Mortgage conditions for salary clients at VTB

All VTB mortgage programs are available to salary card holders. The rate will be lower than the standard rate by 0.3%.

The minimum down payment will be 10%, and it is not required when applying for a non-targeted loan secured by real estate.

| Program | Bid | Sum | Term |

| New building | from 9.6% | up to 60,000,000 rub. | up to 30 years old |

| Secondary housing | from 9.1% | ||

| The larger the apartment, the more profitable | from 8.9% | ||

| Mortgage with state support | from 6% | up to 8,000,000 rub. — in Moscow and St. Petersburg, up to 3,000,000 rub. — in other regions | |

| Non-targeted loan secured by an apartment | from 11.1% | up to 15,000,000 rub. | up to 20 years |

| Collateral property | 9,6% | up to 60,000,000 rub. | up to 30 years old |

| Military mortgage | 9,3% | up to 2,435,000 rub. | up to 20 years |

VTB Multicard and VTB Privilege: latest review

The article about Multicard from VTB was written more than 3 years ago, and due to numerous updates it became simply impossible to read. Conditions changed quite often and quite significantly.

VTB is a large bank and there will always be interest in its products, no matter what conditions are offered. For example, just last month more than 63 thousand people were interested in Multicard:

Therefore, it is quite reasonable to write a new article so that all the advantages and disadvantages of Multicard are at a glance. So, this is what its advertisement looks like on the bank’s website:

Let’s not forget about the premium “Multicard” either

This article is relevant for cards issued from July 20, 2020. The conditions for cards issued before this date are different and continue to apply if the current bonus option is maintained.

VTB multicard. Advantages

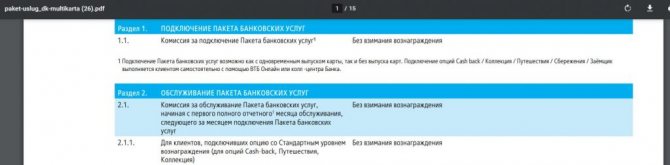

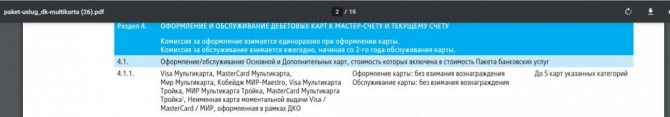

1 Free issue and maintenance.

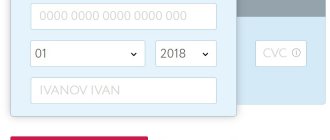

If you choose a standard reward level in the package (1% on the Cash-back, “Travel”, “Collection” options), then the service will be free without any additional conditions. To save time, you can apply for a card online :

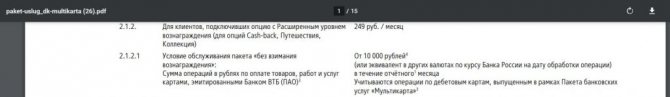

GET A FREE MULTICARD If you choose an extended level (1.5% on the Cash-back, “Travel”, “Collection” options), then to get a free package on debit cards you need to spend at least 10,000 rubles/month, otherwise you will have to fork out 249 RUR/month

For the “Savings” and “Borrower” options the package is free:

You can connect/change the option in VTB Online.

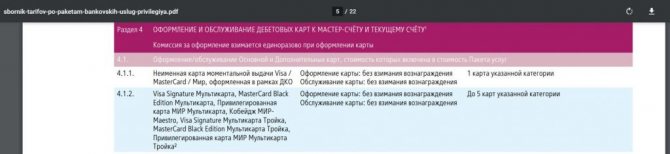

As part of the package, you can issue up to 3 digital cards and up to 5 plastic cards of various payment systems (Visa, MasterCard, MIR, MIR-Maestro coinage, cards with the Troika transport application), including in foreign currency, for free. Cards can be either unnamed or nominal:

In Moscow and St. Petersburg, you can also get a Muscovite and St. Petersburg card (you can place a certified electronic signature on it)

If suddenly the specified number of cards is not enough, then for each subsequent one you will have to pay a one-time payment of 500 rubles.

Nature lovers can for 99 rubles. release an “ECO Multicard” made from biodegradable plastic.

Cards are reissued without commission (except for eco-cards), regardless of the reason.

All issued cards will have the same bonus option.

