Categories of pensioners receiving a mortgage

Some categories of elderly people can apply to the institution for money. Before making a deposit, the representative determines the chances of getting the money back. This is necessary to assess the chances of debt repayment.

Categories of pensioners who have a chance to receive money:

- Married applicants. More often, such couples are considered wealthy and reliable.

- Elderly citizens who have permanent or temporary work. If you receive systematic income once a month, there is a chance to receive a deposit.

- Clients who own a property. If the loan is not repaid, the apartment or car is repossessed.

- The pensioner must have a positive credit history. At the same time, have a pension card from Rosselkhozbank.

An important condition is that the applicant invites guarantors. This increases the chances. They must also be solvent.

Divorced citizens are often refused. Or those involved in litigation. In addition, the application is rejected if the applicant has dependents.

Mortgage for pensioners at Rosselkhozbank - conditions in 2020

Mortgage for pensioners from Rosselkhozbank - an advantageous offer in 2020. The money company offers optimal conditions for Russian citizens. Primary requirements:

- The client is not older than 75 years.

- Bank amounts are paid in Russian currency – rubles.

- When registering, you need to pay an amount that corresponds to approximately 15% of the value of the property.

- Interest varies depending on the loan period and the amount of the down payment.

- Loans are given to citizens for a period of 25 years.

- Make a minimum monthly payment.

- Clients are given 10-200 thousand Russian rubles.

- Auto payment option available. Pension payments are automatically transferred to the repayment account.

- The terms and conditions remain the same during the refund period. There are no additional payments.

- The main goal of the campaign is to help citizens buy housing.

Rosselkhozbank mortgage for pensioners

Mortgage lending at Rosselkhozbank is available not only to the country’s young working population, but also to the retired population. Thanks to this program, pensioners now have a unique opportunity to take advantage of a mortgage and receive finance from the Bank for the purchase of a particular property.

Pensioners take out a mortgage mainly to purchase a dacha or country house, where they can relax from the city noise, spend time in the fresh air, where they can bring their grandchildren and children on vacation.

As you know, a mortgage is a loan secured by purchased or other real estate; at Rosselkhozbank, in addition to a standard mortgage, pensioners can take out a non-targeted loan without collateral up to 500 thousand rubles.

Terms of service

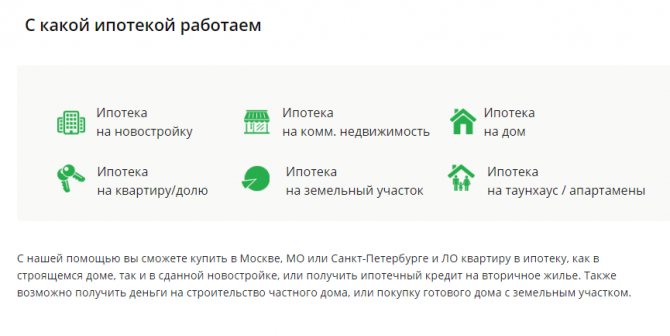

So, mortgage lending applies to the following purposes:

1.Purchase of an apartment:

- secondary housing (resale of apartment)

- in a new house, that is, in the primary housing market (new buildings or housing under construction);

2. Purchase of apartments (apartments with an improved, expanded layout with additional amenities):

- secondary housing;

- new house;

3. Purchase of country real estate with a plot:

- agricultural purposes (house, dacha);

- townhouse, i.e. an apartment in an apartment building with a separate entrance and a plot of land;

4. Purchase of a property under construction along with a land plot.

5. Acquisition of a land plot for the purpose of future construction of a residential or country house on it.

6. Acquisition of land lease rights

for the purpose of future construction of a residential or country house on it.

7. Purchase of land:

- type of individual housing construction (individual housing construction);

- type SNT (horticultural non-profit partnership);

- type of DNP (dacha non-profit partnership).

The mortgage loan is issued only in Russian currency, with a maximum amount of 20 million rubles. The mortgage term cannot exceed the permissible 30 years.

As for the down payment, it directly depends on the type of property purchased with a mortgage:

- For apartments, the contribution amount starts from 30%;

- For apartments on the primary market from 20%;

- For building a house from 15%.

