Refinancing a mortgage at Sberbank in 2020 is an opportunity to reduce the interest rate on the loan, significantly reducing overpayments. Re-registration with the inclusion of preferential programs and subsidies from the state is especially beneficial.

It is important to consider that only mortgages from other banks are subject to refinancing. Sberbank offers only restructuring services to its clients who have taken out a mortgage loan.

Before submitting an application for refinancing at Sberbank, it is very important to calculate your own benefit so that the procedure minimizes the credit burden on the borrower.

Interest rates for mortgage refinancing provided by Sberbank

From January 14, 2020, Sberbank changed the terms of mortgage lending, in particular, this concerns the interest rate:

- for a down payment over 20% it increased by 1 point;

- payments less than 20% increased by 1.2%.

The increase did not affect only preferential programs: “Military Mortgage” and “Mortgage with State Support for Families with Children.” The changes did not affect the mortgage loan refinancing program.

The conditions for refinancing a mortgage at Sberbank depend on the fact of registration of the loan.

| Goals | Rate before confirmation of repayment of refinanced mortgage | Rate before confirmation of loan repayment | Rate after confirmation of repayment of all loan products |

| Before registering a mortgage | |||

| Mortgage | 12,9% | — | 10,9% |

| Mortgage + consumer loan + car loan + credit card + cash | 13,4% | 12,4% | 11,4% |

| Mortgage + cash for own purposes | 13,4% | — | 11,4% |

| After registering a mortgage | |||

| Mortgage | 11,9% | — | 10,9% |

| Mortgage + consumer loan + car loan + credit card + cash | 12,4% | — | 11,4% |

| Mortgage + cash for own purposes | 12,4% | — | 11,4% |

Expert opinion

Irina Bogdanova

Work experience at Sberbank for 12 years.

Before applying, it is important to calculate whether refinancing a mortgage specifically at Sberbank is profitable: it is necessary to take into account all the associated costs, and not rely only on the interest rate.

Requirements for the borrower

Before re-registration, the applicant must meet the basic requirements:

- Age restrictions: from 21 to 75 years at the end of the loan term.

- Total work experience is over 1 year, and at the current place of work – from six months. For persons receiving wages on a Sberbank card, this requirement does not apply.

- Having Russian citizenship.

- No permanent arrears on existing loans.

- Since only an individual can refinance a mortgage at Sberbank, he needs to confirm his permanent income with a 2-NDFL certificate.

All data is indicated when filling out the application form.

Refinance Mortgage Requirements

You can refinance a mortgage at Sberbank if the borrower meets the following conditions:

- There are no arrears on the mortgage loan within the last 12 months.

- The validity period of the agreement from the beginning of its signing is at least six months. At least 3 months before completion of mortgage

- The mortgage has not previously been subject to refinancing or restructuring.

- The borrower agrees to re-issue the insurance contract.

- The mortgage was issued for new or secondary housing, and not for a building under construction.

Requirements for the collateral

Mortgage refinancing provides for certain requirements for collateral real estate:

- The purchased apartment must already be put into operation by the buyer.

- The borrower is required to provide Sberbank with a certificate of ownership of the property.

- The collateral must be the subject of a mortgage from the primary lender.

- Sberbank requires real estate to be re-registered as collateral after the encumbrance is removed and the primary loan is repaid.

- When providing collateral with other property that is not the subject of a mortgage loan, it should not have any encumbrances in favor of third parties.

What does the interest rate at Sberbank depend on?

Above, the loan conditions indicated minimum and preliminary rates, which not all borrowers will be able to receive. The percentage for each client is determined by the bank personally and depends on several factors:

- Specific loan program. Each product has certain conditions.

- Borrower categories. So, if this is a salary client, then he may well count on a favorable minimum rate.

- Insurance. The collateral is required to be insured, but if desired, the borrower can insure health and life. And agreeing to personal insurance can lower the bank's rate.

- Transaction stage. So, after official documentary confirmation of debt repayment, the bank lowers the rate.

