Home/Mortgage repayment/Mortgage account seizure

The presence of unfulfilled obligations can become a reason for the application of sanctions. If a court decision is made against the defaulter and enforcement proceedings are initiated, bailiffs have the right to seize the citizen’s property and money. Incoming funds may begin to be forcibly transferred to pay off the debt. However, a person who bought an apartment on credit, in addition to the standard ones, has a mortgage account. Seizing a mortgage account deprives a citizen of the opportunity to make timely payments. If such a situation arises, it is necessary to act immediately. A number of procedures will need to be followed to remove restrictions from your mortgage account and continue making loan payments.

What is a mortgage account?

A mortgage account is practically no different from classic bank accounts for individuals. It is opened at the time of issuing a loan to purchase a home. Funds are received here monthly to close loan obligations. The amounts in the account belong to the citizen.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

Attention

If enforcement proceedings are initiated, seizure of property and other property is used as one of the measures. Often restrictions are placed on mortgage accounts. As a result, the bank does not receive the money that the citizen transferred. All payments are immediately sent to close the debt to the person in whose favor the judgment was made. Similar schemes operate in all financial institutions.

Calculate a military mortgage using the calculator of the site “Voenpereezd.ru”

https://www.voenpereezd.ru/ipotechnyiy-kalkulyator/

Using this calculator you can calculate the maximum amount for the purchase of housing on a military mortgage , depending on:

- NIS participant savings;

- Your age;

- Own funds;

- Decisions about taking out a consumer loan.

Let's look at how to use this calculator using an example.

Given:

You are now 28 years old.

You received your officer rank in October 2015.

You have saved up 200,000 rubles and plan to spend it on buying an apartment.

In order to buy a better apartment, you want to take out a consumer loan of 1,000,000 rubles on preferential terms.

You are interested in how much money you can spend on an apartment if you use the “military mortgage” program.

Step 1. Calculate your savings as an NIS participant

In the calculator, indicate the date on which the right to be included in the savings-mortgage system arose and the date of actual inclusion.

In our example, you received the right to be included in the NIS immediately after becoming an officer in October 2020.

And they included you in the system a month later.

Enter this data into the calculator. Your savings will be equal to 896,646 rubles.

Step 2. Find out the maximum loan amount

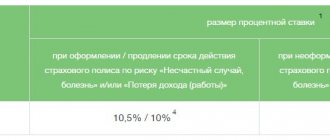

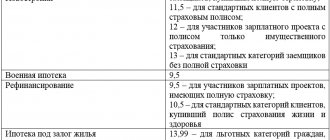

The terms of a military mortgage may differ for each bank.

Select the bank where you want to take out a mortgage and indicate your age.

For our example, we will choose Sberbank.

It should look like this:

You can get a loan of 2,274,238 rubles.

Step 3. Indicate how much of your own savings you want to spend on buying an apartment

We recommend saving some money before taking out a mortgage. By investing this money in purchasing an apartment, you will be able to:

- reduce mortgage payments;

- buy better housing

In our hypothetical situation, you have 200,000 rubles.

Enter this amount in the field.

Step 4. Decide whether you will take out a personal loan

If you have used the Military Mortgage program, the bank can offer you a consumer loan of 1,000,000 rubles on very favorable terms.

This loan will help you buy a more expensive apartment.

In the situation we are analyzing, you decided to take advantage of the offer.

Step 5. Click on the calculate button to find out your maximum budget for purchasing an apartment

You can buy an apartment for 4,370,884 rubles.

Please note that the calculation error may be up to 2%.

In what cases can a mortgage account be seized?

Article 81 of Federal Law No. 229 of October 2, 2007 “On Enforcement Proceedings” states that bailiffs can seize funds in a bank account. If it is open to a mortgage, this does not deprive the bailiff of the opportunity to carry out the procedure. Information about the nature of the account is not requested. Banks provide performers only with information about the availability of funds. To claim the money, the executor issues a decree to seize the mortgage account. The bank is obliged to immediately comply with the order of the bailiffs and apply the restriction. As a result, payments will no longer be made to the lender.

For your information

Seizure of a mortgage account is used if enforcement proceedings are being carried out against a person. It does not matter for what reasons the corresponding decision was made.

