When does it make sense to refinance your mortgage?

The current picture is that the key refinancing rate of the Central Bank is constantly decreasing. As a result, interest rates on loans also decrease. In 2020, the average mortgage rate was 15%. In 2020, it was quite possible to take out a mortgage at 10% per annum, and in 2020 at an even lower percentage, because even the Central Bank recognizes the lowest possible rate. How much is this in specific figures? Let me give you a simple example: the loan amount is 4 million rubles, the mortgage term is 15 years. If the rate is reduced from 13 to 9.25%, the monthly payment will decrease from 50.6 to 41.2 thousand rubles. Not only the monthly amount is reduced, but also the total overpayment on the loan, and this is certainly pleasant.

I saw somewhere that if the difference in rates is less than 1.5%, then the meaning is completely lost. This is absolute nonsense. The benefit from refinancing a mortgage must be calculated manually. There are no calculators that will give you exact information that you need to do this here, and here you need to do it differently, then you will get this benefit. You need to take the amount of debt, the old mortgage loan agreement, the new mortgage loan agreement in the bank whose services you want to use to refinance your mortgage loan, calculate and compare everything. I can’t say where the best conditions will be, but I can tell you what costs you will have to face in the refinancing process, but more on that later.

What I can know for sure is that refinancing a mortgage at 6% is a particularly advantageous offer that has been valid since 2020. You can read more about the conditions here.

Refinancing at Sberbank: is it possible to refinance a mortgage?

No, the institution does not provide such an opportunity. Even if you are not satisfied with the interest rate on an agreement that has already entered into force, it is worth remembering that internal loans are being restructured. Although this is not the only way out, it is also acceptable:

- Contact another serious market player with an established reputation, for example, VTB.

- Become a participant in the state support program (subject to certain conditions), for example, after the birth of your third child, take 450,000 rubles to at least partially repay the debt to buy a home.

- Take a break, a vacation related to the coronavirus and permitted by Federal Law No. 353, namely Article 6.1-1.

But it won’t be difficult to refinance a mortgage issued by other organizations, and let’s see under what conditions.

Mandatory expenses when refinancing a mortgage

Nobody said it would be easy and simple. The mortgage refinancing procedure itself is complex, and also requires expenses that you will not escape.

Apartment valuation

So that the bank understands that this apartment is yours, that the walls in it will not collapse tomorrow, that no one is underestimating the cost of the apartment. When applying for a simple mortgage on a new building, all appraisal documents are provided by the seller of the apartment, but when refinancing, it is your responsibility to conduct an appraisal.

New loan insurance

If you enter into an agreement with a new bank, then you will also need to enter into a new insurance agreement (in most cases you can get your money back for the old one). You can also do it in such a way that the old contract will count against the new one (this is possible if the insurance company is accredited by the new bank); this issue is best clarified with the bank.

Collection of other documents

In fact, all the documents necessary to conclude a mortgage refinancing agreement can be collected quite quickly. If you don’t have something on hand, you can contact the old bank, they can give you some of the documents. Is there anything else missing? Contact the government services portal or pick them up at the passport office (multifunctional center).

Mortgage interest difference

You could say that this is a pitfall. This is inevitable during the refinancing process. Let's say you apply to a new bank to refinance. At the time of application, the amount is the same (it will be indicated to you in the contract), but while you are collecting documents for a new loan, the amount will change slightly upward (after all, interest is paid daily). To repay early, you will have to pay the difference yourself.

FAQ

Can I reduce my mortgage interest rate?

Yes, with our refinancing program. We have a program for refinancing mortgages at a lower interest rate.

What are the benefits of refinancing your mortgage?

The main advantages of refinancing are changing the loan term and payment amount. You choose your mortgage repayment scheme and get the opportunity to close the loan early and without restrictions. The consent of the primary creditor is not required.

Will the mortgaged apartment be pledged to the bank?

Yes. A mortgage is a form of borrowing secured by real estate, and the terms remain the same after refinancing.

