Home/Mortgage Insurance/Title Insurance

If a property is purchased on the secondary market, the financial institution may require the title. Such a prescription causes bewilderment among most citizens. Few people have any idea what title insurance is. Meanwhile, the service is actively used for mortgages. If a bank asks a customer to take advantage of an offer, the first step is to understand what mortgage title insurance is and when purchasing the policy is required.

What is title insurance for a mortgage?

Title – ownership of property, confirmed by documents. If we are talking about buying real estate, such paper is an extract from the Unified State Register or a certificate of registration of ownership.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

The definition of title insurance follows from the above concept. It is understood as protection against the risk of loss of property rights to housing.

The fact is that from time to time situations arise when, after purchasing real estate, persons with ownership rights to the premises appear on a mortgage. They do not agree with the sale of the property and decide to sue the buyer for it. To carry out the action, a claim is prepared and filed in court. During the investigation, the specifics of the situation are clarified. If it is confirmed that the citizen’s claim is legitimate, the transaction may be declared invalid. As a result, the purchased apartment will have to be returned.

Attention

If the borrower finds himself in such a situation, he will have to repay the mortgage in any case. Additionally, the encumbrance will be removed from the premises. Such an action is unprofitable for banks. The company wants to protect itself from a full range of risks. Therefore, when purchasing secondary real estate with a mortgage, banks insist on title insurance. If the borrower refuses to complete the procedure, the company may increase the interest rate. Sometimes, failure to obtain title insurance can result in your mortgage application being rejected.

The importance of redevelopment

It is necessary to distinguish between redevelopment and reconstruction of an apartment. The reconstruction does not require approval, since the changes made during its implementation are not significant. This may be changing the size of doorways (if they are not located in load-bearing walls), moving electrical wiring, etc.

Unauthorized redevelopment increases risks for the bank issuing the loan. It may cause a mortgage refusal if:

- the buyer tries to hide the fact of making changes;

- the redevelopment was carried out with gross violations;

- It is impossible to restore the original state or reconcile the changes made.

Not subject to agreement:

- partial dismantling or complete demolition of load-bearing walls in a panel house;

- installation of heated floors connected to the general house network;

- moving the kitchen and bathroom so that they are above the living rooms of the neighbors below;

- transfer of sewerage, water supply, heating, gas supply risers;

- in a one-room apartment it is prohibited to combine a living room with a kitchen if a gas stove is installed in it;

- It is not allowed to dismantle the wall between the living space and the balcony or loggia while simultaneously moving the heating radiator onto them;

- the formation of residential premises with a width of less than 2.25 m or an area of less than 9 m2;

- dismantling of ventilation ducts;

- welding of fire hatches on loggias and balconies.

If there are such changes, purchasing an apartment with a mortgage is possible only on the condition that the borrower undertakes to restore the premises to their original condition.

Russian legislation is constantly being adjusted to tighten control over redevelopment. Therefore, “red lines” in the technical passport for a mortgage bank are becoming an increasingly serious reason for refusing a borrower.

Order an assessment of the value of real estate for a mortgage.

or call the number

By clicking the “Submit” button, you automatically agree to the processing of your personal data and accept the terms of the User Agreement.

Features of title insurance

If a citizen purchases real estate with a mortgage, the legal relationship between the financial institution and the borrower is regulated by Federal Law No. 102 of July 16, 1998. Article 31 states that the borrower is obliged to insure the property purchased with a mortgage. However, the regulatory legal act does not contain information regarding title protection. This means that the client independently decides whether to purchase a policy. However, banks often insist on using title insurance on mortgages. Financial institutions cannot oblige the borrower to use the service, but they have the right to decide whether to approve an application for a mortgage loan. Very often, failure to obtain title insurance will cause a mortgage application to be rejected.

For your information

Using the service protects the borrower from any pitfalls that may be encountered. The fact is that not all sellers are equally honest. Fraudsters use various tricks to save real estate and take possession of the premises. New schemes are developed periodically. Therefore, the service is beneficial not only to the bank, but also to the citizen himself.

