Mortgage lending is the issuance of a loan for a fairly long period. The average repayment period for a mortgage ranges from 10 to 30 years. In this case, the bank is at great risk, given the factor of uncertainty. No one can guarantee that the client’s solvency will remain the same in ten to twenty years and that he will not be fired from his job. The main goal of banking is to make a profit, but if a bank gives out mortgage loans left and right to everyone, it will quickly “burn out,” so it has to somehow insure itself. The best guarantee of debt repayment is a mortgage on an apartment under a Sberbank mortgage. If the client loses solvency, the bank acquires the right to put the collateral property up for auction and use the proceeds to compensate for its losses.

What is a mortgage on an apartment

An apartment mortgage is an official document, drawn up on a special form and in accordance with the established procedure, which temporarily, for the duration of the mortgage, transfers ownership of the borrower’s apartment to the bank as collateral. Thus, the mortgagor undertakes to repay the entire loan amount along with accrued interest.

From a legal point of view, a mortgage is regarded as a type of security, since the owner (in this case, the bank) has the right to sell the mortgaged property. Sberbank can also remortgage it. The mortgage loses its legal force on the day the last loan payment is made. Despite the fact that by issuing mortgages to clients, a financial organization not only receives a source of profit in the form of interest, but also a huge risk, therefore, in order to minimize its possible losses, the bank puts forward a mandatory condition - the provision of an apartment or other property as collateral, without which the issuance of such a large Long term credit is not possible.

What it is

In European countries, a mortgage on an apartment is an integral part of mortgage lending. In Russia, this document is not mandatory. However, in some cases, Sberbank requires the registration of such a mortgage when applying for a mortgage.

A mortgage note is a security registered security. The owner of such property receives the right to appropriate the property secured by the mortgage.

Simply put, the bank, if it has a mortgage, can confirm its claims to the collateral if the client is unable to pay his debt.

If we talk about the form of the document, then this is a security in which the main parameters of the collateral property are displayed and there is free space for transfer notes.

Why is a mortgage required for an apartment? When issuing a mortgage loan, the bank receives a profit in the form of interest. But the bank gives the borrower an impressive amount and, as a rule, for a fairly long period.

If the bank urgently needs money, it has the right to sell the mortgage to another bank or transfer it as collateral. In this case, the bank that received the mortgage becomes the mortgagee, and it is he who begins to receive interest on the loan.

Another option for using mortgages is the issue of issue-grade securities secured by such mortgages.

This allows you to raise funds from the open market for mortgage lending. The mortgage is valid until the borrower repays the loan received.

As for the bank’s right to dispose of mortgages, this is indisputable. The borrower cannot prevent the transfer of the mortgage in any way. By law, the bank is free to dispose of the document as it sees fit. But, in essence, nothing changes for the borrower.

Credit conditions remain the same. Only the recipient's details change. In some cases, nothing changes at all - the borrower pays the loan to the same bank, which itself sends the funds to their destination.

Once the mortgage loan is fully repaid, the mortgage is returned to the client. In this case, a mark is placed on the document indicating the date of full fulfillment of obligations by the borrower and the signature of the mortgagee.

Within three days, the borrower contacts the body executing state registration of rights to submit a mortgage note with a mark. On this basis, the mortgage record is canceled.

How to apply for a mortgage at Sberbank

Before starting to take out a mortgage, a Sberbank client must go through several stages to obtain a mortgage loan:

- Appear in person at a bank branch and apply for a mortgage.

- Wait until the application is reviewed and a decision is made on it.

- If the bank’s response is positive, the client will be given only 90 calendar days to find suitable housing (if the client does not invest in this period, he will have to re-write the application and receive Sberbank’s approval).

- Use the services of appraisers to calculate the market value of the home you plan to buy.

- Then sign a loan agreement with the bank.

- Draw up a purchase and sale agreement.

Having gone through all these stages, you can begin drawing up a mortgage. This scheme is valid only in cases where the borrower plans to buy an apartment with a mortgage on the secondary real estate market. When purchasing a new home from a developer, the procedure for obtaining a loan and mortgage is somewhat different from that described above. To secure a loan, the client has the right to pledge an apartment, house, cottage, land plot and other valuable property. The procedure for registering a collateral is a rather responsible task and requires extreme care and a thorough approach to the matter.

