More information about the 2-NDFL certificate

A personal income tax certificate is issued by a tax agent. For an officially employed citizen, this is the enterprise or other organization in which he works.

Tax agent - according to the Tax Code of the Russian Federation (Tax Code of the Russian Federation), a person, often a legal entity, who is entrusted with the calculation of taxes, their deduction from employee salaries and transfer to the state budget.

The 2-NDFL certificate is prepared by the accountant at the employee’s place of work and signed by the manager. The certificate is certified by the official seal of the employing organization.

What information is contained in the help?

Certificate 2-NDFL in the form of Sberbank includes five sections of mandatory information:

- Information about the employer's company: its details and full legal name;

- Information about the employee - an individual receiving income;

- Data on monthly income subject to a thirteen percent tax rate, separately for each month;

- Tax deductions with codes (social, property and others);

- The final amount of funds received, the total number of tax deductions and withholding fees.

This certificate must be signed by the manager and have the company seal.

Important! If an individual changed several jobs during the pay period, the manager at the last place of work can only enter information about work in his company in the required income certificate.

What is it for?

Help 2-NDFL is multifunctional. It is needed for:

- Visa processing;

- Alimony payments;

- Transfer from one place of work to another;

- Registration of pensions, benefits;

- Registration of a mortgage loan and provision of other banking services.

When reviewing the package of documents of the applicant for a mortgage, bank employees analyze the 2-NDFL certificate from the content and formal side.

In terms of content, the bank:

- Receives information about the level of official income of the mortgage applicant;

- Makes sure that the potential borrower has an official place of work;

- Obtains evidence that the borrower can regularly pay the loan.

In terms of bank form:

- Makes sure that income information is official;

- Checks the details of the organization (there are databases that provide banks with information about the status of employing organizations);

- Checks the correctness of the document and the authenticity of the seal.

If the mortgage is issued by the title co-borrower and co-borrowers or the borrower and the guarantor, they all provide the bank with a 2-NDFL certificate, because financial solvency is the main criterion that they must meet.

For what period is a 2-NDFL certificate required?

The period reflected in the 2-NDFL certificate depends on the requirements of the bank. There is a pattern here: the longer the expected loan term, the longer the certificate is provided for.

Another pattern may also work: the period reflected in the document must correspond to the applicant’s minimum length of service at his last job. Banks usually consider this length of service to be 6 months. During this period, the financial institution may require a certificate.

The applicant may object to the bank employee requesting a certificate for a period longer than four years.

According to the Tax Code of the Russian Federation, information on taxes of individuals must be stored by tax agents (or taxpayers, if they pay the tax themselves) for no longer than four years. The bank's demands to provide a 2-NDFL certificate or other tax documentation to confirm income for a period exceeding four years have no legal basis.

Responsibility for a fake certificate

Falsifying a 2-NDFL certificate is fraud. Responsibility for this act extends to the citizen himself and the officials who took part in this matter (accountants, personnel officers, managers). Criminal liability arises (Article 292, Article 327 of the Criminal Code of the Russian Federation) and entails punishment depending on the amount of harm caused:

- restriction of freedom from 6 months to 4 years;

- fines from 80,000 rubles;

- compulsory or corrective labor.

An attempt to provide false information may backfire against the mortgage applicant. In the best case, he will end up on the bank’s “black list” of clients and will no longer be able to be serviced there. Therefore, you should not give in to tempting offers to buy a 2-NDFL certificate .

Document processing deadlines

To obtain a 2-NDFL certificate, you must submit an application in free form, indicating the period for providing information on tax deductions. The period during which the certificate is issued should not exceed three working days from the date of submission of the application.

The Tax Code of the Russian Federation does not clearly indicate the deadline for issuing a 2-NDFL certificate. However, all documents related to work (except those related to dismissal) must be provided to the employee within three days.

The employer does not have the right to limit an employee in the number of requests for a 2-NDFL certificate: if the banking organization is not satisfied with the document provided by the applicant, the applicant can apply to re-issue an income tax certificate.

How to get a certificate

To do this, you must draw up a written application in free form and give it to the employer, who must issue the form within 3 working days.

