But it was decided to extend this mortgage program. It is an excellent solution for those people who are attracted by the comfort that is created in their own private home.

Mortgage in Sberbank for a wooden house

Initially, only a couple of financial institutions took part in the lending program for the construction of a wooden house However, in 2020 , 13 organizations joined it. And now you can get such a mortgage in 15 banks in the country, including Sberbank . This type of program allows you to solve several important problems at once, which are as follows:

- Providing the population with environmentally friendly housing;

- The use of wooden materials, which very often remain unclaimed;

- Support for the wood processing industry.

A special feature of a mortgage on a wooden house is the allocation of funds to borrowers to purchase a house or build their own country property according to their own design. In this case, housing can be represented not only by private residential real estate, but also by an apartment located in a house with wooden walls. This program is preferential. Five percent of the cost of real estate or a project is subsidized by the state at the initiative of Dmitry Medvedev. Sberbank offers its clients favorable conditions for cooperation.

This bank mortgage program has its pros and cons. The advantages include the following:

- The loan is provided even without real estate collateral, but collateral will be required, which in most cases is guarantors;

- The down payment is only 10 percent, which is about 15 percent less than for home loans under conventional programs;

- The borrower, through a lending institution, is provided with a government subsidy in the amount of five percent of the cost of the house .

This mortgage program also has shortfalls. One of these disadvantages is that housing is built from wooden materials, and this increases the risk of a fire hazard. Largely for this reason, not every financial organization provides loans for this type of preferential lending to the population. In addition, this mortgage is used to build housing based on factory frames. Self-made log houses cannot be used.

Advantages of a mortgage from Sberbank

In terms of the ratio of the amount of the down payment and the interest rate, a mortgage on a land plot from Sberbank is now the most profitable.

| Bank's name | An initial fee | Interest rate | Loan terms |

| VTB 24 | From 20% | From 10% | From 3 to 50 years |

| Rosselkhozbank | From 15% | From 13.5% | From 360 months |

| Sberbank | From 25% | 11,5% | Up to 30 years old |

The terms of the loan in this case are beneficial for both parties.

When taking out a mortgage loan on a land plot, the borrower is not required to take out real estate insurance

The main advantages of a mortgage from Sberbank are as follows:

- When applying for a mortgage, not only the financial capabilities of the borrower are taken into account. The income of third parties is also taken into account, which may affect the final size of the mortgage.

- There are no hidden fees or application fees.

- If the loan is issued in foreign currency, the interest rate is reduced to 9.1% .

Note! In one of our articles we prepared the latest news about foreign currency mortgages.

- Participants in the salary project from Sberbank are offered more favorable conditions.

- Financial sanctions do not apply to you if you repay the loan early.

- A minimum package of documents is required.

- After obtaining a mortgage, you are given the opportunity to open a credit card with a limit of 200,000 rubles .

- The Sberbank website has a convenient calculator for accurately and quickly calculating the interest rate on a loan.

- Citizens belonging to preferential categories can receive a mortgage under a simplified scheme.

Sberbank currently offers several mortgage programs. Thanks to this, the borrower can choose the most suitable option for himself.

Recommended viewing:

At the moment, two programs have been prepared:

- Country estate;

- Purchase of land for individual housing construction.

| Program | Loan currency | Initial fee | Interest rate | Maximum loan term | Loan repayment method | Security |

| country estate | Rubles | From 15% | From 13% | 30 years | Equal payments | Pledge of the purchased object, guarantee |

| Purchase of land for individual housing construction | Rubles | From 15% | From 13.5% | 30 years | Equal payments | Pledge of land for construction, surety |

Program conditions

Since a wooden mortgage falls into the category of preferential programs, it will be an excellent solution for families who want to improve their living conditions, but do not qualify for other preferential offers from Sberbank . According to it, each borrower can become the owner of their own environmentally friendly wooden house . to this type of mortgage :

- The amount of the down payment should not be less than 10 percent of the cost of the wooden house ;

- The maximum loan amount is three and a half million rubles. But its size does not exceed 75 percent of the total purchase price of the house ;

- Purchasing a house kit produced at a factory;

- A subsidy amount of five percent of the cost of the house is accrued within six months after the mortgage ;

- terms for a wooden house vary up to 15 years. They are calculated for each client individually.

