Applying for a mortgage without a down payment at Sberbank Buying a home has always been a difficult task. It takes a lot of time to accumulate a large amount of money, and if you need to buy your own home in a short time, then the likelihood of such an acquisition is reduced to zero. Modern customer service allows citizens to use calculator , which will provide all the necessary information regarding your situation.

Banking institutions provide the opportunity to purchase housing under specific conditions , but even in this case, many simply do not meet them or, due to the lack of a down payment , can afford such a luxury.

Today, in 2020, Russian citizens have a great chance of purchasing long-awaited square meters. This became possible due to the provision of a mortgage without a down payment from Sberbank.

Who can take out a loan to buy a home without a down payment?

Individuals who are citizens of the Russian Federation, have a stable income and have been officially employed for the last six months can apply for a loan. In fact, such a loan is not provided for all citizens. The down payment will be at least 15%, but you can fall into the category where a mortgage loan is available without a down payment.

So, to take out a mortgage without a down payment :

- young married couples, provided that one of the spouses or both are under 35 years old;

- people in line to receive an apartment on preferential terms;

- persons who have a current loan from another bank and wish to reissue it on more attractive terms from Sberbank;

- families who have a second or third child. The role of the down payment will be played by maternity capital;

- military personnel. Here you can use the money provided by the savings-mortgage system;

- those who wish to apply for a housing certificate. This form of benefit can be used by employees of the Armed Forces who do not participate in the NIS, employees of the internal affairs department and fire safety services, wives of deceased military personnel;

- a single spouse who is raising a minor child;

- married couples during their student years, dependent on parental support.

Each category of citizens has its own nuances, therefore, when contacting Sberbank, you should explain the situation as specifically as possible and have with you the necessary documentation that gives privileges.

Expert advice and reviews from those who bought a home

If this is not the first time you start saving, but then give up, then perhaps a method where real estate is acquired gradually, starting from a dorm room or KGT, will suit you.

The steps described above on how to save up for an apartment without a mortgage with a salary of 30,000 rubles may look complicated. If you take all these points into account, then the realization of your dream will come true in a shorter time.

Features of Sberbank issuing mortgages without a down payment

The process of applying for a mortgage at Sberbank is quite tedious and has its own characteristics. One of the features is that purchasing housing is allowed only from official developers. This program does not allow the purchase of square meters on the secondary market or from a construction company that does not meet the requirements. It is allowed to obtain a mortgage provided that the housing is still under construction or is ready, but from developer companies accredited by the bank.

Another feature is mandatory collateral. The property being purchased or any other immovable property of the borrower or co-borrower can act as collateral. Moreover, the deposit must act as an alternative option for the purchased housing, that is, the estimated value of the objects must be proportionate.

A nuance when filling out an application on terms is insurance of the borrower’s home and life for the full term of the loan.

The period for reviewing an application for a mortgage without down payments takes no more than 8 business days. The loan amount provided by the bank is issued at a time or in installments. Sberbank rules provide for a penalty for late repayment of a housing loan. The amount of the penalty can be found in the loan agreement.

Maternity capital and mortgage for country real estate

When applying for a mortgage on country housing or land at Sberbank, you can use maternity capital as a down payment or to repay part of the loan. But this imposes additional obligations on the borrower:

- the need to register children in the purchased property;

- the residential premises must have an area corresponding to the number of family members of the borrower (minimum 18 sq. m per person);

- the purchased housing must be approved by representatives of the Pension Fund (guarantor of the maternity capital certificate).

Uniform requirements for the buyer

You can become an applicant for a mortgage without down payments on Sberbank terms if you meet specific requirements:

- are citizens of Russia;

- buyer aged from 21 to 75 years. It is possible that the borrower may be under 21 years of age, provided that the parents are guarantors. At the end of the repayment period, the borrower must be no older than 75 years;

- you have property suitable as collateral;

- have an unblemished credit history;

- the contribution for each month should be no more than 40% of monthly income;

- your period of work in your current place is at least six months, and your work experience over the last five years is at least a year.

However, each application is analyzed separately, so conditions are subject to change.

Important bank conditions

For buyers wishing to receive a home loan without a down payment , the bank puts forward a number of conditions:

- The housing loan period is no more than 30 years;

- Mortgage currency ruble;

- It is allowed to repay a housing loan ahead of schedule;

- Mortgages are allowed only for finished housing or real estate under construction from specific developers;

- Providing collateral for the duration of the loan;

- Insurance of the borrower's real estate.

Changes in points affect the change in the home loan rate.

