Getting a mortgage and its terms and conditions is a cumbersome process that forces many families to save, work tirelessly, and count the days until payments are due. This topic is especially acute for socially vulnerable segments of the population: young or large families, military personnel, teachers, etc.

Mortgages with state support at VTB 24 are a set of projects aimed at providing housing to the country's citizens in a shorter period of time and on more favorable terms.

What is a mortgage with state support?

Many people know what a standard mortgage is. This is a banking operation that is based on the bank providing the client with funds to purchase real estate. The purchased housing remains pledged to VTB, although the owner already has ownership rights to it. To become a full owner, the borrower must fulfill all obligations under the loan agreement. In case of violation of the conditions, VTB may confiscate the collateral property.

The main difference between a mortgage with state support is that part of the loan proceeds are paid not by the borrower, but by the Russian Pension Fund. Holders of state certificates can receive such assistance. Additionally, VTB has developed low rates for them.

Today, not all financial and credit organizations implement mortgage programs with state support. Only verified banks, including VTB, cooperate with the state.

Mortgage conditions with state support at VTB 24 Bank

The purpose of a mortgage loan with state support from VTB 24 can be the purchase of housing only directly from the developer in a new building. That is, a bank client can only purchase housing under construction or already completed, but only on the condition that the seller is a legal entity, a developer.

The annual interest rate on the mortgage is fixed and amounts to 11.4%. This rate applies to all borrowers. The minimum size of a mortgage with state support from VTB is 24 – 600,000 rubles, the maximum loan term is 30 years.

The maximum loan size is determined by the borrower’s solvency and is set by the credit institution individually for each client.

To purchase real estate, you will need a down payment, which must be at least 20% of the cost of the apartment under the purchase and sale agreement.

If we consider VTB 24 requirements for borrowers, it is worth noting that they are standard for mortgage offers from other credit institutions, namely:

- Registration on the territory of Russia;

- The borrower must be over 21 years of age;

- The maximum age of the client should be no more than 70 years at the end of the loan agreement;

- The borrower must have a permanent place of work.

By the way, VTB 24 Bank offers to apply for a mortgage not only using the standard 2-NDFL certificate; it is also available to apply for a loan using the VTB 24 form, which is the best option for clients who receive the bulk of their earnings unofficially.

Programs with state support at VTB

For VTB clients there are several programs involving government assistance. If the borrower fits one of them and can confirm this fact, then loyal rates and other bonuses await him.

Mortgage with maternity capital

If a second child is born in a family, then she receives a subsidy from the state. Repayment of the down payment for a mortgage at VTB with maternity capital is the most convenient option for using the subsidy. In addition, VTB clients receive additional loan benefits.

Program for young families

The “young family” category includes spouses living in an official marriage and whose age does not exceed 32 years. If spouses need to improve their living conditions and have also received a housing certificate from a government agency, then they have the right to assistance. By law, they receive half a million, which will cover the down payment of the loan. The interest rate is 9.9%.

Mortgage for the military

Military personnel who are members of the NIS can purchase mortgage housing with the help of a subsidy. This program is only suitable for those military personnel who have been NIS participants for 3 years. The bank also puts forward special requirements for the age of a military person - the borrower cannot be older than 45 years.

General terms

VTB mortgages with government support are provided to clients on the following terms:

- A down payment of 20% of the property value is required;

- a loan in the amount of up to 12 million rubles is issued for the purchase of housing;

- the loan is provided for a period from 1 year to 30 years;

- At VTB, a borrower can receive a loan at a minimum rate of 5% per year.

It is possible to make early repayment without commissions or any penalties at any stage of lending.

Requirements for clients

When contacting VTB, you need to familiarize yourself with the requirements for potential borrowers. They are as follows:

- citizenship of the Russian Federation;

- registration in the region where there is an existing VTB branch;

- age from 21 to 70 years;

- the total work experience must be 1 year, and at the last place of work - at least 3 months;

- at least secondary education.

However, the main requirement is the ability to pay off debt obligations. The client must prove this fact with a certificate of income and other documents.

