Applying for a loan requires the bank client to comply with a number of conditions. What is needed to take out a mortgage is determined directly by the credit institution offering financial assistance in purchasing a home. Since a mortgage is of a different nature from other loan options, special requirements will be established that do not apply to the standard type of debt obligations.

Lenders' requirements for the borrower

A mortgage is a type of collateral relationship under which real estate remains in the use and possession of the debtor until he fully fulfills his obligations under the loan agreement. To obtain such a loan, compliance with a number of requirements put forward by banks must be established. In addition to Russian citizenship and age from 21 to 65 years, the person must have an official income, work experience and a good credit history.

Income

To apply for a loan, it is not enough to say: “I want to take out a mortgage.” You should evaluate your personal capabilities, and you need to start with income. The borrower's salary is a key indicator for financial institutions providing mortgage loans.

The size of the mortgage payment should not exceed 40% of the income received by the citizen.

The bank will only take into account official income confirmed by a 2-NDFL certificate. However, there are also special conditions for obtaining a loan.

The following simplified programs are available:

- applying for a loan without proof of solvency,

- providing a loan taking into account alternative income (profits from rental property, business investments, bank deposits, and so on).

The amount of income required will directly depend on the amount of the mortgage and the terms of provision. The longer the period for fulfilling obligations, the lower the monthly payment, which does not require a high level of wages.

Credit history

The result of assessing a citizen’s credit history is one of the main reasons for making a decision on issuing a mortgage.

A person's borrowing records are kept by credit bureaus and include information about:

- presence or absence of overdue payments,

- the size of the loans received, the timing of their repayment,

- facts of early repayment of debts,

- ongoing legal proceedings regarding non-fulfillment of the loan agreement,

- other circumstances related to loan repayment.

The borrower may also be blacklisted. If at least one bank recognizes the client as dishonest, this guarantees a refusal to provide a mortgage.

Work experience

Each bank sets its own requirements regarding work experience, which is a key criterion when assessing a citizen’s creditworthiness. Taking this into account, you should take a responsible approach to deciding where to take out a mortgage.

Most credit institutions require six months of work experience at the last place of work and at least one year of work in total. However, there are exceptions. For example, Rosevrobank allows you to take out a mortgage within a month after getting a job.

Liquid collateral real estate

A mortgage loan agreement requires collateral that guarantees the bank the return of borrowed funds. As a general rule, it is real estate or its share.

According to Federal Law No. 102-FZ “On Mortgage”, the following objects can be recognized as collateral:

- enterprises, buildings and structures used for business purposes,

- land plots not withdrawn from circulation

- garages, country houses,

- ships and aircraft,

- cars, but with CASCO insurance.

An individual bank may establish additional requirements for collateral.

Lending parameters

To understand how to choose the right mortgage, you should study the parameters of this type of lending. These include indicators on the rate, initial investment of funds, terms and other similar aspects.

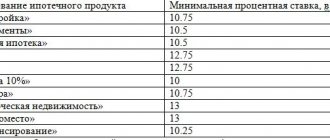

Bid

The requirements for how to properly obtain a mortgage are set by the individual bank independently. The interest rate is also determined by the credit institution.

To determine a favorable rate, you should compare offers from different banks:

- Moscow Credit Bank - from 5.9%,

- Sberbank of Russia - from 6%,

- VTB 24 - from 6%,

- Gazprombank - from 6%,

- Bank "Otkritie" - from 8.5%,

- Binbank - from 8.5%,

- Alfa-Bank - from 8.99%,

- Rosselkhozbank - from 9.3%,

- Uralsib Bank - from 9.9%,

- Raiffeisenbank - from 10.25%,

- Promsvyazbank - from 11.85%,

- Transcapitalbank - 12.25%,

- Metallinvestbank - from 12.75%,

- Zenit Bank - from 13.75%.

There is no maximum bet limit. However, in practice the figure does not exceed 14%.

Term

In order to profitably take out a mortgage for an apartment, the borrower must take into account such a condition as the term of the loan. When determining the appropriate period, the nature of the housing, as well as the individual characteristics of the person, are taken into account.

Depending on the loan term, the following programs are possible:

- debt repayment within 5-10 years,

- full repayment of the loan in 10-20 years,

- mortgage validity over 20 years.

Practice shows that most contracts are concluded for a period of 20 years. However, full repayment of debts is carried out on average in 15 years.