It is better to immediately check the functionality of the card by requesting the balance at your local ATM, where, if necessary, you can change the PIN code for free:

2 Loyalty program.

You can connect 1 of 5 bonus options to your “Multicard”: Cash-Back, “Collection”, “Travel”, “Savings”, “Borrower”.

The Cash-back, “Collection”, and “Travel” options provide cashback for purchases. The “Savings” option for purchases carries an additional interest on deposits/savings/current accounts. On the “Borrower” option - savings in the interest rate on a consumer loan or mortgage.

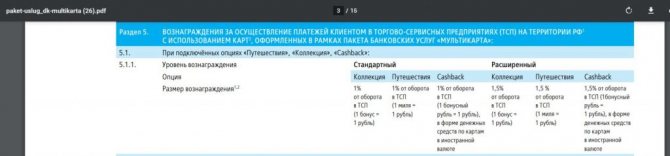

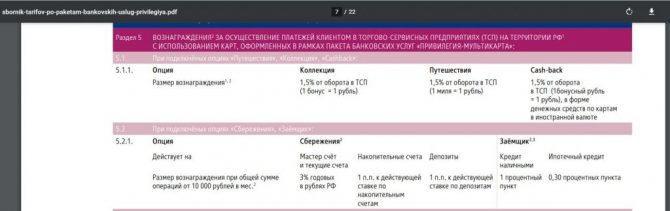

– Options Cash-back, “Travel”, “Collection”

It’s worth saying right away that without some additional promotions, the “Travel” and “Collection” options look useless, because... their remuneration rate is the same as that of the Cash-back option. Only cashback is awarded in points or miles, which can be exchanged for tickets or certificates on the website multibonus.ru , and for Cash-back options - in bonus rubles, which can be converted into regular rubles in your personal account (at the rate of 1 bonus = 1 rub. ).

So, at the standard reward level (at which servicing the “Multicard” package is absolutely free), the Cash-back, “Travel”, “Collection” options offer a 1% cashback on everything. On the extended version (where servicing the Multicard package is free for purchases with debit cards over 10,000 rubles/month) - 1.5% on everything. There is no disadvantageous rounding:

Sometimes additional cashback is offered for purchases from partners.

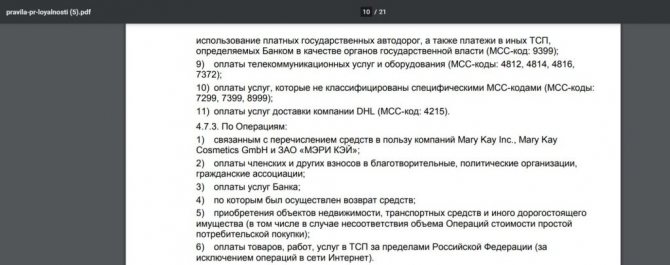

The list of exceptions is quite standard (there is no cashback for communications, taxes, insurance, utilities). Transactions abroad (except for purchases in foreign online stores) will also be without remuneration:

Bonuses are valid for 1 year, so you need to have time to turn bonus rubles into money (this is done in a couple of mouse clicks in your personal account of the bonus program), and exchange miles and points for certificates or tickets.

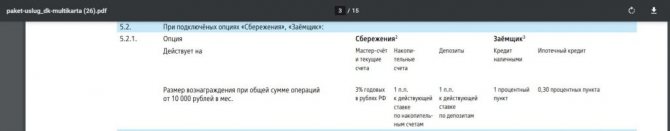

– “Borrower” and “Savings” options

Rewards for the “Savings” and “Borrower” options are paid for purchases of more than 10,000 rubles/month.

The “Borrower” option is eligible for compensation of 1 percentage point on a cash loan or 0.3% on a mortgage.

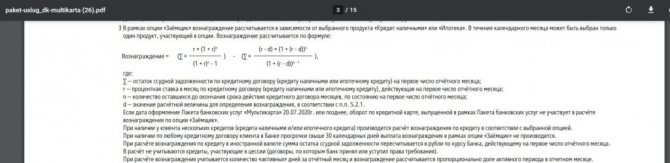

The amount of remuneration is calculated here using a very ornate formula, so it’s not so easy to carry out the calculations yourself:

In general, the “Borrower” option is not particularly interesting, because... The remuneration limit here is limited to only 5,000 rubles/year (awarded in bonus rubles to the bonus account).