If you have not received the document within this time, please resend the application by registered mail with acknowledgment of receipt. If the employer does not issue a certificate, you can file a complaint with the labor inspectorate. Not only employees registered at the enterprise, but also former employees who left no more than three years ago have the right to receive the form.

The employer has no right not to issue a certificate, whatever the reason:

- no fee for issuing a certificate (the document is provided free of charge);

- the same person applying for this form too often;

- the employee requires several copies of 2-NDFL.

Usually it is not difficult to obtain a certificate and it is issued on the day of application.

It is important to ensure that the information is not only accurate, but also complete. Before giving the completed form to a bank employee, you need to make sure that the accountant’s signature is present, whether the date and seal are affixed, and whether there are any corrections.

The form must be filled out using a blue pen only. If the order is violated, the banker will not accept your document and you will have to contact the employer again, which entails a loss of personal time. By law, a certificate can be issued an unlimited number of times.

The Russian Labor Code obliges the employer to issue a document within 3 days, and only working days are taken into account.

Changes in legislation on tax form 2-NDFL

In October 2020, changes were made to the tax legislation of the Russian Federation regarding the issuance of a certificate. They came into force on January 1, 2020.

The changes concern the document form and its completion. The old-style certificate contained information about the employee’s income and tax deductions. According to the new rules, this information is separated into different documents: upon request, the employee receives documented and certified information about income, and the Federal Tax Service receives a certificate of tax withholding from the employee’s salary for the reporting period.

If the bank requires information about income for 2020, the applicant will have to receive a 2-NDFL certificate of a new form established by law.

Validity period of the certificate in form 2-NDFL

There is no set validity period for a personal income tax certificate. However, the bank is interested in receiving up-to-date information about the mortgage applicant’s earnings.

Look at the same topic: Methods for urgent redemption of mortgaged apartments

Typically, banks consider the optimal validity period for a certificate to be 2-4 weeks. Upon completion, the document loses legal force, and, if necessary, the borrower will have to order a new one.

The specific validity period of the document can be found out at a bank branch or by calling customer support.

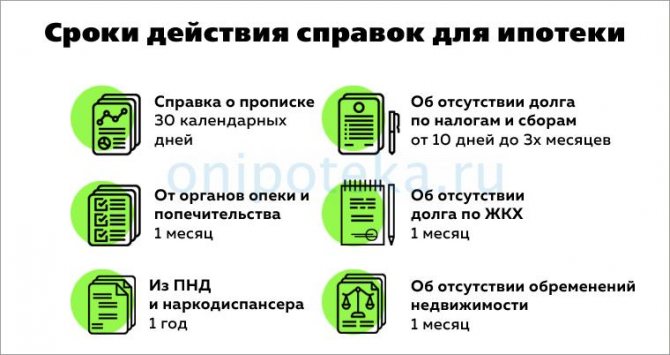

Finding out the validity period of mortgage certificates from the seller

When preparing a voluminous package of documents for a mortgage, some nuances that seem trivial are often overlooked, for example, various certificates

But in vain! They are of great importance, many of them confirm the purity of the transaction and reduce the risks of challenging it.

We present a short overview of certificates from the seller and other documents, as well as their validity periods.

Certificate of registration (registration) at the address of this apartment

Many people know it as a certificate of family composition, issued by the passport office of the housing and communal services or management company. All residents registered at this address and their family ties to the person who ordered the certificate are indicated. There is also a Form 12 certificate - archival, it indicates everyone who was registered in this apartment for the entire period of its existence. This is very important to eliminate the risk of the transaction being invalidated. This can happen if people who went to prison lived there, and so on.

Recommended article: Why the mortgage amount at Sberbank online is increasing

The law does not establish a validity period for such a certificate . But usually it is valid for 30 calendar days, so ordering it in advance is useless.

Certificate of permission from the guardianship and trusteeship authorities for a mortgage

If a minor child is the owner or co-owner of the apartment being sold, the bank will require this certificate. The guardianship authorities review the documents within 2 - 4 weeks, and then issue a guardianship permit for sale. The document is valid for one month and then becomes invalid. Guardianship may be refused if the house is still under construction, or if the conditions of the new housing are in some way worse than those of the existing housing. The decision can be appealed in court.

Certificate of absence of debts on taxes and fees

Issued by the tax office within five working days, since the generation of information involves requests to various authorities.

