Programs that allow you to receive a “Mortgage Bonus”

“Mortgage bonus” from VTB is a loan offer for mortgage holders. It is important to note that only bona fide borrowers who have not made a single delay on the loan will be able to use it.

The proposal is the possibility of obtaining an additional consumer loan on favorable terms, for example, under the VTB “Victory over formalities” program. It can be used for the following needs:

- carrying out cosmetic repairs;

- purchase of upholstered furniture;

- bringing gas, water, electricity and other communications into the house.

Due to the fact that such lending from VTB is not targeted, there is no need to approve expenses.

Moreover, to take advantage of the “bonus” you do not need to provide any certificates from other credit institutions confirming that you have a mortgage. VTB will be able to obtain all the information from the BKI, where you can also find out about the credit history of a potential borrower.

About the loan

Mortgage bonus from VTB 24 Bank is a cash lending program for a strictly defined category of clients. Borrowers who have a valid mortgage with any Russian bank and who repay it in good faith without delays or other violations of the terms of the contract can count on receiving such a loan.

In simple words, a person with one or more mortgage loans can receive an additional consumer loan on favorable terms. The purposes of such a loan may be:

- renovation of an apartment or house;

- purchase of furniture, household appliances;

- establishing the necessary communications, etc.

Confirmation of the intended use of borrowed funds is not required, since the loan is not intended.

No certificates or confirmations from a third-party bank about the availability of a valid mortgage will be required from the borrower; all information is available in the BKI (including information about the client’s integrity and his financial relationship with the lender).

Program conditions in 2020

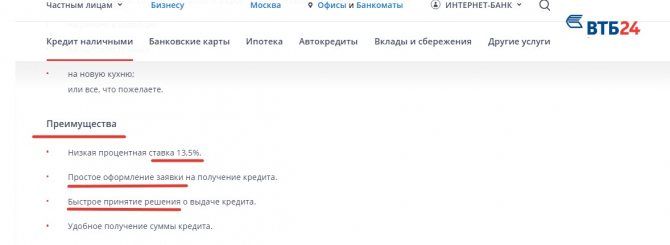

A huge advantage of VTB is the absolute transparency of the conditions of the “Mortgage Bonus” presented. Absolutely everyone can get acquainted with the terms of the loan. To do this, you need to go to the official VTB website. The key parameters are as follows:

- loan amount from 400,000 to 3 million rubles (for those who are VTB salary clients, the maximum limit is 5 million);

- fixed interest rate - 13.5%;

- loan terms from 6 months to 5 years;

- If the loan is planned for more than 3 months, proof of income is required.

There is no need to issue a guarantee or real estate pledge.

Answers to common customer questions

We have collected for you popular questions that borrowers are concerned about when receiving a “Mortgage Bonus”.

Is it possible to achieve the intended use?

The program does not apply to targeted loans, but the bank does not require the client to report on payments. You apply for a regular consumer loan and then use the funds at your own discretion. Banks also do not require confirmation of costs from housing lending agencies.

How to repay the loan?

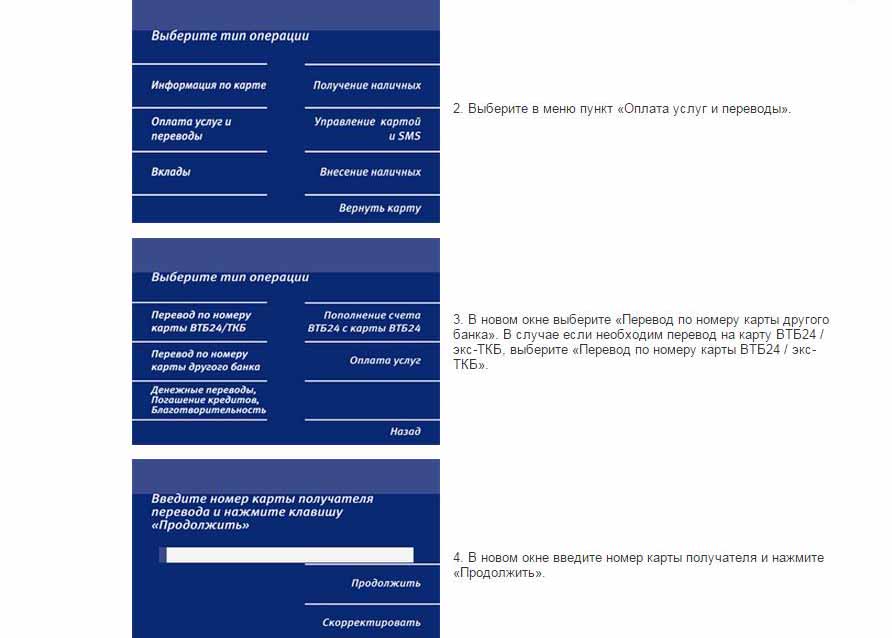

The bank offers borrowers several ways to repay the loan:

- Through an ATM;

- In the “Golden Crown” branches;

- At Russian Post points. At the post office, you must make a payment 10 days before the date specified in the contract so that the money arrives on time;

- By transferring funds to a VTB card.

Who can qualify for the Mortgage Bonus?

This program is available to those who have taken out a mortgage or several with VTB. The main thing is a positive credit history. The loan will not be approved if the client delayed payment for several days or there are arrears.

What features does the program have?

An exclusive feature and main advantage of this product is a clear interest rate. Its size is 12.9% per year. The service is profitable, since regular consumer loans start at 17% per year, and for preferential clients from 15%.

Look at the same topic: Mortgage from Sberbank for secondary housing without a down payment: the procedure for applying for a mortgage and the interest rate for today

What does a borrower need to know about terms?

The bonus from VTB is taken as standard for 3-5 years; for military personnel, the bank has increased the period to 7 years. If the client wants to repay the entire loan or part of it, a separate application is written, the amount and term of the loan are changed.

How to calculate a loan under the Mortgage Bonus program?

There is a calculator on the official VTB website that will help you calculate payment amounts online. Typically, the amount owed is based on the term and interest rate. If you take 600,000 for a year with an interest rate of 13%, then you will have to pay 28,900 rubles monthly.

How to use the VTB Mortgage Bonus program

Each person who decides to use the program receives a comprehensive contract that includes a standard set of services.

Advice for potential borrowers - to increase the likelihood of your application being approved, you need to take out a policy from VTB Insurance.

However, we should not forget that such lending is voluntary. Actions forcing its registration are illegal. In addition, the insurance policy will significantly increase the total amount owed. That is why you need to think several times before deciding to take advantage of the “bonus”.

If you are still determined to use it, you need to write an application to VTB. This can be done in several ways: in person at a bank branch office, on the official website of the organization, or even by phone.

After submitting the application, the bank will take some time to review and review it. Here are some nuances:

- if VTB responded positively, the person will have exactly 60 days to contact this organization to obtain a loan;

- refusal is received only by those borrowers who have made late payments. That is, if everything is good with your credit history, then most likely the bank will approve your application.

What is unique about the Mortgage Bonus?

The appearance of such a program in the credit arena is already a rarity. What is also surprising is that you do not need to prove to the bank that you have a mortgage. VTB will check this information itself. This happens thanks to the bank's close cooperation with the Credit History Bureau.

It is important to pay attention to the nuance - entering the completed mortgage into the Bureau’s archive takes place within two weeks, so it is advisable to wait 10-14 days before applying for the “Mortgage Bonus”.

It is also important to make sure that the bank that provided the mortgage sends information to the BKI in a timely manner.

The peculiarity of this program is that the loan is unsecured.

VTB puts forward a number of requirements for the borrower:

- Only Russian citizens can take advantage of the bonus program.

- Age limit: the client must be between 21 and 70 years old.

- Availability of permanent registration or temporary registration, but with a margin of 6 months before its expiration.

- Constant income from official sources.

- Work experience of at least one year.

- The monthly salary should be 30 thousand rubles for the Moscow region and 20 thousand for other regions. The bank also provides a benefit to those who receive a salary on a VTB card - income can be equal to 15 thousand.

- Availability of a mortgage.

- The mortgage should not be accompanied by late payments.

The conditions cannot be considered difficult to fulfill. On the contrary, in comparison with other banking offers, the “Mortgage Bonus” is distinguished by its loyalty.

VTB 24 does not put forward additional requirements for the duration of the mortgage (how much the client has already repaid, how much remains to be paid). The main thing is that the data is in the BKI database.

Receiving a mortgage bonus

Those who want to take advantage of all the benefits of the “mortgage bonus” from VTB need to follow the following algorithm:

- First of all, you need to familiarize yourself with the terms of the program and the requirements for the borrower;

- collect the necessary package of documents;

- apply.