Currency

The practice of credit institutions involves issuing mortgages both in Russian rubles and in foreign currency format (dollars, euros). The fundamental difference between these options is that when determining the terms of the loan, interest rates will differ, as well as the size of the down payment.

For example, if you take out a loan in rubles with a rate of 14%, then the same amount converted into dollars will entail a reduction in the interest rate to 12%. Accordingly, a difference of 2%, which seems insignificant at the beginning of the mortgage, ultimately leads to serious savings. However, choosing a foreign currency loan is considered a risk, since the instability of the financial situation leads to the opposite effect.

An initial fee

Making a down payment when applying for a mortgage serves as a means of reducing the total loan amount, lowering the interest rate, increasing the chances of loan approval, and also reduces the amount of insurance paid.

The down payment is formed from the following funds:

- maternal capital,

- consumer loan,

- personal savings,

- sales of existing real estate.

The size of the down payment depends on the capabilities of the borrower. As a general rule, a ratio of 30% (initial payment) to 70% (remaining loan amount) is applied. Also in practice, there are cases when the contribution is 50%, which reduces the debt by half.

Other nuances

The conclusion of a mortgage agreement entails a number of restrictions for home buyers, despite the fact that they are potentially recognized as the owners of an apartment or house.

Please be aware of the following restrictions:

- The transfer of an apartment for rent or lease is permitted only with the consent of the lender, that is, a credit institution. In this case, there is a restriction on the rights of the citizen as the owner of the purchased housing.

- Redevelopment of an apartment or other significant changes to housing not related to repairs are carried out exclusively with the permission of the bank.

- You cannot give or exchange mortgaged housing until the debt is repaid.

- The sale of an apartment can only be carried out with the consent of the lender and the buyer.

Preparation of documents

The first thing you need to get a mortgage is to collect a package of documents on the basis of which the selected financial institution will make a decision on lending. For citizens, organizations, as well as certain categories of persons, excellent lists of papers will be provided.

For an individual

Since the mortgage will be issued on the basis of information provided by the credit institution, immediately after choosing a bank, the citizen must clarify the requirements put forward by a specific institution.

Required documents for mortgage lending to individuals:

- passport,

- a copy of the work book to confirm the official employment of the person,

- 2-NDFL certificate showing monthly income.

For an individual entrepreneur

Individual entrepreneurs are the same subjects of lending as citizens. The list of documents will be similar to the list provided for individuals. In addition, the entrepreneur is required to receive a copy of the tax return with the seal of the Federal Tax Service (Federal Tax Service) as confirmation that the original document was transferred to the regulatory authority without violations.

For purchased real estate

Documents for the property being purchased are also provided. The seller provides information.

Such documents include:

- a copy of the certificate establishing the right to housing,

- cadastral passport,

- technical documentation,

- an extract from the register confirming the registration of the right to real estate, valid for no more than 30 days,

- characteristics of the premises - form-7, valid for no longer than 30 days,

- an extract from the house register in form-9, also issued no earlier than one month ago,

- certificate of absence of debt on utility bills,

- a copy of the passport (birth certificate) of other apartment owners.

Individual situations

Despite the fact that employment is the main requirement for citizens applying for a mortgage, this type of lending option is available to both pensioners and officially unemployed persons.

For pensioners

In order to provide people who have reached retirement age with a mortgage, it is necessary to identify the main categories of such citizens and determine the conditions for them.

The following groups of pensioners who are eligible for mortgage lending are distinguished:

- Not working due to age. In such a situation, the only source of income is a pension; accordingly, the size of the mortgage will be minimal.

- Working age. The main advantage here is increased income, which includes both a pension and wages (a 2-NDFL certificate will also be required to confirm this). The mortgage amount increases significantly, but only a small number of banks agree to lend to these citizens.

- Military.

There are no special conditions for preparing documents and going through the lending procedure for pensioners.

Without official employment

Since the key criterion for issuing a mortgage is income, officially unemployed citizens must confirm the fact that they have the funds to repay the loan. Accordingly, such persons will need to provide additional information to the bank.

Documents for obtaining a mortgage for non-officially employed citizens:

- civil contracts for the provision of services,

- copies of receipts for receiving money,

- certificates of work performed by the borrower,

- statements from personal accounts where funds are regularly received,

- certificate of receipt of benefits,

- information about securities, if any,

- statements from brokerage accounts,

- income tax return for previous years.

