Why do you need mortgage insurance?

When receiving a mortgage loan from a bank, the borrower is obliged to pledge the property he is purchasing as collateral to the bank. Therefore, an apartment or house must be insured. This is done in order to reduce the risk of damage or complete destruction of property. If something happens to the home, the damage caused will be compensated by the insurance company. And in some cases, you can count on the insurer to pay off the borrower’s debt to the bank.

Several other risks are insured when concluding a health and life insurance contract. Here we are talking about the working capacity and solvency of the borrower. After all, he may lose income due to illness, injury, accident and other similar situations. But the obligations to the bank will not disappear by themselves. Then you will have a choice: decide on your own where to look for funds to pay the loan, or give your home to the bank. And at the same time, it should be noted that no one will return the money already paid. Therefore, it makes sense to get insurance. If an insured event does occur, the insurer will assume responsibility for repaying the debt. Of course, in the event that all documents and evidence are provided that there was no intentional harm to health.

Separately, it must be said that insurance can also help in the event of the death of the borrower. After all, then his responsibilities will automatically transfer to his relatives. But if they turn to the insurance company, they won’t have to pay other people’s debts.

Features of mortgage insurance

Usually people take out a mortgage for the simple reason that they do not have enough money to make a large purchase, for example, real estate. If you consider that the loan is provided for a long period, for example, twenty years, you should immediately think about taking out insurance. Over such a long period of time, something can happen to both the borrower and the purchased apartment or house. For example, if a home is flooded, its owner will be able to return part of the money.

The lower the amount of remaining debt, the lower the cost of the insurance policy. A clear advantage is that mortgage insurance is carried out very quickly: through the official website or during a personal visit to a banking organization.

The following objects can be insured:

- real estate;

- ownership;

- human life and health.

When taking out insurance for living space, windows, doors, walls, partitions and ceilings are taken into account (in the case of private houses, the roof and foundation are also insured).

Important! People who are clients of Sberbank also have the opportunity to obtain insurance, and this is a very convenient service for those who have taken out a mortgage loan from the same organization. In this case, its annual interest will be equal to 1%.

Possible risks when applying for a mortgage

What mortgage risks may the borrower face:

- actions committed by third parties and contrary to the law;

- natural disasters;

- detection of structural defects that were not noticeable before;

- collapse of large objects on housing (for example, a tree fell on a house);

- lightning strike, fire, gas explosion, that is, incidents leading to the loss of real estate;

- flooding;

- collision of a vehicle into a living space, leading to serious consequences;

- other actions of a negative nature that the owner of the property cannot influence.

Insurance risks

In the case of human life and health insurance, other situations are taken into account. The first is loss of ability to work if a person has become disabled, suffered an unsuccessful operation or a serious illness. The second is the death of the debtor (in such a situation, loved ones are not obliged to pay the mortgage). The third is insurance in case the employing company is liquidated, that is, the borrower loses his job.

Anyone who has taken out a mortgage has the right to insurance, which can be paid for through Sberbank Online. When applying for it, documentation is provided: personal and for property, and the fact of taking a loan from a specific financial institution is also confirmed. You can receive an issued insurance policy either at the bank itself or by mail. The total fee for one year can be four or five thousand rubles.

What risks are insured?

When insuring property, the following risks will be insured:

- Fire

- Causing damage to property due to the actions of third parties

- Vandalism

- Water supply and sewerage accidents

- Gas explosions

- Natural disasters and catastrophes.

When an insured event occurs, the borrower must take all measures available to him to save the property. If damage was nevertheless caused, then it is necessary to notify the insurance company and the bank. The insurer's representative will assess the damage, after which you can submit documents for compensation.

If a life and health insurance contract is concluded, the following are considered insured events:

- Loss of ability to work in case of serious illness.

- Disability due to injury, accident, accident.

- Death of the insured.

Each case will require the provision of a certain set of documents. It is necessary to prove that the injury or death did not occur due to intentional harm.

conclusions

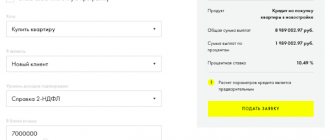

The cost of mortgage insurance is calculated as a percentage and is 0.25% of the outstanding balance of the mortgage loan. That is, the lower the debt, the cheaper the banking product will cost. You can arrange it not only in the office, but also on the Sberbank Insurance service, on the DomClick website. The policy is issued immediately, sent by mail, or sent electronically. Thanks to this service, you can protect your property from many risks. Even if something happens to the property during the entire repayment period of the mortgage, these costs will be covered by insurance payments. The list of such cases is indicated in the contract.

[ratings]

Similar articles:

- How mortgage rates are going down now...

