Conditions for obtaining a mortgage at Transcapitalbank

Transcapitalbank (TCB) offers mortgage programs for the purchase of not only residential, but also commercial real estate. The collateral can be existing or purchased real estate.

Early repayment of a mortgage at TKB Bank is acceptable at any time. Before concluding a mortgage agreement, you need to insure the property against damage and loss. And life insurance is voluntary.

What documents and certificates need to be prepared?

To submit an application for an on-lending loan to TKB, you must have the following documents:

- An application form with the obligatory indication of the employer’s TIN.

- Passport of a citizen of the Russian Federation or a foreign country.

- Certificate 2-NDFL or a certificate in the prescribed form of the bank, certified at the borrower’s place of work;

- A copy of the work record, certified by the employing organization.

- A copy of the loan agreement and additional agreements thereto.

- A certificate of the balance of the borrowed debt, which is valid for 5 working days. It must be provided on the day the loan agreement is concluded.

- Payment details of the original lender and indication of the borrower's current account, which is necessary to repay the previous loan.

How to fill out an application?

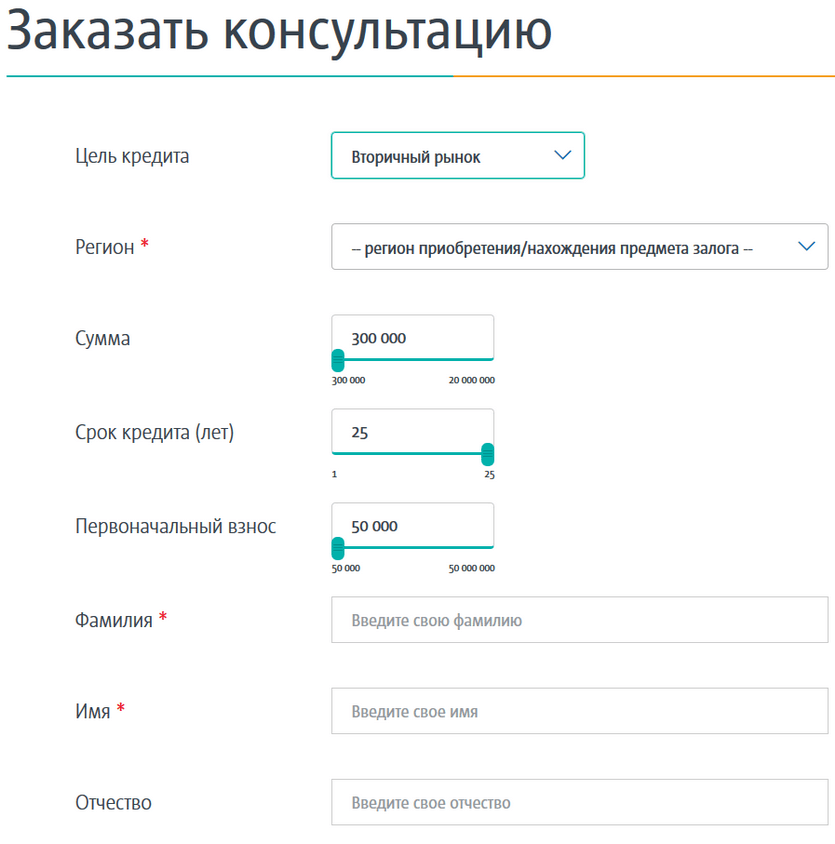

Important! Transcapitalbank provides the opportunity for its future clients to submit an application for refinancing not only when visiting a bank office or its branches in person, but also to send it electronically by filling out a special form, which is available on the TKB website.

It contains the following items:

- purpose of the loan;

- region;

- sum;

- loan term (years);

- an initial fee;

- FULL NAME;

- Date of Birth;

- phone number;

- E-mail address.

In addition, the application contains a box, by clicking on which, the applicant consents to the processing of his personal data.

If the bank approves the received application, the bank manager calls the potential client and invites him to the office to fill out an application form, in which it is necessary to indicate in great detail:

- personal data of the applicant;

- parameters of the requested loan;

- Family status;

- education and employment;

- income and expenses;

- service information;

- legal information;

- additional information, which includes information about the applicant’s non-participation in the legal process during the current period, whether the potential bank client is bankrupt and whether he has a beneficiary.

If there are several co-borrowers, all of them must take part in signing the document.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

+7 (499) 938-90-71Moscow

Mortgage calculator

There is an online calculator on the official website of Transcapitalbank. With its help, you can calculate the amount of the monthly payment, the rate and the minimum allowable income at which a mortgage will be approved.

To make the calculation, you must select a mortgage program, indicate the value of the property, the desired loan term and the amount of the down payment.

Example . When purchasing an apartment worth 3.5 million for 20 years with a down payment of 1 million rubles. The monthly contribution will be 22,000 rubles. The mortgage will be approved with a minimum income of 44 thousand rubles.

