Terms of military mortgage at VTB 24 bank for 2020

VTB 24 Bank is the country's largest financial giant, which is more than half owned by the state. It is part of the VTB Group, which for many years has been recognized as one of the leaders in analytical thinking and development of investment strategies. The range of services of the financial institution VTB 24 covers the following areas:

- services for individuals;

- servicing entrepreneurs;

- complexes for large and medium-sized legal organizations;

- attracting investors and shareholders;

- cooperation with colleagues on the assignment of rights and purchase and sale on the interbank exchange.

The bank's mortgage programs deserve special attention, since there are many of them and each of them is worked out to the smallest detail. A loan to military personnel under a contract is issued by the bank under a loan agreement, which is secured by a tripartite agreement between Rosvoenipoteka, the military personnel and VTB 24. You can get a mortgage loan to military personnel on the following basic conditions:

- The maximum possible amount is 2 million 840 thousand rubles.

- The age range of borrowers is 21 – 50 years.

- The contract period is up to 20 years.

- The down payment amount is from 15 percent.

- Type of housing - primary, secondary markets, houses, cottages, townhouses.

- Insurance is mandatory for real estate.

- Participation in NIS from three years.

Important point! An apartment with a military mortgage is registered only in the name of a military personnel. NIS funds are earmarked, then when dividing property they will not be considered jointly acquired property, which means the apartment will not be subject to division in a divorce.

Maximum amount in 2020

Most military citizens are wondering what determines the amount of a loan issued by a bank and what influences its size. The calculation algorithm is that the younger the borrower, the greater the amount and term of the loan. The maximum cost of housing can reach up to 60 million rubles.

At the same time, the loan amount issued by VTB24 Bank cannot exceed 2 million 840 thousand rubles.

Interest rate

The interest rate on a military mortgage VTB 24 for 2020 is 8.8%, while there is no difference whether a mortgage or a new building will be issued for a secondary building.

Features of the mortgage insurance agreement at VTB

If the client is satisfied with all the insurance conditions at the bank, then he signs an insurance agreement with the company, which must include such items as:

How much does insurance cost at VTB?

The amount of insurance is not constant. The final amount of the insurance policy depends on several factors:

- the value of the property and its location;

- the general condition of the mortgaged property;

- the amount of funds provided by the bank to the client (according to the mortgage agreement);

- conditions and amount of risks according to the insurance contract;

- the amount paid when purchasing an apartment (house).

If you need an exact insurance figure, you can always contact a specialist with a request to calculate the insurance.

Is it possible to refuse mortgage insurance from VTB?

No, you cannot refuse to insure collateral property . However, some banks manage to include life insurance in the contract, as well as health insurance for the insurer. He has every right to refuse such types of insurance.

Is it possible to change insurance?

Yes, it is possible, but under one condition - if the selected company is accredited by VTB Bank.

What happens if you don’t pay insurance to VTB?

Some clients, due to their forgetfulness, do not pay for insurance on time, and some, for personal reasons, refuse to pay for insurance. What threatens them in this case?

If the client of the insurance company does not pay the insurance, then the company acts as follows:

Is it possible to return mortgage insurance to VTB?

Refund of the insurance is possible only if the borrower has fulfilled his obligations ahead of schedule - repaid the mortgage ahead of schedule . If the insurance contract states that the client can return the unused insurance amount upon early repayment of the mortgage, then he has the right to do so.

However, if an insured event was recorded and the insurance company helped the borrower with the problem of the mortgage property, then the borrower does not have the right to demand compensation for the insurance.

To return the insurance amount, the client needs to submit a corresponding application to the insurer’s office. The company is obliged to consider it within 10 days, after which it issues money to the client to the bank account specified in the application. The insurance premium is withheld in proportion to the insurance period.

How to pay for insurance at VTB?

The company provides the opportunity to pay for insurance in several ways:

- Deposit the appropriate amount into the insurance company's cash desk.

- Make a non-cash transfer using the details specified in the contract.

- Using the VTB Online server, make an electronic payment.