- New information on Sberbank deposit Save -...

- The most important thing about Sberbank insurance...

- New programs in Sberbank apartment insurance,…

- Everything about depositing without a passport Sberbank conditions, reviews,…

- Everything about Sberbank investments, opening an account,...

- Basic information about currency exchange Sberbank, calculator,…

- What you didn’t know about Sberbank deposit Top up - new...

- Everything about Sberbank current account for individual entrepreneurs - registration,...

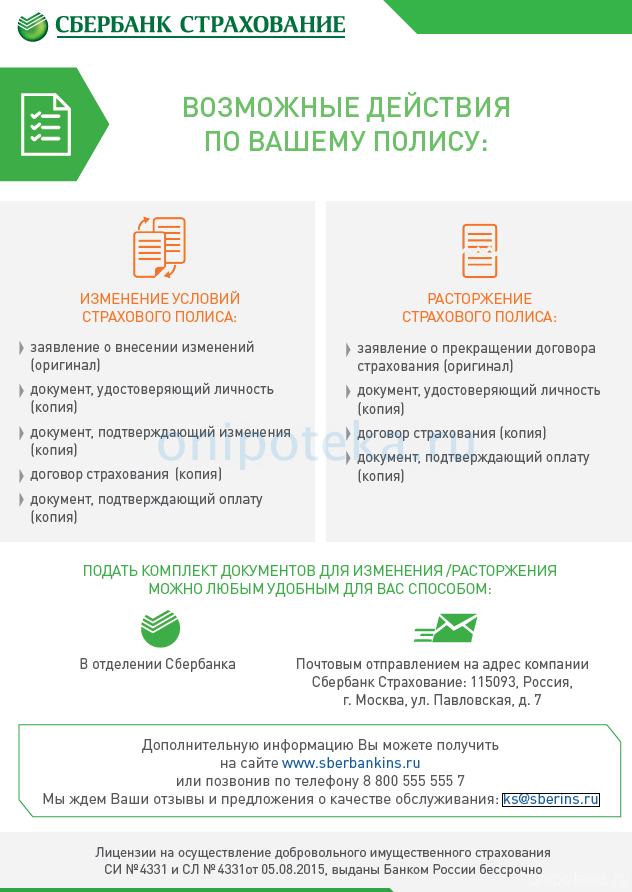

How to conclude an insurance contract

You can obtain a policy from one of the companies accredited by Sberbank or from Sberbank Insurance or Sberbank - Life Insurance. You must first familiarize yourself with the terms of service and select those that are most suitable for a particular case. It is possible to sign a complex agreement, when services for different types of insurance are provided within the framework of one agreement.

Next, you should find out what documents are required to conclude an agreement. This can be done either in person or via the Internet: all information is posted on the official website of the insurer. In addition, the loan agreement can also tell you about this when applying for a mortgage.

The insurance contract itself can be signed both at the insurer’s office and at a bank branch. However, in the second case, you will have to pay for additional bank services. But it will be easier and will save time.

Another option is the DomClick system. It is designed specifically to perform all necessary operations during mortgage lending. There you can do everything from finding a suitable option to paying for loans and insurance and receiving statements. You can also pay for insurance or renew it regularly.

Is there a fee when paying via the mobile version?

Before making a payment, citizens are interested in whether an additional commission is charged. When paying for a mortgage insurance contract through Sberbank Online from a mobile phone, the commission is not charged if the payment is made in the “Loans” section.

When creating a free payment, you will need to pay an additional commission, the amount of which is calculated automatically. The commission amount is 1-1.5% of the payment amount.

To summarize, it can be noted that with a mortgage agreement it is necessary to pay for an insurance form. Until the loan debt is repaid, the client is obliged to pay for insurance. When taking out a mortgage, be sure to insure the structural elements and title (for the secondary market). If a specialist imposes life insurance, we suggest reading the article on how to terminate a life insurance contract on a loan.

You can make payments either through your online account or through an application on your mobile phone. Please note that the bank may charge an additional commission.

