Types of mortgage

Promsvyazbank offers its clients 5 types of mortgage loans, which have different conditions, interests and rates. These include:

1. Refinanced mortgages; 2. Mortgages without down payment; 3. Mortgage loan “Alternative”; 4. Targeted collateral loan from 9.95%; 5. Get a mortgage – lightly.

You can consider all types of mortgage loans on the official website of Promsvyazbank, following the link: www.psbank.ru

Promsvyazbank official page for mortgage lending

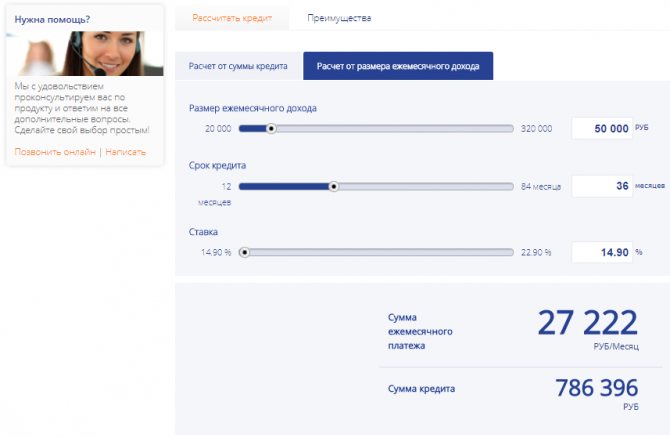

Online mortgage calculation

The mortgage is calculated as follows. You must enter the following information in the information windows of the calculator:

- the cost of residential real estate that the borrower intends to purchase;

- the amount of the down payment;

- loan term – in the service you can select the unit of measurement: month or year;

- mortgage interest;

- choose a payment plan.

If the selected loan program from Promsvyazbank involves additional fees, then they should be entered into the appropriate windows at the bottom of the calculator. If there are no commissions, the fields are left blank.

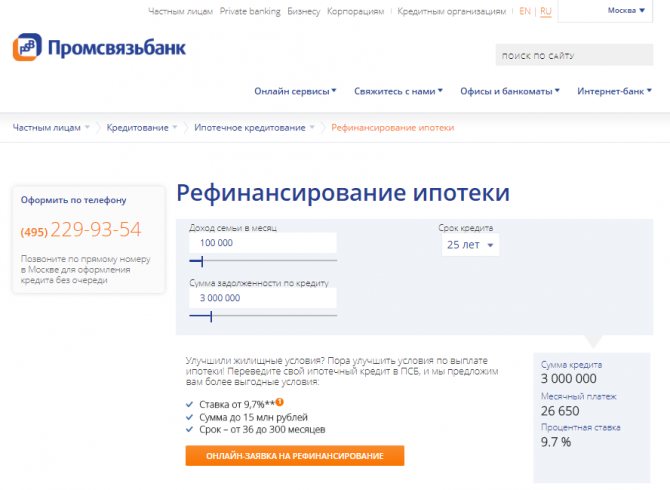

Refinanced mortgages

The first type of mortgage has favorable conditions and can really help improve the living conditions of citizens.

So the loan amount is issued to clients up to 15 million rubles. The interest rate is from 9.7% and the terms for which the mortgage is issued range from 3 to 25 years.

Additional advantages of this mortgage are the following:

- clients can conveniently repay their loan online or through Promsvyazbank’s self-service system. At the same time, the bank will try to reduce customer costs when paying off a mortgage (for example, profitable promotions, low commission);

- the ability to independently increase or decrease the loan lines. The bank will take into account all the nuances and proceed from the client’s needs;

- the ability to manage your mortgage online or through a mobile application;

- To obtain this mortgage you need a minimum of documents. The main confirmation of the client's solvency will be certificates confirming the client's income.

Only citizens of the Russian Federation from 21 to 65 years old can get a mortgage on refinancing terms.

A separate condition of the mortgage is the clients’ work experience. So the work experience must be one year, and work in the last place for a period of 4 months.

For legal entities, you must have documentary evidence of existence for up to 2 years. Borrowers for this type of mortgage can be close relatives.

Attention! When applying for a mortgage loan, you need to have two phone numbers with you. One of the numbers must be a landline phone.

Terms of a refinanced mortgage

Mortgage lending conditions in 2020

The conditions for processing and issuing a mortgage loan at Promsvyazbank are distinguished by their loyalty and profitability for potential clients.