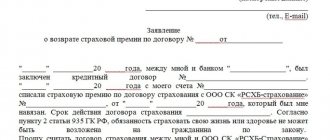

The following information is included in the document:

- Full name of the mortgagor (the person who takes out a mortgage loan and pledges his valuable property).

- Passport details of a citizen of the Russian Federation.

- Personal information about the client applying for a mortgage.

- If the apartment that is being pledged is owned by several people, then the mortgage note contains all the information about the other owners.

- Full information about the bank issuing the mortgage (mortgagee).

- Information about the mortgage agreement.

- The amount of the mortgage loan in local currency.

- Amount of monthly contributions.

- Interest rate.

- Information about the encumbrance.

- The balance of the loan at the time of registration of the mortgage (if part has already been paid).

- Information about property purchased with loan funds.

- Market (estimated) value of the collateral property.

- Data on registration of ownership of collateral property.

- Mortgage loan registration information.

- In case of transfer of the mortgage - information about the new mortgagee.

The property is secured as collateral while the mortgage contract is being drawn up. It is very important at this moment not to miss a single detail and to ensure that all the data in these two documents is true and does not contain controversial data.

Attention! A mortgage is an official document that is drawn up in two copies, one of which remains with the bank, and the second is transferred for storage to the State Register until the borrower pays the entire mortgage amount. Therefore, the mortgagor should make a copy of the document for himself.

After the mortgage is drawn up properly, it is subject to mandatory registration with the local territorial bodies of RosReestr.

Obtaining a duplicate mortgage note

According to the Mortgage Law, if a mortgage is lost, a duplicate must be issued. The text of the duplicate is drawn up by the mortgage bank; before signing, the borrower needs to make sure that this is a duplicate of the lost mortgage, and not a completely new document with different conditions. Initially, you should make copies of documents that are issued only to one of the parties in a single copy (a mortgage refers specifically to such documents). If the borrower does not have a copy of the original version of the mortgage, it will not be easy to verify the identity. Fr. must be present on the document signed by the borrower. After registering the mortgage, a copy of the mortgage remains at the registration chamber (the original is given to the bank), and employees must check that this copy matches the duplicate mortgage.

Sometimes the bank (usually in an oral conversation) tries to charge the borrower with the costs of processing its duplicate - if this is not specified in the loan agreement, you should not agree with such a requirement of the bank.

How long does it take to make a mortgage?

Many borrowers are interested in how long the mortgage process takes. Everything here is purely individual, since the duration of this procedure depends on many factors:

- If you take out a mortgage secured by an apartment that you buy with loan funds, then you will first have to draw up a sales contract and register your ownership, which also takes some time (usually a document confirming ownership rights is provided to the lender for registration of the mortgage in terms specified in the loan agreement);

- to register collateral, an expert assessment is also required to establish its market value (the duration of this procedure also depends on many factors);

- The process of filling out the form by the mortgagor takes a little time, about 30-60 minutes, if you don’t rush and carefully double-check all the data entered in the standard form.

Documents for a mortgage in Sberbank

Documents required to register a mortgage with Sberbank include:

- original extract from the Unified State Register;

- expert assessment with an established market value of the object;

- cadastral passport of a mortgaged apartment or other real estate;

- a document confirming the mortgagor's ownership of the pledged object.

Along with these documents to fill out the mortgage form, you need to have with you:

- mortgage loan agreement;

- passport of a citizen of the Russian Federation;

- for those who are married, you also need to provide official (notarized) consent of your spouse to transfer property as collateral;

- documents of individuals who are co-owners of the pledged property (if the house or apartment belongs to several persons).

Legislative framework of the Russian Federation

Forfeiture on a mortgage loan, unfortunately, is a completely ordinary event in the life of a borrower. A paper document may get lost, wandering between the bank, mortgage agent and Rosreestr. It may be lost in fires, floods or other natural disasters. Often, however, citizens themselves lose their mortgage, having received it in their hands after paying off the mortgage. Even if this suddenly happened, there is no reason to panic.

For both the lender and the borrower, the loss of a mortgage is a very unpleasant event. With the loss of a mortgage, a bank is deprived of a unique document confirming the right to pledge real estate as collateral for an issued loan. The borrower loses the opportunity to quickly remove the encumbrance from the purchased property: Rosreestr will require a mortgage note with a note about debt repayment. Before the loan is paid off. Until this point, the mortgage is always kept by the lender.