Bank partners

Developers and real estate

Real estate agencies, realtors and cottage communities

Key partners of the Bank

Is it possible to refinance a mortgage at Rosselkhozbank if the loan was taken out here?

To answer this question, you need to understand the difference between refinancing and restructuring—the two concepts are often confused. Refinancing involves refinancing, and the loan must be opened in another bank.

In other words, if you received a mortgage from the Russian Agricultural Bank, you will not be able to refinance it here .

But you can restructure. This term refers to making changes to the payment schedule: for example, as a result of restructuring, the monthly payment may be reduced, the loan term may be changed, or the interest rate may be lowered. In some cases, if documentary evidence of compelling reasons has been provided, the borrower may be given a deferment on payments.

Restructuring, unlike refinancing, can be carried out at the same bank where you originally took out the loan. Therefore, in a critical situation, you may not go to another bank, but simply ask the management of the Russian Agricultural Bank to restructure the debt.

Conditions for refinancing a mortgage loan

Basic parameters:

Repayment of a loan (loan) previously provided for the following purposes:

- Primary and secondary residential real estate markets.

- House with land/townhouse with land.

- Refinancing a previously provided mortgage loan (loan).

- Term 12 – 360 months.

- Maximum loan amounts:

- To repay the Bank loan 20,000,000 rubles.

To repay a loan (loan) by a third-party credit organization when providing collateral:

- apartments in the primary and secondary markets

20,000,000 ₽. – Moscow 15,000,000 ₽. – St. Petersburg 10,000,000 ₽. - Moscow region

- residential building with a land plot / townhouse with a land plot

10,000,000 ₽. – Moscow, Moscow region and St. Petersburg

In other cases, 5,000,000 ₽.

The loan is issued in the amount of:

- no more than 80% of the cost of an apartment, townhouse with a land plot, the price of an agreement for participation in shared construction (including under an agreement on the assignment of rights/claims);

- no more than 75% of the cost of a residential building with a land plot.

Pledge (mortgage) of real estate or property rights under a refinanced loan/loan.

No more than 3 co-borrowers. The Borrower's spouse is required to be involved as a Co-borrower for the loan, in the absence of a marriage contract.

Review of the application within 5 working days.

Additional terms:

The refinanced loan/loan must be in Russian currency.

The duration of overdue payments on a refinanced loan/loan for the last 180 calendar days should not exceed 30 calendar days.

The validity period of the refinanced loan/loan until the date of submission of the loan application form to the Bank is:

- at least 6 months, provided there are no overdue payments of any duration;

- at least 12 months in other cases.

No cases of debt prolongation/restructuring and the presence of a positive credit history for the refinanced loan/loan.

The collateral for a refinanced loan/loan is real estate or property rights in respect of which there are no other registered encumbrances other than a mortgage in favor of the primary lender.

If the Borrower has more than one credit/loan, refinancing is carried out for each credit/loan separately.

Insurance:

Mandatory insurance of property accepted by the Bank as collateral for the entire loan term (except for land plots and unfinished real estate)1.

Voluntary life and health insurance of the Borrower/Co-borrowers for the entire term of the loan (is not a mandatory condition for granting the loan and remains at the discretion of the Borrower/Co-borrowers).

1If property rights (claims) are provided as collateral under an agreement for participation in shared construction (including under an agreement for the assignment of rights/claims), then the obligation to provide insurance arises from the date of state registration of ownership of the property.

More detailed information can be found in the territorial divisions of JSC Rosselkhozbank.

Repayment of a loan (loan) previously provided under the Main Agreement for the purposes of:

Secondary housing:

Purchase of an apartment/townhouse/separate part of a residential building with a plot of land.

Refinancing of a previously granted loan/loan for the purchase of an apartment/townhouse/a separate part of a residential building with a land plot.

Salary project participants/“reliable” clients

1

- 8.40% up to 3 million rubles

- 8.20% from 3 million ₽

Employees of budgetary organizations

2

- 8.60% up to 3 million rubles

- 8.40% from 3 million rubles

Other individuals

- 8.70% up to 3 million rubles

- 8.50% from 3 million rubles

New building:

Payment of the price of the agreement for participation in shared construction / agreement for the assignment of the right to claim.