Thus, to obtain loan capital for the purchase of real estate, it is not necessary to pay a down payment , since a special mortgage lending program is in place for these purposes. In other cases, the borrower must pay a down payment, the amount of which varies from 20% to 40%.

Interest rates on mortgage loans are also quite low - their value depends on the specific lending program.

In addition, if the client is the owner of a Promsvyazbank salary card, he can count on reduced interest. In addition, the level of accrued interest is influenced by the developer from whom the individual will purchase the apartment, if we are talking about new buildings.

To accommodate potential borrowers, this banking institution sets a minimum interest rate of 6.99%, which will be valid during the first months so that loan payments are not so large while the client makes repairs and settles in a new place of residence.

The loan period varies from 3 to 25 years, in addition, early repayment of existing debt is provided.

The bank provides its clients with the opportunity to repay their mortgage early without applying additional commissions or penalties . In case of partial early repayment and payment of an amount that exceeds the minimum required amount, the amount of the remaining mandatory monthly payments will be reduced.

A prerequisite when drawing up a loan agreement is the need for mortgage insurance. This will help protect the client in case of loss of ability to work or from unexpected situations that may affect the apartment if it acts as collateral.

In order to obtain a mortgage loan from Promsvyazbank, a potential borrower must meet certain requirements :

- Have Russian citizenship.

- The client's age must be between 21 and 65 years old, that is, he must not have turned 65 years old by the time the loan period ends.

- The potential borrower must be registered in the region where there are branches of this banking institution. A registration mark at the place of actual residence or employment is allowed.

- The client must have 2 valid phone numbers. In addition to your mobile phone number, you must also provide your employer's landline phone number.

- An individual must not be liable for military service or perform military service.

Special requirements are put forward for the employment of an individual:

- A potential borrower can be either a private entrepreneur or an employee.

- The client must have a work experience of at least 1 year and have worked in his last place of employment for at least 4 months.

- An individual entrepreneur or business owner must have been running a business for at least 2 years.

To conclude a loan agreement, a potential borrower, in addition to the application form, must also provide the following documentation :

- Russian passport.

- Certificate of compulsory pension insurance (SNILS).

- A document that will indicate marital status.

- A certificate from the place of employment, which states the amount of wages and indicates data on the actual work experience.

- Military ID - provided to men under 27 years of age.

If the client does not have the opportunity to provide documents from his place of work, then he can apply for a mortgage loan under the “Getting a Mortgage - Easy!” program.

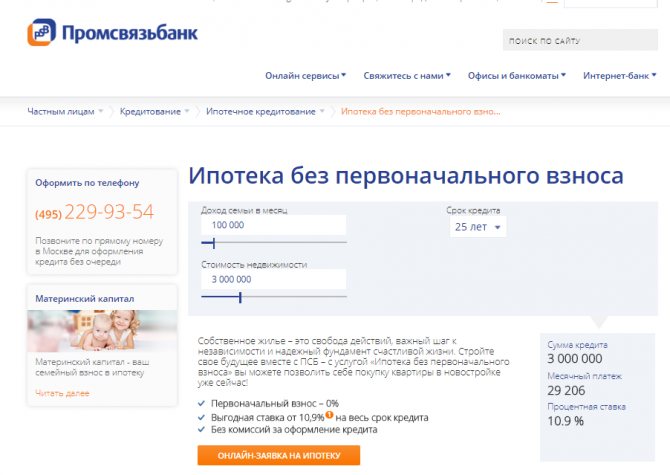

Mortgage without down payment

This type of mortgage allows you to purchase an apartment in a new building right now, without making a down payment on the loan.

Other beneficial advantages of a mortgage are a favorable rate (10.9%) and no commission when applying for a loan.

Clients can take out a loan for a period of 3 to 25 years in the amount of 3 million and have the following advantages:

- the opportunity to immediately buy an apartment you like;

- the ability to pay less money at the start of construction;

- the opportunity to plan your future construction immediately after obtaining a mortgage;

- opportunity to save on commissions.

Mortgage conditions without down payment

The procedure for obtaining a mortgage at Promsvyazbank

For all of the above mortgage programs, it is possible to submit an application online, or visit the Promsvyazbank office with a package of documents. You can consult by phone (495) 229-93-54.