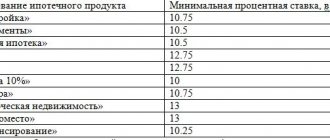

The home loan rate varies for each category of borrower. For example, if maternity capital is used, the interest rate will be from 6.5%; mortgage refinancing provides a rate of 9%; for military personnel - from 8.8%, for participants of the federal program of state support for families - from 5%.

The interest rate is influenced not only by the attitude towards one of the listed groups, but also by the individual characteristics of each case. Therefore, the buyer may well count on a reduction in mortgage .

How to save for an apartment with a salary of 30,000 rubles

To get started, follow the step-by-step instructions:

1 step. Analyze your income and expenses.

At this step, you need to structure all income and expenses per month in a table on a computer or on paper. A visual analysis will allow you to quickly identify shortcomings in the budget and understand where certain expense items can be cut.

In the “Special Notes” column you should indicate the reason why you made this purchase. For example, you were prompted to purchase another bottle of shampoo by the character trait “buying everything in reserve” or “I’ve run out of shampoo,” or “I want expensive shampoo.” Depending on what you specify, the need for the specified purchase in a certain period of time will depend. To quickly save up for an apartment with a salary of 30,000 rubles. You need to develop the habit of monitoring your expenses daily.

A sample expense table might look like this:

| date | Amount, rub. | Specification of expenses | Importance |

| 01.06.2020 | 75 | Directions | Important |

| 70 | Chocolate at work | I wanted to | |

| 240 | Chicken | Important | |

| 50 | Milk | Important | |

| 50 | Cottage cheese | Important | |

| 60 | Sour cream | Important | |

| 55 | Pasta | Important | |

| 40 | Bread | Important | |

| 70 | Chips | I wanted to | |

| 60 | Lemonade | I wanted to | |

| 65 | Cookie | I wanted to | |

| 50 | Bananas | Important | |

| 55 | Eggs | Important | |

| 400 | Face cream | On promotion | |

| 02.06.2020 | 75 | Directions | Important |

| 250 | Lunch at a cafe | Didn't take it from home | |

| 500 | New jersey | I wanted to | |

| 650 | Washing powder | On promotion | |

| 03.06.2020 | 75 | Directions | Necessarily |

| 500 | Refueling the car | Important | |

| 350 | Electricity | Necessarily | |

| 60 | Cookies at work | I wanted to | |

| 700 | Cellular + Internet | Necessarily | |

| 04.06.2020 | 75 | Directions | Important |

| 65 | Tea for work | Important | |

| 500 | Book (magazine) | I wanted to | |

| 250 | Cake | On promotion | |

| 65 | Sour cream | Important | |

| 130 | Cheese | Important | |

| 160 | Sausage | I wanted to | |

| 40 | Bread | It's over | |

| 30 | Potato | It's over | |

| 37 | Cabbage, onion | It's over | |

| 30 | Carrot | It's over | |

| 40 | Apples | It's over | |

| 600 | Card service | Necessarily | |

| 05.06.2020 | 10000 | Rent | Necessarily |

| 75 | Directions | Necessarily | |

| 4500 | Communal apartment | Necessarily | |

| 700 | New case | I wanted to | |

| 1000 | Cafe with friends | Entertainment | |

| 500 | Hookah | I wanted to | |

| 250 | Taxi | Important | |

| 06.06.2020 | 2000 | Sneakers | Worn out |

| 350 | Meat | It's over | |

| 80 | Milk | It's over | |

| 80 | Cottage cheese | It's over | |

| 40 | Soap | It's over | |

| 130 | Shampoo | On promotion | |

| 60 | Garbage bags | Ran out | |

| 200 | New cup | I wanted to | |

| 800 | Movie | Entertainment | |

| 150 | Pop corn | I wanted to | |

| 07.06.2020 | 70 | Cookies for tea | On a visit |

| 65 | Tangerines | On a visit | |

| 250 | Aspirin | Medicines | |

| 180 | Pills | Medicines | |

| 300 | Car wash | Requires care | |

| Total: | 28302 |

I specifically tried to put the most tangible monthly expenses into the table. The amount turns out to be impressive for the average regional resident. Let's see where we can get the money from.

Recommended reading: How to save money

Step 2. Optimization of income and expenses.

We will divide the expenditure part into two parts, fixed and periodic expenses.

Fixed expenses include:

- Food,

- communal payments,

- renting an apartment or garage,

- loan agreements,

- payment for parking,

- tuition fees, etc.

Fixed expenses are extremely difficult to remove (rather impossible), but they can be optimized.

