General concepts

Refinancing is a way of fulfilling debt obligations on favorable terms with a change in the identity of the borrower. This is the same loan, issued to repay the original one from another bank. The purpose of the loan does not matter (car loan, mortgage, etc.).

If there are several obligations, this is the only way to close all loans in exchange for one agreed upon on favorable terms. The procedure allows you to significantly reduce the annual interest and reduce monthly expenses.

Requirements for clients

A group of citizens meeting the following criteria can exercise the right to refinance a mortgage:

- Citizenship of the Russian Federation.

- The age limit is 21-70 years at the beginning of the procedure.

- Permanent registration (registration).

- Stability of monthly income with a value of at least 10 thousand Russian rubles.

- Work experience: total – at least one year, at the last place of employment – at least 3 months.

VTB puts forward its own requirements for the possibility of transferring a loan from another bank:

- the duration of loan payments is at least 3 months;

- no overdue payments or debts for the last six months;

- ruble currency;

Refinancing is allowed for the following types of loans:

Overdue credit is not transferable.

Requirements for the borrower

Basic requirements for the candidate if he is applying for a mortgage transfer to another bank:

- Having Russian citizenship.

- Registration is permanent or temporary. The Passport must have a registration stamp. If it is not there, then you must provide a registration document.

- Positive credit history.

- Age from 20 to 65 years.

- Work experience at last place was six months. Total work experience over the last 5-6 years from one year.

If this is the first job for a young person, where he has been employed for six months, then many banks require at least a year of experience. Provided that the candidate is under 25 years of age.

At Sberbank, the age requirements are softer. You can get a mortgage from 21 to 75 years of age.

Required documents

A bank client can become a participant in the program if he provides a certain package of documents, which include:

- Passport of a Russian citizen.

- Tax return.

- Certificate from the place of employment.

- Income report.

- SNILS.

- Military ID.

- Bank information about the balance of the mortgage amount.

Registration of the procedure requires the personal presence of the applicant at the bank office to fill out a questionnaire in the prescribed form. Submitting an application is also possible online.

How does the mortgage refinancing procedure and documents work?

Now we’ll talk in more detail about how to refinance a mortgage loan with another bank and how to transfer a mortgage effectively. This process consists of a number of stages:

- Contacting the bank for preliminary consultation on refinancing.

- Collection of documents for approval (application form, passports, income certificate, SNILS, copy of employment record, military service for men under 27 years old, certificate from the bank about the balance of mortgage debt and the absence of current arrears, certificate about the quality of mortgage repayment from the beginning to the current date or statement of cash flow in the account, loan agreement and schedule).

- Receiving a positive decision on refinancing (4-5 days). Further, it is really about 120 days.

- Permission from your current bank to transfer the collateral (Sberbank almost always refuses to transfer the collateral, so you need to get a shift refusal from them).

- Providing documents on your property (appraisal, Unified State Register, etc. a detailed list can be obtained from your loan officer).

- The refinancing bank issues a new loan and transfers money to your creditor bank to pay off the mortgage (they may first ask for a certificate of the balance of the mortgage). The refinanced loan is closed (when refinancing a mortgage, check the conditions for early repayment of the current mortgage in advance; you may need to write an application for early repayment).

- Change of mortgage holder for an apartment. This is the most difficult and confusing stage. It differs from bank to bank in terms of implementation. Refinancing a mortgage at the Bank of Moscow and VTB 24 assumes that the banks, independently and without the participation of the borrower, will spend 3-4 months dealing with the transfer of the mortgage between the banks (the security for which the holder of the pledge and the conditions under the mortgage agreement for your apartment are determined) and the registration of a new entry in it by holder. During this period, the mortgage rate will be increased by 2%. The mortgage, if it was provided for in the mortgage agreement, is always in the bank; you do not have it in your hands. At Raiffeisenbank, after paying off a mortgage with a third-party bank, the borrower must himself receive the mortgage from the bank and transfer it to Raiffeisenbank. Next, the new mortgage is registered and a mark is made about the new mortgage holder.

Is it possible to refinance a mortgage with your own bank? This procedure is extremely rare, because it is not profitable for the bank to lose income and, most likely, you will be refused.

