Advantages of an American mortgage

Obtaining a home loan in the USA is suitable for Americans and citizens from other countries. The advantages of such a loan include:

- Most credit companies are loyal to customers. In the United States, a project has been developed to stimulate the construction of new housing and the growth in the use of mortgages. Thanks to it, financial institutions approve the majority of applications for housing loans submitted for a house or apartment. The property may be ready or under construction.

- Floating interest rate. Many American banks offer mortgages with variable interest rates, i.e. their level is influenced by client performance. For borrowers, this type of rate may be unprofitable, since it is constantly changing. But if you pay the loan regularly without delays, this condition does not matter.

- The official salary and the client’s own savings (savings, shares, valuable documents) are taken into account.

There is a lot of competition in the US banking market, so to attract customers, credit institutions are trying to offer more suitable conditions and a low mortgage rate.

Loan program options

Mortgages in the USA for Russians, other foreigners and indigenous people are intended to improve living conditions. There are many programs aimed at different categories of citizens and with individual conditions.

You can become the owner of mortgage real estate through the following programs:

- For construction firms and low-income individuals. Territorial distribution - Florida. This program is intended for individuals whose income is low. Its main idea is to purchase residential real estate from the provided list on individual terms.

- For pensioners. This is a non-performing mortgage that gives people of retirement age the chance to borrow for life. The borrower's existing property is used as collateral for the loan. Ownership of the property remains with the client.

- A loan issued to customers who use energy-saving equipment in their homes. The main differences of this loan are the unique conditions and the minimum interest rate.

- Lending to people who have become victims of various disasters. Intended for borrowers whose homes were damaged due to disasters and catastrophes.

- Refinancing.

You can get a mortgage in the USA at bank branches of First Republic Bank, Bank of America, Wells Fargo, City National Bank, etc.

What mortgage programs are there?

To obtain a mortgage in the USA, there are a number of mortgage programs that the bank provides to its borrowers in order to improve credit conditions, thereby choosing the latter’s banking organization.

The main programs include:

- Mortgage programs for veterans;

- Mortgage programs for low-income families;

- Mortgage programs for disaster victims;

- Mortgage programs for pensioners.

Special mortgage programs are provided to citizens who have appropriate documents confirming their status, which allows them to qualify for one or another program.

In addition to all kinds of mortgage programs, in the USA there is such a service as refinancing.

Refinancing involves taking out a loan from a bank to pay off the balance of a mortgage issued by another bank.

In this case, the bank that provides the loan for refinancing repays the debt to the bank from which the mortgage was taken out.

The new bank evaluates the statistics of debt payments to the old bank, on the basis of which it makes a decision on issuing a loan for refinancing.

Quite often this procedure is a very profitable solution.

Refinancing is possible no more than once a year .

Loan for foreign clients

A mortgage in the US for Russians can cause a number of difficulties caused by the political support of American citizens and the lack of trust in visitors. But since there is no strict ban on issuing housing loans to non-residents, it is possible to obtain such a loan, although with a number of restrictions.

The presence of the following conditions increases the chances for foreigners:

- Letter of recommendation from any bank in Europe. It confirms the reliability and good CI of the borrower.

- Large down payment. Its size should be at least 30-40% of the value of the property.

- Increased interest rate threshold. For citizens of other countries, many banks set higher interest rates.

See this same topic: List of documents needed to apply for a tax deduction for a mortgage

Some American banks offer special mortgages for foreign clients. It is issued for 30 years. It features a fixed percentage for the first few years. Most often this period is 5 years. This approach allows you to set an annuity monthly payment for a time.

Types of mortgage

A loan for the purchase of real estate in the USA is called a mortgage. In this case, loans come in two types: with a fixed interest rate (Fixed-Rate Mortgage) and with a floating rate (Adjustable-Rate Mortgage).

The vast majority of borrowers prefer the first type, since here the rate cannot change: for the entire period of lending, the one specified in the loan agreement will be applied.

The peculiarity of the floating rate is that it is usually 1-2 percent lower, but the bank has the right to raise it, although in principle it can leave it unchanged. Usually in practice it happens like this: for 5-10 years the bank undertakes to lend at a fixed rate, but after this period it has the right to change it (lower or increase).

Thus, the second type is associated with a certain risk; it is more profitable mainly for those who are going to sell the house later.

Types of mortgages in America, collateral, interest rates - the next video is about this.

