ago .

- For refurbishment of rooms with amenities.

- To purchase land with a built house.

If you have saved up more than 50 percent of the total cost of housing, you can use a special program.

There is no commission fee for issuing a mortgage on two documents at Zenit Bank, which is also an important nuance.

But if you cannot make a down payment of 50% of the entire price of the property, then there is no point in taking out this loan.

Mortgages are issued for a period from one year to 20 years . The interest rate is 11.5% (if there is additional security with insurance).

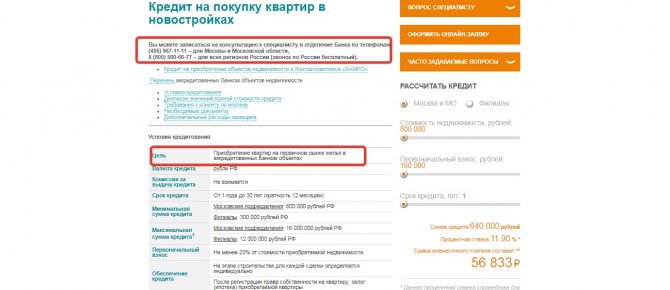

Loan for the purchase of apartments in new buildings

In Russian rubles, Zenit Bank issues a loan for the purchase of newly built apartments, which applies only to verified elements of real estate.

The Zenit Bank website contains the full terms and conditions of a loan for the purchase of a home.

There is no commission fee for issuing a loan by the bank, despite the fact that units are offered on the primary market. The minimum amount for issuing a mortgage is 300 thousand rubles (for branches of the Russian Federation), 600 thousand rubles (for Moscow branches).

If the borrower wants to purchase real estate under this program, he must prepare a contribution of 20%.

Loan collateral for each agreement is determined separately, and registration of ownership is carried out on the security of the purchased property.

When applying for a mortgage, pay attention to loan insurance.

Mortgage repayment at Zenit Bank takes place according to the scheduled payment, which is divided monthly in equal amounts. There is no fee for early repayment , and early repayment in installments can be made on the date of the next payment.

The application is considered within 5 working days with a percentage of 11.9-12.65%.

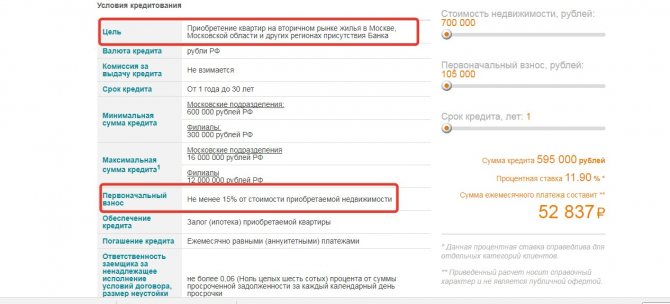

Loan for the purchase of apartments on the secondary real estate market

Mortgages are provided ( not in the category of new buildings ) by Zenit Bank in the MSK region and in other regions where there are branches. Loan repayment period: up to 30 years .

At Zenit Bank you can get a mortgage not only for housing in a new building, but also on the secondary market.

A down payment is required, which is at least 15% of the total cost of the selected property .

The loan is secured by collateral, and insurance is issued at the discretion of the borrower, but if it is refused, the interest rate increases by 1.5%.

We recommend watching the video:

The mortgage agreement is concluded with monthly payment in equal statements, the overdue for which for each day is charged from 0.06% of the debt.

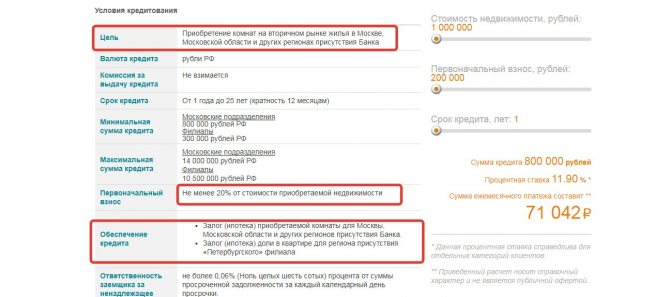

Loan for the purchase of rooms on the secondary housing market

Zenit Bank offers borrowers to draw up a loan agreement for the purchase of a living room with a starting amount of 300 thousand .

You can take out a mortgage not only for an apartment, but also for a room.

In addition to the deposit, you will also need to pay 20% of the value of the property on the secondary market. You can repay the loan in a convenient way that does not contradict banking rules.

Annual interest rate: 11.9 – 12.65% (may increase if you refuse insurance).

