Features of insurance in Sberbank

The structure of the Sberbank financial holding company includes two insurance companies that are subsidiaries of the parent credit organization - Sberbank Insurance and Sberbank Life Insurance. Obviously, these are the companies that are recommended to clients of the country's largest financial institution for obtaining insurance in the first place.

In addition, the banking organization has accredited several companies for each type of insurance, whose policies can also be accepted as documents when processing various bank loan products. A complete list of them is given on the following pages of the site:

- For companies insuring the life and health of Sberbank clients – sberbank.ru

- For companies providing property insurance of mortgage collateral - sberbank.ru

At the beginning of 2020, the first list contains 15, and the second list contains 18 insurance companies.

This number includes, in addition to the subsidiaries of Sberbank, the largest participants in the domestic insurance market, included in the top 10 of almost all ratings, for example, SOGAZ, VSK, AlfaStrakhovanie, RESO-Garantiya and other companies.

What does the bank offer?

A separate section is dedicated to insurance services on the official website of Sberbank, located on sberbank.ru. Of course, own Internet portals have been developed for each of the subsidiaries of the insurance companies mentioned above.

They are located at the following addresses:

Sberbank insurance

– sberbankins.ru

Sberbank life insurance

— sberbank-insurance.ru

First Insurance Company specializes in property insurance, as well as other types of insurance not directly related to protecting the health and life of clients. The second insurance company, on the contrary, is engaged in issuing policies that provide for the occurrence of diseases and other negative consequences for the health and life of clients as an insured event.

Innovations for 2020

A special feature of Sberbank’s work in 2020 is the opportunity to receive comprehensive insurance services, the offer of which is posted directly on the official website of the parent bank at the address indicated above. The number of insurance programs offered by the country's largest bank is extremely large. Moreover, new products are constantly appearing, offered to clients both by Sberbank subsidiaries and other insurance companies accredited by the bank.

List of accredited bank companies

The list of accredited mortgage insurance companies of Absolut Bank includes 9 names. The list includes the following organizations:

- A subsidiary of a credit institution with the same name.

- Alfa Bank.

- SOGAZ.

- VSK.

- VTB.

- Rosgosstrakh.

- Ingosstrakh.

- Reso-Garant.

- Renaissance.

Naturally, the number of accredited mortgage insurance companies in Absolut Bank is negligible. And there is even an opinion that such artificial maintenance of a limited number of insurers violates the law. However, this does not in any way contradict the Government Decree and does not violate the law.

Important! Prices may vary between accredited organizations. Therefore, it makes sense to use online calculators on different sites and compare prices.

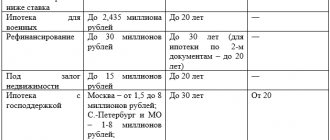

Cost of insurance

When calculating the cost of insurance, a large number of factors are taken into account, the main ones being the type of policy being issued and the object of insurance. For example, insuring the collateral for a mortgage costs the borrower approximately 0,3-0,4%

from the value of the property.

Prices for issuing a personal insurance policy vary widely and can range from 0.75% to 2.5%

of the insured amount, and for some types exceed the specified values.

Mortgage insurance at Sberbank

Sberbank has accredited 18 insurance companies to insure mortgage real estate, including a subsidiary of a financial organization called Sberbank Insurance. All of them comply with the bank’s requirements, which are set out on sberbank.ru

Conditions

Each organization independently determines the terms of the insurance offered to Sberbank clients. This is the essence of competition, when a mortgage borrower has the opportunity to choose a commercial offer that is more profitable for him. As a result, despite Sberbank’s active lobbying of the interests of its subsidiary insurance companies, not all clients prefer to work with them.

This is not surprising, given the fact that the number of accredited insurance companies includes almost all the leaders of the country's insurance market.

Review of accredited insurance companies

A complete list of insurance companies accredited by Sberbank is available on sberbank.ru. Despite the fact that it is compiled in alphabetical order, it is quite logical to mention the most serious participants in the list, which include:

- RESO-Garantiya

. It ranks 2nd in the rating of Russian insurance companies based on the results of 2020, second only to Sberbank Life Insurance. Last year, the company collected more than 89 billion rubles from clients in the form of insurance premiums. Mortgage insurance rates range from 0.16% to 0.68%; - VTB Insurance

. This insurance company occupies the next place in the ranking of the country's largest insurance companies. For mortgage borrowers, a preferential insurance program is offered, which provides for issuing a policy not for one year, as usual, but for 3 or 5 years at once;

- AlfaInsurance

. The insurance company is a member of one of the country's leading financial holdings, Alfa Group, and the largest private participant in the insurance market. It is in 4th place in terms of the volume of insurance premiums collected in 2020; - VSK

. It ranks 5th in the ranking of insurance companies. What stands out among competitors is the variety of products and types of insurance offered, including mortgage real estate.

