On what terms are loans issued by Sovcombank on the primary market?

Sovcombank offers several loans for the purchase of primary housing, including:

- New building , issued under standard conditions.

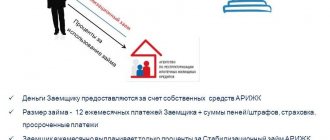

- Subsidy 2018 – the state helps in purchasing housing.

- Commercial real estate - the program is designed for medium and small businesses.

Expert opinion

Zadorozhnaya Irina

Sovcombank employee

Ask a Question

Among all, the most profitable lending program is “Subsidy 2018”. After all, it is here that the borrower can count on the minimum rate of 6% . However, it is important to remember that the credit limit in this case is small - 12 million rubles.

Mortgage conditions from Sovcombank for housing in a new building:

- Minimum annual interest from 10.9%.

- The loan is issued for a period of up to 30 years.

- Credit limit up to 30 million rubles.

- The maximum age of the borrower is 85 years.

Note! No proof of income.

Loan program "New building"

A mortgage is one of the most convenient ways to purchase a home. Sovcombank is trying in every possible way to facilitate the purchase of real estate on the primary market.

The “New Building” loan is issued under the following conditions:

| Program conditions | |

| Maximum loan term | Up to 30 years old |

| Interest rates | From 10.9% |

| Credit limit | Up to 30 million rubles |

| An initial fee | Minimum 10% of the total cost of the apartment |

| Age limits | From 20 to 85 years |

| Issued for purchase | Apartments in new buildings or apartments |

Among the features of this type of lending, we can note the minimum package of documents that must be provided to the bank when applying for a mortgage.

Remember ! The “New Building” loan is also available to pensioners, and they can apply directly on the website.

In this article we talked about available loan programs for pensioners.

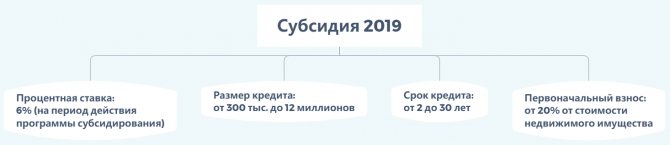

Subsidy 2020

The Subsidy 2020 loan is one of the most profitable mortgages offered by Sovcombank, since it is here that the client can count on the lowest interest rate.

The table below provides current information on the conditions under which loans are issued for the purchase of housing under the Subsidy 2020 program.

| Program conditions | |

| Credit limit | For the Moscow region and Moscow: up to 12 million rubles; |

| For other regions of Russia: up to 6 million rubles | |

| Mortgage term | From two to 30 years |

| Down payment | Minimum 20% of the total value of real estate |

| Age limits | From 20 to 85 years |

| Target orientation | The money can be used to purchase an apartment |

The advantages of this mortgage program include::

- Four co-borrowers are allowed on one loan.

- Can be taken not only by individuals, but also by legal entities.

- A mortgage application is reviewed within one day.

- Opportunity to receive bonuses from partner companies.

- Payments to the seller can be made in secure ways (letter of credit, cashless transfers).

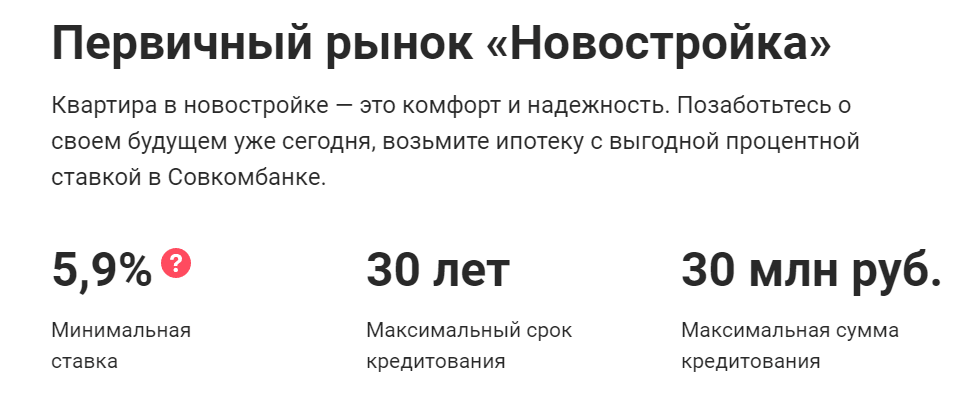

Mortgage for the primary market “New building”

First, let's look at the mortgage offer for new buildings.