Calculator

Loan amount

Payment type

Interest rate, %

Maternal capital

date of issue

Credit term

Early repayments

| date | Type | Amount/rate | |

Schedule

Table

| Term | 0 months |

| Sum | 0 rub. |

| Bid | 0 % |

| Overpayment | 0 rub. |

| Start of payments | 0 |

| End of payments | 0 |

| Required Income | 0 |

| № | date | Payment | Main debt | Interest | Balance owed | Early repayments |

Before submitting an application, it is better to calculate the possible size of the loan, as well as the costs of the loan. This can be done conveniently at home by approximately indicating the cost of housing and family income for the month using an online calculator. The service will independently calculate loan payments and the full overpayment for the entire loan period.

This option allows you to plan in advance the cost of affordable housing under the military mortgage program at VTB 24 Bank, taking into account the amount of accumulated funds in the NIS account.

Registration procedure

VTB 24 provides a very fast procedure for obtaining a mortgage. If the applicant for a loan already has a certificate of NIS participant, then he just needs to contact the bank and apply for a loan. Required:

- Collect a package of documents and fill out an application form (on the bank’s website or at a branch).

- After the bank approves the application (in 2-4 days), sign a loan agreement and three copies of the targeted housing loan agreement.

- Open a bank account and insure the property.

- Submit a package of documents to Rosvoenipoteka.

- After 10 days, receive a response and wait for the money to be credited to your account.

After the money is received from the state, it can be transferred to the seller. Taking into account the coordination of documents with the military department, the terms for issuing a loan can last up to 1-2 months.

A purchased apartment or house is subject to a double burden. The first - from the state (represented by Rosvoenipoteka), the second - from the creditor bank. The encumbrance, like the purchase and sale agreement, is registered in Rosreestr. All costs of paying the state duty are borne by the borrowing military personnel.

Important! After purchasing their apartment, a serviceman’s family may lose their service housing (dorm room, service apartment).

Required Documentation

To sign a loan agreement with VTB 24, you need to collect a large set of documents. Basically, these are copies and do not need to be notarized (it is enough to have the originals on hand). The borrower is required to:

- application form;

- passport of a citizen of the Russian Federation;

- individual taxpayer number (TIN) or insurance certificate of compulsory pension insurance (SNILS);

- certificate of the NIS participant’s right to receive a targeted housing loan.

Separately, you will need to provide copies of:

- title documents for the property;

- extracts from the house register;

- financial and personal account;

- passports of the sellers of the property;

- real estate appraisal report.

If housing is purchased on the primary market, then the bank will need to show the project of the residential building, copies of the developer’s documents, including design documentation and permission to develop the site. This is far from a complete set of documents. The bank may require permission from the guardianship and trusteeship authorities if there are children in the family of the real estate seller, as well as the consent of the borrower’s spouse to issue a mortgage.

Filing an application

You can apply for a military mortgage through the bank’s website. In the first case, it is enough to enter your contacts in the online form and indicate personal data and the amount and loan term. In the second, the application form for obtaining a military mortgage is sequentially filled out. The application states:

- the amount of funds in the NIS account;

- education, place of service;

- service region, registration address;

- data on family composition;

- information about income and expenses.

The bank reviews the application within a week. If the bank approves the application, then this approval is valid for four months from the date of receipt. During this period, you can look for an apartment, but it is advisable to include time during this period for the approval of documents in Rosvoenipoteka (up to 10 days).

Is a down payment required?

When applying for a military mortgage, a down payment of 15% of the cost of housing is required.

Requirements for a borrower for a military mortgage at VTB

The main selection of borrowers for military mortgages is carried out by military institutions, which enter citizens’ data into the NIS program.

NIS is a savings mortgage system created to improve the living conditions of Russian military personnel. It consists of the budget transferring a certain amount of money to the participant’s special account every month. In the future, the Ministry of Internal Affairs pays off the entire mortgage, transferring the accumulated money to the bank to pay off the loan.

The main requirements of the bank:

- The applicant has been a member of NIS for three years.

- The citizen's age exceeds 21 years.

All obligations regarding the solvency and credit reputation of the client are assumed by the military structure, which is the employer.

