The cost of the service is 2,900 rubles 1

15 minutes for registration

Safety of money and respect for the interests of the parties

Conduct a transaction at the Sberbank office with the secure payment service

All documents are completed online; you need to come to the Sberbank office to sign the agreement

Answers to popular questions

How does the service work?

Benefits for the buyer

Benefits for the seller

Are there any additional fees when using the service?

What documents must be provided to obtain the service?

How do the parties find out that the transaction has been registered with Rosreestr and the money has been transferred to the seller?

Where can I sign up for a secure payment service?

We changed our minds about making a deal. How to withdraw money from a nominal account?

- 1 The offer is not a public offer; for detailed information about the conditions, procedure for providing the service and its cost, please contact the mortgage lending manager of Sberbank PJSC.

“Secure Payment Service” (hereinafter also referred to as the Service) is provided by the Limited Liability Company “Real Estate Center from Sberbank” (abbreviated name LLC “CNS”, OGRN 1157746652150, address: 121170, Moscow, Kutuzovsky Prospekt, 32, bldg. 1, www.domclick.ru, above – Real Estate Center from Sberbank), is part of the Sberbank Group of Companies. The provision agreement (hereinafter also referred to as the Service Agreement) is drawn up at the Sberbank Mortgage Lending Center. PJSC Sberbank (General license of the Bank of Russia for banking operations No. 1481 dated 08/11/2015) acts as an agent of CNS LLC on the basis of agreement No. 1 dated 10/19/2015. Execution of a Service Agreement is also possible in the offices of developers (at the developer’s facilities), who act as agents of CNS LLC on the basis of agency agreements.

The provision agreement is an agreement in favor of a third party (Article 430 of the Civil Code of the Russian Federation).

The service allows participants in real estate transactions to make cashless payments using a special account. The security of payments is ensured by the special regime of a special account opened by CNS LLC in Sberbank PJSC.

The service is available for transactions of purchase and sale of apartments/rooms/shares in the right of shared ownership of residential premises, the ownership of which is formalized in accordance with the procedure established by law, as well as for agreements of participation in shared construction and agreements for the assignment of rights of claim under agreements of participation in shared construction.

When conducting transactions using mortgage lending from Sberbank PJSC, the Service can be provided only within the framework of the following products of Sberbank PJSC: “Purchase of finished housing”, “Purchase of housing under construction”. The service is not provided when using the following products of Sberbank PJSC: “Real estate objects under construction/constructed using bank credit funds”, “Use of the Bank’s individual safe when making payments for purchase and sale transactions”.

The service is also available for purchase and sale transactions of land plots (without the use of mortgage lending by Sberbank PJSC), residential premises with land plots (without the use of mortgage lending by Sberbank PJSC or with the use of mortgage lending by Sberbank PJSC within the framework of the Sberbank PJSC product “Purchase of finished housing”).

The service can be provided to individuals - citizens of the Russian Federation and legal entities registered and operating on the basis of the laws of the Russian Federation. In this case, legal entities can act exclusively as sellers of real estate or assignors (in the case of assignment of rights of claim in relation to real estate). The service can only be provided in direct transactions. The service cannot be provided in alternative transactions (“transaction chains”). Under the Service Agreement there cannot be more than two recipients of funds.

Sberbank offers its mortgage borrowers a whole line of additional services and tools designed to minimize time costs and possible risks in the transaction. One of these tools is Sberbank’s secure payment service. Let's take a closer look at what it is, as well as its operating principles and cost.

What it is

When applying for a mortgage, Sberbank clients are given the opportunity to reduce the likelihood of potential fraudulent actions from the other party and minimize the time spent on settlements. To do this, if you wish, you can use the secure payment service, which is a non-cash payment service for real estate, fully controlled by Sberbank.

In simple words, the buyer of residential/non-residential premises transfers the required amount to a special account in the CNS (Real Estate Center in Sberbank), and after successful registration in Rosreestr, the entire amount under the agreement is transferred to the seller’s bank account.

The parties to a mortgage transaction using a secure payment tool can be both private individuals and development companies.

All interested clients can use the service of such calculations in the regional mortgage centers of Sberbank when purchasing a room/apartment/share of premises on the primary and secondary markets.