On the “Savings” option for purchases over 10,000 rubles/month. an additional 1% is applied to the rate on the minimum cumulative balance for the month on savings accounts in rubles (maximum of 1.5 million rubles), or on the minimum cumulative balance for the month on deposits in rubles (maximum of 1.5 million rubles), or +3% on the average monthly total balance on current and master accounts (maximum RUB 100,000). What exactly the additional rate will be applied to must be selected when connecting the “Savings” option.

It is worth noting that some operations from the list of exceptions for cashback (for example, payment for communications or utilities) are quite suitable for accounting for turnover for payment of remuneration.

So, when storing large sums, such operations can generate turnover without actual purchases. Let’s say there are 1.5 million rubles in the savings account. We top up a mobile phone with “Multicard” on the MTS website with MCC 4814 for 10,000 rubles. and thereby perform a turnover to accrue an additional 1% to the interest rate on the “Savings” option. In terms of rubles, this amount is 1229 rubles.

Money from the MTS balance can be withdrawn to an MTS bank card with a commission of 0.9% through the MTS Money wallet, i.e.

3 Free contraction.

The Multicard can be topped up for free from cards of other banks through VTB Online, i.e. the card can withdraw money , it is only important to make sure that the issuer of the donor card does not charge a commission for such operations.

You can also withdraw funds from the Multicard itself without a commission (that is, it does not have a commission for donation).

You can also top up your card for free at your own ATMs, as well as through incoming interbank banking .

Multicard does not offer free pushing (transfers using a card number to other credit institutions).

The only thing is that through VTB Online, using your card number, you can send money without commission to the cards of VTB and the banks of the VTB group (Pochta Bank, Vozrozhdenie Bank, Sarov Business Bank, Zapsibkombank).

4 Participant of the Fast Payment System.

VTB is a member of the Fast Payment System , which means you can send up to 100,000 rubles/month for free from Multicard.

by phone number to other credit institutions. VTB will also not charge a commission for incoming transfers through SBP: The ability to send/receive transfers through SBP must be connected to VTB Online.

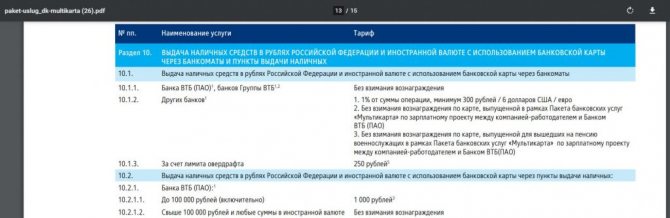

5 Large cash withdrawal limits.

You can withdraw money from the Multicard without commission at ATMs of the VTB Group (VTB Bank (PJSC), PJSC Post Bank, CJSC VTB Bank (Armenia), Subsidiary JSC VTB Bank (Kazakhstan), CJSC "VTB Bank" (Belarus), JSC "VTB Bank" (Georgia), OJSC "VTB Bank" (Azerbaijan), Bank "Vozrozhdenie" (PJSC), PJSC "SAROVBUSINESSBANK", PJSC "Zapsibkombank"), daily limit - 350,000 RUB, monthly - 2,000,000 RUB (or equivalent in foreign currency). At the VTB Bank PVN, cash withdrawal in rubles is free for amounts over 100,000 rubles, and currency withdrawals are free for any amount.

Free cash withdrawal at third-party ATMs is available only to salary earners.

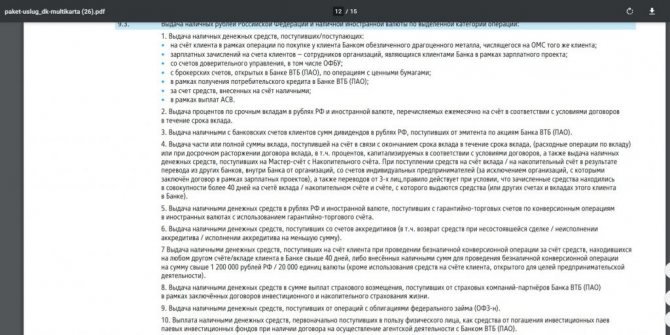

Without using a card for cashing out, a waiting period of 40 days will be required, with the exception of certain cases (including receipts from a VTB brokerage account):