Return to contents

What is the mortgage interest rate in the USA?

Mortgage loans for American borrowers are issued at 3.5-7% per year. But for clients who come from other countries, the rate is significantly higher. This approach is used to reduce the risk if the borrower decides to return to his home country and defaults on the loan.

The average rate for Russians and other non-residents in 2020 was 8-9%. The exact amount of interest is calculated taking into account the client’s solvency and documents proving reliability.

Bank of America is a major banking institution in the United States. Here the mortgage rate is:

- 3.75-4.4% – for Americans;

- 5.75-6.4% – for foreigners.

The amount of interest is determined by the period for which the loan is issued and the type of rate. All applications are considered individually, so each borrower has access to personal conditions and interest rates.

Basic provisions of a mortgage loan

Most foreign citizens are issued a mortgage loan in the amount of 100-150 thousand dollars. The size of the mortgage is affected by the client’s income level.

The most important conditions for issuing a mortgage:

- The average down payment is 40%. It can also be reduced to 30% or, conversely, increased to 50%. The change in the contribution is influenced by the borrower's reputation, credit history and income level.

- Loan term – 15-30 years. Selected at the request of the borrower. Most clients prefer the maximum term, as the monthly premiums are reduced. The minimum loan term is also unfavorable for the bank because it reduces the profit of the lending company.

- Registration of insurance. When buying an apartment or house in America, you must insure the property against natural disasters, catastrophes and other unforeseen circumstances.

- No commission or penalties for early loan repayment.

For foreign citizens wishing to obtain a mortgage from an American bank, there are a number of requirements:

- Age category – 25-75 years;

- Have a valid residence permit, work visa or Green Card;

- Having a social security card;

- Good credit history with no late payments or non-payments;

- A valid account in an American bank containing an amount equal to 12 monthly loan installments.

Clients must pay a 3% commission for providing borrowed funds. There must be a certain amount in the bank account.

Features of mortgage lending in the USA

American banks are quite loyal to borrowers; consumer and mortgage loans are offered not only to US citizens, but also to residents of other countries on almost the same terms.

Here you can get a mortgage not only for finished housing, as in most countries, but also for real estate under construction. In addition, several preferential mortgage lending programs are offered:

- for pensioners;

- for the low-income population;

- for disaster victims;

- for customers using energy-saving devices in their homes;

- refinancing.

For Americans who want to buy a house with a mortgage, it is not difficult to get money from a bank; the main thing is to have a stable official income, a good credit history and a bank account in which the amount covering the down payment is placed.

In addition, when considering an application, not only the client’s official income is taken into account, but also any savings and additional assets, including deposits and securities.

Documentation

To obtain an American mortgage, the borrower must provide the following package of documents:

- Statement;

- Original and copy of international passport;

- A document that gives the client the right to be present in America (work visa or Green Card);

- A certificate indicating the level of profit for the previous three years;

- A bank statement proving the availability of the required amount in the account;

- Social insurance card number;

- A letter of recommendation from a leading credit institution (desirable, but not required);

- An extract from the National Bureau of Credit Histories, with a detailed KI of the client, a description of his diligence and reliability as a borrower;

- A copy of the contract for the purchased house (apartment).

See this same topic: Is it possible to take out a mortgage while on maternity leave? Conditions of registration

A prerequisite is the translation of certificates into English and their notarization.

Providing a note with recommendations from the bank is not a requirement, but it will help reduce the requirements for the borrower and reduce the time it takes to process the application.

How to get a mortgage in the United States

The process of obtaining a mortgage loan in the USA consists of several steps:

- search for the desired property - this can be either finished or under construction housing;

- selection of a bank with optimal conditions - the conditions for issuing a mortgage, the cost of the down payment and the amount of interest may vary significantly for each specific bank;

- opening an account with a selected credit institution - an amount must be placed on the account in advance to cover the down payment, 12 monthly payments and the bank’s commission for the provision of services;

- preparation of the required package of documents - all documents must be translated into English and notarized;

- conclusion of a preliminary purchase and sale agreement (it must indicate the deadline for receipt of money by the seller);

- submission of documents and a loan application to the bank - the application is reviewed within several working days, during which the bank carefully examines the solvency, credit history and reliability of the borrower;

- assessment and verification of the legal purity of the purchased property - based on the assessment of an independent expert, the optimal loan offer is selected, the maximum available amount and interest rate are calculated;

- signing the contract and legal registration of the transaction.