Among the other insurance companies accredited by Sberbank, there are two more that are in the top 10, namely: Ingosstrakh and SOGAZ. As a result, clients of a financial institution are given the opportunity to choose the most profitable of several offers made by the leaders of the country’s insurance market.

Absolut Bank mortgage insurance

Buying a home becomes easier every year. Today, almost every citizen of the Russian Federation with a positive history and corresponding income has the right to purchase real estate. Another condition enshrined at the legislative level is the availability of a policy. Therefore, when completing a purchase and sale transaction, you can obtain mortgage insurance from Absolut Bank.

Necessity of registration

The main reason that forced the government to make this clause mandatory is the huge number of risks that the long term of such a loan carries. Therefore, the policy is designed to compensate for damage in emergency situations (accident, fire, natural disasters, burglary, etc.). In this case, it is very important to draw up a contract correctly so that it protects the interests of both parties.

The cost of this product depends on several factors:

- the year the building was built and the current condition of the housing;

- gender, age and place of work of the applicant;

- type of service selected.

In addition to mandatory insurance with Absolut Bank for a mortgage, consumers have the right to take out a comprehensive product, which includes protection of property rights, life and health. This option means that the company will pay off the debt if the owner loses his job or disability for one reason or another. This also applies to his death. In such a situation, the property will pass into the possession of the relatives according to the law of inheritance. Of course, this service is much more expensive, but if you are taking out a loan for a long period, you should consider all the risks and protect yourself.

Having made your choice, proceed to study the conditions. Absolut Bank has accredited mortgage insurance companies, among which you will have to choose the organization with the most advantageous offer. Consider everything from the total cost to the amount of commissions and whether there are deductibles. If you have any questions, visit the office and talk to the manager - he will tell you in detail about the incomprehensible nuances, and also make calculations for several options - this will make it easier for you to make a decision.

Search portal

On Banki.ru you will find reliable information about insurance products. Here you can find current offers with a detailed description of all conditions and criteria for obtaining. We regularly check and update our resource to provide visitors with the latest information, and the ability to submit an application online will make using the site much more convenient. Banki.ru is an independent financial supermarket with a multimillion-dollar audience throughout the country.

Life and health insurance

The list of companies that are accredited by Sberbank to insure various credit products, with the exception of mortgages, is given on sberbank.ru. It includes 15 insurance companies that meet the requirements of a credit organization formulated on sberbank.ru.

Conditions

The conditions for life and health insurance offered by different companies when applying for a loan from Sberbank may differ quite noticeably. This is also facilitated by the fact that the rate is tied to the insured amount, which also varies at the request of the client, in contrast to a mortgage, where the value of the property is clear and determined during the assessment. As a result, the price of insurance varies from 0.75% to 3-4% of the value of the insured amount and is determined individually for each loan product and client.

Insurance programs

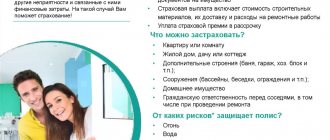

The following insurance programs are offered to Sberbank clients directly on the official website of the financial organization:

- Multipolis “No worries”

. A unique offer that includes almost all types of insurance; - Home protection

. Intended for mortgage loan recipients; - Protection of loved ones

. Provides guarantees to clients in the event of damage to the health of their family and friends; - Accident and illness insurance

. A popular type of life and health insurance. In demand due to the low level of tariffs and the large number of insurance cases included in the policy; - Travel insurance

. The eloquent name of the insurance product does not require additional explanation; - Insurance for Sberbank plastic card holders

. A relatively new insurance product that is popular in the market. This is due to the large number of credit and debit cards issued by the bank; - Savings and investment life insurance

. These types of insurance are offered to privileged categories of financial institution clients who also use Sberbank Premier.