To find out the final rate available to you, you can use an online calculator to calculate it or get advice from a bank credit manager.

What are the benefits of mortgage recalculation?

Refinancing a mortgage at a lower interest rate entails additional costs in the form of issuing an insurance policy or registration costs. Therefore, it is important to calculate your own benefits from refinancing in advance.

Three main options when it becomes profitable:

- Great body of credit. Taking into account that the rate will decrease by only 0.5-1%, the overpayment will decrease several times due to the large balance amount.

- Long loan term. Interest is paid first, followed by the body of the loan. Therefore, early repayment from the primary lender is more profitable at the initial stages with a long term.

- High mortgage rate. Even 1% significantly reduces overpayment.

Many borrowers take out a mortgage from another bank without considering the associated costs, but these are the costs that determine the savings when refinancing.

Table 2.

| Mortgage debt, rub. | Savings per month, rub. | Re-registration costs | ||

| — 1% | — 2% | — 3% | ||

| 1 million | 500 | 1000 | 1500 | 15500 |

| 1.5 million | 800 | 1600 | 2400 | 21000 |

| 2 million | 1050 | 1600 | 3100 | 26500 |

| 3 million | 1600 | 3200 | 4600 | 37500 |

| 4 million | 2150 | 4250 | 6300 | 48500 |

| 5 million | 2825 | 5560 | 8250 | 59500 |

| 6 million | 3500 | 6870 | 10200 | 70500 |

All data in the table is based on an interest rate of 12.5% before refinancing the mortgage.

You can make the calculations yourself, taking into account the terms of your mortgage loan.

For example, on a loan you have 2,000,000 rubles left to repay within 10 years. When refinancing at Sberbank, the interest rate on the loan will be reduced by 2%. The savings will be 19,200 rubles per year and 192 thousand for the remaining period.

However, insurance and property valuation costs were not taken into account. They are charged one-time and amount to 26,500.

The actual savings when refinancing with Sberbank is 165,500 rubles.

Step-by-step procedure for refinancing a mortgage in 2020

The refinancing process consists of several stages, each of which has its own deadlines and restrictions.

The procedure for refinancing a mortgage at Sberbank

Step-by-step design:

- Calculate the benefits according to Table 2, taking into account all possible costs of re-registration.

- Collect all necessary documents and prepare details of the refinanced mortgage.

- Write an application for refinancing and complete the application online through the official DomClick portal. Review from 5 to 10 days.

- If you receive a positive decision, send the documents for the property to the bank and order its appraisal. It lasts about 3-5 days. A complete set of documents with an assessment is reviewed within 5 days.

- Applying for a loan under the refinancing program at 12.9%. The previously obtained mortgage can be closed; the amount issued will be enough to completely liquidate it.

- Write an application for early repayment of the mortgage and transfer the entire amount to the bank, and after closing it, issue a certificate of no obligations, which, according to the rules of refinancing, must be sent to Sberbank within 60 days from the date of receipt of the loan.

- With a mortgage received from a bank, you must contact Rosreestr to remove the encumbrance. Registration takes 2-3 days.

- Registration of the transaction and signing of the mortgage agreement. At this stage, the rate is reduced by 2 points.

Approval of application and pledge

Review of the application and its approval lasts from 5 to 10 days, depending on the requested amount, the availability of special preferential programs or the borrower’s credit history. The bank’s response is influenced by: the loan term, wages and the number of dependents the clients have.

The collateral in the refinancing program is the most important component that can cause the application to be rejected:

- “Small families” cannot become the subject of collateral.

- The interfloor floors of real estate must be reinforced concrete or metal, but not wood.

- Apartments with non-standard features (for example, the presence of niches imitating doors/windows) are not suitable.

- The building has a separate kitchen and bathroom, heating and water supply systems function properly.

How to get a low interest rate when refinancing with collateral

How to refinance with the lowest interest rate possible? Sberbank does not offer minimum interest rates to everyone, and in order to take out a profitable loan, it is best to contact a broker who will provide intermediary services and select the best option.