NOTE! When applying for a mortgage, Sberbank's secure payment service is available only within the framework of standard programs for the purchase of finished and under construction housing.

Scheme of settlements under a letter of credit

The general order is:

1

The seller and buyer agree on a transaction using a letter of credit as a payment instrument and prepare documents.

2

The buyer provides the bank with a draft agreement with the counterparty. The bank analyzes the agreement, helps to include the terms of payment under the letter of credit and issues the letter of credit.

3

The buyer deposits money into a special bank account.

4

The seller fulfills the obligation under the contract: delivers the goods, formalizes the sale of the share, etc. And then provides supporting documents to the bank.

5

The bank checks documents confirming the fulfillment of obligations and transfers money to the buyer.

Benefits of the service

Sberbank's secure mortgage payment service has a number of undeniable advantages for both parties. Let's look at them in more detail.

For the seller

The main advantages for the seller are:

- no need to come anywhere to get money (you just need to provide the correct details for enrollment);

- exclusion of receiving counterfeit banknotes (all money is checked by the bank and credited to the account);

- instant receipt of funds under the contract after confirmation of registration with the Registration Chamber/MFC (the transfer is processed automatically).

For the buyer

Benefits for the buyer:

- no need to cash out (withdrawal from account/card);

- minimum enrollment time (it only takes 15 minutes to complete registration);

- no need to recalculate funds and place them in a safe deposit box/safe.

The buyer’s money is under the reliable protection of Sberbank until the property is encumbered and the mortgage transaction is registered. If registration is successful, the money is transferred to the seller, of which the buyer immediately receives a notification by email/SMS and in his personal account on the Dom.Click portal.

IMPORTANT! The use of the secure payment service does not guarantee the legal purity of the transaction. He guarantees that the seller will receive the money only if it is registered, but no one will thoroughly check the history of the apartment.

What are the priorities when working with the service?

By working with a secure payment service, both parties to the transaction benefit. Registration time takes a maximum of 15 minutes. After which the buyer does not need to cash out money, recalculate funds, or fill out additional documentation. Until all documentation is completed, the funds remain under the reliable protection of Sberbank. After completing all transactions, the buyer receives an electronic confirmation that the amount of money has been credited to the seller’s account. The seller also does not have to worry about the authenticity of the funds; before entering the bank account, all banknotes are checked by specialists, and there is no need to collect the amount of money in person. After the transaction is completed, the money is automatically credited to the seller's account.

How the service works

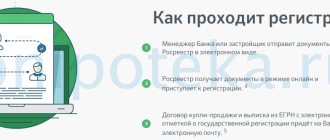

The operation of Sberbank’s secure payment service when applying for a mortgage includes the following stages:

- After concluding an agreement between the seller and the buyer, the latter deposits the required amount (down payment) into a special account in the Sberbank Real Estate Center.

- Documents are sent for electronic registration to Rosreestr.

- If everything is in order, the transaction is registered, ownership rights are transferred to the buyer, and the collateral is encumbered in favor of Sberbank.

- Money is transferred from the account in the central nervous system to the account of the selling party.

- The parties receive notifications that the transaction has taken place.

Sberbank safe transaction

Safe transaction of Sberbank.

Content.

1. Purpose of the service. 2. How the service works. 3. Advantages of the service. 4. Disadvantages of the service. 5. Cost of service. 6. Required documents. 7. Reviews.

1. Purpose of the service.

Sberbank offers its clients a number of additional services that are designed to secure and reduce transaction time. One of them is a secure payment service. The service is most often used when applying for a mortgage. The service allows real estate sellers who don't want to deal with cash to transfer money securely. In addition to the security of calculations, the calculation time is reduced. In fact, this service is nothing more than a cashless payment. Money is transferred from account to account.

The service is provided at the request of the client. Money for purchased real estate is accumulated in a special account in the Sberbank Real Estate Center. As soon as the state registration of the property has passed, the money is transferred to the seller’s account.

Anyone can use the service when buying or selling real estate. To do this, you need to contact the mortgage center of Sberbank of Russia. During a purchase and sale transaction, the secure payment service most often occurs during electronic registration of the transaction in Rosreestr.