Calculate your mortgage on the bank's website

General conditions in TKB for 2020:

- currency of provision – rubles;

- terms of the agreement – from 1 year to 25 years (in increments of 12 months);

- minimum/maximum loan amount in Moscow and Moscow Region, St. Petersburg – 500,000/15,000,000 rubles, in other regions – 300,000/7,000,000 rubles;

- There is no commission for transferring funds, for cash withdrawals - according to the tariffs of cash management services;

- the minimum term of the refinanced mortgage is 6 months as of the date of application;

- In addition to collateral, the bank may require a guarantee from individuals (everything is determined by the client’s solvency).

Even if real estate is issued as collateral for the first loan, TKB will provide money even before the encumbrance on the property is removed from the first bank.

Collateral insurance is an indispensable condition for refinancing. Programs to protect the life and health of the borrower are not included in the mandatory package, however, the presence of a policy has a positive effect on the interest rate, as does Title insurance when owning a property for less than 4 years (the risk of losing ownership of real estate).

The TKB refinancing calculator will help you calculate the optimal conditions. The calculation is carried out based on the remaining debt and the duration of the loan, the current rate and interest on the newly provided loan.

How to submit an online application for a mortgage at Transcapitalbank

You can get a mortgage decision from Transcapitalbank without visiting a bank office. To do this, you need to go to its official website and follow the steps:

- Register in your personal account.

- Select the appropriate loan options.

- Fill out the form.

- Wait for the bank's decision.

The bank makes a preliminary decision instantly. If you would like to receive preliminary advice on a mortgage, you can use the feedback form on the bank’s website.

Reviews of mortgage loans from Transcapitalbank

So, NEVER, literally NEVER - DO NOT TAKE A MORTGAGE FROM THIS BANK! My story is very long and that’s why it probably contains ALL the cases of how NOT to do it! When I took out a mortgage in 2020, my development site had only 2 banks to choose from - this is me anticipating questions about why I came here! I’ll tell you step by step what problems I encountered, and you can decide for yourself how clean and competent the bank is! 1. At the stage of signing the contract, the percentage was 11.9%; after signing it turned out to be 12.27%, it seems like a small thing, right?) Well, who will look at this when you are already sitting and signing, waiting for the coveted home. Multiply by 15 years) 2. Two years later, the bank, in its incomprehensible machinations, resold my mortgage to its own bank “INVESTORGBANK” to the question: why? there was no answer, BUT!!!! I was not informed about this from the word AT ALL and NOWHERE! Moreover, 3 months after the credit scoring, I allegedly did not pay and became a debtor, and then my mortgage was also listed as closed in all databases, all this time I continued to pay the mortgage as usual (because their account did not change for payments!!! ) but I learned later that my credit history was ruined, as well as the fact that I don’t have a mortgage and it’s in a different bank altogether. After I learned all this from the security service of the 3rd bank, I already contacted “my” bank to clarify the situation. 3. After and until recently, I still paid the mortgage on the old account, but in my personal account I could not see either the schedule or the mortgage, and only recently they gave access from the account at the investor bank, where I could simply see the payment schedule. There is no need to explain how inconvenient it is to go to 2 offices of different banks to perform one operation. 4. One day the bank lost my insurance payment slip, and they raised the rate for me to 14%. I also found out about this after the fact when I had to pay at the new rate) the situation was resolved, but for one month I still paid at this rate. 5. The climax - when I finally decided to refinance, the bank behaved once again mega swinely - there is no other way to put it! My mortgage has already been paid off by another bank for almost a month, and I still don’t have the documents in hand! I don’t owe the bank anything, the mortgage is closed, but they still haven’t given me my mortgage, although according to the charter they have 10 days to do this - which have already passed! Before this, while collecting all the documents for the new bank, the bank put obstacles in every way for me, right up to the last payment. I made the payment as usual, in advance, on the eve of signing the agreement with the new bank, and what do you think, a couple of days after the payments were officially credited to me, SMS that I have a debt) 480 rubles) can you imagine that on the eve of a transaction that is not simple, I don’t pay the monthly payment even by that amount) and you yourself understand that this also goes into your credit history))))) like this this is a cool bank) thank you for the most disgusting service! Give me my documents!

How to get a mortgage from Transcapitalbank

When the mortgage is approved by Transcapitalbank, you will only have to complete a few more steps to complete it. You need to choose an apartment that suits you in all respects and meets the requirements of the TKB. It is better to clarify the housing requirements in advance at the bank branch. Next, you need to evaluate the property and hand over the appraisal report to Trnaskapitalbank employees.

Upon successful approval of the loaned object, you need to issue an insurance policy, agree with the seller on the time of the transaction and register ownership in the Registration Chamber.

Go to the bank's website

When can a bank refuse?

