Recently, a mortgage for two people without marriage has ceased to be a rarity in the credit market, which is due to the desire of most financial institutions to expand their client base. This trend allows young people who, for some reason, do not take their relationships into an official channel, receive loan funds to purchase real estate for joint living. However, there are a number of nuances regarding the distribution of costs for repaying the loan and, as a consequence, the formation of ownership rights to the living space.

What's the point

In general, mortgage lending is a reliable tool for the comprehensive development of the social sphere and business. This banking product allows you to use long-term investments of the banking sector to improve existing infrastructure, develop the economy and solve housing problems of citizens, minimizing possible risks through the use of real estate as highly liquid collateral. At the same time, the terms of secured loans are, as a rule, aimed at attracting solvent borrowers who want to use loan capital on favorable terms.

Citizens living together without registering a marriage, in a legal sense, do not have mutual rights and obligations, but can act as co-borrowers when applying for a mortgage.

For these citizens, mortgage loans remain available on a general basis, as for other clients of financial institutions.

Requirements for borrowers

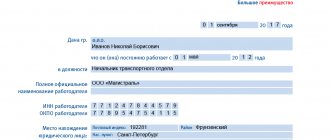

When applying for a mortgage loan, the main focus of financial institutions is on assessing the borrower's creditworthiness - the stability of his income and the availability of suitable property for collateral. In this case, the age of the debtor and his work experience play an important role. In the process of reviewing an application for a mortgage, banking specialists carefully study the repayment history of the client’s previous loans, which allows them to obtain an objective assessment of the potential risks associated with the transaction.

Since the requirements of banking institutions for borrowers who are in a registered marriage and living together without formalizing the relationship do not differ, an affirmative answer should be given to the question of whether a mortgage can be issued for two. At the same time, the main part of the banks’ requirements at the initial stage of obtaining a housing loan concerns, as a rule, the borrower’s documents and payment of the down payment. After that, financial institutions are interested in the results of the assessment of the real estate that serves as the subject of collateral, and the documents for it.

How to apply

Couples who do not register their relationship are actually cohabitants, which from a legal point of view does not imply the presence of certain obligations to each other. It follows from this that property acquired by one of the cohabitants cannot pass to the other upon separation.

There are several options for obtaining a housing loan for persons living together without registering a marriage:

- The loan is issued to one of the spouses, who will subsequently repay it. In this case, the second cohabitant does not have rights to the purchased housing. An exception is possible if it is proven in court that the second spouse took part in paying off the debt or invested his own funds in the improvement of square meters.

- The mortgage is issued to both cohabitants. In this case, the loan application takes into account the total income of the couple, and the amount of the down payment is proportionally distributed between the borrowers. In this case, the loan is also repaid in a certain proportion at the expense of each of the cohabitants, and property rights to the property are distributed according to the share of each of them.

- One of the cohabitants acts as a borrower, and the second acts as a guarantor. In this case, the guarantor is only a guarantor of timely repayment of the debt and has no rights to the purchased square meters if the borrower independently makes payments to the creditor bank.

What are the conditions for a marriage agreement when providing housing loans to unmarried people?

Before entering into such an agreement, you should study the provisions.

Draw up a prenuptial agreement for a mortgage before marriage in writing. It will have to be certified by a notary after registration in order for it to come into force. The document determines the form of ownership (equity, joint, etc.), the procedure for division in case of divorce and other nuances.

An agreement can only be concluded if there is an intention to enter into an alliance. In this case, both spouses must be legally capable. The document itself defines exclusively property and financial relations. The agreement is drawn up for a specific period or may be indefinite.

As a general rule, a prenuptial agreement for a mortgage taken before marriage describes the terms of the intended division of property. Therefore, ambiguous language must be avoided. Based on such an agreement, the bank will decide whether to issue a loan. Real estate registration is also carried out in accordance with the provisions of this document.

Before drawing up, it is advisable to study a sample prenuptial agreement for a mortgage before marriage or contact a lawyer. If the agreement is drawn up only to resolve issues of obtaining a loan for real estate, it must reflect the following points:

- what is the share of each joint borrower in the down payment (if any is paid upon receipt of the loan);

- volume of obligations to make monthly payments (percentages or exact amounts);

- what responsibilities will the parties to the agreement have to improve living conditions (repairs, reconstruction, etc.);

- liability of spouses in case of failure to fulfill obligations (late payment, refusal to deposit funds, etc.);

- how jointly acquired property will be divided in case of a mortgage before marriage (it is advisable to link the division options to the reason for the dissolution of the marriage);

- change in shares and distribution of living space when repaying the loan using mat. capital.

If such points are not specified, real estate acquired by one of the future spouses will be considered his personal property. To get a share in it, you will have to work hard.

If you want the division of the mortgage before marriage to take place without such complications, draw up an agreement. It is also concluded if:

- one spouse is against purchasing property on credit;

- the parents of the young couple will also pay for the loan;

- the husband or wife has negative marks in their credit history;

- the residential property will not be used in the life of a married couple.