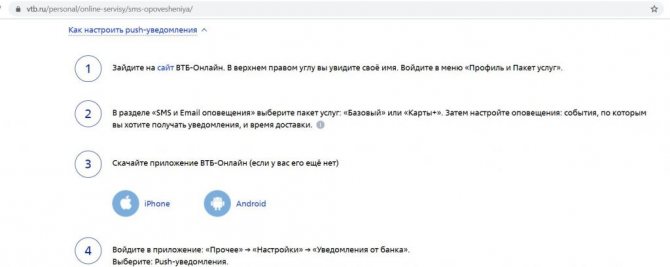

6 Free push notifications.

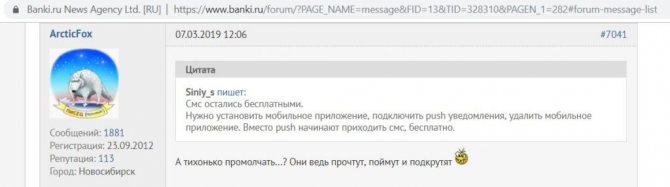

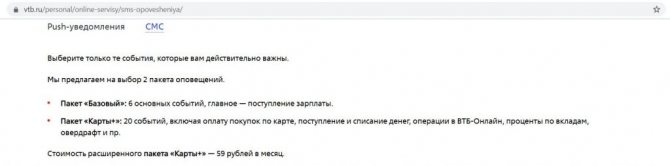

The “Card+” SMS notification package, which includes SMS notifications about incoming and outgoing transactions on the card, is paid and costs 59 rubles/month, but you can use free push notifications instead.

7 Possibility of opening a savings account.

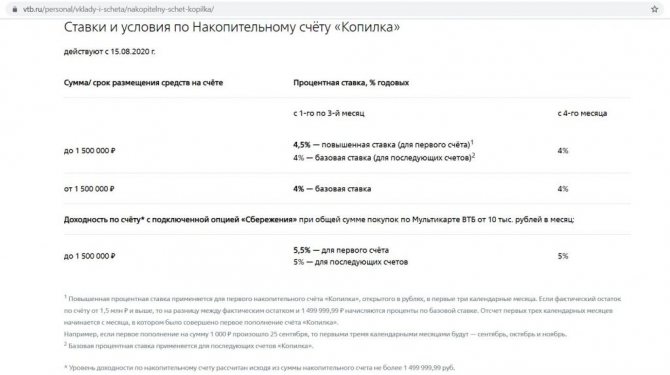

VTB has a savings account called Piggy Bank with fair interest accrual on the daily balance. For the first account in the first three calendar months, an increased rate applies for amounts up to RUB 1,500,000. and standard - for the amount of excess (4% standard and 4.5% increased), then there will be a standard for the entire amount:

If you activate the “Savings” option and spend from 10,000 rubles/month, then in the first three months you can get 5.5% per annum, then 5% per annum. However, it is worth remembering that here an additional 1% is applied to the amount of the minimum account balance for the month. So, in order not to lose interest, the account must initially be replenished on the opening day, then it is better to do this at the end of the month, and expense transactions - at the beginning of the month.

Interest is paid on the last day of the month.

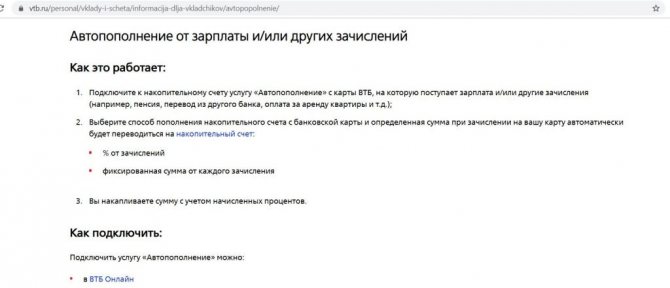

If you wish, you can set up an automatic replenishment for your savings account (for a fixed amount on a fixed date, % of salary or other deposits, % of purchases):

8 Application “VTB My Investments”.

VTB has a simple and understandable application “VTB My Investments”; a detailed article about it is here .

Tariffs for brokerage services are quite humane (commission per transaction 0.05% + 0.01% exchange commission, minimum 1 kopeck), there are no fees for depository services on the “My Online” tariff. The range of available tools is very wide. It’s convenient that in the application you can buy/sell currency from 1 USD, and not in lots of 1000 USD, as with most other brokers.

