Home/Mortgage repayment/Mortgage in case of death of the borrower

Mortgages are provided for a long period of time. During this period, the situation can change significantly. If the mortgage borrower passes away, the debt is not automatically forgiven. The citizen’s family will have to settle the issues with the bank. Individuals may commit to closing the debt or refuse to take action. However, in the latter case, the bank can sell the apartment and use the money to pay off the debt. If the heirs want to receive the mortgaged property after the death of the borrower, they must figure out who the debt will go to and when they should begin paying off the obligations.

Who pays the mortgage in the event of death?

If the main recipient of the mortgage passes away, the first thing you should pay attention to is the presence of insurance that protects life and health. If mortgage insurance is available, the need to cover obligations will be assigned to the insurance company. However, the rules only apply if the relevant risk has been included in the policy. Otherwise, the application for payment will be rejected.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

If there is no life insurance policy for a mortgage, or the situation is recognized as not insurable, but there are heirs, the closure of the debt is entrusted to them (Article 1175 of the Civil Code of the Russian Federation). These citizens have the right to refuse to transfer debts. However, in this case the person will have to reject the inheritance completely. Receive property after the death of the mortgage borrower, but the obligation cannot be waived.

If there are several heirs, the mortgage debt in the event of the death of the borrower, like property, is divided between them in proportion to their shares in the inheritance (Article 1175 of the Civil Code of the Russian Federation). It is noteworthy that the person is liable only to the extent of the value of the property received. The bank cannot demand from a citizen an amount exceeding the established parameters.

Attention

However, the responsibility for closing obligations is not always transferred to the heir. If the second responsible party to the agreement is a co-borrower, he will have to begin providing funds (Article 325 of the Civil Code of the Russian Federation). It is not possible to refuse responsibilities.

Features of inheritance of mortgage housing

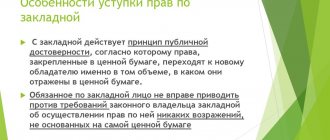

The laws of the Russian Federation do not establish restrictions on inheriting real estate that is encumbered by a bank. The process of transferring assets itself is carried out simultaneously with the transfer of debt obligations, as well as the re-registration of the relevant collateral documentation.

If a person decides to inherit a mortgaged home, then he should know some nuances:

- Simultaneously with the transfer of rights to real estate, the heir also acquires certain obligations regarding the payment of the balance of the loan debt. This includes the amount of the principal debt, interest for using bank money, penalties and penalties for late payments and other payments;

- the amount of interest on the loan will be accrued even after the death of the testator and until the applicants, after six months, enter into inheritance rights. If the relatives of a deceased person do not want to accumulate significant debt and arrears, then it is better, even before entering into an inheritance, to make monthly payments according to the established schedule in the loan agreement;

- the encumbrance on real estate cannot be removed until the debt is paid in full;

- a financial institution can enter into a lending agreement with legal successors on new terms, but this is only a right of the bank, not an obligation;

- if all parties reach an agreement, the mortgaged apartment can be sold, the debt to the bank can be repaid, and the remainder of the amount from the sale of the property is transferred to the heirs;

- if there are several claimants to the inheritance, then they will be able to claim equal shares of the property depending on the order of inheritance.

The procedure for obtaining collateral housing depends on several factors. These features must be taken into account when preparing documents.

Insurance in case of death of the mortgage debtor

Despite the fact that the law does not oblige a citizen to insure life and health, most banks refuse to issue funds or increase the severity of the conditions if the borrower refuses the policy. Therefore, usually a person is financially protected from unforeseen situations. However, the death of a citizen is not always recognized as an insured event.

First of all, you need to pay attention to the provisions of the mortgage insurance contract. Situations in which death is recognized as an insured event are described in detail here. The company representative takes into account the cause of death of the debtor. The application will be rejected if the situation arose as a result of criminal activity, driving while intoxicated, or playing extreme sports. The exact list of reasons is reflected in the agreement.

If the reimbursement application is approved, the person will receive compensation. However, cash payments are not provided. The company will transfer the required amount to the bank to close the debt on the housing loan after the death of the borrower.

If you had insurance

Today, in most banks, you can get a mortgage only if you have insurance coverage for the life and health of the borrower. If the borrower dies on a mortgage with life insurance, the insurance company pays off the loan obligations. But sometimes insurers refuse to compensate for losses, classifying the incident as a non-insurable event. As a result, the loan debt is transferred to relatives or guarantors.

Of course, for the loan recipient, insurance is an additional processing cost, and a considerable one. Moreover, a feature of insurance services is that the insurance contract is a fixed-term one, and it must be renewed annually. But it is important to know that according to this agreement, the death of the mortgage borrower is an insured event, and the legal successors can claim the participation of the insurance company in repaying the bank debt of the deceased.

One more point is important. When applying for insurance, the company often does not focus on whether the insured person has chronic diseases. But if death occurs as a result of an exacerbation of the disease, the event may be classified as non-insurable, and the debt of the deceased is not covered by the insured amount.