Currently, the interest rate on a loan for the construction of a wooden house is 11.6 percent. The area of the housing being constructed must be up to 150 square meters. A loan can also be provided for the assembly of wooden residential building, but it must be collected within four months after receiving the funds.

Features of a mortgage on land

A mortgage on a plot of land is a fairly popular type of classic mortgage loan. Many residents of megacities strive to live away from the bustle of the city, in environmentally friendly areas. A mortgage for the purchase of your own land has a lot of features associated with the presence of increased risks of such real estate objects and their relatively low liquidity.

Getting a mortgage to purchase a plot of land will be much more difficult than to purchase an apartment. The reasons here are quite objective:

- A plot of land has lower liquidity compared to any apartment (especially 1- or 2-room apartments in good condition and in a prestigious area). That is, the subsequent sale of land in the event of the borrower’s failure to fulfill its obligations will be accompanied by additional expenses and increased risks.

- Valuing a property can also have some difficulties. The evaluator will have to take into account many factors: distance to the city, area, infrastructure development, prestige/non-prestige of the area, availability of all necessary communications, etc. Only with a combination of the listed parameters can a conclusion be drawn about the final estimated value of the land plot.

- The situation is complicated by the fact that on the acquired plot, most likely, a house and other non-residential buildings, which are separate real estate objects, will be built. This is associated with additional time costs and lengthy registration when interacting with the creditor bank. Any buildings on mortgaged land automatically become subject to bank collateral.

- It will be possible to buy only a plot intended for the purposes of housing construction, gardening and farming.

In order to minimize potential risks, banks impose rather strict requirements on the property and the borrower, and also force the client to necessarily enter into a comprehensive insurance agreement. The rates on such loans will also be significantly higher than on standard mortgage loans. You can calculate the final overpayment for a specific mortgage program using a visual loan calculator.

Requirements

When applying for a product such as a wooden mortgage , Sberbank defines requirements for borrowers, co-borrowers and real estate that will be purchased with borrowed funds. This type of lending does not involve the purchase of any type of residential property, but one that meets the parameters established by the bank. If a citizen has decided to take out a mortgage on wooden residential building, then it is necessary to comply with all the requirements established by Sberbank . It is recommended that you familiarize yourself with them before applying.

How to get a mortgage on a plot of land from Sberbank?

There are several basic steps that an applicant must go through to obtain a mortgage loan:

- Go to your local branch or to the Sberbank website page, study the conditions and requirements for a plot of land.

- Select a plot of land that meets the requirements.

- Submit your application, which will be reviewed within a few days.

- If the bank makes a positive verdict, then collect documents for the site.

- If there are no contradictions, an agreement is concluded, and the loan funds are transferred to the borrower.

The agreement is drawn up in writing and certified by a notary . It must be registered within 2 weeks after submitting all documents.

The contract must indicate:

- cadastral number of the plot;

- allotment boundaries;

- square;

- possibility/impossibility of erecting buildings on the purchased plot.

Registration of a mortgage agreement goes through several stages:

- Bank approval of the borrower's application.

- Valuation of land.

- Drawing up an act on the liquidity of land.

- Determining the rate and loan term.

To the borrower

Borrowers are subject to the following requirements:

- Availability of Russian citizenship;

- At the time of registration of a mortgage, a citizen must be at least 21 years old. At the time of repayment of the entire debt, the borrower must be no more than 75 years old;

- Official employment;

- At the last place of work, the work experience must be at least six months. And the total work experience over the last five years should not be less than one year;

- The borrower must have an excellent credit history. Otherwise, a loan for a wooden house will not be provided.

To co-borrowers and guarantors

When applying a mortgage to build your own house from wooden material, if the client is married, then he must obtain the consent of his spouse to take out a loan. By law, the husband or wife automatically becomes a co-borrower on the mortgage . This provision applies only if otherwise is not specified in the marriage contract. Sberbank allows up to three co-borrowers on a loan. He and the borrower are not allowed to have unpaid loans. If there are any, then the mortgage may be denied, or there will be less chance of getting one.

