Who is a co-borrower

Taking out a loan secured by real estate involves long-term repayment of the debt. It can be difficult for one borrower to make payments, especially if at the same time he has to deal with the renovation of the purchased home. Often the borrower does not yet have the optimal income to pay off a mortgage, but at the same time it is he who needs housing.

It helps to take out a loan secured by housing by several persons at once. One of them performs the duties of a title co-borrower, who, with the consent of the other parties to the agreement, resolves key issues regarding loan servicing. However, all co-borrowers are responsible for its repayment.

Who can become

When considering the question of how to become a co-borrower on a mortgage at Sberbank, the following key points must be highlighted:

- for a mortgage loan, the third party to the transaction can be any citizen familiar to the main client;

- preference is given to persons with whom there is a family connection (parents, children, spouses);

- when buying an apartment, a husband or wife can be a co-borrower (this is a mandatory condition of Russian banks);

- the spouse does not have to become a party to the transaction if he is not interested in this and a prenuptial agreement for separate property has been previously drawn up;

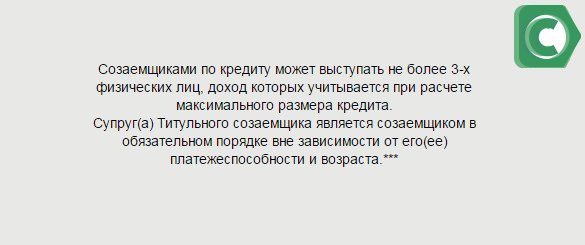

- The client has the right to involve from 1 to 3 persons in the loan transaction, depending on the conditions and requirements of the lender.

If you are married to a citizen of another country (no Russian passport), it will not be possible to involve him in the transaction so that he can become a co-borrower. In such a situation, Russian citizenship is required.

Who can become it

Sberbank provides housing loans to individuals, issuing them to borrowers and co-borrowers. Banks have quite serious requirements for the parties to the agreement: the banking organization will never explicitly risk money.

Theoretically, any person who meets the bank’s requirements and agrees to be responsible for the money borrowed can become a co-borrower: a relative, friend, colleague. But Sberbank still gives preference to family ties, because this minimizes the risk of conflict situations and financial difficulties based on non-payment of a loan at interest.

Rules for attracting second parties

Involving up to 3 persons on a loan will not provide such opportunities in terms of loan size, repayment period and interest rate. That is why bank employees recommend enlisting the support of third parties for applicants whose solvency is low. According to the rules of the institution, the client has the right to attract up to 3 people for this purpose. How many days does Sberbank consider an application for a mortgage 2018? Read more here.

Buying a home on credit should be treated responsibly

By default, this is the spouse. It can also be any person. It should be taken into account that he has the right to own part of the property, so the choice should be approached responsibly. He must submit a package of documents almost identical to the borrower’s package. Therefore, the questionnaire of the person who will be jointly and severally responsible for repaying the loan is similar to the client’s.

Rules for completing the questionnaire

The following items must be completed in the document:

- Last name, full first name and patronymic, incl. previous ones if the data was changed at some point.

- Passport details.

- Address, contacts (all phone numbers).

- Education.

- Marital status, personal data of relatives. Information about spouses and children is required.

- Employment: name of enterprise, field of activity, position, length of service.

- Amount of income and expenses, incl. unconfirmed.

- Availability of property: apartment, house (address, area, year of purchase), vehicle (make, registration number) with an indication of their value.

- Mark on receipt of wages at the bank: card number.