For mortgage lending, all borrowers must purchase insurance, both individual voluntary life insurance and mandatory property insurance. Such conditions maximally insure the bank against possible financial losses, and are almost always required by borrowers as a prerequisite for obtaining a loan.

The loan application will be reviewed quite quickly, about 5 business days from the date of submission, and such a decision on the mortgage will be valid for 3 months from the date of issuance. There is no fee for issuing a loan from the borrower.

Within the framework of what special programs profitable mortgages are possible for pensioners

Mortgage lending from Rosselkhozbank can be beneficial for pensioners; interest rates at the moment depend directly on the loan term and the size of the down payment, and look like this:

- If the down payment is more than 30% of the total loan amount:

— from 14.5% to 5 years — from 15% to 10 years — from 15.5% to 20 years — from 16% to 30 years

- If the down payment is more than 50% of the total loan amount:

— from 13.5% to 5 years — from 14% to 10 years — from 14.5% to 20 years — from 15% to 30 years

As you can see from these mortgage interest conditions, it is more profitable to purchase real estate with a large initial investment and for a period of no more than 10 years. As noted earlier, today there is a special program for lending to pensioners from Rosselkhozbank.

Such a loan can be purchased for any purpose and need without necessarily providing additional methods of security (for example, collateral or guarantee). A loan called “Pension” is provided to pensioners under 75 years of age and for a short period of up to 7 years.

The rates on such a loan are quite attractive for pensioners, especially for those who receive a pension into the account of Rosselkhozbank (from 16%) .

Under such a lending program, no collateral or guarantee is required; you can receive up to 500,000 rubles in loan funds from the bank, which can be spent on any purpose, including the purchase of small real estate, for example, a country house, dacha or garage.

In what cases is the bank most likely to refuse?

Russian banks often refuse to provide loans to individuals, including mortgage lending.

The reasons for refusal are not announced by banks and can be very different, but the most frequent refusals occur under the following conditions:

- the borrower is not within the age limit for the terms of the loan;

- the borrower refuses voluntary life and health insurance;

- the borrower is single, has no relatives or family;

- the borrower has a bad credit history, that is, cases of delays on other loans recorded in the credit history bureau;

- the borrower has a criminal record, current or recently expunged;

- the borrower has immediate relatives with an active criminal record or a recently expunged one;

- the borrower does not receive a pension on Rosselkhozbank accounts and has no additional income;

- the borrower does not have any official additional income other than a pension;

- the borrower, in addition to this loan, has other existing credit obligations;

- the borrower provided an incomplete package of documents;

- the borrower has serious tax debts or fines, unpaid bills or legal obligations;

- the borrower requests a large loan amount for which the monthly payment exceeds half of the pension payments;

- the borrower does not own any property, no car, no dacha, no apartment, no garage;

- the borrower has a low pension and short overall work experience;

- the borrower is disabled or has serious chronic illnesses.

Required documents

For both mortgage lending and non-targeted Pension loans, there is the same package of required documents, as well as various additional documents for a separate loan.

General package of documents:

- Application with personal data;

- Passport of a Russian citizen or other identity document approved by the bank.

- Military ID for men over 27 years of age;

- Marriage registration documents, if available

- Documents confirming the upbringing of minor children, if any;

- Documents confirming financial status and employment.

To obtain a mortgage from the bank, the borrower will also need additional documents for the property provided as collateral, depending on its type and purpose:

1. For a loan for the purchase of an apartment, land plot or residential building with a land plot, you will need:

- Documents confirming ownership of real estate (certificate of state registration);

- Extract from the Unified State Register of Rights (Unified State Register of Rights) for real estate and transactions with it (valid for 1 month);

- Conclusion of an independent expert on the assessment of the collateral value of the purchased property relative to the market value at a given time.

- An extract from the house register or a certificate of family composition (valid for 10 days);

- Notarized consent of the spouse to transfer the purchased property as collateral to the bank (if there is an official marriage);

- Passport for future real estate with BTI (cadastral).