The most convenient way, of course, is to use the online application. In the application form you must indicate:

- Full name of the potential borrower;

- Date of birth;

- Contact details;

- Information about the length of service in general and the length of service at the last place of work;

- A time convenient for the client at which the bank manager can contact him;

- Information about the property that is planned to be mortgaged;

- Desired loan amount and term;

- Information about family income.

The mortgage application is preliminary and can be subsequently adjusted at the Promsvyazbank office. Typically, it takes 3 business days to process your application. If the bank approves the application, the potential borrower needs to visit the nearest Promsvyazbank office and provide the entire package of documents. You will definitely need to join a collective insurance agreement and conclude an agreement with an independent appraisal company to draw up an apartment appraisal report. Of course, the borrower has the right to refuse insurance of his life and health, as well as real estate insurance, but you need to understand that in this case the interest on the loan will be significantly higher - by 3%. After collecting all documents and completing the required procedures, a mortgage loan agreement will be signed.

The borrower needs to keep in mind that in addition to the remuneration amount, he will have to incur a number of additional expenses when applying for a mortgage at Promsvyazbank. Total the borrower pays:

- Loan interest;

- Insurance (0.6 - 0.7%, annually);

- An initial fee;

- Rent of a bank safe (for payments for the purchase of secondary housing);

- State duty for registration of property rights, agreements for participation in shared construction, mortgage agreements;

- Notarization of powers of attorney, statements;

- Realtor commission;

- Real estate appraisal report or act.

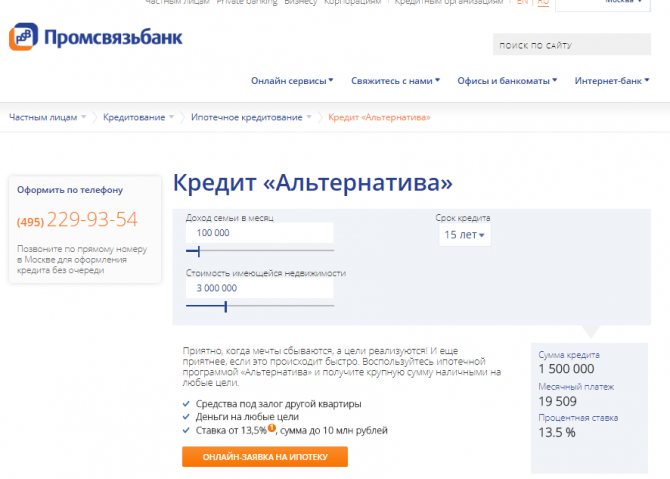

Credit "Alternative"

The “alternative” loan provides its clients with a sum of money for any purpose that may not even relate to the purchase of housing.

The maximum loan amount is 1.5 million rubles at 13.5%. The loan can be issued from 3 to 15 years.

Additional advantages of this loan are:

- the opportunity to take advantage of free legal assistance when preparing documents;

- the ability to repay the loan early without fees or penalties;

- When applying for a loan, the income of 4 family members can be taken.

Conditions of the mortgage loan “Alternative”

Mortgage made easy

It allows clients to save time on paperwork.

If you apply for a loan in this way, then income certificates and work records are unnecessary.

Mortgage interest rates will depend on the property the client wants to purchase:

- 9.4% - at this rate you can buy an apartment in a new building of PSN Group of Companies (residential complex "Domashny", residential complex "SREDA", residential complex "Polyanka 44", residential complex "I'm", residential complex "Grinada") and "Rozhdestveno" (residential complex "The World of Mitino");

- 11% – for apartments purchased from other bank partners;

- 11.3% – for an apartment from the secondary market;

- 13.5% - for other purposes.

Mortgage made easy

Terms of mortgage programs from Promsvyazbank

Promsvyazbank offers a wide range of 8 mortgage programs, adapted to the capabilities and wishes of consumers: some are concerned about the lack of a down payment, some are fundamentally considering only new buildings or, on the contrary, the secondary market, and some are attracted to a country house. Every potential borrower will be able to find an acceptable option among the mortgage programs presented by Promsvyazbank. Moreover, for all programs there is no commission for processing a loan and no penalties for early repayment.

