Who is entitled to it?

Persons who are:

- Employees in budgetary organizations;

- Employees in municipal and state organizations;

- Employees working in law enforcement agencies.

That is, those persons whose work is paid from the state or regional budget can participate in the program. Thus, mortgages on preferential terms can be issued by representatives of the judiciary, the Chamber of Accounts, the tax inspectorate, the MFC and others.

Civil servants also include military personnel. However, they receive a loan under a military mortgage, which is valid in all major Russian banks.

To receive a loan, a civil servant must meet all banking requirements and conditions:

- Must have at least 1 year of work experience;

- Must have Russian citizenship;

- Must be between 21 and 60 years of age;

- Must have a need to improve living conditions.

The need to improve housing conditions means living together with a family in conditions unsatisfactory for a decent life.

Conditions are considered unsatisfactory when:

- A person lives in a rented apartment or room allocated by the state, where there are no amenities;

- A civil servant lives in an apartment that does not meet social and sanitary standards (15 sq.m. per family member);

- A citizen lives with a person who is sick with a contagious disease that causes discomfort to other people.

If any of the above conditions exist, a civil servant can expect to receive a mortgage on preferential terms.

Civil servants have a choice of three benefits options:

- Receiving a free targeted subsidy for housing or paying for its share in shared ownership;

- Reducing the interest rate on a target loan;

- Payment of the principal debt on the mortgage at the expense of the state (all that remains is to pay interest on the mortgage).

The specific case of assistance depends on where the person lives and whether there is a state program for public sector employees and civil servants in this region.

List of documents

To apply for a mortgage, you must fill out an application, attaching your passport, a copy of your work record book (contract), SNILS and a 2-NDFL income certificate. If you receive your salary on the card of the bank where the mortgage is issued, you do not have to provide documents on income and employment. Men of military age must additionally submit a military ID to the bank.

Once your application is approved, you will need the following real estate documents:

- seller's passport;

- certificate of ownership (if available);

- extract from the Unified State Register of Real Estate;

- appraiser's report;

- technical or cadastral passport.

If an apartment is purchased from a developer, you need to collect a complete set of documents on the organization (Charter, order for the appointment of a manager, etc.), as well as an agreement on shared participation in construction.

Transcapitalbank

from 7.99% rate per year

Go

- Amount: from 300 thousand to 50 million rubles.

- Rate: from 7.99%.

- Duration: from one year to 25 years.

- Age: from 21 to 75 years.

- You can get a mortgage using one passport.

- You can confirm your income with a bank certificate.

More details

Rosbank

from 7.39% rate per year

Go

- Amount: from 300 thousand rubles.

- Rate: 7.39 - 11.14%.

- Duration: from 3 to 25 years.

- Age: from 20 to 64 years.

- Down payment: from 20%.

- You can attract 3 co-borrowers.

More details

Alfa-Bank

from 6.5% rate per year

Go

- Amount: from 670 thousand to 20.6 million rubles.

- Rate: 6.5 - 9.29%.

- Duration: from one year to 30 years.

- Age: 21 - 70 years.

- Down payment: from 20%.

More details

Program conditions

Most people in public service solve their housing problem by concluding a mortgage agreement in the largest Russian banks. The money received from the state is later sent to pay off the debt. This is the most common scheme for obtaining benefits, which allows you to reduce your credit load by reducing the size of the payment.

The amount of the subsidy, in addition to the region of residence, is directly influenced by factors such as:

- Marital status of the borrower;

- Family composition;

- Work experience with age.

You can receive such support only once during your entire period of public service. Even if you change your job or field of activity, you cannot get support again.

For potential borrowers who apply for a preferential mortgage, specific age restrictions apply. Thus, married people can take out a loan for up to 40 years, and for people who are not in a legal relationship - up to 30 years.

The amount of support is established according to the legislative standards of the region. In this case, the following indicators must be taken into account:

- Values of one square meter in the real estate market;

- The total area of the apartment or private house being purchased;

- Adjustment coefficients taking into account the place of civil service and the employee’s length of service.

In practice, the weighted average of the money received from the state covers about 40% of the price of the apartment. For example, if it costs 3,000,000 rubles, then the support will be approximately 1,000,000 rubles. This is a significant amount for each person.

Benefits for public sector employees and civil servants

Special co-financing programs for teachers and educators were suspended in 2020. But this does not mean that all housing benefits have been cancelled. This segment of borrowers is included in the list of certain categories of citizens who can participate in the state program “Housing 2015-2020” or “Housing for the Russian Family.” State assistance consists of providing preferential mortgages for economy-class housing. The peculiarity of the subsidy is that the maximum cost of such real estate is determined at the legislative level: no more than 80% of the market price of a similar property, up to 35 thousand rubles per square meter (in private there are exceptions, for example, for Moscow). The mortgage interest rate will not exceed 12%.

