An underfunded mortgage involves understating the value of the property in the purchase and sale agreement. The signing of the package of documents must be accompanied by an experienced lawyer. From our article you will learn the main risks of underfinancing and under what conditions it makes sense to consider the option in principle. Where does the benefit for each party begin to justify the risk?

How does a mortgage transaction with underfunding work?

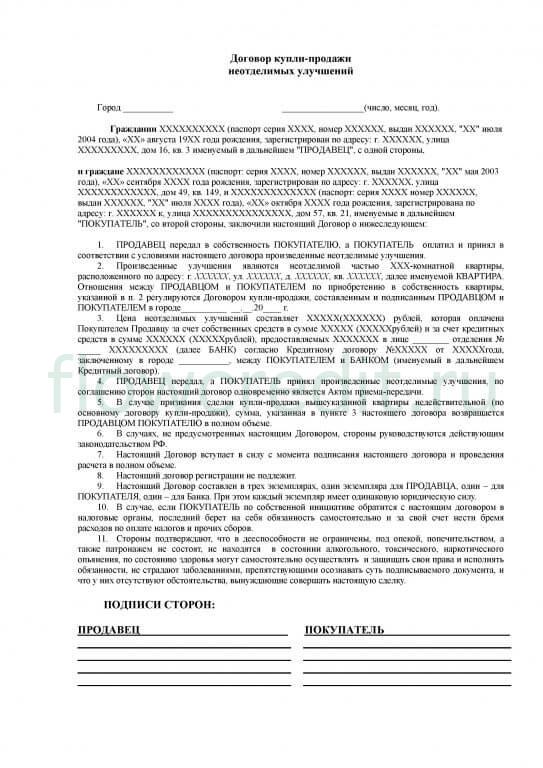

A mortgage transaction with underfinancing involves dividing the total price of the property into two parts:

- price of the property;

- the price of inseparable improvements.

At the same time, the down payment can be specified both in the first agreement and in the second. Only Sberbank agrees to underfunded mortgages.

A purchase and sale agreement and an agreement for inseparable improvements to the apartment are concluded between the seller and the buyer. Only purchase and sale transactions are submitted to government agencies for registration.

Important! If part of the mortgage is indicated in the contract of inseparable improvements, then the transaction will take place in two stages and the seller will receive the credit money only after the second stage:

1.first, the Buyer’s right to real estate and a pledge in favor of the bank are registered (an application is submitted from the Seller and the Buyer, registration period is 9 days through the MFC),

2. then the bank’s First Lien is removed according to the letter (carefully read the letter itself, where the bank asks to pay off the mortgage registration record - the record number must be the Mortgage). And a new pledge is registered on the basis of the Mortgage and Mortgage Agreement (the application is submitted together with a bank representative by proxy).

The attitude of banks towards such registration varies, from a categorical refusal to finance a dubious scheme to a loyal one.

Recommended article: Which apartment can you get a mortgage

Risks

Understating the value of an apartment in a purchase and sale agreement with a mortgage affects the interests of the parties to varying degrees:

| Side | Advantages | Risks, disadvantages |

| For everyone except the state |

|

|

| Salesman |

|

|

| Buyer |

|

|

| Bank |

|

|

| State |

|

|

Risks are often reduced when concluding a transaction between close people with common interests or relatives.

Income tax evasion

Why is it popular to understate the cost of an apartment in a purchase and sale agreement with a mortgage? What are the pitfalls of such an agreement? The seller is interested in lowering the price of real estate because he does not want to pay the income tax levied on him after the sale of the property. It is charged in the following situations:

- • The housing was purchased before January 1, 2016, and the property has been owned for less than 3 years. The sale price exceeds RUB 1,000,000. Income tax of 13% is levied on the amount that exceeds RUB 1,000,000.

- • The property was purchased after 01/01/2016 and was owned by the legal owner for less than 5 years. If the sale amount of such a property exceeds RUB 1,000,000, then the seller will have to pay 13% tax.

A buyer should not accept an underfinanced mortgage, and a seller should not offer one. Tax inspectors will probably be interested in the deal. They will clarify the details of concluding a purchase and sale transaction for a specific object, and will collect all the information on its implementation.

According to the law, the value of the property is one of the priority conditions of the purchase and sale agreement concluded between the parties. If it does not correspond to reality, differs significantly from the market price, then in the event of a trial, the transaction is declared invalid:

- • The property will be transferred to the former owner.

- • The buyer will only return the amount specified in the purchase and sale agreement. An agreement for inseparable improvements will not have legal significance.

Sometimes, after concluding a transaction, the seller refuses to deregister and evict the property. This is a serious violation that causes significant damage to the buyer. He can defend his interests in court, including the right to terminate the purchase and sale agreement.