Guarantors sometimes act as collateral for a loan. If the client fails to fulfill his obligations to the bank, the court assigns the responsibility for all payments to the guarantor. Sberbank on him as on borrowers. The main criterion is its solvency.

Features and process of obtaining a mortgage

The list of documents for obtaining a mortgage at Sberbank is minimal, but they should be provided within 120 days from the date of the decision.

The bank may require additional paperwork if necessary.

This situation may arise if you need to clarify important information about the site or the borrower that is not indicated in the main list of documents.

Standard package includes:

- A copy of the certificate of registration of the owner's rights to this plot. Also, the land owner must provide original documents for a copy to be certified by a notary;

- Copies of passports of the applicant, owner and other parties to the agreement;

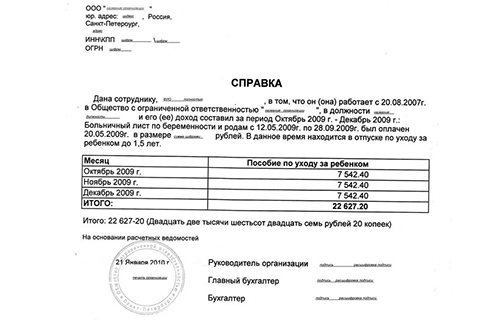

- Papers that confirm the solvency of the borrower, co-borrowers and guarantors;

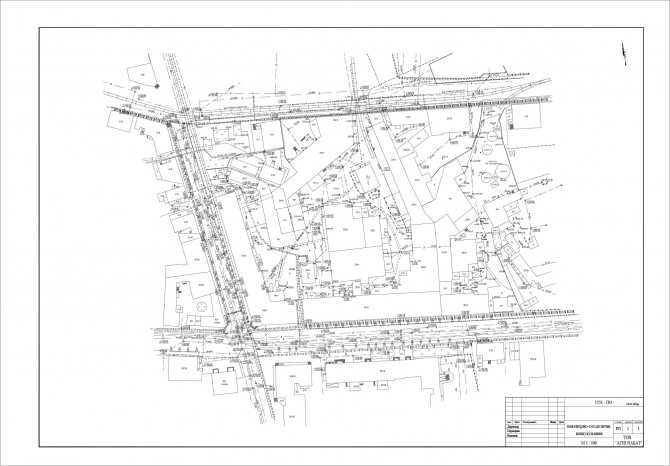

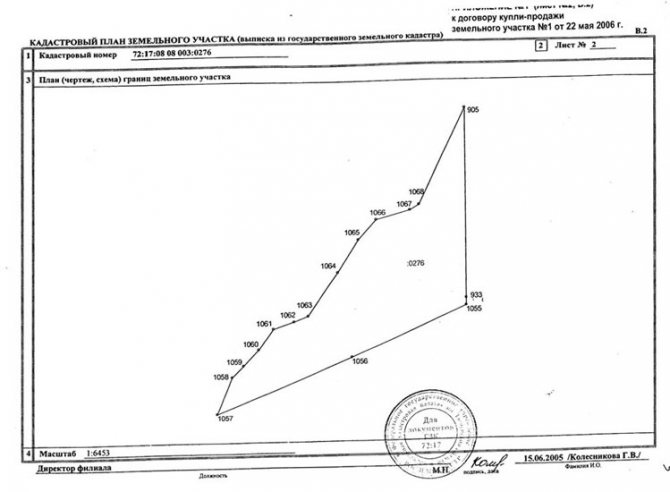

- Cadastral passport and cadastral plan, which indicates the area and purpose of the site;

- Results of the assessment examination;

- Extract from the Unified State Register for land;

- Consent of the spouse to purchase land (must be certified by a notary);

- If the land is sold not by the owner, but by a trustee, then a power of attorney must be provided.

Photo gallery of documents:

Certificate of income Valuation report

Cadastral plan

Cadastral passport

Extract from the Unified State Register

Certificate of registration of rights

After collecting and submitting all documents, an agreement is concluded. This process can only take place in a bank.