VTB will review your application within three days, after which it will notify you of its decision. If the decision is positive, they will most likely call you, if negative, they will notify you via SMS.

Reviews about the “bonus” are quite mixed. Some borrowers claim that this product is an excellent opportunity to get another loan, since if you purposefully apply for a loan to the bank, you will most likely be refused.

Other borrowers believe that the product is not profitable, since in most cases insurance will be imposed on you.

Based on reviews, you can highlight the main advantages and disadvantages of the product. The advantages include the following points:

- the ability to borrow a fairly large amount;

- providing preferential conditions for military personnel and salary clients of the bank;

- no need for collateral or surety;

- Possibility of online appeal.

At the same time, there are also pitfalls. Borrowers often face the following difficulties:

- after preliminary approval of the application by telephone, the person receives a refusal from the bank without explaining any reasons;

- from the reviews of some borrowers, it took VTB not the required couple of days to review the application, but a full 2 weeks;

- long queues at bank branches during paperwork;

- Only privileged clients (salaries and military personnel) have benefits.

Reviews

Customer reviews about this program are characterized by their polarity. Some borrowers claim that such a product is unique due to the impossibility of issuing an additional loan to a client with an existing mortgage. In addition, conditions are more than attractive. Other borrowers, on the contrary, argue that this loan is unprofitable due to the imposition of insurance, the extension of the application review time to several weeks and the provision of an extended package of documents.

Available reviews on well-known banking portals allow us to draw conclusions about the presence of both obvious advantages and disadvantages. Among the advantages:

- the opportunity to receive a large sum (up to 5 million rubles);

- loyal attitude towards salary clients and military personnel;

- lack of collateral and surety;

- the ability to submit an application in real time;

- fixed interest rate for the entire period of debt repayment.

The disadvantages include:

- actual processing times for loan applications differ from those stated (can reach up to 2 weeks);

- “obligatory” purchase of an insurance policy (refusal of the service may contribute to a negative decision regarding a specific borrower).

The VTB-24 mortgage bonus has the main goal of providing additional funds without collateral or guarantors to pay for large purchases or carry out expensive work. Before submitting an application and signing documents, you should definitely study similar offers on the market, study their conditions and determine the best option by making preliminary calculations and using a visual lending calculator. The final decision must be made after comparing your solvency and future credit burden.

You will also be interested in learning how to get a loan secured by real estate from VTB for any purpose.

We are waiting for your questions in the comments. We will be grateful for rating the post, subscribing to updates and reposts.

Features of the program

The peculiarity of this banking product is its fixed interest rate, which is set individually, but subsequently does not change. The rate ranges from 12.9%.

In fact, this is much more profitable than obtaining an unsecured consumer loan, which is subject to an interest rate of 17 to 20% per annum.

The main feature of this program is its simplicity of registration and quick decision-making on issuance.

How to get

The process of obtaining a consumer loan can be activated only after submitting a complete package of documents and the bank checking information about the client in the credit history bureau.

Required documents

the borrower must provide:

- passport;

- certificate of income for six months;

- SNILS;

- if the requested amount exceeds 500,000 rubles, you must bring a copy of your work record book or employment contract with a note from the HR department.

For clients receiving salaries using a VTB 24 card, it is enough to have a passport and SNILS.

Payment schedule calculation

Calculating a payment schedule using the VTB service is no different from calculating using any other calculators. Typically, the following formula is used:

total amount of debt: term + interest rate.

For example, if you need an amount of 600 thousand rubles for a period of 12 months and an interest rate of 13%, then the monthly payment amount will be 28,950 rubles.

Requirements for the borrower

A person wishing to take advantage of a “bonus” from VTB must meet the following criteria:

- presence of Russian citizenship;

- age at least 21 years, but not more than 70 years;

- high wages (the monthly loan payment should be no more than 50% of the person’s monthly earnings);

- official employment (people who have individual entrepreneurs are in most cases refused, since their earnings are not considered stable);

- The total work experience must be at least 1 year, at the current workplace - at least 3 months.

Required documents

To apply for a mortgage bonus you will need the following list of documents:

- passport of a citizen of the Russian Federation;

- a document confirming high and stable profitability (certificate in form 2-NDFL or certificate in the form of a bank);

- SNILS;

- If you are applying for a loan in an amount of more than 500,000 rubles, you must provide a work record book.