Tax inspectors will assess additional income tax and take 70% of the cadastral price for calculation. The seller will still have to pay taxes, since control over such transactions has become stricter. If the cadastral value of an apartment is not established as of January 1 of the year in which it was sold, then tax specialists do not have the right to assess additional taxes.

In addition to additional income tax, the seller will have to pay fines for tax evasion and significant penalties. Their size is determined by Article 122 of the Tax Code. It is also possible that the seller will be held criminally liable.

To what level can the price be reduced?

The greater the difference between the amounts of loan agreements and purchase and sale agreements, the higher the risks described. In case of a significant understatement, government agencies may initiate an audit. Then you will need to justify all amounts.

You can prove that, for example, major repairs were made to the purchased apartment by agreement with the seller. The presented documents from the construction and repair company will clearly testify in your favor that you actually improved the conditions and did not just evade paying taxes. Will the repair team issue such certificates... After all, then they must pay the tax.

The number of nuances in an underfinanced transaction causes a lot of controversy and different points of view among experienced lawyers and judges. There is no exact level to which the contract price can be reduced. When deciding whether to benefit yourself, consider the following legal requirements:

- the price of the property in the contract should not differ significantly from the market price indicated by the expert in the assessment report;

- the minimum value of the premises, which is taken into account for calculating the tax, is 70% of the cadastral value;

- Personal income tax is paid by the seller;

- the amount in the purchase and sale agreement will affect the buyer’s tax liability if he decides to sell the property in the next 5 years; then he will become a seller and will choose between:

- underpricing associated with all risks;

- waiting for the expiration of 5 years;

- payment of tax, which is calculated “Sale price minus purchase price”, that is, the cheaper you bought, the more tax you paid for a “transparent” sale in the future.

Recommended article: Mortgage with a criminal record - which bank to contact, ways to get

Nuances of document preparation

Officially, these manipulations with the purchase and sale transaction are illegal. However, the practice has been known for a long time. Sberbank does not refuse some deviation from the rules in order to satisfy the client’s needs. When deciding to change the facts in the contract, it is worth considering possible risks:

- If the price was lowered and the transaction was terminated for some reason, then the buyer can only receive the amount indicated in the official papers;

- An overpriced option puts the seller at risk. Recognition of the fact of sale as invalid entails the return of funds to the buyer;

- Specifying figures that are too inadequate will attract the attention of tax authorities. Proceedings may result in a huge fine and termination of the contract.

When applying for a mortgage with underfinancing from Sberbank, it is strongly recommended to draw up an additional agreement between the parties. It indicates the real price of the purchased square meters, individual agreements and responsibilities of the parties. The paper will serve as evidence in court if conflict situations arise between participants, as well as during an investigation by the tax service.

To choose the safest path, it is recommended to obtain prior consultation with a lawyer or Sberbank employee. In the second case, the procedure is free. The specialist will explain controversial issues and give advice to minimize risks. Without legal literacy, you should not commit rash acts.

With the growth of the housing lending market, a new term has appeared - underfinancing. This mechanism allows you to avoid paying income tax when selling real estate. Not all banks are ready to use such a scheme. Sberbank is one of the few financial institutions that issues loans for transactions with underfinancing. Underfinancing of a Sberbank mortgage is a process that requires careful study. We’ll talk about it today in this article.

More on the topic How to check traffic police fines online through Sberbank

As already mentioned, the entire procedure is carried out so that the seller does not pay the mandatory tax - 13%. You will have to pay it if the housing was purchased after January 2020 and ownership at the time of sale lasts less than five years. In this situation, tax will need to be paid on amounts exceeding 1,000,000 rubles. This is a very significant amount. For more information about paying sales tax, read this article.

In the event that the person who bought the apartment decides to sell it before the expiration of 5 years, the obligation to pay the tax will fall on him.

As for property deductions and deductions for mortgage interest paid, they will be significantly less than under standard conditions. As confirmation of expenses, a purchase and sale agreement and a credit agreement are submitted to the tax service. In case of underfunding, improvements are formalized by an additional agreement that is not subject to registration. Accordingly, the deduction amount will be calculated based only on the monetary policy.

If the tax service does become interested in the transaction, the parties must be prepared to check their sources of income. The tax office may assess additional personal income tax and apply penalties.

The decision to use an underfunding program should not be made without considering all possible negative consequences. Such transactions lead to the state not receiving the required taxes, which, in fact, is a violation of the law. Before deciding on such an agreement, you should analyze the benefits received and compare them with possible risks.

In order not to lose useful information, the post can be saved or published on social networks.

If after reading you still have questions, the lawyer on duty will be happy to answer them. To do this, click on the icon in the lower right corner of the screen.