Where to apply for a mortgage

Mortgages with state support are issued by a narrow circle of banks participating in this program. The conditions are dictated by the amounts and criteria of government funding, so the banks’ offers are almost identical. Therefore, the choice of borrowers is determined by the minor bonuses offered by the bank.

At VTB, regular clients are provided with a mortgage with state support and are offered participation in the Collection program with bonuses. In addition, salary card holders are exempt from issuing a 2-NDFL income certificate; the bank will independently check the amount of cash receipts into the account.

You should learn more about VTB loyalty bonuses from your credit manager, as conditions change.

Registration procedure

You can apply for a mortgage at a VTB branch. Before contacting a bank, you must ensure compliance with one of the government programs. You must write an application for a mortgage at the bank and also fill out a form. VTB reviews the application within 3 days.

The borrower is notified of the bank's decision by telephone. If it is positive, then he needs to select a property accredited by the bank or that meets its requirements, and also collect the necessary package of documents. Within 4 months, he must visit the VTB branch again to sign the agreement. After this, the loan agreement will be drawn up and come into force.

Mortgage options

Russian bank rates for mortgages range from 10% to 11.5% . The mortgage rate offered by VTB 24 has been reduced to a maximum of 9.5% per annum . It is presented in the projects “Purchasing housing on the Tuesday market or in a new building,” as well as for apartments with a living area of at least 65 square meters. m.

The lenient conditions also affected the personality of the borrower, or rather his place of residence, employment and nationality. According to the information presented on the financial company’s website:

- Registration when applying for a mortgage loan does not matter, nor does the city in which the property will be purchased. It is allowed to work and actually live in one city, and buy housing in another place.

- A potential borrower can work in any field of activity. The bank provides loans to both hired workers and private entrepreneurs, the main thing is stable income, “financial transparency” and timely repayment of debt.

- VTB 24 provides the opportunity to obtain a mortgage for foreigners. A prerequisite is documents of legal residence of an individual in Russia and an official place of work.

The official website of VTB 24 (vtb24.ru) provides an accessible view of the conditions of all current mortgage programs, including the provision of state support.

Below are the basic details and figures for a home loan.

| Program | Down payment | Bid | Duration (years) | Amount (rubles) |

| Apartment with an area of at least 65 sq.m. | From 20% | From 9.5% | Up to 30 | From 600,000 to 6 million |

| Purchasing a primary or secondary home. | From 10% | From 9.5% | ||

| Purchase of collateral housing. | From 20% | 0.1 | ||

| Loan based on two documents. | From 30% | 0.107 | 20 | From 600,000 to 15 million for provinces; Up to 30 million – for Moscow, the region and residents of St. Petersburg. |

| Refinancing | — | From 9.7% | Up to 20 – 30 | Up to 30 million |

VTB 24 has a certain risk when issuing a mortgage on such conditions, but a number of mandatory measures and requirements serve as a kind of shield and protection from unforeseen circumstances:

- Mortgage insurance (and not simple, but comprehensive). Failure to do so will result in an increase in the interest rate.

- Attracting guarantors and co-borrowers. In normal situations, spouses are guarantors for each other, but close relatives can also be involved.

- Pledge. An apartment on which a mortgage is taken or other real estate owned by the borrower becomes such a collateral option.

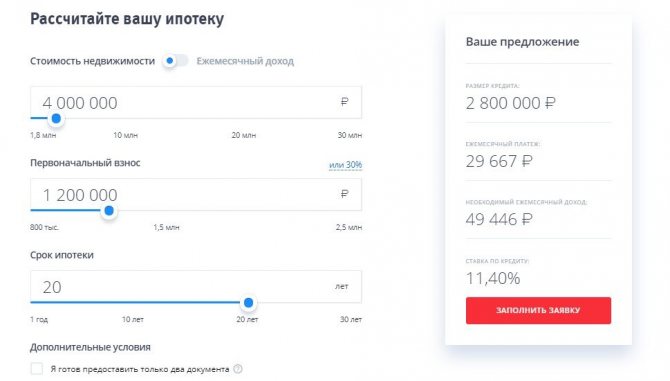

You can calculate your mortgage online on the official VTB 24 website.