2. How the service works. The service scheme is simple and occurs in several stages.

2.1. After concluding a purchase and sale agreement, the buyer makes a down payment to a special account of the Sberbank real estate center. Mortgage funds are also transferred there. Thus, the entire amount specified in the agreement is accumulated in this account. 2.2. A package of documents is sent electronically for registration with Rosreestr.

2.3. After registering the transaction, documents from Rosreestr come to Sberbank in electronic form. 2.4. The money is transferred to the seller of the apartment to his account within one banking day. The seller provides an invoice in advance. 2.5. The seller and buyer will learn that the transaction has been registered via SMS notification. You also receive an SMS from the bank indicating that the money has been transferred to the seller’s account.

In addition, transaction participants receive payment orders by email confirming the transfer of funds. If the seller does not trust SMS and emails from the bank, he can go to the bank and get a statement from his account to verify that the funds have actually been deposited into the account.

3. Benefits of the service.

Many people do not want to deal with cash, this is understandable, there is a risk of losing money. All anxious sellers can calm down. If the apartment is successfully sold, the money will be transferred to a pre-provided account.

The service is more convenient for the seller. The main advantages are:

• there is no need for everyone to get together to open the cell, as with the cash payment method; • there is no risk of receiving counterfeit banknotes; • there is no risk of theft, fraud when transferring money, or robbery; • quick transfer of money after registering documents with Rosreestr.

This service is loved by citizens of foreign countries, as well as our compatriots who live and work abroad. Abroad, they get used to non-cash payments, so in Russia they refuse to deal with cash.

In addition to them, the consumers of this service are elderly people. This is the most vulnerable category of sellers; in addition, with age, people become more cautious and suspicious. Therefore, they often resort to this type of calculation.

4. Disadvantages of the service.

The main disadvantage: you cannot add conditions to the contract for transferring money. As soon as the transaction is registered, the money will be credited to the seller's account.

For the last transaction, when we signed an agreement for non-cash payment, I asked to include in the agreement concluded with the real estate center another condition for the receipt of money by the seller: a clean nine (certificate in form No. 9, stating that the tenants have already been discharged) or an acceptance certificate - transfer of real estate. I was refused. This does not threaten the seller in any way. He got his money and can go anywhere.

What does this mean for the buyer of an apartment?

Possible consequences:

1. This means as soon as the property is registered, the seller can withdraw his money from the account and not transfer the apartment, keys, receipts to the buyer; 2. he may not check out of the apartment or leave his relatives registered there; 3. he may not pay his rent debts.

To be fair, it must be said that our people are mostly responsible. No matter what, they come after receiving the money to transfer the apartment and give the necessary receipts, keys, addresses, passwords, etc.

5. The cost of the secure payment service.

The cost of this service in 2020 is 3,400 rubles. The cost of the service does not depend on the transaction price. If you compare it with the cost of renting a safe deposit box, the secure transaction service is almost half the price. If the money is transferred to a Sberbank account, then no transfer fee is charged. Previously, the cost of the service included the preparation of a purchase and sale agreement by the mortgage manager, but since the spring of 2020, the preparation of a purchase and sale agreement is a separate service and is paid for separately.

6. Required documents.

In addition to the usual transaction documents, they ask:

- passports of the parties;

- TIN of all parties to the transaction;

- SNILS of all participants in the transaction;

- seller's account.

7. Reviews of the service: secure payment from Sberbank during a transaction.

Many people find this service suitable and like it. One of my clients said: “Why are you criticizing Sberbank’s services so much? Everything was so convenient and went well.” We were just lucky in this deal. There are also a lot of negative reviews. People hope to reduce time by agreeing to additional services: electronic registration, secure transactions. But sometimes, instead of the stated 2-3 days, registration takes two weeks or a month.

Problems more often occur for technical reasons, sometimes due to the incompetence of some Sberbank employees. Mortgage centers employ many young people with little work experience. Once they gain enough work experience, they leave. Not everyone can cope with such loads for a long time: a large amount of work, several transactions a day, responsibility, and all this for a small salary.

Unfortunately, mistakes by Sberbank employees are very common. Because of this, the deal is suspended. The service itself is not bad, it is designed to facilitate the transaction, minimize risks and deadlines. Let's hope that over time Sberbank will improve the service and it will become fast and trouble-free.