{amp}gt;Sberbank mortgage with underfinancing

In large banks, a mortgage transaction with underfinancing becomes possible if the appraiser confirms the value of the property, which is indicated in the purchase and sale agreement. Each bank cooperates with professional appraisal companies that have been accredited and comply with its requirements and provide reports in the required form.

Many commercial banks, small in terms of assets, willingly agree to understate the value of the property, while setting their own conditions for the borrower. They require a large down payment on the mortgage. Such financial institutions may provide mortgage loans at higher rates.

A suspiciously low price of an apartment is an important factor that may indicate fraudulent real estate activities and an intention to make money on gullibility. Attackers can enter into a conspiracy with home owners and, under any pretext, persuade them to indicate too low a price in the contract. At the same time, a contract for inseparable improvements is concluded.

After some time, the former owners will go to court, demand that the deal be declared illegal, and will present fair arguments to terminate it. Often the court defends the position of the former owners and satisfies their demands. As a result, the sold apartment is returned to the previous owners, and buyers are entitled to only the actual cost.

A citizen who meets the following criteria has the right to receive approval for a Sberbank mortgage with underfunding:

- Is between 21 and 75 years of age;

- Is a citizen of the Russian Federation;

- Has a permanent official income that allows you to make monthly contributions;

- Carries out labor activity for at least one year without a break, including in the last place - for at least six months;

- Has no debts or arrears on previous credit obligations.

It should be separately noted that transactions with distortion of official facts are subject to more thorough verification by the Sberbank security service. In particular, the circumstances of the sale are clarified, and attention is paid to the “cleanliness” of the property. Employees may request additional documents confirming the reliability of the buyer and seller.

Should I agree?

For the buyer, all other things being equal, a mortgage with underfunding is significantly inferior to a traditional one. The seller's interest is 13% of the amount exceeding the previous purchase price. Possible bonuses that partially compensate for the buyer’s risks:

- the discount covers the difference in the interest rate on the loan, insurance premiums, compensates for risks (interest and insurance can be calculated on a calculator; the acceptability of being subject to criminal liability requires a subjective assessment; the likelihood of getting caught is individual for each case);

- purchasing an exclusive property that is beyond our means on completely transparent terms;

- inclusion of actual repairs in the mortgage amount.

How to reduce risks

When agreeing, take all available measures to reduce the risks associated with the recognition of the contract as invalid. Make sure there is no:

- bankruptcy procedures - website of the Federal Register of Bankruptcy (bankrot.fedresurs.ru/DebtorsSearch.aspx?Name=);

- validity of sellers’ passport (services.fms.gov.ru/info-service.htm)

- real estate encumbrances – extract from the Unified State Register of Real Estate;

- overdue debt to banks - credit history;

- unfulfilled monetary obligations - on the bailiffs website (fssprus.ru/iss/ip/);

- objections to sell the premises if there is a spouse, more than one owner.

The article Sales and purchase agreement with a mortgage - important points for the seller and buyer describes specific ways to reduce risks.

Use non-cash payments. In case of future disagreements, it will be easier for you to confirm the calculations. In addition to traditional transfers, banks offer special services.

Transferring money for a mortgage with Sberbank is possible through the Letter of Credit service. The buyer deposits funds into the account, the buyer receives them by presenting a document confirming the fulfillment of the obligation to register the transfer of rights. For 2,000 rubles, the bank guarantees the fulfillment of obligations by both parties and performs the transfer without additional fees.

Recommended article: Mortgage in Sberbank at the birth of a second child

Answers to readers' questions

Question: Hello! If the transaction when buying an apartment with a mortgage (secondary) is with a lower price and there is an additional agreement (for the amount of cash), on what amount can I receive tax? General or only with the one in the purchase and sale agreement?

Answer: Hello, a tax deduction can be obtained from a purchase and sale agreement. An additional agreement cannot be submitted to the tax office. It’s not just that the amount is divided into two contracts.

You can apply for the deduction amount that you currently do not receive from your purchase when purchasing your next property. How to get a tax deduction when buying a second apartment is described in another article.

Requirements for a potential borrower

In large banks, a mortgage transaction with underfinancing becomes possible if the appraiser confirms the value of the property, which is indicated in the purchase and sale agreement. Each bank cooperates with professional appraisal companies that have been accredited and comply with its requirements and provide reports in the required form.

Many commercial banks, small in terms of assets, willingly agree to understate the value of the property, while setting their own conditions for the borrower. They require a large down payment on the mortgage. Such financial institutions may provide mortgage loans at higher rates.

More on the topic Duties on purchases abroad in 2020: what’s new and how to calculate them

Apart from Sberbank, no one agrees to such a price-lowering scheme.