Documents and registration

To apply for a loan under the Mortgage Bonus program, you must provide the following documents :

- general civil passport of the Russian Federation;

- document confirming monthly income: 2-NDFL certificate, bank certificate, bank account statement for the last six months or certificate from place of employment;

- for borrowers who receive wages into an account opened with VTB Bank, confirmation of monthly income is not required; they only need to provide a passport of a citizen of the Russian Federation;

- pension insurance certificate;

- to receive a loan in the amount of over 500 thousand rubles. You will need to provide a certified copy of your work record book or employment contract.

Attention!

To increase the approval rate, you can provide a valid mortgage agreement.

A client can apply for a loan in three ways:

- by visiting the lender's office in person;

- online on the company’s official website;

- through a support specialist on the toll-free hotline.

As soon as the application form is completed, it will be sent for consideration by a credit inspector, where the terms of compliance with the current mortgage agreement, the reliability of the data provided, as well as the applicant’s credit history will be checked.

After submitting the application, the application will be reviewed within 1-2 days . If the applicant has a positive credit history and a sufficient level of income, then a decision on the application may be received within 15 minutes.

After reviewing the application, the client may be refused a loan, or the loan limit may be reduced or the loan period may be increased.

A positive decision on the application is valid for 60 days from the date of the decision. During this time, the applicant must contact the company’s office with the necessary documents and sign a loan agreement.

The borrower has the right to repay the loan early . This can be done in full or in part. In case of partial repayment, part of the debt will be written off and the further monthly payment will be reduced.

For full early repayment, the client must notify the creditor in advance and clarify the total amount required to repay the obligations.

Mortgage Bonus Requirements

One of the advantages of VTB is the ability to repay a loan ahead of schedule without paying any fines or fees.

It is also possible to speed up repayment terms. This can be done by changing the monthly payment schedule.

If the borrower partially deposits funds, bank specialists recalculate loan obligations.

All this can be done by submitting an application in person to the bank’s office or by calling the VTB service center.

Actions after receiving a response

If the answer from the financial institution is negative, it is unlikely that you will be able to use the program. Most likely the reason for refusal is insufficient profitability. That is why the chance to get such a loan will only be successful if your income increases significantly.

For the most part, reviews of the program are still positive. Disadvantages include inconvenient interest rates and low levels of service. There are many more benefits. These include a small package of documents (in other credit institutions it is much larger) and a quick response with a decision on issuance (within a couple of days).

How to apply for a Mortgage Bonus?

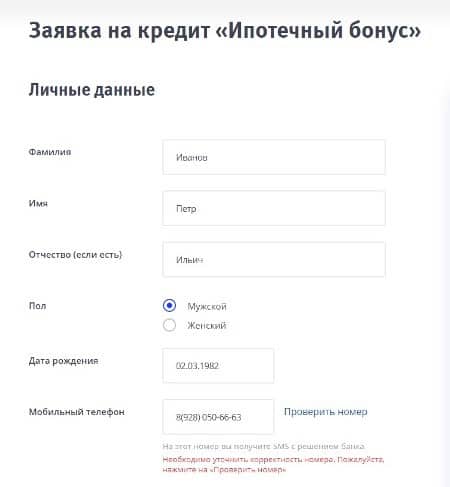

The process is standard, as with any consumer loan. To claim your bonus, you need to submit an application. It can be done:

- On the bank's website online. The application includes personal information, telephone number, place of work, position, income, and information about the mortgage debt. A preliminary response comes within 20 minutes. If it is positive, then you need to visit a bank branch, provide original documents and receive money.

- Call the bank's toll-free line. A call center specialist fills out an application remotely. The verification is carried out within a couple of days for clients “on the street”, and within a few minutes for salary employees. For any answer, an SMS with a solution is sent. Next, the borrower again contacts the office to receive it.

- In the bank. You can prepare the required documents and come to the branch to fill out the application. Salary clients receive a response on the day of their request. Other customers will have to wait a few days and then visit the bank office again to receive their money.

If you receive a positive answer, you need to carefully study all the documents and terms of loan repayment, the accrual of penalties, and the list of repayment methods. It is important here to assess your ability to pay off all debts. If financial difficulties arise, your credit history can be ruined.