- Loan size:

300,000 – 30,000,000 rubles - The maximum age of the borrower is 85 years

- Loan term:

from 1 year to 30 years - Minimum bid – 5,9%

- Currencies in which the loan is provided – Russian ruble (RUB)

Description of the general conditions for the mortgage of new buildings: General conditions.pdf

Great Rate Guaranteed

Take the opportunity to recalculate your loan at a more favorable interest rate: activate the “Excellent Rate Guarantee” program1. With the “Excellent Rate Guarantee” program, it is possible to recalculate interest from 5.9% (7.9% for secondary) per annum. The program is available to owners of the Halva Installment Card.

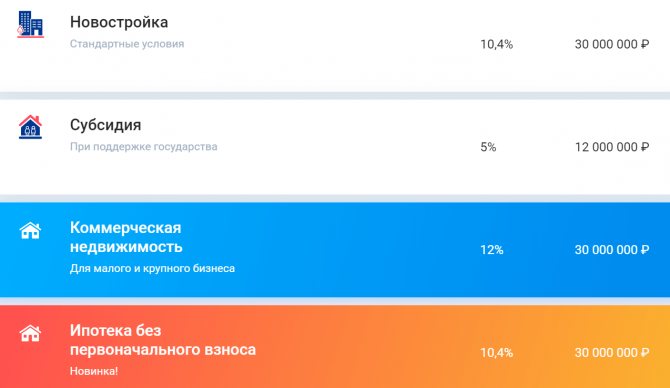

The mortgage program for new buildings includes 3 types:

- New building . Standard conditions for individuals and individual entrepreneurs.

- Subsidy . State-supported subsidy program.

- Commercial real estate . This program is designed for small and large businesses.

New building

Let's consider the most popular program for individuals and individual entrepreneurs. The conditions are as follows:

*Take the opportunity to recalculate your loan at a more favorable interest rate: • activate the “Excellent Rate Guarantee” program1. With the “Excellent Rate Guarantee” program, it is possible to recalculate interest from 7.9% per annum. The program is available to owners of Halva installment cards.

1 The cost of the service is 2.9% of the loan amount. Conditions: service validity period – 3 years; presence of Fin. protection, absence of delays and partial/full early repayment of the loan throughout the entire period of validity of the service, and at least one purchase was made monthly using the Halva Installment Card. Recalculation of interest - at the end of the service period, the difference between paid and calculated interest is returned to the account.

- List of documents for submitting a loan application:

- Application form

- Copy of all passport pages

- A copy of the work record, certified by the employer

- Certificate of income

- Second document*

*SNILS, TIN, driver’s license, military personnel ID, military ID, foreign passport, pension certificate

Mortgage for secondary housing

At Sovcombank, mortgages are issued on the secondary market on very favorable terms and with a low annual interest rate.

In addition, this banking company offers several loan programs, including:

- Tariff “Special” - suitable for salary clients.

- Real estate on the secondary market - this loan is issued on standard terms.

- Commercial real estate - the program is designed for small and medium-sized businesses.

Expert opinion

Alexey Kutepov

Blogger, former employee of Tinkoff Bank.

Ask a Question

The most profitable mortgage is issued under the “Special” program, since it is here that the lowest interest rate is 9%.

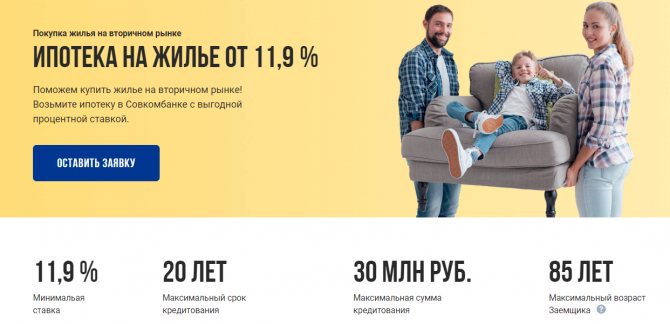

Mortgage terms:

- Annual interest from 11.9%.