Insurance when refinancing a foreign currency mortgage

If the borrower plans to refinance the mortgage with a change of currency, then he will have to enter into an agreement with the insurance company again. The fact is that, by law, insurance cannot be issued in a currency other than that specified in the housing loan agreement. Therefore, refinancing in rubles will be a reason to close the existing agreement with the insurance company.

But during the registration process, the borrower faces certain difficulties:

- lack of accreditation of the insurance company in the new financial institution (if the company does not have it with the new lender, then the insurance contract can not be renegotiated, but extended with changed conditions);

- determination of the insured amount - occurs after a market assessment of the value of the property, but when refinancing, a secondary assessment may be required, which is paid by the borrower;

- undergoing a medical examination - the insurance company has the right to refer the debtor for examination when taking out life and health insurance in order to reduce the expected risks.

If the client does not have the opportunity to undergo a medical examination, then the company may offer to change the currency within the framework of the current contract with an additional agreement attached. Not many insurance companies agree to this option.

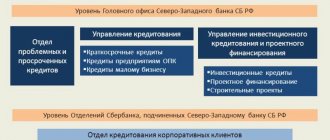

Which banks require title insurance when getting a mortgage?

As stated earlier, financial institutions cannot oblige the borrower to obtain title insurance for a mortgage. According to the law (Article 31 of Federal Law 102 “On Mortgages”), a citizen has the right to purchase only a policy that includes the risks of loss or damage to property. However, in practice, many financial institutions refuse to issue a home loan without title insurance. This policy is followed by:

- Raiffeisenbank;

- DeltaCredit;

- Gazprombank;

- VTB;

- Alfa Bank.

Please note

that when contacting Sberbank there is no need to use the service. The company obliges to insure real estate, as well as life and health. The citizen retains the right to refuse the policy. In this case, only real estate insurance is acceptable. However, the overpayment on the loan will increase by one point.

What does title insurance protect against with a mortgage?

It is considered that the insured event has occurred if the transaction is declared void. This is possible in the following situations:

- There is a fact of fraud. So, if a citizen with a fake power of attorney acted on behalf of the owner of the property, the apartment will be returned to its real owner.

- The transaction was concluded by an incompetent, partially incompetent or insane seller. Misleading the property owner is also grounds for challenging the agreement.

- The previous owner obtained title to the property by fraud, fraud, or threats.

- At the time of concluding the transaction, the seller did not understand the consequences of his actions, or he was influenced through violence and threats.

- The husband or wife entered into a transaction without obtaining the consent of the other spouse.

- A violation of the rights of a minor has occurred. A citizen can challenge the transaction if his parents did not allocate him a share in the new home.

- A person pays rent and sells the property without the consent of the rentee.

- The seller inherited the property and sold it without notifying other heirs, who did not know about their new right to the apartment and could not contact a notary in a timely manner.

If in all the above cases the title was insured, the company is obliged to pay compensation to the client.

What is title insurance

In the insurance business, the concept of “title” refers to documented ownership of property. Ownership of real estate is confirmed by a registration certificate or an extract from the Unified State Register of Real Estate.

Despite the fact that title is recognized as a document of title, the object of title insurance is the property right of the insured. In other words, title insurance is a tool to protect the policyholder from loss of title to the purchased property.

Upon the occurrence of an insured event, the insurer must compensate for the losses of the insured by paying him the market value of the apartment for which ownership was lost and compensation for legal costs incurred during the proceedings.

Note: often a title insurance contract for a mortgage involves indemnification of losses to the bank that issued the housing loan. The law does not prohibit issuing a separate policy that will protect the interests of the borrower.

Title protection is only necessary when purchasing housing on the secondary market. When purchasing an apartment in a building under construction, there is no need to conclude such an agreement, since ownership rights arise only after the housing is put into operation and registered with the authorized bodies.

In practice, title insurance is only used when obtaining a mortgage. When concluding a transaction without borrowing funds, buyers rarely use this service.

Why can you lose your title?

