ABOUT

The state enterprise of the Nizhny Novgorod region "NIKA" is a regional operator for the implementation, implementation and control over the implementation of the federal program for affordable mortgage lending. It was created by the Government of the Nizhny Novgorod region in 2003. The main goal of the enterprise is to provide Nizhny Novgorod residents with the opportunity to purchase their own housing today.

The main tasks that NIKA sets for itself are:

- increasing the availability of mortgages for all categories of citizens with a stable income:

- attracting investment to the region to increase the share of residential construction;

- reduction of interest rates on housing loans;

- improving the mortgage loan processing process.

SE NO "NIKA" daily reviews citizens' applications and provides consultations on lending issues (Monday-Friday from 9-00 to 18-00; Saturday-Sunday - closed). You can send a question, wish or other message to the email address [email protected] or by phone:

- 8-800-200-97-95 – hotline number (free call);

- 8-831-433-69-10;

- 8-831-283-07-30;

- 8-831-428-79-69.

In addition, you can contact directly the General Director of the SE NO “NIKA” Ekaterina Vladimirovna Mukhina:

- address - Nizhny Novgorod, st. Poltavskaya 26;

- Reception telephone – 8-831-433-69-15;

What are the advantages of cooperation with Nika Bank?

What are the advantages of cooperation with a bank?

The first thing that is important in any bank is reliability and professionalism. This is what distinguishes this bank from other organizations. Of course, a lot can be said, but it is important to note that Nika’s Omsk mortgage is issued from the bank’s personal monetary assets, which emphasizes its independence and reliability.

Secondly, it is respect for clients. Thus, mortgage applications are reviewed within three to four business days.

Third, care about your clients. Qualified employees accompany all stages of the transaction, from the beginning to the final completion, so the client does not think about unnecessary things and does not waste his nerves in vain.

Nika mortgage is a solution to any, even the most difficult cases, so the client can apply if he doubts whether he will be given a mortgage loan or not. Everything will be considered individually.

In addition, Nika’s range of mortgage programs in Nizhny Novgorod is very wide and suitable for many segments of the population, social security is especially pleasing.

Mortgage programs

“NIKA” mortgage is a variety of mortgage programs that allow each borrower to choose the most suitable lending option for themselves. Apartments in new buildings and on the secondary market, profitable refinancing and a mortgage program for military personnel, as well as a loan secured by existing real estate - all this and other special offers await potential property owners in the offices of the State Non-Profit Organization “Nizhny Novgorod Mortgage Corporate Alliance” in Nizhny Novgorod. Let's take a closer look at the company's main mortgage programs.

Mortgage NIKA in Nizhny Novgorod

Nizhny Novgorod has always been famous for its social programs and Nika’s mortgage has become especially famous - the famous (Nizhny Novgorod Mortgage Corporate Alliance), whose task was to attract investments to the region in order to organize a mortgage lending system for citizens according to the standards of the Federal Agency for Housing Mortgage Lending. As its regional operator, the alliance offers completely unique ways to provide their own housing to under-protected categories of Nizhny Novgorod residents who have decided to either buy an apartment with a mortgage in a new building or build a house on the land.

What is currently offered in social lending?

Good options for families who have joined the state program Maternity Capital 2013, which allows you not only to pay with state support funds for an already taken (current) loan, but also to use the certificate as payment for the down payment. Let's admit, not every banking institution offers such an opportunity. In addition, a married couple, by attracting co-borrowers (up to 4 people!) significantly increases the average income when calculating a mortgage application. The loan term varies significantly and its maximum limit is up to 360 months (!) - just think about the number! The minimum amount for making an early payment starts from 10,000 rubles, which is significantly (2-3 times!) lower than in other financial institutions, and does not provide for the payment of any fines or penalties.

Military mortgage in NIK - this type of program for providing targeted housing loans to military personnel participating in the NIS (Savings Mortgage System) - allowed at least 43 thousand military personnel to get their own cozy home. Focusing on the amount of funds already accumulated by the NIS participant, corresponding to the down payment, significantly facilitates the execution of a transaction for the purchase and sale of residential real estate - practically no own funds are required at this stage. The interest rate exceeds the Central Bank of Russia refinancing rate by only 2% for any loan period, but not less than 3 years. An essential nuance: the loan must be repaid to the military man before his retirement on a preferential pension, i.e. no later than 45 years of age.

Nika Mortgage offers special, unique conditions for participation in the Young Scientists program in its pilot project for scientists under 40 years of age. Young people get the chance to buy housing in installments with a down payment of only 10% of the cost of the apartment, with further indexation of contributions as their income increases. The uniqueness lies in the approach itself - the available size of the mortgage loan is almost twice as large as with the standard system for calculating annuity payments. You can count on purchasing both a townhouse (!), located on an area belonging to a complex low-rise development, and paying for a share in a residential complex (housing cooperative). And this is in addition to the availability of standard purchases on the secondary market and new buildings.