Therefore, heirs are advised to pay attention to the following:

- insurance companies are very vague about the indemnity obligations in the contract, and in order to achieve repayment, the help of qualified lawyers will be required;

- The insurance contract always clearly indicates non-insurance events. Most often, these include the death of the insured as a result of combat operations, which occurred while engaging in extreme sports, from chronic diseases, as a result of poisoning with alcohol, narcotic substances, or occurring in institutions of the penitentiary system. In these cases, the insurer is not obliged to make payments.

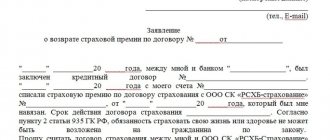

In the event of the death of the insured mortgage borrower, the heirs must:

- submit an application to the insurance company, attaching a death certificate, insurance contract, medical report on the causes of death;

- wait for the insurer's decision. If the result does not satisfy the interested party, they go to court to protect their interests.

If the insurer has decided to pay compensation to the bank, the obligation will be repaid, the mortgage will be closed, and the property will be released from collateral.

Recommended article: How to rent a place with pets: expert advice

Mortgage Inheritance

A citizen has the right to independently determine his heirs. To do this, a will is drawn up. Chapter 62 of the Civil Code of the Russian Federation is devoted to the document. All the features of paper design, its legal force and nuances of application are defined here. However, in practice, a person may not have time to identify heirs. In this case, the procedure for transferring property after the death of the owner will be carried out in accordance with the provisions of Chapter 63 of the Civil Code of the Russian Federation. A legal act defines the rules of inheritance by law. They must be observed, including when receiving mortgage obligations and an apartment for which the debt has not yet been paid.

If a person claims part of the property and is ready to pay off the debt for the testator, it is necessary to contact the notary office located at the last place of residence of the property owner or location of the property. The procedure must be completed within 6 months. The period begins to be calculated from the moment of death of the testator.

The notary will read the citizen’s application, examine the documents confirming the relationship and the fact of the death of the testator, and then open the corresponding case. After 6 months, all heirs who contact the specialist will receive certificates confirming their right to property. Based on the document, it will be possible to re-register the property.

Attention

If a person plans to receive the property of the testator and is ready to repay the mortgage after the death of the borrower, it is necessary to begin interaction with a financial organization immediately after the death of the main borrower.

The procedure will be performed according to the following scheme:

- A citizen notifies a financial institution about the death of a mortgage borrower. You must provide supporting documents.

- The bank is introducing a moratorium on interest charges. The organization does not have the right to apply sanctions for 6 months (Resolution of the RF Armed Forces No. 9 of May 29, 2012). This period is necessary for registration of inheritance.

- When the established period has ended and the successor has received a certificate of inheritance, the person contacts the bank and transfers the debt to himself.

- The financial institution is preparing an additional agreement. The documents record the amount of remaining debt, the amount of overpayment, the timing of mortgage payments and the procedure for closing obligations.

Features of inheritance after the death of a spouse

But in this case, the husband or wife can claim a compulsory share if he is disabled or cares for dependents. The law will protect such a spouse, left without property. It will also play a role whether the property was jointly acquired during the marriage or whether it was received/acquired by the deceased before the marriage, after the divorce.

Any heir is obliged to accept or refuse the inheritance within 6 months from the moment the inheritance case is opened. must be a notary at the request of one of the applicants, which can only happen after the death of the former owner.

During this period, all applicants, including the spouse of the deceased, must submit documents to accept their share or to register. Inheritance by law will occur in the absence of a will, but there are often cases when applicants can inherit property on two grounds.

This is interesting: X dominant inheritance 2020

Who will get the mortgaged apartment in the event of the borrower's death?

Property owned by a citizen passes to his heirs. First of all, you need to pay attention to the presence of a will. In it, the person records his will regarding the disposal of property. The peculiarity of the document is that it can even identify citizens who are not close relatives. Property can be transferred to any person. However, in this situation, dependents and minor children must be allocated a mandatory share (Article 1149 of the Civil Code of the Russian Federation).

If there is no will, the distribution of property will be carried out according to law. In this case, the property goes to relatives. In the Russian Federation there are 8 lines of inheritance (Articles 1142-1145 of the Civil Code of the Russian Federation). The closer a citizen is to the testator, the higher the chance of receiving a mortgage apartment after the death of the borrower. So, the first stage includes:

- spouse;

- natural or adopted children;

- parents.

IMPORTANT

The above persons inherit first. If there are no representatives of the group, the opportunity to receive property will pass to the second or subsequent stages. In practice, there may be several heirs at the 1st level at once. In this case, property and obligations are divided between them in equal parts.

When do co-borrowers pay the mortgage after the borrower's death?

Banks usually insist on attracting co-borrowers. For a financial organization, this is an additional guarantee of timely fulfillment of obligations. If the primary beneficiary of the funds passes away and the heirs refuse to repay the debt, the need to provide funds will fall on the co-borrower. It is not possible to refuse obligations.

Typically, wives, children, husbands, brothers and sisters of the recipient of funds act as co-borrowers. It is acceptable to attract one or several co-borrowers. The rights and obligations of persons are fixed in the mortgage agreement.

Attention

If the person acting as a co-borrower is not a relative, and the heirs after the death of the main borrower are ready to repay the obligations, a joint settlement of the mortgage is acceptable. When the debt is repaid, the property will be divided.