Salary project participants/“reliable” clients

1

- 8.40% up to 3 million rubles

- 8.20% from 3 million ₽

Employees of budgetary organizations

2

- 8.60% up to 3 million rubles

- 8.40% from 3 million rubles

Other individuals

- 8.70% up to 3 million rubles

- 8.50% from 3 million rubles

House with land:

Purchase of a residential building with a plot of land.

Refinancing of a previously provided credit/loan for the purchase of a residential building with a land plot.

Salary project participants/“reliable” clients

1

- 10.75% up to 3 million rubles

- 10.50% from 3 million rubles

Employees of budgetary organizations

2

- 12.00% up to RUB 3 million

- 11.75% from 3 million rubles

Other individuals

- 12.25% up to 3 million rubles

- 12.00% from 3 million rubles

- +1,00%

to the mortgage interest rate in the event of refusal or non-compliance with the continuity of voluntary life and health insurance of the Borrower/Co-borrowers throughout the entire loan term. - +2,00%

for the period until the Bank receives an extract from the Unified State Register of Real Estate confirming the absence of other registered encumbrances in relation to the property/property rights under the agreement for participation in shared construction, except for the pledge in favor of the Bank.

Requirements:

- Citizenship of the Russian Federation

- Registration on the territory of the Russian Federation at the place of residence or stay

- Age from 21 to 65 years (subject to repayment of the loan before the Borrower turns 65 years old)

Age up to 75 years, subject to the following conditions:

- Before the Borrower turns 65, at least half of the loan term has passed

- Before the co-borrower turns 65 years old, the loan repayment period expires

Work experience:

For individuals

- at least 6 months at the last (current) place of work

- at least 1 year of total experience over the last 5 years

For salary clients of the Bank / clients with a positive credit history with the Bank

- at least 3 months at the last (current) place of work

- at least 6 months of total continuous work experience over the last 5 years

For clients receiving a pension from the Bank

- at least 6 months at the last (current) place of work

For citizens running personal subsidiary plots (LPH)

- at least 12 months of running a personal subsidiary plot (presence of an entry in the household register of a local government body)

What documents are needed to refinance a mortgage?

In addition to contracts and apartment valuation documents, you will also need the following list:

- Contract of sale of an apartment

- Certificate of ownership

- Cadastral passport

- Loan agreement

- Payment schedule

- Insurance contract and insurance premium payment receipt

- Certificate F40 from the passport office

- Certificate of absence of debt on utility bills from the settlement center

- Certificate of loan balance

But it’s still best to check with the bank for a complete list.

By the way, from July 31, 2020, you can ask the bank for a mortgage holiday. This is a grace period during which you don’t even have to pay the mortgage at all. Naturally, if there are appropriate grounds.

Related article: what are mortgage holidays

Refinancing procedure. Required documents

It’s important to note right away: no one hands out money. In fact, the scheme is as follows: a new mortgage is issued in the name of the borrower, which is transferred in favor of repaying the old loan. Debt offset is carried out by the bank itself. The client does not need to take any action. On his part, it is only necessary to conclude a new loan agreement.

Regarding the required documents, it all depends on the bank’s policy. In fact, he has the entire package of necessary documents from the borrower, but he needs to create a new credit file. Therefore, it is impossible to say reliably what documents they will ask for again. But almost 100% you will need the following:

- Passport;

- Second identification document: international passport, SNILS, military ID, driver’s license, etc.;

- Certificates confirming employment and official level of income: copies of the work book, certificates from the employer, certificate 2-NDFL, etc.;

- Documents for collateral (may not be needed).

In this case, copies of the loan agreement are not needed, since the bank has them. You may also not need copies of the insurance contract, both the collateral property itself and the borrower’s voluntary insurance.

Thus, you should not think that it is impossible to obtain refinancing from your bank. It is necessary to try and achieve more favorable conditions, especially if the mortgage was issued before 2016, when the conditions were less favorable.