However, the loss of a mortgage does not entail changes in the terms of the loan or loss of collateral. A missing mortgage can always be restored. Although, this procedure may take some time, and therefore may cause inconvenience to the borrower, increasing the time frame for removing the encumbrance from the property. There are three possible scenarios.

In the first case, a duplicate mortgage note is drawn up and registered. Its text is drawn up by the mortgage bank. After signing by the borrower, the document is sent to Rosreestr. Department employees check the mortgage to see if it is identical to the original - they have a copy of the original document - and issue a new one marked “Duplicate”. Payment of expenses is usually carried out by the bank, unless otherwise provided in the loan agreement.

It is possible for the lender and the borrower to jointly submit an application to remove the encumbrance. In this case, the citizen and a representative, as a rule, of the bank’s legal service, personally draw up the necessary documents in Rosreestr. This option is the most effective as it requires less time and costs.

If it is impossible to obtain a duplicate for any reason, you will have to go to court. Rosreestr’s refusal to remove the encumbrance due to the loss of the mortgage will need to be appealed in the prescribed manner. The court will establish that the borrower has fulfilled all obligations under the loan. Based on a court decision, Rosreestr will be able to terminate the pledge.

The Law “On Mortgages (Pledge of Real Estate)” from July 1, 2020 allows the borrower to choose between a paper mortgage and the so-called undocumented one. Using an electronic mortgage will reduce the time and money costs for its issuance and storage. The turnover of mortgages, necessary for the development of the mortgage securities market, is simplified, and, of course, the possibility of losing this important document is completely eliminated.

Sample mortgage note for an apartment under Sberbank mortgage

So that the procedure for registering a pledge does not become a big surprise for you, it is advisable to familiarize yourself with the form and its contents in advance, so that you do not get lost when entering data. If you do not understand something, it is better to consult with an expert or a person who has repeatedly encountered filling out this official document. This could be one of the employees of Sberbank, who is actually engaged in mortgage lending to individuals with the preparation of the relevant documents.

A sample document can be obtained directly from Sberbank or downloaded from Internet resources. When downloading a form from third-party sites, you need to make sure that the version of the document is up-to-date so that it is not outdated. You can also see an example of a completed document.

Registration of a mortgage after delivery of the house

The signing of a loan agreement between Sberbank and the borrower occurs in parallel with the procedure for registering property rights to housing. Therefore, the bank will issue a loan no earlier than the state commission and the potential homeowner accept it.

The final touch in this case is the fact that the developer has signed the acceptance certificate for the constructed house. He must put the facility into operation after going through all the necessary official procedures. After this important document has been endorsed, the future owner of the apartment can safely begin collecting all the necessary documentation for state registration of property rights. Registration of a mortgage with Sberbank after the official commissioning of the house takes place on the basis of collected documents and state registration.

The state registration procedure can be carried out at the State Register or MFC. The future owner of a new building can provide a package of documents to one of the above authorities in person, or in one of the following ways:

- notary;

- through Sberbank (provided that the apartment is not purchased as shared ownership);

- when contacting the developer (if all documentation for apartments in the building is registered at the same time, which takes quite a lot of time).

If you decide to independently collect a package of documents for registration of a mortgage in Sberbank and subsequent registration in the State Register/MFC, then you will save a lot of time and money, since there will be no need to pay for the services of intermediaries (notary, bank). But when applying to the authorities in person, it is advisable to have a representative of the developer present during registration.

Attention! Each specific case has a lot of nuances that a Sberbank employee can clarify for you. Don’t be afraid to draw up a mortgage; bank managers will insure you or fill it out for you if you have all the necessary documents.

The procedure for registering a mortgage with Sberbank after the developer has delivered the house is similar to that carried out when purchasing an apartment on the secondary market.

How to get a mortgage from Sberbank after repaying the mortgage

What to do after paying off the debt? How to get a mortgage for an apartment or house using a mortgage from Sberbank? Initially, when drawing up a loan agreement, Sberbank undertakes to return the mortgage to the mortgagor. After the last payment has been made in favor of repaying the mortgage loan and the debt to the bank is completely closed, the procedure for removing the encumbrance occurs (that is, returning the mortgage on the apartment to the mortgagor), which implies the same algorithm of actions for all types of loans issued in Sberbank secured by real estate:

- During the first three days from the moment the client repays the debt in full, a bank employee must contact the borrower (if you changed your phone number while paying off the mortgage, then you should not wait for a call from the bank, it is better to call there yourself at the right time).