- Credit limit up to 30 million rubles .

- The maximum mortgage term is up to 20 years.

- The borrower's age limit is up to 85 years.

Mortgage for the purchase of housing on the secondary market

This loan program is intended for the purchase of an apartment, as well as apartments on good terms.

You can get a mortgage under these conditions:

- The first payment starts from 10% of the total amount.

- The maximum loan size is up to 30 million rubles.

- Loan term up to 20 years.

- The target orientation of the mortgage is available for the purchase of apartments, as well as apartments.

- Age range – from 20 to 85 years.

Advantages of this mortgage:

- Can be issued by both individuals and individual entrepreneurs.

- The application is reviewed within one day.

- Low down payment.

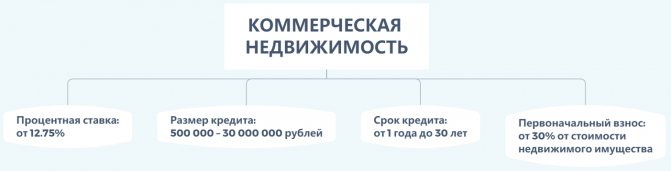

Mortgage for the purchase of commercial real estate

This loan program is designed to purchase commercial real estate on the secondary market.

It is issued under the following conditions:

- Annual interest from 12.75%.

- The down payment on the loan is at least 30% of the total cost.

- Credit limit up to 30 million rubles.

- The borrower's age must be from 20 years to 85 years.

- Mortgages are available for the purchase of non-residential rooms located on the ground floor of an apartment building.

Note! Lending is available to all entrepreneurs.

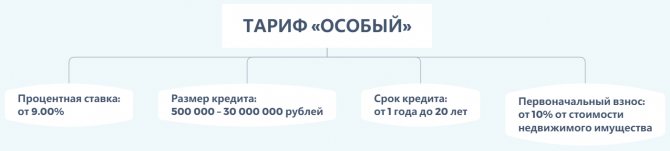

Tariff "Special"

In this case, the mortgage can be used to purchase housing on the secondary market under the following conditions:

- Annual interest from 9%.

- The maximum loan term is up to 20 years.

- The maximum mortgage amount is up to 30 million rubles.

- Down payment from 10% of the cost of housing.

- The funds can be spent on purchasing apartments or apartments.

Important ! This is one of the most profitable loan programs, which is issued for the purchase of housing on the secondary market, as it has the lowest annual interest rate.

Sovcombank mortgage: online application

Unfortunately, it is impossible to know for sure whether the bank will approve a mortgage. Banks reserve the right to refuse to issue a loan without explaining the reason. Therefore, in order not to waste your time, Sovcombank offers to apply for a mortgage online. To do this, just go to the Sovcombank website and send the completed application form. After consideration, a representative of the bank will contact the applicant, who will announce a preliminary decision and invite him to the office with documents. The final decision will be made after the client submits all the necessary documents to the lender.

Conditions for obtaining a mortgage

Individuals who meet the requirements established by the organization can take out a loan from Sovcombank using an online mortgage application. Today banks, including Sovcombank, look at the age that the borrower will reach by the time the loan is fully repaid. In this case, it should not exceed 85 years. The minimum age of the borrower is 20 years. The bank considers both ordinary individuals and the category of individual entrepreneurs and business owners. Mortgage loans are issued only to Russian citizens. In this case, an individual must have permanent or temporary registration and work experience. In total, the borrower must have at least 1 year of official employment and at least 3 months in the place where he is currently employed. But there is a nuance - persons who have confirmed their income may not present work experience. Individual entrepreneurs and business owners must have been operating for at least a year.

What requirements does Sovcombank put forward for the borrower, as well as the property being purchased?

In order for a client to obtain a mortgage from Sovcombank, he must meet the requirements put forward by the bank :

- Availability of Russian citizenship, as well as permanent registration.

- The client must be at least 21 years old.

- Official employment, as well as at least three months of work experience at the last place of work.

There are also certain requirements for property that acts as collateral:

- The residential property must be located in an apartment building in Moscow or the Moscow region.