Step-by-step algorithm for obtaining a housing loan

In order for Russian citizens to obtain a mortgage loan in the United States, the following steps must be followed:

- Find housing (through real estate agencies or independently through advertisements).

- Prepare the necessary documentation.

- Open an account and deposit the required amount into it.

- Using banking programs, calculate the amount of monthly payments, taking into account the conditions of different mortgage offers.

- Choose the appropriate loan option.

- Sign a temporary contract for the purchase of the property. Indicate in it the value of the property and the date of payment of all funds to the seller.

- Submit a loan application and documents to the banking company.

- Conclude a loan agreement.

- Conduct a real estate purchase and sale transaction and conclude it legally.

- Pay additional expenses: commission (3%), insurance (1-3%), payment for inspection and inspection of living space.

Most US banks process applications for about a month.

Additional expenses

Borrowers who plan to get a mortgage loan in the USA should prepare in advance for the fact that additional costs will follow for the services of various types of specialists and insurance.

The list of expenses that you should prepare for includes:

- services of a real estate valuation expert;

- bank commission for preparation and processing of documents;

- services of specialists who will check the condition of the living space;

- translator and notary services;

- registration of an insurance policy for the purchased property and the life of the borrower (paid annually).

Of course, you should not forget about the amount of the down payment; depending on the bank, it can range from 20% to 50% of the expert assessment amount.

Comparison of mortgages in Russia and the USA

A special feature of mortgages in the USA is the low level of mortgage rates – 3-7%. The politics and economy of a country have a direct impact on it. In 2016-2017 as a result of the presidential elections it increased by 0.7%. This growth is significant, but the number of people willing to take out a mortgage during that period was still huge. The minimum mortgage rate on a mortgage loan in Russia today is 10-12%. In some banking organizations you can get a loan at only 9%.

Another difference between mortgages in the two countries is the type of mortgage rate. Most banks in Russia offer a fixed rate, while in the United States they prefer a floating rate. This is why Americans do not always know the size of their monthly contribution in advance. But thanks to the lower mortgage rate, it is profitable to take out a US home loan when you are confident in the possibility of early repayment.

The similarity between Russian and American mortgages is the different price levels of real estate. The average cost of economy and comfort class housing in America is 35-900 thousand dollars. It is determined by the location of the property, area, number of rooms and the availability of nearby infrastructure. If in Florida you can buy only a small apartment with an area of just over 30 sq.m. for 340-350 thousand dollars, then in New Jersey a villa with an area of 80 sq.m. costs the same. Exactly the same conditions affect the cost of housing in Russia.

Mortgages in the USA are available not only to Americans, but also to citizens of other countries, including Russians. Foreigners are issued a loan for 15-30 years for housing that is already completed or is just under construction. Mandatory requirements are an increased down payment and insurance. When applying for a mortgage, the client’s solvency, financial reputation and CI are of great importance.

Mortgage for Russians and other foreigners

It is quite difficult for a foreigner to get a loan in America, and now in practice there are many cases of banks refusing to cooperate with citizens from other countries. Unfortunately, clients from Russia and the CIS countries are among the most undesirable for US banks. Despite this, according to statistics, about half of foreign citizens buy housing in the United States on credit.

You won't be able to get a mortgage in the US without a Green Card.

So, if you are considering the option of buying American real estate on credit, then the main features will be as follows. The cost of housing in different states of America can be found here.

Additional documents will need to be submitted to the bank. In particular, letters of recommendation from other banks, a certificate from a credit history bureau, a green card. For the most part, this is necessary to guarantee the bank that the loan will be repaid.

All documents (both main and additional ones reviewed by us) must be translated into English.

Return to contents

Interest rate

Unfortunately, for foreigners the rate will be higher: as a rule, by 1-1.5 percent - both for fixed and floating.