So, if you need a mortgage loan that does not require a mandatory down payment, you need to pay attention to Promsvyazbank programs:

- “Mortgage without down payment”;

- Credit "Alternative";

- Loan “Target Collateral”;

- Program “Getting a Mortgage – Easy!”;

- Refinancing.

If finished housing is a priority, mortgage programs are offered:

- "Secondary market";

- Loan “Target Collateral”;

- Program “Getting a Mortgage – Easy!”;

- Refinancing.

When looking for housing in a new building, Promsvyazbank programs are suitable:

- "New building";

- “Mortgage without down payment”;

- Program “Getting a Mortgage – Easy!”;

- Refinancing.

Mortgage loans adapted for the purchase of country real estate:

- "Country estate";

- Credit "Alternative";

- Loan “Target Collateral”;

- Program “Getting a Mortgage – Easy!”;

- Refinancing.

Borrowers wishing to use maternity capital to purchase housing were not left without attention. They will like the programs of Promsvyazbank:

- "Secondary market";

- "New building".

Let us consider in order the conditions for each of the mortgage programs presented by Promsvyazbank.

Mortgage of Promsvyazbank "Novostroika"

| Mortgage interest rate | 8,8%-12% |

| Total loan cost | 9,28-15,37% |

| Loan terms | 36-300 months (3 years - 25 years) |

| An initial fee | 10% |

| Housing type | new building |

| Amount of credit | From 500 thousand to 30 million rubles. for Moscow, Moscow Region and St. Petersburg and up to 20 million rubles. for regions |

| Possibility of using maternity capital | Maybe |

| Who can be a borrower | Phys. employee |

| Co-borrower | Spouse only |

The “New Building” program provides for the purchase of housing with a mortgage on the primary market by concluding an agreement for participation in shared construction, a preliminary purchase and sale agreement, or an agreement with a housing construction cooperative, which is a partner of Promsvyazbank. The minimum amount for which it is possible to obtain a mortgage loan is 500,000 rubles, but not less than 20% of the cost of the apartment.

The maximum mortgage amount, although it has a fixed threshold, nevertheless depends on the type of contract. If a purchase agreement is to be concluded, the loan amount cannot exceed 80% of the cost of the apartment. If you choose a loan condition with a down payment of 10-20%, you can get a loan of no more than 90% of the cost of the home. When concluding a share participation agreement, a loan for the full cost is possible.

This program of Promsvyazbank provides for the use of maternity capital. In this case, the mortgage amount may be increased by the amount of maternity capital. If the cost of the apartment is up to 2 million rubles. inclusive, then lending is made up to 90% of the cost, if over 2 million rubles. – no more than 95% of the cost of housing is credited.

Mortgage of Promsvyazbank “Secondary market”

| Mortgage interest rate | 8,9%-11,3% |

| Total loan cost | 9,74-14,88% |

| Loan terms | 36-300 months (3 years - 25 years) |

| An initial fee | From 10% |

| Housing type | Secondary market |

| Amount of credit | from 500 thousand to 30 million rubles. for Moscow, Moscow Region, St. Petersburg, Leningrad Region, and up to 20 million rubles. for regions |

| Possibility of using maternity capital | Maybe |

| Who can be a borrower | Phys. a person employed as an individual entrepreneur, a business owner with a share of more than 25% |

| Co-borrower | Spouse (including common-law spouse) and any relatives. |

Under the “Secondary Market” program from Promsvyazbank, you can buy secondary housing secured by the apartment you are purchasing, as well as buy an apartment with a mortgage, taking into account future major repairs, the costs of which are also included in the loan amount. No more than 80% of the purchase price is credited. If you choose a loan condition with a down payment of 10-20%, you can get no more than 90% of the cost of the home as a mortgage. When lending for the purchase of an apartment in need of major repairs, the maximum loan amount takes into account the amount required to carry out major repairs.

This program of Promsvyazbank also provides for the possibility of using maternity capital. The conditions for its application are similar to the conditions for the “New Building” program.