Order of conduct

Refinancing involves sequential stages:

- comparison of loan terms;

- contacting the VTB office regarding the transfer of a mortgage. The client should study all the requirements and conditions of the program;

- collection of documentation;

- filling out and sending the application;

- 3-day review of the application by the bank;

- notifying the applicant of the decision made by telephone;

- obtaining approval from credit institutions;

- signing a tripartite agreement for the transfer of a loan - repaying the mortgage to the original lender, taking on obligations to the new one.

Additional opportunities for completing the procedure are provided by the official website and mobile application.

Is it profitable to refinance a loan at VTB?

Sberbank clients who have decided to refinance a loan pay attention to the following features:

- interest rate – from 13.9%;

- bank guarantee obligations in relation to bona fide debtors;

- combining up to 6 credits;

- a significant reduction in the monthly payment and overpayment;

- receiving funds into reserve.

It is the cost-cutting benefits that attract people. VTB provides an opportunity to correct a mistake made when processing an expensive loan obligation.

Expert opinion

Alexander Ivanovich

Financial expert

Refinancing is carried out by bank transfer.

General interest rate

In banking, general requirements are established for the transfer of debt:

- amount – from 100,000 Russian rubles. up to 3,000,000 Russian rubles;

- duration of mandatory payments – from 6 months to 5 years;

- interest rate – from 13.9 to 15%.

Of the huge list of banks providing similar types of services, VTB occupies a leading position in terms of favorable conditions.

How to refinance your mortgage

Submit your application

Make a preliminary calculation and apply for a mortgage. Our employee will contact you, advise you and make an appointment at one of the mortgage centers at a time convenient for you.

Submit your documents

Submit the loan documents along with documents for the initial loan and purchased finished or under construction real estate to the mortgage center.

We will review your documents and make a decision. The decision-making period can be up to 5 working days (up to 24 hours under the “Victory over formalities” program).

Complete the deal

Once approved, you will need to contact a mortgage center to apply for a loan.

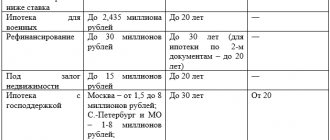

Interest rates and terms of mortgage refinancing

The program applies to full repayment of loans from other banks issued for the purpose of purchasing:

- finished housing;

- new buildings, including those not completed, subject to accreditation of the developer and the facility under construction with VTB and registration of claims to the property within the framework of 214-FZ.

- fixed interest rate for the entire loan term - from 9.3%;

- currency - Russian rubles;

- the loan amount can be no more than 90%*;

- Loans issued 6 months ago or earlier are refinanced;

- loan term - up to 30 years (when considering a loan application based on 2 documents - up to 20 years);

- loan amount - up to 30 million rubles;

- no fees for processing a loan;

- early repayment without restrictions or penalties;

- there is no commission for wire transfer of funds to another bank.

To the borrower:

- permanent registration in the region in which the client applies for a loan is not necessary;

- various forms of income confirmation are considered (certificates in the form and in the form of the bank);

- It is possible to take into account the total income of up to 4 co-borrowers;

- It is possible to record income both from the main place of work and from a part-time job.

* if the ratio of the loan amount to the cost of housing is more than 80%, the loan rate will increase by 0.7 percentage points.

Mortgage repayment

Pay off your loan in any way convenient for you:

No registration required. Login by card number or UNK (unique client number).

The UNK is indicated in the Application for the provision of comprehensive services - the document that you received when applying for a loan.

;

- through the VTB ATM network throughout Russia;

- through the cash desk of any VTB branch, the payment can be made not only by you, but also by any person at your request - you need the number of your loan agreement and the passport of the person who will pay;

- transfer from another bank;

- through Russian Post branches.

You can always repay your loan early. Partial or full repayment can be made without visiting a branch via VTB Online.

Bonuses from the bank

Receive bonuses from the bank

Participants in the Collection program can receive additional bonuses if they have taken out a consumer loan, car loan or mortgage with VTB.

On bonus.vtb.ru in the “Bonuses from VTB” section there is a catalog of gifts for which you can exchange accumulated bonuses.

