Making payments on a mortgage loan at VTB 24

The Russian bank VTB 24 allows you to repay your mortgage debt both partially and completely, even if you have been registered for three weeks already. You will not be fined or incur any penalties for this. Premature settlement is somewhat similar to paying off debt on conventional loans.

In this case, mandatory payments must go in parallel with early repayment. 15 working days in advance. Such payment for early payment must amount to at least 15,000 rubles .

Payment can be made in the following ways:

- Transfer by mail.

- At any bank branch (cash desk).

- Using Telebank (in case you need to deposit a sum of money remotely).

- ATM that accepts cash or plastic cards.

Early repayment of mortgage from VTB 24

For most banks, early repayment of a mortgage loan is unprofitable. In this case, the financial organization receives a minimum income. Some banks stipulate in a separate clause in the agreement that in case of early repayment of the loan by the borrower, the latter is even subject to penalties. Thus, he can repay the loan only with pre-agreed minimum payments once a month for a specified period of time.

Subsequently, the Government of the Russian Federation adopted a number of amendments to the legislation, thanks to which early repayment of mortgage debt became possible from the first day of the contract. This condition also applies to mortgages from VTB 24. But before you start making payments in large amounts, you must notify the credit institution about this.

Making a mortgage payment

VTB 24, like other financial organizations, accepts early partial or full repayment of mortgage debt obligations. This becomes possible from the first day of entry into force of the agreement between the bank and the borrower, and there are no penalties for early repayment.

The payment made, or rather its minimum part specified in the contract, goes to write off the principal debt, and the amount paid in excess will have to be written off by the bank from the client’s account only if they have written a corresponding application. The client must notify the bank with this document at least 15 days before the next date for writing off the mortgage payment. VTB 24 Bank has a restriction - only payments whose value is more than 15 thousand rubles are accepted for write-off for early repayment.

You can pay off your mortgage debt in one of the following ways:

- directly through the bank's cash desk;

- at an ATM with a cash withdrawal function;

- at an ATM using a plastic card from which the payment will be transferred;

- to Russian Post offices;

- via Telebank remote access.

Making changes to the payment schedule

Any loan is associated with an overpayment. The longer the loan period, the more the client overpays in interest for using it. It is precisely to reduce the level of overpayment that VTB 24 offers an early repayment service for mortgages.

You yourself will be able to choose the most suitable terms for you under the mortgage agreement upon partial early repayment. Using the online calculator on the bank's website, you can calculate the amount of the payment.

Advantages of early repayment of a mortgage loan:

- the client will be able to free himself from the debt burden faster;

- the apartment will quickly become the property of the client from the bank, he will be able to dispose of it at his own discretion;

- early repayment reduces the amount of the monthly payment, which means that the burden on the family budget is reduced.

To visualize all the benefits of early repayment of a mortgage, translated into cash equivalent, you can use a special calculator located on the VTB 24 website.

When paying off part of the mortgage debt in advance, there are several options for changing the terms of the agreement:

- Other conditions remain the same, but the amount of the monthly payment changes downwards.

- The amount of monthly payments is maintained, but the loan term is reduced.

Adjustments to the payment schedule

Long-term repayment always implies significant overpayments. Subsequently, early repayment of mortgage debt was accepted at VTB 24. The reason for this may also be the issuance of a loan from a new bank on more optimal terms.

The positive aspects of this repayment method are:

- Making the client's life easier.

- The housing will soon become yours - and you can already dispose of it at your own request.

- Reduced pressure on the family wallet, as the amount of each payment per month decreases.

The VTB 24 Bank online calculator will clearly prove to you the veracity of all the above advantages and will help you calculate everything exactly down to the last penny.

download the calculator in XLS format from this link.

When paying off part of the mortgage debt, you can agree in advance on a couple of options for changing the terms of the agreement:

- All conditions remain the same, only the payment for early repayment will change.

- All conditions will be the same, only the loan period will be reduced.

Having chosen the appropriate option, the client and the manager draw up an additional agreement, where all changes are recorded, and confirm it with the main agreement.

Procedure for renting an apartment after full payment

At the very beginning of the procedure, the former borrower needs to come to the bank and receive a mortgage note with a note on full repayment of the debt - VTB-24, like other banks, issues it immediately upon the client’s personal application to the branch, but only if there are information about repaid debt. There, an application to remove the encumbrance is drawn up and certified by bank employees. The client also needs to receive a certificate in the bank’s form confirming full fulfillment of obligations and the absence of claims.