The calculator will clearly and in an accessible form provide data on the allowed loan amount, monthly payment, and required income level.

Maternal capital

Maternity capital is one of the types of state support for families raising more than one child.

Assistance is provided at the birth or adoption of a second or more children. One of the most important options for managing funds is aimed at improving living conditions.

In order to repay part of the mortgage debt using state support in the form of maternal capital, the borrower needs:

- Contact any VTB 24 branch in the region where the loan was issued for information on the outstanding balance of principal and interest;

- Prepare the package of documents required by the pension fund;

- Send an application to the Russian Pension Fund for crediting maternity capital funds to pay off the mortgage;

Having made a favorable decision, the pension fund credits the money no later than 40 days from the date of submission of the application. The amount of the monthly mortgage payment is automatically reduced, and to change the loan repayment period, the borrower will need to contact the VTB 24 branch with the appropriate application.

Tax benefits

Tax deduction from the amount of a mortgage loan is a type of state support that consists in excluding a certain amount from the tax base and aimed at compensating the paid mortgage debt. Another option is to avoid paying income tax (which is withheld from your salary) in the future.

Conditions for property tax deduction:

- The amount spent on the purchase of housing should not exceed 2 million rubles, for a mortgage - 3 million;

- The tax rate is 13%;

- Such state support is provided in relation to one piece of real estate;

- You can take advantage of the tax benefit after receiving the transfer document and the title to the property;

- A tax deduction is not made if the home was purchased at the expense of the employer or other persons, when using other types of government support, and in transactions between relatives.

- The maximum tax benefit amount does not exceed 650 thousand rubles.

An example calculation looks like this:

An individual bought an apartment for 6 million rubles, of which 3 million were repaid using a mortgage loan. If we assume that the total amount of accrued interest will be 2.3 million rubles, we obtain the following results.

The maximum allowed amount of expenses for the purchase of housing (2,000,000 + 2,300,000) * 13% = 559,000 rubles, which will be returned to the borrower or not deducted from wages in the future.

Military mortgage

Military personnel who have served their required term and after three years of participation in the savings-mortgage system have the right to use the state indexed deposit, credited every year to the personal account of the NIS participant, without waiting for the end of their service period.

A mortgage with state support in VTB 24 for military personnel implies the following conditions for the use of funds:

- The purchased housing may be new or secondary;

- With a minimum period of participation in the NIS (3 years), material resources are used to repay the initial contribution, and a loan is issued for the rest of the cost of the apartment;

- The borrower has the right to repay the loan debt in subsequent terms at the expense of financial contributions from NIS from the state;

- The annual interest rate may increase if the client leaves the savings mortgage system;

- Conditions “in numbers”: from 10.9% - rate; up to 2 million 220 thousand rubles – amount; up to 14 years – debt repayment period;

Online calculator

You can calculate the amount of the monthly overpayment and the main payment yourself over several years. Calculation through the calculator for the years of mortgage lending will allow you to find out the amount of overpayment. In this case, an individual does not have to visit the branch, since all payments are carried out on the VTB website. To calculate a mortgage, you must provide the following information in the calculator form:

- property value;

- an initial fee;

- mortgage term.

After this the result will appear.

How to calculate a mortgage loan?

On its website, VTB 24 provides an online calculator with which you can make automatic calculations. The maximum mortgage amount does not exceed 30 million rubles with a down payment of 20%. In this case, the contract can be issued for 30 years. The rate of 11.9% per annum is issued only under the condition of comprehensive insurance. There are no moratoriums on early repayment, as well as any commissions.

The bank offers to calculate the amount either depending on the monthly payment or on the cost of the apartment. For example, let’s take real estate worth 3.3 million rubles for a period of 15 years. Having taken out comprehensive insurance and fulfilled the conditions for all necessary documents, the interest rate will be 11.9%. The initial payment will be equal to 660,000 rubles.