“Multicard” will be very useful for replenishing a brokerage account, as well as withdrawing funds from it, including currency.

1000 rub. for Tinkoff Black, 500 rub. for “Alpha Card”, 2000 rubles. for Tinkoff Platinum, 2000 rub. for an Opencard credit card, 2000 rubles. for a Tinkoff brokerage account, “100 days without %” from Alfa-Bank with a free year.

Save the Money! recommends:

9 Working with other currencies.

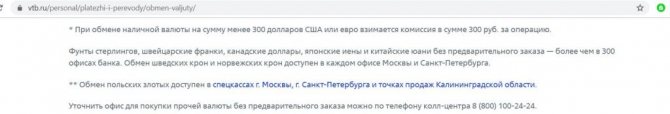

In addition to accounts in rubles, dollars and euros, you can open current accounts with VTB in other currencies (pound sterling, Swiss franc, yen, Swedish krona), and some bank offices also work with cash in these currencies:

10 Reliability.

PJSC VTB Bank, a systemically important financial institution controlled by the Federal Property Management Agency, ranks 2nd in Russia in terms of net assets. So the risk of license revocation from this credit institution tends to zero.

11 Supports Apple Pay, Samsung Pay, Google Pay, MIR Pay.

VTB supports advanced smartphone payment technologies Apple Pay, Samsung Pay, Google Pay and Mir Pay. The same card can be added to several devices and used simultaneously. This way you get free extras.

12 Promotions from payment systems.

As part of the package, you can issue up to 5 cards, and they can be from different payment systems, which means you can participate in various promotions for each of them.

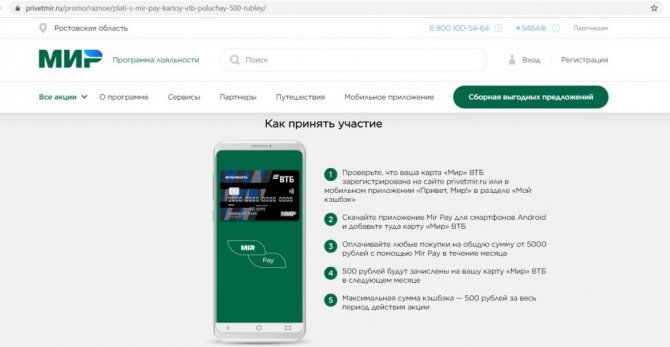

So, with VTB cards of the MIR payment system, you can get a 10% cashback on everything when using the MIR Pay service for purchases (works on Android smartphones). Reward limit 500 rub. To participate in the promotion you need to register a card on the website privetmir.ru . Details can be read here .

VTB multicard. Flaws

1 Commission when working with the cash register.

VTB is actively fighting to reduce transactions through the cash register without using a card.

For example, if you want to withdraw up to 100,000 rubles from your account without using a card, and the branch has working ATMs and your card is in good working order, then you will have to fork out a commission of 1,000 rubles. For depositing into an account without a card from 100 rubles. up to 30,000 rub. VTB provides a commission of 500 rubles. (without commission this can only be done once a month).

2 Unfavorable conversion rate.

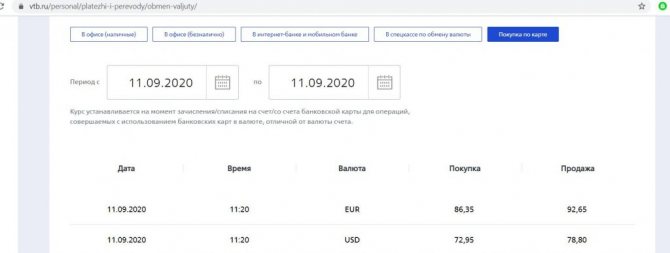

Making purchases in foreign currency using a ruble card, as well as simply changing currency in VTB Online is extremely unprofitable, the spread is very large:

When making purchases in tugriks using a dollar card, there will be one conversion from tugrik to dollar at a favorable rate of the payment system. For the euro zone, the optimal VTB card will be in euros (if you use a dollar card here, there will be an unfavorable cross-conversion rate from VTB Bank, not the payment system).