There is an established belief that if the transaction is completed and the property is registered, the new owner's property is not in danger. However, the opinion is wrong. Real estate on the secondary market has changed owners at least once. Premises are often inherited or sold. As a result, the old owners may demand the apartment back. This is possible in the following cases:

- there has been a violation of the property rights of property owners, their children or heirs;

- the participant in the transaction was declared incompetent;

- there are errors in the documentation;

- the transaction was completed illegally.

Attention

In order not to encounter the above difficulties, it is recommended to familiarize yourself with the history of the purchased object in advance. However, the procedure requires familiarity with a large amount of information. It takes a lot of time even for specialists. Therefore, it is easier to obtain title insurance with a mortgage.

How can you lose your title?

Potential borrowers believe that if a purchase and sale transaction is completed and registered with the registration chamber, then nothing threatens it. This is wrong. Objects on the secondary market have already changed owners at least once: they passed from hand to hand or were inherited.

Under some circumstances, previous owners may demand the property back. Among them:

- violation of the property rights of former apartment owners, their young children or heirs;

- recognition of one of the parties to the transaction as incompetent;

- the presence of errors in the documents for the property;

- the presence of evidence that any of the previously executed transactions was carried out illegally.

All these moments can be avoided, but to do this you need to study in detail the entire history of the property being purchased from the moment the house was built. This procedure is incredibly time-consuming, even for specialists.

Title insurance can be considered a kind of compromise option that allows the transaction to be completed on time and protect the interests of all parties.

How can you lose ownership of real estate?

If a third party believes that its property rights have been violated, it goes to court. To do this, one of two types of claims is drawn up - vindication or to declare the transaction invalid. The documents have a number of features that you should know about in advance.

Vindication claim.

The paper is drawn up to reclaim property from someone else's illegal possession. The possibility of performing the procedure is provided for in Article 301 of the Civil Code of the Russian Federation. Only the owner of the property who has the right to it by law has the right to submit such a document. At the same time, your claims must be substantiated. In the case of a mortgage, the citizen must prove that he did not know about the existence of other owners besides the actual seller and did not receive the premises for free, but purchased it with personal and borrowed funds.

If the court finds that the actual seller did not have the right to sell the property, or if the plaintiff acted against his will, the transaction will be declared void.

Claim to declare a transaction void (invalid).

Article 166 of the Civil Code of the Russian Federation states that a transaction may be declared invalid if there is a violation of the rights of minors, heirs, owners, or fraud is proven. To defend your rights, you must go to court. To do this, you will need to prepare a classic claim. It is drawn up in accordance with the requirements of Article 131 of the Code of Civil Procedure of the Russian Federation. However, the claim will not be considered if the defendant is recognized in court as a bona fide purchaser (Resolution of the Constitutional Court of the Russian Federation of April 23, 2003). Only the first transaction with problematic real estate is subject to challenge. If a person bought an apartment after the original buyer resold it, it is necessary to file a vindication claim.

How is title insurance obtained?

Purchasing title insurance for a mortgage is no different than purchasing other types of policies. Experts recommend proceeding according to the following scheme:

- Choose an insurer. You can only contact accredited organizations. The bank communicates their list to the borrower during the mortgage process.

- Prepare documentation. You will need an identity card, a written document, documents of title to the apartment, and an appraiser's opinion. Additionally, you will need to fill out an application.

- Contact the company and submit the documentation package. The insurer will check the papers and make a decision. The client will be advised of the exact cost of the title insurance policy for the mortgage.

- Conclude an agreement with the insurer, provide funds and receive supporting documentation.

Is title insurance required?

Title insurance is an optional insurance policy. You have every right to refuse it. However, if the transaction is declared void, the apartment (or part of it) will go to the person who initiated the legal proceedings, and you will have to pay the mortgage. The bank issued the money, and you need to give it back anyway.