Note! VTB 24 takes into account the credit history of a military mortgage, which may result in a refusal of the application. You will learn more about which military mortgage banks can bypass this problem in 2020 from a special post.

Advantages of a military mortgage

As we noted above, VTB has competitive lending conditions. In addition, the bank has a wide branch network. This means that borrowers throughout the Russian Federation will be provided with high-quality service, prompt consideration of applications and transaction support in accordance with the bank’s general standards.

The advantages of a VTB mortgage include a free assessment of the collateral: the bank carries out this procedure with the help of its experts.

Mortgage borrowers are given the opportunity to obtain a consumer loan for military personnel at a preferential rate: in 2020, you can get a loan from 12.5% per annum.

VTB’s electronic services also deserve a positive assessment: clients receive free access to their personal Internet banking account and SMS notifications. If you want to return your mortgage, in full or early, this can be done by submitting an application by phone, without any restrictions.

Registration procedure

All processes in the bank are subject to strict regulation and are carried out only if the relevant instructions are followed. Applying for a mortgage consists of several stages, which follow one after another in order:

- Initially, it is necessary to decide on a lending program and make preliminary calculations to understand the general situation.

- Next, you need to submit an application for a loan indicating all the required data. Review period is up to 4 working days. Next, you will have 4 months to find housing.

- This will be followed by a legal examination of the provided real estate documents and a final decision.

- Conducting a transaction includes signing all necessary agreements - credit, purchase and sale, mortgage, insurance and the bank transferring money to the seller after checking the correctness of the signing.

- Coordination of documents with Rosvoenipoteka. It takes about a month.

- Transfer of funds from NIS with a reclaimed mortgage to a special account.

- Registration of the transaction in Rosreestr.

- Transfer of money to the seller.

Note! The mortgage and purchase and sale agreement of real estate is subject to mandatory approval by the Federal State Budgetary Institution Rosvoenipoteka.

How to get a?

Applying for a mortgage consists of several stages, and we will talk about them below; first, let’s look at who can get a military mortgage . It is available to military personnel who have participated for at least 3 years in the program of the savings and mortgage housing support system (NIS).

The algorithm is as follows:

- The military man submits a report to the unit commander;

- His case is being transferred for consideration to the Housing Department of the RF Ministry of Defense.

- Then it is sent to the Federal State Institution “Rosvoenipoteka”, which delivers the Certificate to it in the prescribed manner.

Remember that this document has a limited validity period - only 6 months from the date of signing.

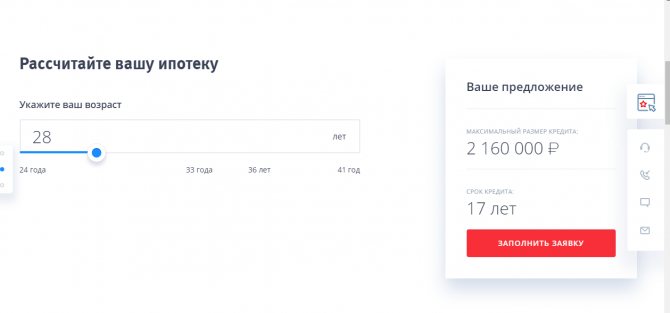

The first stage is filling out an application. To get started, use the online calculator: enter your age in the appropriate service window, and you will find out the approximate loan amount that you can be approved for.

The older you are, the less amount and shorter period you can count on. For example, 28-year-old military personnel will receive 2,160,000 rubles for 17 years, and those who are 41 years old can only count on 670 thousand for a period of 3 years.

But all these figures are preliminary; you will be able to find out the exact amount after you complete the application. A bank specialist will call you, explain all the nuances of the program, accept the missing data and offer to meet at the mortgage center.

In the online application you will need to indicate:

- your last name, first name, patronymic,

- date of birth,

- phone number,

- E-mail address;

- city where the loan was received;

- region of real estate acquisition;

- credit term;

- property value;

- down payment amount;

- loan size;

- passport details.