Reasons for seizure of a mortgage account by bailiffs

The main reason for seizing a mortgage account is the initiation of enforcement proceedings. Typically, debts for:

- alimony;

- other loans;

- service agreements;

- installment plan agreements.

Typically, bailiffs will cooperate if a person makes attempts to fulfill obligations, makes partial payments, or offers other options to get out of the current situation. When a person ignores the demands made against him, bailiffs take measures to force the recovery of the amount.

Consequences of mortgage account seizure

Attention:

If the account is frozen, the person will no longer be able to make payments on the mortgage. All funds transferred to fulfill obligations will be written off and used to pay off the debt under enforcement proceedings. This situation will continue until the arrest is lifted.

Depositing funds through the cash desk of a financial institution will not correct the current situation. Having received the amount from the client to repay the home loan, the operator will deposit the money into the seized mortgage account. As soon as the funds get there, they will be written off immediately. To rectify the situation, it is necessary to pay off the debt or take measures to lift the arrest.

Nominal account of the Real Estate Center in Sberbank

You can understand in practice how it works and what its features are, using the example of the central nervous system in Sberbank. Let us consider in detail what CNS is, Sberbank’s secure payment service, as well as what the cost of services is and the sales scheme using a nominal account.

Central nervous system of Sberbank

In 2020, in order to isolate, minimize time costs and develop the block of real estate operations, Sberbank created a separate structure - Sberbank Real Estate Center LLC (CNS). The CNS carries out its activities through Sberbank’s main platform for obtaining mortgages and submitting online applications – DomClick.

Within this portal, clients are offered a whole range of additional services, the use of which will allow them to obtain the required loan without long waits in queues and frequent visits to the bank office.

In particular, the following additional services are available:

- secure payment service;

- assessment of the cost of purchased housing;

- electronic (remote) transaction registration;

- legal examination (legal purity);

- insurance services;

- price analysis.

All services are provided for an additional fee.

Sberbank secure payment service

It is the secure payment service that allows the client to refuse to use a traditional safe deposit box to transfer cash to the seller, but to transfer a specific amount to a nominal account. The security of payments and the safety of transferred money is guaranteed by Sberbank. After the transaction passes state registration, the money will automatically be transferred to the seller.

There are 4 parties involved in the secure payment system:

- Sberbank (sends the mortgage agreement for registration and confirms the fact of re-registration of the housing to the new owner);

- seller (receives money upon completion of the transaction registration procedure);

- buyer (replenishes the nominal wallet with the amount indicated in the signed agreement from his personal bank account);

- registration authority (checks the provided mortgage documents and registers the transaction, following which the bank receives an electronic extract from the Unified State Register of Real Estate).

Scheme for buying and selling an apartment using a nominal account in Sberbank

The procedure for buying and selling an apartment using a nominal mortgage account with Sberbank includes the following steps:

- The home buyer places the required amount of the down payment on the mortgage in his Sberbank account.

- An agreement is concluded between the seller, CNS and the buyer to carry out secure mortgage payments through the Sberbank service of the same name.

- The CNS receives a fee for providing the service and opens a nominal account with the bank for the sale of real estate.

- The buyer's funds are transferred from his personal account to an open nominal account.

- Upon successful registration of rights and mortgages in Rosreestr, the money is transferred to the seller to his account.

Sberbank directly processes the loan and opens an account for the client, but formally the central nervous system is responsible for everything.

CONCLUSION: That is, the nominal mortgage account of Sberbank is a kind of temporary wallet in which money received from the buyer of real estate is stored and transferred without delay to the seller in case of successful registration in Rosreestr.

Cost of service and commission

To use Sberbank’s secure mortgage payment service through the central nervous system, the mortgage borrower will have to pay a one-time fee of 2 thousand rubles. It includes the opening of a nominal account and full control over the progress of the transaction after the imposition of an encumbrance in favor of the bank.

No additional fees are included in the stated amount. An exception may be the situation when the buyer's account is replenished by transfer from a third-party bank. Interbank transfer fees may then apply. The same applies to the seller, if his account to which the amount of the first mortgage payment is transferred is opened with another credit institution.