There are many reasons why a bank may refuse to refinance a mortgage to a borrower, the main of which are:

- Bad credit history.

- Low level of solvency of the borrower.

- A sharp decline in the value of collateral real estate.

- The presence of illegal redevelopment in the collateral real estate.

- Lack of insurance.

- Used when obtaining a primary loan of maternity capital.

- Inconsistency of the borrower's loan agreement with the requirements of the bank refinancing program.

- Discrepancy between the purpose of the mortgage loan and the terms of the refinancing program.

- The borrower applies for refinancing to the same bank where he took out the mortgage.

- Divorce of spouses without legal division of property.

- No mortgage on real estate.

- Repeated refinancing.

What can you do to increase your chances of approval?

To get approval for an application to refinance a mortgage loan from TKB Bank, you should avoid the mistakes listed above, and also fill out the necessary documents as correctly as possible.

Although the process of refinancing a mortgage loan seems more complicated than obtaining a mortgage for the first time, many borrowers resort to refinancing. They are driven to this by everyday situations that can be more easily overcome with the help of financial benefits from this operation. If you choose the right banking institution and strictly follow the refinancing rules, the benefits outweigh the possible difficulties.

Documents required to receive a loan from TransCapitalBank

During the application process, the borrower will need to provide a certain set of documents for a loan from TransCapitalBank. They play an important role, as they display all the information the bank needs for analysis.

The optimal list of papers includes:

- Passport of a citizen of the Russian Federation.

- Certificate of income received in 2-NDFL format, or in the bank form. For individual entrepreneurs, a tax return for the previous 12 months is mandatory.

- Individual taxpayer number (if available).

- Certified photocopies of all pages of the insurance book. They must bear the employer's seal.

- In the case of refinancing, all documentation related to the previous loan that is being repaid.

- For people of retirement age, you will need a certificate from the Pension Fund about the receipt of appropriate contributions, as well as their amount.

In addition to a certain set of documents, it is worth separately highlighting the presence of a list of requirements that the borrower must meet. If they are not followed, the applicant will not be able to receive a loan.

The list includes:

- The client and all his joint borrowers/guarantors must have citizenship of the Russian Federation.

- The minimum age of the recipient is 21 years, while the maximum is 65 years for men and 60 years for women (by the time the funds are fully returned under the contract).

- The borrower's total work experience must exceed 1 year, while for the current place of work it must be more than three months. For individual entrepreneurs, there is another condition: the period of existence of their business must exceed 1 year.

- It is also mandatory to have a contact phone number (mobile or landline).

Mortgage in TKB

1

Make a request

Go

The biggest problem for Russians is housing. Not every Russian citizen has his own apartment/house, and only a small proportion of people have their own money to buy residential real estate. There are two options: save money or take out a loan. Considering that housing is expensive in any market, the first method is automatically eliminated. It will take a long time to save, and you need to live somewhere. It’s good if the parents’ living space allows it. If not, you will have to rent an apartment and pay.

But why throw money away when you can get a mortgage, pay for it for a while, and then the home will be yours! Therefore, seeing the great demand for mortgage loans, all domestic banks offer such a service to consumers. Transcapitalbank is no exception, the programs of which will be discussed below.

Refinancing conditions

The minimum interest rate is 7.7%, but applies only to borrowers in the Premium segment with the amount of borrowed funds not exceeding 50% of the value of the collateral.

Basic interest rates after registration of property as collateral by TKB are:

- 9.2% - with a loan/collateral ratio of 50%;

- 9.45% - if the loan amount is from 50.01 to 65% of the value of the collateral;

- 9.95% - with a loan/collateral ratio of 65.01 - 80%.

For borrowers, a system of discounts and surcharges is provided in addition to the interest rate:

| Discounts | |

| -0,1% | For borrowers of the “Partner” segment |

| -0,2% | For borrowers of the “Prestige” segment |

| -0,35% | For borrowers of the Premium segment |

| Allowances | |

| +2% | During the period of re-registration of the mortgage |

| +0,5% | If the collateral object is an apartment |

| +1% | If the collateral is a share or a house with land |

| +1,5% | Providing a certificate according to the bank form |

| +0,5% | For individual entrepreneurs and business owners |

| +0,25% | Conclusion of an agreement with the participation of more than 2 borrowers |

| +2,5% | No life or disability insurance |

| +1% | No title insurance |

| +0,25% | If the length of service does not meet the requirements of the bank |

| +5% | For loans issued by TKB Bank or Investtorgbank, but the collateral for which is reflected on the balance sheet of another legal entity |

| +3% | When refinancing a mortgage taken out for repairs or restoration of property |

At the request of the borrower, the bank can apply a paid system of reducing mortgage rates within 3 tariffs: “Practical” - reduced by 0.5% (with payment of 1.5% of the loan amount), “Balanced” - reduced by 1.0% (payment - 3.0% of the loan amount), "Beneficial" - reduced by 1.5% (payment - 4.5% of the loan amount). On the Economy tariff the rate does not change.