The LEGKO-ZALOG company provides assistance to any clients, even those without a stable official income and with a damaged credit history. The terms of a secured loan in Moscow will be better than in many Russian banks:

- Maximum amounts - up to 100 million.

- Flexible terms - up to thirty years.

- Low rates - minimum 9% (during promotions - from 7.5%).

- Prepayments, income certificates and guarantors are not required.

It is possible to obtain a loan before selling real estate, taking an advance before registering a transaction, as well as re-pledge (re-pledge).

List of documents for refinancing a mortgage at Sberbank

To apply for mortgage refinancing, you need the following documents:

- Passport of a citizen of the Russian Federation.

- Completed mortgage refinancing application.

- Documents confirming the borrower's official employment and the presence of a permanent income: a certificate in the form of a bank or 2-NDFL, a copy of the work book certified by the employer.

- Information on a refinanced mortgage loan. The bank requires a loan agreement from the primary lender.

- Statement of the balance of mortgage debt.

- Certificate of presence/absence of overdue debt for the last year.

- Documents regarding the property provided as collateral. A complete list will be provided after the application is approved.

The bank has the right to require additional certificates and statements that are not included in the main package of documents for refinancing.

Sample application for refinancing a mortgage loan

First, you need to enter all the borrower’s information. The reliability of the information provided is an important component on the path to a positive decision.

It is necessary to fill out all fields of the form in full accordance with the bank’s requirements: indicate the amount of wages according to 2-NDFL and the loan amount.

Print out the completed form, sign and send it to the bank.

“Portrait” of a borrower for on-lending at Sberbank

What should a borrower plan to refinance a loan be like? The bank imposes the following requirements on all clients:

- a certain age: at the time of issuing the loan - no younger than 21 years, and at the time of full repayment of the debt under the agreement - no older than 75 years;

- registration at the place of stay or residence;

- duration of work experience: from six months at the current current place and from one year for the past five years (this requirement does not apply to salary clients who receive earnings to a bank account or card);

- attracting as a co-borrower a citizen who participated directly in the processing of the previous loan, as well as a second spouse (unless other conditions are provided for in the marriage contract).

Failure to meet these requirements may result in the bank refusing to issue a loan.

Advantages and disadvantages of refinancing a mortgage at Sberbank

Refinancing a mortgage loan is not without its advantages and disadvantages.

Advantages

Main advantages:

- Reducing the mortgage rate and, as a result, reducing the amount of overpayment. The client partially relieves the credit burden, easing his financial situation. In this case, it is important to calculate your own benefit, because a decrease in interest rate entails associated costs.

- The ability to combine existing loans and mortgages into one common loan, which can be repaid once a month.

- By reducing monthly payments, the borrower can allocate money for personal needs.

- It becomes possible to pay for a loan without commission through Sberbank Online.

Flaws

Cons of refinancing a mortgage:

- If the approach is incorrect, the borrower will suffer losses already at the registration stage. Refinancing requires costs for appraising an apartment or house, purchasing a new life and health insurance policy for the client. It is also worth taking into account the time spent on re-registration (time off and vacation at your own expense).

- Some lenders prohibit prepaying your mortgage before a certain date. The borrower will have to challenge the legality of their actions.

- Inability to refinance legal entities. The program is available only to individuals.

Expert opinion

Irina Bogdanova

Work experience at Sberbank for 12 years.

The main disadvantage of refinancing a mortgage at Sberbank is the loss of the opportunity to receive a tax deduction on real estate. The state provides the right to return 13% of the funds spent on the purchase of housing and interest on the loan. However, there is a limitation - the taxable amount does not exceed 2 million rubles from the cost of the apartment and 3 million from interest paid. The amount of the refund depends on the amount of the borrower's salary.

First of all, using the property tax deduction, you can reimburse the cost of the apartment, and then part of the mortgage interest paid. However, when refinancing is completed, the mortgage loan from the primary lender will already be repaid, so it is no longer possible to receive a full refund on interest.