Tips on how to reduce fixed costs.

If you are renting a home, you may want to consider housing options with lower rent. Alternatively, you can rent a large house, but for several people, which will be cheaper overall. This option is not suitable for everyone, but rather for sociable people under 25 years old.

Also, if your parents have housing, then it is worth considering the option of temporarily living with your parents. If you still live with your parents and the question of how to save for an apartment remains open, then you should think about whether it is worth moving until you have saved the required amount for a down payment on a mortgage or the full amount for an apartment. For many people, such a decision will be painful, but this action will provide an opportunity to save a significant amount.

Saving on quality products is the most unwise decision, because low-quality products directly affect your well-being and overall health. To optimize food costs, financial experts recommend creating a weekly menu and, based on it, making a list of necessary products. Before visiting the supermarket, check out various promotional offers in retail chains. This can be done through applications on your smartphone (edadil, etc.). This approach to shopping will save you a significant amount. After a year, you'll be surprised how much you spent on groceries before.

In terms of utility costs, you can save on electricity by replacing old incandescent lamps with modern LED lamps with a 1-3 year warranty. Try to completely turn off all electrical appliances (except the refrigerator) when leaving the house.

Spending caused by bad habits is a serious help in maintaining a budget. If you smoke, you know that one pack of cigarettes costs from 130 rubles. If you smoke 1 pack per day per month, you get almost 4,000 rubles. Quit smoking, it will be good for your health and wallet. It is worth giving up other bad habits, such as snacks, soda, fast food. Instead, channel the freed energy into sports, jogging or cycling.

Recurring expenses include:

- Gym,

- cafes, bars, cinema and other entertainment,

- cosmetics,

- vacation,

- updating hobby items (any sports equipment), etc.

Periodic expenses are more flexible for optimizing and saving money, because we can remove or reduce them at any time. For example, do not visit a restaurant every Saturday, but go there once every two or three weeks. This doesn’t mean that you will communicate with friends less often, just move the gatherings to someone’s home or to nature. If you want to order pizza, then take a simple recipe from the Internet and cook it yourself.

According to the table, the expense item “wanted, but not necessary” amounted to 2885 rubles. If you reduce the cost of rent, utilities and reduce trips to cafes, you can save another 6,000-7,500 rubles. monthly. Direct the saved 10,000-110,000 rubles into a piggy bank for an apartment, plus add 20-30% of donated funds and unplanned income. Within a year, you will be pleasantly surprised by the savings and your motivation will increase.

Step 3. Choosing housing.

In the process of saving money, you should gradually take a closer look at the real estate you like. You can search for an apartment or house project and print a photo of it. Place this photo in your wallet and the moment you want to make a rash purchase, look at it and remember which goal has a higher priority for you.

Using the recommendations described above, you will see that monthly expenses are reduced and this plays a positive role in savings.

Step 4 Capitalization and investment.

I recommend reading: Forex4You reviews and reviews

When trying to figure out how to save for an apartment without a mortgage, you need to understand how to increase money using different investment tools. Start learning the principles of investing from the first month of savings. This could be company shares, government bonds, investing in PAMM and RAMM accounts, etc.

A clear example of how an allocated 10,000 rubles per month can turn into an apartment in just 53 months. (4 years 5 months) with the help of capitalization and competent investment.

| Duration, months | Monthly replenishment + capitalization, rub. | Interest 4%/month. | Amount with capitalization, rub. |

