Conditions for refinancing a mortgage in AHML

The Agency for Housing Mortgage Lending (AHML) was created in 1997, but in 2020 it received a new name - Dom.RF. The state-owned company is refinancing mortgage loans issued by Russian banks at a lower interest rate.

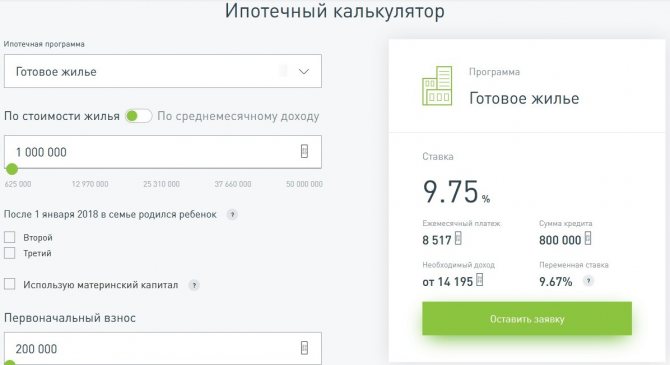

If you decide to refinance your mortgage with AHML, you can choose a fixed or variable interest rate. The fixed rate is 9.75% if the loan amount is less than 50% of the housing price, and 10% in other cases. The variable rate depends on the consumer price index for goods and services in the Russian Federation. It is recalculated every quarter. For example, for the 4th quarter of 2020, the indicator remains at 8.99%.

You can apply for refinancing under the “Easy Mortgage” program without proof of income (without a 2-NDFL certificate). But in this case, a 0.5% surcharge will be applied to the rate.

The loan under the Refinancing program is provided for a period of 3-30 years. The maximum amount is 30 million rubles. for MSK and St. Petersburg or 15 million rubles. for other regions. To increase the loan amount, you can find up to 4 co-borrowers.

The loan is secured by the apartment for which the initial loan was issued. Insurance of real estate serving as collateral against the risks of loss or damage is mandatory for the entire term of the mortgage. A life insurance policy is issued upon request, and if you cancel it, 0.7% is added to the rate.

Registration of mortgage refinancing

Before proceeding with refinancing, the borrower must select a suitable program.

- "Standard". It is a program that provides the opportunity to purchase primary and secondary housing. When applying for a mortgage, the income of attracted co-borrowers (up to 3 people) is taken into account.

- "New building". This program is usually used by borrowers who purchase housing on the primary market. 7.9% is the minimum interest rate.

- "Military Mortgage" This program can only be used by military personnel who participate in the mortgage savings system. The program provides for obtaining a loan of up to 2 million rubles.

- "Maternal capital". Families who have maternity capital have the opportunity to purchase an apartment. “House of the Russian Federation” provides such clients with the opportunity to increase the size of the loan by the amount of available maternity capital. Which allows you to buy the most comfortable apartment.

- "Variable rate". Housing is purchased on the primary or secondary market. The interest rate directly depends on the size of the refinancing percentage of the Central Bank. When preparing documents for a loan, the rate is not fixed in the contract. It changes every 3 months.

- "Collateral housing." Using this program, the borrower has the right to purchase only the housing space that belongs to AHML. The rate is reduced by 3⁄4 of the interest rate of the Central Bank of Russia.

It is important that before choosing a suitable program, the client needs to check with his bank, where the mortgage was issued, whether it cooperates with DOM.RF. The borrower can use (Fig. 3), which is located on the official website. You will need to enter the name of your city and the program will automatically display a list of potential lenders who work with clients on Dom.RF terms.

Where to get a loan

The process of applying for refinancing is carried out in several stages:

- a complete package of necessary documents is collected;

- if the borrower has been approved for refinancing, then he needs to contact the banking institution where the mortgage was obtained and request a statement of the remaining amount of the debt;

- "House of the Russian Federation" is provided with a copy of the loan agreement;

- a mortgage taken out from another bank is repaid early;

- the purchased apartment is transferred as collateral to AHML.

The refinancing period is about three business days.

It is important to note that this type of service, such as mortgage loan refinancing, is gaining increasing popularity among the population. But you should not rush into refinancing; first, it is recommended to calculate all the pros and cons of this procedure.

