More and more Russian families are using mortgages to improve their living conditions. Mortgage insurance provided allows you to minimize the risks of the insured (i.e., the borrower of a mortgage loan). The insurer will promptly compensate for damage caused to the insured property and compensate the bank for the remaining portion of payments in the event of the death or disability of the borrower. In accordance with current legislation, obtaining insurance when obtaining a mortgage loan is mandatory.

Mortgage insurance from RESO

offers comprehensive mortgage insurance, allowing you to avoid unpleasant consequences in the event of an insured event. RESO specialists will be able to issue the following types of mortgage insurance:

- Mortgage life insurance. In the event of the death of the policyholder, the insurance company compensates the bank for the remaining portion of the loan to be paid. If the insurance premium exceeds the value of the mortgage, the balance will be paid to the insured's heirs.

- Mortgage health insurance. In case of loss of ability to work as a result of illness or accident (receipt of the first or second group of disability), the insurance company will also pay the bank the outstanding part of the loan.

- Apartment mortgage insurance (property insurance). The property may be damaged as a result of a fire, utility accident or gas explosion, as well as from other reasons. If the insured property is damaged, the insurance company will compensate for the damage caused.

- Apartment mortgage insurance (property rights). If current legislation was violated during the execution of a real estate transaction, the insurance amount will be able to cover losses in the event of loss or limitation of rights to property.

Mortgage insurance is beneficial to all parties to the contract. The bank eliminates the risk of non-payment under the loan agreement, and the borrower will not lose rights to the property if an insured event occurs.

What types of mortgage insurance are considered basic?

There are three main types of mortgage insurance, each of which includes typical cases:

- The first and most important thing is property insurance. The following are considered typical for compensation: cases of fire or fire, floods, earthquakes, natural disasters, including man-made ones, theft of property from an apartment. Insurance covers the entire loan amount to fully compensate for damage in the event of an unforeseen event.

- The second type is personal in nature – life and disability insurance. Insured events include serious illness, injury, and death. It is worth considering that loss of working capacity does not eliminate the obligation to make monthly loan payments.

- The latter type involves title insurance; it minimizes any risks and encroachments on the property purchased by the borrower. These include cases that occur by mistake or as a result of the actions of fraudsters. For example, if in the process of concluding a sales contract the property rights of the seller’s family members who are disabled or under the age of majority, who have the right to claim part of the apartment, were not taken into account. This type of insurance involves payments to the bank in the event of evidence of the illegality of the transaction. That is, if the policyholder is deprived of property rights to housing purchased on credit, the debt to the bank falls on the insurer.

Our insurance company in Moscow has reasonable prices for services. If you have questions, call the phone number listed on the website. Our specialists will provide a free consultation and help you calculate mortgage insurance.

Still have questions? We will help:

- With the help of an online consultant

- By email

- By phone: +7 (499) 322-47-49

What is required to purchase insurance?

In accordance with the Insurance Rules posted on the official website of the insurer, when concluding an insurance contract, you will need to provide the following documents:

- Application for concluding an insurance contract in a form approved by the insurer.

- Copies of documents proving the identity of the policyholder (for an individual this is a passport, for a legal entity - constituent documents).

- A copy of the real estate purchase and sale agreement.

- A copy of the mortgage agreement.

- A copy of the mortgage (if provided for in the mortgage agreement).

- Documents confirming the borrower's solvency (for a client-legal entity this is a copy of the financial statements for the past period, for an individual - a certificate of income).

- Documents confirming the fact of registration of ownership of real estate.

- Other documents and information that are essential when assessing risks under a mortgage insurance agreement.

It should be remembered that providing the insurer with false information may result in the insurer being released from the obligation to pay the insured amount in the amount specified in the insurance contract. To obtain advice on obtaining mortgage insurance, the company's client must contact specialists by phone, the number of which is listed on the official website. The cost of insurance can be calculated in advance using an online calculator.

"RESO-Garantiya" - Types of mortgage insurance: apartments and houses

SPJSC "RESO-Garantiya" insures legal entities and capable individuals for mortgages under the following insurance programs:

- from accidents and illnesses;

- property;

- pledged real estate against the risk of loss of ownership.

RESO-Garantiya makes payments for each type of insurance differently. If the borrower dies, the company will pay 100% of the amount, if disability money has not been transferred to him before. The same amount is paid when disability is determined.

But the borrower must remember that filing an application to recognize him as disabled and assigning a group to him must occur during the validity of the insurance contract or no later than 180 days from the date of expiration of its validity. Moreover, if, after paying the premium in full, the client is assigned a more severe disability group or he dies, then he is not entitled to any payments.

If the borrower falls ill and is temporarily unable to work, the company pays 1/30 of the monthly debt for each day of sick leave. This payment should not exceed 0.2% of the total amount for each day. What is noteworthy is that payment starts from 31 days. And for each insured event, no more than 90 days of payment are provided.

What amount will be paid if damage to real estate has been caused depends on the severity of the damage: if the real estate cannot be restored or its repair exceeds the intrinsic value of the property, then the insured amount is paid in full. If the damage can be repaired, then the insurance premium is equal to the amount of restoration repairs.