An individual may qualify for housing benefits if his place of work is his main one.

On the official website program-zhrs.rf you can find projects that have already been put into operation in your region, find out their addresses, and other details.

Another form of state support is the inclusion of this category of borrowers in the so-called social mortgage, which provides preferential lending to doctors and teachers. It is most actively offered by AHML and its partner operators. Such projects require a loyal attitude towards clients: reduction of overpayments, issuance of housing subsidies. But the discount also applies to some banks, for example, VTB gives a discount to state employees.

As an addition, we can note related programs operating in 2020: “Young Family”, “Young Professionals”. It is important to note that state support will be provided not only for the status of an employee; in almost all cases, the law has some nuances regarding age, length of service or the availability of living space in the property.

State programs are the basis for the development of more detailed proposals at the regional level. It is the local authorities that are the key authority on which the conditions will depend. For example, special project-programs can be developed that offer various benefits for specific professions.

How to get in line?

To receive a preferential mortgage, a government employee needs to stand in line as a person who needs a subsidy to provide assistance.

To join it, you must write an application and attach the entire package of documents. The application must be written to the head of the administrative commission, which deals with the provision of housing for civil servants.

It indicates whether the applicant has previously participated in the program or not. It is important to not participate and to attach all documents. Otherwise, the application will be considered longer and may be rejected altogether.

The processing time for each application depends on where the person lives. The appeal may take several months. If there is a positive outcome of the case, the citizen will be put on a waiting list, given a serial number, and when his time comes, he will receive state financial assistance.

At the moment, such commissions minimize the time it takes to consider applications and speed up the allocation of the required funds to partially cover the mortgage loan.

Conditions for receiving government assistance

Applicants for preferential mortgages are subject to the following requirements:

- citizenship of the Russian Federation;

- the need for housing or improvement of existing conditions;

- employment in an area covered by the benefit;

- age and length of service – individually, depending on the region.

The need for housing is determined based on the characteristics of the apartment or house where the individual lives. You can apply for state assistance if the area per person is less than the accounting norm: 11–18 sq.m. per family or 33 sq.m. for one and 42 sq.m. for two. Standards may be adjusted in different regions.

Before approving the application, living conditions are checked. If it is discovered that they have been deliberately degraded, subsidies may be denied. The test consists of analyzing housing activity over the past few years. Suspicion may be raised by the sale of large real estate followed by the purchase of a damaged or less comfortable property.

It is important to note here that it is impossible to become a participant in every state program and receive all types of compensation. Firstly, almost all existing projects are subprograms of one major event called “Providing affordable and comfortable housing and utilities for citizens of the Russian Federation.” And within the framework of one law it is impossible to receive several subsidies - after the first, the state’s obligations are considered fulfilled. Secondly, these are already related projects with all the consequences: additional conditions, their own limitations.

Maternity capital can be combined with any government support. All funds can be used to purchase housing and pay off mortgage debt.

Required documents

The complete list of documents for civil servants is as follows:

- Passport with all copies;

- Marriage and birth certificates with copies (if available);

- An extract from the house register indicating the composition of the family who live there;

- A copy of the work book, which is certified by the director of the organization;

- Bank account details where the funds will be transferred;

- Copies of documents to confirm the right to receive financial assistance from the state.

After reviewing the application along with the documents by the territorial commission, the borrower will receive a letter by email stating that the review procedure has begun. If the decision to issue funds is negative, then if you disagree with it, you can go to court.

How to participate in the social program

The first thing you need to do is ask your manager about the possibility of receiving a subsidy, if you have one, then you need to start collecting documents at work to participate in it.

It is also necessary to get on the waiting list for improved housing conditions. With an extract from the queue and documents from work, you need to contact the local administration and write an application for participation in the social program. The administration will consider the application on general terms.

After participation in the benefit program is approved by the administration, you receive a participant certificate (your benefit is stated in the certificate). After receiving the document, you submit an application to the bank for a mortgage loan.

It’s better to apply to several financial institutions at once so that you have a choice; perhaps the bank will approve it on inconvenient conditions. Keep in mind that the application form for consideration by the bank is also submitted under general conditions; you do not have any benefits over the bank.

