Thanks to the benefits of a mortgage, many families have purchased new homes. The bank interest rate decreases annually and loans for large amounts become less profitable. It is possible to transfer loan obligations to another bank and reduce the amount of payments. Refinancing mortgages from other banks with Raiffeisenbank turns out to be a convenient solution that allows you to reduce your debt burden. Thousands of Russians have already taken advantage of this offer.

What is refinancing

Many banks provide services for the transfer of loan obligations. In fact, the borrower receives a new loan equal to the balance of the loan debt, pays off the original obligation and begins working with another financial institution. When deciding to refinance, you need to calculate the costs of applying for a new loan, fees, preparing an appraisal report and insurance and compare them with the benefits of lowering the interest rate.

Raiffeisenbank specialists believe that a financial transaction will be profitable when the interest on the new loan is more than 1% less than on the previous one.

Read in detail:

Mortgage refinancing: in 2020. Interest rates of different banks; Requirements for the borrower; Real estate requirements; and other nuances.

Calculate your mortgage at Raiffeisenbank online

The calculator is a convenient online tool that allows you to choose the most favorable conditions for refinancing. To obtain information, the borrower just needs to enter the following parameters:

- balance of loan debt;

- remaining loan term;

- interest rate.

The client can leave the payment the same. In this case, the overpayment will be reduced by reducing the loan term. If you have financial difficulties, you can reduce the amount of the regular payment by extending the repayment period.

To calculate regular payments at Raiffeisenbank, use a convenient online loan calculator: Calculate...

Advantages of refinancing at Raiffeisenbank

Among the advantages of refinancing at Raiffeisenbank:

- To apply for a mortgage for refinancing, the borrower only needs a passport - an extract from the Pension Fund can be obtained electronically;

- You can refinance not only your mortgage, but also other loan obligations;

- the consent of the previous creditor is not required;

- the loan amount can be increased - additional money for personal purposes at the mortgage rate;

- high level of service;

- You can easily manage your payments through the Raiffeisen Online system.

All this encourages you to reduce your debt level and use the services of a new financial partner. The Raiffeisenbank online mortgage refinancing calculator for individuals will allow you to evaluate the attractiveness of the offer.

Required documents and certificates

When refinancing a mortgage loan at Raiffeisenbank, the usual requirements apply for individuals. The package of documents consists of two parts: one for the client (plus possible co-borrowers), the other for the collateral (real estate).

The full list of documents includes:

- general civil passport (for military personnel - service identification card);

- application form;

- SNILS certificate;

- marriage (divorce) certificate;

- birth certificates of the borrower's children;

- confirmation of income with a certificate on a bank form, 2-NDFL or other documents (lease agreement for rental properties, tax return for entrepreneurs, etc.);

- confirmation of work activity (work book, GPD);

- documents for the refinanced loan (agreement, repayment schedule, certificate of remaining debt, special account number, information about arrears).

All documents are provided in the form of certified copies or on letterheads of banks and enterprises.

Documents for the collateral property constitute the second package. It includes:

- main title document;

- certificate of assignment of cadastral number (for a plot of land);

- technical passport with unexpired validity;

- evaluation report;

- certificate of registration of persons in the living space or its absence.

For new buildings this package can be expanded. From the development company, Raiffeisenbank usually requires information about the economic activities of the enterprise in the form of accounting and financial statements, registration certificate of a business entity, investment plans, etc.

Refinancing of unfinished and uncommissioned objects is considered individually due to the borrower’s lack of a title document. In return, a certificate of share participation may be requested.

Refinancing conditions

Raiffeisenbank offers three refinancing options:

- standard refinancing of mortgages from other banks at a rate of 7.99%;

- refinancing of mortgages + consumer loans (complex of loan products) at a rate of 9.99%;

- refinancing under the Family Mortgage program at a rate of 4.99% - for any clients (our own and other banks).

