What is interesting about mortgages for medical workers at Sberbank

Everyone knows that the salaries of healthcare workers are, to put it mildly, small.

To buy an apartment for cash, you can save all your life and it is unlikely that you will be able to buy what you want. And official income is not always enough to apply for a loan.

Mortgage loan for healthcare workers.

This problem can be solved. The state has developed special programs aimed at improving the living conditions of medical staff. Not only doctors, but also nurses have the right to take out a mortgage loan subject to certain conditions:

- the age of a person wishing to purchase real estate should not exceed 35 years (in some regions it has been increased to 40 years);

- it is necessary to provide evidence of “bad” housing conditions that require improvement;

- have a diploma of secondary specialized or higher education;

- sign up for the queue, that is, become a participant in the program;

- confirm with documents that there is no own real estate;

- You must work in a medical institution for at least one year before participating in the program;

- After receiving credit guarantees, work for a certain period - 5 or 10 years.

For the preferential category of borrowers, financial institutions offer an interest rate not exceeding 7% per annum.

They also provide the opportunity to lower the percentage to 3% or 4%. In addition, regional authorities can reduce the increase in prices by offering an additional discount.

Note! These conditions apply only to borrowers who purchase primary housing from the developer.

Each region has its own program developed and implemented. The general conditions are the same, but there are some “derogations”.

A healthcare worker has the right to count on:

- relatively low rate under the loan agreement;

- reduction in mortgage interest by 5-7 units;

- repayment of part of the debt from public funds if the borrower has earned compensation for years of service;

- applying for a mortgage loan without documents confirming income - because the state vouches for the client;

- payment of an advance payment of 10% from the state budget.

In our vast country, there are many villages and hamlets that are in great need of qualified medical care. It is very difficult to “lure” a modern specialist to a permanent place of residence in a remote corner of the Motherland.

The government has developed a program called “Zemsky Doctor”. If a vacant position is occupied by a university graduate or a specialist who agrees to move for permanent residence to a rural area, then he has the right to receive a 100% discount. Or, in return, issue “lifting money” - money intended for building a house.

Other benefits of mortgages for salary earners

A reduced mortgage rate is not the only advantage for Sberbank clients. In addition to saving budget, they also receive additional services from the bank:

- no need to order and provide certificates confirming solvency if all wages go through the client’s current account with Sberbank;

- relaxation of requirements for work experience: work experience at the last place of work, as for other clients, must be at least six months, but there is no requirement to have a total work experience of at least 12 months over the last 5 years;

- the ability to remotely submit an application for a mortgage (or other loan) without being present at the branch through your Sberbank Online personal account or the Bank at Work service;

- the bank’s loyal attitude towards “its” clients.

The last advantage is that the bank can verify the client’s solvency without providing certificates. Also, according to reviews from some payroll clients, the processing of an application can speed up to 1-2 days or even several hours.

Terms of a secured loan from Sberbank for medical workers

Important! Only certain categories receive preferential loans. In this case, employees of medical institutions who are on the waiting list to improve their conditions and really need new housing.

The main Russian bank Sberbank puts forward the following requirements for borrowers:

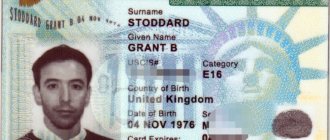

- mortgage loans are issued only to citizens of the Russian Federation;

- The age of the loan recipient must not be less than 21 years. And at the time of repayment of the debt - no more than 75 years;

- official employment is required;

- minimum work experience - 6 months;

- An advance payment of 15%-20% is required.

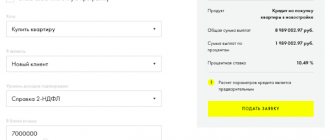

The loan amount cannot exceed 300,000 rubles, and it must be repaid in less than 360 months, or 144 months if the mortgage is issued for a new building. Depending on the type of program, the interest rate varies from 6% to 14%.