| 1 | 10000,00 | 400,00 | 10400,00 |

| 2 | 20400,00 | 816,00 | 21216,00 |

| 3 | 31216,00 | 1248,64 | 32464,64 |

| 4 | 42464,64 | 1698,59 | 44163,23 |

| 5 | 54163,23 | 2166,53 | 56329,75 |

| 6 | 66329,75 | 2653,19 | 68982,94 |

| 7 | 78982,94 | 3159,32 | 82142,26 |

| 8 | 92142,26 | 3685,69 | 95827,95 |

| 9 | 105827,95 | 4233,12 | 110061,07 |

| 10 | 120061,07 | 4802,44 | 124863,51 |

| 11 | 134863,51 | 5394,54 | 140258,05 |

| 12 | 150258,05 | 6010,32 | 156268,38 |

| 13 | 166268,38 | 6650,74 | 172919,11 |

| 14 | 182919,11 | 7316,76 | 190235,88 |

| 15 | 200235,88 | 8009,44 | 208245,31 |

| 16 | 218245,31 | 8729,81 | 226975,12 |

| 17 | 236975,12 | 9479,00 | 246454,13 |

| 18 | 256454,13 | 10258,17 | 266712,29 |

| 19 | 276712,29 | 11068,49 | 287780,79 |

| 20 | 297780,79 | 11911,23 | 309692,02 |

| 21 | 319692,02 | 12787,68 | 332479,70 |

| 22 | 342479,70 | 13699,19 | 356178,89 |

| 23 | 366178,89 | 14647,16 | 380826,04 |

| 24 | 390826,04 | 15633,04 | 406459,08 |

| 25 | 416459,08 | 16658,36 | 433117,45 |

| 26 | 443117,45 | 17724,70 | 460842,14 |

| 27 | 470842,14 | 18833,69 | 489675,83 |

| 28 | 499675,83 | 19987,03 | 519662,86 |

| 29 | 529662,86 | 21186,51 | 550849,38 |

| 30 | 560849,38 | 22433,98 | 583283,35 |

| 31 | 593283,35 | 23731,33 | 617014,69 |

| 32 | 627014,69 | 25080,59 | 652095,27 |

| 33 | 662095,27 | 26483,81 | 688579,09 |

| 34 | 698579,09 | 27943,16 | 726522,25 |

| 35 | 736522,25 | 29460,89 | 765983,14 |

| 36 | 775983,14 | 31039,33 | 807022,46 |

| 37 | 817022,46 | 32680,90 | 849703,36 |

| 38 | 859703,36 | 34388,13 | 894091,50 |

| 39 | 904091,50 | 36163,66 | 940255,16 |

| 40 | 950255,16 | 38010,21 | 988265,36 |

| 41 | 998265,36 | 39930,61 | 1038195,98 |

| 42 | 1048195,98 | 41927,84 | 1090123,82 |

| 43 | 1100123,82 | 44004,95 | 1144128,77 |

| 44 | 1154128,77 | 46165,15 | 1200293,92 |

| 45 | 1210293,92 | 48411,76 | 1258705,68 |

| 46 | 1268705,68 | 50748,23 | 1319453,90 |

| 47 | 1329453,90 | 53178,16 | 1382632,06 |

| 48 | 1392632,06 | 55705,28 | 1448337,34 |

| 49 | 1458337,34 | 58333,49 | 1516670,84 |

| 50 | 1526670,84 | 61066,83 | 1587737,67 |

| 51 | 1597737,67 | 63909,51 | 1661647,18 |

| 52 | 1671647,18 | 66865,89 | 1738513,06 |

| 53 | 1748513,06 | 69940,52 | 1818453,59 |

| 54 | 1828453,59 | 73138,14 | 1901591,73 |

| 55 | 1911591,73 | 76463,67 | 1988055,40 |

| 56 | 1998055,40 | 79922,22 | 2077977,62 |

| 57 | 2087977,62 | 83519,10 | 2171496,72 |

| 58 | 2181496,72 | 87259,87 | 2268756,59 |

| 59 | 2278756,59 | 91150,26 | 2369906,85 |

| 60 | 2379906,85 | 95196,27 | 2475103,13 |

As you can see, for this it is enough to invest funds at 4% per month , which corresponds to a moderately conservative portfolio. You should not immediately rush into purchasing various assets, because in 99% of cases this will lead to partial or complete loss of funds. I recommend first familiarizing yourself with the terminology and rules of investing and seeing how the market behaves and what works.

At the initial stage, to build up your deposit, you can choose financial instruments with moderate risk and low initial entry:

- ramm accounts with a deposit of $100 and a risk limit of 5-7% per month. I talked about what ramm accounts are in the article Where to invest money 2020 . The current list of accounts in which I invest can be found in the weekly reports.

- investing in dividend shares of Russian and foreign companies with large capitalization through an individual investment account.

- short-term stock trading . For this I recommend proven brokers:

- Roboforex Stock

- FxPro

Roboforex Stock - with minimal commissions for purchasing foreign shares

- 15 years in the stock market,

- $100 is the minimum deposit,

- 95% positive feedback,

- Access to American and European stock markets,

- Free stock trading training course,

- Dividend payment,

- Current trading ideas for investment,

- Free demo account with the ability to test robots.

Invest in shares of American companies

FxPro is the best in trading CFD contracts and in terms of execution speed

- Shares of leading companies in the USA, England, France and Germany,

- 1:25 — leverage for buying shares,

- Trading in the familiar MT4,

- 11 milliseconds - average execution speed ,

- Dividend payment,

- Withdrawal of funds without commissions

- You can make money when stocks fall.

Open an account in 15 seconds.