- The client needs to personally appear with documents (passport, mortgage agreement, copy of the mortgage, etc.) to the Sberbank branch where the loan was issued in order to pick up the document.

- Sberbank employees return the client’s mortgage with a note indicating full repayment of the mortgage, as well as other documents for removing the encumbrance.

- With this mortgage, the client must go to the State Register or MFC, where all encumbrances are removed from the mortgagor.

How to get a mortgage

A mortgage is an official document, and for this reason its execution is carried out in accordance with strict rules. Some banks additionally put forward their requirements. Sberbank draws up paper according to the following principles:

- The title “Mortgage” is located in the center of the line.

- Next, you need to enter the client’s personal data (full name). If the loan is issued to a legal entity, then you must provide the company details.

- The next step is to indicate information about the mortgagee - Sberbank details.

- The basis for registration of a mortgage is a mortgage agreement; for this reason, the valuable document must contain the main points of the real estate agreement. Next, you need to specify the terms of the loan, the amount of debt and interest rate, and the method of depositing funds into the debt account.

- A detailed description of the collateral property with the payment of its full value.

To register a mortgage, the client must provide Sberbank employees with a list of necessary documentation: passport, mortgage agreement, right to own real estate. In this case, the paper indicating ownership must be with the borrower, otherwise the collateral agreement is automatically issued to the seller - the last owner of the home.

It is also required to provide: passports of the co-owners of the property, if any, the consent of the spouse to hold the event (certified by a notary), the original extract from the Unified State Register, and the housing assessment report. If there is a child in the family, then permission from the guardianship authority will be required. Additionally, a report on the degree of wear and tear of the apartment may be required.

The terms of the mortgage come into force from the moment its number is entered into the Sberbank database. In addition, the assignment of a registration number must be completed within certain deadlines established by the government agency. Their duration should be determined during the preparation of the document.

The security may be printed on a printer or written by hand. Signatures must be original on each form.

Important! Carefully re-read all clauses of the mortgage. If a controversial issue arises, the terms of this document, and not the loan agreement, are taken into account to resolve it.

Before signing the paper, the client needs to check the borrower’s personal information (address, full name). At the end of the mortgage procedure, details are assigned. Once a document has been registered, it is prohibited to make any changes to it. The original of the executed mortgage is kept in the Sberbank branch. The client receives it in his hands only after full repayment of the debt to the financial institution.

Can a bank sell a mortgage?

The mortgage is the property of Sberbank, where it is stored until the borrower fully pays off the mortgage. During the period of ownership of the mortgage, the bank has the right to sell and remortgage it an unlimited number of times. Regardless of how many “hands” your mortgage goes through and who it ultimately ends up with, the terms of the agreement remain the same: the terms, interest rates, monthly payment amount, etc. do not change.

Important! In the event of the sale or collateral of your mortgage on an apartment, the bank is obliged to inform you about the implementation of the transaction and its details.

After full repayment of the loan and return of the mortgage, on the back of this document there must be an endorsed entry with a wet seal and the signature of an authorized representative of Sberbank stating that the obligations under the loan agreement have been fulfilled by both parties in full, and neither party has any claims against each other .

Why do you need a mortgage on a mortgaged property?

The main feature of a mortgage loan is that the lender takes as collateral the real estate purchased with borrowed funds. The mortgage serves as documentary evidence of the existence of this pledge.

For the lender, this paper acts as a guarantee of receiving back the funds issued to the client. If the mortgage agreement allows you to simply sell the property if the client fails to pay the loan, the mortgage gives the bank many more options:

- Use of the document in the creditor's circulation.

- The ability to partially assign the rights to claim a debt to another person.

- Possibility of selling debt to collectors or another bank.

- Exchange of debts with other creditors, etc.

As for the mortgage client, for him a mortgage on an apartment under a Sberbank mortgage can only be useful in terms of reducing the loan rate. Sber's new building lending program provides for a reduction in the rate by one point after the client prepares a mortgage and submits it to the mortgage department.