What are the benefits of a medical mortgage? A health worker has the right to take advantage of not only a preferential loan for public sector employees, but also an additional discount if he or she is eligible for one. For example it could be:

| Mortgage for military doctors | The military fund helps make a down payment and pay off the loan. But if a doctor serving in the army can contribute his own funds, then in this way he will be able to purchase a more expensive apartment. The rate for this category is 9.5%, the amount is 2.33 million rubles, the term is up to 20 years. |

| Mortgage plus maternity capital | The interest rate and term in this case depend on the type of housing purchased: • if you buy an apartment in a new building - 7.4% or 7.9% (maximum 144 months); • secondary housing - 9.4% (up to 360 months). |

| Mortgage for a young family | When applying for a preferential loan, a young family, in addition to a subsidy, receives a cash certificate in the amount of up to 40% of the cost of the purchased housing. Thus, physician spouses can reduce the loan amount, thereby reducing the amount of overpayment. |

Unfortunately, it is impossible to arrange square meters “in reserve” - no more than 18 sq.m. per person.

Important! Preferential conditions apply only to employees who receive wages from the state budget. That is, an employee of a private medical office does not have the right to apply for such offers.

General requirements and documents for submitting a mortgage application

Salary clients of Sberbank who wish to obtain a mortgage loan must meet all the same requirements as regular borrowers, with the exception of work experience:

- citizenship of the Russian Federation;

- age from 21 years at the time of registration and up to 75 years at the end of the loan;

- at least six months of official employment in the last place;

- sufficient solvency;

- positive credit history;

- absence of negative factors (criminal record, registration with a psychiatrist or narcologist, presence of valid writs of execution).

Due to the fact that such a client’s salary is credited to the Sberbank card, he will not need to order an income certificate, and the mortgage manager will be able to calculate his solvency independently using a salary account statement. The future borrower will have to provide the following documents:

- copies of Russian passports of all borrowers;

- documents on the income of co-borrowers participating in the loan who do not receive salaries on a Sberbank card;

- copies of work books of mortgage participants;

- documents about marital status and presence of children.

All necessary documents can be submitted in the form of scans or photographs along with an electronic application form through an application in the bank’s personal account.

"Crib sheet" for the borrower

Applying for a loan for a healthcare worker

Let's consider point by point what you need to consider when applying for a loan:

- "Take a price." First of all, you need to familiarize yourself with housing prices. Please note that the loan amount directly depends on the cost of the apartment.

- Study the lending programs offered by Sberbank.

- Thanks to a special loan calculator, calculate the amount of the expected payment. This option will allow you to assess the reality of receiving and repaying a loan.

- Prepare documents without which it is impossible to obtain a loan.

- Submit an application to a financial institution and wait for approval.

- Collect documents for the purchased property.

- Arrange for additional services and register ownership.

When choosing an apartment, you need to pay attention to the condition of the housing. It will not be possible to obtain a loan if the house or apartment is in disrepair or has undergone redevelopment.

What are the benefits of cooperation with a bank?

Today, many Russian banks practice special offers for salary clients, which is due to the special status of such citizens. To assign it, a person must receive wages on a credit institution card. All costs for issuing a payment instrument and servicing are usually borne by the bank. The amount of the commission for the transfer of wages is paid by the employer and on average varies from 1 to 3%.

Payroll clients, the bank and the employer, that is, all participants in the payroll project, benefit from such cooperation.

The organization's interest is related to the following points:

- Savings on wages, since cashier positions are eliminated due to lack of need;

- No expenses for payment of services of collectors;

- Simplification of document flow and reduction of enterprise costs;

- The ability to connect special services with which you can quickly generate salary slips online;

- High confidentiality of data and payment information.

Salary bank clients receive the following benefits:

- Free use of the card, the ability to withdraw cash from ATMs at any time;

- Fast transactions, including replenishment and transfer of funds, payment for purchases, repayment of debt on loans and fines;

- Stable transfer of wages or advances even during periods of absence from work.

- Possibility of receiving “passive” income in the form of cashback and interest accrual on the balance.

For a bank, concluding an agreement with an organization means expanding its customer base and obtaining new sources of profit. Income consists of commissions for transferring funds, interest received from partners for paying for purchases with a card, and the use of bank credit products by holders of payment instruments.

Mortgage loan for medical workers living in Moscow

In each region, doctors can take advantage of the benefit and get a mortgage. Some cities are intentionally building new housing specifically for medical professionals. This way, colleagues can live next door.