Ready-made investment portfolios with risk distribution can be found in the articles:

- Where to invest 100,000 rubles

- Where to invest 200,000 rubles

The right approach to money management will bring you 40-60% per annum, and with the capitalization of invested funds, you can reduce the deposited amount by 1/3. This will allow you to save up for an apartment ahead of schedule and significantly bring your goal closer to completion.

Step 5 Additional income.

To quickly save up for an apartment in a year or two, you should think about additional work or a promotion to your current position with an increase in income accordingly. If possible, take on additional responsibilities at work and fulfill them to the best of your ability. The manager will quickly understand that your potential in your current position has not been fully realized and you will be promoted. If this does not happen within 6 months, and your bosses are accustomed to shifting responsibilities to you, then you should look for a higher-paying job.

Consider creating passive income without investment or with minimal investment. In the TOP passive income , I discussed both options.

Before the holidays, let your family and friends know that you would like to see cash as a gift. If possible, try to put this money in a piggy bank.

Great options for additional income could be:

- Favorite hobby. While doing what you love in your free time, think about how you can turn it into income. A hobby can be absolutely anything. For example, if you like to go hiking, then try to shoot content for a YouTube channel, where you will review various hiking items and give people positive emotions.

- A second job is one of the simplest options for earning extra income. All you need is to find a part-time job and try to combine it with your main job and with rest.

Examples of such work without compromising health and rest may be:

- Having a car, you can engage in private transportation or cargo transportation,

- There is an interesting part-time job walking dogs, if you walk often, you can combine these activities and earn money,

- Search for work on freelance exchanges. Having computer skills, you can easily find customers. The work can be anything, from programming to banal presentation design.

- Get an additional profession, such as hairdresser and manicurist. These types of services are in demand today and you can easily combine them with your main job.

- Leading a sports lifestyle, you can try yourself as a coach. You can create a website or a YouTube channel where you can share your knowledge with people who want to improve themselves.

- Any other monetization of hobbies. Let's say you like to go hiking, then try to shoot content for YouTube or Instagram, where you will review different hiking items or show interesting routes. Over time, you will be able to insert advertisements into videos and make money from it.

Today, thanks to the Internet, we have great opportunities for generating income. All that is required of you is to decide in which direction you will move and understand how you will earn income from it. The age of the Internet gives everyone an equal opportunity to start, so all that is needed from you is desire and perseverance. Increase your income and it will be easier for you to save up for an apartment with a salary of 30,000 rubles.

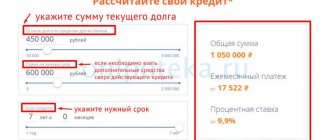

Mortgage Calculator

Our website provides the opportunity to independently calculate the main mortgage indicators. To be aware of the loan rate and the amount of payments for each month, you need to use a mortgage calculator. A very convenient service, since you do not need to visit the bank office, you just need to use the Internet resource.

It is worth indicating the following information: apartment price, down payment amount, loan period, interest rate, payment option, etc. After filling in the fields, you need to click the “Calculate” button, and the program will automatically display your result.

Mortgage

How to save for an apartment: setting a goal

When intending to save for an apartment, it is important to know exactly what goal we are pursuing. In other words, how much money you need to save to buy an apartment, accurate to 50,000-100,000 rubles. It is also necessary to calculate by what period we want to achieve the desired result. Knowing the initial data, it will be easier to calculate what monthly amount needs to be put into our piggy bank in order to achieve the goal.

Let’s say we set a task: to save money for an apartment whose price is 1,800,000 rubles in 5 years or 60 months. Based on these data, to implement the plan to buy an apartment without lending, we need to save 30,000.00 rubles monthly. At this step, many people finish the calculation, because in the regions, the average monthly salary is 30 thousand rubles. Don't rush to give up on your dreams.

Secure payment service

Banking services provide a cashless payment service for buyers and sellers. This is an advantageous offer for purchasing housing for both parties. The price of such a service is 2000 rubles. Registration is carried out in 15 minutes, and the service is considered safe, since the money is safe and the interests of the parties are strictly respected.

The operation of the service is simple, so it does not take much time from the user. The transaction consists of the buyer of the property transferring money to the account of the Sberbank Real Estate Center, after which the Center requests data on the transaction from Rosreestr. If the transaction is registered, the Center sends the amount of funds to the seller’s account.

This calculation system significantly saves time and effort for both the seller and the buyer. There is no need for the buyer to withdraw cash at the cash desk or issue a receipt. In turn, the seller does not have to take the money; it is enough to provide the account number where it should go after registering the transaction.