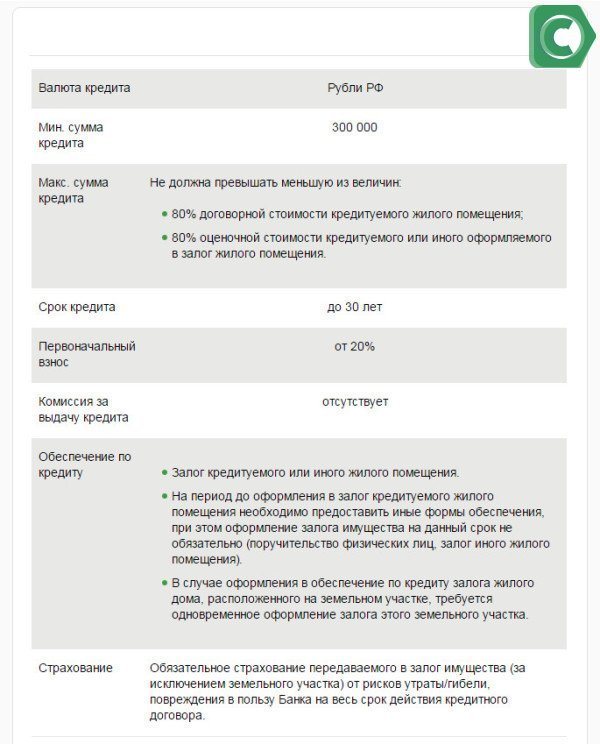

Conditions of mortgage lending in Sberbank An application for a housing loan in Sberbank (a sample of completion by a co-borrower can be viewed further on the website) requires signatures in certain blocks. It is imperative to put o.

Download the co-borrower application form for a mortgage

Download file:

Co-borrower application form at Sberbank

Bank requirements for co-borrower

Sberbank will approve a candidate who meets the following criteria:

- Citizenship of the Russian Federation;

- Age limits – 21-75 years (the upper age limit is calculated by the time the loan is fully paid off);

- Six months (or more) experience in one workplace and at least 3 months for Sberbank salary clients;

- The ability to pay contributions in full, spending no more than 40% of the official salary;

- Credit rating indicating integrity and solvency;

- No criminal record;

- Legal capacity.

The maximum number of co-borrowers allowed by Sberbank is 3 people.

Who is a mortgage co-borrower: his rights and obligations

When drawing up a loan agreement, the banking organization acts on one side, the borrower is the second party, in addition, a co-borrower and a guarantor can be involved.

The borrower has the legal right to own the property, and according to the loan agreement, he must make monthly payments in accordance with the repayment schedule.

The guarantor acts as a guarantor. If the main borrower experiences financial difficulties (wages decreased, change of place of employment, layoffs, loss of ability to work, etc.), the guarantor assumes the obligation to repay the debt.

If necessary, the provisions of the agreement involve the co-borrower, also if the income level of the main borrower is insufficient, to obtain the bank's approval for issuing a mortgage loan. The income of both borrowers is taken into account as a combined income, so approval can be obtained from the financial institution.

When analyzing the requirements for a co-borrower on a mortgage at Sberbank, you should provide age, salary level sufficient to support the borrower, and work experience. If the primary client encounters unforeseen financial difficulties, the co-borrower assumes all obligations to repay the mortgage loan.

The co-borrower has equal ownership of the borrowed new building or apartment on the secondary market with the main borrower, unless otherwise specified in the marriage contract or other documents certified by a notary.

Who has the right to speak to them?

Any person can be a co-borrower, depending on the provisions of the mortgage loan agreement, family status and documents agreed upon by the notary. It could be:

- spouse;

- parents;

- friends, relatives and other people in a position of trust, and in the event of unforeseen circumstances, can fulfill obligations to repay the debt on a housing loan.

This person must meet the bank’s established requirements:

- age range 21 - 65 years;

- total work experience over the previous 5 years of 1 year and 6 months at the current place of employment;

- an appropriate level of income that ensures solvency.

Basically, one of the spouses is involved as a co-borrower, since he has equal rights with the borrower, including the ownership of residential property. A marriage contract officially certified by a notary may contain a clause stating that the spouse does not have the right to own certain real estate or other real estate and movable property acquired on credit.

All detailed information is posted on the official website of Sberbank in the Mortgage tab, where you can select a suitable offer, in addition, perform a preliminary calculation of the mortgage with a co-borrower in a special Sberbank calculator.

Rights and obligations

Before appointing a co-borrower, the borrower needs to know what he is applying for. This is especially true when it is not a relative, but a friend or colleague: a formal stranger can ultimately lay claim to a lot.

Rights:

- Rights to an apartment that is being purchased (in shared participation), since the co-borrower, like the borrower, contributes personal money to the purchase.

- A tax deduction from money contributed to pay off a mortgage, including interest.

- The right to cease being a co-borrower if a new suitable candidate is found and approved by Sberbank.

The outlined range of rights concerns the most general cases: in specific situations they depend on the status of the property being purchased, the presence/absence of a marriage contract or other documents establishing the boundaries of the rights and capabilities of the parties to the contract.

Rights of a co-borrower under a mortgage at Sberbank

The rights of a co-borrower under a mortgage with Sberbank are necessarily prescribed in a separate chapter of the loan agreement. They depend on who the borrower and co-borrower are related to each other, on the presence or absence of a marriage contract among the spouses taking the mortgage, on the status of the property and other conditions.