Upon Death of the Mortgage Borrower Who Repays the Loan

Article 1175 of the Civil Code of the Russian Federation determines that the debt on a mortgage loan is subject to mandatory payment to the lender. After the death of the debtor, all his debts are transferred to his heirs. However, a mortgage has a number of features.

Interaction with an insurance company is often accompanied by difficulties when an insured event occurs.

The contract specifies cases that under no circumstances will be considered insurable. In particular, if a person had chronic diseases, was involved in extreme sports, consumed alcohol or drugs, and the death of the borrower occurred for such reasons, then there is a very high probability that the event will be considered non-insurable. Heirs (read more...)

When does the bank pay the mortgage after the death of the debtor?

The bank will not write off or independently pay off the mortgage for a client after death. If there are no co-borrowers, the situation is not recognized as an insured event, and the heirs refuse to receive obligations, the financial organization initiates legal proceedings, during which they consider the possibility of selling the apartment and using the proceeds to pay off the mortgage debt. In most situations, the company's requirements are satisfied. As a result, the apartment will be sold, and the proceeds will be used to pay off the debt.

What happens to the mortgaged property after the death of the borrower?

If the apartment is not needed, and accordingly, the heir does not want to be liable for the debts of the testator, the law allows for a notarized refusal of the inheritance.

After submitting such a document to the bank, all claims against the heir will be dropped. In a situation where the mortgage borrower has insured himself against potential death and loss of health, the bank will receive an insured amount for the occurrence of an insured event, with which it will pay off the debt. The property itself will become the property of the immediate family.

Rights of the guarantor

Often one of the conditions for issuing a mortgage is the mandatory involvement of guarantors. Unlike co-borrowers, persons acting in this role cannot claim part of the property purchased on credit. However, guarantors bear full responsibility under the contract if the main recipient of funds for some reason can no longer continue to fulfill obligations (Article 363 of the Civil Code of the Russian Federation).

If the person who took out the mortgage dies, the possible consequences depend on the specifics of the situation. When the borrower changes and the heir begins to act in his capacity, the liability of the guarantor can be retained. Such measures are applied only if the person agrees to bear responsibility, or the contract states that it does not disappear even if the borrower changes.

IMPORTANT

In practice, a person may not have any heirs, or they have formalized a refusal to accept obligations under the mortgage and property. In this case, the property passes to the state. The guarantor has the right to refuse the obligations assumed.

Repayment by the insurer

Is the death of the borrower considered an insured event? If the court decides that one of the relatives or guarantors is obliged to pay the debt, then it will be impossible to refute this decision. But there is one plus here. Unlike ordinary debt, mortgage debt, in addition to payment obligations, guarantees receipt of the subject of the debt (that is, an apartment).

Banks usually insist on attracting co-borrowers. For a financial organization, this is an additional guarantee of timely fulfillment of obligations. If the primary beneficiary of the funds passes away and the heirs refuse to repay the debt, the need to provide funds will fall on the co-borrower. It is not possible to refuse obligations.

Mortgage in case of death of one of the spouses

If the borrower is in a formal relationship, his spouse will act as a co-borrower. In addition, a person is considered a first-degree heir. If a couple has minor children, the parents represent their interests. When a person passes away, the responsibility for closing obligations to the bank will pass to the husband or wife of the recipient of the funds. Usually the calculation scheme does not change. However, a citizen can contact the bank to review the terms of closing mortgage obligations in the event of the death of the borrower. The action is carried out at the time of loan renewal.

Military mortgage in case of death of a serviceman

Military mortgages are provided in compliance with the provisions of Federal Law No. 117 of August 20, 2004. If a soldier dies, there are three possible outcomes:

- There was insurance. If the case is recognized as insured, the company will independently pay off its obligations to the bank. As a result, the serviceman's family will not have to make payments. The heirs will receive the apartment.

- An agreement will be drawn up with the heir, who will assume the obligations for the loan. If there are savings left on the personal account of an NIS participant that belong to this person, the state will continue to close the obligations. However, if the amount is not enough, the heir will have to pay the balance of the mortgage debt himself after the death of the borrower.

- There will be a one-time repayment of the debt. To do this, the citizen must provide the required amount.

For your information

, relatives can decide whether they want to use contributions from Rosvoenipoteka or pay off the obligations themselves.

Upon Death of the Mortgage Borrower Who Repays the Loan

If the death of the debtor is recognized as an insured event, then interested parties (for example, relatives) must notify the insurer about the incident and provide the necessary package of documents. After this, the insurance company will request information from the bank about the balance of the debt and transfer the required amount to the mortgage account.

- Who pays the mortgage if the borrower dies?

- Mortgage if the borrower dies who pays

- Notify the creditor of the incident. To do this, you must draw up a notice in free form and attach a copy of the death certificate to it.

- 6 months after the death of the debtor, accept the inheritance.

- Contact the bank to draw up an additional agreement, which will indicate who will continue to pay the mortgage, as well as the procedure for making payments (in parts or at a time).

Procedure for heirs of a mortgaged apartment (read more...)