“Secured loan target from 8.9%”

| Mortgage interest rate | 8,9%-9,4% |

| Total loan cost | 9,52-14,70% |

| Loan terms | 36-300 months (3 years - 25 years) |

| An initial fee | 0% |

| Housing type | apartment, house with land, apartments on the primary or secondary housing market |

| Amount of credit | from 500 thousand to 30 million rubles. for Moscow, Moscow Region, St. Petersburg, Leningrad Region, and up to 20 million rubles. for regions |

| Who can be a borrower | Phys. a person employed as an individual entrepreneur, a business owner with a share of more than 25% |

| Co-borrower | Spouse (including common-law spouse) and any relatives. |

| Pledge | Existing real estate owned by the borrower or third parties |

A loan under this program is issued by Promsvyazbank without a down payment secured by real estate or a plot of land with a house or secured by apartments. If there is an uncoordinated layout, no more than 50% of the cost of housing is credited, in other cases - up to 90% of its market value. It is also possible under this program to take out a mortgage on housing that needs major repairs, including its cost in the loan amount.

Mortgage of Promsvyazbank "Country Real Estate"

| Mortgage interest rate | From 11.9% |

| Loan terms | 36-300 months (3 years - 25 years) |

| An initial fee | 0% |

| Housing type | Townhouse, house under construction, finished house with a plot in the region where Promsvyazbank operates |

| Amount of credit | up to 15 million rubles |

| Who can be a borrower | Phys. employed person Business owner with a share of more than 25% |

| Co-borrower | Spouse (including common-law spouse) and any relatives. |

| Pledge | Purchased or existing real estate owned by the borrower or third parties |

Under this program, you can take out a country house on credit in those regions where Promsvyazbank has offices: Khabarovsk, Nizhny Novgorod, Novosibirsk, St. Petersburg, Stavropol, Yekaterinburg, Volgograd, Yaroslavl.

Promsvyazbank program “Alternative”

| Mortgage interest rate | 11,2%-11,3% |

| Total loan cost | 11,82-14,71% |

| Loan terms | 36-180 months (3 years - 15 years) |

| An initial fee | 0% |

| Housing type | apartment, house with land, apartments on the primary or secondary housing market |

| Amount of credit | from 1 million to 10 million rubles. (from 20% to 50% of market value) |

| Who can be a borrower | Phys. a person employed by an individual entrepreneur - for all regions. Business owners with a share of more than 25% receive loans in Moscow and Moscow Region, St. Petersburg, Voronezh, Tomsk, Novosibirsk and Yekaterinburg (including regions) |

| Co-borrower | Spouse (including common-law spouse) and any relatives. |

| Pledge | Existing real estate owned by the borrower or third parties |

Promsvyazbank's program provides for issuing a loan for any purpose not related to the payment of interest and other payments to the bank under other loan agreements, the purchase of securities, and the provision of loans to third parties. Thus, under this program, although it cannot be considered fully a mortgage program, it is possible to purchase housing using an existing apartment as collateral.

Mortgage without down payment from Promsvyazbank

| Mortgage interest rate | 10,9% -12,3% |

| An initial fee | 0% |

| Housing type | new building |

| Maximum loan term | up to 25 years |

| Amount of credit | up to 30 million rubles |

This program is designed for the purchase of housing with a mortgage under special offers from Promsvyazbank partners:

- GC "PSN", "PIK", "Inteko" - rate 12%

- Urban Group, Morton, NDV - rate 12.3%

The special offer is valid for Moscow, Moscow Region and St. Petersburg.

Promsvyazbank loan “Easy for a mortgage!”

| Mortgage interest rate | 9,4%- 11,2% |

| An initial fee | 30%-40% depending on the object |

| Housing type | New construction and secondary market |

| Maximum loan term | 25 years |

| Amount of credit | up to 30 million rubles |

| Who can be a borrower | Phys. a person employed as an individual entrepreneur, a business owner with a share of more than 25% |

| Co-borrower | Spouse (including common-law spouse) and any relatives. |

| Pledge | Purchased and existing real estate owned by the borrower or third parties |

The program “Getting a Mortgage is Easy!” intended for the sale of real estate from Promsvyazbank partners in Moscow, Moscow Region and St. Petersburg. The client is required to provide a minimum package of documents and does not need proof of income. The interest rate depends on the type of object:

- 9.4% - for the purchase of an apartment from PSN Group (Domashny Residential Complex, SREDA Residential Complex, Polyanka 44 Residential Complex, I'm Residential Complex, Grinada Residential Complex) and Rozhdestveno LLC (Mir Mitino Residential Complex ") in a new building

- from 10.8%—for the purchase of an apartment from other partners in a new building. The list of partners can be found on the official website of Promsvyazbank.