3 There is no interest on the balance.

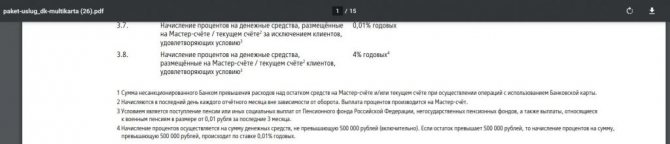

By default, Multicard does not have interest on the balance (0.01% per annum does not count), the only thing for those who receive a pension or other social benefits on Multicard is for a daily balance of up to 500,000 rubles. 4% per annum is due:

In addition, for the “Savings” option when spending over 10,000 rubles/month. for daily balance up to RUB 100,000. will be +3% to the rate.

4 Small limits on cashback.

To be honest, the cashback limits on the Multicard are very small, only 300 rubles. on the “Standard” option and 1125 rubles. on “Advanced”, so there is not much point in making a lot of purchases with these cards.

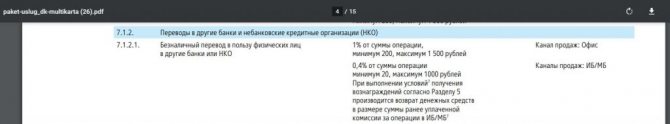

5 Paid interbank.

VTB does not have a free interbank service ; a transfer from IB or MB to another credit institution by account number will cost 0.4% (minimum 20, maximum 1000 rubles):

For salary clients, the interbank commission is returned in the month following the reporting month.

6 High probability of changing conditions.

The conditions for the Multicard change very often, and this applies to both the bonus program and service tariffs. To appreciate the scale, just look at the first article about Multicard .

7 Use of the “anti-money laundering” law (115-FZ).

VTB also has already familiar clauses according to which the bank can refuse to carry out a transaction, block a card, or request documents

VTB Privilege Multicard. Peculiarities

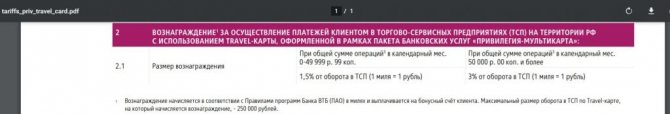

Spoiler alert: “VTB Privilege” (the current offer for premium clients) did not impress me much. Here, as on a regular “Multicard”, you can choose 1 bonus option out of 5, and the “Savings” and “Borrower” options do not have any additional benefits, and the Cash-back, “Travel”, “Collection” options also only have 1.5% cashback, except that the limit is slightly increased (the maximum amount of bonus transactions for calculating rewards is 150,000 rubles/month):

Alternatively, if you have assets from VTB of 5 million rubles, then you can additionally open a “Travel card” (if there are fewer assets, then monthly card maintenance will cost 1,000 rubles), where with a turnover of 50,000 rubles or more ./month All purchases are eligible for 3% cashback with miles, maximum turnover is RUB 250,000/month. The list of exceptions for cashback here is the same as for Multicard.

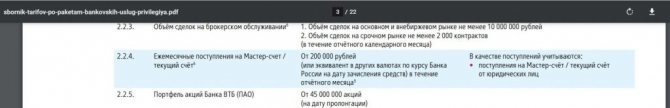

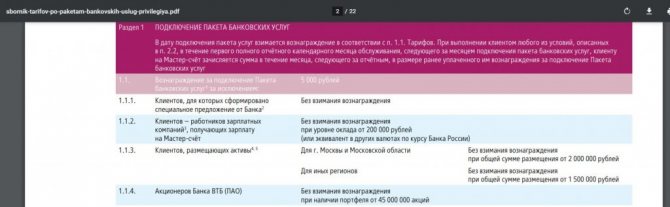

But the criteria for free service of “Privilege” are completely market-based, the most humane of them, in my opinion, is the presence of assets in all accounts at VTB (including brokerage accounts) from 2 million rubles. (for Moscow and the region) and 1.5 million rubles. for everyone else (or the equivalent in currency). In addition, you can ensure freeness by having a spending turnover of 100,000 rubles/75,000 rubles, receiving a salary of 200,000 rubles, and having 45,000,000 VTB shares (at the current price of 0.035 rubles, this is 1,575,000 rubles) , as well as turnover on the brokerage account. If none of the conditions are met, the fee will be 5,000 rubles/month.