2. For a loan for participation in shared construction and the purchase of housing in a new building:

- Documents to establish the legal actions of the developer;

- A document confirming ownership of the plot or the right to lease this plot of land;

- Extract from the Unified State Register of Rights (Unified State Register of Rights) for real estate and transactions with it in relation to the land plot on which construction is being carried out (valid for 1 month);

- Permission to build a new apartment building on the provided land plot;

- Project of a future apartment building and declaration of current construction from the developer;

- Agreement for the borrower's participation in shared construction of a house;

- Notarized consent of the spouse to transfer the purchased property as collateral to the bank (if there is an official marriage).

3. For a loan for the construction of a residential building on your own land plot:

- Documents confirming ownership of this land plot;

- Extract from the Unified State Register of Rights (Unified State Register of Rights) for real estate and transactions with it in relation to the land plot on which construction is being carried out (valid for 1 month);

- Passport for the plot from the BTI (cadastral);

- Financial estimate for the entire construction period and plan for building a house on a plot of land;

- An approved contract for the construction of a house on the site.

Requirements for real estate objects

Today you can take out a mortgage from Rosselkhozbank to purchase any real estate; the bank’s main conditions for lending are:

- Confirmation of the seller's ownership of the property;

- The future property must be owned by the seller for more than 3 years;

- The real estate should not be listed as collateral with the state or another bank;

- The seller must pay all existing utility obligations on his property and any debts on it;

- No types of seizures or confiscations should be imposed on the acquired real estate;

- If the property being purchased has several owners, they must agree to the transaction and be present at it, and the consent of all registered residents is also required.

Requirements for borrowers

Borrowers of a mortgage loan from Rosselkhozbank can be the following:

- whose age does not exceed 65 years at the time of loan repayment (pensioners can take out loans from the age of retirement, from 50 years for women and 55 for men, for a period of no more than 10 years, lending under the “Pension” loan program provides loans up to 75 years );

- having permanent housing registration at the place where the loan was received;

- receiving pension transfers to the Rosselkhozbank account;

- having Russian citizenship, which is confirmed by an official document.

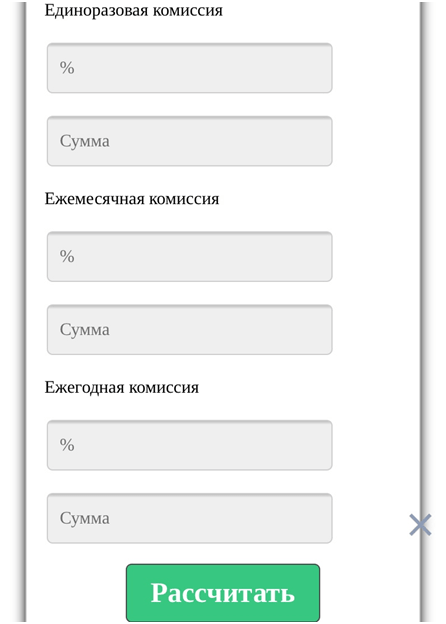

Mortgage calculator

A mortgage calculator is a standard program that is needed to assess the status of cash payments. The service helps you independently determine the profitability and feasibility of lending. A citizen will understand how beneficial a loan is in this situation. In addition, it will assess all financial risks. The following information is used to determine data:

- the full amount of the property being purchased;

- duration of the loan agreement;

- possible additional interest and commissions;

- debt elimination plan.

Please fill out all fields to get accurate information. Now, the system will provide a payment schedule.

Required documents

To formalize the contract, you will need to provide a list of documents. Without them, the credit institution will not consider the request of an elderly person. Before visiting the office, collect all necessary originals or copies. Check with a representative in advance. Call support and find out detailed information. Main list:

- passport (original and copy);

- official application for obtaining a mortgage;

- statement of current income, according to form 2-NDLF;

- a certificate from the pension fund indicating the money;

- documents on living space as collateral. The deposit is determined depending on the type of property;

- real estate insurance.

In addition, in rare cases, Rosselkhozbank requires additional information and certificates. Most often this is:

- marriage certificate and documents of the husband or wife;

- statement of income of the client and his spouse;

- documents confirming the absence of criminal records and litigation.