- from 11.2%—for purchasing an apartment on the secondary market

- from 11.2%—for any purpose (secured by real estate).

Mortgage refinancing from Promsvyazbank

| Mortgage interest rate | 9,1%-9,2% |

| Total loan cost | 10,24-12,97% |

| Loan terms | 36-300 months (3 years - 25 years) |

| An initial fee | 0% |

| Housing type | apartment, house with land, apartments on the primary or secondary housing market |

| Amount of credit | from 1 million to 15 million rubles. (from 20% to 80% of the market value, but not more than the balance of the loan principal) |

| Who can be a borrower | Phys. person employed as an individual entrepreneur, business owners with a share of more than 25% |

| Co-borrower | Spouse (including common-law spouse) and any relatives. |

| Pledge | An existing property that has an original loan or buyer's rights to purchase it. |

A mortgage loan under this program is issued by Promsvyazbank for full repayment of debt to third-party creditors. A mortgage is issued against the security of: an apartment owned, for the purchase of which a loan was initially provided, as well as against the rights of the buyer under an equity participation agreement. At the same time, you can submit an application for mortgage refinancing by Promsvyazbank no earlier than 6 months from the date of concluding a loan agreement with a third-party lender, but no later than 36 months before the end of the agreement. An important condition is the absence of overdue debt to the lender on the date of application to Promsvyazbank for mortgage refinancing.

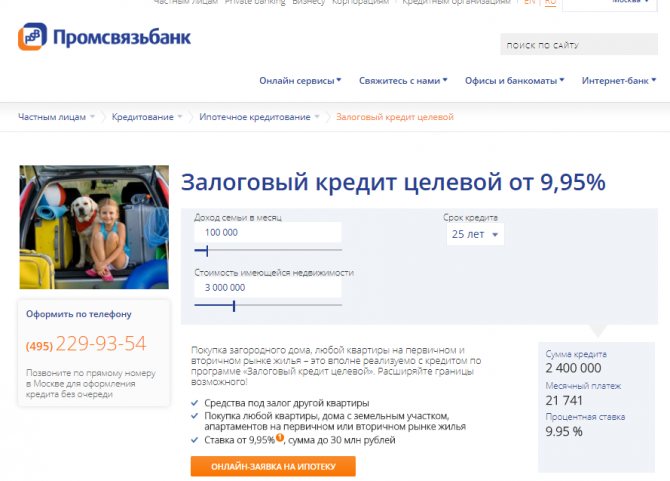

Secured loan target from 9.95%

This loan provides clients with the opportunity to purchase an apartment on the primary or secondary market at a favorable interest rate of 9.95%.

Clients can take out a mortgage from 3 to 25 years and take out 2.4 million rubles in credit.

Attention! Under the terms of this loan, clients can take out a mortgage and funds secured by another apartment (not necessarily their own). You also have the opportunity to buy any apartment or house with land on any real estate market.

Additional advantages of this loan are:

- the opportunity to take advantage of free legal assistance provided by the bank;

- the ability to quickly obtain a loan without extra fees;

- clients can repay the loan early at any time, without overpaying fines and commissions;

- the opportunity to purchase a home without restrictions from the bank.

Terms of collateral mortgage-loan target from 9.95%

What documents are needed?

To apply for a mortgage loan, Promsvyazbank employees will require certain documents, which are best prepared in advance.

Such documents include:

- passport;

- documents confirming work experience (work book) and family income;

- pensioners need to have SNILS;

- for men under 27 years of age, you must provide a military ID.

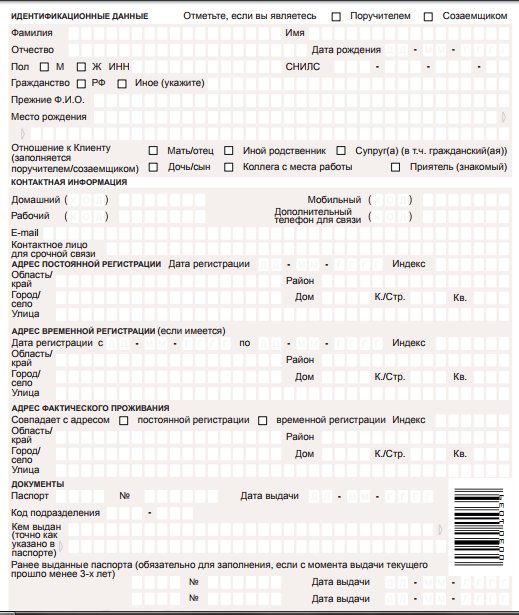

When applying for a mortgage loan, the client will have to fill out a mortgage application form.