This validity period is not established by law, and each bank can independently determine the number of days the document is valid. Some banks consider the certificate valid only for 10 days, many specify a period of one month or even three months; this should be clarified with your bank.

Certificate of absence of debt on utility bills

Such a document can be obtained by contacting the HOA accounting department or the cash settlement center (RCC), where it is issued according to the standard EIRC 22 form.

The terms of issue and validity period are not established by law; it is necessary to clarify the requirements of the bank. But usually this certificate is valid for a month, since utility bills are usually paid once a month.

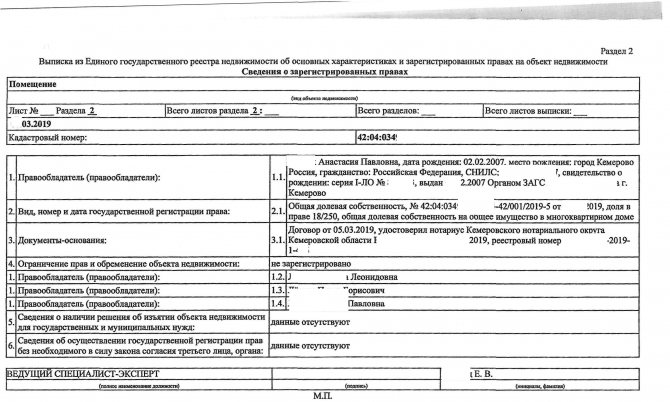

Certificate of absence of encumbrances on real estate

This is an extract from the USRN (Rosreestr database), anyone can request it. All restrictions and encumbrances on real estate for the entire period of its existence are entered into the Rosreestr database. All of them (arrest, pledge, easement, lease and others) will be indicated in the extract, and the risks of challenging the transaction will be minimized.

You can receive the document at Rosreestr itself (3 days), through the MFC (5 days) or online on the Rosreestr website and on the State Services portal. The validity period of such an extract is not specified by law; it is usually valid for 1 month, including for banking institutions.

Certificates from the psychoneurological dispensary PND and narcological dispensary

They are necessary so that the transaction is not invalidated due to a person’s mental disorder or drug addiction. You can receive a certificate at the dispensary on the same day, its validity period depends on the purpose of receipt, for the bank it is valid for 1 year.

What to do if it is impossible to get a certificate

Certificate 2-NDFL can be issued only to officially employed persons. But there are citizens for whom this document remains inaccessible or does not reflect all income.

These are the following categories of individuals:

- Employees who receive part of their salary “in an envelope” (they can receive a 2-NDFL certificate, but the information about income in it will be significantly understated);

- Citizens receiving “black” wages (obtaining such a document at their place of work is not available to them);

- Individuals engaged in honest practice;

- Individual entrepreneurs;

- Persons living on rent;

- Self-employed citizens.

There are also other situations that make issuing a 2-NDFL certificate difficult. So an employee can work in a branch, and the top-level structure can be located in another city. In this case, receiving the certificate may be late (if the mortgage is required urgently).

In cases where it is impossible to obtain a 2-NDFL certificate, it makes sense to replace it with another document confirming income.

- Persons conducting private practice, individual entrepreneurs, self-employed citizens paying taxes can issue a certificate, otherwise called a tax return. It is filled out by the taxpayer himself, based on the established form, and submitted to the Federal Tax Service (FTS). When applying for a mortgage, he can contact the Federal Tax Service with a request to draw up a certified statement of tax deductions. This is an official document that takes into account all the taxpayer’s income (if he does not hide the fact of part-time work from the Federal Tax Service). An extract based on a tax return is even better than a 2-NDFL certificate, since it takes into account all the declared income of the applicant, not just the official salary.

- An alternative to a personal income tax certificate is to issue a certificate in the form of a bank. Its advantage over the 2-NDFL certificate is the ability to reflect the unofficial part of earnings in it. However, such a certificate requires the signature of the chief accountant and the head of the employing organization, as well as the affixing of an official seal. Therefore, it is possible that the employer will not agree to issue such a certificate to the employee.

Why do you need the income right?

If a citizen intends to apply for a mortgage loan from a bank, he needs to prepare and submit to the potential lender a whole package of documents. One of the main ones is a certificate of income of an individual.