Information: at VTB-24, a certificate of full repayment of the debt is not issued free of charge - 1000 rubles for preparing the document within three days (the document can be prepared in 28 days, but in this case you will not have to pay for it). This fee is always specified in the mortgage agreement.

After receiving these papers, the applicant must draw up a complete package of documents necessary to remove the encumbrance. It consists of:

- Originals and copies of internal passports of the Russian Federation of all property owners. The original is needed only so that Rosreestr employees are convinced of the genuine nature of the documents - the original is returned, and the copy remains with the registration authorities.

- Application requesting the removal of the encumbrance.

- Original and copy of the mortgage agreement. The document must be drawn up in full accordance with Art. 9 of the Federal Law “On Mortgage (Pledge of Real Estate)” dated July 16, 1998 N 102-FZ, otherwise the process of removing the encumbrance will stop, since drawing up a document in an illegal form implies the illegal nature of the bank issuing a mortgage.

- Certificate of debt repayment and no claims. Bank employees are required to issue it if the borrower has actually repaid the loan and contacted the branch with a request to draw up this document.

- The original mortgage note and its copy. The mortgage must contain a note indicating full repayment of the debt as part of the mortgage lending.

- Certificate of registration of property rights or an extract from the Unified State Register of Real Estate confirming the right to property.

Information: as of July 15, 2017, a certificate of registration of ownership of the property is no longer issued; instead, the owner of the property can receive from the territorial bodies of Rosreestr an extract from the Unified State Register of Real Estate, certifying the registration of ownership of the object - it performs the same functions. - Original and copy of a document confirming payment of the state fee for issuing a new extract.

As of 2020, the cost of producing a new document is 200 rubles for individuals and 600 rubles for legal entities, in electronic form - 150 and 300 rubles, respectively. You can pay the fee through Internet banking, terminals (including terminals located in the MFC), ATMs or electronic payment systems. You can also pay the fee through the cash desk of any Russian bank. - Original and copy of the purchase and sale agreement for mortgaged real estate. The data in the purchase and sale agreement and in the mortgage agreement must necessarily agree: the same address of the property, information about the technical condition of the property, and so on.

After collecting the papers, the apartment owners bring the entire package of documents to the MFC or to the territorial body of Rosreestr (you can find out how the procedure for removing the mortgage encumbrance in Rosreestr, MFC and State Services and what documents are needed for this can be found here). It is necessary to separately note that if the procedure does not include powers of attorney for third parties, all home owners must submit documents personally, otherwise Rosreestr may not accept the documents - the absence of one of the owners may be regarded as refusal or disagreement with the procedure.

Within the period established by law, the applicant either receives a ready-made extract with a note indicating that there is no encumbrance, or he is given a notice of suspension of the process due to an incomplete package of documents.

Partial repayment of a mortgage loan at VTB 24

Mortgages are a rather slippery subject. Here it is - and here are the incomprehensible interest rates on it. We strongly recommend that you carefully read what conditions VTB 24 provides for partial loan repayment.

Now at VTB 24 it is quite possible to partially and early repay the debt. You have a card linked to the agreement. It is on it that a certain amount of money should be located. You, like many others, cannot carry out this operation on your own.

You can call your manager by phone and find out all the details. Next, you come to VTB 24 and fill out an application to withdraw a certain amount of money from your card to pay for the loan, excluding the minimum monthly payment. The telephone number for Moscow is +7 and the telephone number for the regions is 8 .

Required documents to repay a mortgage loan

Having completed the necessary documents for a loan agreement, in this case for a mortgage, you receive a schedule (dates and required amounts) for the receipt of funds to pay the loan. If this schedule is missing or lost, you can contact the manager, through the remote Telebank system or directly at the branch.