So, if the interest rate is 1% lower than the current one, then refinancing will be a profitable solution. For more accurate and faster calculations, you can use the calculator on the official website, which will carry out all the calculations online.

Mortgage calculator

The borrower has some obligations:

- Make loan payments according to the repayment schedule, without delays;

- In the case of a property insurance agreement, it is necessary to make periodic contributions;

- It is recommended to inform the lender about a change of residence or phone number in order to stay in touch.

In general, using the refinancing service at the “House of the Russian Federation” will be the right decision.

Few banking institutions can offer such low interest rates, which means it is profitable for the borrower to refinance his mortgage.

In addition, using maternity capital is an attractive option for many families.

Attention! All information on this site is presented for informational purposes only. The site does not collect or process personal data. Federal Law No. 152-FZ of July 27, 2006 “On Personal Data” is not violated.

| Dom.rf on Instagram | Dom.rf Vkontakte |

| Dom.rf on Facebook | Dom.rf on Twitter |

Refinance calculator

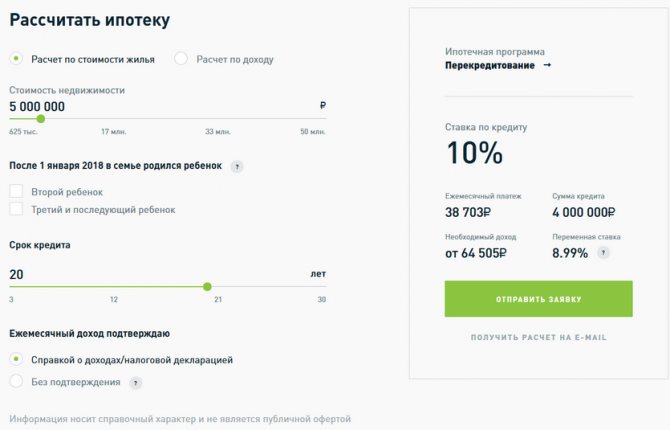

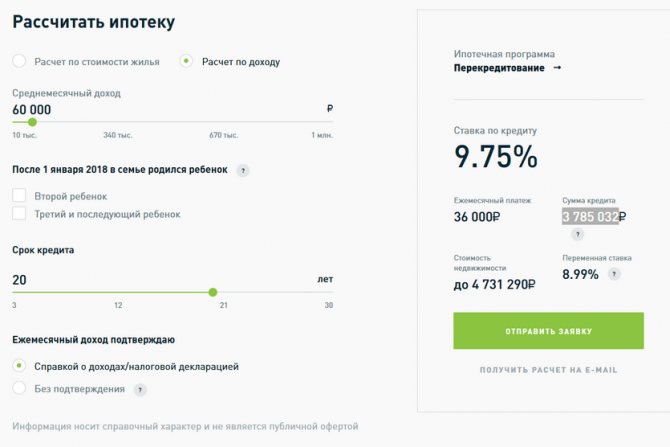

Using the calculator on the Dom.RF website, you can calculate the monthly payment based on the value of the property or determine the maximum possible loan and payment amount taking into account your average monthly income.

To calculate the cost of housing in the calculator, you must indicate:

- property value;

- desired loan term;

- method of income confirmation (income certificate, tax return or without confirmation);

- information about children born in the family after January 1, 2018.

When recalculating by income, instead of the value of real estate, you need to indicate the amount of average monthly income.

Example 1 . The cost of the apartment is 5 million rubles, the remaining debt is 4 million rubles, the desired loan term is 20 years. When confirming income using a salary certificate or tax return, the monthly payment amount will be 38,703 rubles, and the rate will be 8.99%. The loan can be approved if the income exceeds 64,505 rubles.

Example 2 . With an average income of 60 thousand rubles. per month you can count on mortgage approval up to 3,785,032 rubles, then the monthly payment will be 36 thousand rubles. for 20 years.