What documents are provided to the bank:

- Certificate of participant in the preferential subsidy program;

- Russian Federation passport;

- Certificate confirming income;

- Document confirming employment;

- Marriage certificate (if you are married);

- Spouse’s passport and his income certificate (if available);

- Birth certificates of the child(ren);

- Maternity capital (if available);

- Documents for the apartment (if you have already chosen it).

You can submit an application to the bank before the apartment is selected; the decision will be valid for 90 days. But then, when the apartment is selected, the application will go back for consideration, as new input data will appear.

You can choose housing under the social program, either secondary or among new buildings. It is necessary that the apartment meets both the social program and the requirements of the bank. And that is:

- The house should not be in disrepair;

- The house should not be on the list for demolition;

- Real estate must be liquid;

- The house must be at least 80% complete if you are buying an apartment from a developer.

After the lender approves your loan, you sign the agreement, receive all the documents, and a copy of the agreement must be taken to the administration so that they can subsidize it.

Maternity capital or other benefits can be paid as a down payment. The government makes subsidies in accordance with the payment schedule, as specified in your contract.

You can also apply for a credit holiday on a social mortgage if it becomes difficult for you to make payments. If you quit your position, the state stops subsidizing your loan.

Also, the benefit is provided only once, for the purchase of the applicant’s first and only home or improvement of living conditions.

How to use?

After a positive decision is received from the administrative commission to allocate a targeted state subsidy for mortgage repayment, the person needs to wait until it is his turn to receive the money.

You often have to wait for years, but after the queue arrives, you need to promptly notify the bank where the loan was issued. This must be done quickly, since some banks accept applications for partial or full repayment of the loan.

Usually the commission reports the mortgage subsidy account number with the details for making the transfer. After the money is credited, loan payments will be adjusted.

Procedure for applying for benefits

To apply for housing benefits you need:

- Collect the package of documents discussed in the article;

- Submit documents along with the application to the commission;

- Receive a certificate of acceptance of documents;

- Wait for registration.

Documents should be prepared very carefully. The slightest inaccuracy may cause the commission to doubt and refuse. Then you will have to start over and time will be lost.

Look at the same topic: How to get a home loan from Sberbank? Conditions for [y] year

How is it calculated?

For 2020, the following standards for housing were adopted:

- 32 square meters for one person, unmarried and without children;

- 42 square meters for children of two people;

- 18 square meters for a family of three or more people.

This parameter directly affects whether subsidies will be allocated from the state for a particular person or not.

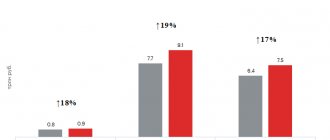

The second factor is the length of service on which the coefficient is calculated. If a person works in a government department for 3 to 5 years, the coefficient is 1.05%, from 11 to 15 years - 1.2%, over 25 years - 1.5%. There is no coefficient for work experience up to 3 years.

The third factor in determining the total price of state support for a mortgage is the average price of housing in the region. This indicator is calculated by the commission, looking at real estate from the economy class.

As a result, the final amount of government assistance differs across the country. In Moscow, St. Petersburg and other cities with a million inhabitants, the value will be greater than, for example, in a village or region.

Regional mortgage programs

As an example, consider two regional programs for housing mortgages for employees of the public service and the public sector. All of them were implemented by AHML partners.

Moscow region

The benefit is provided to doctors, teachers, young and unique specialists. Moreover, it can be used by both persons already engaged in activities and anyone who is ready to move to the Moscow region. An entry fee of 50% of the cost of housing is paid from budget funds, the remaining 50% is transferred in the form of monthly payments. Thus, the specialist only pays interest on the loan.

The annual rate is 8.75% for finished housing and 9% for housing under construction. To receive a subsidy, an individual will need to contact the relevant Ministry of Defense and submit an application for participation.

Requirements for professional skills:

- Doctors and health workers. Minimum 3 years of experience, willingness to enter into a contract for at least 10 years.

- To teachers. Possibility to sign an employment agreement for 10 years, teaching experience of 5 years.

- Scientists. Age up to 35 years, experience from 1 year.

- Specialists in the military-industrial sphere. Experience from 1 year, age up to 35 years.

Voronezh region

The government of the Voronezh region approved the following conditions:

- Before purchasing a home, the applicant and his family members must own at least 11 sq.m.

- Price 1 sq.m. housing should not be more than twice the cost approved by local authorities.

- Registration for at least one year in the Voronezh region before the date of application.

- Work experience more than 3 years.

The amount of compensation depends on the social standards of housing per person, the cost of 1 square meter and the size of the entry fee, which cannot exceed 70%.