- The apartment should not be in disrepair or located in a building that is on the demolition list.

- If a mortgage is issued for an apartment in a new building, then the house must be completed, and the borrower must have documents confirming his ownership.

Real estate requirements

An apartment, house, non-residential premises, or apartments purchased on credit must meet certain conditions:

- the maximum wear level is 50%;

- lack of wooden floors;

- the redevelopment has been documented;

- absence of defects on the walls of the house - cracks, screeds;

- gas equipment is located in the kitchen, and any movement of it is documented.

The mortgage will not be approved for emergency housing, sealed, for which litigation is ongoing, and also if the living space is subject to demolition or reconstruction. The apartment or house must not be collateralized by another credit institution. Until the debt obligations to the bank are fully covered, the apartment will serve as collateral.

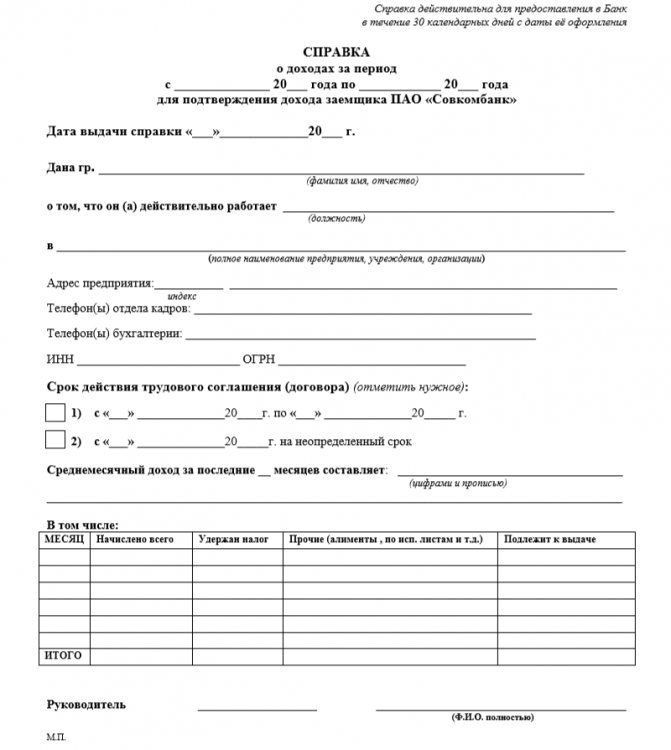

What documents need to be prepared to get a mortgage from Sovcombank?

In order to receive a positive response, the client must prepare a complete package of documents:

- Original Russian passport, as well as copies of all completed pages.

- A document that confirms the client's income.

- A copy of the work record book, which must be certified by the employer.

- International passport, SNILS or driver's license.

- Official papers that confirm ownership of real estate.

