The legal topic is very complex, but in this article we will try to answer the question “Law on reducing mortgage interest 2020 for those who have already taken out a loan.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

Alexey Izotov, a member of the State Duma Committee on the Financial Market, recalled the paradoxical situation when the borrower reaches an amicable agreement with the lender, the property is transferred to the latter’s balance sheet, but the citizen is not relieved of the obligation to pay the enforcement fee.

Law on reducing mortgage interest 2020 for those already taken

If you need assistance of a legal nature (you have a complex case and you don’t know how to fill out documents, the MFC unreasonably requires additional papers and certificates or refuses them altogether), then we offer free legal advice:

Mortgage Interest Reduction Law 2020

The measure also applies to cases where the property pledged by him was sold at auction to pay off the debt. Citizens who, for one reason or another, could not cope with the credit burden and lost in court to the bank. This is a very painful topic for people, very complex. The adopted law not only removes vulnerable categories of citizens from the sanctioning influence of bailiffs, but also changes one of the principles for calculating the enforcement fee, which today is actually another punishment for some categories of borrowers.

“A mortgage rate of 7% is a prospect for the next one or two years. According to AHML forecasts, by the end of 2020 average mortgage rates will be around 8%,” said AHML General Director Alexander Plutnik. In turn, Sberbank on Thursday, March 1, already promised to reduce the rate.

Is it possible to get a mortgage in foreign currency?

If a few years ago there were no difficulties in obtaining a mortgage in foreign currency, today most banks issue mortgages in rubles. This was caused by global changes in the foreign exchange market and the depreciation of the ruble. Such venerable market participants as Sberbank, VTB24, Unicreditbank and others have curtailed their mortgage lending programs. Today, you can get a mortgage in foreign currency only in two banks: Energotransbank and Moskommertsbank.

Putin reduces mortgage interest rates 2020

Since the beginning of 2020, about 2.7 thousand mortgage loans have been issued in the region for a total amount of about 4.2 billion rubles. The Novosibirsk region has seen a boom in mortgage lending. According to experts, the main reason is rates that have dropped to historic lows.

Presidential decree on reducing mortgage interest rates in 2020

He also recalled that there are separate programs for mortgage lending for large families. In addition, families will be able to refinance existing loans with a rate reduction of up to six percent.

“Rates at 8-9% are a realistic scenario that can be implemented by the end of 2020 if we do not see strong shocks in the economy,” Deev said. Minister of Economic Development Maxim Oreshkin said that mortgage rates in 2020 could drop to 8-9%. According to him, they are already reaching 10% today and therefore will be able to decline by next year. It will be possible to make rates lower due to low inflation, which the Central Bank keeps at 4%.

This is interesting: News on major repairs 2020

What stocks to buy to get big dividends in 2020

A reliable reference point is the RTS and MICEX indices on the Russian market and the Nasdaq and S&P 500 on the American market. Financial advisor and asset manager Andrey Chernykh does not recommend buying shares when the market is down. And when indices are rising, he advises looking at those sectors that you understand. From these, you need to choose strong securities (blue chips) with a good dividend yield and carefully buy them in stages, forming a portfolio.

Financial analysts predict that, for example, dividends on shares of Tatneft in 2020 will be at the level of 12%, Gazprom - 8.5-15%, Norilsk Nickel - 9-12%, LSR - 10.5 %. But keep in mind that things can change.

Mortgage Interest Reduction Law 2020

But those who took out a loan six months or two years ago are more concerned about another question: is it possible to reduce the interest rate on the existing mortgage? On the one hand, for banks, a revision of the current mortgage terms will actually mean a loss of profit, and a considerable one.

Putin reduces mortgage interest rates 2020

The New Year 2020 was marked by a number of changes related to the provision of mortgage loans. The latest news on this topic says that the amendments were made on the personal instructions of V.V. Putin. The President of the Russian Federation instructed the Government to develop a number of rules that will help determine target areas and procedures for subsidizing mortgages.

- the birth of a child and the need to incur additional expenses;

- unforeseen deterioration in financial situation, change of job, unfavorable change in health status;

- desire to close the loan early on favorable terms.

And they submit documents to the Government confirming the fulfillment of the requirements of the participant in the subsidy program. The state transfers the right to the banks themselves to resolve such issues. An interesting point of the program is that it is possible to refinance an already taken loan, if only it was issued, again, for a new building. Moreover, they can even refinance several mortgages into one, thereby reducing their costs and making working with the bank more convenient.