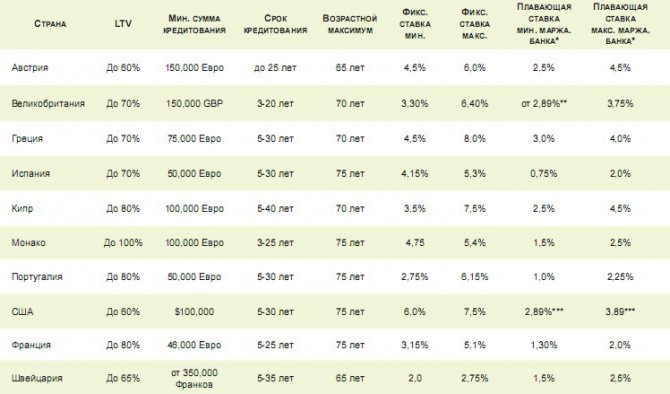

In general , in America the rates are higher than in European countries, but significantly lower than in Russia . For many years in the USA, rates remained at the level of 3-4%, but now they are growing. By the beginning of 2020, it varies around 5-6%.

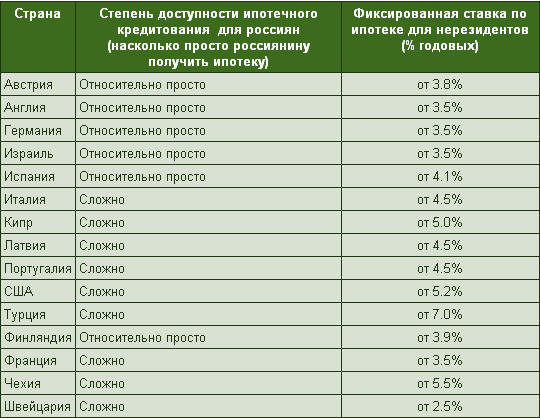

How difficult is it for Russian citizens to get a mortgage abroad?

Let us remind you that floating rates may be slightly lower, and rates for foreigners may be higher, by 1-1.5%. Thus, a Russian intending to purchase a house in the United States today should expect an average rate of 7.5-8%, although again it must be remembered that each case is individual.

A foreign citizen will have to take additional steps: appraise the property (about $500), insure it (about 2% of the cost of the house). It is advisable to insure every year.

In addition, there is a penalty for early repayment of the loan (3% of the remaining debt in the first year, 2% in the second and 1% in the third).

Let us remind you that you will have to spend money separately on flights, temporary residence in America and other formal nuances. Therefore, if you still set out to buy a home in America, it is better if this goal is justified by moving to the United States.

Before taking out a mortgage, you need to calculate the payment amount, which will not be too burdensome, and only then contact the lender - the lender. More details in the next video.

Return to contents

Documentation

We have already reviewed additional documents for foreigners, now let’s talk about the main ones. So, a person who wants to take out a loan from an American bank with a mortgage must submit:

- Passport (or it could be a US driver's license, green card).

- Social security number.

- Your credit history.

- Information about income (as a rule, this is a certificate of salary for the last 3 years).

- Bank account statements confirming that they have funds (usually for the last two years).

- A copy of the contract under which you purchase the house.

- Other documents (banks have the right to request other documentation, it all depends on the specific case).

Return to contents

Remote way of obtaining a loan for foreigners

If you have an open US visa, you do not have to come to America to complete all loan and mortgage formalities. You can do this remotely. You will need to use the services of organizations that specifically deal with these issues, or you can contact lawyers.

Under what conditions are mortgages given in different countries, in particular in the USA?

The bottom line is that the documents are certified by the Russian US Consulate and then sent by mail. The method as a whole is quite optimal and profitable.

Return to contents

other expenses

We have already talked about home appraisal; this procedure will cost from 350 to 2000 dollars, but if the property is valued at more than one million dollars, you will have to pay twice as much.

Separately, you will need to pay the bank for the mortgage registration services (about $35).

A fee will be required (approximately 2% of the total loan amount).

Return to contents

An initial fee

Most often, it ranges from 10 to 50% of the loan amount (it is higher for foreigners than for citizens). However, some banks may provide loans with a lower down payment or no down payment at all. Therefore, a potential borrower is advised to carefully search for more profitable lending options; there are a lot of offers on the market.

It’s easier to get a mortgage in Russia, but in the USA it’s easier to pay it off

Return to contents

Loan size

Typically, US banks provide funds in amounts ranging from 100 thousand to 20 million dollars. Although each bank has its own characteristics, take a closer look at what different banks offer.

Return to contents

Loan term (mortgage)

The specific period is indicated in the loan agreement between the bank and the citizen. The minimum term is usually 5 years. If we turn to practice, most often a loan secured by real estate (mortgage) is provided for 15-30 years.

Return to contents