The co-borrower can claim a share in the purchased apartment if this item is specified in the contract by the title borrower. If there is no such provision in the agreement, and the co-borrower made full or partial payments on the mortgage, you can prove your rights to part of the living space through the court. If a co-borrower voluntarily renounces his share in the mortgaged housing, the obligation to pay the debt in the event of the insolvency of the main participant in the transaction is not removed from him.

What is the difference between a co-borrower and a guarantor?

People who are not versed in law and finance often confuse the two terms - co-borrower and guarantor, believing that they are essentially the same thing. However, these are two different statuses of an individual. In general terms, they differ according to the following criteria.

| No. | Criterion | Co-borrower | Guarantor |

| 1 | Income level | Important | Not important |

| 2 | Right to purchased property | Available | Not available |

| 3 | Loan repayment | Mandatory | Possible only through court |

Comparing them shows that the responsibility of a co-borrower is, by definition, higher than that of a guarantor. In case of violation of the loan agreement, if it includes a co-borrower and a guarantor, claims will first be brought against the first, and then through the court - against the second.

What is the difference between a co-borrower and a guarantor?

Co-borrower and guarantor are forms of loan security. In both cases, individuals or legal entities act as guarantors and undertake to repay the loan instead of the main client. They have similar rights and obligations, but there are also differences:

- The guarantor becomes the owner of the property only by decision of the main borrower.

- The moment when the bank has the right to demand payment from the guarantor is determined by the form of its liability.

- The guarantor cannot influence the course of the transaction - arrange a mortgage holiday, ask the bank for restructuring or refinancing.

Required documents

Sberbank requires documents from a person applying for co-borrower status:

- Russian Federation passport (registration required);

- Second identification document (optional, based on availability);

- A copy of the work book, certified by an employee of the HR department from the place of work;

- A certificate of income in the form provided by Sberbank (the form and sample form are available on the bank’s website);

- Completed application form.

See this same topic: How to recalculate a mortgage for early and partial repayment?

What documents need to be prepared?

To draw up a loan agreement, you will need the following documents:

- Completed application form;

- Passport with a mark of permanent registration;

- Additional identification document (military ID, international passport, etc.);

- A copy of the work book (all sheets);

- Certificate 2-NDFL.

If a co-borrower intends to become a participant in the Young Family program, he must present a marriage certificate. You must also provide paper confirming the birth of your children. The mortgage agreement must specify the relationships of all parties to the transaction. The debt repayment mechanism should also be described there. The person involved has the right to a share in the collateral real estate, the amount of which depends on the amount of contributions made.

The person attracted by the borrower is required to sign an insurance contract. The amount of the insurance premium is determined based on the distribution of the debt load. If an insured event occurs, the insurer will pay financial compensation to the injured party. The remaining policyholders will continue to pay premiums in the same amount. Mortgage documents must be collected before the title borrower applies for the loan.

Registration of a mortgage

On average, registration takes six months. This is due to the fact that its individual stages objectively require a lot of time: the choice of a mortgage and housing program must be approached with all responsibility.

The execution of a contract goes through the following stages:

- Choosing a home loan program;

- Collection of documents;

- Selection of real estate and preparation of a package of documents for it;

- The transaction (will take place after reviewing all documents and receiving a loan from Sberbank);

- Registration of the right to own housing.

The last point is worth clarifying: housing purchased with a mortgage, while the credit relationship is in force, is collateral. After the contract expires, the encumbrance on the property is removed, and the owner can dispose of it unconditionally.

Sberbank performs the procedure for removing encumbrances from collateralized housing automatically.

Registration of a mortgage with the participation of a co-borrower

The procedure for applying for a mortgage with co-borrowers is standard. First, you need to submit all the necessary documents to Sberbank, then select a property. If the application is approved, the same group of persons signs the mortgage agreement.

What is included in the package of documents

To draw up a mortgage agreement, Sberbank specialists request a basic package of documents. It includes:

- application form for obtaining borrowed funds;

- civil passport with a mark of permanent registration;

- a second document confirming the identity of an individual;

- documents on employment, certificates of monthly income.

As a second document, the bank accepts a driving license, a federal service employee ID or a military ID, a passport for traveling abroad, a military ID or a SNILS card. To confirm official employment you must submit:

- A copy/extract from the work book.

- A certificate from the employer about the length of service, position held and salary, if the type of employment involves the absence of labor.

- Part-time employment is confirmed by a copy of the agreement or contract.