The land mortgage agreement must specify the following:

- Location of the site and its name;

- Estimated value of the site;

- Loan amount and loan repayment period;

- Land ownership;

- Registration authority.

For privileged categories of citizens, a simplified scheme for obtaining a mortgage on a land plot is offered. In this case, the registration is carried out in accordance with the state program, which gives the borrower a chance to save on the process of preparing all the necessary papers. But such applications are considered on an individual basis and require the provision of additional documents.

Useful video:

Sberbank offers preferential mortgages for:

- Young families (even a married couple in which one of the partners has not reached 35 years );

- Bank clients who are participants in the salary project;

- Clients who are employees of accredited companies.

To real estate

Sberbank for real estate purchased with borrowed funds that are important to take into account. They are as follows:

- The construction of the facility is made from wooden materials of strong and durable species;

- For a wooden mortgage, an important point is the use of factory-made products in the construction of a residential building, which are represented by fiberboard, chipboard, wood or lamellas;

- The basis for the construction of a house must be a foundation, which is solid or buried;

- The finished building must be suitable for living in at any time of the year. Under this program, loans are not issued for the construction of seasonal country houses;

- A residential property made of wood is built only on a plot owned by the borrower. A solution is also allowed when the construction of an object is carried out on a site that was leased by the borrower. But at the same time, the lease terms must be longer than the mortgage terms;

- Housing must be ready four months after signing a mortgage agreement with Sberbank .

Registration procedure

At the first stage of obtaining a mortgage for the construction of wooden residential building, you must submit an application. This can be done at the nearest office of a credit institution or using Sberbank Online. The system will automatically transfer the client to the DomClick service, where the electronic document is processed. The application must include information about income with all tax deductions and loan payments, if any. of the wooden object and the required loan amount are also indicated You must also provide contact information.

All information provided is verified by bank employees. If inaccuracies appear, then Sberbank has the right to refuse the client a mortgage . The following stages of registration apply for a wooden mortgage

- Collection of necessary documents, the list of which can be checked with employees of the banking organization;

- Waiting for approval, which can take Sberbank about ten days;

- Search for housing. At the same time, a wooden house in advance for its subsequent assembly;

- Registration of papers for real estate, which will act as collateral;

- Opening a credit account;

- Providing a down payment to the bank in the amount of 10 percent of the total cost of the house ;

- Signing a mortgage agreement. It is accompanied by a certificate confirming payment of the down payment;

- Registration of an insurance policy for real estate and the life and health of the borrower;

- Registration of a collateral agreement.

If the construction of the house is completed, Sberbank transfers the entire loan amount to the seller’s account. In other cases, funds are transferred to the institution that is responsible for constructing a residential facility for the client. The borrower is provided with a mortgage for the construction of a wooden house . In addition, the client also has a paper with a debt repayment schedule in his hands. After all stages, it is necessary to make mandatory payments to repay the mortgage for building a house .

Requirements for the loaned object

Sberbank has set fairly high requirements for future real estate. A credit institution tries to reduce risks by obtaining a obviously illiquid object as collateral.

Real estate requirements:

- High level of fire safety;

- Availability of access roads;

- Availability of developed infrastructure at the location of the site;

- Availability of a cadastral plan drawn up by the relevant authorities;

- Satisfactory technical condition;

- Availability of communications.

A borrower may be denied a mortgage if:

- The house is subject to demolition;

- The property is an architectural monument;

- There is an uncoordinated redevelopment;

- Other owners are claiming real estate.

Required documents

The package of documents for a mortgage for the construction of a wooden house is standard. It is practically no different from the list of papers required for processing other loans for the purchase of real estate. The first thing that needs to be provided to the employees of the credit institution is the following list of papers:

- Application, which can be in paper or electronic form;

- Identification document of the borrower and co-borrower;

- Documents that confirm the solvency of the borrower, co-borrower and guarantor. They are represented by salary certificates. At the employer's accounting department or at the tax service, every officially employed citizen has the opportunity to obtain a 2-NDFL certificate. If the employer's company is unable to issue it, a certificate in the bank's form is accepted.

It is worth taking into account that the organization’s salary clients are not required to provide certificates to confirm their income.