Banks require it to verify the client’s solvency. A mortgage loan involves providing the borrower with a large amount for a long period of time. Naturally, in such a situation, the lender wants to receive more guarantees. Therefore, it requires a certificate with which an individual confirms a sufficient level of his income and the stability of its receipt.

For this purpose, a certificate in form 2-NDFL is quite suitable. It contains the following information about the recipient:

- Basic information of the employee (full name, date of birth).

- Source of income.

- Total income for the period.

- Income amounts by month (if provided).

- The amount of official deductions from wages (for example, alimony or fines).

- Income tax rate and personal income tax amount: total and by month.

- Total amounts: income, deductions, income tax.

The certificate must also contain information about the employer who provides the certificate:

- Full name of the structure and its address.

- TIN, checkpoint.

- Employer contact information.

The 2-NDFL certificate must contain the seal of the structure in which the citizen works and the signature of the chief accountant or other responsible person.

If a citizen needs to obtain a 2-NDFL certificate, he should apply for it to the accounting department of the enterprise where he works. The employer does not have the right to refuse to issue a certificate for any reason. There is no fee for its registration from the employee.

Citizens often wonder whether it is possible to take out a mortgage loan from a bank without an income certificate. As you know, the number of people who have income but are not officially employed in Russia is large. Most of them will be denied a loan.

Of course, there are also private practitioners (notaries, lawyers, etc.). They have no one to request a 2-NDFL certificate from. But such specialists can issue a certificate of income to the Federal Tax Service. It is also suitable for presentation to creditors. The same rule applies to persons who have a stable income from the use of their property. For example, they rent out their own apartments and deduct personal income tax on their income.

Not all banks are satisfied with the classic form of the 2-NDFL certificate. They develop their own forms and ask for information on the forms they provide to clients when applying for a mortgage. In this case, you should take this form to your accounting department and ask them to fill it out. Some lenders require that the forms be filled out not by employers, but by potential borrowers themselves.

If it is impossible to confirm your income with a certificate from the employer from the Tax Service, and the income certificate is filled out by the potential borrower himself, a mortgage without personal income tax can still be provided. But in this case, other requirements become more stringent. For example, a bank requests an amount of at least 30% of the total loan amount as a down payment.

Is it possible to get a mortgage without 2-NDFL?

Each Russian bank strives to attract the maximum number of clients: each client means bank profit. The bank's management is aware that it is not always possible for a mortgage applicant to provide a certificate of income in the prescribed form. Therefore, banking organizations are developing new mortgage conditions, under which the registration and provision of a 2-NDFL certificate is not necessary.

Below we will discuss ways to apply for a mortgage without providing a personal income tax certificate. Not all of them are acceptable for any bank, but still the percentage of solving the problem of obtaining a mortgage without a 2-NDFL certificate for each of them is quite high.

And most importantly: any of them is legal. Unscrupulous applicants, in an effort to obtain a housing loan, consider it possible to indulge in fraud: issuing a fake income certificate.

Banks approach checking information about a mortgage applicant with great responsibility, because a home loan involves a loan for a large amount and for a long period.

The 2-NDFL certificate undergoes several checks:

- Verifying the authenticity of the official seal;

- Calling the employer to clarify whether the applicant is among the organization’s employees;

- Accessing databases to verify the authenticity of the employer’s details (to exclude cases of a certificate being provided by an organization undergoing bankruptcy proceedings).

If a fake is discovered, the bank will not only refuse the applicant a loan: it is possible that the financial institution will sue him under the article “Fraud.”

And using a legal option for obtaining a mortgage (alone or in combination with others) may be effective, even if not in relation to any bank. Provided that the applicant studies the mortgage programs and offers of different banks, he will find a financial organization that will agree to approve the mortgage.

What to do if you can’t get it

If the future borrower cannot obtain a certificate of income in form 2NDFL, then he will need to provide the bank with other information about his income. This document can be replaced by other certificates and papers:

- personal account statement;

- income certificate in the form of a bank;

- documents confirming regular active or passive income - apartment rental agreement, documents on ownership of securities, service agreement, etc.