A good example: the borrower purchased an apartment worth 1.5 million, for 10 years at 12.5%. The overpayment is 832 thousand. The maximum tax deduction for an apartment is 195 thousand (13% of 1.5 million), and from interest paid 108 thousand (13% of 832 thousand). In total, the state can pay 303 thousand. You can calculate the approximate amount of the deduction using the DomClick calculator.

Let's return to table 2. The borrower refinances in the 6th year of the mortgage. At Sberbank, the rate will be reduced by 2 points, therefore, the benefit for the month will be 1,600 rubles, for the remaining 4 years - 76,800, but you also need to take into account the cost of re-registration in the amount of 21 thousand. The total savings is 55.8 thousand.

In this case, the borrower will lose part of the tax deduction. But, it is worth taking into account that the client has been regularly paying interest on the mortgage for 6 years, which means that he can still receive 13% from them.

It is for this reason that it is very important to calculate your own benefit, taking into account not only the low interest rate, but also the tax deduction and the amount of associated costs. And only after full payment, apply for mortgage refinancing.

What loans can be refinanced?

It often happens that a family, in addition to the mortgage, borrows money for repairs, furnishing an apartment or a car. Over time, circumstances may change (change of job, birth of children) and the loan burden becomes unbearable. To reduce the amount of your total monthly payment, take advantage of Sberbank’s offer - refinancing mortgages from other banks.

The process involves combining several loans into one, which has a reduced rate. As a result, not only the monthly load is reduced, but also the total overpayment on all loans. You can refinance at Sberbank:

- mortgage;

- car loan;

- credit card debt;

- consumer loans.

In addition to reducing overpayments, consolidating multiple loans simplifies the process of paying off debts. A single monthly repayment date is established, transfers are made in one payment, and one account is used. It is easier to monitor the movement of funds, and the costs of insurance under the contract are lower.

Nuances of refinancing a mortgage at Sberbank in 2020

When applying for refinancing, difficulties often arise, especially if it is related to the connection of maternity capital.

In accordance with the law, children and parents must be equal owners of the purchased property, therefore, after repaying the mortgage from the primary lender, the children must be allocated equal shares.

The difficulty of refinancing a mortgage with maternal capital is that banks bear a huge risk associated with the possible termination of payments of monthly contributions by parents. Children are socially protected sections of society, therefore, if arrears occur, the bank will not be able to confiscate the apartment they own under the mortgage to pay off the debts.

It is also quite difficult to use maternity capital after refinancing. The fact is that with on-lending, the purpose of the loan changes from “purchase of residential premises” to “repayment of the borrower’s obligations to a third party (another bank).” According to the law, one can use maternity capital to repay a loan taken to pay off a previously granted loan for the purpose of purchasing or building housing. However, there is a strict rule: a loan from a primary lender and refinancing must be issued before rights to maternity capital arise, i.e. before the birth of your second child!

If the child has already been born, then the parents have to choose:

- use maternity capital from the primary lender and subsequently lose the opportunity to refinance;

- refinance the mortgage and use maternity capital for other purposes.

Similar difficulties arise in almost all benefit programs. The exception was the refinancing of a military mortgage at Sberbank; this procedure is standard and does not have significant nuances.

Loan issuance and rate

The execution of the agreement is carried out only with the full consent of the borrower with the terms of refinancing the mortgage loan at Sberbank.

Particular attention should be paid to the interest rate. When signing an agreement to close the mortgage debt, it will be equal to 12.9%. Only after repaying the loan, completing the registration procedure and signing the mortgage documents, the rate will be reduced to 10.9%.

At the same time, many banks do not limit the borrower; he has the right to refinance again if the most favorable mortgage conditions are available. However, in this case the benefit is important, since re-registration will require additional costs. Judging by customer reviews, refinancing is a procedure that requires greater financial costs than the expected benefits.

Fast mortgage refinancing

Transferring a mortgage to a lower percentage is a long and labor-intensive process that involves investing not only personal funds, but also your own time. That is why offers of quick refinancing from third-party organizations should only raise suspicions.