With title insurance, in the event that the borrower completely loses the property, the insurance is paid at 100%. If part of it is lost, then the premium is equal to the market value of the lost share of the property.

Mortgage insurance at RESO: where is it cheaper to get it?

It will be cheaper to issue a RESO policy for Sberbank and Russian Capital Bank. The cost of the contract for property is 0.18%, life and health 1%.

Currently the company insures the following risks:

- death, damage and loss of real estate;

- civil liability for damage caused to a third party;

- loss of ownership of the collateral;

- causing harm to the life and health of the borrower;

- failure of the borrower to fulfill obligations to repay the mortgage loan.

Each program has its own conditions and tariff rates.

How not to make a mistake with your choice?

If you don’t know what type of insurance to choose, consider a few points:

- Firstly, the state of your health. If you are not sure about it, and you have been diagnosed with chronic diseases, then it makes sense to take out personal insurance, because if something happens to you, then the entire burden of the loan will fall on the shoulders of your family and friends.

- Secondly, job stability. If the employer’s financial condition is unstable, it makes sense to take out insurance against the risk of job loss and the debtor’s failure to fulfill obligations to the bank.

What happens when the insurance is not paid by the borrower? In this case, the company will simply terminate the contract.

How to buy insurance?

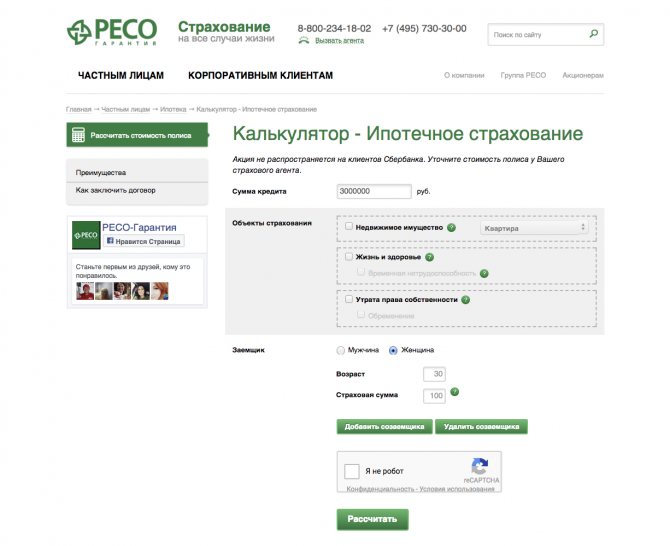

To apply for mortgage insurance, you must visit the website located at https://www.reso.ru, then select the tab “For individuals ", then click on the "Mortgage" button. In the subsection of the site that appears, the client will be able to familiarize himself with the types and rules of mortgage insurance.

In addition, here you can calculate the preliminary cost of an insurance policy using a calculator. To do this, you need to click on the appropriate button, then in the dialog box that appears, specify the initial data: the amount of the mortgage loan, the object of insurance, the gender and age of the borrower, as well as the insured amount. If there is a co-borrower, this information will also need to be specified by clicking on the “Add co-borrower” button. After this, you need to click on the “Calculate” button, and the calculator will indicate the estimated cost of mortgage insurance.

It is possible to issue a policy by visiting any of the insurance offices. To find the nearest one, you need to click on the “Nearest office” button on the insurance company’s website, located in the upper left corner of the page. After this, you will need to enter an address or select a metro station to find a company office located nearby.

For residents of Moscow and the Moscow region, the service of calling an insurance agent is available. In order to use it, you should click on the website, then in the dialog box that appears, fill in the contact information: first and last name, contact phone number and e-mail, indicate the insurance product you are interested in, as well as the time at which the insurance agent needs to contact the client. After this, click on the “Submit” button. A specialist will come to your home or office at a time convenient for the client and issue an insurance policy.

The process of obtaining an insurance policy

The specialist will examine the documents provided by the policyholder and calculate the cost of insurance in accordance with the selected type of insurance (the amount may differ slightly from the cost calculated on the online calculator). After this, the policyholder will need to pay the insurance premium (the insurer can provide the client with installment payments). Payment of insurance premiums can be made by bank transfer (bank transfer) or by depositing funds into the insurer's cash desk (cash payment). The final stage of obtaining a policy is signing an insurance contract.

Mortgage insurance from RESO is profitable!

Mortgage insurance from is a guarantee of stability in the event of an unforeseen situation. Apartment mortgage insurance and mortgage life insurance will allow you to fulfill the borrower's obligation to repay the mortgage loan. Advantageous offers from us allow you to save on life insurance for a mortgage or when taking out other types of insurance. In order to compare the cost of insurance with offers from other insurers, you should use the calculator on the company’s official website. This will allow the client to choose the best insurance option.

Reviews about mortgage insurance at RESO-Garantiya

In fact, there are very few positive reviews about mortgage insurance at RESO-Garantiya. Borrowers leave such comments on the Banki.ru website.

Complaint about non-refund of insurance:

About non-payment of premium in case of refusal of insurance upon early repayment of the loan:

There are also positive reviews:

All reviews about RESO can be found here: banki.ru/insurance/resogarantiya.