Review of accredited insurance companies

Most of the companies described above as part of the list of organizations accredited by Sberbank for mortgage insurance are allowed by the credit institution to issue life, health and other types of policies. This number includes AlfaStrakhovanie, VSK, Ingosstrakh, RESO-Garantiya, SOGAZ, VTB Insurance. In addition, the following companies are accredited:

- Sberbank life insurance

. Based on the results of 2020, the subsidiary structure of the parent bank topped the rating of participants in the country’s insurance market. The company collected almost 32 billion rubles in insurance premiums over the year, which is noticeably more than all its competitors. A significant role in this was played by active lobbying of the interests of the insurance company by Sberbank, which has the largest client base in Russia; - Zetta Insurance

. The company closes the top 30 in the ranking in terms of the volume of insurance premiums collected in 2019. Among the main achievements of the organization is offering clients more than 9 dozen different insurance programs; - Liberty Insurance

. It is in 40th place among the largest participants in the Russian insurance market. It is part of the international insurance group of the same name, which provides the company with a reliable financial base and a stable position that distinguishes the organization from many Russian competitors;

- SO Surgutneftegaz

. Belongs to one of the largest oil enterprises in the country. As a result, it is one of the regional leaders in the insurance market of the Urals and Western Siberia, where the main production facilities of the parent organization are located. Like the main company, the Insurance Company is a client of Sberbank, which is the main reason for mutually beneficial cooperation; - Absolute Insurance

. It is included in the top 50 of the country's insurance market, ranking 48th in the 2019 ranking. The main feature of the insurance company registered in the capital is its active work with Sberbank clients, as well as participation in the credit organization’s loyalty program “Thank you from Sberbank.” As a result, serious benefits and discounts are provided for borrowers of the country's leading banking sector, which allows SK Absolut Insurance to significantly increase its own client base.

Life and health insurance for mortgage lending

Life insurance on a mortgage at Absolut Bank in a minimum amount is possible for the amount of debt + 10 percent. For example, if a bank client took out a loan for 2 million, then he must make a payment for 1,100,000 rubles.

Note! All co-borrowers who repay the loan participate in mortgage life insurance at Absolut Bank.

You can calculate mortgage life insurance online at Absolut Bank using a special calculator. You can take out a policy for disability or death resulting from an accident. In case of loss of ability to work, only disability groups 1 and 2 are taken into account. The cause of disability must be such serious diseases as pneumonia, oncology, heart attack, and so on. Or an accident can cause harm to health - a traffic accident, beating, and so on.

Note! Some companies exclude death due to illness from their policies. As a result, mortgage life insurance at Absolut Bank is calculated at a lower price. Unfortunately, the truth can only be revealed when the borrower dies.

What does accreditation of a company by Sberbank mean?

Sberbank is the undoubted leader in the country's banking sector. As an example, we can cite the following data: in terms of assets, it is almost 2.5 times ahead of VTB, which is in 2nd place in the ranking. The logical consequence of this situation is the presence of a huge customer base. It is not surprising that any insurance company would like to be among those accredited by Sberbank. However, doing this is far from easy even for large and well-known insurers.

For example, the recent leader of the country's insurance industry, Rosgosstrakh, lost its accreditation with Sberbank in the second half of 2020 due to violation of several requirements of the credit institution. This decision almost immediately affected the financial condition of the insurer, which had previously been the most stable. Moreover, at the end of 2020, Rosgosstrakh insurance company immediately dropped to 9 places in the ranking of the largest insurance companies, falling from 1st to 10th place. It is important to note that the outlook for 2020 for the insurer is also very unfavorable. The above example shows the importance of successful cooperation between an insurance company and Sberbank and the availability of the accreditation necessary for this.

"Sberbank Insurance" - Features of Life and Health Insurance

First of all, you need to pay attention to the fact that it is part of the group of the same name, which owns 100% of the shares of the insurer. The organization specializes in risk, savings and investment life insurance for its clients.

Over the past few years, the insurer has been steadily developing and growing. Direct evidence of this is the increase in insurance premiums by 83% in 2020 alone. Currently, more than 9 million Russians use the organization’s services. Rating agencies also evaluate the insurer’s work positively (the current rating by Expert RA is “ruAAA”).

Among the features of issuing a policy at Sberbank Life Insurance are:

- A wide variety of investment and savings programs.

- Dividing the client's funds into two parts, thanks to which the return of banknotes is guaranteed, regardless of market conditions.

- Possibility of obtaining tax deductions and other benefits.

- A large number of branches. Since products can be issued at any Sberbank office, the service is available in all regions of the country.

- The opportunity not only to earn money, but also to protect the financial situation of your family in the event of death (the money will be paid to the relatives of the insured person).

- Investment of funds invested by the client through international funds.

Sberbank guarantees a full return of invested funds. Moreover, depending on the behavior of the underlying asset, insurance programs in this area also provide an opportunity to earn extra money.