With this agreement, the pre-marital mortgage in the event of a divorce is divided according to the terms of this document. Therefore, lawyers recommend filing it in any case.

Which banks to contact

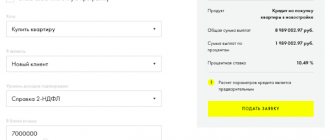

When applying for a mortgage, married couples (living with or without official marriage registration) give preference to financial institutions with the most attractive lending conditions. In this case, the main indicators influencing the profitability of the transaction are:

- The size of the interest rate (directly affects the amount of overpayment).

- The amount of the starting payment.

- The amount of available funds (often set depending on the debtor’s income and the cost of the purchased living space).

- Duration of lending (allows you to extend the repayment of the principal debt over time).

Despite the fact that for many years a mortgage for two spouses was considered commonplace, recently most financial institutions have been lending on general terms for the purchase of real estate by couples who are not in a formal family relationship. Let's consider the main conditions under which mortgage loans are issued in the most famous banking institutions in the country.

| Bank | Bid, % | An initial fee, % | Loan amount, rub. | Loan term, years |

| Sberbank | from 7.4 | from 15 | from 300 thousand | up to 30 |

| VTB 24 | from 9.5 | from 20 | up to 60 million | up to 30 |

| Rosselkhozbank | from 6.0 | from 15 | up to 20 million | up to 30 |

| Binbank | from 9.0 | from 20 | up to 20 million | up to 30 |

| Raiffeisen | from 9.75 | from 10 | up to 26 million | up to 30 |

Rights of spouses

When getting a divorce, you need to pay attention to the following points:

- Article 34 of the Family Code of the Russian Federation defines property acquired during marriage as common property. In case of divorce, it is divided in half;

- By taking out a mortgage for an apartment, the buyer-borrower becomes the owner of the property.

Who is the owner of the property?

The second point explains: the spouse who bought the property is the rightful owner. If the action was committed before marriage, he alone owns the rights. In case of divorce, the second spouse does not have rights to housing: full transfer of ownership, receipt of a share, sale and subsequent division of the proceeds. The apartment belongs to only one person and remains with the owner after the divorce. If a mortgage was taken out and the amount was not paid when registering the marriage, Article 34 of the RF IC comes into play: the income received by spouses during marriage is common. Even if the wife did housework or looked after the children without paying the mortgage. The money used to repay the mortgage monthly is joint property. If the marriage breaks up, both parties can claim them. In the event of a divorce, the owner pays the second spouse a share of the amount made in payments to pay off the mortgage during the existence of the marriage. It is impossible not to give up the apartment, take it away or not pay the money. If one of the spouses had no income without a good reason and the mortgage was paid off by the working spouse, this must be proven. Judicial practice shows that this is difficult and requires weighty arguments. If the reason for the lack of income is alcoholism or drug use, there is a chance to win the case. Otherwise, the court will agree with the objective reasons for the lack of earnings. The law specifies valid reasons and it is difficult to prove the wife’s non-involvement in running the household or raising a child.

Some lawyers argue: there is a chance not to give up the share if you provide the court with receipts that the mortgage was paid by direct deduction from the salary recorded in the organization’s accounting department, without receiving the money in hand, which means there was no actual income and there is nothing to divide. In practice, this option has no legal basis. Article 34 of the RF IC applies to all types of income considered general. In judicial practice, there were options when the owner of the property wanted to issue a deed of gift to a relative and not pay part of the funds spent on the mortgage in the event of a divorce. A loophole like this is not viable. To sell/donate property if the mortgage has not been repaid, permission from the bank is required - it is extremely difficult to obtain. It is allowed to sell, but the bank will sell the property on its own.

About the division of property

The main disadvantage of taking out a mortgage in a civil marriage, as many believe, is the problems in dividing property that arise when partners separate. However, in contrast to an official divorce, when jointly acquired property is divided equally (unless an alternative is provided for in the marriage contract), dealing with real estate taken on a mortgage jointly with a cohabitant is much easier if the loan agreement clearly indicates the shares of each of the borrowers.

About ways to protect yourself

Since a mortgage in a civil marriage requires appropriate legal registration, in order to avoid disagreements when dividing property in the event of a possible separation, couples should take care of the availability of documents such as:

- Loan agreement indicating the shares of each borrower (according to the amount of payments made or as agreed).

- Title documents indicating the persons entering into shared ownership of the living space.

- Checks and receipts confirming the transfer of funds from the borrower’s personal account to repay the debt, etc.

Mortgage before marriage

3 Nov

2015 Contents

:

- Mortgage acquired before marriage: division in divorce

- An apartment with a mortgage before marriage: the nuances of dividing a new building

- Marriage after a mortgage: how to protect yourself from losses during divorce

- Adviсe

According to the law, property acquired before marriage is not subject to division during divorce. However, there are situations when the apartment was purchased on credit, which was not repaid at the time of divorce. You will learn from the article how to divide such a mortgage and avoid losses.