Good luck! Galina Cherkis

Electronic registration of a transaction in Sberbank

How does a mortgage transaction work at Sberbank?

2020

Features of the service when the contract price is not full

Understating the cost of an apartment in a contract when selling it is relevant, first of all, for sellers if they have owned it for less than three years. Not wanting to pay income tax to the budget, many sellers try to indicate an incomplete value of the property in the DCT.

The bottom line is that the contract stipulates a price that is less than the actual cost of the apartment. It is this amount that the borrower transfers to the seller, and the balance is paid against receipt. Such situations are not uncommon and often do not meet resistance from creditor banks, but they are associated with serious risks associated with the potential for termination of the transaction.

The secure payment service involves transferring only the amount that was specified in the purchase and sale agreement. Therefore, if it contains incomplete value, then if the transaction is declared invalid or not concluded, the buyer will be returned only those funds that were indicated in the contract.

Therefore, it is recommended that you carefully read the history of the property you are purchasing (for example, how the current owner acquired ownership of it) and under what circumstances you can proceed with the transaction.

A simple example: the owner of an apartment bought an apartment 2 years ago and sells it for 1.5 million rubles. The contract asks to indicate the cost of 1 million rubles, and to pay the rest by receipt. Using the secure payment service, after registering the transaction, 1 million rubles will be transferred to the seller’s account. Hypothetically, if the apartment was received by the owner by inheritance and suddenly another contender for housing appears, then the transaction can be challenged and terminated. In this situation, the buyer will get back only 1 million instead of the 1.5 million rubles actually paid.

The presence of a receipt, of course, plays a role. But she will have to go to court. And this is fraught with considerable expenditure of nerves and effort, taking into account the failed deal to purchase real estate.

CONCLUSION: You should only get involved with the purchase of housing at less than the full price in the contract if you have the most reliable information about its history and the integrity of the owner. This scheme is relevant only for legally clear transactions.

The safest way to pay for an apartment

Experts call non-cash payment methods and the use of safe deposit boxes safer than transferring cash at the office of a real estate company. For non-cash payments, the buyer opens a bank account in his name, provides the details of the recipient (seller) and an application to transfer funds to the seller’s account.

In this case, you don’t need to think about how to organize the transportation of money. On the day of the transaction, funds are transferred from the buyer’s account to the seller’s account, the transaction is carried out under the control of a third party - the bank, and all payment documents remain in the hands of the parties, from which the movement of funds through the accounts is visible. “They are proof of receipt of money. But you still need to get a receipt for the money from the seller,” advises Natalya Polyanskaya.

The disadvantage of this method is that with non-cash payment it is required that the full cost of the apartment be indicated in the contract, which not all sellers agree to do, especially if the property being sold has been in their ownership for less than three years.

Like cash payments, non-cash payments can also be made both before and after registration of the transfer of rights to the object.

Service cost and additional commissions

Regardless of the price of the purchased property, the cost of secure settlements for a mortgage transaction is 2 thousand rubles . Sberbank does not charge any additional commissions or payments.

However, if money is transferred to the special account of this service from the account of a third-party bank or financial organization, then a transfer fee may be charged. Its size will depend on the tariff policy of this third-party bank. If the account from which the buyer will transfer funds under the agreement is opened with Sberbank, then nothing additional will be required.

In addition, when Sberbank settles with the former owner of the apartment, an additional commission may arise due to the transfer from the account of a legal entity to the account of a citizen. You can clarify this point with the receiving bank.

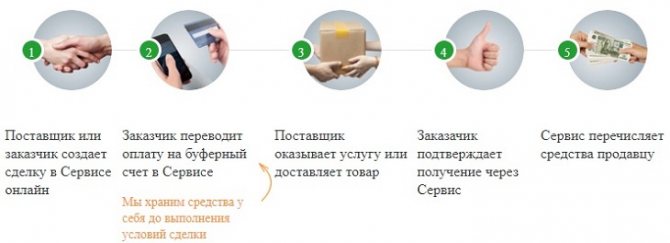

How does the system work?