- Self-employed citizens provide a certificate of state registration of individual entrepreneurs/lawyer certificate/order of appointment to the position of a notary.

How to fill out the form

The Sberbank questionnaire is almost the same for all co-borrowers, including the title borrower. You can fill out the form on the Sberbank website or directly at one of its branches.

The application form consists of several pages and includes complete information about the applicant:

- Personal Information;

- Passport details;

- Information about place of work and income;

- Contact details.

If a borrower or co-borrower wants to fill out a form at a Sberbank branch, then this will need to be done in such a way that the information can be read as clearly as possible. Typically, bank employees strongly recommend filling it out in block letters. The advantage of filling out the form at a bank branch is that any question that arises while filling it out can easily be clarified by a bank employee. When filling out the form online, you can contact the customer support service for the necessary clarifications by calling the hotline 8 800 555 55 50.

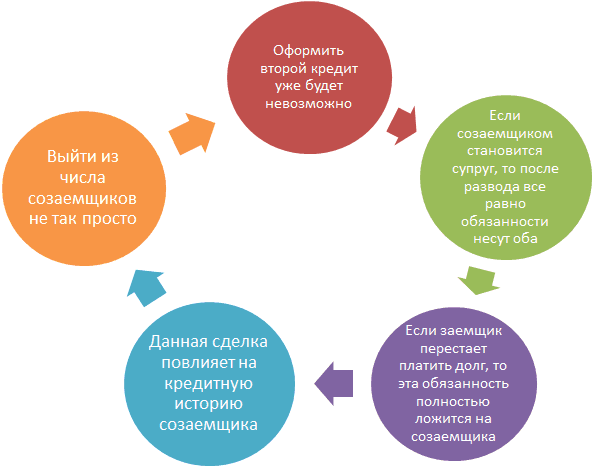

Things to consider before becoming a co-borrower

Taking out a home loan is a serious step that requires large material costs and is associated with enormous responsibility and, in case of failure to comply with the terms of the agreement, with very unpleasant consequences.

Before agreeing to become a co-borrower, you need to take into account possible problems and it is better to do this before the moment when all the signatures are affixed to the agreement.

The most common of them:

- If a co-borrower needs a loan for personal needs, the bank may refuse, since a mortgage has already been taken out.

- If a person gets married, and the spouse previously took out a mortgage, he will automatically have to become a co-borrower, but he will not have the right to a share in the acquired property. If such spouses divorce, he will have to pay his share of the loan, without having rights to this housing.

- By law, a husband and wife register an apartment purchased with a mortgage during marriage as jointly owned. In a situation of divorce, the apartment will have to be divided.

- You should be very careful when a colleague or friend asks for help with a mortgage: one day he may stop paying contributions, and then the co-borrower will have to do it in full. Often, “friendship” suddenly ends precisely at these moments.

If a person agrees to be a co-borrower of a colleague or friend as a friendly favor, when applying for a mortgage, care should be taken to draw up an additional agreement, according to which the co-borrower is guaranteed to receive from the borrower a return of the money paid towards the mortgage or a share in the purchased housing.

In practice, there are frequent cases when “friends” or “girlfriends,” abusing the trust of others, persuade the latter to participate in a mortgage. Co-borrowers are soon surprised to discover that they must bear the entire burden of payments: “friends” are disappearing from the horizon. It is difficult to prove anything in such cases: an individual’s consent to become a co-borrower is voluntary, and he is required by law to pay debts.

See the same topic: All about the income tax refund from the mortgage in [y] year

What documents must the co-borrower present?

To formalize a loan agreement, a co-borrower on a mortgage with Sberbank must present:

- Completed application form;

- Passport with a mark of permanent registration;

- Additional identification document (military ID, international passport, etc.);

- A copy of the work book (all sheets);

- Certificate 2-NDFL.

If a co-borrower intends to become a participant in the Young Family program, he must present a marriage certificate. You must also provide paper confirming the birth of your children. The mortgage agreement must specify the relationship between the borrower and co-borrowers. The debt repayment mechanism should also be described there. The co-borrower has the right to a share in the collateral real estate, the amount of which depends on the amount of contributions made.

The co-borrower is required to sign an insurance contract. The amount of the insurance premium is determined based on the distribution of the debt load between the borrower and co-borrowers. If an insured event occurs, the insurer will pay financial compensation to the injured party. The remaining policyholders will continue to pay premiums in the same amount. Documents for a co-borrower on a Sberbank mortgage must be collected before the title borrower applies for a loan.