Refinancing conditions

The refinancing program was developed with the goal that the client could fully repay loans taken from another bank, which were received for the purchase of finished or under construction housing. By using the refinancing service, the client can count on the following conditions at VTB-24:

- the interest rate for salary clients is from 8.3%, and for clients served by other banks, from 8.5%;

- refinancing is carried out exclusively in rubles. Therefore, the amount of debt will not depend on the value of foreign currency on the financial market;

- the maximum amount that can be provided to refinance a mortgage in VTB-24 taken out from Sberbank can be 90% of the principal debt;

- refinancing can be used by any client who took out a mortgage six months ago or earlier;

- the maximum loan amount cannot exceed 30 million rubles;

- You will not need to pay a commission to apply for a loan.

On a note! Loan refinancing at Sberbank for individuals in 2021

Special programs for refinancing mortgage loans

Victory over formalities

| Purpose of lending | Bid | Loan amount, ₽ | Down payment | |

| Refinancing a mortgage loan without providing income certificates | 9,65% | up to 30 million | — | |

Mortgage with state support | Refinancing of loans that meet the conditions of the Mortgage program with state support | 5% (subject to personal and property insurance) | up to 12 million | — |

If you already have a mortgage with VTB or another bank, subject to the conditions of the Mortgage with state support program, you can get new conditions and reduce the interest rate to 5% per annum (subject to personal and property insurance) for the entire loan term. Please note that real estate and the intended use of the loan must comply with the requirements reflected in Decree of the Government of the Russian Federation of December 30, 2017 N 1711.

Benefits of refinancing for clients

Today, the Savings Bank of the Russian Federation is considered one of the leading banks that provides favorable lending conditions. But if the mortgage loan was issued in 2020, the rate at that time was 12.5%.

Now VTB-24 is offering to refinance a mortgage taken out from Sberbank at an interest rate of 9.45%. In this case, the client receives a number of other benefits. Among them:

- reducing the payment amount by reducing the interest rate offered by the bank for new clients;

- the monthly payment is reduced by increasing the loan term;

- selection of a convenient payment schedule, which most often coincides with the client’s salary receipt schedule;

- transfer of a foreign currency loan into rubles if the mortgage at Sberbank was issued in foreign currency.

On a note! Alfa Bank mortgage refinancing in 2020

VTB-24 Bank offers its clients to refinance loans that were taken out for the purchase of secondary housing or housing in a new building. At the same time, not only those who find themselves in a difficult life situation and cannot cope with payments can apply for a reduction in the loan rate, but also anyone who wants to reduce the interest rate on the loan.

In this case, the collateral property is transferred from Sberbank to VTB-24. That is, an apartment purchased with a mortgage will be pledged to the bank until the borrower repays the loan amount.

When contacting VTB-24 regarding refinancing, you can combine several loans into one, but the main thing is that one of the loans is a mortgage. You can combine a mortgage, a consumer loan and a credit card loan into one loan.

Clients who receive wages on a VTB-24 card can receive more favorable conditions in 2021. In addition, for the bank itself, the refinancing offer is also beneficial, since it receives a new client, and with it, profit.

Advantages

Possibility of consolidating mortgage and other loans obtained from different banks into one loan

When consolidating loans in other banks - convenience of loan payment: one payment date, one payment, one invoice

Certificates about the balance of loan debt in other banks are not required*

The consent of the primary lender is not required for a subsequent mortgage

Possibility to reduce the total amount of loan payments

Opportunity to receive an additional amount for personal consumption at a low interest rate

Individual approach to consideration of a loan application

* A certificate may be requested by the bank if the loan is not found in the BKI or the loan data in the BKI is incorrect.

Refinancing Sberbank credit cards at VTB24

In 2020, the minimum interest rate for obtaining a loan through a Sberbank credit card was 14.9%. It applied only to those borrowers who received a pension or salary through Sberbank; other persons had to take out card loans at higher interest rates (up to 20%).

Combine all loans into one! Reduce your overpayment and monthly payment!