When calculating assets, brokerage account balances are taken as of the last day of the month:

If you connect “Privilege” without balances of 2/1.5 million rubles/not being a salary client/without VTB shares/without a special offer, then VTB will first write off 5,000 rubles. for connection, then, however, it will be returned if the criteria for the free “Privilege” service are met:

It is inconvenient that when connecting to “Privilege”, the “My Online” tariff on the brokerage account becomes unavailable and changes to the “Investor Privilege” tariff (the commission for transactions here is slightly lower - 0.03776% +0.01% exchange commission, but there is a fee for depository at 150 rubles/month if there is at least one transaction with securities).

In the Privilege Multicard package, you can issue up to 5 cards of the Visa Signature/MasterCard Black Edition categories:

Interbank here is also paid, there is no free pushing, there is no free cash withdrawal at third-party ATMs, and interest on the balance on the card is not provided by default. Cash withdrawal limits are slightly higher (400,000 rubles/day, 3,000,000 rubles/month), there is free SMS notification.

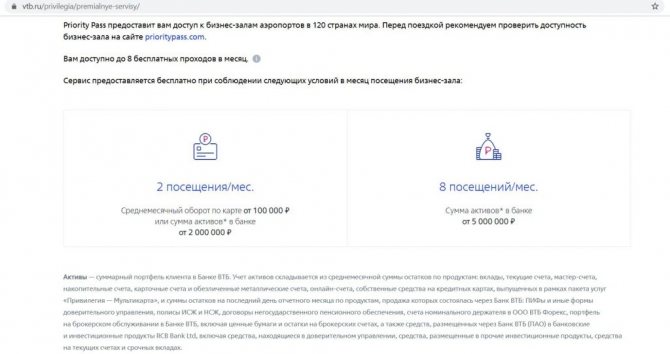

As additional goodies in the “Privilege” package with balances of 2 million rubles. or with a spending turnover of 100,000 rubles. (for regions - balances from 1.5 million rubles or spending turnover from 75,000 rubles/month) 2 free visits to airport business lounges under the Priority Pass program, with balances from 5 million rubles. — 8 visits per month:

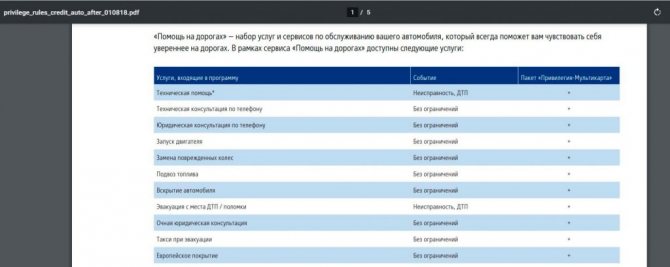

There is roadside assistance from:

Conclusion

“Multicard” at the “Standard” reward level is free without any conditions, and the package includes up to 5 free cards, including in currency. Thanks to large cash withdrawal limits and convenient replenishment, this card will be very useful for a brokerage account at VTB .

GET A FREE MULTICARD

Of course, I would like the limit and amount of cashback to be larger. Well, at least there is no unfavorable rounding. For cashback, it still makes sense to pay attention to other cards .

The “Savings” option seemed interesting, which provides an additional 1% to the interest rate on a savings account, a turnover of 10,000 rubles. easy to do even without actual purchases

The main advantage of the “Privilege” package is the accounting of balances on all accounts (including a brokerage account) to make the package free of charge. The cashback offered for premium is not enough.

I hope my article was useful to you; write about any clarifications and additions in the comments. I would be grateful for your repost :)

You can follow updates in this and other articles on the Telegram channel: @hranidengi . Channel mirror in TamTam: tt.me/hranidengi .