Signing agreements with pensioners

Here it is necessary to take into account a large number of risks for the banks themselves when issuing money. But there are conditions for this category of clients. Such programs expand the user base. Here are some of the requirements put forward in such situations:

- Payments must stop before age 75.

- An extract from the Pension Fund is an official confirmation of income received. Information about deposits and savings, if available, would be an excellent addition.

- Shorter debt repayment periods, higher interest rates.

- Existing property with collateral function. If there is no other income, this option is suitable for finding solutions.

But not all banking structures agree to accommodate pensioners halfway.

Documents for participants of special programs

The law provides for certain lending cases that provide for conditions different from the general provisions.

With maternity capital

To sell maternity capital for a mortgage, namely its down payment, you will need to prepare an established list of papers.

The following documents are required:

- borrower's passport,

- certificate of availability of maternity capital,

- SNILS,

- 2-NDFL certificate on income status,

- statement of absence of debt on utility bills.

Additionally, a purchase and sale agreement, a certificate from the BTI and other papers required by the bank on an individual basis may be provided.

Military mortgage

When applying for a military mortgage, you will need to provide papers not only to the bank, but also to Rosvoenipoteka after signing the loan agreement.

Documents for the tank:

- banking sample form,

- passport,

- consent to the processing of personal data,

- a certificate confirming the person’s participation in the savings investment system,

- document confirming receipt of income (2-personal income tax, personal account statement, etc.),

- a copy of the spouse’s passport, certificate of marriage (divorce),

- technical documentation of the apartment,

- information about the developer,

- a certificate reflecting the absence of registered persons, as well as debts on utility bills.

Documents for "Rosvoenipoteka":

- a copy of the loan agreement,

- certificate of apartment assessment results,

- passport.

For young families

When applying for a mortgage, young families will first need to provide proof of relationship and the presence of children. Otherwise, the information transmitted will not differ from the general list.

Documents for young families:

- application (one of the spouses),

- passport,

- marriage certificate,

- certificate of birth of a child,

- a copy of the work book (at least six months of experience),

- certificate 2-NDFL about income,

- documents confirming the availability of funds for the down payment (account statement, maternity capital certificate, etc.).

A young family is considered to be spouses who registered their marriage no more than 3 years ago. Moreover, at least one of them should not be more than 30 years old.

Social loan

Social loan is material support from the state in the form of loans on more lenient terms compared to banks. Support is provided to young and needy families, collective borrowers, and so on. To obtain a loan, you must submit an application to the city administration.

Required documents:

- passports of family members

- birth certificates of children under 14 years of age,

- a copy of the work book,

- certificate of income of each family member (to determine need),

- SNILS,

- certificate of family composition,

- information about benefits received.

State employees and civil servants

For employees of budgetary institutions, in particular civil servants, a separate list of documents is also provided for obtaining a mortgage. The decision to issue a loan is made by a special commission that assesses the welfare of the civil servant.

List of documents:

- passport,

- marriage and birth certificates of children, if available,

- an extract on the number of persons living with the civil servant,

- a copy of the work book,

- Bank details,

- documents establishing the right to real estate (certificate, extract from the register).

Mortgage without official work

Such situations are associated with difficulties in providing income certificates. We are talking about form 2NDFL. It may seem that such citizens are deprived of the chance to purchase real estate under one of the mortgage programs. But banks take such situations into account.

Several programs are being developed for this purpose. The procedure for submitting documents is the only factor that changes. Other conditions remain standard.

For such citizens, it was allowed to draw up a certificate of income in free form.

Procedure

When determining how to take out a mortgage correctly, you need to pay attention to the sequence of actions when applying for a loan. The following steps are provided.

Studying offers and choosing a lender

Determining a suitable bank to apply for a loan is the main step. There is a large choice for citizens; accordingly, you need to carefully evaluate and compare the conditions in at least five financial institutions at once.

When researching lenders, you need to pay attention to:

- interest rate, the average of which does not exceed 14%,

- down payment amount,

- conditions for early repayment of debt,

- monthly income requirements,

- reviews of other clients about the selected bank.

Application

Submission of an application to the selected credit institution is carried out directly by contacting a bank employee and providing the required list of papers. To avoid having to submit an application several times, you should get advice in advance and decide on the documents and terms of the loan.

After submitting an application, the consideration of which may take up to several days, the citizen is informed of the decision made. If the answer is yes, then the applicant signs a loan agreement. You need to study the agreement thoroughly, no matter how large the document is. Only after the loan has been issued will the person be provided with funds.