The application has a number of points that relate to identification data, contact information, addresses of permanent and temporary registration, documents, and so on.

After filling out the form, the bank considers the application, which can last up to 20 minutes.

Questionnaire with identification data

If approved, the person must begin searching for housing. Once housing has been found, an agreement is concluded and submitted to the bank for review.

Only after this the client can receive a mortgage for the chosen apartment.

Documents for obtaining a mortgage loan

General list of documents provided by the borrower to obtain a mortgage at Promsvyazbank:

| 1 | Questionnaire-Application |

| 2 | Passport of a citizen of the Russian Federation |

| 3 | Insurance certificate of compulsory pension insurance (SNILS) |

| 4 | Marriage certificate (divorce, death of a spouse) or a statement that the borrower is not in a registered marriage. The application must be signed in the presence of a bank employee or notarized. |

| 5 | Work book or employment contract |

| 6 | Certificate of income in the form of a bank or declaration 2-NDFL |

| 7 | Military ID (copy and original), if the borrower is a man under 27 years old. |

| 8 | Other documents, depending on the status of the borrower (for individual entrepreneurs and business owners there are their own nuances, as well as for those wishing to use maternity capital or refinance) |

Mortgage calculator

In order to know the approximate cost of your mortgage loan and the calculation of the interest rate, you can use the services of a mortgage manager or calculator.

In the latter option, the client can go to the official page of Promsvyazbank and, through a special application, calculate the entire amount for the selected mortgage loan.

As a result, it is profitable to take out mortgage loans from Promsvyazbank.

The bank provides many programs and loans that allow clients to choose the ideal mortgage option.

Credit calculator

Also, in addition to everything, each time the bank provides various promotions, for example, now there is a New Building promotion from 9.5%, which allows you to profitably buy an apartment on the primary real estate market. https://youtube.com/watch?v=m1bz4NZstIU

Attention! This site does not collect or process personal data. All information is for informational purposes only. Federal Law No. 152-FZ of July 27, 2006 “On Personal Data” is not violated.

| Promsvyazbank Vkontakte | Promsvyazbank on Facebook |

| Promsvyazbank on Twitter | Promsvyazbank on Instagram |

Download the Promsvyazbank application for Android Download the Promsvyazbank application for iPhone

The procedure for repaying a mortgage at Promsvyazbank

Loans under mortgage programs are provided by transferring money to the borrower's account opened with Promsvyazbank. The same account is used to repay the loan.

Repayment conditions are specified in the loan agreement. In the standard case, the loan and interest on it must be repaid monthly on the date specified in the agreement and agreed with the bank. Attached to the agreement is a mortgage payment schedule, with calculation of amounts and payment dates. To prevent penalties from accruing, you must adhere to the received schedule.

You can pay off your Promsvyazbank mortgage in the following ways:

- Write a corresponding statement, and the bank will independently debit money from the account, and if there is insufficient money, the debit will be carried out from all other accounts and cards opened by the borrower at Promsvyazbank. The borrower only needs to monitor the availability of money in the account and replenish it in a timely manner by transferring or depositing cash through the cash register.

- Take the bank details from the bank manager and pay for the loan yourself by depositing cash at the cash desk or through ATMs.

How to quickly pay off your mortgage? Promsvyazbank in its mortgage loan agreements provides for the possibility of early repayment, both partial and full, without penalties. If you deposit the amount into the account in part - early repayment, you can, upon application, either reduce the amount of the monthly mortgage payment or shorten the loan term. Practice shows that it is more profitable for the borrower to shorten the loan term, because in this case, much greater savings are obtained on the amount of interest paid.

Mortgage loans from Promsvyazbank provide an opportunity for different categories of the population with different needs and capabilities to acquire housing. The level of mortgage interest rates is, in principle, in the average range of rates offered by other banks. However, a significant advantage of the programs from Promsvyazbank is its recently acquired status as a state bank, which protects borrowers from possible hassles associated with license revocation, bankruptcy and other troubles that may arise when collaborating with a private bank, especially with such a long-term loan as mortgage.