Documents for refinancing have been collected. What's next?

And then you sign a new agreement with a new bank, the new bank buys your apartment from the old bank (to be extremely precise, it buys the encumbrance on your apartment for its part, because the apartment is pledged to the bank, but is owned by the person paying the mortgage ), the refinancing procedure is completed. Just don't relax!

Usually such questions do not even arise, but it is important to know. In order for the apartment to be pledged to the new bank, you need to make sure that the money has arrived in the account of the old bank, and then take a mortgage from it with a note on the fulfillment of obligations. While the document is being prepared, the loan will actually be unsecured (some banks charge a higher percentage during this period). Next, you need to go to the MFC and write two applications: to remove the encumbrance and to impose a new one.

How to refinance a mortgage at Rosselkhozbank?

After submitting all required refinancing documentation to Rosselkhozbank, it is reviewed. The period for consideration of such an application is limited to 5 working days .

If the decision is positive, if the borrower agrees with all the conditions specified in the loan agreement, then it is signed by him.

The final step in processing refinancing is drawing up and signing an application for a one-time transfer of funds by Rosselkhozbank to the account of the credit institution in which the refinanced mortgage is being repaid.

Loss of tax deduction when refinancing a mortgage

If you don’t know what this is, here’s the article: mortgage tax deduction

Yes, this practice happens. We look at subparagraph 4 of paragraph 1 of Article 220 of the Tax Code:

“property tax deduction in the amount of expenses actually incurred by the taxpayer to repay interest on targeted loans (credits) actually spent on new construction or the acquisition on the territory of the Russian Federation of a residential building, apartment, room or share(s) in them, the acquisition of land plots or shares (shares) in them provided for individual housing construction, and land plots or shares (shares) in them on which the acquired residential buildings or share (shares) in them are located, as well as for the repayment of interest on loans received from banks for the purpose refinancing (on-lending) loans for new construction or acquisition on the territory of the Russian Federation of a residential building, apartment, room or share(s) in them, acquisition of land plots or share(s) in them provided for individual housing construction, and land plots or shares (shares) in them, on which the acquired residential buildings or share (shares) in them are located”

It’s all somehow written in a complicated way, isn’t it? Now let’s put it in human language: if the loan refinancing agreement clearly states that it was issued to refinance the original mortgage loan (there are references to the original loan or to subsequent loans that have already been refinanced), then no one will refuse to issue you a tax has no deduction rights. Are they still refusing? Contact a lawyer and then go to court!

Mortgage refinancing at Rosselkhozbank 2020: rates and conditions

Mortgage refinancing at Rosselkhozbank today occurs on favorable terms. But before we begin to consider the conditions and interest rates, we will answer simple questions that will likely arise among those who intend to refinance their mortgage at Rosselkhozbank.

What mortgage loans can be refinanced at Rosselkhozbank

Rosselkhozbank allows you to refinance mortgage loans received for the purchase of an apartment on the primary or secondary markets, or the purchase of a residential building (including a townhouse) with a land plot. In addition, the bank accurately described the criteria for loans that can be refinanced.

Firstly, the refinanced mortgage loan must be in Russian rubles.

Secondly, the duration of late payments on the refinanced mortgage for the last six months should not exceed 30 days.

Thirdly, the validity period of the current mortgage before the date of submission of the application form for refinancing to Rosselkhozbank must be:

- at least 6 months, provided there are no overdue payments of any duration;

- at least 12 months in other cases.

Important criteria are the absence of cases of debt restructuring, as well as the presence of a positive credit history on the refinanced mortgage.

Can a creditor bank refuse to refinance with another bank?

Let's say you are puzzled by the issue of refinancing your mortgage and find a new bank that offers more favorable conditions. Can the old bank prevent this? There have been such cases in practice. These subtleties are specified in the contract. In this case, banks refer to Article 43 of Federal Law No. 102-FZ “On Mortgage”. There is a subtlety here. The new bank may first pay off your mortgage in full to the old bank, wait for the encumbrance on the property to be lifted, and then register the encumbrance on itself by issuing you a loan. Only in this case you may have problems with a mortgage tax refund, so it is better to first consult with a lawyer.