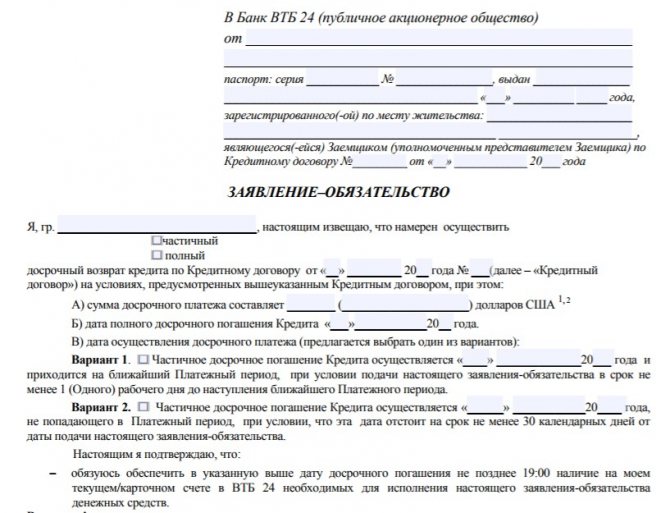

It is mandatory to submit an application for early repayment in advance to VTB 24, paying attention to the payment period scheme. Maximum – one day before payment is due in a certain period.

Payment of a loan outside the time frame requires an application written no later than thirty working days.

A certain amount is also required in the account assigned to this agreement in order to write it off against the debt on this loan. Payment is made exactly on the due date for mandatory payments.

Features of early repayment at VTB

Applying to VTB for a mortgage is due to the high rating of the financial institution and reasonable rates. A big advantage is the possibility of early settlement with the bank without paying a commission.

The payer under any type of mortgage agreement has the right to contribute additional funds. This money is not taken into account when initially calculating the amount of payment for using the loan (here both the “body” of the loan and the assigned interest).

To make a transfer using an early payment, you need to draw up and submit an application that will display dated information about the next deadline for transferring funds on which interest is not charged.

It is recommended to make the application one day before the expected deposit of funds, since according to the terms of the credit institution, the mortgage loan holder must send a notification by 18:00 on the working day before payment. It is important to pay attention to the correctness of the written dates, because if there is erroneous information or failure to meet deadlines (it is important to comply with the requirement to send the application one business day in advance), this financial procedure will not be successful and interest for closing a housing loan ahead of schedule will not be taken into account.

Before transferring the amount of the early investment, you should check with the consultants of the banking organization whether your application has been received and whether it is currently possible to carry out the procedure for early write-off of mortgage funds at VTB Bank.

Early repayment calculator

Regardless of whether you will make mortgage payments in full or in parts, on the official website, even more for yourself, calculate the amount that you will have to pay later. You can also find out more details in the financial department of VTB 24.

As a result, you will be able to see the overall picture of early debt repayment. Particular attention should be paid to those who are planning early payment. This is due to the fact that even any missing amount will cause complications when closing the loan agreement.

Partial repayment

The partial repayment procedure is a little more complicated than the procedure for full repayment of a debt obligation. Any borrower should be aware of the presence of pitfalls. One of the problems is the limit on the funds contributed to partially close the loan. Here, the minimum amount for early repayment will be 15 thousand rubles.

You should study the following algorithm for making a partial early payment to your account:

- Come to the branch 24 hours in advance to notify the credit institution of your decision (notification can also be sent remotely). If there is an overdue debt, you should pay it off first.

- Transfer funds for the loan on the day specified in your payment schedule. If the funds are in your account later than 7 pm, then the application for partial repayment of the debt will not be accepted. A financial institution may apply a fine to a client if payment deadlines are violated. Accordingly, funds must always be deposited on time, ideally in advance.

- Check out the new schedule. The remaining amount of the debt obligation due to early closure of the debt will be different. The banking institution will provide a choice of options for reducing the debt burden: reduce the amount of a one-time payment or reduce the total number of payments.

- Pay off the arrears on your housing loan, if any.

- Remember that early repayment made on a date other than the payment date will not save you from the next replenishment of your account according to the schedule.

Upon completion of the housing loan agreement with part of the funds or in full, the borrower has the right to receive a refund of part of the interest already paid. The owner has the right to a tax deduction for the purchase of housing with a mortgage upon receipt of a certificate of ownership of the property. After one calendar year has passed from this point, you can apply for a refund. You will not be able to receive financial compensation for the years prior to the official purchase.

Let's look at an individual example. The owner of the property participated in the shared construction of an apartment building. The delivery of the property took years, but he took ownership only upon the issuance of a certificate. It is the date indicated in the certificate that will be considered the starting point for receiving compensation in the future.

See this same topic: Where can I find the cheapest mortgage insurance in [y] year?