By calling the toll-free phone number 8 800 100-24-24 , you can clarify information on loan terms and familiarize yourself with all available programs.

A very important document for the bank is the Certificate of eligibility to receive a targeted housing loan. It must be obtained before submitting documents. Once all documents have been collected, they should be submitted to the mortgage center.

How approval occurs: within 5 days, the bank examines the submitted documents, the applicant’s data, his credit history, and then makes a decision, which is communicated by the manager over the phone. The approval is valid only for 4 months from the date of receipt.

The second stage is the submission of remaining documents. Decide on real estate. Depending on whether the housing is in a new building or on the secondary market, different documents are required. For example, for secondary housing you will need copies of:

- cadastral passport;

- extracts from the house register about people registered in the apartment;

- characteristics of the living space;

- seller's passport (all pages);

- report of the assessing organization.

In addition, if minors live in the apartment, you will need to bring permission to alienate the apartment from the guardianship authorities, as well as documents confirming the presence of other housing.

In any case, you can always consult with the bank manager about the necessary documents for each type of real estate purchased.

Also at this stage it is necessary to conduct an appraisal and home insurance. Moreover, insurance against the risk of loss and damage to the purchased property is mandatory.

VTB recommends contacting appraisers, insurance companies, and construction organizations that are its partners. But the borrower’s right to choose is not limited - you can contact any organization, but the bank warns that the time frame for reviewing documents in this case will be longer. The completed documents are submitted to the lender to verify the legal purity of the property.

Third stage. Making a deal. At this stage the following agreements are signed:

- purchase and sale with a home seller;

- insurance;

- credit and mortgage (a security in the name of the bank, which transfers to it the right to pledge, in the event of failure by the debtor to fulfill its obligations).

If there are guarantors, an agreement will be signed between him and the bank. VTB then transfers the money to the seller.

Regardless of whether housing is purchased in a new building or on the secondary market, a mortgage is issued in favor of the bank until the debt is fully repaid. Real estate on the secondary market is registered as the borrower's property immediately, and an apartment in a new building after construction is completed.

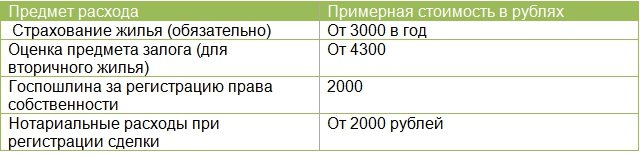

Below are the costs you may face:

The bank will also charge a commission for transferring funds to the seller’s account if it is opened in another bank.

What documents will be needed

When applying for a VTB24 military loan, you will only need a passport and family income data. The initial package of documents includes the following copies:

- general civil passport of the applicant;

- TIN and SNILS;

- official confirmation of participation in the NIS program;

- borrower's questionnaire filled out according to the VTB Bank form.

Note! If the client is married, then the same package of documents will be needed for the spouse (except for the NIS certificate), as well as a marriage certificate and identifying documents for children, if available. Solvency documents are not required.

After approval of the borrower's candidacy, an inspection of the property will follow based on the following documentation:

- Confirmation of ownership of real estate.

- Extract from the Unified State Register of Real Estate (no later than one month).

- Passports and TIN of all owners.

- No utility debt.

- Technical housing plan.

- Valuation report from an independent valuation company.

- Help f. 3 about registered residents.

Important! All real estate documents must be provided in the original at the time of the transaction and when submitting the documentation to the mortgage center of VTB24 Bank for legal examination.

Repayment methods

The system of interaction between the parties allows the borrower not to worry about making mandatory monthly mortgage payments. Military structures will send all transfers directly to the bank in accordance with the concluded trilateral agreement. It is necessary to notify the lender only in case of partial or full early repayment at the request of the borrower. To do this, you need to perform the standard actions in this situation:

- Notify the creditor in writing of the date of payment of the repayment amount (the application is written according to the VTB Bank form).

- Appear at the bank branch exactly on the specified date or transfer money online.

- Receive a recalculation of the schedule for partial repayment of the debt.

- Receive a certificate of full fulfillment of debt obligations in case of full repayment of the mortgage.