Risk insurance

A mortgage involves taking out a long-term loan, the term of which can be up to 30 years. Even in a shorter period of time, the circumstances that accompanied the approval of the mortgage may change for the worse: the borrower or co-borrower may lose their job or change it, but with a lower salary. Any of them can become seriously ill and even die. At the same time, it is beneficial for all parties to the contract that the mortgage debt is completely eliminated.

Current legislation does not provide for compulsory life insurance, but Sberbank strongly recommends that at least a loan applicant do this. The co-borrower can also take out insurance: it guarantees that the bank will receive the money due under the agreement without creating a debt for the loan participants.

Sberbank invites clients to use the services of its insurance subsidiaries and Sberbank Life Insurance LLC, which offer various insurance products for individuals. Mortgage insurance is a long-term service that protects the owner of the mortgaged home from damage or loss. Most insurance policies can be purchased and obtained online.

Insurance is perceived by many clients as an imposition of services: Sberbank often refuses to issue a loan if it is not accompanied by insurance. But in the case of a mortgage, everything is simpler: the client can refuse life and health insurance, but the mortgage rate at Sberbank will increase by 1%.

Sberbank requirements

The number of co-borrowers on a mortgage should not exceed three people. They can be both relatives of the borrower and third parties who meet the selection criteria. The requirements for a co-borrower on a mortgage at Sberbank are no different from the requirements for the borrower himself: citizenship and registration of the Russian Federation; age based on the program, but not younger than 21 and not older than 75 years; permanent job and stable income; general experience (at least one year over the last 5 years) and at the last place of work (from 3 to 6 months).

Co-borrowers also fill out a form and provide a package of documents: passport, copy of employment and income certificate (if they are not salary earners of Sberbank). After checking the candidacy by the bank, the procedure ends with the signing of the loan agreement by all its participants.

A co-borrower's candidacy may be rejected if:

- it does not meet the basic criteria;

- his income is not enough to pay the loan;

- he has existing obligations that do not allow him to take on new ones;

- he has a bad reputation.

Thus, it is clear that finding the right co-borrowers is not so easy. But is it worth being a co-borrower at all?

Co-borrower rights and marriage contract

By default, a married borrower taking out a mortgage makes his or her spouse a co-borrower, with all the rights and responsibilities that come with them.

If spouses for some reason do not want to own real estate jointly and be responsible for each other in case of non-payment of the loan, a solution may be to draw up a marriage contract that regulates the property relations between the persons who entered into it. It can specify who is responsible for paying the down payment and periodic payments and who will be the owner of the purchased property.

Sberbank has a positive attitude towards concluding such an agreement, as this allows one to avoid many conflict situations during the life of the mortgage.

Responsibilities and rights

The loan obligations and the rights of the second party to the transaction are specified in the agreement with the bank.

The co-borrower has the right:

- own a share of real estate;

- renounce his share (in this case, his financial obligations to the lender are removed);

- take advantage of tax deductions;

- terminate the contract and withdraw from the transaction.

ATTENTION! A separate issue concerns the right of a co-borrower to the purchased housing. It is established by the parties to the transaction individually. If both parties to the agreement pay the loan in equal shares, then they can register the property together.

The Sberbank agreement provides for the opportunity to independently determine the amount that the co-borrower must contribute to pay off the loan.

Now let's move on to the responsibilities of the second borrower :

- he has the same responsibility for repaying the mortgage as the title borrower;

- If the main borrower for some reason stops making payments, then all responsibility for repaying the debt completely passes to the co-borrower.

Thus, the rights and obligations of the co-borrower are exactly the same as those of the main client who received the loan.

Removal of a co-borrower from the list of debtors during a divorce

Since, by default, collateral housing purchased with a mortgage loan is the common property of the spouses, during a divorce it is necessary to resolve the issue of ownership and payment of the housing loan. The removal of co-borrowers here occurs on the basis of a court decision, which determines who will own the collateral property.

If the court decides to leave housing and debt to one of the divorcing spouses, the other ceases to be a co-borrower. For a final conclusion, he must submit a court decision to Sberbank.

Requirements for a co-borrower

The responsibility of such a participant in the loan processing process is commensurate with the responsibility of the client. He is obliged to fulfill the terms of the loan even if he loses his share in the real estate. His rights and obligations are determined before the loan is issued and are specified in the agreement. These include:

- The second person repays a specific amount of the monthly payment (if specified in the agreement).

- If the client is unable to pay the debt, the second person is obliged to pay it himself.