The return of funds after the sale and purchase agreement is recognized as illegal should be handled by the borrower, but not by the bank. The seller of the apartment must return the money, but in practice the matter drags on for many years. Technically, this is the problem of the borrower; the lender, when issuing a mortgage, is not interested in the past of the collateral. The client had to hire a realtor or lawyer and thoroughly check the chain of transfer of ownership.

If the transaction took place without a real estate specialist, legal purity was not observed, it is recommended to obtain title insurance. You don't have to buy it when:

- The last transaction on the apartment was completed more than 3 years ago and at the moment the risks of challenging the contract in court have been rejected. The verification function is partially transferred to the notary when shared ownership is registered during a mortgage. It should be borne in mind that a notarial transaction can be declared invalid if it does not comply with the law;

- If you are buying a new building from a developer. It is best to cooperate with bank-accredited construction companies. In this case, the likelihood of challenging a real estate transaction tends to zero.

To encourage the client to obtain financial protection, the bank may reduce the interest rate if there is a policy. In some cases, it is even more profitable for borrowers to buy insurance than to overpay interest to the bank.

How does the cost of title insurance indicate the cleanliness of the apartment?

The insurer evaluates the profitability of the proposed contract. For this purpose, the property is checked. After this, the following scenarios are possible:

- the client will be offered to purchase the premises at the market price;

- the cost will exceed the market average;

- the company will refuse to start cooperation without explaining the reasons.

Note:

In the latter case, it is recommended to find a new apartment. In the second option, there is a certain risk, but the probability of its occurrence is low.

Documents and requirements for the contract

To conclude a deal, you will need to prepare a package of documents. The list must include:

- identification;

- agreement concluded with the creditor;

- completed application;

- contract of sale;

- real estate documents (technical passport, extract from the Unified State Register of Real Estate);

- appraiser's conclusion.

If the company agrees to provide title insurance for a mortgage, an agreement will be entered into with the client. The paper records all the terms of cooperation and prescribes a list of risks from which the policy protects. Actions with the insurer are carried out strictly within the framework of the agreement. Therefore, it is important to carefully read the information reflected in the document.

The concept of real estate title insurance

Title insurance is a type of financial protection against loss of title to a property that is mortgaged to the bank. The fact is that the apartment or other real estate that the borrower buys has a whole chain of owners in its history. If a contract for the transfer of ownership (purchase, donation, privatization, etc.) or another document confirming a change of owner is drawn up incorrectly, it can be challenged in court.

The objects of insurance are:

- Apartments, private houses, rooms and other residential premises;

- Commercial and other non-residential real estate (garages, parking spaces, warehouses, buildings, etc.);

- Land.

Challenging a real estate transaction is possible within 3 years after its completion. If you bought an apartment whose owner changed during this period, there is a risk that the purchase and sale agreement will be invalidated. Of course, when applying for a mortgage, the bank will check the history of the property, this is a kind of guarantee of the purity of the transaction. However, the verification does not go further than the current owner (seller).

The bank only evaluates the legality of the text of the purchase and sale agreement, the availability of the necessary documents and other risks relating to it, but not to the client. Therefore, you should not rely on the lender in this matter. Approval of a property by a bank does not mean that interested parties will not be able to challenge this transaction in the future. Why else would you need title insurance?

If within 3 years after the execution of the mortgage transaction it is declared void, the client is deprived of ownership of the property. If you have title insurance, the home loan is closed by the insurance company. The payment amount is equal to the property value of the object. Otherwise, the client will return the loan for the apartment that was taken away from him.

Justice in this case is on the side of the creditor, unless the intentionality of the bank employees’ actions or significant errors in the documentation are proven.

How long is the title insurance contract for?

Article 196 of the Labor Code of the Russian Federation states that the general limitation period is 3 years. It is during this period that a person has the right to go to court if information appears about the unlawful disposal of real estate from the property. Therefore, banks insist on title insurance if the previous owner owned the apartment for less than 3 years.

The contract itself is usually concluded for one year. After this, an extension of the agreement will be required if the mortgage has not yet been repaid. However, the parties may agree on a different insurance period. There is also an upper limit. The maximum term of the agreement does not exceed 10 years.