Standard mortgage refinancing at 7.99%

Standard conditions for refinancing at Raiffeisenbank for the current period are as follows:

| Maximum amount | 26 million rubles. |

| Term | 1-30 years |

| Minimum interest rate (for salaried and premium clients) | 7.99% per annum |

| Standard rate | 8,19% |

You can use mortgage refinancing to refinance a third-party bank against the security of an apartment, townhouse, or apartment under construction. It is not possible to refinance a house under this program.

Refinancing several loans at Raiffeisenbank at 9.99%

Raiffeisenbank offers refinancing of several loans at once in addition to the mortgage. This is convenient - you can combine several loans into one and reduce the overall overpayment.

| Maximum amount | 9 million rubles and no more than 70% of the price of the mortgaged apartment |

| Term | 1-20 years |

| Minimum interest rate | 9.99% per annum |

You can refinance at Raiffeisenbank:

- mortgage;

- car loans;

- consumer loans;

- credit card limit.

At the same time, there should be no more than 2 mortgage loans, and no more than 5 consumer loans. The presence of at least one mortgage in the complex is mandatory, that is, it will not be possible to refinance only consumer loans.

Refinancing of Raiffeisenbank for a family mortgage at 4.99%

Those borrowers who had a second or subsequent child between the beginning of 2020 and the end of 2022 can reduce their mortgage rate to 4.99%. The opportunity is available both to clients of other banks and to borrowers of Raiffeisenbank itself. At the same time, repeated refinancing is also not prohibited.

| Maximum amount | 12 million rubles. |

| Term | 1-30 years |

| Minimum interest rate | 4.99% per annum |

Raiffeisenbank will approve refinancing for the following purposes:

- acquisition of an apartment under construction from a legal entity (except for an investment fund, including its management company) under a DDU/assignment;

- purchase of an apartment/townhouse from a legal entity - the first owner (except for an investment fund, including its management company) under the DCT.

An apartment under construction must be located only in a new building accredited by Raiffeisenbank.

Read in detail:

Conditions for obtaining a Family mortgage: in 2020. Interest rates of different banks; Requirements for borrowers; Real estate requirements; and other nuances.

Convenient and cost-effective moments for the client in the Raiffeisenbank refinancing program

These factors include the bank’s loyal attitude towards its clients. A mortgage is a classic type of long-term lending, in which even 0.5% of the financing amount for 10.15 years results in a significant overpayment for the client, reaching hundreds of thousands of rubles over this period. Therefore, the bank tries to create the most comfortable and cost-effective conditions for providing mortgage loans for the borrower.

The bank does not consider it obligatory for the borrower to make contributions to non-state pension funds. Raiffeisenbank management does not require the borrower to issue a bank credit card, withholding a fee for opening the card, and paying various commissions.

For salary clients of a bank with a positive credit history, the conditions for issuing money for a mortgage may include various benefits and bonuses. The most significant of these benefits is considered to be lending to the client at a discount rate of less than 10.5%, established for borrowers who contact the bank to cover their debt obligations in other financial institutions. You can be sure that by contacting Raiffeisenbank, mortgage rates in 2020 are among the TOP 3 most profitable options, successfully competing with Sberbank’s offers. This fact is confirmed by information on the Internet from the Raiffeisenbank section, mortgage reviews, here is the most rational way to solve the housing problem in the economic realities of today.

Transactions in the residential real estate sector are quite a complex issue from a legal point of view for the vast majority of ordinary citizens. Therefore, the entire range of consulting services at the bank is provided to the borrower free of charge, with the entire package of turnkey documents completed. All a potential client should take care of to obtain a mortgage from Raiffeisenbank is to obtain a statement of accounts payable from the previous bank.

An effective economic consultant for people who have applied to the Raiffeisenbank mortgage calculator. This service option on the banking website will allow you to instantly find out the amount of payment for the loan taken, and the amount of monthly payments required to pay off the borrower’s accounts payable.