- If the second person is not the client's spouse, he still has the right to a share in the real estate.

- The second person has the right to use a tax deduction.

If at some point the help of a third party is no longer needed, it is worth clarifying how to withdraw him from the home loan agreement. At the same time, it is very difficult to remove spouses, even after a divorce. The procedure occurs when applications are submitted from the borrower and a second party about the need to release him from debt obligations. In some cases, it is possible to recalculate the balance of the debt if the client’s solvency is low.

Who can act on an equal footing with the borrower?

The requirements for such persons do not have a clear framework. There is an age limit commensurate with the limits for the borrower.

Package of documents for co-borrower

- passport;

- registration document;

- paper confirming marriage status (if available);

- copies of identity cards of his relatives living in the same housing;

- diploma of education;

- employment history;

- NFLS-2 certificate.

Additional ones may be required: driver’s license, pension, military ID.

filling out the form

Download file:

Sample of filling out a co-borrower’s questionnaire at Sberbank

For more information about mortgage lending, watch the video review.

How to change or refuse a co-borrower on a mortgage

It happens that due to circumstances, the co-borrower is no longer able to fulfill the requirements of the loan. Refusal from a co-borrower is possible, but it is advisable that another candidate be selected in his place, not inferior to the previous one.

A change of co-borrower is possible if this issue is fully resolved by all parties to the agreement. But in practice, banks are reluctant to do this, and they are required to provide compelling evidence that the co-borrower cannot fulfill the obligations. In difficult cases, refusal can be achieved through the court.

If a co-borrower dies, withdrawal is based on the death certificate. However, Sberbank has the right to demand its replacement or proof of the borrower’s solvency.

The co-borrower is one of the key figures when approving a mortgage. Its presence does not guarantee unconditional approval of a mortgage loan from Sberbank, but the bank will certainly be more willing to accommodate several solvent co-borrowers than one borrower. Often it is the co-borrower who saves the situation in which the borrower is unable to pay the mortgage alone. Since he shares responsibility with the borrower, the decision to become one is not made spontaneously, but after weighing all the pros and cons.

Sberbank implements various mortgage programs that allow co-borrowers to choose the best option with maximum risk reduction.

Responsibilities of a co-borrower under a mortgage

Co-borrowers on a mortgage loan are required to repay the loan amount and interest that was not paid by the borrower on time.

Package of documents

The package of documents that Sberbank requests from the Co-borrower to obtain a mortgage loan mostly coincides with the documentation required for the borrower.

The list is presented below:

- passport, indicating registration (in the same region as the bank branch) and citizenship data;

- Taxpayer identification number;

- Standard document 2-NDFL, to confirm the client’s solvency;

- employment history;

- information about family members: marriage certificates, birth certificates of children;

- diploma of education.

The procedure for drawing up a questionnaire for the bank

The initial step for applying for a mortgage loan at Sberbank is to calculate key parameters on a calculator (obligation rate, interest and purchase period), and then the borrower sends a questionnaire either in paper form to a bank branch or through Sberbank’s personal account via an electronic service. In both cases, the client fills out a questionnaire consisting of 5 pages (the same for the applicant, co-borrower and guarantor) and two blocks (one of them is filled out by a bank employee).

The following is a list of the main questions of the questionnaire:

- role in the proposed transaction. You need to select from “borrower”, “co-borrower”, “guarantor”, “mortgagor”

- Personal Information. Indicate last name, first name, patronymic, date of birth, place of birth, tax identification number

- Passport details (series, number, who issued it and when, department code)

- Contact information (phone and e-mail)

- Level of education without specifying the institution

- Registration address

- Address of the actual residence

- Family status

- Indication of all immediate relatives with consanguineous ties

- Information about the place of work, type of organizational and legal form, tax identification number of the organization

- Position and category for the specified position

- Type of activity of the organization, number of people working in the organization, length of service in the current organization, number of places of work over three years

- Information on monthly income divided into confirmed, additional, periodic. Family income is also taken into account (a civil marriage is a family in this case).

- Information about real estate (type, year of acquisition, area, market value) and vehicle (registration number, make, market value, age and year of acquisition)

- Information about accounts, cards, deposits in the Sberbank system

- Date and time of filling out the form

- Information about the requested loan (type, purpose of lending, indication of promotion, special conditions, type of loan object)

- How to issue a loan

All items requiring explanation are provided below with a reference description, so there should not be any difficulties in filling them out. Also on the Sberbank website there is a “chat” service, in which you can talk online about unclear items to fill out.