Deadlines for settlements using a nominal account

The stated terms for obtaining a mortgage using a nominal account with Sberbank are minimal. Thus, no more than 15 minutes are allotted for the procedure for preparing documents and concluding an agreement with the central nervous system. The duration of the transaction itself until the seller receives the full amount should not exceed a week (7 calendar days).

After a mark appears in the system about the successful encumbrance of real estate in favor of Sberbank, the money should be transferred to the seller within one to five business days.

Practice shows that the designated deadlines are almost never observed. All operations usually take much longer.

Will the debt increase if the mortgage account is seized?

You should not expect that the application of sanctions by bailiffs will freeze your mortgage debt. The Bank will continue to act in accordance with the provisions of the agreement. The document states that the person is required to make monthly payments in accordance with the loan schedule. The occurrence of delay entails the imposition of penalties and fines. Additionally, debts will begin to form.

If a person wants to try to correct the situation, he can contact the bank and ask for a deferment. However, the company is not obligated to comply. She will act in accordance with her own interests. Typically, a request for an installment plan will be granted if the borrower provides evidence that his or her financial situation will soon improve and the person will be able to pay off the debts and begin repaying the mortgage according to the established schedule.

Questions and answers

Many people have questions related to the Dom.RF organization and VTB Bank. The most common questions are mortgage related issues.

What should a client do if he receives a message that the owner of mortgage securities has changed? How to pay off the loan in the future?

This means that a number of securities were transferred to the new owner of DOM.RF LLC. The loan continues to be serviced by VTB Bank. When the owner changes, the terms of the securities do not change.

Can a new company measure the terms of the contract and other data that are written down in the documents?

After the transfer, all terms of the agreement and document remain unchanged. That is, all initial data (interest rate, payment amount, etc.) remain the same. The new owner has no right to change the terms of the contract.

Where can I file mortgage claims?

You can submit a claim to any office of VTB PJSC Bank. You can also send your dissatisfaction by email from the VTB Bank website or contact a bank employee by toll-free phone.

How to pay off your mortgage?

It is still possible to bypass the restrictions of freezing your mortgage account. To do this, it is necessary to exclude the deposit of funds into the borrower’s account from the repayment scheme. To make mortgage payments, a citizen can use the following methods:

- Transfer money without opening an account. In this case, the funds will go directly to the lender. You can complete the procedure by coordinating the actions with the bank.

- Contact a relative or friend and ask to open an account with a financial institution. You will then need to prepare an application for an excise-free write-off to pay off the mortgage.

First of all, it is necessary to try to normalize the financial situation and resolve the issue with the bailiffs. Resolution of the Plenum of the Supreme Court of the Russian Federation No. 50 dated November 17, 2020 states that a person has the right to prepare an application for a deferment or installment plan for the execution of a court order. If the requirements are satisfied, the seizure will be removed from the mortgage account. As a result, the defaulter will be able to make payments according to the standard scheme. Compulsory collection measures are not applied.

To use the method, you must contact the bailiff in charge of enforcement proceedings. The procedure must be completed within 5 days from the date of seizure. The application must be supplemented with a certificate confirming the financial situation of the debtor. This could be a certificate of income, a document demonstrating the amount of monthly payments under a mortgage agreement, papers confirming family expenses, the number of dependents, etc.

Attention

If you can’t arrange an installment plan, you should try to negotiate with the bank. To do this, you will need to contact a financial institution and ask for a mortgage holiday, change the deadline for depositing funds, or extend the loan with a reduction in the monthly installment. As a result, the person will be able to maintain a positive credit history, establish themselves as a responsible borrower and reduce the burden on the budget. As a result, the person will have funds to pay off the obligations due to which the mortgage account was frozen.

Procedure for transferring funds

- The purchased property is assessed by an independent expert (the price of the property is recorded in writing);

- The parties to the transaction draw up a preliminary purchase and sale agreement. The cost of the apartment specified in the agreement must correspond to the price set by the appraiser;

- The buyer pays the deposit to the seller (the transfer of cash is certified by a receipt);

- The buyer submits to Sberbank a package of documents related to the object being sold. This step is necessary to prevent fraudulent activities against the seller;

- The agreement is registered in Rosreestr;

- The buyer of the apartment draws up a statement of ownership of the living space;

- Counterparties come to the office of a credit institution and present the collected documents to a Sberbank employee;

- When does Sberbank transfer mortgage money to the seller? The bank enters into a mortgage agreement with the buyer, and the seller receives money for the property (payment for the purchase is made within 5 days).