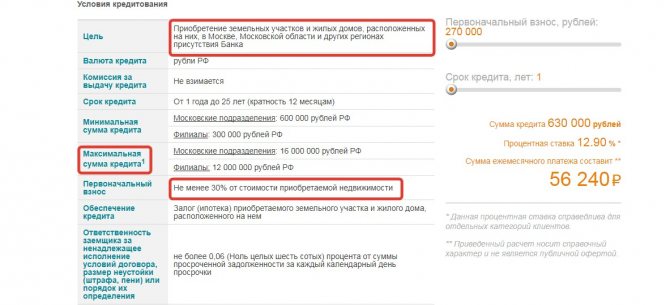

Loan for the purchase of land with a residential building

This type of loan agreement is valid for the purchase of residential properties in the MSK region and in other areas where Zenit Bank has offices.

Requirements for a borrower for a loan to purchase a plot with a house are indicated on the Zenit Bank website.

The minimum amount starts from 300,000 rubles , and the loan term is a multiple of 12 months ( from a year and not more than 25 years ). The contribution must be made from 30% followed by monthly loan payments.

The percentages vary between 12.9-13.65% (set individually depending on the income of the applicant).

Loan for the purchase of real estate on the Bank’s balance sheet

Borrowers can borrow everything that is on the balance sheet of Zenit Bank if they wish.

The following objects are considered:

- A plot of land.

- A room that is ready to move in.

- House with plot.

- Apartment.

In this case, the interest rates are set to minimum - from 10.5% per annum . Loan term: minimum (1 year), maximum (30 years). The client can pay for an amount from 500 thousand rubles to 30 million rubles .

Borrowers are not charged a fee for early repayment, but the main thing is to pay it on time.

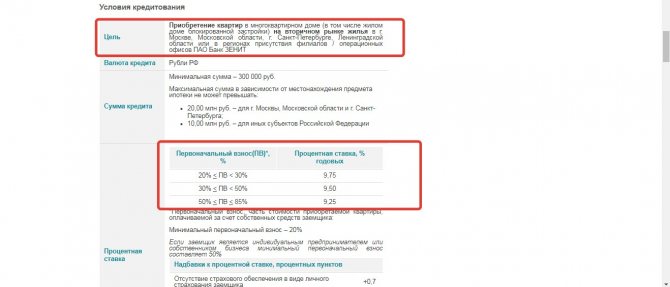

Apartment Standard AHML

This loan applies to apartments purchased in an apartment building that are put up for sale on the secondary market.

It is issued in Russian rubles with a minimum amount of 300,000 rubles . Initial contribution from 20%. Depending on the location, the mortgage amount cannot exceed 10 million rubles . In the absence of insurance coverage, 0.7% is added to the basic interest rate.

Conditions for mortgage lending at Zenit Bank for the purchase of housing in an apartment building.

on the subject of the mortgage :

- Must be connected to electrical power and have proper bathroom facilities.

- Located on the territory of the Russian Federation.

- Comply with BTI projects.

- Connected to heating system.

- Not burdened with the rights of third parties.

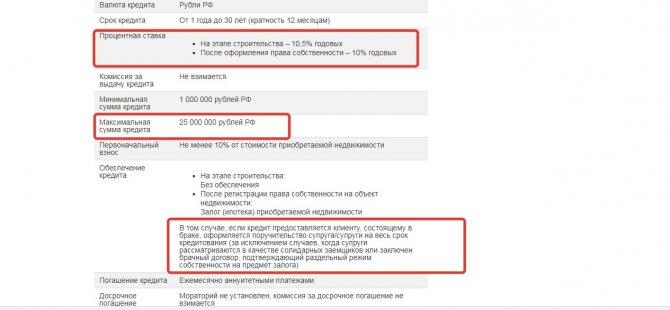

Loan for the purchase of real estate in a cottage village

In the Primavera cottage zone you can purchase townhouses, residential buildings, and plots of land under a loan agreement from Zenit Bank. The paperwork-based transaction for the purchase of real estate is carried out.

If the loan is taken out at the construction stage, the rate will be 10.5%, and if you register your own property - 10%.

Zenit Bank issues a mortgage for the purchase of housing and land in the Primavera cottage village

The contribution must be at least 10%, taking into account that the minimum loan amount starts from 1,000,000 rubles. The loan application is considered within 10 days after the agreement is concluded and signed. The borrower must be registered at the place of residence and have Russian citizenship - the same applies to co-borrowers.