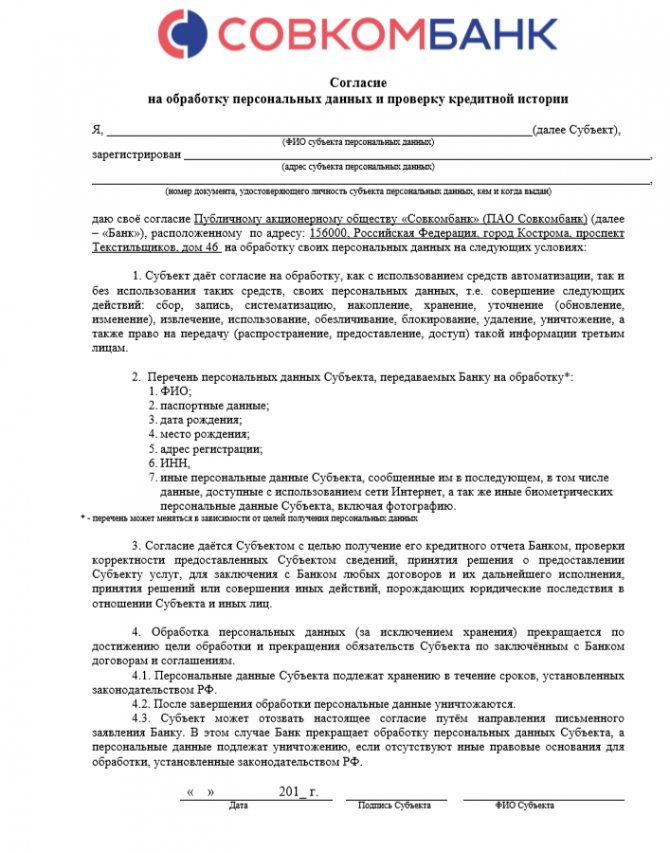

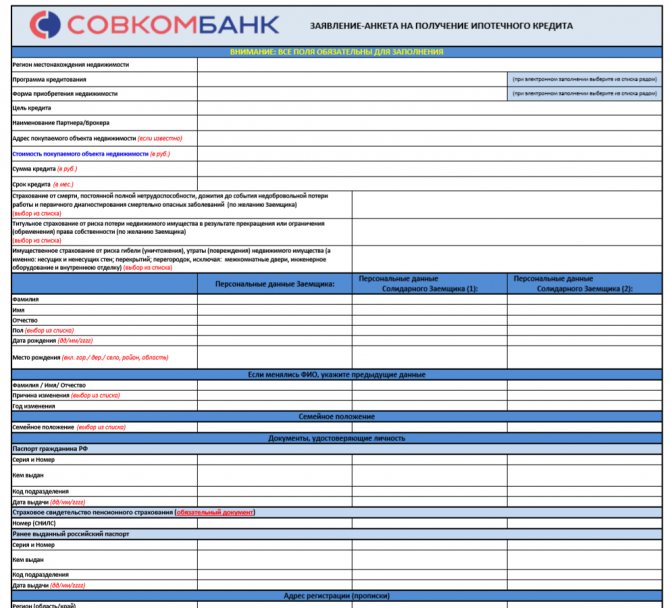

Certificate of income according to bank form

Consent to the processing of personal data

Borrower questionnaire

Note! Pensioners are required to provide a pension certificate.

It is also important to remember that all persons under the age of 27 are required to provide a military ID to the bank. If there are no documents that can confirm the deferment, then you can only get a mortgage if you provide a co-borrower.

For individual entrepreneurs, you will need a different package of documents, which includes:

- Certificate of registration as an individual entrepreneur.

- Tax return, which contains a note about the payment of taxes for the reporting period.

- TIN.

Important ! Applying for the loan program “Loan for the purchase of housing” is possible using two documents: a Russian passport, as well as a second document of the borrower’s choice.

But, despite this, Sovcombank has the right to demand other official papers.

Mortgage terms

Sovcombank provides an opportunity for adult Russian citizens who are employed and have a stable income to take out a loan to purchase housing with minimal requirements.

Today you can get a Sovcombank mortgage for individuals under the following conditions:

- minimum loan amount – 500 thousand rubles;

- maximum amount – 30 million rubles;

- loan term – from 12 months to 20 years;

- the interest rate for an apartment in a new building is 11.4%!;

- interest rate on secondary housing - 11.9%! - 16.9%!

The borrower can apply for a mortgage loan directly on the bank’s website sovcombank.ru. To do this, he needs to fill out the form correctly, providing his basic personal data for processing: full name, date of birth, place of residence, passport information, employment information, contact information. After this, a bank employee will call you back and announce a preliminary decision. If it is positive, the potential client will be invited to the bank branch with a full package of documents.

Required documents

An advantageous distinctive feature of a loan for the purchase of a residential property from Sovcombank is that it is provided with only two documentary acts. A Sovcombank mortgage requires two documents to be presented to the organization:

- ID card of a Russian citizen (RF passport);

- second document to choose from: tax registration act, military ID, driver's license, international passport, pension book.

In addition, the borrower may be additionally asked for: an act in form 2-NDFL, a copy of the completed pages of the work book.

However, this list is valid only for the borrower. The seller of real estate (if we are talking about buying a secondary home) will also need certain documents, namely:

- Passport of a citizen of the Russian Federation;

- an act stating that the object is registered as a property;

- purchase and sale agreement (donation agreement, inheritance agreement, privatization agreement, etc.);

- excerpt from the house register;

- paper confirming the absence of utility debts;

- other documentation.

Post Bank and VTB 24: are they the same bank or not?