Mortgage rate nuances

Not all borrowers know that the minimum interest rate is provided only to those clients who have used comprehensive mortgage insurance services. The term of the new mortgage can be any, within the limits, it is not related to the one for which the original one was provided.

An important point is that for the period before the registration of the pledge in favor of Raiffeisenbank, the rate will increase by 2%. This is a common practice, such rules exist in all banks. To reduce the overpayment on your mortgage, you need to promptly register all documents with the MFC.

Based on the fact that the discount rate of the Bank of Russia, on which credit market participants rely, is constantly decreasing, we can expect that the interest rate for refinancing at Raiffeisenbank will also decrease. There are also cases when the interest rate may change within the framework of an already concluded agreement. The loan agreement may indicate that the interest rate will be increased if the borrower does not fulfill current obligations.

But due to the current economic situation, the deadlines for fulfilling monthly obligations may be postponed, this is indicated in the bank’s public offer. But the deferment is not provided automatically; the client will be required to indicate his desire to use it through any convenient channel of communication with the credit institution.

Raiffeisenbank requirements for mortgage refinancing

A number of criteria will apply to potential borrowers when considering a refinancing application:

- over 21 years of age and under 65 years of age at the time of repayment of the mortgage;

- any citizenship, but residence and place of work - only in Russia;

- minimum work experience – six months in the current position and 1 year in total;

- Individual entrepreneurs, business owners – the activity has been carried out for 3 years;

- for notaries and lawyers, refinancing is approved if private practice continues for more than 1 year;

- It is necessary to have a work and mobile phone;

- minimum income from 15-20 thousand rubles depending on the region;

- no bad credit history and no more than 2 other existing loans.

There are also requirements for collateral. The apartment must be fully suitable for living, have a separate kitchen and bathroom. There should be no problems with sewerage, water, heat and gas supply. Regarding unauthorized redevelopments, the bank decides in each individual case whether it is permissible to refinance such housing.

Requirements for the location of collateral can be found here.

Is it permissible to refinance a loan taken from another bank?

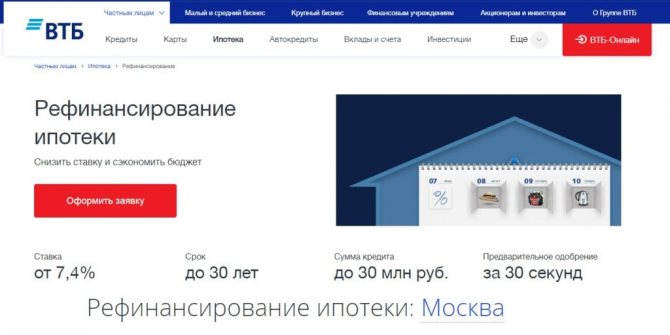

Raiffeisenbank is ready to refinance mortgage loans taken from other banks (Sberbank, VTB, Otkritie, Gazprombank, Rosselkhozbank, Delta-Credit, Svyaz-Bank, etc.). The main thing is that the borrower does not have overdue debts, fines, and meets other requirements of the new lender on the date of submitting the application form to Raiffeisenbank.

Terms and requirements

The requirements for borrowers from other banks are very strict.

The bank does not know anything about their payment history, and therefore will request a certificate about the status of the debt and statistics on late payments on the loan.

The collateral property will also need to be re-evaluated by an independent appraiser. Requirements for the borrower:

- age from 21 years;

- good credit history;

- age limit 60-65 years;

- your telephone number for communication;

- having a permanent income;

- the total experience is at least one year, and for business owners or individual entrepreneurs at least 3 years.

The collateral must be:

- located in settlements where the bank is represented or within 50 km from the Moscow Ring Road;

- in good condition (with normal plumbing equipment, windows and roof (the latter for apartments on the top floors), with the exception of apartments without interior decoration in newly constructed buildings and apartments where renovation work is underway.