To speed up the process you need to follow some simple recommendations:

- Check that all documents and details are available.

- Before refinancing, it is advisable to check the quality of your credit history; this can be done for free on the Equifax website.

- When filling out the application, indicate all available sources of income that can be confirmed (renting premises, alimony, co-founding, etc.).

- After receiving approval, do not delay the remaining stages and submit all documents on time.

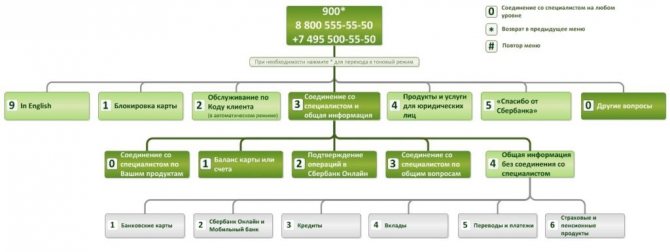

Sberbank's mortgage refinancing hotline is open for clients. Specialists will answer all your questions and help you submit your application.

Nuances when refinancing

Before you refinance, you should be aware of the following:

- This will require certain financial investments - the borrower himself pays for the services of appraisers (necessary to provide the bank with current data on the market value of the object subject to collateral), services of a notary and any other third-party organizations.

- It takes time. If you need to refinance urgently because there is simply no money for the next payment, then refinancing is unlikely to suit you. The process can take at least a month, and sometimes several.

- The bank may refuse at the very last moment. In this case, it is worth having a backup option. Even if your initial application is approved, a refusal may come at the stage of consideration of the collateral property.

- If you have a bad credit history, the bank will refuse you. But other factors may also be the reason for refusal.

The hotline, which operates around the clock: 8 (800) 555-55-50, can help you clarify unclear points in advance.

Why did the bank refuse?

The bank does not explain the reason for the refusal. This is the policy of any bank - this is the so-called trade secret policy, which prohibits disclosing the criteria for evaluating potential borrowers. He refused and refused. But the bank does not hide the fact that there are about 20 parameters by which a potential borrower, as well as a potential co-borrower on a loan, are assessed.

Regardless of why Sberbank refuses, you can resubmit your application after the time specified in the letter accompanying the refusal has expired. Sometimes it is possible to re-apply immediately, but there is little point in this. It's worth waiting at least a couple of months.

Here are a few reasons why you may be rejected:

- The level of monthly income is not suitable,

- No experience required

- Not the right age

- The loan was previously refinanced,

- There are less than 90 days left until the loan is fully repaid,

- And so on.

It is worth remembering that the reason for the refusal could not be you as a potential borrower, but the property or your co-borrower.

Military mortgage

Sberbank is engaged in processing military mortgages from scratch, but does not refinance existing ones. In general, no bank does this. Information has appeared in the media that refinancing military mortgages will become possible from the end of 2017. Until then, the military will have to manage its own accumulated funds only within the framework of the military mortgage program as such.

How many times can you refinance your mortgage?

Only one. Confirmation of this can be found in the conditions that Sberbank imposes on refinanced loans. On the bank’s website it is written that one of the conditions is the absence of restructuring for the entire period of the loan. Just in case, you can ask the hotline managers about how many times you can refinance your mortgage. But we are sure that the answer will be the same - one.

Is it possible to refinance another loan with the same bank that has already undergone this procedure? No.

Does Sberbank refinance its mortgage loans? Yes.

Do I need a deposit?

Yes. Like a regular mortgage loan, a mortgage refinance requires collateral. This capacity is usually the same property for which you took out a mortgage from a third-party bank. Although it is not forbidden to draw up a mortgage lending agreement with the participation of any other suitable property, if you want to leave unencumbered the property that fell under it under the primary agreement (this will allow you to dispose of it at your discretion even before you finish paying off the loan).