State employees interested in purchasing apartments from the following industries - education, healthcare, sports and culture - are compensated in the amount of 10% for both interest on the loan debt and are given a one-time subsidy in the amount of 10% of the total price of the property. Those. Under the Budget Mortgage program, Nizhny Novgorod residents receive very substantial compensation for their invested funds. Considering that housing prices in NN and the region are “unaffordable” for most residents, it is the development of such social targeted programs that has become a priority in the activities of the Nizhny Novgorod Mortgage Corporate Alliance.

Obtaining up-to-date information for citizens who decide to become owners of residential real estate is greatly simplified both in the city and in the region - thanks to competent employees, you can get full advice on all current credit products, as well as recommendations from leading experts on choosing an investment object. It is very convenient that the borrower will not need the services of a residential space appraiser - work in the NIKA mortgage is organized in a “one window” mode, which greatly simplifies the moment of approving the application before receiving the money and, as a result, your home.

[google]

Secondary housing

Apartments on the secondary housing market already have an owner, have been lived in by other people, but this does not make them worse or lose their liquidity. Among the advantages of purchasing such real estate are:

- convenient location;

- developed infrastructure;

- proximity to necessary social facilities (schools, kindergartens, shops, etc.);

- a large selection of offers in any area of the city;

- opportunity to bargain with the owner.

If the borrower has chosen a suitable residential property on the secondary housing market, SE NO “NIKA” will provide the following mortgage conditions:

- Loan size – from 500,000 to 10,000,000 rubles.

- The duration of borrowing is from 3 to 30 years.

- The minimum down payment is 20% of the cost of the selected housing.

- Interest rate – from 9 to 9.25% (depending on the amount of the down payment).

The borrower has two additional options available under this program:

- "Variable rate". During the loan period, the interest rate changes its value depending on rising prices and the level of inflation. In this case, the monthly payment is set when the loan is issued and does not change until the debt is fully repaid. When the inflation rate decreases, the loan term decreases.

- "Easy Mortgage" Registration with just two documents is available to borrowers who are willing to contribute 50% of the cost of housing from their own funds. In this case, the mortgage interest rate is set at 9.5-9.75%.

Nika mortgage Nizhny Novgorod website

Nika mortgage Nizhny Novgorod

You can find out all the necessary information on a mortgage loan on the bank’s official website. So, you will have the opportunity not only to ask all the questions that you have, but also to use a loan calculator, which can be used to calculate everything down to the smallest detail. For example, the period for which you will repay the loan, what interest rate, etc. very comfortably. Let us note that Nika Bank has favorable conditions for mortgages in Nizhny Novgorod and all this can be reviewed in detail on the official website.

Military mortgage

Military personnel who are official participants of the NIS and have the right to receive a targeted housing loan, when applying to the SE NO “NIKA”, can count on the following lending conditions:

- Loan amount – from 500,000 to 2,486,000 rubles (the limit is set by the requirements of the state program “Military Mortgage”).

- Duration of borrowing – from 3 years.

- The down payment is at least 20% of the cost of the selected property.

- Interest rate – 9%.

Important! The right to obtain a mortgage and purchase housing becomes available to a military personnel 3 years from the date of registration in the NIS program. During this time, an amount sufficient to make a down payment accumulates in the serviceman’s individual account. Further payments will be made from budget funds until the military man is dismissed from the ranks of the RF Armed Forces.

Popular mortgage programs in Nizhny Novgorod

Nika offers a huge number of programs for every segment of the population. Next is a list of services that, according to many city residents, are considered very convenient:

- Budget mortgage. This type of mortgage is designed for people working in the field of education. Teachers, doctors, cultural workers, entering into an agreement, purchase one-time assistance equal to 10%;

- Maternal capital. Issued to citizens who have the right to receive and repay a mortgage using maternity capital;

- Military mortgage;

- Young scientists.

Having set itself the goal of creating more comfortable conditions, the company provides appraiser services and real estate insurance.

Targeted loan secured by real estate

If a potential borrower owns liquid real estate (residential or non-residential), he can take out a profitable mortgage loan for the purchase of:

- apartments on the primary or secondary housing market;

- rooms;

- private house;

- townhouse;

- non-residential premises.

The loan is secured by a mortgage on the existing property. The loan terms for the program are as follows:

- The loan amount is in the range from 500,000 to 10,000,000 rubles, but not more than 60% of the value of the collateral property.

- Loan term – from 3 to 30 years.

- Interest rate – 9.25-9.50%.

Important! Borrowed funds are issued for the purchase of a specific property, so documentary evidence of their use is required. After this, the increased interest rate is reduced by 4 points.

A mandatory condition of the mortgage program is insurance of the collateral.