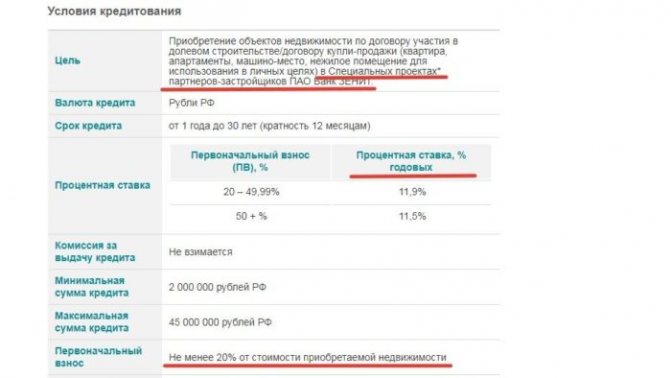

Loan for objects in Special projects of partner developers

You can purchase real estate in the near future on credit from Zenit Bank using a form for participation in partial construction or in special partner programs .

In these partner companies of Zenit Bank you can purchase housing on special terms.

The mortgage is issued by the bank in rubles for no more than 30 years (a period of multiples of 12 months is selected). The minimum loan amount starts at 2 million rubles , and the down payment must be at least 20% of the total cost.

Securing the loan is accompanied by collateral, as well as a guarantee both at the construction stage and when considering other situations.

Loan restructuring

Zenit Bank also offers its clients the opportunity to restructure loans, which involves changing the terms of a certain part of the agreement.

To use the service, you need to contact the financial institution in advance and fill out a corresponding application.

Useful video:

There are several restructuring options:

- Help for certain categories of borrowers who find themselves in difficult financial situations.

- Request for deferment of principal for 6-12 months.

- Review of the loan term.

- Deferment of interest repayment.

- Changing the currency or loan rate using the drop-down ruler.

Requirements for a refinanced loan

In order not to be refused by the bank, you must comply with the requirements. Loans taken from third-party organizations for the purchase of real estate located in the areas where branches are present are subject to refinancing. Loans are issued only in ruble equivalent. Current delays in obligations are unacceptable, as well as demands from the primary creditor for full early repayment of the debt. Refinancing is carried out after registration of property rights. Property insurance is mandatory, other types are optional.

The procedure for obtaining a mortgage at Zenit Bank

Having prepared all the necessary documents, the client can submit an application for opening a mortgage at Zenit Bank.

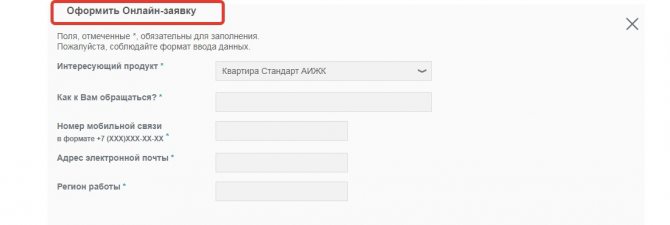

The decision on the part of the financial institution is made within 5 days (in certain cases, up to 10 days are considered). Borrowers can also complete a loan agreement through the bank’s official page by filling out an electronic form.

Submitting an application for a mortgage loan on the bank's website will take very little time.

But before submitting an application, you need to decide what type of real estate you want to arrange in installments at Zenit Bank. You can make a decision together with a consultant or on your own.

Interest rates at Zenit Bank

For a more specific consideration of the conditions, it is worth familiarizing yourself with the following table:

| Program | Interest rate |

| Mortgage for a new building | 9,4 |

| Mortgage for secondary housing | 9,4 |

| Family mortgage at Zenit Bank | 6 |

| Refinancing | 9,5 |

| Military mortgage | 9,4–12,5 |

| Mortgage for a room | 9,4 |

| Mortgage on a house with land | 9,4 |

| Mortgage secured by real estate | 10–18 |

| Non-residential premises | 9,4 |

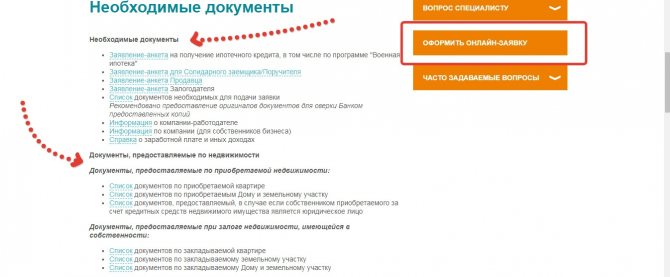

List of required documents

To apply for a mortgage loan, you need to provide several important documents to the bank. Their list may vary depending on the specific case. Zenit Bank requires documents due to their importance, dividing them into mandatory and additional.

Mandatory documents are:

- Those that confirm the marital status of the borrower.

- Application for receiving credit money.

- A copy of the passport with all pages.

- Certificate of income form.

- Copy of work book.

List of documents required to obtain a mortgage loan.

Additional documents that may be required to be presented:

- Entrepreneur registration form.

- A copy of the declaration.

- Report on financial results of business activities.

- Extract from current accounts for past reporting periods.