An old bank may deliberately delay issuing the necessary documents. Nothing can be done here...

Mortgage refinancing with state support for families with children

This is a special loan for refinancing a previously issued mortgage loan for families in which a second and/or third child was born from 01/01/2018 to 12/31/2022.

Refinancing a mortgage loan under the preferential Program allows you to change the interest rate, loan term, monthly payment amount, as well as attract co-borrowers and pay off the mortgage loan on more favorable terms.

When refinancing, the 6% rate is valid for 3 years at the birth of the second child and 5 years at the birth of the third. After the end of the grace period, the interest rate is set at the key rate of the Central Bank of the Russian Federation on the date the loan was issued, increased by 1.8 percentage points.

The maximum loan amount for mortgage refinancing for Moscow and the Moscow region, St. Petersburg and the Leningrad region is 8 million rubles, for other regions of Russia - 3 million rubles.

The maximum loan term is 30 years.

An application for mortgage refinancing under the State Support Program at Rosselkhozbank is available using a standard package of documents, provided that confirmation is provided that a second or third child was born in the family after January 1, 2020.

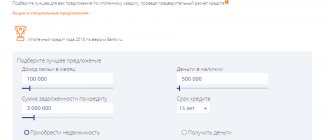

Rosselkhozbank mortgage refinancing calculator

You can calculate the monthly payment and the amount of overpayment when refinancing a mortgage at Rosselkhozbank using an online mortgage calculator.

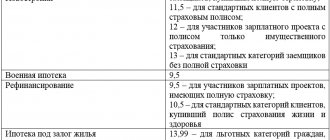

Interest rates for refinancing at RSHB for 2020

The interest rate when refinancing a mortgage at Rosselkhozbank for individuals depends on the type of real estate for which the loan was previously issued, as well as on the borrower’s credit history and the amount borrowed:

- If the loan was issued for the purchase of an apartment on the secondary market or in a new building, and the loan size does not exceed 3 million rubles, then salary clients (or borrowers with a positive credit history) can count on an interest rate of 8.2% per annum. If the amount is greater, then the interest rate when refinancing a mortgage at RSHB for such clients will be 8% per annum. Employees of budgetary organizations can receive an interest rate of 8.4% if the amount of on-lending does not exceed 3 million rubles, and 8.2% if the amount is larger. Other individuals can expect to receive a rate of 8.5% per annum (when borrowing up to 3,000,000 rubles) and 8.3% (if the borrower borrows more than 3 million rubles).

- If the mortgage loan was initially issued for the purchase of a house with land, then RSHB clients who receive salaries into an account with this bank can expect to receive an interest rate of 9.75% per annum on the new mortgage loan if the purchase amount was less than 3 million rubles. If the amount was greater, then the interest rate will be 9.5%. Public sector employees will receive 10.75% or 10.5% per annum (depending on the amount borrowed under the refinancing agreement). Individuals not included in the above categories of people can expect an interest rate of 11% and 10.75%.

When applying for refinancing of mortgages and housing loans at Rosselkhozbank, it is necessary to take into account that the following factors also influence the interest rate on the loan:

- the presence or absence of permanent life and health insurance for the borrower or co-borrowers. If there is no insurance contract, the borrower will receive an interest rate 1 percentage point higher. If there is, then below;

- the interest rate when refinancing a mortgage at the Russian Agricultural Bank will be increased by 2% until the borrower provides the bank with an extract from the Unified State Register of Real Estate, confirming the absence of additional encumbrances in relation to the property.

How to refinance a mortgage - step-by-step instructions

Don't have extra money to invest and have been paying off your mortgage for several years? Consider refinancing your loan. This is a very labor-intensive, but overall quite profitable event that will help you save a lot of money.

Now that the key rate of the Bank of Russia is 7.5%, for citizens who bought an apartment with a mortgage several years ago, the issue of refinancing previously taken loans is increasingly relevant. And if earlier this service was almost an exotic product, now all large banks, without exception, offer to refinance a loan taken from another bank.