The appraiser's report must be no older than six months. It can be ordered separately (on average you will have to spend from 2 to 8 thousand rubles, depending on the area of the property). The bank will check the age of the building in which the apartment is located, the absence of encumbrances (except for a mortgage), and the state of repairs (based on the appraiser’s report and the BTI registration certificate).

Important! Raiffeisenbank can not only refinance loans, but also combine many loans into one. This is a great way to save money for good borrowers.

How to refinance a mortgage

The problem is solved in 5 stages:

- Consultation with a specialist and preparation of documents for the application.

This will take one business day. You can contact any institution, you can create an application online. Consultation is also available by calling the toll-free Hotline or. - Bank decision making.

This takes from one working day. After receiving the package of documents, the bank assigns the applicant a personal credit manager, who can ask a number of clarifying questions. - Approval of the collateral object.

This process usually takes about three days. It is necessary to submit to the bank documents on the property that are current on the date of applying for a loan. Thus, the assessment report is valid for more than 6 months. It may be necessary to order a new package of technical documentation, for example, if there was a redevelopment and a new report. Your personal manager will tell you in detail about all the questions and nuances. - Preparation for the transaction.

The borrower gets acquainted with the package of contracts, and a time is set for signing them. He determines who will carry out the re-registration of the collateral - he himself or the bank’s partners. At this stage, notary expenses may be incurred for the preparation of powers of attorney or copies of documents. The amount of expenses depends on the structure of the transaction and the number of its participants. At this stage, you need to notify the previous lender of your intention to refinance the loan and request from him documents that will help remove the previous encumbrance from the property. - Deal.

It takes 1 day. The borrower or co-borrowers sign documents, after which the money is sent to the previous creditor to pay off the debt. At this stage, the following expenses arise - state duty, payment for registrar services, insurance premium.

Re-registration of collateral with Raiffeisenbank

After the loan has been received and refinancing has taken place, the borrower will be required to perform a number of other actions:

- register a pledge of real estate, and, if necessary, register a pledge of claims;

- if funds were raised for the construction of a house or for the purchase of an apartment in a new building, register a pledge after putting the object into operation;

- choose a loan repayment method.

It should be taken into account that it is possible to repay the loan early or use maternity capital funds to pay off obligations to refinance it with Raiffeisenbank. It is also allowed to direct subsidies allocated to improve housing conditions for young families or military personnel for these purposes.

For the time until the collateral is registered with Raiffeisenbank, the rate will be increased by 2%.

Pros and cons of refinancing a mortgage

Refinancing a mortgage in itself implies that the borrower sees more favorable conditions for himself than those on which he took out a loan earlier.

If we analyze Raiffeisenbank, we can note the following advantages and disadvantages:

| Advantages | Flaws |

| Fast application review. | The need to again collect a complete package of documents for the borrower, real estate and guarantors. |

| Possibility of communicating with the manager by phone. | Additional costs for appraisal, notary and transaction registration. |

| High percentage of approved applications. | Not all lenders are willing to “let go” of the borrower right away, so some of them require permission, and early repayment may have a high penalty rate. |

| Help at all stages. | — |

| More favorable conditions than those offered by other banks. | — |

| Reducing monthly payments and possibly increasing the mortgage term. | — |

| Possibility to change foreign currency to national currency. | — |

Mortgage insurance

A number of points related to mortgage refinancing need to be taken into account. If the borrower refuses the comprehensive mortgage insurance service and signs only a mortgage insurance agreement, which insures the risk of loss or damage to the property, the bank will offer him the following conditions:

- the borrower or co-borrower is not yet 45 years old - the interest rate will increase by one percentage point;

- if he is older and the risk of illness or disability is more likely, he will have to pay 3.2% more.

Comprehensive insurance includes, in addition to the risks of property loss, risks that threaten the life or health of the client. The client has the right to change the insurance company, choosing any other one with more favorable conditions instead of the one initially offered by the bank. All that is required is that it be included in the list recommended by Raiffeisenbank.

Insurance under the previous mortgage agreement will not work; you will have to take out a new one.