Next, you need to wait for the approval of the application for a mortgage loan for the construction of a wooden building. After the bank has confirmed the issuance of a loan to the borrower, you can provide other documents to the institution:

- A certificate confirming ownership of the property that will be used as collateral;

- Construction estimate for the construction of a wooden house . It specifies all mandatory construction work and materials that are used in the process;

- Agreement with a construction organization, if the client entered into an agreement with the contractor;

- Receipt for payment of the down payment on the loan.

In order for the financial institution to control the process of building a wooden house , the client provides the following reporting documents:

- Confirmation that the borrower is registered in the house purchased under mortgage lending. Certificates of registration of all members of his family are also needed;

- Cadastral technical passport;

- Documents that confirm ownership;

- Copies of receipts to confirm that mortgage funds were used to purchase building materials and everything necessary to construct a property from wood.

Alternative options

Despite the seemingly numerous advantages (the ability to quickly acquire land, a long loan repayment period, large amounts secured by the bank), a land mortgage is not the most profitable option for acquiring land. The point here is that a plot of land is a non-standard collateral object, and it is quite likely that it is also illiquid. It is simply unprofitable for any financial institution to issue a lump sum to the borrower, given that the bank may not recoup this investment for itself. Therefore, a fairly common outcome of any attempt to contact a bank with a request to issue a mortgage loan for an illiquid plot of land will be that the mortgage amount is too small.

To protect themselves, banks use an increased coefficient to determine the loan amount: you may not have enough money to purchase land, which you will have to obtain without the help of the bank. Here you will have only three ways to get out of the situation:

- Offer the bank additional collateral, for example an apartment.

- Apply for a consumer loan.

- Take out a loan secured by existing real estate.

For any bank, the most profitable option will be option number one - they will willingly accept an apartment as collateral. But this will only make sense if the loan funds cover not only the purchase of land, but also the construction of a house on it.

A consumer loan will be a real salvation in a situation where the plot of land you have chosen does not meet the bank’s requirements, the cost of such land is relatively small, and you can easily repay the loan debt within up to 5 years. Then you will not only not overpay, but will also save yourself from the need to bother with documents for collateral.

A mortgage secured by existing real estate can help if the bank has not approved the land plot and there are not enough consumer loan funds to purchase land and build a house on it.

Of course, the interest rate on such a mortgage will be higher than for a mortgage secured by the purchased property, but even in general, the overpayment and the rate will be lower or equal to what is offered by the bank in the event that the land is not suitable or does not quite meet the established requirements . We are waiting for your questions in the comments. Subscribe to project updates and support the post - click the social media buttons.

How to extend a wooden mortgage

The first experience of introducing this mortgage program was unsuccessful, since very few people across the country were able to take advantage of it. Some people did not know about its launch, others thought it was not very safe to build housing from wood, and still others were not ready to exchange the bustle of the city for living in the countryside. For these and many other reasons, only one hundred citizens of the country managed to take advantage of the program at the end of 2020.

But even despite the fact that this type of mortgage lending remained undervalued, it was decided to extend it. And in order for citizens to be able to evaluate this program, Sberbank is taking measures to inform the population about its features and conditions. Today, clients of a financial institution can take out a loan to build their own home made of wood until 2022. It was for this period that it was extended this year. Its conditions are available on the website of the banking institution.

Mandatory requirements for a land plot with and without a house

Basic requirements for pledging a plot and house in a bank:

- The plot the borrower likes must belong to the territories of populated areas. The land should not belong to urban areas: parks, squares, forests adjacent to the reservoir, environmental protection zones, squares.

- It is necessary to have permission to use the land for individual housing construction.

- A short distance from the city, no more than 30 km. For Moscow, the maximum distance is 100 km.

If agricultural land is mortgaged, then the type of permitted construction must be - dacha construction. Previously, financial institutions did not work with this type of loan at all, but now large lenders have such programs.

A house subject to a mortgage must have access roads and a road. It is necessary to have communications for individual housing construction: water supply, sewerage, electricity, heating. Lenders do not accept dilapidated housing with more than 65% wear and tear.