Subscribe in Telegram Subscribe in TamTam

Subscribe to stay updated on all changes :)

comments powered by HyperComments

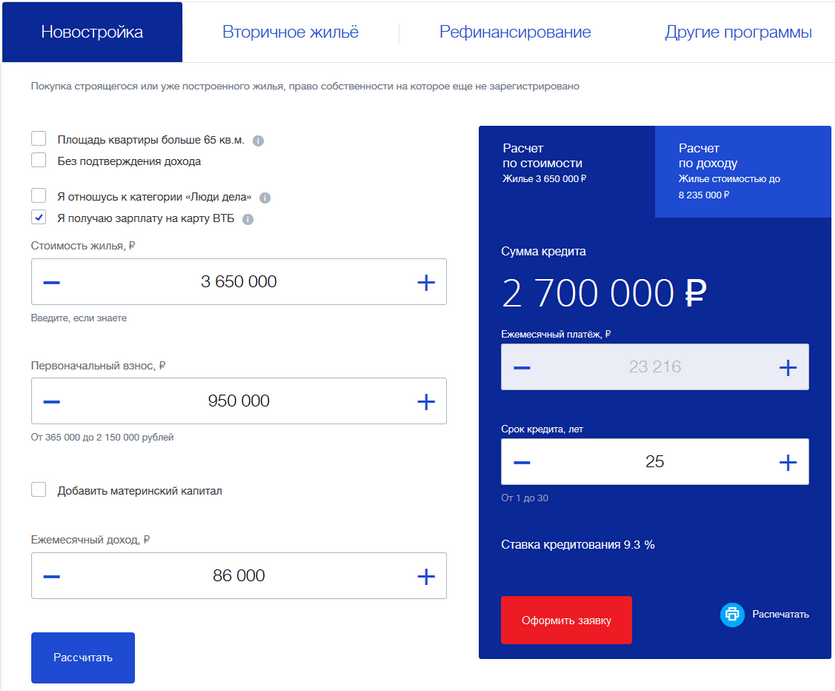

Mortgage calculator

Using the calculator on the VTB website, you can calculate how much you need to pay monthly for your mortgage. To make the calculation, it is enough to indicate the value of the property, the amount of the down payment and the approximate income per month. You can immediately check the box for having a VTB salary card.

Example . When purchasing an apartment in a new building with a mortgage for RUB 3,650,000. for 25 years with a down payment of 950,000 rubles. Every month you have to pay 23,216 rubles. (including discounts for salary clients).

Client requirements

The holder of a salary card belongs to the category of reliable and solvent bank clients. But, despite this, VTB puts forward a number of requirements for such borrowers. Among them:

- The period of ownership of the card must be at least six months;

- over the last 3 months, at least 3 cash payments must have been transferred to the card;

- The client's work experience must be 6 months or more;

- The client must be at least 21 years old at the time of registration of the mortgage and not older than 75 years at the time of its repayment.

As you can see, the above requirements are more flexible than the standard ones. They are necessary in order to avoid fraud and scams. If the client fully complies with them, then with a high degree of probability the application will be approved.

How to submit an online application to VTB

You can apply for a mortgage through the VTB website. To do this, on the page of the appropriate loan program, click on the “Fill out an application” button and fill out the form that opens.

Data you will need to provide in the online application:

- FULL NAME.;

- date of birth;

- telephone;

- email;

- employer's tax identification number;

- data on work experience with the current employer and total length of service;

- approximate family income (per month);

- passport details.

A VTB manager will contact you within 3 hours to clarify the information. A decision on it will be made in 1 - 5 days.

Also read: Consumer cash loan at VTB 24: conditions, rates and reviews

Required documents

You will need:

- Russian passport and TIN;

- military ID for men of military age ( up to 27 years );

- a form that is filled out without errors or corrections ;

- marriage and birth certificates;

- certificate of income from the place of work;

- confirmation of the first payment;

- documents for housing issued with a mortgage.

After you have fulfilled all the requirements, wait for the bank's decision. If the bank gives a positive answer, a loan agreement will be concluded with you, the seller will receive the money, and you will be able to move into your apartment. By applying for a mortgage, you agree to fulfill all the terms of the contract, since fines will be imposed on you for late payments.

And remember that you become the full owner of your home only after you have fully repaid your debt to the bank.

Despite the complexity of the mortgage, the borrower invests money in his own home , and, moreover, receives great benefits from this operation. The most important advantage of a mortgage loan is that you quickly move from the status of a tenant to an owner .

State support program

Not all citizens can choose such a program. It can only be received by families with more than two children born between January 1, 2018 and December 31, 2022. They will enjoy the following privileges from VTB Bank:

- the possibility of purchasing primary and secondary housing;

- the loan rate is 5%;

- the subsidy is provided for a maximum of 8 years;

- the largest amount for purchasing an apartment is 12,000,000 rubles;

- down payment – at least 20%.