Is it possible to lift the arrest?

Paragraph 45 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 50 states that funds in accounts and newly received funds are subject to arrest. The amounts are used to pay off obligations to the plaintiff. The procedure is carried out until the debt is completely closed. Article 70 of Federal Law No. 229 states that bailiffs are obliged to foreclose on funds located in such accounts. For this purpose, decisions are made. As a result, the bank is obliged to carry out the order of the representatives of the FSSP and transfer the amount to the treasury account of the unit.

However, not all courts agree with such rules. The Orenburg Regional Court considered the appeal in case No. 33 AD 2002-2012. As a result, it was established that the account created for the mortgage is opened on the basis of a loan agreement and is not used for making classical calculations. Therefore, it does not correspond to the characteristics of a current account (clause 2 of Article 11 of the Tax Code of the Russian Federation) and is a target account. As a result, the provisions of Article 81 of Federal Law No. 229 cannot be applied.

The court concluded that the seizure of the account violates the rights of the mortgage borrower. Therefore, the bailiff’s decision was considered illegal and was canceled. However, there is no uniform practice on the above issue.

Attention

Removing a lien from a mortgage account is still permissible. The action can be performed after receiving a deferment or installment plan for the debt, carried out on the basis of a court decision or after the closure of obligations. However, lifting the arrest does not relieve the person from the need to provide funds to repay the debt. It is recommended to make the calculation as soon as possible.

How to remove a seizure from an account

Considering real precedents when courts declared the seizure of a loan account illegal, interested borrowers should take the path of appealing against such actions by bailiffs. To do this, debtors interested in canceling the arrest must apply to the court with an administrative claim to cancel the arrest order. As an argument, it is necessary to refer to existing practice, including the ruling in case No. 33-2002/2012. An administrative claim must comply with the requirements of Art. 125 CAS and must be filed with the district court at the location of the territorial OSB, which imposed the arrest.

Note!

The reasoning set out in the ruling in case No. 33-2002/2012 seems controversial, therefore it is impossible to unequivocally guarantee a positive outcome of such an appeal.

In addition to appealing, it is necessary to take into account other grounds for lifting the arrest:

- termination of enforcement proceedings in cases of death of the claimant, approval by the court of a settlement agreement between the parties, or refusal of the claimant to carry out collection;

- completion of enforcement proceedings in cases of repayment of debt in full, return of a writ of execution in the event that the debtor lacks liquid property, declaring the debtor bankrupt, foreclosure on wages.

How to remove a seizure from a mortgage account imposed by bailiffs?

A citizen can try to remove restrictions from the mortgage account imposed by bailiffs. To do this, you must proceed according to the following scheme:

- Contact the bank and find out the reason for the restrictions. If a person finds out that the order of the bailiffs is to blame, he can additionally find out which branch of the FSSP to contact.

- Pay off your obligations in full. If there is no possibility of providing funds, you can ask for a deferment or installment plan. The right to receive it is provided for in Article 203 of the Code of Civil Procedure of the Russian Federation. To use the benefit you will need to fill out an application. The document form is not fixed. The paper is drawn up in accordance with the classical rules of office work. It will be necessary to reflect information about the participants in the procedure, information about the case in which forced penalties were imposed, and also record a request for an installment plan or deferment.

- Contact the bailiff service. You can visit the organization in person, send documents by mail or transfer them through a third party. In the latter case, it is necessary to issue a power of attorney.

- Wait for a decision to be made. If it is positive, the seizure will be removed from the mortgage account.

Additional information

If a citizen believes that sanctions were applied in violation of current legislation, you can file a complaint. It is issued in the name of the bailiff who heads the local branch of the FSSP. The text of the document must contain references to legal norms that violate the actions of the bailiff. Additionally, it is allowed to prepare a statement of claim and submit it to court. There is real judicial practice to remove restrictions from a mortgage account and recognize the actions of bailiffs as illegal. In this case, the person will be able to obtain the return of all written-off funds that were transferred to repay the housing loan.