Volume of borrowed funds: from 0.3 to 9.5 million rubles in Moscow, Moscow Region and St. Petersburg. For other regions, for example, Perm, the maximum limit is 6.5 million rubles.

Period of use of the loan: from 12 to 300 months (multiples of 12 months). The loan currency is Russian rubles; for foreign currency mortgages, conversion is carried out at the TKB rate on the day of issue.

The loan amount cannot exceed 50% of the collateral for a house with a plot, 70% for a room, townhouse, 80% for apartments.

Mortgage reviews

Most TKB clients speak positively about the bank's mortgage programs. Here are some reviews:

- Before TKB, I applied to several financial organizations, but I was rejected everywhere. But here my application was approved within a day. The girl called and said that I could prepare the necessary documents to sign the contract and receive the money. A week later I had a loan and had a chance to buy my own apartment

- I am not a resident of the Russian Federation, but I needed an apartment in Krasnodar. All banks refused to give me a loan, only TKB was accommodating. In 2017, I took out a mortgage and purchased a home. I would like to note the convenient mobile application of the bank, with which I make payments online and control all transactions

- In 2020, there was a “No Documents” mortgage program. A 30% down payment was required. I had this amount, but the seller did not want to deal with this bank. I persuaded him, he agreed as an exception and was surprised. The bank approved the application within 24 hours. From the documents they asked for a passport with SNILS. The institution approved 5 million at 11.9% with state support. It took 2 weeks to prepare the documents, and 2.5 hours to draw up the mortgage agreement, but they waited a long time for the bank representative

We talked about mortgage programs and provided reviews from real clients about TKB Bank mortgages. You can compare the conditions of this organization with the offers of other financial institutions and decide where it is profitable to take out a mortgage!

Credit programs of TransCapitalBank

Another extremely important point in drawing up contracts is which TransCapitalBank lending program the drawer will choose. There are several financial products with unique parameters and features that will be most relevant in various life situations. All systems offered by the company are presented in the following list.

"Budget solution." This system is the optimal solution for citizens who want to receive a large amount of money to use for any purpose. Its characteristics will be optimal for most possible cases.

They look like this:

- The amount that the designer can receive can be at least 100 thousand rubles, but not exceed 1.5 million: the exact figure depends on the applicant himself.

- The period of time during which the lending will take place is standard and ranges from 6-60 months.

- The annual rate on the loan is 9%, provided that the loan repayment will take no longer than 3 years, as well as the execution of an insurance contract. In other cases, this indicator may be increased.

- It should be noted that there is an additional “Favorable” tariff, which allows you to reduce the interest rate by another 2%. It is worth noting that this service is paid.

"For our own." The main difference between this program and all others is that it is provided only to regular customers of the bank in question, as well as employees of companies that are its partners: these categories of borrowers are provided with more attractive conditions.

In this case, the following indicators are provided:

- To begin with, it should be noted that the range of possible loan amounts has significantly increased. The minimum amount of funds was reduced to 20,000 rubles, and the maximum to 3,000,000. However, it should be noted that the increased loan size can only be obtained if the applicant has provided additional security. As such, you can pledge your own car to the bank, or involve guarantors in the agreement.

- The payment period remained standard.

- The interest rate can vary significantly: if the loan period is shorter than three years, it will be equal to 16.5%, if longer - 17.5%. An additional reduction is provided for insured persons who have confirmed their income, as well as those who are employees of partner companies or who have previously used the bank’s services. If all these conditions are met, as well as the “Favorable” tariff is activated, this figure can be reduced to 8%.

"Pensioners." This financial product is intended for issuing consumer loans from TransCapitalBank to pensioners under 75 years of age. The funds issued can be used for any consumer needs. The conditions under which funds are provided differ significantly from the standard ones:

- The smallest loan amount is 20 thousand rubles, but the maximum is only 250 thousand if there is a co-borrower and confirmation of his income, or 150 thousand without him.

- The loan period ranges from 6 months to 5 years.

- The annual rate for any loan term will be 17%. You can lower it by attracting a co-borrower, as well as choosing the “Favorable” tariff. The minimum indicator in this case is 14%.

"One credit." The program is the only targeted one and is intended solely to repay debts on the loan already existing with their subsequent transfer to TransCapitalBank. However, along with debt repayment, you can receive additional funds. The parameters of this system are as follows:

- The minimum loan size is 100 thousand rubles for two capitals (Moscow and St. Petersburg), and the maximum is 1 million for ordinary individuals or 1.5 million for bank clients.

- The payment period is 5 years.

- The interest rate for ordinary borrowers is 15%. You can lower it by confirming your own income, as well as taking out insurance.