What applies to insurance events?

The right to ownership of real estate can only be challenged in court. If a person lays claim to the premises and has submitted a statement of claim, a summons will be sent to the new owner. In this situation, you must immediately notify the insurance company. The time frame within which the action will need to be completed is fixed in advance in the contract. The circulation period cannot be violated.

The insurer is on the borrower's side. It is important for the company that the client defends ownership rights. Therefore, experienced and well-known lawyers are usually recommended to a person. However, a person can hire his own lawyer.

IMPORTANT

It is important to carefully review the title insurance provisions of your mortgage. Sometimes it states that it is the insurance company’s lawyer who is responsible for protecting the interests of the citizen. In addition, hiring an experienced human rights defender will increase the chances of winning the case.

Additionally, it is recommended to notify the bank about the current situation. If, as a result of the proceedings, the citizen is nevertheless deprived of the right to premises, compensation will be paid. When a decision is made to impose an encumbrance on an object without a change of owner, the case is not recognized as insurable. In this situation, no compensation is paid.

conclusions

A borrower cannot do without insurance when refinancing a mortgage. When concluding a contract, you should not refuse any types of insurance - this will raise the interest rate on the loan. A purchased policy can always be returned to the insurance company, but this is only relevant for a contract relating to life and health. Real estate title insurance cannot be avoided.

- Related Posts

- What is the essence of loan refinancing?

- Mortgage refinancing programs for large families in 2020: which banks should you contact?

- How does a bank loan refinance?

- Is refinancing a mortgage or consumer loan profitable for individuals?

- Tax deduction when refinancing a mortgage loan: personal income tax refund in 2020

- Features of refinancing a military mortgage in 2020: conditions for refinancing military mortgages

Add a comment Cancel reply

How do I get my title insurance payout?

If an insured event occurs under title insurance with a mortgage, you must proceed according to the following scheme:

- Prepare an application and contact the insurance company. The deadline for completing the procedure is fixed in the contract.

- Provide a package of documents along with the application. The list must include your passport and all papers demonstrating the occurrence of an insured event. It is important to include in the list the documented details of the account to which the compensation will be transferred.

- Wait for the inspection to take place. The insurer will review all the papers, get acquainted with the current circumstances and make a verdict. If it is positive, compensation will be transferred.

If the company violates the provision of the contract by refusing to issue funds, it will be necessary to send a pre-trial claim to the insurer. In situations where there is no response, it is necessary to file a claim and go to court.

What is considered an insured event?

The current ownership right can only be challenged through court. If the previous owner of the property decides to take this step, you will receive a subpoena from the court.

This fact should be immediately reported to the insurance company . Notice periods are usually specified in the contract and cannot be violated.

The insurance company usually recommends the services of experienced and well-known lawyers to clients. You have the right to retain your own lawyer. But it is better to take advantage of the offer of insurance companies.

Firstly, the policy may not provide otherwise, and secondly, a lawyer with experience in such cases will increase the chances of winning the case.

If there is a threat to the title to the mortgaged apartment, re-read the title insurance agreement and notify its representatives about the current situation. If the court deprives you of your right to real estate, you will receive compensation from the insurance company .

If the court imposes an encumbrance on the object without a change of owner, the case will not be considered insured. In this case, compensation is not issued and legal costs are not reimbursed.

Grounds for refusal to provide compensation

Statistics show that in situations where title insurance for a mortgage is involved, compensation is rarely denied. However, this is still possible. The reasons become:

- occurrence of force majeure circumstances;

- the recipient of the funds fulfilled his obligations under the mortgage loan agreement in bad faith;

- dishonesty of the organization that insured the title.

Please note that the policy does not cover damage caused to the object due to the fault of the owner or third parties. If there is destruction, the insurance company will refuse to pay because there has been no loss of ownership. This is provided only within the framework of property insurance. The list of force majeure circumstances includes:

- confiscation of property by the state;

- rights to real estate were lost as a result of hostilities;

- loss of property rights occurred due to a natural or man-made disaster.