The SBR action scheme includes six steps:

- one of the participants in the procedure creates a transaction in the system;

- the buying party transfers money to a special account;

- the financial institution holds the funds until the process is confirmed;

- the supplied person transfers the immovable property to the buyer;

- the party purchasing the property certifies receipt of the goods at the SBR;

- the money is credited by the banking system to the party that sold the object.

How to find out who owns a Sberbank card by number?

Documents for registration

In order to use Sberbank's secure mortgage payment service, participants in the transaction will have to provide a small package of papers.

The seller will need:

- passport;

- full bank details for depositing funds.

From the buyer:

If one of the parties is a legal entity, then it will be required to provide constituent/registration documents and bank details.

In addition, a mandatory document is the basis agreement for the purchase of this property. For example, in the case of the sale of secondary housing, this is a purchase and sale agreement.

Required documents and cost of service

To draw up an agreement for receiving a service, the buyer only needs to provide a TIN; the seller presents a civil passport, as well as bank account details of an individual/legal entity. A real estate purchase and sale agreement is also required.

On basic terms, the service costs 3,400 rubles. However, the final cost should be clarified directly at the CNS service office; due to individual factors, it may be increased. There are no additional fees for transferring or withdrawing funds.

Reviews

Examples of real reviews from Sberbank borrowers who used the secure payment service in a mortgage transaction:

- Irina, St. Petersburg: “I bought an apartment with a mortgage through Sberbank. During the consultation process, the manager persuaded me to use the new secure payment service. For 2 thousand rubles. the transaction will be registered in the shortest possible time and without any risks. I agreed, although the realtor strongly did not recommend contacting any additional services of Sberbank. Now I really regret that I didn’t listen to him. Instead of the promised 2-5 days, registration took almost a month. In response to all my questions and indignations about why this was happening, the bank employees sent me to read the contract, explaining that it was technical failures and a lack of employees. I am sure that all these days the bank used my money for its own purposes and deliberately delayed the deadline. I highly recommend not using this service.”

- Marina, Nizhny Novgorod: “I entered into a mortgage agreement with Sberbank for the purchase of a 2-room apartment. apartments. The mortgage manager highly recommended the new secure payment service and electronic transaction registration. I refused both for objective reasons. I tried to find out the details of the secure payment service and the essence of this special account into which money will be credited. The employee does not understand the difference between this invoice and a letter of credit and cannot correctly explain the nuances. Considering this fact, I was afraid that problems might arise in the future, so I refused, and the deal was formalized in the standard way.”

- Svetlana, Moscow: “I bought a ready-made apartment with the help of a Sberbank mortgage. The seller insisted on using the new secure payment service. At first she refused, but since this apartment suited me very well in all respects, I decided to meet him halfway. This service may be provided without any complaints only in Moscow, but there were no shortcomings. Everything is fast and on time as promised. There are probably many nuances in the regions.”

What is the secure payment service from Sberbank

Real estate transactions involve turnover of large amounts of money. A buyer moving cash is at risk of losing it or being deceived by a counterparty. Depositing money into bank accounts entails additional expenses and, due to official registration, taxation. Sberbank's secure settlement service is a portal of a bank subsidiary that allows you to pay for a transaction online after completing all the necessary actions for the purchase and sale.

Thanks to the service from Sberbank, there is no need to personally visit the office to rent a safe deposit box or pay for contingent monetary obligations. By registering on the portal, the purchaser transfers his money to a nominal account in the Real Estate Center. When the agreement is confirmed by Rosreestr, the seller’s account will be replenished with the amount specified in the agreement. Selling and buying an apartment is fast, simple and safe.

The services of the Internet portal can be used by both individuals and legal entities, for example representatives of construction companies. If the purchase of housing is intended without the participation of borrowed funds, the type of development does not matter. The premises can be new or already put into operation; you can buy an apartment, a room or a share of living space.

In the case when the buyer uses mortgage programs from Sberbank, the type of housing must comply with the lending conditions. That is, funds for the right to purchase an apartment on the secondary market cannot be used in shared construction or for independent construction of a house.

Sberbank Secure Payment Service (SBR)

The service allows you to make non-cash payments for purchase and sale transactions of finished housing.

- What does it mean?