To reduce your mortgage rate by refinancing with another bank, you can either contact banks directly or use an aggregator of bank offers, which, for example, is Tinkoff or other resources.

If in the first case everything is clear - you work with one bank and collect a package of documents according to its requirements - then in the second case, with all its advantages, there are hidden disadvantages: since the aggregator works with a pool of banks whose requirements may differ, you will have to collect a package of documents that suits everyone. In addition, all aggregators have their own relationships with banks, which makes the process not completely transparent. Let's take a closer look at the refinancing procedure, the main stages of the process and the things you should know when getting involved in this process. Collection of documents

To refinance a mortgage loan, you must have the following documents ready:

- A completed application form from the bank where you are applying for refinancing.

- A certificate of income from your place of work confirming your income in Form 2-NDFL (if you are a salary client at a bank, then, as a rule, it is not required).

- A copy of the work record book or employment contract (if you are a salary client at the bank, then, as a rule, it is not required).

- A copy of the main pages of the passport.

- Certificate of debt balance with the original creditor bank

- Title documents for the apartment (a copy of the purchase and sale agreement and a copy of the certificate of ownership)

- A copy of the loan agreement and payment schedule. Some banks require these documents at later stages.

So, you have collected all the documents and submitted them to the bank that provides mortgage refinancing services.

After receiving documents from you, he, as a rule, first makes a preliminary decision on you as a potential borrower and decides on the rate that he can offer you, taking into account various factors: gender, age, experience and place of work, the ratio of the value of the collateral to the amount requested loan. Be prepared for the fact that you may be refused even by the bank where you are a payroll client. You also need to be prepared for this. If your family circumstances have changed since the conclusion of the mortgage agreement, be prepared that you will have to arm yourself with additional documents. If you get married, a potential creditor bank may demand that your other half become a co-borrower of a new loan, arguing this under articles of the civil and family codes.

Do not rush to agree with the bank and remember that you have a choice in the form of a marriage contract, which may not necessarily regulate the entire complex of property relations, but a separate part of it in the form of an apartment for which a mortgage is issued. For a marriage contract you will have to pay the notary about 10,000 rubles (prices hereinafter are in Moscow).

Entering into a deal

Let's assume everything is fine and you are pre-approved for a loan. Now we have to collect documents for the apartment. You will need:

- Independent assessment of the apartment. Please note that each bank has its own list of companies with which it works and its own requirements for the report format. Thus, if you have assessed an apartment for one bank, it is almost guaranteed not to be suitable for another, and if suddenly at this stage you still want to consider other banks for refinancing, you will have to pay extra to redo the report, which can be an unpleasant surprise. For appraisal companies, this is a way to make money out of thin air, and for you it is unjustified expenses. The average cost of the report is 7,000-10,000 rubles; for changes to the report to suit the requirements of another bank, you will have to pay an additional 3,000 rubles.

- A single housing document, which can be obtained for free at.

- An extract from the Unified State Register of Real Estate, it can also be obtained from. The extract is prepared there within 7 working days. However, you can use other information and service resources.

- Title documents for the apartment, purchase and sale agreement. In some cases, a receipt is required from the seller of the apartment (if you bought a secondary home) that you have paid him in full and in the proper manner, but the bank must notify you in advance of the need for this document. Typically, after the three-year period, a receipt is not required.

- Transfer deed for the apartment.

- Technical passport for the apartment. Please keep in mind that the technical passport is valid for 5 years. If your passport has expired, then you need to contact, order a call from a technical specialist and pay for the production of a technical passport. Its cost, including calling a specialist, for a two-room apartment is approximately 10,000 rubles. From the moment of payment, the passport is produced in about 15-20 working days. A technical passport from the early 2000s and even the 90s (explication and floor plan) is accepted for consideration, if the owner of the apartment has it in paper form. If tech. If the passport is lost or has not been issued and there have been no BTI engineers at the site over the past 5 years, then the process of obtaining a technical passport will not be quick, which will take about 3-4 weeks.