If it is impossible to obtain a certificate from the accounting department, the borrower must provide the bank with all documentary evidence that he regularly receives income, otherwise the lender will not be able to assess his reliability and solvency.

A bank income certificate is the main document on the basis of which the bank makes a decision on issuing a mortgage. It is checked first of all, establishing the reliability of the specified data. Without this certificate, you can get a mortgage, but in this case the interest rate will be slightly higher.

Simplified mortgage processing

Many banks offer borrowers a mortgage with a minimum of documents. The required document to present is a Russian passport with permanent registration.

The second document could be:

- TIN;

- SNILS;

- Driver's license;

- Military ID, etc.

Just from the passport data, the bank can learn a lot about a potential borrower, including obtaining information about his financial solvency through an analysis of his credit history.

Provided that documents on income are provided (tax returns, bank certificates) confirming that the client’s earnings are high enough, the bank can turn a blind eye to the absence of a 2-NDFL certificate.

Naturally, the bank will offer housing loan terms that differ from a standard mortgage. After all, when lending to such a borrower, a financial institution risks more than in the case of issuing a mortgage to a person with an official income.

See the same topic: All about the income tax refund from the mortgage in [y] year

Bank:

- Will shorten the loan term (in such cases, the maximum loan repayment period is 20 years instead of the standard 30 years);

- Will require the borrower to make an enlarged down payment (40-50% of the estimated value of the collateral housing instead of the standard 20-25%);

- Will increase the interest rate (approximately up to 12.5-14% per annum).

But the housing loan will be approved and received by the borrower.

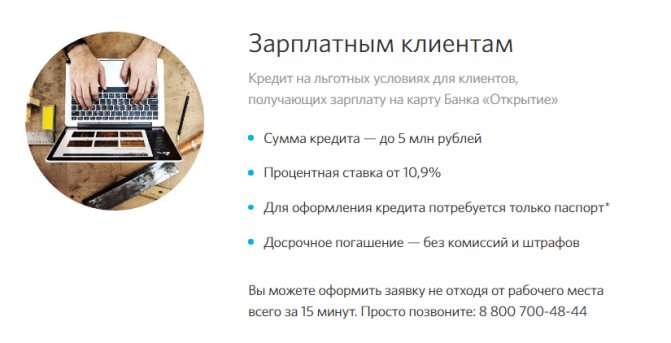

Registration of a mortgage by a bank's salary client

Salary clients are a special category entitled to a number of benefits. Typically, banks provide such borrowers with a mortgage loan at a lower relative standard interest rate.

But payroll clients have another advantage: they have the right not to submit a 2-NDFL certificate to the bank, since the bank has a clear picture of the status of their clients’ accounts and movements on them. Therefore, when applying for a mortgage, a potential borrower can provide a salary account statement as proof of creditworthiness.

Registration of a mortgage with additional collateral

Typically, a mortgage loan is taken out in order to use the borrowed money to buy real estate. In addition to the object of the loan, it also serves as collateral for the mortgage.

When applying for a mortgage, the borrower has the right to provide the bank with additional collateral, which can be real estate or a car that he owns.

When considering the application, the bank takes into account the borrower’s provision of additional collateral, which is clearly demonstrated by the mortgage loan application form. It must have a field to fill out, reserved for the assets of the potential borrower: open bank accounts, personal transport, real estate.

If the applicant has significant additional security, the bank may forgive him for his inability to issue a 2-NDFL certificate, although not every bank will agree to such lending.

Registration of a mortgage with co-borrowers and/or guarantors

Security for a mortgage can be expressed not only in the form of collateral. Guarantees for loan repayment can be provided by co-borrowers or guarantors with a high monthly income.

The co-borrower, along with the borrower, is financially responsible for paying off the mortgage. He pays his share of the loan as agreed with the borrower in turn with him or by investing his share in each monthly payment. If the borrower cannot pay the loan debt, by law the bank has the right to demand repayment of the debt from the co-borrower.

The guarantor does not participate in the ongoing payments of the mortgage loan. However, if the borrower is objectively unable to repay the debt, the guarantor will have to do this by court decision.

The co-borrower and the guarantor differ from each other not only in their obligations, but also in their rights to the mortgaged property: the co-borrower owns a share of the housing being purchased or under construction, while the guarantor does not have such rights.