To get a loan secured by real estate that is already pledged to another bank, you must first obtain approval for refinancing from Sberbank. He will transfer to the bank's account an amount equal to your debt on the loan, after which it will remove the encumbrance. From this moment on, you can mortgage the property in Sberbank.

Is it possible to use maternity capital?

It is possible if we are talking about taking out an initial loan to purchase a home. With maternity capital, you can also contact the bank to repay part of the principal debt or for early repayment of an existing loan.

But the question of whether refinancing at Sberbank allows you to offset maternity capital remains controversial. There are cases when it was possible to use maternity capital during refinancing, and all of them were resolved through the courts. If you are ready for the legal red tape, you can try it.

How to refinance a mortgage at 6 percent in Sberbank in 2020

Despite the fact that Sberbank has reduced mortgage refinancing rates, they still do not reach the coveted 6%. The lowest rate is available to families upon the birth of a second child and for large families.

Basic conditions for refinancing a mortgage at Sberbank at 6 percent for the second and third child:

- The program is valid from January 1, 2020 until December 31, 2022. It can be extended until March 31, 2025, if the second (or subsequent) child was born in the family between July 1, 2022 and December 31, 2022.

- The maximum validity period of the reduced rate is 8 years. Three years at the birth of the second child, and 5 years are added at the birth of the third. We have devoted separate material to benefits and subsidies for mortgages.

- Only mortgages for housing in new buildings or under construction are eligible for the program.

- The cost of real estate is up to 12 million rubles - for Moscow and St. Petersburg. For other regions – up to 6 million.

- Life and health insurance is a must. Done immediately before refinancing.

- The loan agreement was executed no earlier than January 1, 2020, and the refinancing agreement no earlier than August 1 of the same year.

- Refinancing is possible provided that the second and third baby were born between January 1, 2020 and December 31, 2022.

- Children must have citizenship of the Russian Federation.

- There are no arrears on the refinanced mortgage.

Borrower action algorithm:

- Prepare a complete package of documents, supplementing it with a birth certificate for children in the period from January 1, 2020 to December 31, 2022.

- Contact Sberbank to fill out an application for refinancing under a preferential program.

- Review of the application takes 5-10 days. In case of refusal for a reason not related to the borrower’s credit history, it is necessary to request written confirmation with justification and send it to higher authorities.

conclusions

Every borrower can apply for refinancing, but subject to the established requirements of Sberbank. Before submitting an application, you must prepare a complete package of documents and fill out the application form correctly.

Refusal to refinance may occur not only due to a bad credit history, but also due to a discrepancy between the collateral and the terms of the refinanced mortgage. Most often, it is impossible to change the decision of a banking organization, but sometimes, if an error or typo is made, the application is revised.

Before signing documents for a mortgage, you should weigh the pros and cons, calculate the tax deduction, your own monthly savings and compare both indicators. It is very important to carefully read all the provisions of the contract in order to avoid further difficulties.

All necessary information on mortgage refinancing can be obtained via the hotline or on the bank’s official website.

How to apply for a new loan: instructions for refinancing

Let's consider detailed instructions for refinancing a loan at a bank:

- Preparation of documents. The package includes a completed application form by the applicant, his civil passport, documentation confirming official work activity and financial status (2-NDFL certificate or bank forms, copies of completed pages of the work book or employment contract with management signatures), as well as information on all refinanced loans ( date of conclusion and number of the agreement, its validity period, currency and size of the loan, interest rate, details of the financial organization, as well as the size of one monthly payment).

- Filing an application. It is left either at the branch or from the official website of the bank.

- During submission, some documents are immediately presented.

- The reply is in process. Requests are processed within two to six business days.

- If approved, you need to go to a bank branch to sign a loan agreement.

- Getting a loan. The amount is issued at the office in a lump sum.

- Repayment of past refinanced loans.

- Confirmation of complete closure of debts. Providing relevant statements to the bank.

- Repayment of the loan provided by Sberbank with annuity (equal) monthly payments.

For delays, a penalty is charged - 20% per year of the amount of the delayed payment during the entire period of delay.