Note! Some regions offer additional “discounts”. In Moscow there are many more of them, because it is the largest city in the country.

In some cases, the housing mortgage lending agency pays the cost of housing in full. The borrower can only repay the accrued interest. The amount of this discount is divided into two parts:

- one is paid as a down payment;

- the other repays the principal debt - the body of the loan.

The tax deduction has also not been cancelled. Medical workers are officially employed, so they have the right to claim a kind of refund.

The condition for doctors and nurses in the capital is that they must live and work in this area for at least five years.

Benefits for salary clients

Banks often offer special lending conditions and special offers on mortgage products to salary project participants. Cardholders can receive rewards for active use of the card and replenishment in the form of a percentage on the balance.

Popular offers and marketing moves include:

- receiving discounts from bank partners;

- rewards for purchases made;

- credit offers on favorable terms;

- SMS – notifications about new products and special offers.

Special conditions apply to salary clients within the framework of loan offers.

Today Sberbank is ready to provide the following benefits:

- no need to provide a certificate of the amount of income received;

- the ability to count on the base rate on the loan;

- making a minimum down payment;

- cooperation with a trusted bank;

- higher credit limit for approval;

- no additional commissions;

- reducing requirements for length of work experience.

Salary clients can apply for a loan using standard mortgage products or take advantage of the offer to receive funds for any purpose. The fastest option for obtaining a loan is to use a simplified procedure, in which to receive a loan you only need to provide a Russian passport and a second document.

Salary clients can expect approval of their application within 2 hours, provided they use the electronic service. You can also arrange it remotely when connecting.

It might be interesting!

Is it possible to take out 2 mortgages at the same time?

Interest rate

The interest rate is one of the main criteria that often determines the profitability of a banking product. Its value directly affects the size of the final overpayment, so a reduction of even a fraction of a percent allows you to save money in the family budget.

The size of the rate offered by the bank may be influenced by the following factors:

- type of housing purchased;

- consent to enter into voluntary insurance;

- attracting co-borrowers and guarantors;

- quality of credit history;

- the amount of the down payment made.

The base rate on primary market offers today at Sberbank is 6.5%. The option of finished housing will cost the client more, since the minimum value is set at 8.5%. The largest financial institution has social programs, so military personnel and large families can take out a loan, counting on government assistance when paying the mortgage.

Sberbank provides the following opportunities to reduce interest rates:

- 1% - to participants of the salary project;

- 1% - when concluding a life insurance contract;

- 0.3% — when completing a transaction using DomClick;

- 0.4% - if the family belongs to the “young” category.

The introduction of an electronic transaction registration service allows the bank to simplify the procedure for relationships with clients. With its help, the lender reduces its costs and the workload of specialists, which allows the organization to make concessions and reduce the loan rate. At the same time, the potential borrower receives financial benefits, saves his own time and effort when going through the mandatory steps of the procedure for obtaining a mortgage.

It might be interesting!

Terms of the mortgage subsidy program at Sberbank

What salary is enough for a mortgage?

Today, an acceptable level of earnings for a person who wants to take out a housing loan is an amount of at least 30-40 thousand rubles of net income. At the same time, monthly deductions for existing loans, alimony and other obligations, if you have them, are deducted from your salary.

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

At Sberbank of Russia, when submitting an application from a potential borrower, only official income is taken into account, i.e. the figure indicated by your employer or accountant in the certificate in form 2-NDFL. If you cannot document your solvency, your chances of having your application approved are very low.

Some other banks also consider other income of applicants:

- from part-time work

- from shares and deposits

- from renting out real estate

- insurance payments, etc.

When applying for a mortgage, you need to realistically assess your solvency and select the conditions that will help you not receive a negative answer and pay off your debt without problems in the future.

Advantageous mortgage offers from Sberbank of Russia ⇒

For example, the shorter the term, the higher your salary should be. If you don't earn much, then apply for a home loan with a maximum term.

In Sberbank for the Moscow region there is no concept of a minimum wage, but there is a living wage - 15 thousand rubles per family member. That is, if your salary is 80 thousand rubles, then the maximum mortgage payment can be 40 thousand rubles.

You might also be interested in these articles: