What determines the loan approval period?

How long it takes banks to approve a mortgage depends on a number of factors:

- Credit history. If it is completely negative, the refusal will be received immediately, and if there are certain problems, the verification will take longer.

- Down payment amount. The more funds the client has, the lower the bank’s financial risks, so the application is approved faster.

- Availability of a complete package of documents required to apply for a mortgage.

- Income level and availability of its confirmation. If you submit a certificate in Form 2-NDFL, the bank will be able to check the borrower’s financial condition faster by requesting data from the Pension Fund. If you confirm income using a bank form, additional time will be required for analysis. The least amount of time is spent making decisions on applications from payroll clients, since the bank has access to all the data on their financial condition.

- The age of the borrower - if he is in the range from 30 to 45 years, the mortgage approval period is shorter; if the client is older or younger, the bank analyzes all his data in more detail.

Thus, you can not only roughly calculate how long it will take the bank to approve a mortgage, but also influence the speed of receiving a response.

Terms of consideration

Despite the fact that for advertising purposes banking organizations mention the possibility of obtaining a mortgage loan within one or two days, as a rule, financial institutions, with rare exceptions, take up to five working days to consider an application, but sometimes up to several weeks. For example,

- on the official website of Sberbank it is indicated that applications are considered from two hours to five days;

- at VTB 24 - one or two days for credit clients and up to one and a half weeks if the branch has a high load and the loan amount exceeds 500 thousand rubles;

- at Rosselkhozbank the procedure requires up to 10 working days;

- Gazprombank makes a decision within three to five working days.

Credit departments work more quickly with applications from bank clients, since they already have some information regarding their income, solvency and reliability. In other cases, the time required to consider a mortgage application depends on:

- type of selected property;

- registration, credit history, confirmation form and amount of income of the applicant;

- use of state support for mortgage purposes (maternity capital);

- availability of guarantors and co-borrowers;

- completeness of all necessary documents.

Concealing correct or indicating false facts and documents may lead to prolongation of approval of the application or its rejection. How many days it will take to review your mortgage application depends on the completeness of the documents. A long review may be caused by problems in the operation of the software, in the interaction of various departments and services, as well as in the instructions and algorithms used in the institution.

When the application and package of documents reaches the bank, they are dealt with by specialists from several departments at once.

- First, applications undergo automatic scoring, based on the results of which scores are assigned (if there are not enough of them, the application will be rejected).

- Then the application goes to the next stage - assessment of the credit history (if evidence of unreliability is found in it, the applicant will be denied).

- Then the security service begins, submitting requests to the pension fund, tax, migration service, employer, co-borrowers and guarantors of the client, checking the relevance and authenticity of the information transmitted to the bank.

- The analytical department evaluates the applicant’s real solvency, and the risk department evaluates job stability, age, health and other aspects that affect loan payments.

In this matter, the human factor cannot be excluded, since all applications for mortgages are reviewed by credit department employees exclusively manually, and an individual approach is applied to each client.

Best programs

| Bank | Bid | Commission | Monthly payment | Application |

| Renaissance | 9.2 | 0 | 35 917 | Submit your application |

| Rosselkhozbank | 10 | 0 | 37 612 | Submit your application |

| UniCredit Bank | 10.25 | 0 | 38 149 | Submit your application |

| Raiffeisenbank | 10.25 | 0 | 38 149 | Submit your application |

| Promsvyazbank | 10.5 | 0 | 38 689 | Submit your application |

| VTB | 10.6 | 0 | 38 907 | Submit your application |

| DOM.RF | 10.75 | 0 | 39 234 | Submit your application |

| Absolut Bank | 11.24 | 0 | 40 310 | Submit your application |

| Sberbank | 11.3 | 0 | 40 443 | Submit your application |

| Sovcombank | 11.9 | 0 | 41 781 | Submit your application |

Stages of mortgage approval

Buying an apartment using borrowed funds involves going through certain stages, each of which takes a certain time.

- Initial application to a financial institution - review of banks, mortgage loan terms, preliminary calculations using an online calculator. The time it takes to complete this stage depends only on the borrower and how long it will take him to choose a suitable bank.

- Collecting documents and submitting an application for approval of a housing loan. This may take up to 7 business days , depending on how quickly the certificates are ready. It is important to consider that most documents are valid for 30 days, so you should take them immediately before applying for a mortgage loan.

- Waiting for a response from the lender. The term depends on the selected bank. For example, it takes no more than 5 working days to approve a mortgage at Sberbank.

- If a positive decision is received on the application, search for a property. An approved application is valid for 3-4 months , depending on the policy of a particular bank.

- Collection of real estate documents for transfer to the lender. The timing depends on the borrower; it may take up to 1 month , including an expert assessment.

- Approval of the property by the bank. 5-14 days to check all documents and make a decision depending on the type of property (if a new building is purchased, the decision is made faster).

- Registration of an insurance contract will require another 1 working day .

- Concluding a mortgage agreement at a bank branch. All documents are signed during the day.

- Registration of the transaction. The seller and buyer submit documents to register the transfer of ownership of the property. This operation takes up to 30 days, but in the case of a housing loan, the time frame is reduced to 5 working days.

- Making a down payment. Non-cash transfer or cash transfer is possible. In the latter case, it is necessary to obtain a receipt and draw up a deposit agreement.

- Transfer of the remaining amount by the bank to the seller’s account. The bank carries out the transaction within 1-3 business days after completing all other stages.

Thus, issuing a mortgage loan and obtaining ownership of the property can take up to 5 months , depending on how quickly a suitable apartment or house is found.

How long does it take to obtain a mortgage?

Home — Articles — How long does it take to get a mortgage?

Articles 50283 +132

Applying for a mortgage in 2 days – this is what the advertising slogans of most banks that provide these types of loans say. In practice, this process turns out to be much longer than banks promise in their advertisements. How many days does it actually take to obtain a mortgage from the moment you first contact the bank until you receive a certificate of ownership of the property purchased using a bank loan?

To answer this question, you need to look at the approximate terms that the average borrower requires for each stage of lending. We will assume that you have already familiarized yourself with all the information you are interested in during the mortgage consultation and have clearly decided on the bank with which you will cooperate in the future. In this case, all your actions can be taken in the form of the following sequential steps:

Step 1: Submitting a loan application and having it reviewed by the bank. If we do not take into account the time it will take to prepare for the bank a minimum set of documents about your income and work activity, then this stage will take you at least 2 days , since it is during this period that most lenders make a decision regarding the possibility of providing you loan.

Step 2: Finding an apartment. At this stage, the determining factors will be your personal preferences, the real estate standards set by the bank, the seller’s readiness for the transaction and the quality of the title documents. Today, searching for a typical apartment takes, at best, from 2 weeks to one month . This period can be reduced somewhat by contacting real estate agencies, since often their databases contain much more objects than can be found in the public domain on your own. At the same time, the decision whether to use the services of agents or get a mortgage without a realtor remains with the borrower. Whatever search method you choose, the main thing is to meet the validity period of the bank’s positive decision. It is this stage that mainly determines how long it takes to obtain a mortgage.

Step 3: Approval of the property with the lender. The only thing that is required of you here is to send the title documents for analysis. As a rule, lawyers of the creditor bank have time to check them and make sure that the transaction is clear in 1-3 days . In some cases, they may ask for additional documents, for example, if the apartment was often sold in a similar manner, this will require a few additional days .

Step 4: Appraisal and Insurance. In accordance with established banking practice and the requirements of the Federal Mortgage Law, the responsibility for real estate insurance falls on your shoulders. Before proceeding directly to this procedure, it is necessary to obtain a report from an independent appraiser, the preparation of which on average takes 2-3 days . During approximately , insurance company specialists will be preparing the relevant contract.

Step 5: Preparing to enter a trade. Here, how long it takes to obtain a mortgage will depend solely on banking specialists, who must once again check the availability of all the necessary papers and internal approvals for the transaction. As practice shows, such procedures take no more than 3 days . You need to understand that the immediate day of settlement with the seller is determined by the workload of the branch in which the transaction will be made.

Step 6: Obtaining a certificate of ownership. If you do not delay the mortgage registration process, then approximately a week after the completion of the transaction, ownership will transfer from the seller to you.

Using simple calculations, we can easily determine the actual time required to obtain a mortgage, which in our example turned out to be at least 30 days. It should be noted that our option is “ideal”: we did not take into account the costs of preparing papers by the seller (for example, extracts from the house register or documents from the BTI), as well as situations when the bank for some reason did not receive confirmation from insurance company, lost some of your certificates, etc. This is why we recommend setting the deadline for applying for a mortgage at least 2 months.

Did you like the content?

+132

Return to list

How to find out if a decision has been made

The bank independently notifies the client of the decision made on the application. Most often this happens through:

- telephone number specified in the application form - the employee contacts the borrower if the application is approved and provides additional information about which office and at what time to go to bring documents to begin processing the transaction;

- SMS – the bank informs about the decision made in the form of a text message to the number specified in the application form (more often this method is used in case of refusal, but some banks send SMS even if the application is approved with a warning about a subsequent call from a specialist);

- Internet – information about the status of the application can be found through your personal mobile banking account.

If you do not receive a response for a long time, you should take the initiative and contact the bank to obtain information on your application.

How a mortgage loan application is analyzed

In order to avoid making mistakes before applying for a loan, you should know what information bank employees require. Incorrect or incomplete information about a potential borrower may lead to refusal to approve the application, delaying the time frame for reviewing the submitted papers.

The decision-making credit manager will need:

- Passport data of a citizen of the Russian Federation;

- Place of residence;

- Certificate of income indicating the ability to repay payments on time and in full;

- Confirmation from the place of work of permanent employment;

- If there is collateral, a package of documents related to it.

The submitted papers must be correctly drawn up and contain truthful information.

After checking the client’s information, the manager contacts the database for a credit history. If there are gaps or insufficient information, a request may be made to provide additional certificates clarifying incomplete data on the borrower’s financial affairs. Due to the need to confirm the absence of debts, the application takes longer to study.

Difficult situations

At any stage of obtaining a housing loan, difficult situations may arise due to the human factor:

- Scoring. All information provided by the borrower about his solvency, including credit history, is checked. Various failures may occur due to which the client will receive an unlawful refusal of the application.

- Work of the security service and underwriting department. During the analysis of the client's reliability level, errors may be made that affect the result.

Also, the situation with obtaining a housing loan may become more complicated if the assessment result does not coincide with the approved amount - in this case, the loan amount will be reduced.

If the reporting documents have not yet been sent to the bank, it is worth re-ordering the assessment; if they are already with the lender, all that remains is to wait for the final amount of the amount to be issued.

How much does the mortgage approval period depend on the submission of documents?

To minimize the waiting time for a response from the bank, you should prepare in advance a list of documents on the basis of which you can submit an application. The mandatory list includes:

- an application filled out according to the bank's form;

- valid passport;

- Marriage certificate;

- children's birth certificate;

- income certificate from your place of work;

- a copy of the work book certified by the employer;

- a copy of the employment contract (if any).

If third parties (guarantor, co-borrower) are involved in the transaction, they need to prepare so many documents that it will take additional time to check them.

How can I speed up the processing of my application?

The speed of review depends on several factors:

- The fact of customer service at the bank. If the client has never been served by a bank, then the attitude towards him will be more attentive. If a client receives a salary from a given bank, has deposits, loans, cards, then the bank already has an overall picture. For salaried clients, I can approve a mortgage using two documents in the shortest possible time, since the information about the salary and the employer is already known.

- Documents provided. If the borrower provides a work book and 2NDFL, then there will be fewer questions for him, since the information in them is of an official nature. When employment contracts or agreements are presented, and a certificate in free form or in a bank form is presented as proof of income, then it will take more time to study, because such documents are easy to forge.

- Guarantors and borrowers. Involving additional persons in a mortgage transaction increases the likelihood of a positive decision on the mortgage, on the one hand, but on the other hand, the bank will need more time to study each of them.

Thus, there are enough factors to change the speed of consideration of applications. In addition to the above, the timing of consideration will be influenced by the bank’s systems for analyzing a potential borrower, the quality of the software, the experience of employees working with the peculiarities of mortgages, etc.

Based on all of the above, a standard mortgage application will be processed within 5-7 days. If the client has a salary card, then the period will be reduced, and if the client has not been serviced by the bank before, and guarantors and co-borrowers are involved in the transaction, then the terms can extend up to a month.

Coordination of the collateral object

This is a mandatory stage in obtaining a housing loan, since the bank must ensure the liquidity of the purchased property.

How long does it take to approve a mortgage in a new building?

If an apartment is purchased in a new building from a developer accredited by a bank, the approval period is minimal - partnerships allow you to check compliance with the conditions very quickly.

Nuance. If the house has already been registered and delivered, it will take no more than 2 days for the bank to check it.

Documents provided to the bank:

- technical plan of the facility;

- building permit from the local municipality;

- act on redistribution of housing stock;

- certificate of ownership or long-term lease agreement for the land plot on which construction work is being carried out.

Even if we are talking about a house under construction, the transition to the final stage of obtaining a mortgage will be minimal.

Features of mortgage approval for secondary housing

If housing is purchased on the secondary market using a mortgage, the time frame for receiving a response to the application from the bank depends on how long it takes to inspect the property.

You need to find an apartment that meets the following requirements:

- suitable for living (not on the list of emergency housing);

- compliance with technical specifications;

- absence of illegal redevelopment, encumbrance on real estate, arrest, consent to sale from the second spouse.

If a non-compliance is identified, you will have to find suitable housing again, provided that the time allotted for searching for real estate has not yet expired.

Stages of obtaining a mortgage

Buying an apartment or other housing with a mortgage is a responsible step, and there is no need to rush into this matter. The mortgage process takes place in several stages:

- Selecting a bank and submitting an application. Typically, the bank reviews application documents within 2-5 days, but sometimes additional checks are required, and you have to wait longer - up to 10 days.

- Selection of real estate. How long it will take to choose the right apartment or other property to buy will depend on you. If you have selected a suitable option in advance, then you will not have to waste time. Otherwise, the search may take up to 1 month or more. It must be remembered that the validity period of a positive decision is limited. For example, in Sberbank it is valid for 90 days.

- Conducting an assessment. The appraisal must be carried out by a company that has a license for appraisal activities. It is recommended to contact appraisers who have been accredited by the selected bank. Preparation of the report takes from 3 to 7 days.

- Real estate approval. After appraising an apartment or other real estate, you need to agree on it as collateral with the bank. To do this, you need to hand over the assessment report and all the seller’s real estate documents to his employees (extract from the Unified State Register of Real Estate, technical and cadastral passport, etc.). The bank will check the legal purity and other parameters of the purchased housing within 3-10 days and report its decision.

- Purchasing insurance policies. Usually it takes no more than one day to obtain insurance. But some insurance companies, when purchasing a life and health insurance policy, ask to provide a health certificate. Its processing may take 1-3 days.

- Preparation for concluding a loan agreement and transaction. At this stage, employees prepare loan documentation. You also need to agree on the time of the transaction with the real estate seller and make the first payment, having first opened a personal bank account. It takes 3-4 days to prepare all documents.

- Concluding a deal and signing loan documentation. In most cases, the conclusion of a loan agreement and a transaction with the seller occurs simultaneously within a few hours.

- Registration of the transaction in Rosreestr. Together with a bank representative, you must contact the registration chamber or MFC to register the transfer of ownership of real estate and its pledge. The procedure takes 5-10 days. At Sberbank and some other banks you can use the electronic transaction registration service. In this case, the manager will send all documents to Rosreestr in electronic form, and after registration is completed, you will receive an extract from the Unified State Register and a purchase and sale agreement (or equity participation in construction) by email.

Transcapitalbank

from 7.99% rate per year

Go

- Amount: from 300 thousand to 50 million rubles.

- Rate: from 7.99%.

- Duration: from one year to 25 years.

- Age: from 21 to 75 years.

- You can get a mortgage using one passport.

- You can confirm your income with a bank certificate.

More details

Sovcombank

from 5.9% rate per year

Go

- Amount: from 300 thousand to 30 million rubles.

- Rate: 5.9%.

- Duration: from one year to 30 years.

- Age: from 20 to 85 years.

- You can confirm your income with a bank certificate.

More details

Alfa-Bank

from 6.5% rate per year

Go

- Amount: from 670 thousand to 20.6 million rubles.

- Rate: 6.5 - 9.29%.

- Duration: from one year to 30 years.

- Age: 21 - 70 years.

- Down payment: from 20%.

More details

Rosbank

from 7.39% rate per year

Go

- Amount: from 300 thousand rubles.

- Rate: 7.39 - 11.14%.

- Duration: from 3 to 25 years.

- Age: from 20 to 64 years.

- Down payment: from 20%.

- You can attract 3 co-borrowers.

More details

Opening

from 8.7% rate per year

Go

- Amount: from 500 thousand to 30 million rubles.

- Rate: 8.7 - 14.45%.

- Duration: from 5 to 30 years.

- Age: 18 - 65 years.

- Down payment: from 10%.

- They accept income certificates in the bank form.

More details

Gazprombank

from 7.5% rate per year

Go

- Amount: from 500 thousand to 60 million rubles.

- Rate: 7.5%.

- Duration: from one year to 30 years.

- Age: 20 - 65 years.

- Down payment: from 10%.

- Review of the application from 1 working day.

More details

Reasons why the bank delays processing

When answering the question of how to find out how long it will take for a bank to approve a mortgage, you need to take into account that a lot depends on the borrower himself.

Most often, the reason for a long review of an application is an incomplete package of documentation and the client’s sluggishness.

Also, the increase in decision-making time is affected by:

- attracting several guarantors - the bank determines the reliability rating of each of them;

- a lengthy search for a property or its non-compliance with the bank’s requirements;

- the need to collect additional documentation;

- expiration of some documents submitted during the initial application;

- impossibility of quick communication with the borrower.

In all these cases, the time for approval of a mortgage loan increases exactly by the period necessary to eliminate the problem that has arisen.

How to speed up the bank's response

To minimize the time it takes to obtain a mortgage, you should adhere to certain rules:

- submit an application online - it is processed faster than one drawn up in the office;

- find in advance the property that will be purchased with a mortgage (you can select several options in case the first one does not meet any of the bank’s requirements);

- use the electronic method of registering a transaction;

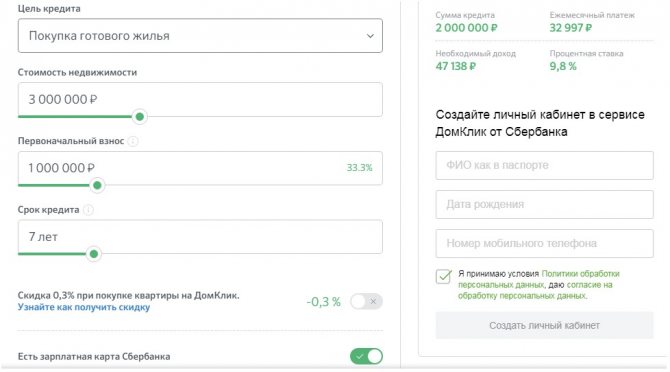

- make preliminary calculations using an online calculator to know approximately how much you can expect.

Before applying, you should also carefully study the policies of the bank where you plan to apply for a mortgage - for example, possible discounts and bonuses.