Selection and registration of housing

In addition to carefully choosing a lender, you should research the market and determine the right housing option.

You can purchase with a mortgage:

- apartments in new buildings,

- private houses and cottages,

- housing under construction,

- secondary market objects.

Some credit institutions (Sberbank, Rosselkhozbank) can provide money for construction.

The seller should always be informed that payment will be made with borrowed funds. Some apartment owners, especially those on the secondary market, do not agree to the deal due to the buyer using credit money.

Learn more about down payments

It is enough to follow two steps to understand what the down payment will be.

- First, the price of the property for which they plan to purchase is determined.

The necessary information is posted on websites that search for real estate properties with satisfactory characteristics. If there are several options with parameters of the desired level, an approximate average value is sought. Then one percent of the resulting amount is calculated.

- Next, they determine how much percent of the cost of housing the citizen pays independently.

You will need to find out how much accumulated funds the future client already has. The resulting figure is divided by 1 percent of the total cost of housing. Thanks to this indicator, it is easy to choose a specific mortgage program.

Expert advice

Since mortgage lending is widespread, experts have formulated several general tips for those who plan to obtain borrowed funds to purchase a home.

Stay informed about housing prices

To choose the right apartment, you need to study the market and compare several offers. This will help you avoid buying overpriced homes. Such a study involves clarifying with the sellers what is included in the price of the apartment (availability of repairs, infrastructure near the house, number of floors, and so on). You should always compare multiple options.

Buy liquid

The liquidity of housing refers to the possibility of its further sale. This criterion should be assessed despite the fact that the alienation of property is not planned. When appraising a home, you need to determine which properties will be difficult to sell in the future.

The following apartments are selling poorly:

- in houses built 25-30 years ago,

- in “bad” areas,

- close to busy traffic,

- on the top or first floor,

- with poorly developed infrastructure,

- away from public transport stops.

Bargain by season

Demand for real estate is seasonal. According to market research, in most cases, apartments are purchased from the end of summer until the New Year. Accordingly, during this period, real estate prices increase. To buy a home, it is better to choose the “low season” - from mid-spring to autumn. At this time, it will be possible to reduce the cost of the apartment.

Do you need a realtor

In fifty percent of cases, citizens encounter realtors when purchasing a home. Representatives of this profession do not always perform their work conscientiously, demanding about 100 thousand rubles for services. It is advantageous for the buyer to contact the home owner directly - this guarantees the security of the transaction and will reduce costs.

TOP 5 profitable lenders

Analysis of the market and the activities of credit institutions and advice from experienced ones will help identify the most preferable banks for cooperation in obtaining a mortgage.

The top 5 best lenders in the country include:

- Sberbank of Russia. Absolute leader. The volume of mortgage loans issued over the past six months amounts to 455.9 billion rubles. The increase in transactions for all 12 months is 1.6%. The loan rate in most cases does not exceed 11%, and the amount of the contribution can vary from 30% to 50%.

- VTB. The second bank in popularity and quality of service. The volume of loans is 141.6 billion rubles, but the growth of transactions for the year went into the negative by 6%. Despite this, VTB is recognized as a reliable lender, offering a rate of up to 13% and a negotiated amount of the initial investment.

- Rosselkhozbank. In third place in popularity. The volume of loans is significantly lower - 48.5 billion rubles, but the rate is calculated from 9.3%. In addition, the increase in transactions for the year is higher than that of Sberbank - 3.1%.

- Gazprombank. It is on the same level as the previous option. The volume of mortgage lending is 46.7 billion rubles, and the increase in transactions is 2.6%. The mortgage rate does not exceed 12% per annum.

- Raiffeisenbank. A little-known but reliable option. The volume of loans does not exceed 25.1 billion rubles, the increase in transactions is slightly lower than Sberbank’s indicators - 1.4%. The minimum rate is 11%, which rarely increases by more than 2%.

Bad credit history: can you get a mortgage with it?

Many people have problems with their credit history. The reason is not only the crisis situation in the country, but also the low level of financial literacy. For most situations, this is enough for banks to refuse to issue a mortgage.

The main thing is to be prepared for the fact that the bank will in any case find out about the delays on previous loans. High-risk status is assigned even to those who made a mistake, but then corrected the situation.

Credit brokers are specialists who can help with obtaining a mortgage even in such a situation. They study hundreds and thousands of different offers, including for clients who have damaged their credit history.