Refinance

In 2020, the situation changed; today the minimum interest rate for a card loan in Sberbank is 12.5%, which influenced the refinancing procedure at VTB 24 to make the service more popular. Refinancing a credit card at VTB 24 is carried out under the following conditions:

- loan term – from 6 months. up to 5 years;

- interest rate for a loan up to 600 thousand rubles – 14-17%;

- interest rate for amounts from 600 thousand rubles – 13.5%;

- Up to 6 different debt obligations can be combined into one agreement;

- the client is given the opportunity to receive an additional amount, which he spends at his own discretion.

From the information above, it becomes clear that refinancing card loans from Sberbank at VTB 24 today is only beneficial for those clients who took on a debt obligation before 2020.

At VTB 24 Bank you can refinance a car that you have on credit

Interest rates

Lending terms

Should not exceed the lesser of:

- 80% of the value of the property indicated in the appraisal report - the amount of principal balances and current interest on refinanced loans, as well as the amount requested by the borrower or co-borrowers for personal consumption

Maximum amounts for various purposes of obtaining a loan:

- To repay a mortgage in another bank: - up to 7,000,000 rubles - for Moscow and the Moscow region; - up to 5,000,000 rubles - for other regions.

- To repay other loans: 1,500,000 rubles

- For personal consumption: 1,000,000 rubles

Pledge of real estate:

- residential premises (apartment, including in a residential building consisting of one or several block sections - “town house”)

- House

- room

- part of an apartment or residential building, consisting of one or more isolated rooms (including part of a residential building of a blocked building - “town house”)

- residential premises with the land plot on which it is located

If the property is purchased with a refinanced mortgage loan, it may be encumbered with a mortgage in favor of the primary lender. This encumbrance is removed after the refinanced mortgage loan is repaid, after which the property is pledged to the Bank.

If funds from a refinanced mortgage loan were not used when purchasing a property, then such property must be free from encumbrance with the rights of third parties/ be under arrest (ban).

| Loan currency | Russian rubles |

| Minimum loan amount | from 300,000 rubles |

| Maximum loan amount | |

| Credit term | from 1 year to 30 years |

| Loan issue fee | absent |

| Refinanced loans | With one loan “Refinancing secured by real estate” you can refinance: - One mortgage loan provided by another credit institution for the purposes of:

— Up to five different loans:

Refinancing a mortgage loan is required to obtain a loan under the “Refinancing secured by real estate” product. |

| Loan issue fee | absent |

| Loan collateral | |

| Insurance | Voluntary life and health insurance of the borrower in accordance with the requirements of the Bank. |

Requirements for borrowers

at least 21 years old

at least 6 months at the current place of work and at least 1 year of total work experience over the last 5 years**

| Age at the time of loan provision | |

| Age at the time of repayment of the loan under the agreement | |

| Work experience | |

| Attracting co-borrowers | The Borrower/Title Co-borrower must be a borrower/one of the co-borrowers on the Refinanced Loans on the refinanced home loan (only if he is the spouse of the borrower on the refinanced home loan). If there are conditions in the credit documents for a refinanced housing loan, according to which all actions related to its execution, receipt, support are assigned to a specific co-borrower, the Borrower/Title Co-borrower must be this individual. The requirements for the Co-borrower(s) are similar to the requirements for the Borrower. The spouse (s) of the title co-borrower is not included in the composition of the Co-borrowers only in the following cases:

|

| Citizenship | Russian Federation |

The essence of the refinancing program carried out at Sberbank

Refinancing (or refinancing) at Sberbank is based on full repayment of the existing debt on an existing housing loan. Moreover, under current conditions, Sber allows the consolidation of debt existing in several banks (up to five) at once . For these purposes, the borrower issues a new consumer loan.

For Sberbank, 2018 was marked by a significant reduction in annual payments for consumer loans aimed at on-lending, which made this service quite attractive for most borrowers.

Registration of refinancing at Sberbank helps borrowers solve several problems at once. Including:

- Reduces the total amount of regular payments on existing loans.

- Receive additional funds for personal use.

- Combine existing loans into a single one issued at Sberbank. This greatly simplifies the client’s actions to repay numerous loans.