AHML in Dom.RF

AHML and Dom.RF are one organization. And the existence of two different names at once is explained by the rebranding. Considering the above, it is easy to conclude that the main purpose of this company is to support government housing programs and help borrowers who find themselves in a difficult situation. But now the list of tasks has expanded significantly, so anyone can get money for an apartment (if they meet the requirements). To be convinced of what has been said, it is enough to study the current credit line.

How to submit an online application on the DOM.RF website

You can submit an application and receive preliminary approval for refinancing without visiting Dom.RF partner banks.

To do this, just go to the official website of the company and fill out a special application, indicating:

- FULL NAME.;

- mortgage program - “Refinancing”;

- telephone;

- email;

- region and city in which you plan to refinance.

During the day, a manager will contact you to clarify the information. He will also talk about the next steps for refinancing.

Reviews of mortgage loans from Bank DOM.RF

I applied to the House of the Russian Federation for mortgage loan refinancing. When registering on June 25, 2020, everything was great - acceptable conditions, friendly employees, low interest rate. At the time of signing, the girl mentioned that within 3 months I needed to remove the encumbrance from the previous bank, call an employee of the House of the Russian Federation to set a date for submitting documents to set up an encumbrance on the House of the Russian Federation. Satisfied with the service, I left the branch, not suspecting what awaited me in the future, but the devil, as we know, is in the details... After repaying the loan, Sberbank (the previous lender) lifted the encumbrance within a week, which pleasantly surprised me, and I was already thinking about scheduling a meeting with a representative of the House of the Russian Federation. This was all complicated by the fact that I was going on a business trip for 2 weeks, but I, being sure that 2 and a half months before the deadline, I would have time to do everything, went on a business trip. After returning (around the end of July), I contacted a bank employee named Dina, who set the date for submitting documents for encumbrance almost at the end of the next month (August), explaining this by heavy workload. What terrible thing could happen, I thought - after all, there’s still a whole month left!

Shortly before the cherished day arrived, I contacted Dina and found out that she was resigning, so she was transferring me to her colleague named Ksenia. This was the first bell, but what can you do, this happens. Having contacted Ksenia, we again set the date for submitting documents for the 20th of September, again, due to the heavy workload of employees. Closer to the notorious date, 2 days before, I contacted Ksenia and... found out that she was on sick leave. I understand that in such a difficult period it’s easy to get sick, but couldn’t Ksenia herself notify her clients about the state of her health, because after the expiration of the period for placing the encumbrance, the borrowers’ interest rate increases significantly?

I was transferred to Maria (3rd employee), who, understanding my situation, set a date for the nearest possible date - October 5th. Maria did everything at the highest level, I really liked her professionalism and attitude towards the client. So, the documents were submitted, I left a request to the hotline number to cancel the rate increase for reasons beyond my control. 10/12/2020 I receive a message with a response from the bank, which struck me like a bolt from the blue, and a text in the spirit of “we don’t know anything, 3 months have passed, the interest rate has increased, I’m a fool,” which completely destroyed the positive and loyal attitude towards the bank.

Dear employees of the House of the Russian Federation, I understand that you obviously have a personnel problem that cannot be solved overnight, this is not the issue. But explain to me why I have to pay for your bank’s personnel problems from my own pocket? Is this the bank's policy to recoup the cost of part of the low interest rate? Because, unfortunately, for me it looks exactly like this.

I urge the bank to reduce my interest rate to the one specified in the contract with the correction of the monthly payment amount to the previous level (payment for October 2020). If this issue is not resolved, I intend to contact the Central Bank and Rospotrebnadzor.

List of required documents

When applying for refinancing, you will need to fill out an application form.

The following documents must be attached to it:

- passport;

- SNILS or other additional document, for example, a driver’s license;

- military ID (for men of military age);

- a certified copy of the work book;

- salary certificate;

- loan agreement for the original mortgage;

- certificate of debt balance;

- a certificate of timely repayment of debt on the original loan.

After the application is approved, prepare real estate documents:

- certificate of ownership (if available);

- document providing the basis for the emergence of property rights, for example, a purchase and sale agreement;

- appraiser's report;

- technical and cadastral passport;

- extract from the Unified State Register of Real Estate.

If you are refinancing a mortgage on an apartment whose construction has not yet been completed, you will need a construction share agreement.