How to reduce your mortgage interest

If a family wants to refinance a previously taken out mortgage loan, then they can only turn to banks, but not to JSC AHML. The applicant should not have arrears on the loan or other negative aspects that may affect the final decision.

Sberbank also agrees to make concessions to its reliable clients and analyzes applications for refinancing your own home loan, thereby you can achieve a reduction in interest on your existing mortgage from Sberbank in 2020. If you approach the issue from the right side, you can significantly reduce the amount of the monthly payment, or the total balance of the debt.

What is more profitable: a mortgage in rubles or dollars

It all depends on the currency in which the borrower receives his salary, as well as the stability of the employing organization. But under any circumstances, the risk of a ruble mortgage is significantly lower than that of a foreign currency mortgage. This indicates that it is better to take out a housing loan in rubles, even if the salary is paid in euros or dollars.

Currently, according to Central Bank statistics, the average rate on ruble loans is 9.8% per annum, and when refinancing you can expect 8–9%. The Ministry of Construction forecasts a further reduction in the rate, so financing in rubles will become even more profitable.

Important! The advantage of the domestic currency is that inflation gradually eats up part of the amount. The 100 thousand rubles taken 10 years ago have become significantly cheaper today, as salaries and budget contributions have increased. In the case of dollars or euros, you can’t count on this if you pay attention to the exchange rate statistics. It is possible that the situation will turn out the other way and the ruble will rise in price sharply. But it is difficult to imagine how this phenomenon will affect the real estate market and services provided in the banking sector.

There are currently no advantages of foreign currency mortgages, since the range of current offers from banks is catastrophically narrow. The state has some influence on this, increasing the risks of creditors. And if you analyze the parameters of ruble mortgage loans over the past few years, you can see that the most favorable conditions are currently observed in terms of requirements and interest rates.

A law has been passed to reduce mortgage rates

The basic conditions for purchasing an apartment on the secondary market are now as follows: Overview of the current amount of fees for using a loan when purchasing an apartment on the primary market: The tables show the average values of the indicator. As part of promotions carried out by each bank, the rate may be lower.

Conditions for reducing the interest rate on an existing mortgage

Federal Law No. 151 is the basis for the functioning of MFOs. On its basis, microfinance organizations are included in the register of the Central Bank of the Russian Federation on a paid basis. Currently, the lending market is gaining momentum, developing and improving its services.

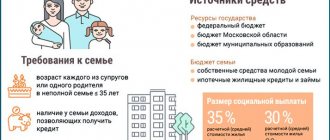

The government decree expects that the provision of preferential mortgages at 6 percent for the birth of a second and subsequent child after January 1, 2020 will begin to apply on April 13, 2020.

What will happen to real estate prices in 2020

Urban housing prices are growing steadily. And this trend is likely to continue. Marketing Director of LEGENDA Vsevolod Glazunov notes that the increase in prices that is now observed in the primary market is not associated with the introduction of a scheme of work through escrow accounts and project financing. Today, only a small number of developers are working under the new scheme, and the main pool of projects is being implemented according to the old scheme. Therefore, we will be able to observe the first results of this transition only in the next 1.5–2 years. Currently, prices on the primary market still depend primarily on the location of the facilities and the stage of project implementation.

Law on reducing the interest rate on mortgages 2020 for the second

Thus, families will have the opportunity to lower the rate of the current mortgage loan taken from the beginning of the year, or the future. In August 2020, on behalf of V.V. Putin introduced rules according to which families with more than three children can now take advantage of state support.

Refinancing after the birth of the second and third child at 6 percent in 2020

The program provides for the purchase of apartments only on the primary market, that is, in houses under construction. President Vladimir Putin believes that the actual unavailability of inexpensive mortgage loans for families with two or more children is a mistake by the government, in particular the Ministry of Finance.

Mortgage refinancing in order to reduce the interest rate in 2020 will be available to Sberbank clients on the following conditions: The following real estate can be collateral for a mortgage refinancing transaction: housing in an apartment building (apartment); town house; individual residential building; separate residential premises owned by the applicant (for example, a room); the borrower's share in an apartment or private house; a plot of land with a residential building located on it.