The bank can expand or simplify the above list at its discretion.

How to apply for a mortgage at Sovcombank?

It should immediately be noted that the application can be submitted both through a Sovcombank branch and through the official website.

Video on the topic:

If you use the second method, you will need to provide some information in the form.:

- The required loan amount.

- Client's age.

- Salary level (reliable information must be provided here, since in certain cases Sovcombank requires proof of income).

- For how long is the loan required?

After the application has been reviewed, the bank manager will call you back and inform you of the bank’s decision. At the same time, you can get detailed advice regarding lending from Sovcombank, as well as the established interest rate.

How to apply for a mortgage

You can contact Sovcombank for a mortgage:

- by visiting a bank branch;

- by filling out a special form on the lender’s official website.

After consideration of the appeal, a preliminary decision will be made. If it turns out to be positive, you need to collect a package of documents and submit an official application. This can only be done at a Sovcombank branch; online submission is not provided in this case.

The final decision on the application and the conditions for granting a mortgage is made after analyzing the submitted documentation.

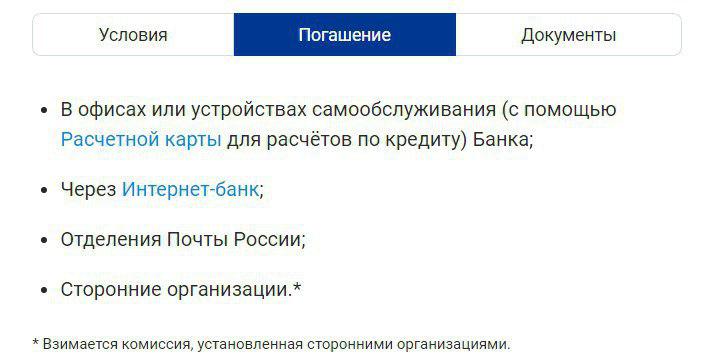

How to pay off mortgage debt?

Sovcombank offers its clients several ways to make the monthly mandatory payment:

- Through the bank's cash desk, at any nearest branch.

- Through an ATM of Sovcombank or its partner.

- At a Russian Post office (but in this case it is necessary to take into account the period for crediting funds to the account).

- By making a transfer from the card.

- Using Internet banking.

Payment options for monthly loan payments

Is it possible to pay off a mortgage early?

Do you intend to pay off your mortgage early?

Not really

Many Sovcombank clients are interested in this issue, and therefore it is worth considering in more detail.

It is worth saying right away that early repayment of the mortgage is possible and this is provided for in the loan agreement. But in order to do this, you must personally visit a Sovcombank branch and write a corresponding application.

In 2020, there are two types of early repayment: partial and full. In both cases, this involves recalculating the mortgage and making appropriate changes to payments.

Note! According to Russian legislation, Russians who took out mortgages for the first time have the right to receive a 13% tax back.

This deduction is formed from two components:

- 13% of the total mortgage amount - paid once and only if the loan amount is less than two million rubles;

- 13% of the amount of interest paid on the loan - repayment occurs only after the mortgage is fully paid.

Conditions

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Before submitting an application, you must carefully study the conditions for providing a mortgage product for citizens of retirement age.

The bank is ready to provide funds for the purchase of:

- apartments, both in new buildings and on the secondary market;

- non-residential premises;

- apartments

It is also necessary to take into account that the bank cannot provide a mortgage loan in all regions. You can get the necessary information by calling the hotline or on the lender’s official website.

Conditions for granting a mortgage loan on general terms:

| Currency | All contracts are concluded in Russian rubles |

| Sum | The minimum amount for a mortgage product is 500,000 rubles. Every citizen of retirement age can apply for a maximum limit of 20,000,000 rubles. |

| Term | Loan funds are issued for a period of up to 20 years |

| An initial fee | The down payment amount ranges from 20% to 40%, depending on the loan program. |

| Interest rate | The interest rate on the loan is set individually for each borrower and ranges from 11.40% to 16.90%. Typically, the interest rate depends on the type of property being purchased and the size of the down payment. |

| Repayment schedule | The lender offers only an annuity method of debt repayment. This means that the borrower must make payments in equal installments throughout the term of the mortgage agreement. |

| Fines and penalties | The agreement provides for additional payments, in the form of penalties and fines, for missing a monthly payment. |

| Application processing time | This is the only bank that is ready to announce a decision within 1 hour, after receiving the entire package of documents. |

| Partial repayment | Each client can use the partial early repayment service. In this case, the financial company can recalculate and:

Which option to choose is up to each borrower to decide for himself. |

| Early repayment | The borrower can repay the debt at any time without penalties. |

| Insurance | According to the lender’s terms, each borrower must issue two insurance contracts and insure:

|

As for the insurance contract, it is concluded for the entire term of the loan agreement. The insurance protection agreement is accompanied by a schedule of mandatory payments, according to which the borrower must pay for insurance services every year. The insurance contract can only be terminated if the debt on the mortgage product is fully repaid.

Reviews about Binbank's mortgage can be found in the article: Binbank's mortgage. Features of DeltaCredit Bank's mortgage are discussed here.

Mortgage from Sovcombank: advantages and disadvantages

The advantages of mortgage lending from this bank include:

- High credit limit up to 100 million rubles.

- Minimum rate from 8.8%.

- It is possible to reduce the annual interest rate.

Among the shortcomings:

- Typically, only residents of the Moscow region and Moscow can take advantage of a mortgage.

- If you take out a loan for a short period, the annual interest is several times higher.

- The advertisement says that the mortgage is issued based on two official documents, but in reality they may request more documents.

Mortgage interest rates

Since the interest rate is of greatest interest to potential borrowers, this is where you should focus the most attention. According to the current mortgage offer at Sovcombank, lending conditions can be divided into 2 large groups, depending on the developer chosen by the client.

If it turns out to be a partner of a credit institution:

- the minimum rate when purchasing an apartment will be 7.9% (if the down payment is 15%);

- the lowest loan cost for those who bought apartments is set at 10.9%.

If real estate is not purchased from partners, borrowers should expect the following minimum rates:

- 7.9% when buying an apartment;

- 10.9% when choosing apartments;

- 12.5% for commercial real estate (down payment from 50%).

It is important to add that before the collateral documents are transferred to the bank, the interest rate will be half a percent higher, so you should not delay in registering the collateral and preparing the documents.

Customer Reviews

Kirill, Moscow : “I live in Moscow, when I needed a mortgage I decided to contact Sovcombank. I collected all the documents (I needed not only a passport, but also other official papers). I waited for a response for several days, but then the manager called back and said that my application had been approved. We were invited to the nearest branch to complete paperwork. The bank employee advised me on all issues.”

Nikolay, Ufa : “I wanted to get a mortgage from Sovcombank secured by real estate, but I was refused, since this service is only available to residents of Moscow and the Moscow region. I had to apply for a loan on other terms, since it is not possible to get a loan without a down payment.”

Galina, Moscow : “My husband and I took out a mortgage under the Subsidy 2020 program for maternity capital. I liked the terms of the loan, since it really has the lowest annual rate. But in order to get it we had to collect quite a lot of documents. We also took out property insurance and reduced it by 0.12%.”

The procedure for obtaining a mortgage for pensioners at Sovcombank for the purchase of an apartment

The entire registration procedure consists of several main stages.

To obtain a mortgage loan, a pensioner will need:

- Prepare a package of documents

To receive a loan, you must prepare a complete package of documents. Only if the complete package is available, the lender accepts and considers the application.

- Decide on a property

Each borrower must tell the financial company what kind of real estate they plan to purchase. Therefore, you will need to look at the property in advance and find out its value.

- Make a request

You can submit an application only at the office of the financial company. A company employee will accept all the necessary documents, ask you to fill out a special form and send all documents for review. In practice, the decision is made within 1 business day.

- Sign a loan agreement

As soon as a positive decision is received from the financial company, you will need to agree on the time of the visit and contact the office to sign a loan agreement. Before signing, you will need to make a down payment and obtain insurance.

At this stage, there is no need to rush, as you should carefully read all the terms of the loan agreement. Pay special attention to payment deadlines and penalties.

- Obtain a certificate of ownership

As soon as the loan agreement is signed, the bank will transfer the funds to the property seller. Then all that remains is to obtain a certificate of ownership and promptly make payments on the loan.