You will not be able to receive a refund if you violate the terms of the mortgage agreement. If the property is repossessed due to debt on a home loan, the application for payment will be rejected. Therefore, it is important to comply with the established requirements. The mortgaged premises cannot be sold, given away, its technical condition changed, or used for other purposes. Allowing the above violations will also be grounds for refusal of payment.

For your information

During the decision-making process, the integrity of the acquirer will be checked. This means that if the transaction is declared illegal due to fraudulent actions by the seller, the mortgage borrower will have to prove that he did not know about this. Otherwise, your title insurance claim will also be denied.

In what cases is the insurance company not required to pay?

The refusal of an insurance company to reimburse expenses upon the occurrence of an insured event is a rare situation rather than a natural one. The following factors may be the reason for this:

- dishonest performance by the borrower of its obligations under the mortgage lending agreement;

- force majeure;

- uncleanliness of the insured;

- other circumstances.

Title insurance does not cover damage to the property that is your fault. In the event of mechanical failure, you will also not receive payments under the policy, since you have not lost ownership. Such situations are resolved within the framework of property insurance.

The following situations are considered force majeure:

- loss of rights to real estate as a result of hostilities;

- confiscation of housing by the state;

- consequences of natural or man-made disasters.

Compensation is also not paid if you violated the terms of the mortgage agreement. If, by a court decision, the apartment is confiscated due to loan debt, do not count on title insurance.

Reasons for refusing insurance payments may include the following:

- use of residential or non-residential premises for other purposes;

- change in the technical condition of the apartment (redevelopment) without notifying the insurance company and the bank;

- donation or sale of the collateral to third parties;

- rental of housing;

- other violations.

These situations described are encountered quite often in insurance practice. Therefore, it is important to remember that any actions in a mortgaged apartment before you make the final loan payment must be (!) agreed upon with the bank and insurance company.

Insurers may refuse compensation based on the buyer's good faith. This means that if the transaction is declared illegal by the court due to fraudulent actions of the seller, you will have to prove to the insurance company that you did not know that the seller did not have the rights to sell the property.

You will also have to prove that you did not know about the impending quackery. This technique is used only by unscrupulous companies, which, fortunately, are becoming fewer and fewer with the development of the insurance services market.

Before choosing an insurance company, if the lender provides you with such a right, read reviews from past clients - they may be useful.

Title insurance for the maximum period is not only justified, but also necessary. “If something happens,” insurance companies will provide you with qualified legal support, including in the courtroom.

Title insurance is not altruism, it is pure calculation . The insurer is not interested in reimbursement of expenses, so it will do everything possible to defend the interests of the client.

Advantages and disadvantages

There are a number of advantages and disadvantages to using title insurance for a mortgage. The main advantage is obtaining a guarantee of ownership of the purchased object. A person can be confident in the safety of property. If an insured event occurs, the company will bear all incurred expenses. The person will be helped to keep the property or provided with compensation for the full cost.

The disadvantage of the service is that it is imposed by banks. Sometimes companies will refuse to issue a mortgage loan if the borrower does not want to purchase a title insurance policy. In other situations, the interest rate may increase significantly.

What is mortgage insurance?

There are three main types:

1. Insurance of collateral property. Includes insurance of the apartment against fires and other natural disasters, against domestic gas explosions, flooding and other accidents, against the actions of third parties that violate the laws of the Russian Federation, including vandalism and hooliganism. You can't refuse this look.

2. Life and health insurance. Insured events include loss of work, temporary loss of ability to work due to illness, permanent loss of opportunity to work due to disability or injury, death of a bank client, etc. Not a mandatory type of insurance, but if you conclude an agreement and take out a life insurance policy, the mortgage rate will decrease by 0.5-1%.

3. Title insurance. Covers risks in the event that a person is deprived of ownership rights to an apartment that was purchased with a mortgage. Deprivation of rights must be ordered by a court. Often, it is problematic for the borrower to prove the occurrence of an insured event for a given risk. Title insurance can be waived if desired.