- An updated certificate from the bank about the current debt on the mortgage loan as of the date of the refinancing transaction and a certificate about the full account details for repaying the debt with the original creditor bank. In some cases, an application for full early repayment is requested on the date of the transaction with a note indicating its acceptance by the primary creditor.

Transaction

On the day of the transaction, you come to the new creditor bank, open an account and get acquainted with the documents. If possible, ask for documents to be sent to you in advance, since it is impossible to carefully read and understand all the provisions of the contract on the spot.

By the way, the content of mortgage agreements has changed a lot over several years. Now the bank prescribes truly “draconian requirements” in relation to the client: the opportunity to inspect the apartment at least once a year, the ability to periodically request information about the client and his income, an actual ban on renting out the apartment, the obligation on the part of the client to notify the lender about relatives, whom he wants to register in the apartment and much more. And then you suddenly have to seriously weigh everything and decide for yourself what is more important to you - a reduction in the monthly payment by 10,000-20,000 rubles or your own relative freedom.

Let's assume you signed everything and the money was transferred to your account, and then sent to the account at the original creditor bank. Please note that you will not only be required to repay the principal amount of your mortgage to your original lending bank, but also the interest that has accrued since the date of your next monthly payment. Keep in mind that in this regard, the total amount to be repaid will certainly increase and the more days that pass from the date of the next monthly payment, the greater this amount will be.

You also need to conclude an agreement on life, disability, and property insurance.

Paperwork

If you thought that this was all over, you are mistaken. At this stage the fun begins. As a rule, the new creditor bank sets an increased interest rate for the period until the old mortgage is repaid and a new one is issued.

So, you need to obtain from the original creditor bank a complete package of documents to remove the encumbrance from your apartment. This package of documents includes a mortgage note, as well as a notarized copy of the power of attorney for the bank employee who marked that you have fulfilled your obligations to the bank. It is also better for you to take a certificate of interest paid to the bank and that the debt has been repaid in full. In different banks, the time frame for preparing a mortgage varies: for example, at Fora Bank, a mortgage is issued every other day, and at VTB after 15 working days. You yourself understand that the period during which you will pay at an increased rate in the new bank depends on the speed of issuing a mortgage.

With this package of documents, as well as your passport and certificate of ownership, you go again to “My Documents” and there you submit a package of documents to Rosreestr to remove the encumbrance. The encumbrance is removed within 7 working days. You will be given a notice of removal of the encumbrance. Next, you need to receive an extract from the Unified State Register of Real Estate, which will indicate that the encumbrance has been lifted. And with these documents you need to go to “My Documents” again. According to the period for registering the encumbrance, this is the same 7 working days.

In some situations, banks reissue a mortgage without the client's participation, but this is more likely to happen in a situation of internal sale rather than refinancing. Here you yourself must walk around. There is, however, a market for intermediary services who can re-register documents for you. The timing will hardly change, and you will have to pay about 30,000 rubles (for example, at Tinkoff Bank) for these services.

Once you take out a mortgage, your rate and payments should decrease accordingly from the next payment period.

Example of estimated cost and benefit of refinancing a mortgage

- The balance of debt with the original creditor bank is 6,130,000.

- Initial interest rate 13.25%.

- The monthly payment amount is 94,900.

- The loan requested for refinancing is 6,000,000.

- The interest rate before registration of the mortgage is 11.7%.

- The monthly payment amount is 84,100.

- The interest rate after registration of the mortgage is 9.74%.

- The monthly payment amount is 77,400.

- Marriage agreement: 10,000.

- Registration certificate: 10,000.

- Apartment valuation: 7,000-10,000.

- Certificates from banks: 4,000.

- Extracts from the Unified State Register of Real Estate: 800.

- Conclusion of a new insurance contract: individually depending on the tariffs of the insurance company.

- Registration through intermediary aggregators: 30,000.

Expenses

Follow Financial One on social networks:

Facebook

|| VKontakte || Twitter || Youtube