— You don’t have to use a safe deposit box to transfer cash for an apartment; the bank guarantees that you will receive money in a special nominal account and then transfer it to the seller at the end of the transaction.

The procedure for working using “safe” technology involves 4 parties and consists of 4 steps:

- The buyer must replenish the nominal account of the Sberbank Real Estate Center from his personal account.

- The bank sends a request to Rosreestr and waits for confirmation of the registration of the property under the new owner.

- Rosreestr - carries out checks and registration actions, sends an electronic extract of the Unified State Register to the bank.

- The seller receives money from the bank to his personal account in Sberbank.

The scheme looks transparent, but there is no information about where the nominal account came from, how and by whom it is opened, and whether there are any pitfalls.

You also need to figure out the timing of all stages and the cost of the procedure, whether there are any commissions.

Advantages of the secure payment service

For both participants, the secure payment service has a number of undeniable advantages. A common positive quality is the security and reliability of the transaction. You don’t have to carry a large amount of money in a bag and you don’t have to look for a place to check it. In addition, the electronic portal allows you to save time, which can be successfully spent on drawing up contracts and registering documents, since enrollment and transfer are made online from home or any other place using a mobile application.

A nominal account on the CNS portal is a virtual service created for the buyer to deposit money, store and transfer capital to the seller’s account.

Benefits for the buyer

The buyer's risks in real estate transactions are quite high. In case of fraud, a person risks losing money and being left without an apartment. Therefore, a secure payment service will be a good guarantor of financial security and quick purchase of housing, this is the following:

- Quick registration, after which it’s easy to start using the portal.

- Transfers are made online, there is no need to cash out capital.

- Save time on counting and checking the authenticity of banknotes.

- There is no need to enter into additional agreements when accepting and transferring money, etc.

Until the transaction is officially registered in the Unified State Register of Real Estate, Sberbank provides protection of financial resources. After the certificate of execution of the purchase and sale agreement, the payer will receive a notification that his funds on the Sberbank central nervous system have been transferred to the recipient.

An important nuance should be noted: the secure payment service guarantees the safety of money and timely exchange of capital, but does not ensure transparency of the legal side. Therefore, it is important for the buyer to thoroughly check the history of the future home.

Benefits for the seller

An honest real estate seller has nothing to risk. Upon completion of the agreement, he will automatically receive financial resources to the specified account with the details. The secure payment service will protect it:

- From the possibility of receiving counterfeit banknotes.

- No need to come personally for payment.

How security is ensured

Sberbank launched a secure payment program after researching the market for buying and selling real estate. In some regions, preference was given to cash payments, despite the presence of safe deposit boxes for rent in Sberbank centers. It was possible to attract new clients with the help of SBR; citizens liked the idea of a safe and fast way to pay for real estate.

The service has become widespread in transactions involving clients who have applied for a loan. Through the Real Estate Center portal, Sberbank allows you to carry out contracts with the assistance of other banks, if they agree to this option.

The security of the purchase and sale is ensured by the fact that financial resources are transferred to the account of the selling party and become available only if the relevant documents are fully completed. In cases where the second party intentionally or accidentally delays registration, the buyer can refuse to interact and withdraw his money from the account.

System operation schemes

The secure payment service from Sberbank is simple and easy to use. By following simple instructions, you can quickly and safely complete a purchase or sale transaction. Algorithm of actions:

- Log in to the portal and create a deal.

- The buyer must transfer the amount specified in the agreement to the Sberbank account.

- The bank is responsible for the storage and security of funds until the transaction is completed.

- The second party fulfills its obligations: registers the contract, produces and transfers the goods or performs the service.

- The buyer or receiver marks the agreement on the portal. In the case of real estate, the fact of the transaction is confirmed by documents from the Unified State Register of Real Estate.

- An automatic transfer of funds to the seller's account is made.

- The parties are notified of the completion of the transaction.

When a buyer applies for a loan to a bank, the financial institution replenishes the account after registering the loan, then the full amount is sent to the other party. It is possible to top up your account when using a package of services by self-collection through ATMs.

The devices are capable of accepting 200 banknotes at a time and are available for use around the clock. The process of depositing large amounts is safe, convenient and fast. After depositing, the denomination and number of banknotes are recorded on the screen. Security is ensured through the use of a personal account with a unique login and password.