For credit institutions, government employees are attractive clients because they have official income and are almost always in demand, regardless of their region of residence. The most active participant in various government programs is Sberbank. The financial institution accepts certificates, opens special accounts, and also provides a whole range of different mortgage programs on quite favorable terms.

Where to go?

As mentioned earlier, the procedure for obtaining a mortgage for a government employee on preferential terms is simple - the borrower takes out a classic mortgage loan, then creates an application for assistance from the state, receives money and repays part of the debt with the allocated money. Naturally, it is better to go to trusted banks with extensive experience in working with citizens on mortgages.

The most popular are Sberbank of Russia, VTB 24, Gazprombank, Rosselkhozbank and others. For all banking programs, it is possible to pay the principal debt or an initial contribution with maternity capital in the amount of 453,000 rubles. Together with a subsidy of 30-40% of assistance, this is good help in improving housing conditions and paying off the mortgage.

Today, Sberbank can offer the most favorable lending conditions. There you can take out a loan for secondary and primary housing in the amount of 300,000 rubles for 30 years at 7.4%. Plus, you can get various mortgage discounts if the housing costs more than 3,800,000 rubles, 0.3% if the client is a state employee and not a salary earner. However, it is not advisable to refuse insurance, otherwise 1% will be added for refusal.

| Bank | Interest rate | An initial fee | Work experience, months | Age, years |

| Sberbank | 9,1% | 15% | 6 | 21-75 |

| VTB 24 and Bank of Moscow | 9,1% | 15% | 3 | 21-65 |

| Gazprombank | 10% | 20% | 6 | 21-60 |

| FC Otkritie | 10% | 15% | 3 | 18-65 |

| Bank Center-Invest | 10% | 10% | 6 | 18-65 |

| Rosselkhozbank | 10,25% | 15% | 6 | 21-65 |

| Binbank | 10,75% | 20% | 6 | 21-65 |

| Raiffeisenbank | 10,99% | 15% | 3 | 21-65 |

| UralSib | 11% | 10% | 3 | 18-65 |

| ZhilFinance | 11% | 20% | 6 | 21-65 |

| AHML | 11% | 20% | 6 | 21-65 |

| Absolut Bank | 11% | 15% | 3 | 21-65 |

| Rosevrobank | 11,25% | 15% | 4 | 23-65 |

| Svyaz-Bank | 11,5% | 15% | 4 | 21-65 |

| Bank "Revival | 11,75% | 15% | 6 | 18-65 |

| Zapsibcombank | 11,75% | 10% | 6 | 21-65 |

| Eurasian Bank | 11,75% | 15% | 1 | 21-65 |

| Alfa Bank | 11,75% | 15% | 6 | 20-64 |

| Promsvyazbank | 11,75% | 20% | 4 | 21-65 |

| Russian capital | 11,75% | 15% | 3 | 21-65 |

| SMP Bank | 11,9% | 15% | 6 | 21-65 |

| Deltacredit | 12% | 15% | 2 | 20-65 |

| Globex Bank | 12% | 20% | 4 | 18-65 |

| UniCredit Bank | 12,15% | 20% | 6 | 21-65 |

| Bank "Saint-Petersburg | 12,25% | 15% | 4 | 18-70 |

| Transcapitalbank | 12,25% | 20% | 3 | 21-75 |

| AK Bars | 12,3% | 10% | 3 | 18-70 |

| Metallinvestbank | 12,75% | 10% | 4 | 18-65 |

| Credit Bank of Moscow | 13,4% | 15% | 6 | 18-65 |

| Bank Zenit | 13,75% | 15% | 4 | 21-65 |

In general, government employees in any bank are a favorite category of clients due to maximum transparency of their income, especially when the borrower’s salary is transferred directly to the bank card. In addition, if the borrower does not make payments on time or violates the terms of the mortgage agreement, then it is easier for the bank to contact them through the employer.

Requirements for civil servants applying for preferential housing

Since 2009, civil servants began to receive targeted payments for housing as part of the implementation of the resolution “On providing federal civil servants with a one-time subsidy for the purchase of residential premises” dated January 27, 2009 No. 63.

You can get help buying a home:

- civil servants of the Russian Federation and its constituent entities;

- representatives of the Presidential Administration and other government services related to the activities of the first person of the state;

- prosecutors;

- court employees at all levels;

- federal legislative staff;

- representatives of other government positions.

Subsidies are not given to everyone. To receive assistance from the state in purchasing residential real estate, an employee must meet a number of requirements:

- citizenship of the Russian Federation;

- work experience in a government position of at least 1 year;

- presence of official status of those in need of improved housing conditions.