This is interesting: Apartment purchase and sale agreement sample 2020 between individuals

Mortgage Rate Reduction Act 2020

According to the agency, this year the mortgage market will not be able to repeat last year’s record: the volume of issuance will not exceed 2.5–2.6 trillion rubles, which is 10-15% less than in 2020. At the beginning of the month, the head of Sberbank, German Gref, said that rates on mortgage loans would begin to decline this year, but could not specify whether to 8% or 9%. It was previously stated that a reduction to the target would not happen in the near future - it would take a whole year. The Ministry of Finance has prepared a draft government resolution in this regard; it is posted on the Federal Portal of Draft Regulatory Legal Acts. In particular, the document states that the subsidy will be provided to a family even if the second or third child in it was born on the last day of the program - December 31, 2022. These families will be able to receive assistance until March 31, 2023.

What is known about the reduction in mortgage interest rates in 2020

According to analysts, such measures will entail not only positive, but also negative consequences. However, do not rush to delude yourself about this; in the near future, rates will be maintained, at least until the end of this year.

Mortgages currently paying off high-interest loans are lucky - they have the opportunity to reduce the severity of their burden by reducing their monthly payments. This is easy to do: you need to come to the bank and write an application for a reduction in the interest rate established by the loan agreement and wait about a month. Somewhere you are allowed to apply for a reduction online.

Terms of foreign currency mortgage

An initial fee

In order for Moskommertsbank to issue a foreign currency mortgage, you must have a down payment of at least 20% of the total cost of the home (the interest rate on the loan will depend on the amount of this amount). Energotransbank is more loyal in this matter: the down payment can be anything or none at all.

Amount of credit

Energotransbank is also loyal in the amount of the loan provided: it can be up to 30 million rubles (in currency equivalent). At the time of writing, these amounts are about 450 thousand dollars and 390 thousand euros, respectively. Unlike Energotransbank, Moskommertsbank does not issue mortgages in euros (only in dollars) and limits the maximum amount to $300 thousand.

Prerequisites

To get a foreign currency mortgage loan from Moskommertsbank, you have to select an apartment or house from the bank’s collateral database. Any real estate object, except land, must be insured against loss or damage. The amount of insurance must be equal to the full value of the property or the amount of the issued loan (if the cost of housing exceeds the amount of the issued mortgage) - this is an indispensable condition of the bank.

Energotransbank puts forward security in the form of collateral as its main condition, but does not oblige you to insure the object. Until you pay off the mortgage, the property you purchased will be pledged to the bank.

Loan terms and interest rates

The minimum loan term in both banks starts from one year. At the same time, the maximum loan term in Energotransbank is 10 years, in Moskommertsbank - 15 years.

Important! In the first bank, the interest rate does not depend on conditions other than the loan currency: in dollars - 8.5%; in euros - 8%. At Moskommertsbank, its level is also influenced by the amount of the down payment and the period for which you take out the loan (see table):

| An initial fee | Loan term up to 7 years | Loan term from 7 to 15 years |

| 20-30% | 11% | 11,50% |

| 30-50% | 10% | 10,50% |

| more than 50% | 9,50% | 10% |

Law on reducing mortgage interest, what has been done

avoidance of delays, non-payments during the entire payment period, confirmation of solvency, impeccable credit history of the borrower, the need to attract a guarantor or co-borrower based on the lending bank’s program, liquidity of the property, absence of possible claims from former owners, which is verified based on a request for transfer of ownership to an apartment or other residential property, the presence of the consent of the spouse in the joint property regime when the borrower is married, the absence of registered minors or minors in the collateral object in case of renewal of the contract through refinancing.

Do you want to reduce your mortgage rate? We found 5 ways!

There are two ways here, if you are not overdue and can make payments: Take out a new loan and pay off all existing ones at once in one fell swoop, and then pay only one new bank, but at a lower rate. One payment per month is better than several. This is called “Refinancing”.

He also recalled that there are separate programs for mortgage lending for large families. In addition, families will be able to refinance existing loans with a rate reduction of up to six percent.

Mortgage Interest Reduction Law 2020

For three years, until September 1, 2021, the state will help you pay interest on your mortgage loan. The subsidy period is 3 years. The program lasts from January 1, 2020 to December 31, 2022, so families in which children were born before or after this period cannot count on such state support.

Putin reduces mortgage interest rates 2020

This is certainly Vladimir Putin, President of the Russian Federation. Putin also said that last year about a million mortgage loans were issued in Russia. Now we have the opportunity, without accelerating inflation and maintaining a very careful, responsible approach, to gradually reduce interest rates and increase the availability of loans. I am counting on support from the Bank of Russia here.