Mortgage acquired before marriage: division in divorce

Article No. 36 of the Family Code of the Russian Federation states that real estate taken on credit by one of the spouses before marriage is his property, unless the contrary is proven in court. The second spouse has the right to apply to the court for the allocation of a share of the apartment if there is documentary evidence:

- participation in mortgage repayment;

- carrying out major repairs or reconstruction at your own expense;

- other financial or labor investments that increase the cost of housing.

The share of property allocated by the court to the second spouse is commensurate with the money contributed.

After getting married, you can submit an application to the bank to register your spouse as a guarantor or co-borrower on the loan. In this case, during a divorce, only the part of the property paid for jointly is subject to division.

Upon divorce, the following options for dividing mortgage obligations are provided:

- Recognition of the loan as the personal debt of the spouse who originally issued it. He pays the funds previously contributed by the second spouse in court or by agreement of the parties.

- Dividing the property into shares, after which the loan is reissued to each spouse separately.

- Joint repayment of the loan by divorced spouses, after which each receives their share.

- A requirement for early repayment if the borrower's income decreases after the divorce.

An apartment with a mortgage before marriage: the nuances of dividing a new building

If a loan was received for an apartment in a building under construction, which is not legally registered, then during a divorce you need to take into account the following:

- You will receive ownership rights only after the object is put into operation.

- If a marriage is entered into before taking possession of an apartment, this property will be considered jointly acquired.

- Regardless of who made the down payment and other payments, the second spouse will receive half of the property upon division.

If the divorce proceedings took place before the apartment was rented out, then the former spouse has the right to file a claim in court for reimbursement of half of the payments made during the period of cohabitation.

Marriage after a mortgage: how to protect yourself from losses during divorce

You can insure yourself against property loss:

- By concluding an agreement on the division of property. It contains a scheme for dividing joint real estate and the procedure for distributing debt obligations. The document is drawn up in writing and certified by a notary.

- Having drawn up a marriage contract, which will stipulate the terms of the mortgage:

- the size of each spouse's share;

- the amount of compensation in the event that one of the parties refuses a share in the apartment;

- the amount of mortgage payments by each spouse;

- the possibility of repaying the debt with other real estate and its value.

When dividing property, sometimes spouses manage to reach an agreement without litigation, but it is more prudent to conclude a prenuptial agreement before the wedding.

Adviсe

- After a divorce, spouses have the right to agree on the joint use of a mortgaged apartment, having received the bank’s consent to rent it out.

- When the relationship is not officially registered, you should not participate in a mortgage before marriage. Property in a common-law marriage goes to the spouse who took out the loan. If you purchased housing together, then in court you will need to prove not only financial costs, but also the fact of family relationships.

- One of the options for dividing a mortgaged apartment is to sell it with the consent of the bank to repay the loan.

About the advantages and disadvantages

As you know, a mortgage for two people not married until recently was rare, which was explained by the reluctance of banks to expose their assets to risks associated with the lack of legally formalized mutual rights of co-borrowers. However, recently, financial institutions have been actively meeting the needs of citizens who wish to jointly receive a loan to purchase a home with subsequent registration of it as shared ownership. We will consider the main strengths and weaknesses of such transactions in the table.

| Advantages | Flaws |

| Possibility of obtaining a significant loan amount based on the total income of debtors | Lack of opportunity to participate in preferential lending programs for young families |

| Reducing the financial burden on each borrower when repaying the loan together | High probability of disputes arising during the division of property |

| Availability of equal rights and obligations of co-borrowers to the creditor bank | Problems with the creditworthiness of one of the co-borrowers may have a negative impact on the decision of the lending bank |

| Possibility of registering real estate as shared ownership |

How to get a housing loan before registering a marriage

According to the law, an apartment can be mortgaged before marriage, but it will be problematic to divide it if the spouses formalize the relationship and then divorce. Also keep in mind that if the loan is not repaid by the time the union is dissolved, not only the real estate will have to be divided, but also the debts (). Obtaining funds for the purchase of living space is possible not only for husband and wife. They are issued:

- just physical persons;

- cohabitants (civil relations);

- people planning to get married.

In the latter case, the couple submits an application to the bank before the wedding. In the case of cohabitants, it is allowed to issue a mortgage to the husband before marriage or to the common-law wife.

The procedure for issuing funds is standard, but there are some differences. They depend on the category of people applying for a loan.

- People in a civil union are more likely to be given a loan to purchase real estate in shared ownership.

- If a couple planning to get married applies for a loan, it is advisable to prepare a prenuptial agreement, because the mortgage before marriage in the event of a divorce will also be divided between the former spouses.

- The bank considers applications from co-borrowers: the main borrower is one person (common-law husband or wife), and the second acts as a joint borrower.

Depending on the situation, the package of documents required for issuing funds also changes. This way, people planning to get married can provide a prenuptial agreement.