The status of someone in need of improved housing conditions can be obtained in the following situations:

- the applicant lives in a service apartment and does not have his own home;

- the employee and his family live in rented housing and do not have their own property;

- the employee lives in communal housing, where basic utilities are partially lacking (toilet on the street, no hot water supply);

- the applicant and his family members have less than 15 m² of living space;

- the employee lives in the same premises with a person who suffers from a serious chronic illness, and there is a danger of infection or obvious discomfort from such proximity.

Important: if it turns out that an applicant for state support deliberately worsened his housing situation before submitting documents for a subsidy, the deadline for receiving the payment is postponed for 5 years. The following actions are considered as intentional worsening of the housing situation:

- moving people other than family members into the living space occupied by a civil servant;

- alienation of one’s own real estate or part thereof in favor of third parties;

- exchange of housing with obvious deterioration in living conditions;

- intentional failure to comply with a social tenancy agreement with the eviction of a civil servant and his family from the occupied residential premises.

To apply for a subsidy, the applicant must collect the necessary package of documents:

- a statement to the head of the commission for the provision of housing compensation of a federal government agency indicating that the subsidy has not previously been paid to the applicant;

- applicant's personal passport;

- a copy of the work record book certified by the employer;

- an extract from the house register on the number and composition of those living in the family of a civil servant;

- if the applicant and (or) members of his family own real estate, copies of documents on ownership are required (for example, a copy of an extract from the Unified State Register of Real Estate and a copy of the purchase and sale (donation) agreement on the basis of which the transfer of ownership took place);

- a copy of the marriage certificate and birth certificates of children (if available);

- copy of personal account.

The amount of compensation payment is calculated individually. In addition to the regional adjustment factor and the average cost per square meter, the calculation takes into account the length of service in a government organization. The longer a specialist has worked in the authorities, the larger the subsidy will be.

A civil servant can use compensation funds as follows:

- acquisition of residential real estate under a purchase and sale agreement. The transfer of subsidy funds is made after the conclusion of the purchase and sale agreement and the transfer of ownership of the purchased residential premises to the civil servant;

- repayment of the mortgage and interest on a housing loan, with the exception of payment of penalties and fines for late payments on the loan;

- payment for work on the construction of your own residential building. The plot for construction must be purchased or leased at your own expense;

- repayment of the share payment for housing in a housing cooperative cooperative.

What are the features of preferential lending?

The first thing people pay attention to is the age and marital status of the borrower. A state employee who is not burdened by marriage can count on benefits if he has not yet crossed the threshold of 30 years. For family people, the opportunity to participate in the preferential lending program has been extended to 40 years.

By receiving mortgage benefits, an employee of an institution obliges himself to work in his place for a certain period of time. But if the borrower still decides to quit for any reason, he will remain. The funds spent by the state to pay off his loan will have to be returned. Sometimes partially, and sometimes entirely.

The negative side of the issue

- Not everyone and not always succeeds in receiving the desired support from the state . This question contains many pitfalls and small nuances that will become an obstacle to your cherished goal.

- Those whose right to preferential loan terms have been confirmed need to understand that payment will not be made immediately. You will have to stand on a waiting list of similar applicants.

- Even for those who managed to become a participant in the program, the state will not be able to pay the entire cost of housing . You need to understand that the issue of paying off a mortgage can become one of the key issues for many years.

- Don't forget about overpayment . After all, you will have to pay the bank not only for the cost of the apartment, but also for the interest that will be accrued.

- A large amount of funds are allocated from the state budget for these purposes, but they are limited . And it happens that there simply may not be enough for everyone who applies. Even after receiving approval, the wait for the coveted help can last for years. And despite the fact that the person has not yet received payment from the state, no one will exempt him from paying the loan.

Advantages of mortgages for civil servants

- The option of not paying off the mortgage debt in full.

- As a rule, banks are happy to see people in this category as their clients and are willing to issue them a mortgage loan.

- Credit institutions themselves can make lucrative offers to public sector employees.

How to calculate

The amount of the subsidy is determined by the formula, O x N x K1 x K2, where:

- O - total area;

- N - standard average cost of 1 sq. m in the real estate market for the constituent entity of the Russian Federation in which the public service takes place;

- K1 - coefficient for adjusting the average cost of 1 sq. m. m;

- K2 is the coefficient for adjusting the subsidy taking into account length of service.

The total area of the apartment is determined by the formula, Standard + Additional – Personal, where:

- Standard - standard indicator of the total area;

- Additional - additional space provided in cases provided for by law and by decision of the leadership of the federal body;

- Personal - the total total area owned and socially leased by the employee and (or) his family members.