Thus, we will receive a monthly payment of 31,515 rubles, and the monthly income must be no lower than 52,525 rubles.

Package of documents

Registration at VTB Bank is a troublesome matter. The borrower will have to collect an impressive package of documents. These papers must confirm the applicant’s high income, as well as his eligibility to participate in the government program. The required documents are the following:

- Russian passport;

- SNILS;

- marriage certificate;

- children's birth certificate;

- income certificate;

- certificate from place of work;

- military ID;

- document confirming the right to a subsidy.

Sometimes VTB may ask the client to provide additional papers that confirm income.

How is a mortgage calculated?

A mortgage at VTB 24 Bank is calculated based on the value of the property or the total income of the borrower and co-borrowers.

VTB 24 Bank specialists, taking into account the amount that a client can pay monthly without affecting family income, calculate the amount of mortgage payments.

This amount is specified in the mortgage agreement.

It is also possible to provide for a deferment of mortgage payments for several years, subject to certain conditions.

Mortgage calculator

You can also calculate the amount of monthly mortgage payments yourself using a mortgage calculator.

This should be done before applying for a loan to check your ability to pay the required amount each month.

After the calculation, you can find other cheaper housing so that the mortgage amount is smaller.

You just need to enter your data in the appropriate fields, then click “Calculate” and you will receive a detailed mortgage payment schedule according to the terms of your loan.

You can also calculate how much you overpay to VTB 24 Bank if you enter into a mortgage agreement.

Useful video:

Insurance

By issuing a mortgage, VTB is exposed to a certain risk, which is associated with both the property and the borrower. To protect yourself, VTB recommends that its clients take out an insurance policy. Comprehensive insurance will cover unexpected expenses in the event of the client's disability or death, as well as if the collateral is damaged.

Insurance of the life and health of the borrower, as well as the apartment, allows you to reduce the commission by 1%.

How to apply for a mortgage from VTB with state support 2020

A Russian citizen who wants to purchase housing on preferential terms can fill out an application directly on the website. It is enough to indicate:

- city - it is not necessary to buy an apartment in the same city where the borrower lives;

- loan amount;

- size of down payment and income;

- availability of maternal capital;

- FULL NAME;

- contact phone number and email address.

If approved, the borrower is sent instructions for further processing of the mortgage loan.

Repayment procedure

According to the agreement, the VTB client must return the funds for the property to the bank, as well as pay for its services for the entire period, that is, a commission. Payment must be made every month. The monthly payment amount is specified in the contract. You can pay either through a bank cash desk or through a terminal. You can also make transfers online.

Sometimes the borrower has the opportunity to repay the loan early. VTB provides such an opportunity. In addition, the client does not receive fines or sanctions. You can pay off your mortgage early by shortening the loan term or reducing the monthly payment.

In 2020, the conditions for obtaining a mortgage with state support will appeal to many benefit recipients. A loan can be taken out for several million rubles, but not more than 8. The interest rate is 12%. The loan term can be extended up to 30 years. Military personnel, young families, families with a second child, and other categories of citizens can become participants in the program.

Military mortgage

At VTB 24, when applying for a loan, state support for military personnel is provided in cases where borrowers are members of a special savings system (NIS).

NIS is a special system of funded contributions, under the terms of which the state monthly transfers certain funds to a special account of system participants, which can be used to pay the down payment after 3 years from the date of participation in the NIS. And the rest of the missing amount is provided by the bank in the form of a mortgage loan.

Repayment of borrowed funds for the entire period of a citizen’s service is also carried out through savings contributions paid by the state.

Of course, under the terms of this lending program, you can receive a maximum amount of 2,840,000 rubles. And the maximum interest rate is only 8.8%. The loan is provided for a fairly short period (maximum 25 years). At the same time, at the time of full repayment, the borrower should not be more than 50 years old.

The down payment amount is only 15% of the cost of the purchased home.

Borrowers are subject to minimum requirements: it is enough to have work experience at the time of applying for the loan (at least 1 year).