Customer Reviews

Masha : “I want to share my impressions when applying for a loan at Zenit Bank. My husband and I took out a mortgage for a new building in the Korenevsky Fort residential complex. As it turned out, this bank provides separate conditions and a program specifically for these apartments. The transaction took place successfully and quickly, and the interest rate was set at a minimum of -12.6%.

Peter: “We needed to get a loan to buy a house with a plot on the secondary market. I was immediately confused by the offers of Zenit Bank, so I contacted their office personally. All difficult issues were resolved immediately. They selected the optimal conditions and percentage for me. I was pleased. I pay the loan without delays.”

Leonid : “It is clear that Zenit Bank takes its work responsibly. When applying for a mortgage, I also signed an insurance contract (you never know what can happen in life). The calculator calculated the amount suitable for me for 10 years and a small rate. I am now paying off my loan without much difficulty. The attitude is conscientious and this cannot but rejoice.”

Mortgage lending programs at Zenit Bank in 2019

Zenit Bank offers clients favorable mortgages for the purchase of real estate. Each potential borrower can choose the optimal lending program that is available at a financial institution. Depending on the selected offer, the purpose of the loan, interest rate, amount and down payment change.

Mortgage for a new building

Zenit Bank offers clients a mortgage for the purchase of a finished apartment on favorable terms. As part of the program, the borrower will have to make an advance payment of 20% of the price of the property in the new building.

- A minimum interest rate of 10.45% per annum is provided.

- You can choose a comfortable monthly payment, as the loan is available for a period from 1 to 30 years.

- The loan amount is from 300 thousand to 15 million rubles (for Moscow from 500 thousand to 20 million).

Mortgage lending for secondary housing at Zenit Bank

Zenit Bank issues mortgages to clients to purchase a resale apartment. Borrowers can apply for credit programs if they have a down payment of 15% of the price of an apartment or other real estate (can be paid using maternity capital).

- You can purchase secondary housing for a period from 12 to 360 months.

- The minimum rate is set at 10.45% per year.

- Loan amount from 300 thousand to 15 million rubles.

Family mortgage at 6% in the financial institution Zenit

A mortgage for a new building at Zenit Bank can be issued under a program with government support on the following conditions:

- A loan of up to 8 million rubles is available.

- A down payment of 20% of the cost of the property is required.

- This loan can also be obtained for secondary housing.

- The loan term is up to 30 years.

A mortgage for secondary housing at Zenit Bank as part of family lending is available only if the borrower’s requirements are fully met.

Refinancing at Zenit Bank

Zenit Bank provides profitable mortgage refinancing for its clients. The borrower can apply to obtain a loan for a term of up to 30 years .

- The maximum loan size is 25 million rubles.

- Refinancing is provided at a rate of 10.45% per annum.

No down payment or loan origination fee is required. Refinancing is available only if there are more favorable conditions than under the current lending program.

Military mortgage

A profitable military mortgage is available to clients. As part of the program, the bank provides a loan for the purchase of an apartment in the amount of up to 2.8 million rubles. The lender calculates the interest rate individually.

- The minimum value is set at 10.5% per year.

- An initial payment of at least 20% of the price of an apartment, room, house or other real estate is required.

- The program is provided for both secondary housing and new buildings for a period of 1 year.

- At the time of loan repayment, the borrower must not be older than 45 years.

Mortgage for a room

Clients can apply to Zenit Bank to receive a loan to purchase a room. A loan is available for processing under the following conditions:

- interest rate from 10.45% per year;

- loan term from 12 to 360 months;

- an initial payment of 15% is required;

- the loan is provided in an amount of up to 20 million rubles in Moscow (up to 15 million in the rest of Russia).

Bank mortgages are issued for properties located in the same area as the lender's operating branch.

Mortgage on a house with land

Bank clients can obtain a mortgage for the purchase of a land plot and residential properties located on it.

- An advance payment of 30% of the property value is required.

- You can get a loan at a minimum rate of 11.45% per year.

- The lender provides up to 20 million rubles for a period from 1 year to 30 years.

Mortgage secured by real estate

If necessary, a room, apartment in a new building or other property can be used as collateral when applying for a loan.

- The minimum interest rate is set at 13.5% per year.

- The bank provides up to 20 million rubles.

- The funds received can be returned within a period of time from 12 to 180 months.

- There is no down payment or advance fee required.

Non-residential premises

If necessary, you can obtain a loan from a financial institution to purchase commercial real estate or other non-residential property in a new building. To register, you will need to make an initial payment, which will cover more than 30% of the cost of the property.

- The loan is issued for a period of up to 10 years.

- You can qualify for a minimum interest rate of 10.5% per year.

- The loan amount cannot exceed 3 million rubles.

Important! Refinancing or another program implies the selection of individual conditions for the client, depending on his solvency and reliability.