What does the bank require?

is issued if the future borrower meets the age requirements, and also:

- is a citizen of Russia with registration of residence/stay;

- has at least one year of work experience out of the 5 years preceding registration, and at least six months at the current place of employment, and for salary recipients in a bank - at least 3 months.

For pensioner borrowers who are not engaged in work, the bank has no length of service requirements.

To apply for a mortgage at Rosselkhozbank, pensioners under 75 years of age must submit the following documents:

- ;

- passport or identity document;

- for men liable for military service - military ID or registration certificate;

- documents on marriage and birth of children;

- copies of documents confirming work activity and length of service;

- document confirming income (for example, or).

A similar package of documents is provided by the co-borrower.

Requirements

Rosselkhozbank provides a list of requirements to all clients. Special attention is paid to elderly people. The bank faces many risks when issuing funds to such applicants. Main conditions:

- At the time of full repayment of the debt, the client’s age must not exceed 75 years.

- The applicant must be a permanent resident of Russia.

- At the same time, have citizenship of the Russian Federation.

- The client must have additional income in addition to the pension.

- Adding guarantors. This person is not necessarily a close relative. The main thing is that he is solvent. Certificates are required for confirmation.

- The Applicant does not have any negative credit experience. The last few decades are taken into account.

In addition, special conditions apply to real estate. In particular:

- living space is not an element of any collateral;

- the apartment was owned by the previous owner for about 3 years;

- there are no debts to utility services;

- the property is not subject to court cases and is not seized;

- The block is sold with the consent of all owners.

Requirements for borrowers

Rosselkhozbank has special requirements for pensioners who plan to take out a mortgage. The maximum age of the client at the end of the contract is 75 years. Registration is required on the territory of the Russian Federation at the place where the loan was received; Russian citizenship is required.

The bank checks the stability of income that does not relate to pension accruals (all documented sources of income). When a mortgage is issued to a married couple, their monthly earnings are analyzed. A good credit history over the past few years is required. It is important that the pension is transferred to an account at Rosselkhozbank.

Failure Cases

A credit institution refuses an applicant in several cases:

- the borrower does not meet the parameters;

- the applicant has no relatives or family;

- the citizen refuses to draw up an insurance policy;

- has a criminal record;

- the client has no income and does not receive a pension from the company;

- borrower without real estate as collateral.

Thus, any pensioner can become a client of Rosselkhozbank. To obtain a positive result, a person must meet the requirements of the company. You can repay the loan at your discretion. If you make a payment ahead of time, the fees do not increase. A mandatory requirement is to issue an insurance policy.

Possible reasons for refusal

The bank may refuse for several reasons. Considering the requests of older people, refusal may be associated with health problems. Banks categorically do not lend to citizens with oncology, diabetes mellitus, or people with disabilities. According to the charter, the bank may not disclose the reason for its refusal. Such borrowers are not given credit, since it is believed that a person spends most of his income on treatment; for the bank, the risks of losing the borrower or his payments are too high. If the client is admitted to the hospital, he may not pay the fees.

The age of the borrower is also a limitation. If the client did not take into account the loan repayment age in the application, the bank will refuse or offer to shorten the loan term. If the borrower has not fulfilled one of the conditions of Rosselkhozbank regarding old age: submitted an application without a co-borrower who will be under 65 years of age at the time of repayment or will pay half of the loan by the age of 65 years.

In addition, the bank may consider the pensioner insolvent. This happens when there is a small pension and no additional sources of income. A loan cannot be issued if after payment the pensioner has an amount less than the subsistence level. For many citizens, their pension is paid a little more than the minimum wage, but since taxes are then deducted from it, what remains is even less than the minimum subsistence level. With such income, you can’t really count on a loan.

In case of refusal, you can contact a credit broker ➦ dom-bydet.ru. These are experts who can help you get a mortgage in difficult circumstances. For example, a pensioner has an additional source of income, but he cannot confirm it. A broker can select the best bank, as well as advise the borrower on the pros and cons of a particular bank, and take into account the nuances. You can also get help in preparing documents and maximize your chances of having your application approved, since the company cooperates with leading banks and knows their requirements.