But you can get a deduction for all periods following the year of purchase. Money will be credited every year until the balance of funds due is completely spent.

Repayment in full

Having the necessary amount of money to fully cover the loan immediately deprives you of debt on the loan. At VTB 24 you can solve the issue of credit debt this way. But there may be nuances here.

You can pay the loan at any time convenient for you (meaning the days of the week the bank is open). You are required to notify the financial institution of your decision and submit an application to the bank no later than 24 hours before making the payment.

There is one more point, without which you can’t go anywhere. Early payment of the mortgage must be made within the time period specified by you in the original application.

The money must be in the account before 19.00 Russian time inclusive, otherwise your application will be cancelled, but it is possible to repeat this operation. All you have to do is write a new application.

Repayment using government support funds

VTB 24, as a bank with state participation and a lender participating in the implementation of government programs, does not have the right to refuse a borrower to repay a mortgage using state support funds.

In 2020, the following categories of borrowers will have the opportunity to fully or partially repay a mortgage loan at VTB using targeted funds:

- Holders of maternity capital certificates, the funds of which can be used to repay the down payment or debt on a previously issued loan;

- Families in which a third child or subsequent children will appear from 2020 to 2022. This category of families with outstanding mortgage loans has the right to receive a subsidy from the state in the amount of 450,000 rubles, which can be used to repay the principal debt on the mortgage or interest, if the body of the loan is written off, the subsidy is not fully used.

Both assistance can only be used once. However, the procedure for repayment using such funds will differ. So, for example, in order to repay a loan with maternal capital, the borrower first needs to obtain a certificate and obtain permission from the Pension Fund.

When repaying a mortgage with a subsidy, an application is submitted to the credit institution, after which the lender submits the documents to JSC DOM. RF. And only after verification and consideration of the application, the company will transfer state support funds to VTB 24.

Closing a mortgage loan agreement

Almost no one knows that paying all payments under a loan agreement does not mean that it is closed. You need to do a number of procedures, otherwise the mortgage will appear to you as an open loan in the BKI.

Partial early repayment is not particularly important here, but if payment has been made in full, then be extremely vigilant and go through all the stages of completely closing the loan agreement with VTB 24.

This requires an additional transaction on the occasion of closing the loan. You need to draw up an agreement at the bank, in which the basis is the client’s will. The mortgage card account will also be cancelled.

In your presence, the bank manager must destroy the plastic by swiping it along a magnetic line. Plus, you will submit an application to cancel the card.

The time frame within which the bank deems it necessary to close the credit account completely is uncertain. After all the necessary stages have been completed, the client has every right to take a notarized document from a VTB Bank branch, so that they have no more questions for him. This paper will resolve any situation in the BKI if questions begin to arise for you. This is what happens in practice.

Next, you should go to the insurance company so that all funds paid under this loan agreement are returned to you. You should remove the encumbrance from your home by contacting the registration chamber with an application.

Principles and procedures for closing a mortgage loan

To use funds to partially or fully repay a home loan, you must go through the following list of steps:

- Submit an application to close a mortgage loan at an operational branch of a banking institution in person or in your VTB Online personal account. You can also use the support phone number, but then you will not have a document confirming the transaction. Be prepared to indicate personal information (full name, passport information), as well as information on your mortgage agreement (time of conclusion and corresponding number) and deadlines for making payment.

- Choose the most convenient option for changing the loan agreement: shortening the payment period or reducing the payment amount. To independently calculate the most profitable method, it is recommended to use an online calculator.

- Replenish funds to your account in a timely manner.

See this same topic: What is an apartment mortgage?

When submitting an application at the office of a credit institution, it contains information on the amount deposited, your interest on the loan, and the date it is credited to the account.

conclusions

Paying debts in advance at VTB 24 has such advantages as saving on interest, reducing terms, and the absence of service surcharges and any sanctions. You can see a clear example of the benefits on the official VTB 24 website in a special section - online calculator. The sooner you say goodbye to the loan, the sooner your home will be in your hands and you will be able to dispose of it as you wish. Until this moment, it is far from your property. Plus a refund from the insurance company is a nice bonus after significant expenses.

Pay attention to the paperwork at VTB Bank. It is important to do all this correctly, in order to then close the current account, cancel the card and receive a message that the bank has no further claims against you.

Afterwards, the registration chamber will make a note that you are now the new owner of the home!