Service operation scheme

The supplier or customer forms a transaction in the online service. After which the customer credits the amount to the bank’s buffer account, where the money is stored until each of the terms of the contract is fulfilled. The supplier fulfills its obligations in the prescribed manner, the customer reports this in confirmation through the service. On this basis, the supplier receives money.

Requirements and necessary documents

Any Sberbank service has certain conditions that its customer must meet. For the secure payment service, the applicant must have Russian citizenship. Legal organizations using the portal are required to provide documents relevant to their activities. Organizations can act in transactions on the part of the seller of real estate or the person assigning the right of claim.

On the secure payment service, only direct agreements between two parties are legitimate, thus eliminating chain-type shady frauds. The number of accounts to which funds are transferred upon completion of the transaction is two.

If the owner is listed as the owner for less than three years, he is required to pay income tax when selling the apartment. In an effort to avoid this scenario, many owners in real estate transactions deliberately underestimate the real cost of the apartment in contracts on the secure payment service. Thus, when an agreement is concluded, it indicates a lower price for the property, and the buyer pays the remaining amount in cash or other means.

A significant drawback of such an agreement is the fact that in the event of possible termination of the purchase and sale of housing transaction, the buyer is returned only that part of the amount that is indicated in the application on the portal. And funds transferred in another way may remain in question.

A receipt for the transfer of a certain amount of money has legal force. But in order to get the funds back, you will most likely have to go to the courts. The trial procedure will take time and require new material costs. Therefore, transactions with reduced prices are justified only in cases where the counterparty is reliable and the history of the property is transparent and clean.

When concluding an agreement through the secure payment service, the following documents are required:

- from the purchaser - the borrower’s passport;

- payer's TIN;

- from the receiving party - an identification document of an individual, or a certificate of registration for legal entities;

- the seller must provide account details to which the money will be transferred.

A common document drawn up by both parties - a purchase and sale agreement - is also submitted to Sberbank.

Requirements

As with any other banking product, the secure payment service requires its participants to fulfill a number of specific requirements. Participants can be:

- Citizens of the Russian Federation.

- Legal entities that are registered in accordance with the procedure established by law.

It should be borne in mind that a legal entity can only act in a contract in the role of:

- Seller of real estate.

- Assignor (when assigning rights of claim).

This service is available only for direct transactions; protection of chain contracts is not provided.

Another requirement involves limiting the number of recipients. Thus, the maximum number of persons to whom funds will be transferred upon completion of the transaction is 2 people.

Required documents

In order to use the service, the parties need to provide a minimum package of documents:

- Buyer: Identity document (passport).

- TIN.

- Identity document (passport) or certificate of registration of a legal entity.

Additionally, an agreement is provided to the bank, which confirms the fact of purchase and sale of real estate.

Service cost

The assistance provided by the secure payment service is not free. Regardless of the cost of the property being sold, the payment is 2,000 rubles. However, there are several parameters that may affect its cost:

- When crediting funds from accounts of banks other than Savings, a commission is charged. The amount of the contribution depends on the standards established by the financial institution.

- Discounts provided by Sberbank to its clients and certain segments of the population.

- If funds are transferred from an individual to a legal account or vice versa, a commission must be paid.

The service includes opening a virtual account, checking and confirming the change of owner of the apartment, crediting and transferring finances from the buyer to the seller.

The fee for most applicants is 0.8%. The secure payment service is in great demand in the real estate market. It is reliable and easy to use, saving time and money when purchasing housing in different regions.

Service price and additional fees

Sberbank is an intermediary in the contractual act of purchase and sale. The credit institution charges a commission for the services provided. The cost of the service is determined personally. The price tag is influenced by:

- total amount of the contract;

- availability of discounts.

The mandatory commission amount is 0.8% of the contract amount. The amount is divided between the parties to the agreement. If the settlement occurs between accounts created in the Sberbank system, then there are no additional fees. When transferring finances from a third-party credit institution or to an account opened with another organization, the presence and size of the commission fee is determined by the tariffs of the “native” banking structure.

Transfer of pension from mail to Sberbank bank card