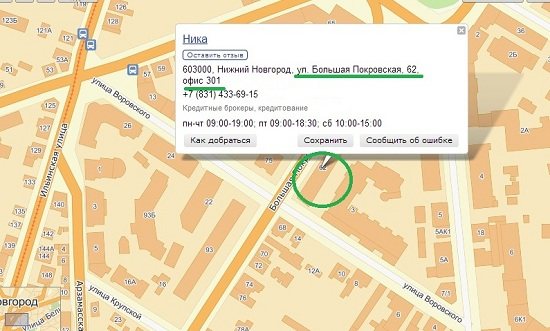

Description of the organization

“Nizhny Novgorod Mortgage Corporate Alliance, GP” is located in Nizhny Novgorod at Poltavskaya, 26. The establishment is located in the “Sovetsky” district.

You can get here by your own car, search coordinates on the map are 56.3141, 44.0275. It is also possible to get there by metro (the nearest station is Gorkovskaya), from which the Nizhegorodsky Mortgage Corporate Alliance, GP is only 2000 meters away. This establishment is included in category 1. You can get more information by using the phone or website. Does Nizhny Novgorod Mortgage Corporate Alliance, GP have the address and telephone number or the company's opening hours listed in error? Write to us!

Relevant news

- Hungary demanded that NATO stop supporting Ukraine

Hungary sent a letter to NATO Secretary General Jens Stoltenberg with an initiative to review support programs allianceUkraine. European Pravda reported this on Friday, May 25. The appeal from Budapest states that “the Ukrainian state has weakened to such an extent that it is unable to fulfill its basic obligations, including ensuring...

- Former USSR

Ukraine

May 25, 2020, 11:29 pm

NATO's general policy towards Ukraine has not changed after it was assigned the status of a postgraduate country within the alliance

. NATO Deputy Secretary General Rose Gottemoeller stated this in an interview with the Kommersant newspaper. “Whether or not to seek NATO membership is a decision for the countries themselves. Ukraine has officially made this decision, which we noted by introducing...

- Former USSR

Ukraine

11 April 2020, 19:39

Analytical credit

The rating agency (ACRA) assigned the SME Corporation

a credit

rating at the level of financial obligations of the government of the Russian Federation (AAA(RU), outlook “Stable”).

The agency drew attention to the sustainability of the business model and the Corporation’s low own credit

risks. ACRA experts noted the high systemic importance...

- Economy

Banks

27 April 2020, 21:16

Calculator

Loan amount

Payment type

Interest rate, %

Maternal capital

date of issue

Credit term

Early repayments

| date | Type | Amount/rate | |

Schedule

Table

| Term | 0 months |

| Sum | 0 rub. |

| Bid | 0 % |

| Overpayment | 0 rub. |

| Start of payments | 0 |

| End of payments | 0 |

| Required Income | 0 |

| № | date | Payment | Main debt | Interest | Balance owed | Early repayments |

Potential borrowers at the stage of planning a future loan at SE NO “NIKA” can use the mortgage calculator service for calculations. With its help, you can determine the following important loan parameters:

- total amount;

- optimal loan term;

- comfortable monthly payment.

To start the calculation you will need to enter the following data:

- selected loan program;

- the cost of the acquired property;

- monthly income of the borrower;

- desired loan term;

- down payment amount.

Based on the calculation results, it is much easier to determine what mortgage amount is needed, whether the family can make the monthly payment and what the total amount of the overpayment on the loan is.

Procedure for obtaining a mortgage

The process of obtaining funds for the purchase of residential real estate is as follows:

- Preparatory stage. Borrowers need to visit the office of SE NO “NIKA” or call the contact phone number. The company’s employees will answer all your questions and also provide a list of documents required when applying for a mortgage.

- Filing an application. Applicants must fill out a form and provide papers confirming the borrower’s identity and income level.

- Collection of real estate documentation. After approval of the application, you need to prepare a package of documents for the selected apartment or house.

- Make a deal. If all stages are completed and approval is received, a date is set for signing the mortgage agreement and registering the real estate transaction with Rosreestr.

Necessary stages of obtaining a mortgage Nika

In order to obtain permission for mortgage lending, you must go through several steps:

- Come to the office and consult with the manager. View the proposed options and decide. The company’s specialists will help with this; they approach each client individually;

- Collect the entire package of documents, thanks to which the process will be launched;

- Fill out the proposed candidate questionnaire;

- Collect documents for the apartment you plan to buy;

- Conclusion of a contract. Review all the points, as your signature will mean your agreement with everything listed in the contract.

Documentation

The documentary part of obtaining a mortgage is an important and responsible stage, because the absence of one certificate can derail the entire deal. The list of required papers includes:

- Russian passport;

- income certificate in form 2-NDFL;

- SNILS;

- military ID;

- a copy of the work book certified by the employer;

- real estate seller's passport;

- certificate of registration of ownership of the selected apartment or house;

- title documents (sale and purchase agreement, certificate of privatization, inheritance, etc.);

- the result of the assessment examination;

- cadastral passport;

- extract from the Unified State Register of Real Estate;

- an extract from the house register about registration in a residential property.

In each specific case, the list may change (for example, for military personnel or employees of the Ministry of Internal Affairs, when using maternity capital, etc.), therefore, preliminary consultation with NIKA employees is necessary.