Conclusion Mortgage lending is a very important area in the activities of banks, since it allows citizens to purchase residential real estate on fairly favorable terms. How to Lower Your Mortgage Rate In 2020, many borrowers have already successfully lowered their prevailing mortgage rates. Banks accept applications from their clients and often allow them to take this step.

This is interesting: Veteran of federal significance Tomsk

In the near future, the average down payment amount will be fixed at 20-25%, experts say. This factor also helps to increase demand, since the entry barrier to purchasing your own apartment is reduced.

Law on reducing interest on existing mortgage loans 2020

The question arises, what should ordinary citizens do to avoid aggravating the situation with the purchase of real estate by waiting until 2020? According to experts, since some banks are currently offering mortgage lending at 9.5% or other “favorable” figures, you should hurry. Otherwise, an increase in interest rates on loans in the future is quite possible.

It is convenient to get a new loan from the same bank that issued the first one. In this case, paperwork is reduced and the need for some payments (real estate appraisal, insurance, transfer of collateral to a new lender) is eliminated. However, only a few practice refinancing their own borrowers.

- Signing a new contract or additional agreement to an existing one . Refinancing can occur both within one credit institution and when moving from one bank to another. In any case, when refinancing, a new mortgage is issued. To do this, a standard package of documents is provided, the bank conducts an inspection and only after that makes a decision.

- Debt restructuring . It is carried out both in relation to clients whose financial condition has worsened, and those who, on the contrary, have increased their income. In the first case, this is just an attempt to maintain the borrower’s solvency and extend the loan term. In the second case, this means a beneficial reduction in interest rates and a reduction in debt repayment terms. You will only need to submit a 2-NDFL certificate to the bank with the client’s increased income level.

- Changing the mortgage program . If the loan terms change, you will need to prove your new preferential status. As a rule, there are many such applicants, and clients have to make efforts to become a happy participant in the state mortgage program.

- Judicial rate reduction . In court, the rate can be reduced only if the plaintiff manages to prove that the borrower was misled or hidden bank commissions were charged. Litigation requires additional costs, which are not always justified, because the courts rarely make a positive decision on them.

What is the benefit of reducing rates within one bank?

Before deciding to refinance, you need to evaluate the hypothetical savings. The general rule is: the lower the remaining amount to be paid and the term of the mortgage, the less advisable it is to refinance, and vice versa.

- Mortgage 6 percent from 2020: Putin’s decree

- Subsidizing a mortgage at 6 percent upon the birth of a second child

- At the birth of the third child

- Program conditions

- How to get

- What banks

- If you have already taken out a secondary loan

- Main

In preparation for his next re-election, the current Russian president at the end of 2020 announced several new measures that will really be useful for many families and will appeal to voters. In particular, it was the first person who was entrusted with announcing government developments to increase the birth rate in the country. The situation with demographics in Russia is truly unsatisfactory, and the maternity capital program alone, especially in the form in which it has existed all these years, cannot be done.

Mortgage subsidies, interest rate reduction to 6%

The Ministry of Construction did not specify whether this means 2020 or the entire period of the program. What if mortgage interest rates in Russia decline? Indeed, in the last couple of years there has been a decline in mortgage rates. Thus, in 2020, for the first time in history, the cost of mortgages decreased on average across the country to below 10%. Against the backdrop of record low inflation and the Central Bank’s constant reduction of the key rate (and interest on any loans depends directly on it), it is quite reasonable to expect standard mortgage rates to continue at the same 6 percent in the coming years if this trend continues.

Government decision on foreign currency mortgages

Of course, the current situation could not go unnoticed by the Government of our country. The state proposed several options to solve the problem of borrowers:

- restructuring,

- refinancing,

- allocation of subsidies,

- forgiveness of part of the debt,

- bankruptcy of an individual.

The most popular among the population was the cash payment program, which allowed a number of debtors to receive a free subsidy in the amount of 10% of the debt, but not more than 600,000 rubles.

Previously, there was a special program with state support in conjunction with AHML, where borrowers with foreign currency loans could apply. Their debts were transferred to this agency, the currency was exchanged for rubles, and some of the fines could be written off. It ended in 2020.

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

Latest news: how can the government help now? Considering that the majority of foreign currency borrowers appeared 5 years ago, during this time many have already managed to solve their problems by changing the currency under the agreement to the national one.

For those who for some reason did not do this, the only option left is to go to court to declare themselves bankrupt. In this case, all debts will be written off, but the bank will have the right to take the collateral property for itself.