How to pay for a policy through Sberbank Online

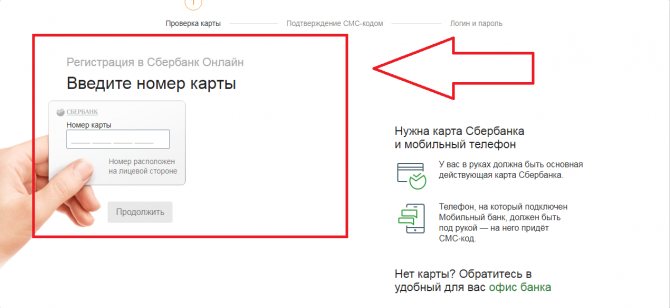

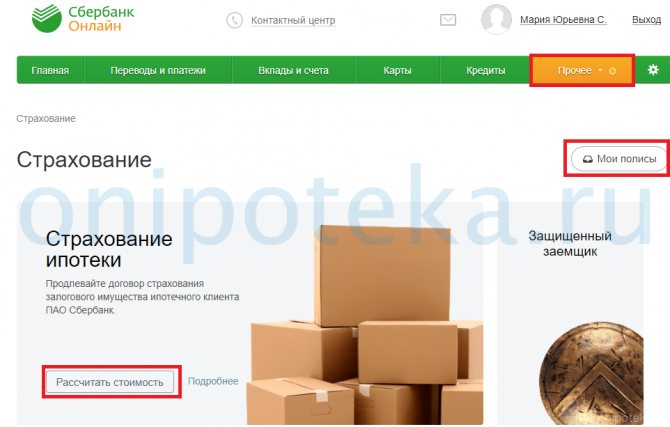

In order to make a payment through Sberbank Online, you must register in the system. After this, you should proceed according to the following algorithm:

- Log in to your personal account.

- Select the "Payments" section.

- In it you will find the subsection “Insurance and Investments”.

- Select “Sberbank Insurance” (if the policy was issued by this company).

- If you have chosen the services of an accredited organization, then you need to find it in the “Other insurance companies” section. There you can simply scroll through the list or find the desired company by name or tax identification number.

- Select the type of insurance.

- Specify the service from the drop-down list.

- A payment order form will appear on the screen, where some of the details will already be entered. All that remains is to enter additional information about the insurance policy and the payer.

Since this operation will be performed more than once, it would be wise to set up automatic payment. In addition, this will serve as a reminder that the policy renewal deadline is approaching.

Step-by-step mortgage insurance through Sberbank Online: from application to insurance registration

You can get insurance for your home purchased with a mortgage in a few minutes. To do this, you need to open the Sberbank Online application, having first downloaded it from Google Play or the App Store. After installing the mobile application, you must log in by entering your username and password. You can get them at one of the bank's offices. A department employee can help with this by connecting.

After authorization on a smartphone, tablet or computer (the full version is available without downloading the program), the user must go through two-step authentication by entering a code automatically received via SMS.

The next step is to find the right service. This is quite easy to do. When you open the application, you will see basic information about your bank cards and accounts. Just below, next to the “Home” section, find the “Payments” icon and open it.

Go to the “Other” section and select “Recommended”. In the open menu you will see 2 choices: “Purchase” and “My policies”. The second involves extending the current policy. Let's take a closer look at the purchase itself.

How to renew your policy through Sberbank Online

Taking into account the fact that the policy period is usually one year, and the mortgage loan is provided for a much longer period (can reach 25 years), the insurance must be renewed regularly. This operation is also very simply carried out through the Sberbank Online system. The procedure will be as follows:

- Log in to your personal account in the system.

- Select the “Policy renewal” section.

- A form will appear on the screen that you need to fill out. There you should indicate the current policy number and the amount of the remaining mortgage debt.

- After this, the questionnaire must be sent to the system.

- Wait for a response from the insurance company.

- After receiving the renewal notice, make payment using the method indicated above. Details of the new policy will be sent in a message from the insurer.

Purchasing a policy from Sberbank Online: instructions

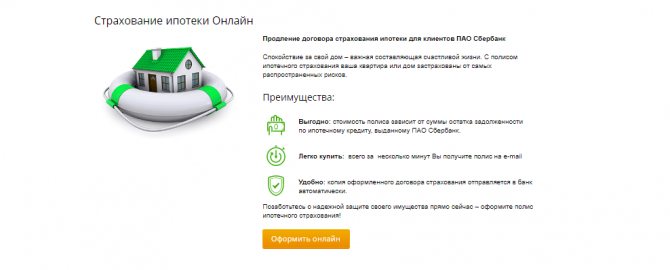

After scrolling through the menu in the “Purchase” section, go to the “Mortgage Insurance” subsection and read the main criteria and insurance rules for obtaining a policy.

Sample of an electronic insurance policy from Sberbank

Insurance rules Sberbank-insurance

After reading, click the “Proceed to Calculation” button. In the open window, review the calculations for your loan, and by clicking the “Buy Policy” button, select a convenient payment method. An amount equal to the cost of the policy will be debited from your account, and an electronic version of the document will be sent to your email, which will automatically be attached to your personal loan file.

Recommended article: Life Insurance for Mortgage

Also, to compare the cost of insurance, calculate the offer from Ingosstrakh using the calculator below.